false

0001356090

0001356090

2024-08-06

2024-08-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 6, 2024

PRECIGEN, INC.

(Exact name of registrant as specified in its

charter)

| Virginia |

|

001-36042 |

|

26-0084895 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

20374 Seneca Meadows Parkway, Germantown, Maryland 20876

(Address of principal executive offices) (Zip

Code)

(301) 556-9900

(Registrant’s telephone number, including

area code)

N/A

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Common Stock, No Par Value |

|

PGEN |

|

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

Item 2.02 Results of Operations and Financial

Condition.

Precigen, Inc. (the “Company”) hereby furnishes the

estimate that, as of June 30, 2024, the Company’s cash, cash equivalents, and short-term investments were approximately $19.5

million.

The information set forth above is preliminary and unaudited and reflects

preliminary financial information as of and for the quarter ended June 30, 2024. In preparing this information, the Company’s

actual results for the quarter ended June 30, 2024 have not yet been finalized by management or reviewed or audited by the Company’s

independent registered public accounting firm. The foregoing results are also not a comprehensive statement of financial results as of

and for the quarter ended June 30, 2024. Subsequent information or events may lead to material differences between the foregoing

preliminary financial information and those reported in the Company’s subsequent filings with the Securities and Exchange Commission.

This information shall not be deemed “filed” for purposes

of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities

Act of 1933, except as shall be expressly set forth by specific reference in such filing.

Item 7.01 Regulation FD Disclosure.

On August 6, 2024, the Company issued a press release titled

“Precigen Strategically Prioritizes Portfolio and Aligns Resources to Focus on First Potential Gene Therapy Launch.” A copy

of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

On August 6, 2024, the Company announced it has commenced an

underwritten public offering (the “Offering”) of $30.0 million of its common stock. In addition, the Company intends to grant

the underwriters a 30-day option to purchase up to an additional $4.5 million of common stock. The Offering is subject to market and other

conditions, and there can be no assurance as to whether or when the Offering may be completed, or as to the size or terms of the offering.

A copy of the press release relating to the Offering is furnished as Exhibit 99.2 to this Current Report on Form 8-K.

This information, including the Exhibits attached hereto, shall not

be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated

by reference in any filing under the Securities Act of 1933, except as shall be expressly set forth by specific reference in such filing.

Item 8.01 Other Events.

In connection with the implementation of the Company’s strategic

reprioritization and streamlining of resources, the Company estimates it will record non-cash impairment charges to goodwill and other

assets of approximately $32.9 million, net of tax, in the second quarter of 2024 and also estimates it will record severance costs of

approximately $3.0 million in the aggregate between the second and third quarters of 2024.

The Company’s strategic reprioritization and streamlining of

resources, together with the anticipated net proceeds from the Offering, and cash on hand, is expected to fund the Company’s operations

into early 2025, which is beyond its currently anticipated completed submission of a rolling biologics license application (“BLA”)

under an accelerated approval pathway for PRGN-2012. In addition to the recently announced proposed equity offering, the Company is

currently exploring a number of potential non-dilutive financings for future liquidity.

Forward-Looking Statements

Some of the statements made in this Current Report on Form 8-K

are forward-looking statements. These forward-looking statements are based upon the Company’s current expectations and projections

about future events and generally relate to plans, objectives, and expectations for the development of the Company’s business, including

the Company’s estimated cash position as of June 30, 2024, the Company’s plans for, and availability of, future liquidity,

the Company’s statements about its expected cash runway and estimated timeline to BLA submission for PRGN-2012, and the proposed public

equity offering and the anticipated receipt of proceeds. Although management believes that the plans and objectives reflected in or suggested

by these forward-looking statements are reasonable, all forward-looking statements involve risks and uncertainties and actual future results

may be materially different from the plans, objectives and expectations expressed in this Current Report on Form 8-K. The Company

has no obligation to provide any updates to these forward-looking statements even if its expectations change. All forward-looking statements

are expressly qualified in their entirety by this cautionary statement. For further information on potential risks and uncertainties,

and other important factors, any of which could cause the Company’s actual results to differ from those contained in the forward-looking

statements, see the section entitled “Risk Factors” in the Company’s most recent Annual Report on Form 10-K and

subsequent reports filed with the Securities and Exchange Commission.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Precigen, Inc. |

|

| |

|

|

| By: |

/s/ Donald P. Lehr |

|

| |

Donald P. Lehr |

|

| |

Chief Legal Officer |

|

Dated: August 6, 2024

Exhibit 99.1

Precigen Strategically

Prioritizes Portfolio to Focus on First Potential

Gene Therapy Launch

–

PRG-2012 is on track for a rolling BLA submission under an accelerated approval pathway;

patient enrollment initiated in the

confirmatory clinical trial –

GERMANTOWN,

MD, August 6, 2024 – Precigen, Inc. (Nasdaq: PGEN), a biopharmaceutical company specializing in the development

of innovative gene and cell therapies to improve the lives of patients, today announced a strategic reprioritization of the Company’s

clinical portfolio and streamlining of resources, including a reduction of over 20% of its workforce, to focus on potential commercialization

of the PRGN-2012 AdenoVerse® gene therapy for the

treatment of recurrent respiratory papillomatosis (RRP).

