RBB Bancorp (NASDAQ:RBB) and its subsidiaries, Royal Business

Bank (the “Bank”) and RBB Asset Management Company (“RAM”),

collectively referred to herein as “the Company,” announced

financial results for the quarter and fiscal year ended December

31, 2023.

Fourth Quarter 2023 Highlights

- Net income increased to $12.1 million, or $0.64 diluted

earnings per share, up from $8.5 million, or $0.45 diluted earnings

per share for the third quarter.

- Return on average assets increased to 1.20%, up from 0.83% for

the third quarter.

- Return on average common equity of 9.48% and return on average

tangible common equity (1) of 11.12%, up from 6.66% and 7.82% for

the third quarter.

- Recognized a $5.0 million Community Development Financial

Institution Equitable Recovery Program award.

- Redeemed $55.0 million of 6.18% subordinated notes at par on

December 1, 2023.

- Repurchased 396,374 shares for $6.7 million during the fourth

quarter.

- Nonperforming loans decreased to $31.6 million from $40.1

million at the end of the third quarter.

- Allowance for loan losses to loans held for investment

increased to 1.38%, up from 1.36% at the end of the third

quarter.

- Book value and tangible book value (1) per share increased to

$27.47 and $23.48, up from $26.45 and $22.53 per share at end of

the third quarter.

The Company reported net income of $12.1 million, or $0.64

diluted earnings per share, for the quarter ended December 31,

2023, compared to net income of $8.5 million, or $0.45 diluted

earnings per share, for the quarter ended September 30, 2023. Net

income for the year ended December 31, 2023 totaled $42.5 million,

or $2.24 diluted earnings per share, compared to net income of

$64.3 million, or $3.33 diluted earnings per share, for the year

ended December 31, 2022. The results for the fourth quarter and

year ended December 31, 2023 included a Community Development

Financial Institution (“CDFI”) Equitable Recovery Program (“ERP”)

award of $5.0 million on a pre-tax basis; there was no similar

income included in the other periods presented.

“We undertook several initiatives in 2023 to position the

Company for the future,” said David Morris, CEO of RBB Bancorp. “We

strengthened our management team by adding respected senior

executives and restructured our operations in order to improve the

management of our national banking franchise. We addressed

regulatory concerns by adopting enhanced corporate governance

policies and reconstituting our Board of Directors. Additionally,

we increased liquidity and mitigated balance sheet risk by

strategically exiting certain higher risk lending relationships and

reducing our loan to deposit ratio.”

Mr. Morris continued, “While some of these actions had a

negative impact on our short-term results, we are confident that

they will drive long-term shareholder value and have positioned the

Company for improved profitability in a variety of economic

environments.”

“The changes implemented by management and the Board of

Directors are intended to enhance shareholder value,” said Dr.

James Kao, Chairman of the Company. “The Board of Directors

appreciates the efforts of all RBB employees and their commitment

to providing exceptional financial services to the Asian-American

community.”

(1)

Reconciliations of the non–U.S. generally

accepted accounting principles (“GAAP”) measures included at the

end of this press release.

Net Interest Income and Net Interest Margin

Net interest income was $25.7 million for the fourth quarter of

2023, compared to $27.6 million for the third quarter of 2023. The

$1.9 million decrease in net interest income was primarily due to

higher interest expense of $1.2 million and lower interest income

of $731,000. The increase in interest expense was due to an

increase in the average rate paid on interest-bearing liabilities,

offset by lower average balances of interest-bearing liabilities.

The decrease in interest income was due to lower average balances

of loans and securities, offset by higher average balances for

Federal funds sold, cash equivalents & other and a higher yield

on this earning asset category.

Net interest margin was 2.73% for the fourth quarter of 2023, a

decrease of 14 basis points from 2.87% in the third quarter of 2023

primarily due to a 20 basis point increase in the average rate paid

on interest-bearing liabilities, partially offset by a 4 basis

point increase in the average yield earned on interest-earning

assets. The higher overall funding costs were due mostly to a 25

basis point increase in the average cost of interest-bearing

deposits to 4.08% in the fourth quarter of 2023 from 3.83% in the

third quarter of 2023. The cost of interest-bearing deposits

increased due to increasing market rates and peer bank deposit

competition.

The Company redeemed all $55.0 million of its outstanding 6.18%

fixed-to-floating rate subordinated notes on December 1, 2023 at

par. The subordinated notes had an original maturity date of

December 1, 2028 and an effective interest rate of 6.18% as of

their redemption date.

Provision for Credit Losses

The Company recorded a reversal of its provision for credit

losses of $431,000 for the fourth quarter of 2023 compared to a

$1.4 million provision in the third quarter. The $1.8 million

decrease in the provision for credit losses was primarily due to

lower net charge-offs in the fourth quarter compared to the third

quarter and the impact of improved credit quality coupled with

lower total loans at the end of the fourth quarter. Total net

charge-offs were $109,000 for the fourth quarter of 2023 compared

to net charge-offs of $2.2 million in the prior quarter.

Noninterest Income

Noninterest income was $7.4 million for the fourth quarter of

2023, an increase of $4.6 million from $2.8 million in the third

quarter of 2023. The increase was primarily driven by $5.0 million

of income recognized from the CDFI ERP award, partially offset by

lower net gains on the sale of other real estate owned of $247,000

and loans of $96,000.

Noninterest Expense

Noninterest expense for the fourth quarter of 2023 was $16.4

million, compared to $16.9 million for the third quarter of 2023.

The $483,000 decrease was primarily due to lower salaries and

employee benefits expenses of $884,000 related to lower taxes and

incentives expense, partially offset by higher insurance and

regulatory assessments of $392,000 due to the timing of such

assessment notifications, and higher legal and other professional

fees of $269,000. The annualized operating expense ratio for the

fourth quarter of 2023 was 1.63%, down from 1.65% for the third

quarter of 2023.

