Current Report Filing (8-k)

December 01 2022 - 4:55PM

Edgar (US Regulatory)

NY false 0001802768 0001802768 2022-12-01 2022-12-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 1, 2022

Royalty Pharma plc

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

| England and Wales |

|

001-39329 |

|

98-1535773 |

| (State or Other Jurisdiction of Incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

|

|

|

| 110 East 59th Street New York, New York |

|

|

|

10022 |

| (Address of Principal Executive Offices) |

|

|

|

(Zip Code) |

Registrant’s telephone number, including area code: (212) 883-0200

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| |

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Class A Ordinary Shares, par value $0.0001 per share |

|

RPRX |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.06 |

Material Impairments. |

On December 1, 2022, Royalty Pharma plc (the “Company”) concluded that a non-cash impairment charge related to the financial royalty asset associated with gantenerumab is required under generally accepted accounting principles of the United States (“GAAP”) in the three months ending December 31, 2022. This non-cash impairment charge will not impact the Company’s non-GAAP financial results. On November 30, 2022, Roche stated that it would discontinue clinical trials of gantenerumab after the GRADUATE I and II studies evaluating gantenerumab in people with early Alzheimer’s disease did not meet their primary endpoint of slowing clinical decline, which led the Company to conclude its financial royalty asset is impaired. The Company expects that the non-cash impairment charge will be $273.6 million, which was the net carrying value of the asset as of September 30, 2022. No portion of the impairment charge relates to future cash expenditures.

SIGNATURES

Pursuant to the requirement of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

ROYALTY PHARMA PLC |

|

|

|

|

| Date: December 1, 2022 |

|

|

|

By: |

|

/s/ Terrance Coyne |

|

|

|

|

|

|

Terrance Coyne |

|

|

|

|

|

|

Chief Financial Officer |

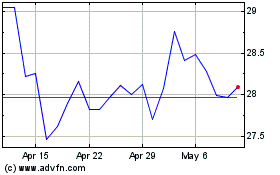

Royalty Pharma (NASDAQ:RPRX)

Historical Stock Chart

From Jun 2024 to Jul 2024

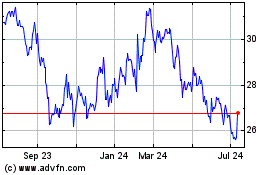

Royalty Pharma (NASDAQ:RPRX)

Historical Stock Chart

From Jul 2023 to Jul 2024