Form 8-K - Current report

August 15 2024 - 3:05PM

Edgar (US Regulatory)

false

0001168455

0001168455

2024-08-14

2024-08-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report: August 14, 2024

(Date of earliest event reported)

Plumas Bancorp

(Exact name of registrant as specified in its charter)

| California |

000-49883 |

75-2987096 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification Number) |

| 5525 Kietzke Lane, Suite 100, Reno, |

|

|

| Nevada |

|

89511 |

| (Address of principal executive offices) |

|

(Zip Code) |

775-786-0907

(Registrant's telephone number, including area code)

Not Applicable

(Former Name or Former Address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, no par value

|

PLBC

|

The NASDAQ Stock Market LLC

|

Item 1.02 Termination of a Material Definitive Agreement.

On August 14, 2024, Plumas Bank (the “Bank”), a wholly-owned subsidiary of Plumas Bancorp (the “Company”), and Mountainseed Real Estate Services, LLC, a Georgia limited liability company (“Mountainseed”), mutually agreed to terminate an Agreement for Purchase and Sale of Real Property dated as of January 19, 2024 (the “Purchase Agreement”).

The Purchase Agreement provided that Mountainseed would purchase from the Bank three properties operated by the Bank as administrative offices for an aggregate purchase price of approximately $7.9 million, subject to Mountainseed performing satisfactory due diligence and other customary closing conditions. The Purchase Agreement further provided that upon the completion of the sale transaction, Mountainseed would lease the properties back to the Bank.

The termination of the Purchase Agreement does not affect the Bank’s sale and leaseback transaction with Mountainseed with respect to nine branch office properties, which, as previously reported, was completed on February 14, 2024.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit

No.

|

|

Description of Exhibit

|

|

10.1

|

|

|

|

10.2

|

|

|

|

10.3

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

* Certain schedules and exhibits to this exhibit have been omitted pursuant to Item 601(a)(5). The registrant hereby agrees to furnish a copy of any omitted schedule or similar attachment to the SEC upon request.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Plumas Bancorp |

|

| |

(Registrant) |

|

| |

|

|

|

| August 15, 2024 |

By: |

/s/ Richard L. Belstock |

|

| |

|

Name: Richard L. Belstock |

|

| |

|

Title: Chief Financial Officer |

|

Exhibit 10.3

TERMINATION AGREEMENT

THIS TERMINATION AGREEMENT (this “Termination Agreement”) is entered into as of August 14, 2024 (the “Effective Date”)by and between MountainSeed Real Estate Services, LLC, a Georgia limited liability company (“MountainSeed”), and Plumas Bank, a California corporation (“Company”). Each of MountainSeed and Company may be referred to herein individually as a “Party” or collectively as the “Parties”.

RECITALS

A. MountainSeed and Company are parties to that certain Agreement for Purchase and Sale of Property dated January 19, 2024, as amended by that certain First Amendment to Agreement for Purchase and Sale of Property dated March 14, 2024 (as amended, the “Existing Agreement”). All initially capitalized terms used by otherwise defined herein shall have the meanings set forth for such terms in the Existing Agreement.

B. MountainSeed and Company now wish to terminate the Existing Agreement, subject to the terms set forth in this Termination Agreement.

AGREEMENT

|

1

|

Termination of Existing Agreement. As of the Effective Date, the Existing Agreement is hereby terminated in its entirety, and the parties to the Existing Agreement shall no further rights or obligations thereunder, except for those which expressly survive any termination of the Existing Agreement.

|

|

2

|

Deposit. The Parties acknowledge and agree that Company is entitled to retain the Deposit and MountainSeed hereby authorizes Escrow Agent to disburse the Deposit to Company.

|

|

3

|

Mutual Release. Each Party releases and forever discharges the other Party and all of its employees, agents, successors, assigns, legal representatives, affiliates, directors and officers from and against any and all actions, claims, suits, demands, payment obligations or other obligations or liabilities of any nature whatsoever, whether known or unknown, which such Party or any of its employees, agents, successors, assigns, legal representatives, affiliates, directors and officers have had, now have or may in the future have directly or indirectly arising out of (or in connection with) the Existing Agreement, including any activities undertaken pursuant to any of the Existing Agreement.

|

|

4

|

Representations and Warranties. Each Party hereby represents and warrants to the other Party that:

|

|

4.1

|

It has the full right, power and authority to enter into this Termination Agreement and to perform its obligations hereunder.

|

|

4.2

|

The execution of this Termination Agreement by the individual whose signature is set forth at the end of this Termination Agreement on behalf of such Party, and the delivery of this Termination Agreement by such Party, have been duly authorized by all necessary action on the part of such Party.

|

|

4.3

|

This Termination Agreement has been executed and delivered by such Party and constitutes the legal, valid and binding obligation of such Party, enforceable against such Party in accordance with its terms.

|

| TERMINATION AGREEMENT |

Page 1 of 3 |

|

5

|

Entire Agreement. This Termination Agreement constitutes the full and accurate understanding and agreement between and among the Parties relating to the entire subject matter and supersedes all prior agreements, representations and understandings of the Parties.

|

|

6

|

Governing Law. This Termination Agreement and all claims or causes of action (whether in contract or tort) that may be based upon, arise out of or relate to this Termination Agreement or the negotiation, execution or performance of Termination Agreement, shall be governed by the internal laws of the State of Georgia without regard to any conflicts of law principles.

|

|

7

|

Counterparts & Electronic Signatures. This Termination Agreement may be executed in counterparts, in which event all executed copies taken together or a copy with all of the signature pages attached thereto, shall constitute one and the same instrument, and shall become effective when one or more counterparts have been signed by each Party and delivered to the other Party. The electronic transmission of signatures to this Termination Agreement shall be valid, legal and binding on both Parties.

|

[Signature Page Follows]

| TERMINATION AGREEMENT |

Page 2 of 3 |

IN WITNESS WHEREOF, the parties hereto have executed this Termination Agreement as of the day and year first written above.

MOUNTAINSEED:

MOUNTAINSEED REAL ESTATE SERVICES, LLC

By: /s/ Nathan Brown

Name: Nathan Brown

Title: President

COMPANY:

PLUMAS BANK

By: /s/ Richard Belstock

Name: Richard Belstock

Title: CFO

| TERMINATION AGREEMENT |

Page 3 of 3 |

v3.24.2.u1

Document And Entity Information

|

Aug. 14, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Plumas Bancorp

|

| Document, Type |

8-K

|

| Document, Period End Date |

Aug. 14, 2024

|

| Entity, Incorporation, State or Country Code |

CA

|

| Entity, File Number |

000-49883

|

| Entity, Tax Identification Number |

75-2987096

|

| Entity, Address, Address Line One |

5525 Kietzke Lane, Suite 100

|

| Entity, Address, City or Town |

Reno

|

| Entity, Address, State or Province |

NV

|

| Entity, Address, Postal Zip Code |

89511

|

| City Area Code |

775

|

| Local Phone Number |

786-0907

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

PLBC

|

| Security Exchange Name |

NASDAQ

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001168455

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

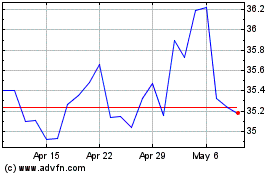

Plumas Bancorp (NASDAQ:PLBC)

Historical Stock Chart

From Nov 2024 to Dec 2024

Plumas Bancorp (NASDAQ:PLBC)

Historical Stock Chart

From Dec 2023 to Dec 2024