Income Taxes

The effective tax rate was 29.4% for the fourth quarter of 2023,

and 29.9% for the third quarter of 2023.

Balance Sheet

At December 31, 2023, total assets were $4.03 billion, a $43.3

million decrease compared to September 30, 2023, and a $107.0

million increase compared to December 31, 2022.

Loan and Securities Portfolio

Loans held for investment, net of deferred fees and discounts,

totaled $3.0 billion as of December 31, 2023, a decrease of $89.1

million from September 30, 2023. The decrease from September 30,

2023 was primarily due to a $78.3 million decrease in construction

and land development loans, a $17.5 million decrease in

single-family residential mortgages, and a $1.0 million decrease in

other loans, partially offset by a $3.6 million increase in

commercial real estate loans, a $2.4 million increase in commercial

and industrial loans, and a $1.7 million increase in Small Business

Administration (“SBA”) loans. During 2023, management strategically

decreased loans and strengthened the Company's liquidity position

which also resulted in a lower loan to deposit ratio. The loan to

deposit ratio ended 2023 at 94.2% compared to 97.6% at September

30, 2023 and 110.7% at December 31, 2022.

As of December 31, 2023, available-for-sale securities totaled

$319.0 million, including $271.0 million of available-for-sale

securities maturing in over 12 months. As of December 31, 2023,

gross unrealized losses totaled $28.1 million on available-for-sale

securities, a $9.0 million decrease due to changes in market

interest rates, compared to gross unrealized losses of $37.1

million as of September 30, 2023.

Liquidity and Deposits

Total deposits were $3.2 billion as of December 31, 2023, a

$20.7 million, or 0.7%, increase compared to September 30, 2023.

This increase was due to a $53.5 million increase in

interest-bearing deposits and a $32.8 million decrease in

noninterest-bearing demand deposits. The increase in

interest-bearing deposits included higher non-maturity deposits of

$24.7 million and higher time deposits of $28.8 million. The

increase in time deposits, included a $20.4 million decrease in

wholesale deposits (brokered deposits and collateralized State of

California CD's), which totaled $338.1 million at December 31,

2023, and $358.5 million at September 30, 2023.

As of December 31, 2023, the Company had $431.4 million in cash

and due from banks, an increase of $100.6 million, or 30.4%,

compared to September 30, 2023. In addition to this cash liquidity,

the Company had secondary sources of liquidity that totaled $1.2

billion at December 31, 2023. As of December 31, 2023, the

Company's cash balances and secondary sources of liquidity

represented 123% of total uninsured deposits.

Credit Quality

Nonperforming assets totaled $31.6 million, or 0.79% of total

assets, at December 31, 2023, compared to $40.4 million, or 0.99%

of total assets, at September 30, 2023. The $8.8 million decrease

in nonperforming assets was due to the payoff of a $9.8 million

non-accrual loan, the sale of one other real estate owned property

that had a carrying value of $284,000, and non-accrual loan

charge-offs of $150,000. These decreases were partially offset by

loans placed on non-accrual status of $1.8 million, consisting

primarily of single-family residential mortgages.

Special mention loans totaled $32.8 million, or 1.08% of total

loans, at December 31, 2023, compared to $31.2 million, or 1.00% of

total loans, at September 30, 2023. The increase was due to

additional special mention loans of $4.4 million, consisting

primarily of commercial and industrial loans, partially offset by

loan paydowns of $2.7 million.

Substandard loans totaled $61.1 million, or 2.01% of total

loans, at December 31, 2023, compared to $71.4 million, or 2.29% of

total loans, at September 30, 2023. The $10.3 million decrease was

due to loan paydowns of $11.0 million and upgrades to pass loans of

$1.5 million, partially offset by additional substandard loans of

$2.2 million, consisting primarily of single-family residential

mortgages.

30-89 day delinquent loans, excluding non-accrual loans,

decreased $2.9 million to $16.8 million as of December 31, 2023

compared to $19.7 million as of September 30, 2023. The decrease in

past due loans was due to $17.1 million in loans that migrated back

to past due for less than 30 days, consisting primarily of

commercial real estate loans, $918,000 in loans that converted to

non-accrual status, and $218,000 in loan payoffs or paydowns,

partially offset by $15.5 million in new delinquent loans.

As of December 31, 2023, the allowance for credit losses totaled

$42.5 million and was comprised of an allowance for loan losses of

$41.9 million and a reserve for unfunded commitments of $640,000.

This compares to the allowance for credit losses of $43.1 million

comprised of an allowance for loan losses of $42.4 million and a

reserve for unfunded commitments of $654,000 at September 30, 2023.

The $540,000 decrease in the allowance for credit losses during the

fourth quarter of 2023 was due to net charge-offs of $109,000 and a

negative provision for credit losses of $431,000. The allowance for

loan losses as a percentage of loans held for investment was 1.38%

at December 31, 2023, compared to 1.36% at September 30, 2023. The

allowance for loan losses as a percentage of nonperforming loans

was 133% at December 31, 2023, an increase from 106% at September

30, 2023.

Shareholders' Equity and Capital Actions

At December 31, 2023, total shareholders' equity was $511.3

million, an $8.7 million increase compared to September 30, 2023,

and a $26.7 million increase compared to December 31, 2022. The

increase in shareholders' equity for the fourth quarter was due to

net earnings of $12.1 million, lower net unrealized losses of $6.2

million, offset by dividends paid of $3.0 million and share

repurchases totaling $6.7 million. As a result, book value per

share increased to $27.47 from $26.45 and tangible book value per

share increased to $23.48 from $22.53.

On January 18, 2024, the Company announced the Board of

Directors had declared a common stock cash dividend of $0.16 per

share, payable on February 9, 2024 to shareholders of record on

January 31, 2024.

