false 0001556263 0001556263 2024-01-08 2024-01-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 08, 2024

Syros Pharmaceuticals, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

| Delaware |

|

001-37813 |

|

45-3772460 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

|

|

| 35 CambridgePark Drive 4th Floor |

|

|

| Cambridge, Massachusetts |

|

|

|

02140 |

| (Address of Principal Executive Offices) |

|

|

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: (617) 744-1340

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

|

SYRS |

|

The Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01 |

Regulation FD Disclosure. |

From time to time, Syros Pharmaceuticals, Inc. (the “Company”) intends to conduct meetings with third parties in which its current corporate slide presentation is presented. A copy of this slide presentation, dated January 2024, is furnished as Exhibit 99.1 to this Current Report on Form 8-K. The information responsive to Item 7.01 of this Form 8-K and Exhibit 99.1 hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as expressly set forth by specific reference in such a filing.

On January 8, 2024, the Company issued a press release announcing its 2024 anticipated milestones. The full text of this press release is filed as Exhibit 99.2 to this Current Report on Form 8-K and is incorporated herein by reference. The information contained on the websites referenced in the press release is not incorporated herein.

| Item 9.01 |

Financial Statements and Exhibits. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

Syros Pharmaceuticals, Inc. |

|

|

|

|

| Date: January 8, 2024 |

|

|

|

By: |

|

/s/ Jason Haas |

|

|

|

|

|

|

Jason Haas Chief Financial Officer |

Advancing Novel Treatments for

Hematologic Malignancies JP Morgan Conference January 2024 Exhibit 99.1

Forward-looking statements This

presentation contains forward-looking statements (including within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended) concerning Syros and other matters, such as

Syros’ clinical development plans, including with respect to tamibarotene, Syros’ ability to deliver benefit to patients and value to stockholders, the timing and impact of upcoming enrollment milestones and clinical data readouts, and

the sufficiency of Syros’ capital resources to fund its operating expenses and capital expenditure requirements into the second quarter of 2025. These statements may discuss goals, intentions and expectations as to future plans, trends,

events, results of operations or financial condition, or otherwise, based on management’s current beliefs, as well as assumptions made by, and information currently available to, management. Forward-looking statements generally include

statements that are predictive in nature and depend upon or refer to future events or conditions, and include words such as “may,” “will,” “should,” “would,” “expect,”

“anticipate,” “plan,” “likely,” “believe,” “estimate,” “project,” “intend,” and other similar expressions. Statements that are not historical facts are

forward-looking statements. Forward-looking statements are based on current beliefs and assumptions that are subject to risks and uncertainties and are not guarantees of future performance. Actual results could differ materially from those contained

in any forward-looking statement as a result of various factors, including, without limitation, Syros’ ability to: advance the development of its programs, including tamibarotene, under the timelines it projects in current and future clinical

trials; demonstrate in any current and future clinical trials the requisite safety, efficacy and combinability of its drug candidates; sustain the response rates and durability of response seen to date with its drug candidates; successfully develop

a companion diagnostic test to identify patients with the RARA biomarker; obtain and maintain patent protection for its drug candidates and the freedom to operate under third party intellectual property; obtain and maintain necessary regulatory

approvals; identify, enter into out-licensing arrangements with third parties; manage competition; manage expenses; raise the substantial additional capital needed to achieve its business objectives; attract and retain qualified personnel; and

successfully execute on its business strategies. The foregoing review of important factors that could cause actual events to differ from expectations should not be construed as exhaustive and should be read in conjunction with statements that

are included herein and elsewhere, including the risk factors included in Syros’ Annual Report on Form 10-K for the year ended December 31, 2022 and Syros’ Quarterly Report on Form 10-Q for the quarter ended September 30, 2023, each of

which is on file with the Securities and Exchange Commission (SEC). Except as required by applicable law, Syros undertakes no obligation to revise or update any forward-looking statement, or to make any other forward-looking statements, whether as a

result of new information, future events or otherwise.

