- Total revenue growth of 14% year over year

- Company raises its full-year 2024 EPS guidance

- Operating cash flow of $170 million increased 160% year over

year

- Share repurchases accelerated to $146 million for Q2 2024

NICE (NASDAQ: NICE) today announced results for the

second quarter ended June 30, 2024, as compared to the

corresponding period of the previous year.

Second Quarter 2024 Financial Highlights

GAAP

Non-GAAP

Total revenue was $664.4 million and

increased 14%

Total revenue was $664.4 million and

increased 14%

Cloud revenue was $481.7 million and

increased 26%

Cloud revenue was $481.7 million and

increased 26%

Operating income was $128.8 million and

increased 22%

Operating income was $201.7 million and

increased 19%

Operating margin was 19.4% compared to

18.1% last year

Operating margin was 30.4% compared to

29.2% last year

Diluted EPS was $1.76 and increased

34%

Diluted EPS was $2.64 and increased

24%

Operating cash flow was $169.7 million and

increased 160%

“We are pleased to conclude the first half of 2024 with strong

Q2 results across the board. Total revenue increased 14% to $664

million, once again driven by industry-leading cloud growth of

26%,” said Barak Eilam, CEO of NICE. “The growing adoption of our

extensive and innovative portfolio of AI solutions fueled an

all-time record quarter for CXone bookings.

“Our consistently robust top line results continue to drive

top-tier software industry profitability. We reported our fourth

consecutive quarter of non-GAAP operating margin of at least 30%

and exceeded the high end our non-GAAP earnings per share guidance

range with $2.64. Additionally, we generated $170 million in

operating cash in Q2, and $725 million over the past 12

months.”

Mr. Eilam continued, “We continue to gain market share with the

most comprehensive CX platform in CXone, rapid innovation in AI

that is experiencing significant enterprise adoption and the

flexibility afforded by our rock-solid financial position. We are

positioned to further expand our market leadership and deliver

long-term growth.”

GAAP Financial Highlights for the

Second Quarter Ended June 30:

Revenues: Second quarter 2024 total revenues increased

14% to $664.4 million compared to $581.1 million for the second

quarter of 2023.

Gross Profit: Second quarter 2024 gross profit was $439.6

million compared to $391.4 million for the second quarter of 2023.

Second quarter 2024 gross margin was 66.2% compared to 67.4% for

the second quarter of 2023.

Operating Income: Second quarter 2024 operating income

increased 22% to $128.8 million compared to $105.4 million for the

second quarter of 2023. Second quarter 2024 operating margin was

19.4% compared to 18.1% for the second quarter of 2023.

Net Income: Second quarter 2024 net income increased 33%

to $115.8 million compared to $87.4 million for the second quarter

of 2023. Second quarter 2024 net income margin was 17.4% compared

to 15.0% for the second quarter of 2023.

Fully Diluted Earnings Per Share: Fully diluted earnings

per share for the second quarter of 2024 increased 34% to $1.76

compared to $1.31 in the second quarter of 2023.

Cash Flow and Cash Balance: Second quarter 2024 operating

cash flow was $169.7 million. In the second quarter 2024, $146.1

million was used for share repurchases. As of June 30, 2024, total

cash and cash equivalents, and short-term investments were $1,503.6

million. Our debt was $457.9 million, resulting in net cash and

investments of $1,045.7 million.

Non-GAAP Financial Highlights for the

Second Quarter Ended June 30:

Revenues: Second quarter 2024 total revenues increased

14% to $664.4 million compared to $581.1 million for the second

quarter of 2023.

Gross Profit: Second quarter 2024 gross profit was $469.4

million compared to $416.3 million for the second quarter of 2023.

Second quarter 2024 gross margin was 70.7% compared to 71.6% for

the second quarter of 2023.

Operating Income: Second quarter 2024 operating income

increased 19% to $201.7 million compared to $169.6 million for the

second quarter of 2023. Second quarter 2024 operating margin was

30.4% compared to 29.2% for the second quarter of 2023.

