false

0001886894

0001886894

2024-11-13

2024-11-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): November 13, 2024

Snail,

Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-41556 |

|

88-4146991 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

Number) |

12049

Jefferson Blvd

Culver

City, CA 90230

(Address

of principal executive offices) (Zip Code)

+1

(310) 988-0643

(Registrant’s

telephone number, including area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which

registered |

| Class A Common Stock,

$0.0001 par value per share |

|

SNAL |

|

The Nasdaq Stock Market

LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

2.02 Results of Operations and Financial Condition.

On

November 13, 2024, Snail, Inc. (“Snail”) issued a press release announcing its financial results for the third fiscal quarter

ended September 30, 2024. A copy of the press release is attached hereto as Exhibit 99.1.

Neither

the information in this Current Report on Form 8-K nor the information in the press release attached hereto as Exhibit 99.1 shall be

deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly

set forth by specific reference in such a filing.

Item

9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

| |

SNAIL, INC. |

| |

|

|

| Date: November 13, 2024 |

By: |

/s/ Xuedong

Tian |

| |

Name: |

Xuedong Tian |

| |

Title: |

Co-Chief Executive Officer |

Exhibit

99.1

Snail,

Inc. Reports Third Quarter 2024 Financial Results

Culver

City, CA – November 13, 2024 – Snail, Inc. (NASDAQ: SNAL) (“Snail” or “the Company”), a

leading, global independent developer and publisher of interactive digital entertainment, today announced financial results for

its third quarter ended September 30, 2024.

Tony

Tian, Co-Chief Executive Officer of Snail, commented, “Since taking over as Co-CEO of Snail in April, we’ve continued to

see a transformation in the business, guided by the extraordinary talent and vision of our dedicated team. Snail is committed to pushing

the boundaries of interactive entertainment, and we are thrilled with the successes seen across our titles and DLCs this quarter, including

Aberration, part two of Bobs Tall Tales and the Ark franchise. We remain focused on delivering innovative gaming

experiences that exceed our fans’ expectations around the globe, staying true to the creative spirit that has defined our company’s

remarkable journey.”

Third

Quarter 2024 Operational Highlights:

| ● | ARK:

Survival Ascended and Ark: Survival Evolved |

| ○ | On

October 25, 2023, the Company launched its flagship remake of the ARK franchise leveraging

Unreal Engine 5’s stunning graphics and introduced a game-altering cross-platform modding

system, ushering in a new era of creativity. |

| ○ | In

the three and nine months ended September 30, 2024, the Company sold 0.4 million units and

1.3 million units of ARK: Survival Ascended, respectively. |

| ○ | In

the three and nine months ended September 30, 2024, ARK: Survival Evolved and ARK:

Survival Ascended combined for an average total of 210,000 and 212,000 daily active users

on the Steam and Epic platforms, respectively. |

| ○ | Through

September 30, 2024, the Company’s ARK franchise game has been played for 3.8

billion hours with an average playing time per user of 162 hours and with the top 21.2% of

all players spending over 100 hours in the game, according to data from the Steam platform. |

| ● | Product

and Business Updates: |

| ○ | ARK:

Ultimate Survivor Edition. On July 16, 2024, the Company announced the expansive

adaptation of the acclaimed ARK franchise into iOS and Android mobile devices. |

| ○ | Wandering

Wizard, an indie branch of the Company, strategically acquired the publishing rights

to four new games since the second quarter of 2024. The games, The Cecil, Chasmal

Fear, Castle of Secrets, and Stoneguard, are still under development. |

| ○ | For

The Stars. On August 15, 2024, the Company officially announced a new AAA title For

The Stars, a space-themed survival sandbox MMO game set to launch on PC, PS5, and Xbox

Series X|S. |

| ○ | Honeycomb:

The World Beyond. Snail acquired the publishing rights to the upcoming sci-fi survival

adventure game in the third quarter of 2024, further enhancing our sandbox survival content

portfolio. |

Third

Quarter 2024 Financial Highlights:

| ● | Net

revenue for the three months ended September 30, 2024 was $22.5 million, an increase

of $13.5 million, or 150.9%, compared to $9.0 million in the three months ended September