Advancing our vision to deliver on the

value of tamibarotene Commercial company delivering new standard of care for frontline treatment of hematologic malignancies Advancing tamibarotene as a potential new standard of care for HR-MDS and AML patients with RARA gene overexpression

Preparing for product launch and commercialization Cash runway to fund planned operations into Q2 of 2025 Now Vision

Advancing

Tamibarotene: Potential to establish new standard of care for the frontline treatment of hematologic malignancies LARGE MARKET OPPORTUNITIES IN FRONTLINE SETTINGS Building a

focused infrastructure to support targeted patient populations underserved by existing options MEANINGFUL NEAR-TERM CATALYSTS Upcoming opportunities to build momentum and create value:

pivotal SELECT-MDS-1 data and additional randomized SELECT-AML-1 data, both expected in 2024 ENCOURAGING, CONSISTENT DATA FROM MULTIPLE CLINICAL TRIALS SUPPORT DEVELOPMENT STRATEGY Growing body of evidence in MDS and AML patients with RARA

overexpression $45M FINANCING ADDS TO STRONG CORPORATE POSITION: CASH RUNWAY TO FUND OPERATIONS INTO Q2 OF 2025

Multiple near-term value-driving

milestones and pre-launch activities underway Last patient enrolled for the pivotal CR data from SELECT-MDS-1 Phase 3 trial Pivotal data from SELECT-MDS-1 Phase 3 trial Initial data from randomized SELECT-AML-1 trial

Dec. 2023 Additional data from randomized SELECT-AML-1 trial 2024 1Q 24 By mid-4Q 24 Tamibarotene in newly diagnosed HR-MDS Tamibarotene in newly diagnosed unfit AML Educating and preparing the treatment community for tamibarotene and RARA

overexpression Planning distribution and sales infrastructure Partnered with Qiagen to ensure RARA testing availability at launch Pre-launch activities ��

Tamibarotene: Compelling profile that

addresses large targeted populations Tamibarotene is a selective and potent RARa agonist1 1McKeown, Cancer Discovery 2017; 2de Botton S., et al. Blood Advances 2022 ~50% of patients with AML are positive for RARA overexpression2 ~30%

Normal RARA overexpression with tamibarotene RARA overexpression without tamibarotene of patients with HR-MDS are positive for RARA overexpression2

Growing body of clinical evidence for

tamibarotene in HR-MDS and AML patients with RARA overexpression supports development strategy 1Data presented at ASH 2017, and Syros Data on File; 2de Botton S., et al. Blood Advances 2022; 3Response includes CR, CRi or CRh; 4Data presented by

Syros 06Dec2023 Single-agent tamibarotene in R/R HR-MDS patients1 Phase 2 initial randomized data evaluating Tami/Ven/Aza vs. Ven/Aza in ND unfit AML patients4 Phase 2 data evaluating Tami/Aza in ND unfit AML patients2 Tamibarotene in

HR-MDS Tami/Ven/Aza Median time to response: 21 days including one marrow CR 60% Hematologic response1 61% CR/CRi Rate 67% CR in low-blast subset Median time to response3: 1.2 months Median duration of response: 10.8 months Overall survival for

complete responders: 18 months 72% Transfusion independence 2023 2017 2020 CR/CRi 70% CR/CRi TREATMENT ARM: Tami/Ven/Aza CONTROL ARM: Ven/Aza 78% CR 22% CRi 30% CR 40% CRi 100% Tamibarotene in AML

