Current Report Filing (8-k)

August 19 2015 - 12:12PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 18, 2015

| PURE CYCLE CORPORATION |

| (Exact name of registrant as specified in its charter) |

|

|

| Colorado |

| (State or other jurisdiction of incorporation) |

|

0-8814

|

|

84-0705083

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

| 34501 E. Quincy Avenue, Bldg. 34, Box 10, Watkins, CO 80137 |

| (Address of principal executive offices) (Zip Code) |

| Registrant’s telephone, including area code |

(303) 292-3456 |

|

| N/A |

| (Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

o

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

o

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

o

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 2.01 Completion of Acquisition or Disposition of Assets.

On August 18, 2015, Pure Cycle Corporation, a Colorado corporation (“Pure Cycle”), and PCY Holdings, LLC, a Colorado limited liability company wholly owned by Pure Cycle (together with Pure Cycle, the “Company”) closed the transactions contemplated by the previously announced Purchase and Sale Agreement (“Agreement”), dated as of March 11, 2015, as amended on March 31, 2015, May 18, 2015, June 18, 2015 and July 2, 2015, between the Company and Arkansas River Farms, LLC, a newly formed Colorado limited liability company (“Arkansas River Farms”) and affiliate of C&A Companies, Inc., a Colorado corporation, and Resource Land Holdings, LLC, a Colorado limited liability company.

Pursuant to the Agreement, the Company sold approximately 14,600 acres of real property located in Bent, Otero and Prowers Counties, Colorado, and certain water rights, including over 18,000 shares of stock in The Fort Lyon Canal Company, 45 shares of stock in the Lower Arkansas Water Management Association, 170 shares of stock in The Arbor Lateral Company, 568 shares of stock in The Consolidated Lateral Company, and 691 shares of stock in The Wheat Ridge Mutual Lateral Ditch Company (the “Arkansas River Assets”), to Arkansas River Farms for approximately $45.8 million in cash. Approximately $1.3 million of the closing consideration remains in escrow pending resolution by the parties of certain outstanding items.

Item 8.01 Other Events.

On August 18, 2015, Pure Cycle issued a press release relating to the sale of the Arkansas River Assets. A copy of the press release is attached hereto as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit

No.

|

|

Description

|

| |

|

|

|

|

|

Press Release dated August 18, 2015 regarding completion of the sale of the Arkansas River Assets.

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: August 19, 2015 |

|

| |

PURE CYCLE CORPORATION |

| |

|

| |

By: /s/ Mark W. Harding |

| |

Mark W. Harding

|

| |

President and Chief Financial Officer

|

EXHIBIT INDEX

|

Exhibit

No.

|

|

Description

|

| |

|

|

|

|

|

Press Release dated August 18, 2015 regarding completion of the sale of the Arkansas River Assets.

|

Exhibit 99.1

Pure Cycle Corporation Announces

Completion of Sale of its

Agricultural Holdings

Denver, Colorado – August 18, 2015 – Pure Cycle Corporation (NASDAQ Capital Market: PCYO) (“Pure Cycle” or the “Company”) announces today that it has completed the sale of its approximate 14,600 acres of farm land to Arkansas River Farms, LLC, an affiliate of C&A Companies, Inc. and Resource Land Holdings, LLC.

“We are pleased to announce the completion of the sale of our farms and we would like to express our appreciation to Arkansas River Farms, LLC, and their team for their efforts to complete the closing of this transaction. We are confident that they will be successful in their operation of the farms and in transitioning the farms to create new efficiencies and increase farm yields. We also want to thank all of our tenant farmers that we have developed strong and mutually beneficial relationships with over the years and wish them well in their future endeavors,” commented Mark Harding, President of Pure Cycle. “With this transaction complete, we will continue to focus our efforts and resources on our core water utility model and the development of our Sky Ranch property,” continued Mr. Harding.

“The acquisition of the farms in the Fort Lyons Canal system is an exciting opportunity for us. We are delighted to have worked closely with Pure Cycle on this transaction and want to express our appreciation for the smooth transfer of ownership of the properties,” commented Aaron Patsch, from Arkansas River Farms. “We look forward to developing the operation of the farms and working with the local community to develop long term relationships,” continued Mr. Patsch.

The Company received approximately $44.4 million in closing proceeds with approximately $1.3 million remaining in escrow while the parties resolve certain outstanding items.

Company Information

Pure Cycle owns water assets in the Denver, Colorado metropolitan area. Pure Cycle provides water and wastewater services to customers located in the Denver metropolitan area including the design, construction, operation and maintenance of water and wastewater systems.

Additional information including our recent press releases and Annual Reports are available at www.purecyclewater.com, or you may contact our President, Mark W. Harding, at 303-292-3456 or at info@purecyclewater.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are all statements, other than statements of historical facts, included in this press release that address activities, events or developments that we expect or anticipate will or may occur in the future, such as statements about development of our water utility and Sky Ranch. The words “anticipate,” “likely,” “may,” “should,” “could,” “will,” “believe,” “estimate,” “expect,” “plan,” “intend” and similar expressions are intended to identify forward-looking statements. Investors are cautioned that forward-looking statements are inherently uncertain and involve risks and uncertainties that could cause actual results to differ materially. Factors that could cause actual results to differ from projected results include, without limitation: the possibility that we may be unable to obtain shareholder approval or the parties to the Purchase and Sale Agreement may be unable to satisfy the other conditions to closing the proposed transaction; the proposed transaction may involve unexpected costs; the risk factors discussed in Part I, Item 1A of our most recent Annual Report on Form 10-K; and those factors discussed from time to time in our press releases, public statement and documents filed or furnished with the U.S. Securities and Exchange Commission. Except as required by law, we disclaim any obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

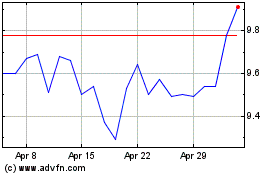

Pure Cycle (NASDAQ:PCYO)

Historical Stock Chart

From Oct 2024 to Nov 2024

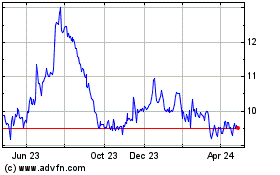

Pure Cycle (NASDAQ:PCYO)

Historical Stock Chart

From Nov 2023 to Nov 2024