SoFi to Award a Total of $500,000 to 50 People

Working to Improve Women’s Financial Independence and Inspire All

to Achieve Their Financial Ambitions

In honor of the 50th anniversary of the Equal Credit Opportunity

Act (ECOA), SoFi (NASDAQ: SOFI), the one-stop shop for digital

personal financial services, has teamed up with tennis champion,

entrepreneur and author Venus Williams and Los Angeles Sparks

forward Cameron Brink to launch the Give Her Credit campaign. With

this national initiative, SoFi will begin accepting submissions to

award $500,000 to 50 people (each receiving $10,000) to help

further advance women’s financial independence and help inspire

their financial ambitions.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20241015124751/en/

SoFi Partners with Venus Williams and

Cameron Brink to Launch the ‘Give Her Credit’ Campaign in Honor of

the 50th Anniversary of the Equal Credit Opportunity Act. (Photo:

Business Wire)

Before the ECOA, banks could restrict women from getting loans,

credit cards, as well as access to other credit based financial

products without a male co-signer. But today, thanks in large part

to this law, 90% of women either manage or share household

financial decisions with their partner,1 and single women own more

homes than single men.2 SoFi, along with Venus Williams and Cameron

Brink, will commemorate the accomplishments made in women’s

financial independence since the passage of the ECOA and recognize

how much work is left to achieve true financial equality.

When this groundbreaking law was signed on October 28, 1974 and

eventually expanded to other historically marginalized groups, it

dramatically reshaped people’s financial autonomy, making it

illegal to deny credit mainly based on gender, marital status, or

race. The ECOA prevented financial institutions from discriminating

against over half of the U.S. population, effectively opening the

door for more women to take control of their personal finances and

pursue their ambitions with newfound financial independence.

“At an early age, I had clear ambitions and drive to be the

best, with the discipline and determination to win, but soon

learned of the inequalities and imbalances I would have to face to

succeed,” said Venus Williams, who will serve as a judge for the

‘Give Her Credit’ campaign. “I am very proud to partner with SoFi

to help identify people who are helping women across the country to

reach their financial independence. This campaign is about more

than just celebrating progress – it’s about creating real

opportunities for financial independence that empower the next

generation of women to dream big and win.”

Cameron Brink, SoFi’s newest brand athlete added, “Partnering

with SoFi on the 50th anniversary of the ECOA through the Give Her

Credit campaign is deeply personal to me. As a female athlete, I’ve

seen firsthand how vital financial independence is to women’s

progress, and it’s been a key part of the conversations I’ve had to

navigate my own career. Just fifty years ago, women like me

wouldn’t have had access to credit or the opportunities I have

today. While we've come a long way, there's still work to do. This

campaign isn’t just about celebrating progress—it’s about ensuring

the next generation of women have the financial tools and

confidence to take control of their futures.”

While significant progress has been made over the last five

decades, the financial gap for women persists. According to a

recent SoFi survey, 77% of female SoFi members believe they can

accomplish any financial goal they set,3 yet, only 51% of women

reported feeling confident managing their finances. Even more

concerning, for the first time in 20 years, the U.S. Census

recorded a 'statistically significant' decline in the ratio of

female-to-male earnings — with women working full-time earning on

average just 83 cents for every dollar paid to a man in 2023, a

slight dip from the 84 cents marked in the agency's 2022 report.4

Studies also show that women often receive lower credit limits than

men,5 face higher interest rates,6 and are less likely to secure

lower APRs when requested.7

“As we celebrate the 50th anniversary of the ECOA, we reflect on

a pivotal milestone that has transformed the financial landscape

for women,” says Liz Young Thomas, Head of Investment Strategy at

SoFi. “The ECOA was a significant milestone in protecting women’s

ability to independently access credit, ultimately paving the way

for greater financial independence. At SoFi, we recognize the

importance of continuing this legacy, and I’m proud that through

our Give Her Credit initiative, we’ll support efforts to further

advance women’s financial independence. SoFi remains committed to

driving progress and ensuring that every woman has the opportunity

to build a secure financial future.”

How to Enter the Give Her Credit Campaign:

- Open call for entries:

- Submissions must be entered at www.SoFi.com/givehercredit

starting on October 15, 2024, and ending on November 13, 2024, at

11:59 pm PT.

- $10k Winners will be notified in early December, 2024, with the

official announcement taking place in January 2025.

- Submission requirements:

- Individuals will be asked to outline a project supporting

women’s financial independence.

- These projects can be existing efforts or new initiatives

inspired by the award.

- Submissions will be judged on their potential impact, ability

to inspire others, rationale for success, and the clear use of

funds.

- Eligibility:

- Entrants must be 18+ and legal residents of the United

States.

To learn more about SoFi’s Give Her Credit campaign, full entry

details, eligibility, and terms and conditions, please visit

SoFi.com/givehercredit.

About SoFi

SoFi (NASDAQ: SOFI) is a member-centric, one-stop shop for

digital financial services on a mission to help people achieve

financial independence to realize their ambitions. The company's

full suite of financial products and services helps its more than

7.5 million SoFi members borrow, save, spend, invest, and protect

their money better by giving them fast access to the tools they

need to get their money right, all in one app. SoFi also equips

members with the resources they need to get ahead – like, financial

planners, exclusive experiences and events, and a thriving

community – on their path to financial independence.

SoFi innovates across three business segments: Lending,

Financial Services – which includes SoFi Checking and Savings, SoFi

Invest, SoFi Credit Card, and SoFi Relay – and Technology Platform,

which offers the only end-to-end vertically integrated financial

technology stack servicing 150 million users across the world. SoFi

Bank, N.A., an affiliate of SoFi, is a nationally chartered bank,

regulated by the OCC and FDIC and SoFi is a bank holding company

regulated by the Federal Reserve. The company is also the naming

rights partner of SoFi Stadium, home of the Los Angeles Chargers

and the Los Angeles Rams. For more information, visit SoFi.com or

download our iOS and Android apps.

1 GOBankingRates - What Is the State of Women & Money in

2024? 2 Pew Research - Single women own more homes than single men

in the U.S., but that edge is narrowing 3 SoFi Study: Women &

Financial Accomplishments (August - September, 2024) 4 Institute of

Women’s Policy Research - National Gender Wage Gap Widens

Significantly in 2023 for the First Time in 20 Years! 5 Federal

Reserve Bank Philadelphia - Decomposing Gender Differences in

Bankcard Credit Limits 6 American Progress - The Economic,

Educational, and Health-Related Costs of Being a Woman 7 Lending

Tree - Despite Federal Reserve Rate Hikes, 76% of Lower Credit Card

APR Requests Were Granted in Past Year

SoFi-F

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241015124751/en/

PR@sofi.org

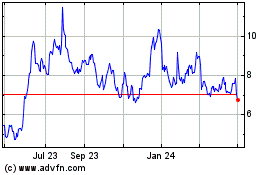

SoFi Technologies (NASDAQ:SOFI)

Historical Stock Chart

From Jan 2025 to Feb 2025

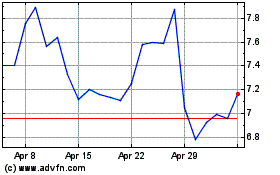

SoFi Technologies (NASDAQ:SOFI)

Historical Stock Chart

From Feb 2024 to Feb 2025