false

0001211805

0001211805

2024-08-14

2024-08-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): August 14, 2024

MY

SIZE, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-37370 |

|

51-0394637 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

HaNegev

4, POB 1026,

Airport

City, Israel 7010000

(Address

of principal executive offices and Zip Code)

Registrant’s

telephone number, including area code +972-3-600-9030

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.001 par value per share |

|

MYSZ |

|

Nasdaq

Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.02 Results of Operation and Financial Condition.

On

August 14, 2024, My Size, Inc. issued a press release which included its results of operations for the second quarter ended June 30,

2024. The press release is attached hereto as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference herein

in its entirety.

The

information included in this Item 2.02 of Current Report on Form 8-K, including the attached Exhibit 99.1, shall not be deemed “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject

to the liabilities of that section, and shall not be deemed to be incorporated by reference in any filing under the Securities Act of

1933, as amended, or the Exchange Act, whether made before or after the date of this Current Report, regardless of any general incorporation

language in any such filing, except as expressly set forth by specific reference in such filing.

Item

9.01. Financial Statement and Exhibits.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

MY

SIZE, INC. |

| |

|

|

| Date:

August 14, 2024 |

By: |

/s/

Ronen Luzon |

| |

Name: |

Ronen

Luzon |

| |

Title: |

Chief

Executive Officer |

Exhibit

99.1

MySize

Reports Second Quarter 2024 Financial Results

Highlighting

53% Revenue Growth and Path to Profitability

Revenues

and gross profits up 53% and 61%, respectively, driven by growth at Orgad and Naiz Fit

AIRPORT

CITY, Israel – August 14, 2024 – MySize, Inc. (Nasdaq: MYSZ), a leader in AI-driven measurement solutions for the e-commerce

industry, today announced its financial results for the second quarter ended June 30, 2024. The company reported robust financial performance,

marked by a 53% increase in revenues and a 61% rise in gross profit, reflecting the strong performances of Orgad and the successful markets

penetration from Naiz Fit

Key

Financial Highlights for the Three Months Ended June 30, 2024 Compared to Prior Year Period

| |

● |

Revenue:

MySize achieved a 53% year-over-year increase in revenues, reaching $1.97 million in Q2 2024, compared to $1.29 million in Q2

2023. This growth was driven by the enhanced performance of Orgad and the steady SaaS revenue stream from Naiz Fit. |

| |

● |

Gross

Profit: Gross profit surged by 61% to $984,000, up from $519,000 in the prior-year period, mainly thanks to increase in revenues. |

| |

● |

Operating

Loss: Operating loss narrowed by 44% to $877,000, compared to $1.55 million in Q2 2023, reflecting our disciplined cost management

and strategic focus on higher-margin business segments. |

| |

● |

Net

Loss: Net loss improved by 25% to $964,000, down from $1.29 million in Q2 2023, driven by increased revenues and reduced operational

costs. |

| |

● |

Cash

Position: As of June 30, 2024, MySize held $3.2 million in cash and cash equivalents. |

Management

Commentary

MySize’s

second-quarter results underscore the strength of our strategic direction,” said Ronen Luzon, CEO and Founder of MySize, Inc. “Our

53% revenue growth and 61% increase in gross profit are clear indicators that our efforts to enhance Orgad’s revenue in the North

American market and to optimize our SaaS offerings through Naiz Fit are paying off. The reduction in our operating and net losses further

demonstrates our commitment to achieving profitability through disciplined cost management and operational efficiency.”

Luzon

continued, “As we move forward, our focus will remain on leveraging our AI-driven retail solutions to drive continued revenue growth,

reduce product returns, and improve customer satisfaction.”

Looking

Ahead: “Looking ahead, we are confident in our ability to sustain this momentum and achieve our long-term goal of cash flow

positivity,” Luzon added. “With a clear path to profitability, we believe we are well-positioned to capitalize on the growth

opportunities in the e-commerce and retail sectors. We remain committed to delivering value to our shareholders through continued innovation

and strategic execution.

About

MySize Inc.

MySize,

Inc. (Nasdaq: MYSZ) (TASE: MYSZ.TA) is an omnichannel e-commerce platform and provider of AI-driven measurement solutions including MySizeID

and recently acquired Naiz Fit to drive revenue growth and reduce costs for its business clients. Orgad, its online retailer platform,

has expertise in e-commerce, supply chain, and technology operating as a third-party seller on Amazon.com and other sites.

MySize

has developed a unique measurement technology based on sophisticated algorithms and cutting-edge technology with broad applications,

including the apparel, e-commerce, DIY, shipping, and parcel delivery industries. This proprietary measurement technology is driven by

several algorithms that are able to calculate and record measurements in a variety of novel ways. To learn more about MySize, please

visit our website: www.mysizeid.com.

We

routinely post information that may be important to investors in the Investor Relations section of our website. Follow us on Facebook,

LinkedIn, Instagram, and Twitter.

Please

click here for a demonstration of how MySizeID provides a full sizing solution for the retail industry.

To

learn more about MySize and for additional information, please visit: our website: www.mysizeid.com.

Forward-looking

Statements

This

press release contains certain forward-looking statements within the meaning of the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995, including statements related to its strategic and business plans, technology, relationships, objectives

and expectations for its business, growth. These statements are identified by the use of the words “could,” “believe,”

“anticipate,” “intend,” “estimate,” “expect,” “may,” “continue,”

“predict,” “potential,” “project” and similar expressions that are intended to identify forward-looking

statements. All forward-looking statements speak only as of the date of this press release. You should not place undue reliance on these

forward-looking statements. Although we believe that our plans, objectives, expectations and intentions reflected in or suggested by

the forward-looking statements are reasonable, we can give no assurance that these plans, objectives, expectations or intentions will

be achieved. Forward-looking statements involve significant risks and uncertainties (some of which are beyond our control) and assumptions

that could cause actual results to differ materially from historical experience and present expectations or projections. Actual results

may differ materially from those in the forward-looking statements and the trading price for our common stock may fluctuate significantly.

Forward-looking statements also are affected by the risk factors described in the Company’s filings with the U.S. Securities and

Exchange Commission. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements,

whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the

occurrence of unanticipated events.

Investor

Contacts:

Or

Kles, CFO

ir@mysizeid.com

v3.24.2.u1

Cover

|

Aug. 14, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 14, 2024

|

| Entity File Number |

001-37370

|

| Entity Registrant Name |

MY

SIZE, INC.

|

| Entity Central Index Key |

0001211805

|

| Entity Tax Identification Number |

51-0394637

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

HaNegev

4

|

| Entity Address, Address Line Two |

POB 1026

|

| Entity Address, City or Town |

Airport

City

|

| Entity Address, Country |

IL

|

| Entity Address, Postal Zip Code |

7010000

|

| City Area Code |

+972

|

| Local Phone Number |

3-600-9030

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, $0.001 par value per share

|

| Trading Symbol |

MYSZ

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

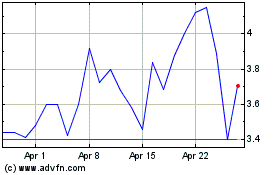

My Size (NASDAQ:MYSZ)

Historical Stock Chart

From Nov 2024 to Dec 2024

My Size (NASDAQ:MYSZ)

Historical Stock Chart

From Dec 2023 to Dec 2024