Solid Power Announces $50 Million Share Repurchase Authorization

January 23 2024 - 8:00AM

Solid Power, Inc. ("Solid Power") (Nasdaq: SLDP), a leading

developer of solid-state battery technology, today announced that

its Board of Directors has authorized the repurchase of up to $50

million of the company’s common stock.

“This program is a reflection of our strong cash position and

commitment to creating shareholder value,” said John Van Scoter,

President and Chief Executive Officer of Solid Power, Inc. “It is

driven by our view that Solid Power’s shares are undervalued and

demonstrates confidence in our progress. We believe that with our

unique capital-light business model, we can opportunistically buy

back shares while continuing to drive technology development.”

Repurchases may be made at management’s discretion from time to

time on the open market or through privately negotiated

transactions. The repurchase program expires December 31, 2025, may

be suspended for periods or discontinued at any time, and does not

obligate the Company to acquire any amount of shares.

About Solid Power, Inc.Solid

Power is developing solid-state battery technology to enable the

next generation of batteries for the fast-growing EV and other

markets. Solid Power’s core technology is its electrolyte material,

which Solid Power believes can enable extended driving range,

longer battery life, improved safety, and lower cost compared to

traditional lithium-ion. Solid Power’s business model – selling its

electrolyte to cell manufacturers and licensing its cell designs

and manufacturing processes – distinguishes the company from many

of its competitors who plan to be commercial battery manufacturers.

For more information,

visit http://www.solidpowerbattery.com/.

Forward-Looking StatementsAll

statements other than statements of present or historical fact

contained herein are “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended,

including Solid Power’s or its management team’s expectations,

objectives, beliefs, intentions or strategies regarding the future

and statements relating to Solid Power’s plans regarding share

repurchases. When used herein, the words “could,” “should,” “will,”

“may,” “believe,” “anticipate,” “intend,” “estimate,” “expect,”

“project,” “plan,” “outlook,” “seek,” the negative of such terms

and other similar expressions are intended to identify

forward-looking statements, although not all forward-looking

statements contain such identifying words. These forward-looking

statements are based on management’s current expectations and

assumptions about future events and are based on currently

available information as to the outcome and timing of future

events. Except as otherwise required by applicable law, Solid Power

disclaims any duty to update any forward-looking statements, all of

which are expressly qualified by the statements in this section, to

reflect events or circumstances after the date hereof. Readers are

cautioned not to put undue reliance on forward-looking statements

and Solid Power cautions you that these forward-looking statements

are subject to numerous risks and uncertainties, most of which are

difficult to predict and many of which are beyond the control of

Solid Power, including the following factors: (i) risks

relating to the uncertainty of the success of our research and

development efforts, including our ability to achieve the

technological objectives or results that our partners require, and

to commercialize our technology in advance of competing

technologies; (ii) risks relating to the non-exclusive nature

of our original equipment manufacturers and joint development

agreement relationships; (iii) our ability to negotiate,

execute, and perform on our agreements on commercially reasonable

terms; (iv) rollout of our business plan and the timing of expected

business milestones; (v) delays in the construction and operation

of production facilities; (vi) our ability to protect our

intellectual property, including in jurisdictions outside of the

United States; (vii) broad market adoption of EVs and other

technologies where we are able to deploy our cell technology and

electrolyte material, if developed successfully; (viii) our

success in retaining or recruiting, or changes required in, our

officers, key employees, including technicians and engineers, or

directors; (ix) risks and potential disruptions related to

management and board of directors transitions; (x) changes in

applicable laws or regulations; (xi) risks related to

technology systems and security breaches; (xii) the

possibility that we may be adversely affected by other economic,

business or competitive factors, including supply chain

interruptions, and may not be able to manage other risks and

uncertainties; (xiii) risks relating to our status as a

research and development stage company with a history of financial

losses, and an expectation to incur significant expenses and

continuing losses for the foreseeable future; (xiv) the

termination or reduction of government clean energy and electric

vehicle incentives; (xv) changes in domestic and foreign

business, market, financial, political and legal conditions; and

(xvi) our ability to implement our plans regarding share

repurchases. Additional information concerning these and other

factors that may impact the operations and projections discussed

herein can be found in the “Risk Factors” sections of Solid Power’s

Annual Report on Form 10-K for the year ended December 31, 2022 and

Quarterly Report on Form 10-Q for the quarter ended March 31, 2023

and other documents filed by Solid Power from time to time with the

SEC, all of which are available on the SEC’s website at

www.sec.gov. These filings identify and address other important

risks and uncertainties that could cause actual events and results

to differ materially from those contained in the forward-looking

statements. Solid Power gives no assurance that it will achieve its

expectations.

Contact InformationKevin PaprzyckiChief

Financial Officer1 (800)

799-7380investors@solidpowerbattery.com

Website: www.solidpowerbattery.com

Source: Solid Power, Inc.

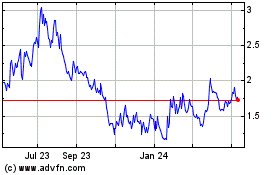

Solid Power (NASDAQ:SLDP)

Historical Stock Chart

From Dec 2024 to Jan 2025

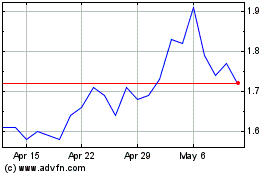

Solid Power (NASDAQ:SLDP)

Historical Stock Chart

From Jan 2024 to Jan 2025