Net Income: Second quarter 2024 net income increased 23%

to $174.2 million compared to $141.5 million for the second quarter

of 2023. Second quarter 2024 net income margin was 26.2% compared

to 24.4% for the second quarter of 2023.

Fully Diluted Earnings Per Share: Fully diluted earnings

per share for the second quarter of 2024 increased 24% to $2.64

compared to $2.13 in the second quarter of 2023.

Third Quarter and Full Year 2024

Guidance:

Third-Quarter 2024: Third-quarter 2024 non-GAAP total

revenues are expected to be in a range of $676 million to $686

million, representing 13% growth year over year at the

midpoint.

Third-quarter 2024 non-GAAP fully diluted earnings per share are

expected to be in a range of $2.62 to $2.72, representing 18%

growth year over year at the midpoint.

Full-Year 2024: Full-year 2024 non-GAAP total revenues

are expected to be in a range of $2,715 million to $2,735 million,

representing 15% growth at the midpoint compared to full-year

2023.

The Company increased full-year 2024 non-GAAP fully diluted

earnings per share which are expected to be in a range of $10.60 to

$10.80, representing 22% growth at the midpoint compared to

full-year 2023.

Quarterly Results Conference Call

NICE management will host its earnings conference call today

August 15, 2024, at 8:30 AM ET, 13:30 GMT, 15:30 Israel, to discuss

the results and the company's outlook. To participate in the call,

please dial into the following numbers: United States

1-877-407-4018 or +1-201-689-8471, United Kingdom 0-800-756-3429,

Israel 1-809-406-247. The call will be webcast live on the

Company’s website at

https://www.nice.com/investor-relations/upcoming-event.

Explanation of Non-GAAP measures Non-GAAP financial

measures are included in this press release. Non-GAAP financial

measures consist of GAAP financial measures adjusted to exclude

share-based compensation, amortization of acquired intangible

assets, acquisition related and other expenses, amortization of

discount on debt and loss from extinguishment of debt and the tax

effect of the Non-GAAP adjustments.

The Company believes that these Non-GAAP financial measures,

used in conjunction with the corresponding GAAP measures, provide

investors with useful supplemental information about the financial

performance of our business. We believe Non-GAAP financial measures

are useful to investors as a measure of the ongoing performance of

our business. Our management regularly uses our supplemental

Non-GAAP financial measures internally to understand, manage and

evaluate our business and to make financial, strategic and

operating decisions. These Non-GAAP measures are among the primary

factors management uses in planning for and forecasting future

periods. Our Non-GAAP financial measures are not meant to be

considered in isolation or as a substitute for comparable GAAP

measures and should be read only in conjunction with our

consolidated financial statements prepared in accordance with GAAP.

These Non-GAAP financial measures may differ materially from the

Non-GAAP financial measures used by other companies. Reconciliation

between results on a GAAP and Non-GAAP basis is provided in a table

immediately following the Consolidated Statements of Income. The

Company provides guidance only on a Non-GAAP basis. A

reconciliation of guidance from a GAAP to Non-GAAP basis is not

available due to the unpredictability and uncertainty associated

with future events that would be reported in GAAP results and would

require adjustments between GAAP and Non-GAAP financial measures,

including the impact of future possible business acquisitions.

Accordingly, a reconciliation of the guidance based on Non-GAAP

financial measures to corresponding GAAP financial measures for

future periods is not available without unreasonable effort.

About NICE With NICE (Nasdaq: NICE), it’s never been

easier for organizations of all sizes around the globe to create

extraordinary customer experiences while meeting key business

metrics. Featuring the world’s #1 cloud native customer experience

platform, CXone, NICE is a worldwide leader in AI-powered

self-service and agent-assisted CX software for the contact center

– and beyond. Over 25,000 organizations in more than 150 countries,

including over 85 of the Fortune 100 companies, partner with NICE

to transform - and elevate - every customer interaction.

www.nice.com

Trademark Note: NICE and the NICE logo are trademarks or

registered trademarks of NICE. All other marks are trademarks of

their respective owners. For a full list of NICE' marks, please

see: http://www.nice.com/nice-trademarks.

