SHL Telemedicine Receives Buy Rating with $11.00 Price Target

March 14 2024 - 10:40AM

Business Wire

A leading equity research firm provides a

double-digit price target for SHL Telemedicine, positioning it as

an undervalued opportunity considering its unique technology,

expertise and expanding global market.

SHL Telemedicine Ltd. (NASDAQ: SHLT, SIX: SHLTN;) ("SHL" or the

"Company"), a leading provider and developer of advanced personal

telemedicine solutions, is pleased to announce that Litchfield

Hills Research, a leading equity research firm has initiated

coverage of with a 'Buy' rating and an $11.00 price target. This

price target represents a significant premium over the company's

current share price, highlighting the firm's confidence in SHL's

growth trajectory and market position.

The equity research report emphasizes SHL Telemedicine's

innovative approach and expanding market opportunities, noting that

"SHLT is a pure-play in the rapidly expanding $115B telemedicine

market. We believe this is a ~$30B market for goods and services in

the U.S. alone. SHLT has been at the forefront of this with more

than 30 years’ experience, 3MM interactions annually and 24/7

telehealth monitoring capabilities. SHLT has established itself as

a leader in the telemedicine landscape.”

The report also highlights the company’s impressive initial

clinical trial results conducted by the Mayo Clinic and Imperial

College London, alongside progress and expected growth in the US

and Germany which provide substantial market opportunities which

SHL has made significant strides towards capturing.

The $11.00 price target is based on a comprehensive analysis of

the company's financial health, growth prospects, and the expanding

market for telemedicine services. The report further highlights

that SHL Telemedicine's valuation is attractive compared to its

peers, presenting a compelling investment opportunity for those

looking to invest in the healthcare technology sector.

Litchfield Hills Research produces FINRA and MIFID II compliant

research, and the analyst, Theodore R, O'Neill, has 25+ years of

Sell-Side experience with firms such as Wells Fargo, A.G. Edwards,

Needham & Co. In addition, he is a two-time winner of the Wall

Street Journal Allstar Analyst Awards.

To access the report alongside its full disclaimers and

disclosures, please go to:

https://bit.ly/shltinitiation

About SHL Telemedicine SHL Telemedicine is engaged in

developing and marketing personal telemedicine systems and the

provision of medical call center services, with a focus on

cardiovascular and related diseases, to end users and to the

healthcare community. SHL Telemedicine offers its services and

personal telemedicine devices to subscribers utilizing telephonic

and Internet communication technology. SHL is listed on the SIX

Swiss Exchange (SHLTN, ISIN: IL0010855885, Security No.: 1128957)

and on the Nasdaq Stock Exchange (SHLT, ISIN: US78423T2006, CUSIP:

78423T200).

For more information, please visit our website at

www.shl-telemedicine.com.

Forward-Looking Statements Some of the information

contained in this press release contains forward-looking

statements. Readers are cautioned that any such forward-looking

statements are not guarantees of future performance and involve

risks and uncertainties, and that actual results may differ

materially from those in the forward-looking statements as a result

of various factors. SHL Telemedicine undertakes no obligation to

publicly update or revise any forward-looking statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240314157429/en/

Fabienne Farner, IRF, Phone : +41 43 244 81 42,

farner@irf-reputation.ch

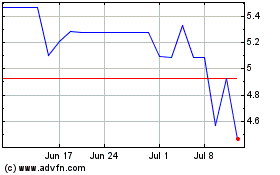

SHL Telemedicine (NASDAQ:SHLT)

Historical Stock Chart

From Jan 2025 to Feb 2025

SHL Telemedicine (NASDAQ:SHLT)

Historical Stock Chart

From Feb 2024 to Feb 2025