These strategic changes substantially reduce

required resources for non-priority programs and will enable the Company to focus on pre-commercialization efforts on PRGN-2012,

including supporting submission of a rolling biologics license application (BLA) under an accelerated approval pathway anticipated

in the second half of 2024, conducting the confirmatory clinical trial, and manufacturing of commercial product. Additionally, the

Company will continue acceleration of commercial readiness efforts for a potential launch in 2025, led by the Company’s new

Chief Commercial Officer, Phil Tennant.

Strategic prioritization will also include:

| · | PRGN-2009 AdenoVerse®

Gene Therapy Clinical Trials:

The Company plans to continue PRGN-2009 Phase 2 trials under a cooperative research and development agreement (CRADA) with the National

Cancer Institute (NCI) in recurrent/metastatic cervical cancer and in newly diagnosed HPV-associated oropharyngeal cancer. PRGN-2009 clinical

trial enrollment at non-NCI clinical sites will be paused. |

| · | UltraCAR-T® Clinical

Programs: The Company has completed enrollment of the Phase 1b trial

for PRGN-3006 in acute myeloid leukemia (AML), which received Fast Track designation from the FDA, and is preparing for an end of Phase

1b meeting with the FDA to discuss next steps. The Company will pause all other UltraCAR-T clinical programs, including PRGN-3005 and

PRGN-3007. The Company will minimize UltraCAR-T spend and focus on strategic partnerships to further advance UltraCAR-T programs. |

| · | Preclinical Programs: The Company will

pause all preclinical programs. |

| · | ActoBio: The Company has initiated a shutdown

of its Belgium-based ActoBio subsidiary operations, including planned elimination of all ActoBio personnel. In conjunction with this shutdown,

ActoBio’s portfolio of intellectual property will be made available for prospective transactions. |

“We

are on track toward our goal of submitting a rolling BLA for PRGN-2012 in the second half of this year and we are pleased to announce

that the confirmatory clinical trial, an important step guided by the FDA to support an accelerated approval, has already been initiated

and is actively enrolling patients,” said Helen Sabzevari, PhD, President and CEO of Precigen. “These prioritization steps

enhance our ability to rapidly prepare for potential commercialization of PRGN-2012, which if approved, we believe has the safety, efficacy,

and route of administration profile to be the first and best-in-class therapy for RRP patients.”

Please refer

to the Company’s 8-K filing for additional details.

###

Precigen: Advancing Medicine with Precision™

Precigen

(Nasdaq: PGEN) is a dedicated discovery and clinical stage biopharmaceutical company advancing the next generation of gene and cell therapies

using precision technology to target the most urgent and intractable diseases in our core therapeutic areas of immuno-oncology, autoimmune

disorders, and infectious diseases. Our technologies enable us to find innovative solutions for affordable biotherapeutics in a controlled

manner. Precigen operates as an innovation engine progressing a preclinical and clinical pipeline of well-differentiated therapies toward

clinical proof-of-concept and commercialization. For more information about Precigen, visit www.precigen.com or follow

us on X @Precigen, LinkedIn or YouTube.

AdenoVerse®

Precigen's AdenoVerse platform utilizes a library

of proprietary adenovectors for the efficient gene delivery of therapeutic effectors, immunomodulators, and vaccine antigens designed

to modulate the immune system. Precigen's gorilla adenovectors, part of the AdenoVerse library, have potentially superior performance

characteristics as compared to current competition. AdenoVerse gene therapies have been shown to generate high-level and durable antigen-specific

T-cell immune responses as well as an ability to boost these responses via repeat administration. Superior performance characteristics

and high yield manufacturing of AdenoVerse vectors leveraging UltraVector® technology allows Precigen to engineer cutting-edge

investigational gene therapies to treat complex diseases.

About PRGN-2012 AdenoVerse®

Gene Therapy

PRGN-2012

is an investigational off-the-shelf AdenoVerse gene therapy designed to elicit immune responses directed against cells infected with

human papillomavirus (HPV) 6 or HPV 11 for the treatment of RRP. PRGN-2012 was the first to receive Breakthrough Therapy Designation

and an accelerated approval pathway for RRP from the US Food and Drug Administration (FDA). PRGN-2012 received Orphan Drug

Designation from the FDA and from the European Commission. Results from the Phase 1 portion of the Phase 1/2 study were published

in the peer-reviewed journal, Science Translational Medicine, a leading publication from the American Association for the

Advancement of Science (AAAS).

Trademarks

Precigen, AdenoVerse, UltraVector, and Advancing

Medicine with Precision are trademarks of Precigen and/or its affiliates.