Forward-Looking Statements This press release contains

forward-looking statements as that term is defined in the Private

Securities Litigation Reform Act of 1995. In some cases,

forward-looking statements may be identified by words such as

“believe,” “expect,” “seek,” “may,” “will,” “intend,” “should,”

“project,” “anticipate,” “plan,” and similar expressions.

Forward-looking statements are based on the current beliefs,

expectations and assumptions of the Company’s management regarding

the future of the Company’s business, performance, future plans and

strategies, projections, anticipated events and trends, the

economic environment, and other future conditions. Examples of

forward-looking statements include guidance regarding the Company’s

revenue and earnings and the growth of our cloud, analytics and

artificial intelligence business.

Forward looking statements are inherently subject to significant

uncertainties, contingencies, and risks, including, economic,

competitive and other factors, which are difficult to predict and

many of which are beyond the control of management. The Company

cautions that these statements are not guarantees of future

performance, and investors should not place undue reliance on them.

There are or will be important known and unknown factors and

uncertainties that could cause actual results to differ materially

from those expressed or implied in the forward-looking statements.

These factors, include, but are not limited to, risks associated

with changes in economic and business conditions, competition,

successful execution of the Company’s growth strategy, success and

growth of the Company’s cloud Software-as-a-Service business,

difficulties in making additional acquisitions or effectively

integrating acquired operations, products, technologies and

personnel, the Company’s dependency on third-party cloud computing

platform providers, hosting facilities and service partners,

rapidly changing technology, cyber security attacks or other

security breaches against the Company, privacy concerns and

legislation impacting the Company’s business, changes in currency

exchange rates and interest rates, the effects of additional tax

liabilities resulting from our global operations, the effect of

unexpected events or geo-political conditions, such as the impact

of conflicts in the Middle East, that may disrupt our business and

the global economy and various other factors and uncertainties

discussed in our filings with the U.S. Securities and Exchange

Commission (the “SEC”).

You are encouraged to carefully review the section entitled

“Risk Factors” in our latest Annual Report on Form 20-F and our

other filings with the SEC for additional information regarding

these and other factors and uncertainties that could affect our

future performance. The forward-looking statements contained in

this press release speak only as of the date hereof, and the

Company undertakes no obligation to update or revise them, whether

as a result of new information, future developments or otherwise,

except as required by law.

NICE LTD. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS

U.S. dollars in thousands

June 30,

December 31,

2024

2023

Unaudited

Audited

ASSETS

CURRENT ASSETS:

Cash and cash equivalents

$

739,556

$

511,795

Short-term investments

764,042

896,044

Trade receivables

580,101

585,154

Debt hedge option

-

121,922

Prepaid expenses and other current

assets

216,908

197,967

Total current assets

2,300,607

2,312,882

LONG-TERM ASSETS:

Property and equipment, net

181,689

174,414

Deferred tax assets

190,471

178,971

Other intangible assets, net

245,299

305,501

Operating lease right-of-use assets

98,957

104,565

Goodwill

1,820,746

1,821,969

Prepaid expenses and other long-term

assets

214,050

219,332

Total long-term assets

2,751,212

2,804,752

TOTAL ASSETS

$

5,051,819

$

5,117,634

LIABILITIES AND SHAREHOLDERS'

EQUITY

CURRENT LIABILITIES:

Trade payables

$

73,129

$

66,036

Deferred revenues and advances from

customers

342,405

302,649

Current maturities of operating leases

13,057

13,747

Debt

-

209,229

Accrued expenses and other liabilities

509,779

528,660

Total current liabilities

938,370

1,120,321

LONG-TERM LIABILITIES:

Deferred revenues and advances from

customers

60,839

52,458

Operating leases

96,861

102,909

Deferred tax liabilities

8,057

8,596

Debt

457,930

457,081

Other long-term liabilities

22,900

21,769

Total long-term liabilities

646,587

642,813

SHAREHOLDERS' EQUITY

Nice Ltd's equity

3,455,172

3,341,132

Non-controlling interests

11,690

13,368

Total shareholders' equity

3,466,862

3,354,500

TOTAL LIABILITIES AND SHAREHOLDERS'