On June 14, 2022, the Board of Directors authorized the

repurchase of up to 500,000 shares of common stock, of which 36,750

shares were available as of December 31, 2023. The repurchase

program permits shares to be repurchased in open market or private

transactions, through block trades, and pursuant to any trading

plan that may be adopted in accordance with Securities and Exchange

Commission (“SEC”) Rules 10b5-1 and 10b-8. The Company repurchased

396,374 shares at a weighted average share price of $17.02 during

the fourth quarter of 2023.

Corporate Governance and Regulatory Updates

The Company is providing the following update on various

corporate governance and regulatory matters previously

reported:

- Since May 2022, the Boards of Directors of the Company and the

Bank have taken several actions to enhance the Company’s corporate

governance and oversight:

- In late 2022 and early 2023, the Company’s Board of Directors

adopted new corporate governance policies and standards which

include enhanced director independence standards, an independent

Board chair, updated board committee charters and an amended and

restated code of ethics.

- Since May 2022, 6 new directors have been added to the Boards

of Directors of the Company and the Bank. These new directors have

extensive regulatory, executive leadership, wealth management, risk

management, and community banking experience. Nine out of the ten

(10) current directors of the Company are classified as

‘independent directors’.

- During 2023, the Boards of Directors of the Company and the

Bank took certain actions to strengthen the Company’s management

team, including hiring a President / Chief Banking Officer, Chief

Financial Officer, Chief Administrative Officer, SBA Manager,

Deputy Chief Risk Officer/BSA Officer, and an East Coast head of

branch banking.

- The Bank entered into a Consent Order (the “Consent Order”)

with the Federal Deposit Insurance Corporation (the “FDIC”) and the

California Department of Financial Protection and Innovation (the

“DFPI”) on October 25, 2023. The Consent Order requires the Bank to

take certain actions with respect to its Anti-Money

Laundering/Countering the Financing of Terrorism (“AML/CFT”)

compliance program and to correct certain alleged violations of the

Bank Secrecy Act (“BSA”) program. The Bank was proactive in

addressing the items identified in the Consent Order prior to

entering into the Consent Order, taking the actions described in

its Current Report on Form 8-K filed with the SEC on October 31,

2023. As of December 31, 2023, the Bank believes it has addressed

all of the deficiencies identified in the Consent Order, although

there can be no guarantee that additional measures will not be

required until the FDIC and the DFPI have reexamined and retested

the Bank’s AML/CFT policies and procedures to the FDIC’s and the

DFPI’s satisfaction, the timing of which is uncertain.

- As reported in connection with the Company’s second quarter

2023 earnings release, the Company was voluntarily responding to

informal requests from the SEC's Division of Enforcement for

information regarding, among other things, certain Company policies

and procedures, certain Company expenditures, certain former

officers and directors, their roles and relationships, and the

circumstances relating to and surrounding their departures,

including potential violations of laws and/or regulations. The SEC

subsequently notified the Company that the SEC has concluded its

inquiry with respect to the Company without any enforcement action

against the Company.

The Company’s Board of Directors remains committed to continuing

to evaluate and, where necessary or appropriate, further enhancing

the Company’s corporate governance and oversight to ensure the

Company’s governance structure aligns with its business operations

and corporate strategy, as well as regulatory and investor

expectations.

Corporate Overview

RBB Bancorp is a community-based financial holding company

headquartered in Los Angeles, California. As of December 31, 2023,

the Company had total assets of $4.0 billion. Its wholly-owned

subsidiary, the Bank, is a full service commercial bank, which

provides business banking services to the Asian communities in Los

Angeles County, Orange County, and Ventura County in California, in

Las Vegas, Nevada, in Brooklyn, Queens, and Manhattan in New York,

in Edison, New Jersey, in the Chicago neighborhoods of Chinatown

and Bridgeport, Illinois, and on Oahu, Hawaii. Bank services

include remote deposit, E-banking, mobile banking, commercial and

investor real estate loans, business loans and lines of credit,

commercial and industrial loans, SBA 7A and 504 loans, 1-4 single

family residential loans, automobile lending, trade finance, a full

range of depository account products and wealth management

services. The Bank has nine branches in Los Angeles County, two

branches in Ventura County, one branch in Orange County,

California, one branch in Las Vegas, Nevada, three branches and one

loan operation center in Brooklyn, three branches in Queens, one

branch in Manhattan in New York, one branch in Edison, New Jersey,

two branches in Chicago, Illinois, and one branch in Honolulu,

Hawaii. The Company's administrative and lending center is located

at 1055 Wilshire Blvd., Los Angeles, California 90017, and its

finance and operations center is located at 7025 Orangethorpe Ave.,

Buena Park, California 90621. The Company's website address is

www.royalbusinessbankusa.com.

Conference Call

Management will hold a conference call at 11:00 a.m. Pacific

time/2:00 p.m. Eastern time on Tuesday, January 23, 2024, to

discuss the Company’s fourth quarter 2023 financial results.

To listen to the conference call, please dial 1-888-506-0062 or

1-973-528-0011, the Participant ID code is 885254, conference ID

RBBQ423. A replay of the call will be made available at

1-877-481-4010 or 1-919-882-2331, the passcode is 49681,

approximately one hour after the conclusion of the call and will

remain available through February 6, 2024.

The conference call will also be simultaneously webcast over the

Internet; please visit our Royal Business Bank website at

www.royalbusinessbankusa.com and click

on the “Investors” tab to access the call from the site. This

webcast will be recorded and available for replay on our website

approximately two hours after the conclusion of the conference

call.

Disclosure

This press release contains certain non-GAAP financial

disclosures for tangible common equity and tangible assets and

adjusted earnings. The Company uses certain non-GAAP financial

measures to provide meaningful supplemental information regarding

the Company’s operational performance and to enhance investors’

overall understanding of such financial performance. Please refer

to the tables at the end of this release for a presentation of

performance ratios in accordance with GAAP and a reconciliation of

the non-GAAP financial measures to the GAAP financial measures.