30, 2023. The increase in net revenue was due to the recognition of $8.2 million in revenue

from the release of Aberration and part II of Bobs Tall Tales, an increase

in total Ark sales of $5.9 million, an increase in Bellwright sales of $1.0

million, $1.2 million recognized for meeting the performance obligations of releasing Genesis

II and Myth of Empires on certain platforms, partially offset by a decrease in

Ark Mobile sales of $0.3 million, and an increase in deferred revenues of $2.6 million

related to sales of ARK: Survival Ascended and Bobs Tall Tales DLC’s

which have not yet been released. |

| ● | Net

income for the three months ended September 30, 2024 increased significantly to $0.2

million versus a net loss of $4.4 million in the third quarter of 2023 as a result

of the increase in net revenue driven by the release of new titles. |

| ● | Bookings

for the three months ended September 30, 2024 was $16.1 million as compared to $10.5

million for the three months ended September 30, 2023, an increase of $5.6 million, or 53.6%.

The increase was primarily due to the release of ARK: Survival Ascended in the fourth

quarter of 2023, the releases of Bobs Tall Tales and Bellwright in the first

half of 2024, as well as the ARK: Survival Ascended DLC’s Aberration

and Scorched Earth in September and April of 2024, respectively. |

| ● | Earnings

before interest, taxes, depreciation and amortization (“EBITDA”) for the

three months ended September 30, 2024 was $0.5 million compared to an EBITDA loss of $5.1

million in the prior year period. The $5.6 million, or 109.7%, increase in EBITDA was due

to an increase in net income of $4.6 million and a decrease in the benefit from income taxes

of $1.4 million, that was partially offset by a decrease in interest expenses of $0.3 million. |

| ● | As

of September 30, 2024, unrestricted cash was $10.6 million and the Company has repaid $3.0 million of its revolving loan, $2.3

million in notes payable, and $0.8 million of its convertible notes that were outstanding as of December 31, 2023. |

Use

of Non-GAAP Financial Measures

In

addition to the financial results determined in accordance with U.S. generally accepted accounting principles, or GAAP, Snail believes

EBITDA, as non-GAAP measure, and Bookings, as an operating metric, are useful in evaluating its operating performance. EBITDA is a non-GAAP

financial measure that is presented as a supplemental disclosure to net income (loss) and should not be construed as an alternative to

net income (loss) or as an alternative to cash flow provided by operating activities as a measure of liquidity, as determined in accordance

with GAAP. Snail supplementally presents Bookings and EBITDA because they are key operating measures used by management to assess financial

performance. Bookings adjusts for the impact of deferrals and, Snail believes, provides a useful indicator of sales in a given period.

EBITDA adjusts for items that Snail believes do not reflect the ongoing operating performance of its business, such as certain non-cash

items, unusual or infrequent items or items that change from period to period without any material relevance to its operating performance.

Management believes Bookings and EBITDA are useful to investors and analysts in highlighting trends in Snail’s operating performance,

while other measures can differ significantly depending on long-term strategic decisions regarding capital structure, the tax jurisdictions

in which Snail operates and capital investments.

Bookings

is defined as the net amount of products and services sold digitally or physically in the period. Bookings is equal to revenues, excluding

the impact from deferrals. Below is a reconciliation of total net revenue to Bookings, the closest GAAP financial measure.

