On August 7, 2024, TenX Keane Acquisition (Nasdaq: TENKU, TENK,

TENKR) (“TenX”), a publicly traded special purpose acquisition

company, was notified by The Nasdaq Stock Market that trading in

TenX’s securities had been halted for “additional information

requested” from the company. The trading halt was imposed following

volatility in the trading price and volume of TenX’s securities on

Wednesday, August 7, 2024. TenX and its advisors have been in

contact with representatives of Nasdaq regarding the lifting of the

trading halt. While the trading halt is in place, TenX understands

that its securities cannot be traded on any other exchange or in

the over-the-counter market.

On August 8, 2024, Citius Pharmaceuticals, Inc.

(“Citius Pharma”) (Nasdaq: CTXR) announced that the FDA had

approved LYMPHIR™ (denileukin diftitox-cxdl) for the treatment of

relapsed or refractory (r/r) cutaneous T-cell lymphoma after at

least one prior systemic therapy.

TenX and Citius Pharma are working diligently

toward closing and expect it to occur in the near future. The newly

combined public company is to be renamed Citius Oncology, Inc. and

will continue to trade on the Nasdaq stock exchange under the

symbol “CTOR.”

About the Merger

Pursuant to the business combination agreement,

TenX will acquire Citius Pharma’s wholly owned subsidiary via a

merger, with the newly combined publicly traded company to be named

Citius Oncology, Inc. In the transaction, all shares of Citius

Pharma’s wholly owned subsidiary will be converted into the right

to receive common stock of the new public company, Citius Oncology.

As a result, upon closing, Citius Pharma will hold approximately

65.6 million shares of common stock of Citius Oncology which will

represent approximately 90% of the new public company. As part of

the transaction, Citius Pharma will contribute up to $10 million in

cash to Citius Oncology to fund transaction expenses and working

capital post-closing. An additional 12.75 million existing options

will be assumed by Citius Oncology from Citius Pharma’s

subsidiary.

The description of the transaction contained

herein is only a summary and is qualified in its entirety by

reference to the business combination agreement, a copy of which

has been filed by TenX in a Current Report on Form 8-K, filed with

the U.S. Securities and Exchange Commission on October 24,

2023.

Advisors

Newbridge Securities Corporation is acting as

exclusive financial advisor to TenX and Maxim Group LLC is acting

as exclusive financial advisor to Citius Pharma. The Crone Law

Group, P.C., Han Kun Law Offices, Ogier are acting as U.S., PRC,

and Cayman legal advisors to TenX, respectively. Wyrick Robbins

Yates & Ponton LLP is acting as legal advisor to Citius Pharma

and Citius Oncology.

About TenX Keane

Acquisition

TenX Keane Acquisition is a blank check company,

also commonly referred to as a special purpose acquisition company

(SPAC) formed for the purpose of effecting a merger, share

exchange, asset acquisition, share purchase, reorganization, or

similar business combination with one or more businesses or

entities. TenX is led by Xiaofeng Yuan, Chairman and Chief

Executive Officer, and Taylor Zhang, Chief Financial Officer, who

are growth-oriented executives with a long track record of value

creation across industries.

About Citius Oncology, Inc.

Citius Oncology will serve as a platform to

develop and commercialize novel targeted oncology therapies. In

August 2024, the U.S. Food and Drug Administration (FDA) approved

LYMPHIR for an orphan indication in the treatment of adults with

relapsed or refractory cutaneous T-cell lymphoma (CTCL), a rare

form of non-Hodgkin lymphoma. Management estimates the initial

market for LYMPHIR currently exceeds $400 million, is growing and

is underserved by existing therapies. Robust intellectual property

protections that span orphan drug designation, complex technology,

trade secrets and pending patents for immuno-oncology use as a

combination therapy with checkpoint inhibitors would further

support Citius Oncology’s competitive positioning.

About LYMPHIR™

(denileukin diftitox-cxdl)

LYMPHIR is a targeted immune therapy for r/r

CTCL indicated for use in Stage I-III disease after at least one

prior systemic therapy. It is a recombinant fusion protein that

combines the IL-2 receptor binding domain with diphtheria toxin

fragments. The agent specifically binds to IL-2 receptors on the

cell surface, causing diphtheria toxin fragments that have entered

cells to inhibit protein synthesis. After uptake into the cell, the

DT fragment is cleaved and the free DT fragments inhibit protein

synthesis, resulting in cell death. Denileukin diftitox-cxdl

demonstrated the ability to deplete immunosuppressive regulatory T

lymphocytes (Tregs) and antitumor activity through a direct

cytocidal action on IL-2R-expressing tumors.