Cautionary Statement Regarding Forward-Looking

Statements

Some of the statements made in this press release

are forward-looking statements. These forward-looking statements are based upon the Company's current expectations and projections about

future events and generally relate to plans, objectives, and expectations for the development of the Company's business, the Company’s ability to successfully partner or

sell its paused programs and activities in a timely manner, the timing and progress of clinical trials, and related milestones including

BLA submission and potential launch of PRGN-2012, and the promise of the Company's portfolio of therapies. Although management believes

that the plans and objectives reflected in or suggested by these forward-looking statements are reasonable, all forward-looking statements

involve risks and uncertainties and actual future results may be materially different from the plans, objectives and expectations expressed

in this press release. The Company has no obligation to provide any updates to these forward-looking statements even if its expectations

change. All forward-looking statements are expressly qualified in their entirety by this cautionary statement. For further information

on potential risks and uncertainties, and other important factors, any of which could cause the Company's actual results to differ from

those contained in the forward-looking statements, see the section entitled “Risk Factors“ in the Company's most recent Annual

Report on Form 10-K and subsequent reports filed with the Securities and Exchange Commission.

Investor Contact:

Steven M. Harasym

Vice President, Investor Relations

Tel: +1 (301) 556-9850

investors@precigen.com

Media Contacts:

Donelle M. Gregory

press@precigen.com

Glenn Silver

Lazar-FINN Partners

glenn.silver@finnpartners.com

Exhibit 99.2

Precigen Announces Proposed $30 Million Public

Offering of Common Stock

GERMANTOWN, MD, August 6, 2024

- Precigen, Inc. (Nasdaq: PGEN) today announced it has commenced a $30.0 million underwritten public offering of its

common stock. In addition, Precigen intends to grant the underwriters a 30-day option to purchase up to an additional $4.5 million

of common stock. The offering is subject to market and other conditions, and there can be no assurance as to whether or when the

offering may be completed, or as to the size or terms of the offering. All of the shares in the proposed offering are to be sold by

Precigen.

Stifel is acting as the sole book-running

manager for the offering.

The public offering will be made pursuant

to a shelf registration statement on Form S-3 that was previously filed with the Securities and Exchange Commission (SEC) and became

effective on January 17, 2024. A preliminary prospectus supplement and accompanying base prospectus relating to and describing the

terms of the offering will be filed with the SEC and will be on the SEC’s website at www.sec.gov. Copies of the preliminary

prospectus supplement and base prospectus relating to this offering may be obtained, when available, from Stifel, Nicolaus &

Company, Incorporated, Attention: Prospectus Department, One Montgomery Street, Suite 3700, San Francisco, CA 94104, by telephone

at +1(415) 364-2720 or by email at syndprospectus@stifel.com. The final terms of the offering will be disclosed in a final prospectus

supplement to be filed with the SEC.

This press release shall not constitute an offer to sell or a solicitation

of an offer to buy, nor shall there be any sale of these shares in any state or jurisdiction in which such an offer, solicitation or sale

would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

About Precigen

Precigen (Nasdaq: PGEN) is a dedicated discovery

and clinical stage biopharmaceutical company advancing the next generation of gene and cell therapies using precision technology to target

the most urgent and intractable diseases in our core therapeutic areas of immuno-oncology, autoimmune disorders, and infectious diseases.

Our technologies are designed to enable us to find innovative solutions for affordable biotherapeutics in a controlled manner. Precigen

operates as an innovation engine progressing a preclinical and clinical pipeline of well-differentiated therapies toward clinical proof-of-concept

and commercialization.

Cautionary Statement Regarding Forward-Looking Statements

Some of the statements made in this press

release are forward-looking statements. These forward-looking statements are based upon Precigen’s current expectations and projections

about future events, including the proposed public offering and the size or terms of such offering. Various factors may

cause differences between Precigen’s expectations and actual results. These risks and uncertainties include, without limitation,

risks and uncertainties related to market conditions and satisfaction of customary closing conditions related to the proposed public offering,

as well as that we have broad discretion in the use of proceeds. There can be no assurance that Precigen will be able to complete the

proposed public offering on the anticipated terms, or at all. For further information on potential risks and uncertainties, and other

important factors, any of which could cause Precigen’s actual results to differ from those contained in the forward-looking statements,

see the section entitled “Risk Factors” in Precigen’s most recent Annual Report on Form 10-K and subsequent reports

filed with the Securities and Exchange Commission.

Investor Contact:

Steven M. Harasym

Vice President, Investor Relations

Tel: +1 (301) 556-9850

investors@precigen.com

Media Contacts:

Donelle M. Gregory

press@precigen.com

Glenn Silver

Lazar-FINN Partners

glenn.silver@finnpartners.com

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

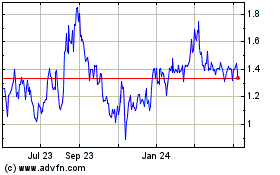

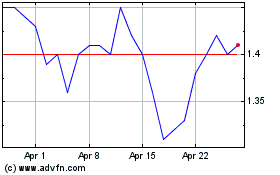

Precigen (NASDAQ:PGEN)

Historical Stock Chart

From Oct 2024 to Nov 2024

Precigen (NASDAQ:PGEN)

Historical Stock Chart

From Nov 2023 to Nov 2024