| | |

Three Months Ended

September 30, | |

Nine Months Ended

September 30, |

| | |

2024 | |

2023 | |

2024 | |

2023 |

| | |

(in millions) |

| Total net revenue | |

$ | 22.5 | | |

$ | 9.0 | | |

$ | 58.3 | | |

$ | 32.3 | |

| Change in deferred net revenue | |

| (6.4 | ) | |

| 1.5 | | |

| 0.4 | | |

| 0.8 | |

| Bookings | |

$ | 16.1 | | |

$ | 10.5 | | |

$ | 58.7 | | |

$ | 33.1 | |

We

define EBITDA as net income (loss) before (i) interest expense, (ii) interest income, (iii) income tax provision (benefit from) and (iv)

depreciation and amortization expense. The following table provides a reconciliation from net income (loss) to EBITDA:

| | |

Three Months Ended

September 30, | |

Nine Months Ended

September 30, |

| | |

2024 | |

2023 | |

2024 | |

2023 |

| | |

(in millions) |

| Net income (loss) | |

$ | 0.2 | | |

$ | (4.4 | ) | |

$ | 0.7 | | |

$ | (11.5 | ) |

| Interest income and interest income – related parties | |

| (0.1 | ) | |

| - | | |

| (0.2 | ) | |

| (0.1 | ) |

| Interest expense and interest expense – related parties | |

| 0.1 | | |

| 0.4 | | |

| 0.6 | | |

| 1.0 | |

| Provision for (benefit from) income taxes | |

| 0.2 | | |

| (1.2 | ) | |

| 0.3 | | |

| (3.0 | ) |

| Depreciation and amortization expense | |

| 0.1 | | |

| 0.1 | | |

| 0.2 | | |

| 0.3 | |

| EBITDA | |

$ | 0.5 | | |

$ | (5.1 | ) | |

$ | 1.6 | | |

$ | (13.3 | ) |

Webcast

Details

The

Company will host a webcast at 4:30 PM ET today to discuss the third quarter 2024 financial results. Participants may access the live

webcast and replay on the Company’s investor relations website at https://investor.snail.com/.

Forward-Looking

Statements

This

press release contains statements that constitute forward-looking statements. Many of the forward-looking statements contained in this

press release can be identified by the use of forward-looking words such as “anticipate,” “believe,” “could,”

“expect,” “should,” “plan,” “intend,” “may,” “predict,” “continue,”

“estimate” and “potential,” or the negative of these terms or other similar expressions. Forward-looking statements

appear in a number of places in this press release and include, but are not limited to, statements regarding Snail’s intent, belief

or current expectations. These forward-looking statements include information about possible or assumed future results of Snail’s

business, financial condition, results of operations, liquidity, plans and objectives. The statements Snail makes regarding the following

matters are forward-looking by their nature: growth prospects and strategies; launching new games and additional functionality to games

that are commercially successful; expectations regarding significant drivers of future growth; its ability to retain and increase its

player base and develop new video games and enhance existing games; competition from companies in a number of industries, including other

casual game developers and publishers and both large and small, public and private Internet companies; its ability to attract and retain

a qualified management team and other team members while controlling its labor costs; its relationships with third-party platforms such

as Xbox Live and Game Pass, PlayStation Network, Steam, Epic Games Store, My Nintendo Store, the Apple App Store, the Google Play Store

and the Amazon Appstore; the size of addressable markets, market share and market trends; its ability to successfully enter new markets

and manage international expansion; protecting and developing its brand and intellectual property portfolio; costs associated with defending

intellectual property infringement and other claims; future business development, results of operations and financial condition; the

ongoing conflicts involving Russia and Ukraine, and Israel and Hamas, on its business and the global economy generally; rulings by courts

or other governmental authorities; the Company’s current program to repurchase shares of its Class A common stock, including expectations

regarding the timing and manner of repurchases made under this share repurchase program; its plans to pursue and successfully integrate

strategic acquisitions; and assumptions underlying any of the foregoing.

Further

information on risks, uncertainties and other factors that could affect Snail’s financial results are included in its filings with

the Securities and Exchange Commission (the “SEC”) from time to time, including its annual reports on Form 10-K and quarterly

reports on Form 10-Q filed, or to be filed, with the SEC. You should not rely on these forward-looking statements, as actual outcomes

and results may differ materially from those expressed or implied in the forward-looking statements as a result of such risks and uncertainties.