Safe Harbor

Certain matters set forth herein (including the exhibits hereto)

constitute forward-looking statements relating to the Company’s

current business plans and expectations and our future financial

position and operating results. These forward-looking statements

are subject to risks and uncertainties that could cause actual

results, performance and/or achievements to differ materially from

those projected. These risks and uncertainties include, but are not

limited to, the Bank’s ability to comply with the requirements of

the Consent Order we have entered into with the FDIC and the DFPI

and the possibility that we may be required to incur additional

expenses or be subject to additional regulatory action, if we are

unable to timely and satisfactorily comply with the consent order;

the effectiveness of the Company’s internal control over financial

reporting and disclosure controls and procedures; the potential for

additional material weaknesses in the Company’s internal controls

over financial reporting or other potential control deficiencies of

which the Company is not currently aware or which have not been

detected; business and economic conditions generally and in the

financial services industry, nationally and within our current and

future geographic markets, including the tight labor market,

ineffective management of the U.S. federal budget or debt or

turbulence or uncertainly in domestic of foreign financial markets;

the strength of the United States economy in general and the

strength of the local economies in which we conduct operations; our

ability to attract and retain deposits and access other sources of

liquidity; possible additional provisions for loan losses and

charge-offs; credit risks of lending activities and deterioration

in asset or credit quality; extensive laws and regulations and

supervision that we are subject to, including potential supervisory

action by bank supervisory authorities; increased costs of

compliance and other risks associated with changes in regulation,

including any amendments to the Dodd-Frank Wall Street Reform and

Consumer Protection Act; compliance with the Bank Secrecy Act and

other money laundering statutes and regulations; potential goodwill

impairment; liquidity risk; fluctuations in interest rates; the

transition away from the London Interbank Offering Rate (LIBOR) and

related uncertainty as well as the risks and costs related to our

adopted alternative reference rate, including the Secured Overnight

Financing Rate (SOFR); risks associated with acquisitions and the

expansion of our business into new markets; inflation and

deflation; real estate market conditions and the value of real

estate collateral; environmental liabilities; our ability to

compete with larger competitors; our ability to retain key

personnel; successful management of reputational risk; severe

weather, natural disasters, earthquakes, fires; or other adverse

external events could harm our business; geopolitical conditions,

including acts or threats of terrorism, actions taken by the United

States or other governments in response to acts or threats of

terrorism and/or military conflicts, including the conflicts

between Russia and Ukraine and in the Middle East, which could

impact business and economic conditions in the United States and

abroad; public health crises and pandemics, and their effects on

the economic and business environments in which we operate,

including our credit quality and business operations, as well as

the impact on general economic and financial market conditions;

general economic or business conditions in Asia, and other regions

where the Bank has operations; failures, interruptions, or security

breaches of our information systems; climate change, including any

enhanced regulatory, compliance, credit and reputational risks and

costs; cybersecurity threats and the cost of defending against

them; our ability to adapt our systems to the expanding use of

technology in banking; risk management processes and strategies;

adverse results in legal proceedings; the impact of regulatory

enforcement actions, if any; certain provisions in our charter and

bylaws that may affect acquisition of the Company; changes in tax

laws and regulations; the impact of governmental efforts to

restructure the U.S. financial regulatory system; the impact of

future or recent changes in FDIC insurance assessment rate of the

rules and regulations related to the calculation of the FDIC

insurance assessment amount; the effect of changes in accounting

policies and practices or accounting standards, as may be adopted

from time-to-time by bank regulatory agencies, the SEC, the Public

Company Accounting Oversight Board, the Financial Accounting

Standards Board or other accounting standards setters, including

Accounting Standards Update 2016-13 (Topic 326, “Measurement of

Current Losses on Financial Instruments, commonly referenced as the

Current Expected Credit Losses Model, which changed how we estimate

credit losses and may further increase the required level of our

allowance for credit losses in future periods; market disruption

and volatility; fluctuations in the Company’s stock price;

restrictions on dividends and other distributions by laws and

regulations and by our regulators and our capital structure;

issuances of preferred stock; our ability to raise additional

capital, if needed, and the potential resulting dilution of

interests of holders of our common stock; the soundness of other

financial institutions; our ongoing relations with our various

federal and state regulators, including the SEC, FDIC, FRB and

DFPI; our success at managing the risks involved in the foregoing

items and all other factors set forth in the Company’s public

reports, including its Annual Report as filed under Form 10-K and

Form 10-K/A for the year ended December 31, 2022, and particularly

the discussion of risk factors within that document. The Company

does not undertake, and specifically disclaims any obligation, to

update any forward-looking statements to reflect occurrences or

unanticipated events or circumstances after the date of such

statements except as required by law. Any statements about future

operating results, such as those concerning accretion and dilution

to the Company’s earnings or shareholders, are for illustrative

purposes only, are not forecasts, and actual results may

differ.

