Filed Pursuant to Rule 424(b)(3)

Registration No. 333-275365

PROSPECTUS SUPPLEMENT

(To Prospectus dated November 15, 2023)

6,000,000 American Depositary Shares, each representing

ten (10) Ordinary Shares

This

prospectus supplement, or the Supplement, modifies, supersedes and supplements certain information contained in, and should be read in

conjunction with, that certain prospectus originally filed with the Securities and Exchange Commission, or the SEC, by Steakholder Foods

Ltd., the Company, dated November 15, 2023, or the Prospectus, and subsequently amended, related to the resale by the selling shareholders

named therein of up to an aggregate of 6,000,000 American Depositary Shares, or ADSs, each ADS representing ten (10) ordinary shares,

no par value, issuable upon the exercise of warrants originally issued in a private placement on July 27, 2023, or the July 2023 Private

Placement, at an exercise price of $1.10 per ADS, subject to customary adjustment as set forth therein.

Our ADSs are listed on the

Nasdaq Capital Market under the symbol “STKH.” The last reported sale price of our ADSs on January 24, 2024 was $0.4725 per

ADS.

The

information contained in this Supplement modifies and supersedes, in part, the information in the Prospectus. This Supplement is not complete

without, and may not be delivered or used except in connection with, the Prospectus. Any information that is modified or superseded in

the Prospectus shall not be deemed to constitute a part of the Prospectus, except as modified or superseded by this Supplement.

We

may amend or supplement the Prospectus from time to time by filing amendments or supplements as required. You should read the entire Prospectus

and any amendments or supplements carefully before you make an investment decision. This Supplement

amends only those sections of the Prospectus contained in this Supplement; all other sections of the prospectus supplement remain unchanged.

Investing

in our securities involves risks. See “Risk Factors” on page 5 of the Prospectus and in the documents incorporated by

reference into the Prospectus, including the risks described under “Risk Factors” in our Annual Report on Form 20-F for the

year ended December 31, 2022.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this Supplement or the Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

FORWARD-LOOKING STATEMENTS

You

should carefully consider the risk factors set forth in or incorporated by reference into the Prospectus, as well as the other information

contained in or incorporated by reference into this Supplement and the Prospectus. This Supplement, the Prospectus and documents incorporated

therein by reference contain forward-looking statements regarding events, conditions, and financial trends that may affect our plan of

operation, business strategy, operating results, and financial position. You are cautioned that any forward-looking statements are not

guarantees of future performance and are subject to risks and uncertainties. Actual results may differ materially from those included

within the forward-looking statements as a result of various factors. Cautionary statements in the “Risk Factors” section

of the Prospectus and the reports incorporated by reference therein identify important risks and uncertainties affecting our future, which

could cause actual results to differ materially from the forward-looking statements made or included in this Supplement and the Prospectus.

AMENDMENTS TO EXISTING

WARRANTS

This Supplement is being

filed to disclose the following:

On

January 24, 2024, the Company entered into an inducement offer letter agreement, or the Inducement Letter, with a certain holder, or the

Holder, of certain of the Company’s existing warrants to purchase up to (i) 6,000,000 of the Company’s ADSs issued on July

27, 2023 at an exercise price of $1.10 per ADS, or the July 2023 Warrants, (ii) 6,500,000 of the Company’s ADSs issued on January

10, 2023 at an exercise price of $1.00 per ADS, or the January 2023 Warrants, and (iii) 1,857,143 of the Company’s ADSs issued on

July 5, 2022 at an exercise price of $1.00 per ADS, or the July 2022 Warrants, and together with the July 2023 Warrants and the January

2023 Warrants, the Existing Warrants.

Pursuant to the Inducement Letter, the Holder agreed to exercise for

cash its Existing Warrants to purchase an aggregate of 14,357,143 of the Company’s ADSs at a reduced exercise price of $0.46 per

ADS in consideration of the Company’s agreement to issue new warrants to purchase ADSs, or the New Warrants, to purchase up to an

aggregate of 28,714,286 ADSs, or the New Warrant Shares, at an exercise price of $0.485 per ADS. The Company expects to receive aggregate

gross proceeds of approximately $6.6 million from the exercise of the Existing Warrants by the Holder, before deducting placement agent

fees and other offering expenses payable by the Company.

The

closing of the transactions contemplated pursuant to the Inducement Letter is expected to occur on or about January 29, 2024, subject

to satisfaction of customary closing conditions. The Company expects to use the net proceeds from the transactions contemplated in the

Inducement Letter as working capital for general corporate purposes.

The date of this Prospectus

Supplement is January 24, 2024.

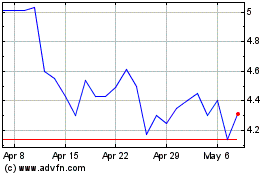

Steakholder Foods (NASDAQ:STKH)

Historical Stock Chart

From Jun 2024 to Jul 2024

Steakholder Foods (NASDAQ:STKH)

Historical Stock Chart

From Jul 2023 to Jul 2024