All forward-looking statements in this press release are based on management’s beliefs and assumptions and on information currently

available to Snail, and Snail does not assume any obligation to update the forward-looking statements provided to reflect events that

occur or circumstances that exist after the date on which they were made.

About

Snail, Inc.

Snail

is a leading, global independent developer and publisher of interactive digital entertainment for consumers around the world, with a

premier portfolio of premium games designed for use on a variety of platforms, including consoles, PCs and mobile devices.

For

additional information, please contact: investors@snail.com

Snail,

Inc. and Subsidiaries

Condensed

Consolidated Balance Sheets (Unaudited)

| | |

September 30, 2024 | | |

December 31, 2023 | |

| | |

| | |

| |

| ASSETS | |

| | | |

| | |

| | |

| | | |

| | |

| Current Assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 10,566,294 | | |

$ | 15,198,123 | |

| Accounts receivable, net of allowances for credit losses of $523,500 as of September 30, 2024 and December 31, 2023 | |

| 6,804,338 | | |

| 25,134,808 | |

| Accounts receivable - related party | |

| 3,035,555 | | |

| - | |

| Loan and interest receivable - related party | |

| 105,255 | | |

| 103,753 | |

| Prepaid expenses - related party | |

| 4,952,002 | | |

| 6,044,404 | |

| Prepaid expenses and other current assets | |

| 1,336,744 | | |

| 639,693 | |

| Prepaid taxes | |

| 9,713,430 | | |

| 9,529,755 | |

| Total current assets | |

| 36,513,618 | | |

| 56,650,536 | |

| | |

| | | |

| | |

| Restricted cash and cash equivalents | |

| 1,119,565 | | |

| 1,116,196 | |

| Accounts receivable - related party, net of current portion | |

| 3,000,592 | | |

| 7,500,592 | |

| Prepaid expenses - related party | |

| 8,994,630 | | |

| 7,784,062 | |

| Property, plant and equipment, net | |

| 4,446,772 | | |

| 4,682,066 | |

| Intangible assets, net - other | |

| 271,115 | | |

| 271,717 | |

| Deferred income taxes | |

| 10,260,441 | | |

| 10,247,500 | |

| Other noncurrent assets | |

| 571,711 | | |

| 164,170 | |

| Operating lease right-of-use assets, net | |

| 1,600,520 | | |

| 2,440,690 | |

| Total assets | |

$ | 66,778,964 | | |

$ | 90,857,529 | |

| | |

| | | |

| | |

| LIABILITIES, NONCONTROLLING INTERESTS AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| | |

| | | |

| | |

| Current Liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 3,948,039 | | |

$ | 12,102,929 | |

| Accounts payable - related parties | |

| 15,689,072 | | |

| 23,094,436 | |

| Accrued expenses and other liabilities | |

| 2,734,535 | | |

| 2,887,193 | |

| Interest payable - related parties | |

| 527,770 | | |

| 527,770 | |

| Revolving loan | |

| 3,000,000 | | |

| 6,000,000 | |

| Notes payable | |

| - | | |

| 2,333,333 | |

| Convertible notes, net of discount | |

| - | | |

| 797,361 | |

| Current portion of long-term promissory note | |

| 2,743,378 | | |

| 2,811,923 | |

| Current portion of deferred revenue | |

| 13,349,641 | | |

| 19,252,628 | |

| Current portion of operating lease liabilities | |

| 1,629,835 | | |

| 1,505,034 | |

| Total current liabilities | |

| 43,622,270 | | |

| 71,312,607 | |

| | |

| | | |

| | |

| Accrued expenses | |

| 254,731 | | |

| 254,731 | |

| Deferred revenue, net of current portion | |

| 19,940,995 | | |

| 15,064,078 | |

| Operating lease liabilities, net of current portion | |

| 266,397 | | |

| 1,425,494 | |

| Total liabilities | |

| 64,084,393 | | |

| 88,056,910 | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| | | |

| | |

| | |

| | | |

| | |

| Stockholders’ Equity: | |

| | | |

| | |

| Class A common stock, $0.0001 par value, 500,000,000 shares authorized; 9,379,488 shares issued and 8,029,213 shares outstanding as of September 30, 2024, and 9,275,420 shares issued and 7,925,145 shares outstanding as of December 31, 2023 | |