Tamibarotene has demonstrated a

well-tolerated safety profile 1Amnolake® post-marketing surveillance data on file; 2Data presented at ASH 2017; 3de Botton S., et al. Blood Advances 2022; 4Data presented at ASH 2022; 5Data presented by Syros 06Dec2023 50% CRi 33% CR Data from

randomized portion of SELECT-AML-1 trial Phase 2 trial expected 2023 / 2024 Single agent in AML and MDS patients and doublet (Tami/Aza) in AML patients2,3 Triplet (Tami/Ven/Aza) in AML patients4,5 Safety profile supports use of tamibarotene in

combination with azacitidine in MDS and with venetoclax/azacitidine in AML Daily dosing of tamibarotene as a single-agent and in combination with azacitidine has been generally well-tolerated.2-5 No evidence of increased toxicity in combination,

with rates of myelosuppression comparable to single-agent azacitidine.2-5 As a triplet, myelosuppression has been comparable to venetoclax + azacitidine4,5 The majority of non-hematologic AEs have been low grade and

reversible2-5 Well-characterized in over 1,000 acute promyelocytic leukemia (“APL”) patients treated with tamibarotene1

Significant unmet need in newly

diagnosed unfit AML 1 Ferrara F., Clin Lymphoma Myeloma Leuk. 2011; 2DiNardo CD, et al., New England Journal of Medicine, 2020; 3Maiti A., et al., Haematologica, 2021. Acute myeloid leukemia (AML) is a cancer of the blood forming cells in the

bone marrow ~50% of the patients are not eligible for intensive treatment and are considered “unfit”1 Venetoclax with azacitidine is standard of care, with a 66% CR/CRi, 37% CR rate and median OS of 14.7 months2 Approximately 1/3 of

patients do not respond, and nearly all relapse with a very poor prognosis, median OS of 2.4 months3 Normal AML The standard of care falls short, underscoring the critical demand for improved treatments for newly diagnosed unfit AML

patients

Randomized portion of trial ~80

patients Tamibarotene + venetoclax + azacitidine Venetoclax + azacitidine randomization (1:1) Safety lead-in completed Ongoing SELECT-AML-1 Phase 2 trial of triplet regimen (Tami/Ven/Aza) in newly diagnosed unfit AML patients with RARA

overexpression Key Milestones Initial randomized SELECT-AML-1 clinical data from 23 enrolled patients^ Additional data from randomized SELECT-AML-1 trial Primary endpoint1 CR/CRi rate 2024 �� 1 The study is 80% powered to detect a

difference between the CR/CRi rates in the experimental and control arms ^ Data presented by Syros 06Dec2023; Data cut-off was November 13, 2023

Initial randomized SELECT-AML-1

Phase 2 data in newly diagnosed unfit AML patients with RARA overexpression demonstrate 100% CR/CRi rate CR/CRi Rate 70% CR/CRi Rate 100% CONTROL ARM: Ven/Aza TREATMENT ARM: Tami/Ven/Aza 22% CRi 78% CR CR Rate 78% CR/CRi Rate N=9 30% CR CR/CRi Rate

N=10 CR Rate 30% Data presented by Syros 06Dec2023; Data cut-off was November 13, 2023 Initial randomized data builds on previous reported data from the safety lead-in: Tamibarotene in combination with venetoclax and azacitidine was well

tolerated with no new safety signals identified 40% CRi

Initial randomized SELECT-AML-1

Phase 2 data: Hematologic safety profile shows no additive myelosuppression when combining tamibarotene with Ven/Aza Febrile neutropenia Neutropenia Thrombocytopenia Leukopenia Anemia Hematologic AEs - All Causality Tami/Ven/Aza Safety Population,

N=11; Ven/Aza Safety Population, N=12* * Includes 1 patient randomized to Tami/Ven/Aza who received Ven/Aza and discontinued treatment prior to receiving tamibarotene. ^ No low-grade (Grade 1/Grade 2) Hematology AEs were reported for patients in

either arm of the study. Preferred Term Regimen TEAEs reported were all Grade 3 or 4 ^ Tami/Ven/Aza Ven/Aza

1 Greenberg, Blood, 2012; 2Garcia,

J et al., Leukemia Research, 2021; 3Elihu Estey, et al., Blood 2022 Higher-Risk MDS (HR-MDS) is closely related to AML Myelodysplastic syndrome (MDS) is also a cancer of the blood forming cells in the bone marrow HR-MDS often is a precursor to AML.