In 2021, denileukin diftitox received regulatory

approval in Japan for the treatment of CTCL and PTCL. Subsequently,

in 2021, Citius acquired an exclusive license with rights to

develop and commercialize LYMPHIR in all markets except for Japan

and certain parts of Asia.

About Citius Pharmaceuticals,

Inc.

Citius Pharma is a biopharmaceutical company

dedicated to the development and commercialization of

first-in-class critical care products. In August 2024, the FDA

approved LYMPHIR, a targeted immunotherapy for an initial

indication in the treatment of cutaneous T-cell lymphoma. Citius

Pharma’s late-stage pipeline also includes Mino-Lok®, an antibiotic

lock solution to salvage catheters in patients with

catheter-related bloodstream infections, and CITI-002 (Halo-Lido),

a topical formulation for the relief of hemorrhoids. A Pivotal

Phase 3 Trial for Mino-Lok and a Phase 2b trial for Halo-Lido were

completed in 2023. Mino-Lok met primary and secondary endpoints of

its Phase 3 Trial. Citius is actively engaged with the FDA to

outline next steps for both programs. For more information, please

visit www.citiuspharma.com.

Forward-Looking Statements

This press release may contain "forward-looking

statements" within the meaning of Section 27A of the Securities Act

of 1933 and Section 21E of the Securities Exchange Act of 1934.

Such statements are made based on our expectations and beliefs

concerning future events impacting TenX. You can identify these

statements by the fact that they use words such as "will,"

"anticipate," "estimate," "expect," "plan," "should," and "may" and

other words and terms of similar meaning or use of future dates.

Forward-looking statements are based on management's current

expectations and are subject to risks and uncertainties that could

negatively affect our business, operating results, financial

condition and stock price. Factors that could cause actual results

to differ materially from those currently anticipated are: the

planned transaction between TenX Keane Acquisition and Citius

Pharma to form Citius Oncology may not be completed for failure to

meet closing conditions or other reasons; the anticipated benefits

of the transaction may not be realized fully, if at all, or may

take longer to realize than expected; risks relating to the results

of research and development activities, including those from our

existing and any new pipeline assets; the need for substantial

additional funds; the ability to commercialize products if approved

by the FDA; the dependence on third-party suppliers; the estimated

markets for product candidates and the acceptance thereof by any

market; the ability of product candidates to impact the quality of

life of target patient populations; the ability to obtain, perform

under and maintain financing and strategic agreements and

relationships; uncertainties relating to preclinical and clinical

testing; the early stage of products under development; market and

other conditions; risks related to our growth strategy; patent and

intellectual property matters; our ability to identify, acquire,

close and integrate product candidates and companies successfully

and on a timely basis; government regulation; competition; as well

as other risks described in our SEC filings. These may be further

impacted by any future public health risks or geopolitical events.

Accordingly, these forward-looking statements do not constitute

guarantees of future performance, and you are cautioned not to

place undue reliance on these forward-looking statements. Risks

regarding our business are described in detail in our Securities

and Exchange Commission (“SEC”) filings which are available on the

SEC’s website at www.sec.gov, including in our Annual Report on

Form 10-K for the year ended December 31, 2023, filed with the SEC

on April 16, 2024, and updated by our subsequent filings with the

SEC. These forward-looking statements speak only as of the date

hereof, and we expressly disclaim any obligation or undertaking to

release publicly any updates or revisions to any forward-looking

statements contained herein to reflect any change in our

expectations or any changes in events, conditions or circumstances

on which any such statement is based, except as required by

law.

Investor Contact:

Taylor Zhangtarget@TenXkeane.com

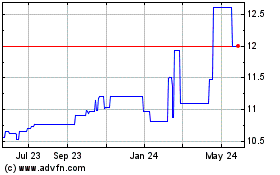

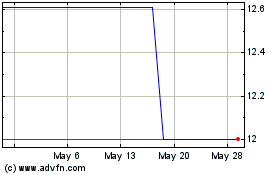

TenX Keane Acquisition (NASDAQ:TENKU)

Historical Stock Chart

From Nov 2024 to Dec 2024

TenX Keane Acquisition (NASDAQ:TENKU)

Historical Stock Chart

From Dec 2023 to Dec 2024