EQUITY

$

5,051,819

$

5,117,634

NICE LTD. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

INCOME

U.S. dollars in thousands (except per

share amounts)

Quarter ended

Year ended

June 30,

June 30,

2024

2023

2024

2023

Unaudited

Unaudited

Unaudited

Unaudited

Revenue:

Cloud

$

481,693

$

381,948

$

950,099

$

749,515

Services

147,611

158,945

296,524

318,802

Product

35,096

40,220

77,086

84,655

Total revenue

664,400

581,113

1,323,709

1,152,972

Cost of revenue:

Cloud

170,702

134,984

340,680

266,580

Services

46,663

47,019

92,749

94,924

Product

7,418

7,710

14,023

14,805

Total cost of revenue

224,783

189,713

447,452

376,309

Gross profit

439,617

391,400

876,257

776,663

Operating expenses:

Research and development, net

86,522

78,640

174,354

156,741

Selling and marketing

157,645

151,964

312,660

300,443

General and administrative

66,626

55,367

138,980

120,543

Total operating expenses

310,793

285,971

625,994

577,727

Operating income

128,824

105,429

250,263

198,936

Financial and other income, net

(15,645)

(9,350)

(29,654)

(18,071)

Income before tax

144,469

114,779

279,917

217,007

Taxes on income

28,684

27,424

57,759

52,711

Net income

$

115,785

$

87,355

$

222,158

$

164,296

Earnings per share:

Basic

$

1.82

$

1.37

$

3.50

$

2.57

Diluted

$

1.76

$

1.31

$

3.36

$

2.47

Weighted average shares outstanding:

Basic

63,534

63,723

63,406

63,831

Diluted

65,856

66,435

66,192

66,548

NICE LTD. AND SUBSIDIARIES

CONSOLIDATED CASH FLOW

STATEMENTS

U.S. dollars in thousands

Quarter ended

Year ended

June 30,

June 30,

2024

2023

2024

2023

Unaudited

Unaudited

Unaudited

Unaudited

Operating

Activities

Net income

$

115,785

$

87,355

$

222,158

$

164,296

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

51,520

42,033

103,280

83,879

Share-based compensation

42,226

39,314

86,630

84,275

Amortization of premium and discount and

accrued interest on marketable securities

(2,096)

(224)

(3,328)

1,046

Deferred taxes, net

(15,773)

(8,994)

(11,407)

(16,872)

Changes in operating assets and

liabilities:

Trade Receivables, net

(6,707)

(8,665)

1,430

8,087

Prepaid expenses and other current

assets

1,740

(10,674)

10,501

(22,046)

Operating lease right-of-use assets

3,372

2,435

6,653

5,503

Trade payables

17,702

(9,668)

6,939

(10,848)

Accrued expenses and other current

liabilities

(40,836)

(48,832)

(43,704)

(49,526)

Deferred revenue

4,742

(18,424)

50,281

14,823

Operating lease liabilities

(3,976)

(3,494)

(7,776)

(7,401)

Amortization of discount on long-term

debt

425

1,129

974

2,283

Loss from extinguishment of debt

-

37

-

37

Other

1,544

1,926

1,527

2,789

Net cash provided by operating

activities

169,668

65,254

424,158

260,325

Investing

Activities

Purchase of property and equipment

(6,455)

(4,513)

(16,976)

(17,619)

Purchase of Investments

(105,991)

(121,817)

(437,113)

(191,359)

Proceeds from sales of marketable

investments

51,971

107,653

568,121

172,552

Capitalization of internal use software

costs

(15,238)

(14,491)

(31,174)

(28,627)

Net cash provided by (used in) investing

activities

(75,713)

(33,168)

82,858

(65,053)

Financing

Activities

Proceeds from issuance of shares upon

exercise of options

520

765

2,312

1,724

Purchase of treasury shares

(146,088)

(65,196)

(187,603)

(129,911)

Dividends paid to noncontrolling

interest

-

-

(2,681)

(1,480)

Repayment of debt

-

(1,534)

(87,435)

(1,534)

Net cash used in financing activities

(145,568)

(65,965)

(275,407)

(131,201)