More than half of HR-MDS patients progress to AML1 Azacitidine, a hypomethylating agent (HMA), is SOC with a 17% CR rate and a median OS of 18.6 months2 There is a significant need for new therapies - no new therapies beyond HMAs

approved since 2006 “MDS-excess blasts” and “AML” essentially form a continuum…Rather than blast percentage, disease categorization may be more accurate if based on biologic features.” – Estey et al.,

20223 Precursor States AML HR-MDS LR-MDS

Ongoing SELECT-MDS-1 Phase 3 trial

in newly diagnosed HR-MDS patients with RARA overexpression Robustly designed, double-blind, placebo-controlled study 2:1 randomization Global study with over 120 sites recruiting in 13 countries FDA feedback supports: Focus on population with RARA

overexpression CR as primary endpoint for approval (full or accelerated) with supporting data on durability of remission Azacitidine as appropriate comparator Primary endpoint of CR rate is over 90% powered to detect a difference between

experimental and control arms with a one-sided alpha of 0.025 Inclusion of OS key secondary endpoint will allow this single trial to efficiently serve as a confirmatory study if needed for full approval Fast Track Designation by the FDA Key

Milestones Last patient enrolled for the pivotal CR data from SELECT-MDS-1 Phase 3 trial 1Q 24 Pivotal data from SELECT-MDS-1 Phase 3 trial SELECT-MDS-1 trial randomization (2:1) Tamibarotene + azacitidine

Placebo + azacitidine Primary endpoint CR rate (190 patients) Key secondary endpoint Overall Survival (OS) (~550 patients) by mid-4Q 24

Experienced leadership team with

proven capabilities and expertise in launching targeted oncology medicines Planning our distribution and sales infrastructure strategy for a launch in the U.S. Targeted patient populations will allow for a focused, specialized sales force

Partnered with Qiagen to ensure RARA testing availability Planning our commercial launch in the United States

Large market opportunities in

frontline settings ~25,000 Newly Diagnosed Unfit AML patients in US and EU annually2 Building infrastructure to target synergistic patient populations underserved by existing options ~21,000 Newly Diagnosed HR-MDS patients in the US and EU annually1

~$4.7B3 MYELODYSPLASTIC SYNDROME (MDS) ACUTE MYELOID LEUKEMIA (AML) PROJECTED MDS GLOBAL MARKET BY 2028: ~$7.5B4 PROJECTED AML GLOBAL MARKET BY 2028: 1Epidemiology projections from DRG Myelodysplastic Syndromes-Landscape &

Forecast-Report 2020 and from DRG Acute Myelogenous Leukemia-Landscape & Forecast-Report 2020; 2Epidemiology projections from DRG Acute Myelogenous Leukemia-Landscape & Forecast-Report 2020; 3Evaluate Pharma global market estimate

includes all risk groups for MDS; 4Global market estimate includes all AML (fit and unfit)

Multiple near-term value-driving

milestones and pre-launch activities underway Last patient enrolled for the pivotal CR data from SELECT-MDS-1 Phase 3 trial Pivotal data from SELECT-MDS-1 Phase 3 trial Initial data from randomized SELECT-AML-1 trial

Dec. 2023 Additional data from randomized SELECT-AML-1 trial 2024 1Q 24 by mid-4Q 24 Tamibarotene in newly diagnosed HR-MDS Tamibarotene in newly diagnosed unfit AML Educating and preparing the treatment community for tamibarotene and RARA

overexpression Planning distribution and sales infrastructure Partnered with Qiagen to ensure RARA testing availability at launch Pre-launch activities ��

Exhibit 99.2

Syros Highlights Anticipated 2024 Milestones to Deliver on the Value of Tamibarotene

— On-Track to Complete Enrollment of 190 patients for Primary Analysis in SELECT-MDS-1 Phase 3 Trial in 1Q 2024;