RBB BANCORP AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited) (Dollars in

thousands)

December 31,

September 30,

December 31,

2023

2023

2022

Assets

Cash and due from banks

$

431,373

$

330,791

$

83,548

Interest-bearing deposits in other

financial institutions

600

600

600

Investment securities available for

sale

318,961

354,378

256,830

Investment securities held to maturity

5,209

5,214

5,729

Mortgage loans held for sale

1,911

62

—

Loans held for investment

3,031,861

3,120,952

3,336,449

Allowance for loan losses

(41,903

)

(42,430

)

(41,076

)

Net loans held for investment

2,989,958

3,078,522

3,295,373

Premises and equipment, net

25,684

26,134

27,009

Federal Home Loan Bank (FHLB) stock

15,000

15,000

15,000

Cash surrender value of bank owned life

insurance

58,719

58,346

57,310

Goodwill

71,498

71,498

71,498

Servicing assets

8,110

8,439

9,521

Core deposit intangibles

2,795

3,010

3,718

Right-of-use assets

29,803

29,949

25,447

Accrued interest and other assets

66,404

87,411

67,475

Total assets

$

4,026,025

$

4,069,354

$

3,919,058

Liabilities and shareholders'

equity

Deposits:

Noninterest-bearing demand

$

539,621

$

572,393

$

798,741

Savings, NOW and money market accounts

632,729

608,020

615,339

Time deposits, $250,000 and under

1,190,821

1,237,831

837,369

Time deposits, greater than $250,000

811,589

735,828

726,234

Total deposits

3,174,760

3,154,072

2,977,683

FHLB advances

150,000

150,000

220,000

Long-term debt, net of issuance costs

119,147

174,019

173,585

Subordinated debentures

14,938

14,884

14,720

Lease liabilities - operating leases

31,191

31,265

26,523

Accrued interest and other liabilities

24,729

42,603

21,984

Total liabilities

3,514,765

3,566,843

3,434,495

Shareholders' equity:

Shareholders' equity

530,700

528,200

506,156

Non-controlling interest

72

72

72

Accumulated other comprehensive loss, net

of tax

(19,512

)

(25,761

)

(21,665

)

Total shareholders' equity

511,260

502,511

484,563

Total liabilities and shareholders’

equity

$

4,026,025

$

4,069,354

$

3,919,058

RBB BANCORP AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (Unaudited) (In

thousands, except share and per share data)

For the Three Months

Ended

December 31, 2023

September 30, 2023

December 31, 2022

Interest and dividend income:

Interest and fees on loans

$

45,895

$

47,617

$

49,468

Interest on interest-bearing deposits

4,650

3,193

697

Interest on investment securities

3,706

4,211

1,874

Dividend income on FHLB stock

312

290

265

Interest on federal funds sold and

other

269

252

347

Total interest income

54,832

55,563

52,651

Interest expense:

Interest on savings deposits, NOW and

money market accounts

4,026

3,106

2,471

Interest on time deposits

22,413

21,849

7,798

Interest on subordinated debentures and

long-term debt

2,284

2,579

2,491

Interest on other borrowed funds

440

440

898

Total interest expense

29,163

27,974

13,658

Net interest income before

(reversal)/provision for credit losses

25,669

27,589

38,993

(Reversal)/provision for credit losses

(431

)

1,399

1,887

Net interest income after

(reversal)/provision for credit losses

26,100

26,190

37,106

Noninterest income:

Service charges and fees

972

1,057

940

Gain on sale of loans

116

212

112

Loan servicing fees, net of

amortization

616

623

581

Increase in cash surrender value of life

insurance

374

356

335

(Loss)/gain on sale of other real estate

owned

(57

)

190

—

Other income

5,373

332

384

Total noninterest income

7,394

2,770

2,352

Noninterest expense:

Salaries and employee benefits

8,860

9,744

6,930

Occupancy and equipment expenses

2,387

2,414

2,364

Data processing

1,357

1,315

1,203

Legal and professional

1,291

1,022

1,045

Office expenses

349

437

405

Marketing and business promotion

241

340

406

Insurance and regulatory assessments

1,122

730

489

Core deposit premium

215

236

253

Other expenses

571

638

1,061

Total noninterest expense

16,393

16,876

14,156

Income before income taxes

17,101

12,084

25,302

Income tax expense

5,028

3,611

7,721

Net income

$

12,073

$

8,473

$

17,581

Net income per share

Basic

$

0.64

$

0.45

$

0.93

Diluted

$

0.64

$

0.45

$

0.92

Cash dividends declared per common

share

$

0.16

$

0.16

$

0.14

Weighted-average common shares

outstanding

Basic

18,938,005

18,995,303

18,971,250

Diluted

18,948,087

18,997,304

19,086,586

RBB BANCORP AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (Unaudited) (In

thousands, except share and per share data)

For the Year Ended

December 31, 2023

December 31, 2022

Interest and dividend income:

Interest and fees on loans

$

194,264

$

171,099

Interest on interest-earning deposits

10,746

1,353

Interest on investment securities

14,028

6,084

Dividend income on FHLB stock

1,125

938

Interest on federal funds sold and

other

985

1,496

Total interest income

221,148

180,970

Interest expense:

Interest on savings deposits, NOW and

money market accounts

12,205

5,561

Interest on time deposits

76,837

13,338

Interest on subordinated debentures and

long-term debt

9,951

9,645

Interest on other borrowed funds

2,869

2,872

Total interest expense

101,862

31,416

Net interest income before provision for

credit losses

119,286

149,554

Provision for credit losses

3,362

4,935

Net interest income after provision for

credit losses

115,924

144,619

Noninterest income:

Service charges and fees

4,172

4,145

Gain on sale of loans

374

1,895

Loan servicing fees, net of

amortization

2,576

2,209

Increase in cash surrender value of life

insurance

1,410

1,322

Gain on sale of fixed assets

32

757

Gain on sale of other real estate

owned

134

—

Other income

6,320

924

Total noninterest income

15,018

11,252

Noninterest expense:

Salaries and employee benefits

37,795

35,488

Occupancy and equipment expenses

9,629

9,092

Data processing

5,326

5,060

Legal and professional

8,198

5,383

Office expenses

1,512

1,438

Marketing and business promotion

1,132

1,578

Insurance and regulatory assessments

3,165

1,850

Core deposit premium

923

1,086

Other expenses

3,016

3,551

Total noninterest expense

70,696

64,526

Income before income taxes

60,246

91,345

Income tax expense

17,781

27,018

Net income

$

42,465

$

64,327

Net income per share

Basic

$

2.24

$

3.37

Diluted

$

2.24

$

3.33

Cash Dividends declared per common

share

$

0.64

$

0.56

Weighted-average common shares

outstanding

Basic

18,978,075

19,099,509

Diluted

18,997,265

19,332,639

RBB BANCORP AND SUBSIDIARIES

AVERAGE BALANCE SHEET AND NET INTEREST INCOME (Unaudited)