| 937 | | |

| 927 | |

| Class B common stock, $0.0001 par value, 100,000,000 shares authorized; 28,748,580 shares issued and outstanding as of September 30, 2024 and December 31, 2023 | |

| 2,875 | | |

| 2,875 | |

| Additional paid-in capital | |

| 25,334,672 | | |

| 26,171,575 | |

| Accumulated other comprehensive loss | |

| (230,857 | ) | |

| (254,383 | ) |

| Accumulated deficit | |

| (13,237,356 | ) | |

| (13,949,325 | ) |

| Treasury stock at cost (1,350,275 as of September 30, 2024 and December 31, 2023) | |

| (3,671,806 | ) | |

| (3,671,806 | ) |

| Total Snail, Inc. equity | |

| 8,198,465 | | |

| 8,299,863 | |

| Noncontrolling interests | |

| (5,503,894 | ) | |

| (5,499,244 | ) |

| Total stockholders’ equity | |

| 2,694,571 | | |

| 2,800,619 | |

| Total liabilities, noncontrolling interests and stockholders’ equity | |

$ | 66,778,964 | | |

$ | 90,857,529 | |

Snail,

Inc. and Subsidiaries

Condensed

Consolidated Statements of Operations and Comprehensive Income (Loss) (Unaudited)

| | |

Three months ended

September 30, | | |

Nine months ended

September 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

| | |

| | |

| | |

| |

| Revenues, net | |

$ | 22,530,372 | | |

$ | 8,981,135 | | |

$ | 58,252,751 | | |

$ | 32,331,876 | |

| Cost of revenues | |

| 13,823,944 | | |

| 9,463,086 | | |

| 39,369,816 | | |

| 29,659,788 | |

| | |

| | | |

| | | |

| | | |

| | |

| Gross profit (loss) | |

| 8,706,428 | | |

| (481,951 | ) | |

| 18,882,935 | | |

| 2,672,088 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| General and administrative | |

| 3,845,301 | | |

| 3,452,141 | | |

| 8,923,225 | | |

| 11,915,126 | |

| Research and development | |

| 3,885,926 | | |

| 1,317,400 | | |

| 7,523,329 | | |

| 3,892,039 | |

| Advertising and marketing | |

| 495,938 | | |

| 215,477 | | |

| 1,331,163 | | |

| 488,318 | |

| Depreciation and amortization | |

| 72,402 | | |

| 112,914 | | |

| 235,294 | | |

| 346,084 | |

| Total operating expenses | |

| 8,299,567 | | |

| 5,097,932 | | |

| 18,013,011 | | |

| 16,641,567 | |

| | |

| | | |

| | | |

| | | |

| | |

| Income (loss) from operations | |

| 406,861 | | |

| (5,579,883 | ) | |

| 869,924 | | |

| (13,969,479 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other income (expense): | |

| | | |

| | | |

| | | |

| | |

| Interest income | |

| 60,675 | | |

| 47,147 | | |

| 225,227 | | |

| 98,411 | |

| Interest income - related parties | |

| 504 | | |

| 504 | | |

| 1,501 | | |

| 1,496 | |

| Interest expense | |

| (95,997 | ) | |

| (370,376 | ) | |

| (634,262 | ) | |

| (961,196 | ) |

| Other income | |

| 74,891 | | |

| 313,156 | | |

| 546,484 | | |

| 321,331 | |

| Foreign currency transaction loss | |

| (55,835 | ) | |

| (1,394 | ) | |

| (32,055 | ) | |

| (25,606 | ) |

| Total other income (expense), net | |

| (15,762 | ) | |

| (10,963 | ) | |

| 106,895 | | |

| (565,564 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Income (loss) before provision for (benefit from) income taxes | |

| 391,099 | | |

| (5,590,846 | ) | |

| 976,819 | | |

| (14,535,043 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Provision for (benefit from) income taxes | |

| 157,938 | | |

| (1,156,675 | ) | |

| 269,501 | | |

| (3,044,380 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net income (loss) | |

| 233,161 | | |

| (4,434,171 | ) | |

| 707,318 | | |

| (11,490,663 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss attributable to non-controlling interests | |

| (1,986 | ) | |

| (1,539 | ) | |

| (4,650 | ) | |

| (7,222 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net income (loss) attributable to Snail, Inc. | |