Pivotal CR Data

Expected by Mid-4Q 2024 —

— Additional Data from

SELECT-AML-1 Phase 2 Trial Expected in 2024; Initial Data Demonstrated 100% CR/CRi Rate

and Favorable Tolerability Profile —

— Strengthened Balance Sheet with Gross Proceeds of Approximately $45.0 Million from Recent Equity Financing,

Extending Cash Runway into 2Q 2025 —

CAMBRIDGE, Mass., January 8, 2024 – Syros Pharmaceuticals (NASDAQ:SYRS), a biopharmaceutical company committed to advancing new standards of care

for the frontline treatment of hematologic malignancies, today highlighted anticipated 2024 milestones to deliver on the value of tamibarotene.

“We

are beginning the year with tremendous momentum toward our mission of delivering tamibarotene as a new standard of care for the frontline treatment of hematologic malignancies,” said Conley Chee, Chief Executive Officer of Syros

Pharmaceuticals. “Last month, we announced encouraging initial data from the randomized portion of the SELECT-AML-1 Phase 2 trial, which demonstrated a 100% CR/CRi

rate and favorable tolerability, strongly supporting continued development in AML and HR-MDS. In addition, we closed an approximately $45.0 million equity financing, providing us additional capital to

advance the development of tamibarotene. We are continuing pre-launch activities, including efforts to drive awareness of tamibarotene and of RARA overexpression in support of a future launch.”

Mr. Chee continued, “Following these achievements, we are preparing for an important transformation. By the middle of the fourth quarter of

2024, we expect to report pivotal data from the SELECT-MDS-1 Phase 3 clinical trial. If successful, these data will allow us to file our first New Drug Application and,

ultimately, to deliver tamibarotene to the thousands of HR-MDS patients in need of better options. We also plan to report additional data from

SELECT-AML-1, which we expect will build on our growing body of clinical evidence and continue to demonstrate a highly differentiated product profile. We look forward to

these major milestones as we work to deliver better outcomes to the many HR-MDS and AML patients with RARA overexpression.”

Program Updates and Expected Milestones

Syros is

developing tamibarotene, an oral, first-in-class selective retinoic acid receptor alpha (RARα) agonist for the frontline treatment of higher-risk myelodysplastic

syndrome (HR-MDS) and acute myeloid leukemia (AML) in patients with RARA gene overexpression. Syros believes tamibarotene – a biologically targeted agent that has demonstrated high complete

response rates, a rapid time to response and favorable tolerability across multiple clinical trials to date – has the potential to set a new standard of care for patients with RARA overexpression, which accounts for approximately

50 percent of the HR-MDS and 30 percent of the AML populations.

Syros is currently evaluating

tamibarotene in combination with azacitidine in newly diagnosed HR-MDS patients with RARA overexpression in the ongoing

SELECT-MDS-1 Phase 3 trial. The primary endpoint of SELECT-MDS-1 is the complete response

(CR) rate. Syros expects to complete enrollment of the 190 patients necessary to support the CR primary endpoint analysis in the first quarter of 2024 and to report pivotal CR data by the middle of the fourth quarter of 2024.

Syros is also evaluating tamibarotene in combination with venetoclax and azacitidine in newly diagnosed unfit AML patients with RARA overexpression. In

December, Syros announced encouraging initial data from the ongoing randomized SELECT-AML-1 Phase 2 trial, demonstrating a 100% CR/CRi rate in response-evaluable

patients treated with the triplet regimen of tamibarotene, venetoclax and azacitidine, as compared to 70% among patients treated with venetoclax and azacitidine alone. The median time to CR/CRi response was rapid; all patients treated with the

triplet regimen achieved a CR/CRi by the end of cycle one. Consistent with prior clinical experience reported last

year, tamibarotene in combination with approved doses of venetoclax and azacitidine was generally well tolerated, and the overall safety profile demonstrated no additive toxicities or new safety

signals, and no evidence of increased myelosuppression compared to treatment with the doublet combination of venetoclax and azacitidine. Syros expects to report additional data from

SELECT-AML-1 in 2024.