For the Three Months

Ended

December 31, 2023

September 30, 2023

December 31, 2022

Average

Interest

Yield /

Average

Interest

Yield /

Average

Interest

Yield /

(tax-equivalent basis, dollars in

thousands)

Balance

& Fees

Rate

Balance

& Fees

Rate

Balance

& Fees

Rate

Interest-earning assets

Federal funds sold, cash equivalents &

other (1)

$

348,940

$

5,231

5.95

%

$

285,484

$

3,735

5.19

%

$

94,932

$

1,310

5.47

%

Securities

Available for sale (2)

329,426

3,684

4.44

%

369,459

4,187

4.50

%

245,348

1,847

2.99

%

Held to maturity (2)

5,212

46

3.50

%

5,385

48

3.54

%

5,733

50

3.46

%

Mortgage loans held for sale

1,609

29

7.15

%

739

13

6.98

%

192

3

6.20

%

Loans held for investment: (3)

Real estate

2,870,227

41,950

5.80

%

2,968,246

43,583

5.83

%

3,006,293

43,864

5.79

%

Commercial

183,396

3,916

8.47

%

187,140

4,021

8.52

%

280,326

5,601

7.93

%

Total loans held for investment

3,053,623

45,866

5.96

%

3,155,386

47,604

5.99

%

3,286,619

49,465

5.97

%

Total interest-earning assets

3,738,810

$

54,856

5.82

%

3,816,453

$

55,587

5.78

%

3,632,824

$

52,675

5.75

%

Total noninterest-earning assets

253,386

250,083

247,589

Total average assets

$

3,992,196

$

4,066,536

$

3,880,413

Interest-bearing liabilities

NOW

$

54,378

$

214

1.56

%

$

55,325

$

201

1.44

%

$

67,854

$

77

0.45

%

Money Market

422,582

3,252

3.05

%

403,300

2,656

2.61

%

561,575

2,337

1.65

%

Saving deposits

148,354

560

1.50

%

123,709

249

0.80

%

136,623

57

0.17

%

Time deposits, $250,000 and under

1,162,014

13,244

4.52

%

1,285,320

14,090

4.35

%

716,476

3,884

2.15

%

Time deposits, greater than $250,000

781,833

9,169

4.65

%

717,026

7,759

4.29

%

631,897

3,914

2.46

%

Total interest-bearing deposits

2,569,161

26,439

4.08

%

2,584,680

24,955

3.83

%

2,114,425

10,269

1.93

%

FHLB advances

150,000

440

1.16

%

150,000

440

1.16

%

196,304

898

1.81

%

Long-term debt

155,536

1,895

4.83

%

173,923

2,194

5.00

%

173,491

2,194

5.02

%

Subordinated debentures

14,902

389

10.36

%

14,848

385

10.29

%

14,684

297

8.02

%

Total interest-bearing liabilities

2,889,599

29,163

4.00

%

2,923,451

27,974

3.80

%

2,498,904

13,658

2.17

%

Noninterest-bearing liabilities

Noninterest-bearing deposits

535,554

571,371

856,917

Other noninterest-bearing liabilities

61,858

67,282

46,628

Total noninterest-bearing liabilities

597,412

638,653

903,545

Shareholders' equity

505,184

504,432

477,964

Total liabilities and shareholders'

equity

$

3,992,195

$

4,066,536

$

3,880,413

Net interest income / interest rate

spreads

$

25,693

1.82

%

$

27,613

1.98

%

$

39,017

3.58

%

Net interest margin

2.73

%

2.87

%

4.26

%

Total cost of deposits

$

3,104,715

$

26,439

3.38

%

$

3,156,051

$

24,955

3.14

%

$

2,971,342

$

10,269

1.37

%

Total cost of funds

$

3,425,153

$

29,163

3.38

%

$

3,494,822

$

27,974

3.18

%

$

3,355,821

$

13,658

1.61

%

(1)

Includes income and average balances for

FHLB stock, term federal funds, interest-bearing time deposits and

other miscellaneous interest-bearing assets.

(2)

Interest income and average rates for tax-exempt loans and

securities are presented on a tax-equivalent basis.

(3)

Average loan balances include non-accrual loans and loans

held for sale. Interest income on loans includes - amortization of

deferred loan fees, net of deferred loan costs.

RBB BANCORP AND SUBSIDIARIES

AVERAGE BALANCE SHEET AND NET INTEREST INCOME (Unaudited)

For the Year Ended

December 31, 2023

December 31, 2022

Average

Interest

Yield /

Average

Interest

Yield /

(tax-equivalent basis, dollars in

thousands)

Balance

& Fees

Rate

Balance

& Fees

Rate

Interest-earning assets

Federal funds sold, cash equivalents &

other (1)

$

231,851

$

12,857

5.55

%

$

276,923

$

3,787

1.37

%

Securities

Available for sale (2)

331,357

13,928

4.20

%

338,437

5,973

1.76

%

Held to maturity (2)

5,509

198

3.59

%

5,865

208

3.55

%

Mortgage loans held for sale

627

46

7.34

%

1,263

66

5.23

%

Loans held for investment: (3)