$ | 235,147 | | |

$ | (4,432,632 | ) | |

$ | 711,968 | | |

$ | (11,483,441 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Comprehensive income (loss) statement: | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Net income (loss) | |

$ | 233,161 | | |

$ | (4,434,171 | ) | |

$ | 707,318 | | |

$ | (11,490,663 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other comprehensive income (loss) related to currency translation adjustments, net of tax | |

| 52,116 | | |

| (1,512 | ) | |

| 23,526 | | |

| 19,515 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total comprehensive income (loss) | |

$ | 285,277 | | |

$ | (4,435,683 | ) | |

$ | 730,844 | | |

$ | (11,471,148 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net income (loss) attributable to Class A common stockholders: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | 51,312 | | |

$ | (955,763 | ) | |

$ | 154,972 | | |

$ | (2,477,768 | ) |

| Diluted | |

$ | 51,312 | | |

$ | (955,763 | ) | |

$ | 127,440 | | |

$ | (2,477,768 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net income (loss) attributable to Class B common stockholders: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | 183,835 | | |

$ | (3,476,869 | ) | |

$ | 556,996 | | |

$ | (9,005,673 | ) |

| Diluted | |

$ | 183,835 | | |

$ | (3,476,869 | ) | |

$ | 458,041 | | |

$ | (9,005,673 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net income (loss) per share attributable to Class A and B common stockholders: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | 0.01 | | |

$ | (0.12 | ) | |

$ | 0.02 | | |

$ | (0.31 | ) |

| Diluted | |

$ | 0.01 | | |

$ | (0.12 | ) | |

$ | 0.02 | | |

$ | (0.31 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted-average shares used to compute income (loss) per share attributable to Class A common stockholders: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 8,024,369 | | |

| 7,901,145 | | |

| 7,998,686 | | |

| 7,909,715 | |

| Diluted | |

| 8,024,369 | | |

| 7,901,145 | | |

| 8,148,133 | | |

| 7,909,715 | |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted-average shares used to compute income (loss) per share attributable to Class B common stockholders: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 28,748,580 | | |

| 28,748,580 | | |

| 28,748,580 | | |

| 28,748,580 | |

| Diluted | |

| 28,748,580 | | |

| 28,748,580 | | |

| 28,748,580 | | |

| 28,748,580 | |

Snail,

Inc. and Subsidiaries

Condensed

Consolidated Statements of Cash Flows (Unaudited)

| For the nine months ended September 30, | |

2024 | | |

2023 | |

| | |

| | |

| |

| Cash flows from operating activities: | |

| | | |

| | |

| Net income (loss) | |

$ | 707,318 | | |

$ | (11,490,663 | ) |

| Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: | |

| | | |

| | |

| Amortization - intangible assets - license, related parties | |

| - | | |

| 1,253,623 | |

| Amortization - intangible assets - other | |

| 603 | | |

| 603 | |

| Amortization - loan origination fees and debt discounts | |

| 60,242 | | |

| 142,656 | |

| Accretion - convertible notes | |

| 222,628 | | |

| - | |

| Depreciation and amortization - property and equipment | |

| 235,294 | | |

| 346,084 | |

| Stock-based compensation expense (income) | |

| (896,893 | ) | |

| 622,007 | |

| Interest income from restricted escrow deposit | |

| - | | |

| (33,935 | ) |

| Deferred taxes, net | |

| (12,884 | ) | |

| (3,058,738 | ) |

| | |

| | | |

| | |

| Changes in assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| 18,330,470 | | |