Effect of exchange rates on cash and cash

equivalents

(1,309)

546

(3,248)

1,713

Net change in cash, cash equivalents and

restricted cash

(52,922)

(33,333)

228,361

65,784

Cash, cash equivalents and restricted

cash, beginning of period

$

794,597

$

632,212

$

513,314

$

533,095

Cash, cash equivalents and restricted

cash, end of period

$

741,675

$

598,879

$

741,675

$

598,879

Reconciliation of cash, cash equivalents

and restricted cash reported in the consolidated balance sheet:

Cash and cash equivalents

$

739,556

$

598,079

$

739,556

$

598,079

Restricted cash included in other current

assets

$

2,119

$

800

$

2,119

$

800

Total cash, cash equivalents and

restricted cash shown in the statement of cash flows

$

741,675

$

598,879

$

741,675

$

598,879

NICE LTD. AND SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP

RESULTS

U.S. dollars in thousands (except per

share amounts)

Quarter ended

Year to date

June 30,

June 30,

2024

2023

2024

2023

GAAP revenues

$

664,400

$

581,113

$

1,323,709

$

1,152,972

Non-GAAP revenues

$

664,400

$

581,113

$

1,323,709

$

1,152,972

GAAP cost of revenue

$

224,783

$

189,713

$

447,452

$

376,309

Amortization of acquired intangible assets

on cost of cloud

(24,133)

(19,396)

(49,500)

(38,765)

Amortization of acquired intangible assets

on cost of product

(150)

(257)

(410)

(506)

Cost of cloud revenue adjustment (1,2)

(2,852)

(2,253)

(5,854)

(4,200)

Cost of services revenue adjustment

(1)

(2,617)

(2,864)

(4,995)

(5,748)

Cost of product revenue adjustment (1)

(30)

(140)

(60)

(278)

Non-GAAP cost of revenue

$

195,001

$

164,803

$

386,633

$

326,812

GAAP gross profit

$

439,617

$

391,400

$

876,257

$

776,663

Gross profit adjustments

29,782

24,910

60,819

49,497

Non-GAAP gross profit

$

469,399

$

416,310

$

937,076

$

826,160

GAAP operating expenses

$

310,793

$

285,971

$

625,994

$

577,727

Research and development (1,2)

(7,484)

(7,783)

(15,627)

(16,181)

Sales and marketing (1,2)

(13,210)

(13,055)

(27,382)

(24,157)

General and administrative (1,2)

(17,429)

(14,059)

(37,260)

(35,355)

Amortization of acquired intangible

assets

(4,972)

(4,428)

(10,211)

(8,943)

Valuation adjustment on acquired deferred

commission

8

36

23

76

Non-GAAP operating expenses

$

267,706

$

246,682

$

535,537

$

493,167

GAAP financial and other income, net

$

(15,645)

$

(9,350)

$

(29,654)

$

(18,071)

Amortization of discount and loss of

extinguishment on debt

(425)

(1,166)

(974)

(2,320)

Change in fair value of contingent

consideration

(35)

(578)

(79)

(578)

Non-GAAP financial and other income,

net

$

(16,105)

$

(11,094)

$

(30,707)

$

(20,969)

GAAP taxes on income

$

28,684

$

27,424

$

57,759

$

52,711

Tax adjustments re non-GAAP

adjustments

14,963

11,793

28,779

24,101

Non-GAAP taxes on income

$

43,647

$

39,217

$

86,538

$

76,812

GAAP net income

$

115,785

$

87,355

$

222,158

$

164,296

Amortization of acquired intangible

assets

29,255

24,081

60,121

48,214

Valuation adjustment on acquired deferred

commission

(8)

(36)

(23)

(76)

Share-based compensation (1)

43,622

40,154

89,266

85,919

Acquisition related and other expenses

(2)

-

-

1,912

-

Amortization of discount and loss of

extinguishment on debt

425

1,166

974

2,320

Change in fair value of contingent

consideration

35

578

79

578

Tax adjustments re non-GAAP

adjustments

(14,963)

(11,793)

(28,779)

(24,101)