Real estate

2,998,250

176,740

5.89

%

2,774,348

151,164

5.45

%

Commercial

206,748

17,478

8.45

%

322,438

19,869

6.16

%

Total loans held for investment

3,204,998

194,218

6.06

%

3,096,786

171,033

5.52

%

Total interest-earning assets

3,774,342

$

221,247

5.86

%

3,719,274

$

181,067

4.87

%

Total noninterest-earning assets

246,981

244,894

Total average assets

$

4,021,323

$

3,964,168

Interest-bearing liabilities

NOW

$

58,191

$

725

1.25

%

$

73,335

$

262

0.36

%

Money Market

429,102

10,566

2.46

%

631,094

5,114

0.81

%

Saving deposits

126,062

915

0.73

%

144,409

185

0.13

%

Time deposits, $250,000 and under

1,146,513

47,150

4.11

%

609,464

6,583

1.08

%

Time deposits, greater than $250,000

742,839

29,687

4.00

%

565,059

6,755

1.20

%

Total interest-bearing deposits

2,502,707

89,043

3.56

%

2,023,361

18,899

0.93

%

FHLB advances

172,219

2,869

1.67

%

192,438

2,872

1.49

%

Long-term debt

169,182

8,478

5.01

%

173,275

8,777

5.07

%

Subordinated debentures

14,821

1,474

9.95

%

14,603

868

5.94

%

Total interest-bearing liabilities

2,858,929

101,864

3.56

%

2,403,677

31,416

1.31

%

Noninterest-bearing liabilities

Noninterest-bearing deposits

602,291

1,050,063

Other noninterest-bearing liabilities

59,561

39,647

Total noninterest-bearing liabilities

661,852

1,089,710

Shareholders' equity

500,540

470,781

Total liabilities and shareholders'

equity

$

4,021,321

$

3,964,168

Net interest income / interest rate

spreads

$

119,383

2.30

%

$

149,651

3.56

%

Net interest margin

3.16

%

4.02

%

Total cost of deposits

$

3,104,998

$

89,043

2.87

%

$

3,073,424

$

18,899

0.61

%

Total cost of funds

$

3,461,220

$

101,864

2.94

%

$

3,453,740

$

31,416

0.91

%

(1)

Includes income and average balances for

FHLB stock, term federal funds, interest-bearing time deposits and

other miscellaneous interest-bearing assets.

(2)

Interest income and average rates for tax-exempt loans and

securities are presented on a tax-equivalent basis.

(3)

Average loan balances include non-accrual loans and loans

held for sale. Interest income on loans includes - amortization of

deferred loan fees, net of deferred loan costs.

RBB BANCORP AND SUBSIDIARIES

SELECTED FINANCIAL HIGHLIGHTS (Unaudited)

For the Three Months

Ended

For the Year Ended December

31,

December 31,

September 30,

December 31,

2023

2023

2022

2023

2022

Per share data (common stock)

Book value

$

27.47

$

26.45

$

25.55

$

27.47

$

25.55

Tangible book value (1)

$

23.48

$

22.53

$

21.58

$

23.48

$

21.58

Performance ratios

Return on average assets, annualized

1.20

%

0.83

%

1.80

%

1.06

%

1.62

%

Return on average shareholders' equity,

annualized

9.48

%

6.66

%

14.59

%

8.48

%

13.66

%

Return on average tangible common equity,

annualized (1)

11.12

%

7.82

%

17.33

%

9.97

%

16.26

%

Noninterest income to average assets,

annualized

0.73

%

0.27

%

0.24

%

0.37

%

0.28

%

Noninterest expense to average assets,

annualized

1.63

%

1.65

%

1.45

%

1.76

%

1.63

%

Yield on average earning assets

5.82

%

5.78

%

5.75

%

5.86

%

4.87

%

Yield on average loans

5.96

%

5.99

%

5.97

%

6.06

%

5.52

%

Cost of average total deposits (2)

3.38

%

3.14

%

1.37

%

2.87

%

0.61

%

Cost of average interest-bearing

deposits

4.08

%

3.83

%

1.93

%

3.56

%

0.93

%

Cost of average interest-bearing

liabilities

4.00

%

3.80

%

2.17

%

3.56

%

1.31

%

Net interest spread

1.82

%

1.98

%

3.58

%

2.30

%

3.56

%

Net interest margin

2.73

%

2.87

%

4.26

%

3.16

%

4.02

%

Efficiency ratio (3)

49.58

%

55.59

%

34.24

%

52.64

%

40.13

%

Operating expense ratio, annualized

1.63

%

1.65

%

1.45

%

1.76

%

1.63

%

Common stock dividend payout ratio

25.00

%

35.56

%

15.05

%

28.57

%

16.62

%

(1)

Non-GAAP measure. See Non–GAAP

reconciliations set forth at the end of this press release.

(2)

Total deposits include non-interest

bearing deposits and interest-bearing deposits.

(3)

Ratio calculated by dividing noninterest expense by the sum of

net interest income before provision for credit losses and

noninterest income.

RBB BANCORP AND SUBSIDIARIES

SELECTED FINANCIAL HIGHLIGHTS (Unaudited) (Dollars in

thousands)

At or for the quarter

ended

December 31,

September 30,

December 31,

2023

2023

2022

Credit Quality Data:

Loans 30-89 days past due

$

16,803

$

19,662

$

15,249

Loans 30-89 days past due to total

loans

0.55

%

0.63

%

0.46

%

Nonperforming loans

$

31,619

$

40,146

$

23,523

Nonperforming loans to total loans

1.04

%

1.29

%

0.71

%

Nonperforming assets

$

31,619

$

40,430

$

24,100

Nonperforming assets to total assets

0.79

%

0.99

%

0.61

%

Special mention loans

$

32,842

$

31,212

$

42,212

Special mention loans to total loans

1.08

%

1.00

%

1.27

%

Substandard loans

$

61,091

$

71,401

$

61,966

Substandard loans to total loans

2.01

%

2.29

%

1.86

%

Allowance for loan losses to total

loans

1.38

%

1.36

%

1.23

%

Allowance for loan losses to nonperforming

loans

132.52

%

105.69

%

174.62

%

Net charge-offs

$

109

$

2,206

$

85

Net charge-offs to average loans

0.01

%

0.28

%

0.01

%

Capital ratios (1)

Tangible common equity to tangible assets

(2)

11.06

%

10.71

%

10.65

%

Tier 1 leverage ratio

11.99

%

11.68

%

11.67

%

Tier 1 common capital to risk-weighted

assets

19.07

%

17.65

%

16.03

%

Tier 1 capital to risk-weighted assets

19.69

%

18.22

%

16.58

%

Total capital to risk-weighted assets

25.92

%

26.24

%

24.27

%

(1)

December 31, 2023 capital ratios are

preliminary.