Financial Guidance

Based on its current operating plans, and including gross proceeds of approximately $45.0 million received in its December 2023 equity offering before

underwriting discounts and commissions and offering expenses, Syros expects that its existing cash, cash equivalents and marketable securities will be sufficient to fund its anticipated operating expenses and capital expenditure requirements into

the second quarter of 2025, beyond the Phase 3 data from the SELECT-MDS-1 trial and additional data from

SELECT-AML-1.

About Syros Pharmaceuticals

Syros is committed to developing new standards of care for the frontline treatment of patients with hematologic malignancies. Driven by the motivation to help

patients with blood disorders that have largely eluded other targeted approaches, Syros is developing tamibarotene, an oral selective RARα agonist in frontline patients with higher-risk myelodysplastic syndrome and acute myeloid leukemia with

RARA gene overexpression. For more information, visit www.syros.com and follow us on Twitter (@SyrosPharma) and LinkedIn.

Cautionary Note

Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning of The Private Securities Litigation

Reform Act of 1995, including without limitation statements regarding Syros’ clinical development plans, including with respect to the progression of its clinical trials involving tamibarotene and related

pre-launch activities, the timing and impact of upcoming clinical data readouts, the timing to complete enrollment of the 190 patients necessary to support the CR primary endpoint analysis in SELECT-MDS-1, the therapeutic potential of tamibarotene, and the sufficiency of Syros’ capital resources to fund its operating expenses and capital expenditure

requirements into the second quarter of 2025. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “hope,” “intend,” “may,”

“plan,” “potential,” “predict,” “project,” “target,” “should,” “would,” and similar expressions are intended to identify forward-looking statements, although not all

forward-looking statements contain these identifying words. Actual results or events could differ materially from the plans, intentions and expectations disclosed in these forward-looking statements as a result of various important factors,

including Syros’ ability to: advance the development of its programs under the timelines it projects in current and future clinical trials; demonstrate in any current and future clinical trials the requisite safety, efficacy and combinability

of its drug candidates; sustain the response rates and durability of response seen to date with its drug candidates; successfully develop a companion diagnostic test to identify patients with the RARA biomarker; obtain and maintain patent

protection for its drug candidates and the freedom to operate under third party intellectual property; obtain and maintain necessary regulatory approvals; identify, enter into and maintain collaboration agreements with third parties; manage

competition; manage expenses; raise the substantial additional capital needed to achieve its business objectives; attract and retain qualified personnel; and successfully execute on its business strategies; risks described under the caption

“Risk Factors” in Syros’ Annual Report on Form 10-K for the year ended December 31, 2022 and Quarterly Report on Form 10-Q for the quarter ended

September 30, 2023, each of which is on file with the Securities and Exchange Commission; and risks described in other filings that Syros makes with the Securities and Exchange Commission in the future.

Syros Contact

Karen Hunady

Director of Corporate Communications & Investor Relations

1-857-327-7321

khunady@syros.com

Investor Contact

Hannah Deresiewicz

Stern Investor Relations, Inc.

212-362-1200

hannah.deresiewicz@sternir.com

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

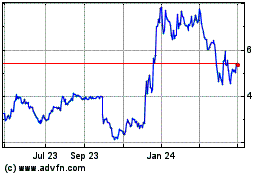

Syros Pharmaceuticals (NASDAQ:SYRS)

Historical Stock Chart

From Nov 2024 to Dec 2024

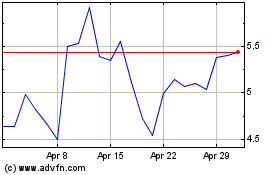

Syros Pharmaceuticals (NASDAQ:SYRS)

Historical Stock Chart

From Dec 2023 to Dec 2024