Non-GAAP net income

$

174,151

$

141,505

$

345,708

$

277,150

GAAP diluted earnings per share

$

1.76

$

1.31

$

3.36

$

2.47

Non-GAAP diluted earnings per share

$

2.64

$

2.13

$

5.22

$

4.16

Shares used in computing GAAP diluted

earnings per share

65,856

66,435

66,192

66,548

Shares used in computing non-GAAP diluted

earnings per share

65,856

66,435

66,192

66,548

NICE LTD. AND SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP

RESULTS (continued)

U.S. dollars in thousands

(1)

Share-based

compensation

Quarter ended

Year to date

June 30,

June 30,

2024

2023

2024

2023

Cost of cloud revenue

$

2,852

$

2,253

$

5,792

$

4,200

Cost of services revenue

2,617

2,864

4,995

5,748

Cost of product revenue

30

140

60

278

Research and development

7,484

7,783

15,297

16,181

Sales and marketing

13,210

13,055

26,739

24,157

General and administrative

17,429

14,059

36,383

35,355

$

43,622

$

40,154

$

89,266

$

85,919

(2)

Acquisition

related and other expenses

Quarter ended

Year to date

June 30,

June 30,

2024

2023

2024

2023

Cost of cloud revenue

$

-

$

-

$

62

$

-

Research and development

-

-

330

-

Sales and marketing

-

-

643

-

General and administrative

-

-

877

-

$

-

$

-

$

1,912

$

-

NICE LTD. AND SUBSIDIARIES

RECONCILIATION OF GAAP NET INCOME TO

NON-GAAP EBITDA

U.S. dollars in thousands

Quarter ended

Year to date

June 30,

June 30,

2024

2023

2024

2023

Unaudited

Unaudited

Unaudited

Unaudited

GAAP net income

$

115,785

$

87,355

$

222,158

$

164,296

Non-GAAP adjustments:

Depreciation and amortization

51,520

42,033

103,280

83,879

Share-based compensation

42,226

39,314

86,630

84,275

Financial and other expense/ (income),

net

(15,645)

(9,350)

(29,654)

(18,071)

Acquisition related and other expenses

-

-

1,912

-

Valuation adjustment on acquired deferred

commission

(8)

(36)

(23)

(76)

Taxes on income

28,684

27,424

57,759

52,711

Non-GAAP EBITDA

$

222,562

$

186,740

$

442,062

$

367,014

NICE LTD. AND SUBSIDIARIES

NON-GAAP RECONCILIATION - FREE CASH

FLOW FROM CONTINUING OPERATIONS

U.S. dollars in thousands

Quarter ended

Year to date

June 30,

June 30,

2024

2023

2024

2023

Unaudited

Unaudited

Unaudited

Unaudited

Net cash provided by operating

activities

$

169,668

$

65,254

$

424,158

$

260,325

Purchase of property and equipment

(6,455)

(4,513)

(16,976)

(17,619)

Capitalization of internal use software costs

(15,238)

(14,491)

(31,174)

(28,627)

Free Cash Flow (a)

$

147,975

$

46,250

$

376,008

$

214,079

(a) Free cash flow from continuing operations is defined as

operating cash flows from continuing operations less capital

expenditures of the continuing operations and less capitalization

of internal use software costs.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240815570615/en/

Investor Relations Marty Cohen, +1 551 256 5354,

ir@nice.com, ET Omri Arens, +972 3 763-0127, ir@nice.com, CET

Corporate Media Christopher Irwin-Dudek, +1 201 561 4442,

media@nice.com, ET

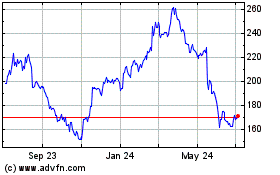

NICE (NASDAQ:NICE)

Historical Stock Chart

From Oct 2024 to Nov 2024

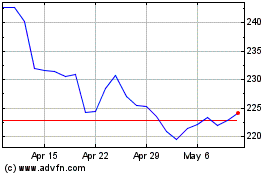

NICE (NASDAQ:NICE)

Historical Stock Chart

From Nov 2023 to Nov 2024