| 2,674,655 | |

| Accounts receivable - related party | |

| 1,464,445 | | |

| (255,045 | ) |

| Prepaid expenses - related party | |

| (118,167 | ) | |

| (2,500,000 | ) |

| Prepaid expenses and other current assets | |

| (697,051 | ) | |

| 156,450 | |

| Prepaid taxes | |

| (183,675 | ) | |

| - | |

| Other noncurrent assets | |

| (407,441 | ) | |

| (2,903 | ) |

| Accounts payable | |

| (7,891,975 | ) | |

| 846,553 | |

| Accounts payable - related parties | |

| (7,405,363 | ) | |

| (248,391 | ) |

| Accrued expenses and other liabilities | |

| (152,658 | ) | |

| 134,131 | |

| Interest receivable - related party | |

| (1,501 | ) | |

| (1,496 | ) |

| Lease liabilities | |

| (194,125 | ) | |

| (148,233 | ) |

| Deferred revenue | |

| (1,026,070 | ) | |

| 767,883 | |

| Net cash provided by (used in) operating activities | |

| 2,033,197 | | |

| (10,794,759 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | |

| Repayments on promissory note | |

| (68,545 | ) | |

| (59,589 | ) |

| Repayments on notes payable | |

| (2,333,333 | ) | |

| (3,750,000 | ) |

| Repayments on convertible notes | |

| (1,020,000 | ) | |

| - | |

| Repayments on revolving loan | |

| (3,000,000 | ) | |

| (3,000,000 | ) |

| Borrowings on notes payable | |

| - | | |

| 2,275,000 | |

| Proceeds from issuance of convertible notes | |

| - | | |

| 847,500 | |

| Refund of dividend withholding tax overpayment | |

| - | | |

| 1,886,600 | |

| Purchase of treasury stock | |

| - | | |

| (257,093 | ) |

| Payments of capitalized offering costs | |

| - | | |

| (342,318 | ) |

| Payments of offering costs in accounts payable | |

| (262,914 | ) | |

| - | |

| Net cash used in financing activities | |

| (6,684,792 | ) | |

| (2,399,900 | ) |

| | |

| | | |

| | |

| Effect of currency translation on cash and cash equivalents | |

| 23,135 | | |

| 20,390 | |

| | |

| | | |

| | |

| Net decrease in cash and cash equivalents, and restricted cash and cash equivalents | |

| (4,628,460 | ) | |

| (13,174,269 | ) |

| | |

| | | |

| | |

| Cash and cash equivalents, and restricted cash and cash equivalents - beginning of period | |

| 16,314,319 | | |

| 19,238,185 | |

| | |

| | | |

| | |

| Cash and cash equivalents, and restricted cash and cash equivalents – end of period | |

$ | 11,685,859 | | |

$ | 6,063,916 | |

| | |

| | | |

| | |

| Supplemental disclosures of cash flow information | |

| | | |

| | |

| Cash paid during the period for: | |

| | | |

| | |

| Interest | |

$ | 421,986 | | |

$ | 725,885 | |

| Income taxes | |

$ | 401,671 | | |

$ | 504,581 | |

| Noncash transactions during the period for: | |

| | | |

| | |

| Issuance of warrants in connection with equity line of credit | |

$ | - | | |

$ | (105,411 | ) |

| Debt converted to equity | |

$ | (60,000 | ) | |

$ | - | |

| Right-of-use assets obtained in exchange for a lease liability | |

$ | (85,588 | ) | |

$ | - | |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

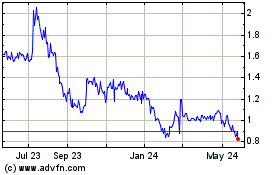

Snail (NASDAQ:SNAL)

Historical Stock Chart

From Nov 2024 to Dec 2024

Snail (NASDAQ:SNAL)

Historical Stock Chart

From Dec 2023 to Dec 2024