(2)

Non-GAAP measure. See Non-GAAP

reconciliations set forth at the end of this press release.

RBB BANCORP AND SUBSIDIARIES

SELECTED FINANCIAL HIGHLIGHTS (Unaudited)

Loan Portfolio Detail

As of December 31,

2023

As of September 30,

2023

As of December 31,

2022

(dollars in thousands)

$

%

$

%

$

%

Loans:

Commercial and industrial

$

130,096

4.3

%

$

127,655

4.1

%

$

201,223

6.0

%

SBA

52,074

1.7

%

50,420

1.6

%

61,411

1.9

%

Construction and land development

181,469

6.0

%

259,778

8.3

%

276,876

8.3

%

Commercial real estate (1)

1,167,857

38.5

%

1,164,210

37.3

%

1,312,132

39.3

%

Single-family residential mortgages

1,487,796

49.1

%

1,505,307

48.2

%

1,464,108

43.9

%

Other loans

12,569

0.4

%

13,582

0.5

%

20,699

0.6

%

Total loans (2)

$

3,031,861

100.0

%

$

3,120,952

100.0

%

$

3,336,449

100.0

%

Allowance for credit losses

(41,903

)

(42,430

)

(41,076

)

Total loans, net

$

2,989,958

$

3,078,522

$

3,295,373

(1)

Includes non-farm and non-residential

loans, multi-family residential loans and non-owner occupied single

family residential loans.

(2)

Net of discounts and deferred fees and costs of $542, $384,

and ($521) as of December 31, 2023, September 30, 2023, and

December 31, 2022, respectively.

Non-GAAP Reconciliations

Tangible Book Value Reconciliations

The tangible book value per share is a non-GAAP disclosure.

Management measures the tangible book value per share to assess the

Company’s capital strength and business performance and believes

these are helpful to investors as additional tool for further

understanding our performance. The following is a reconciliation of

tangible book value to the Company shareholders’ equity computed in

accordance with GAAP, as well as a calculation of tangible book

value per share as of December 31, 2023, September 30, 2023, and

December 31, 2022.

(dollars in thousands, except share and

per share data)

December 31, 2023

September 30, 2023

December 31, 2022

Tangible common equity:

Total shareholders' equity

$

511,260

$

502,511

$

484,563

Adjustments

Goodwill

(71,498

)

(71,498

)

(71,498

)

Core deposit intangible

(2,795

)

(3,010

)

(3,718

)

Tangible common equity

$

436,967

$

428,003

$

409,347

Tangible assets:

Total assets-GAAP

$

4,026,025

$

4,069,354

$

3,919,058

Adjustments

Goodwill

(71,498

)

(71,498

)

(71,498

)

Core deposit intangible

(2,795

)

(3,010

)

(3,718

)

Tangible assets

$

3,951,732

$

3,994,846

$

3,843,842

Common shares outstanding

18,609,179

18,995,303

18,965,776

Common equity to assets ratio

12.70

%

12.35

%

12.36

%

Tangible common equity to tangible assets

ratio

11.06

%

10.71

%

10.65

%

Book value per share

$

27.47

$

26.45

$

25.55

Tangible book value per share

$

23.48

$

22.53

$

21.58

Return on Average Tangible Common Equity

Management measures return on average tangible common equity

(“ROATCE”) to assess the Company’s capital strength and business

performance and believes these are helpful to investors as an

additional tool for further understanding our performance. Tangible

equity excludes goodwill and other intangible assets (excluding

mortgage servicing rights), and is reviewed by banking and

financial institution regulators when assessing a financial

institution’s capital adequacy. This non-GAAP financial measure

should not be considered a substitute for operating results

determined in accordance with GAAP and may not be comparable to

other similarly titled measures used by other companies. The

following table reconciles ROATCE to its most comparable GAAP

measure:

Three Months Ended

Year Ended

December 31,

December 31,

(dollars in thousands)

2023

2022

2023

2022

Net income available to common

shareholders

$

12,073

$

17,581

$

42,465

$

64,327

Average shareholders' equity

505,184

477,964

500,540

470,781

Adjustments:

Goodwill

(71,498

)

(71,498

)

(71,498

)

(70,948

)

Core deposit intangible

(2,935

)

(3,882

)

(3,282

)

(4,131

)

Adjusted average tangible common

equity

$

430,751

$

402,584

$

425,760

$

395,702

Return on average common equity

9.48

%

14.59

%

8.48

%

13.66

%

Return on average tangible common

equity

11.12

%

17.33

%

9.97

%

16.26

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240122238325/en/

Lynn Hopkins, Interim Chief Financial Officer (213) 716-8066

lhopkins@rbbusa.com

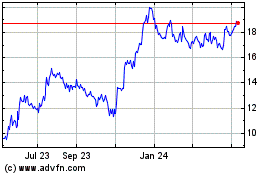

RBB Bancorp (NASDAQ:RBB)

Historical Stock Chart

From Nov 2024 to Dec 2024

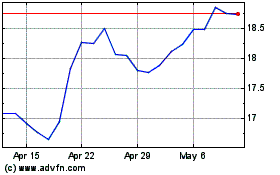

RBB Bancorp (NASDAQ:RBB)

Historical Stock Chart

From Dec 2023 to Dec 2024