UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant

to Section 14(a) of the

Securities Exchange

Act of 1934

Filed

by the Registrant x Filed by a party other than the Registrant ¨

Check the appropriate box:

| ¨ |

Preliminary Proxy

Statement |

| ¨ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x |

Definitive Proxy

Statement |

| ¨ |

Definitive Additional

Materials |

| ¨ |

Soliciting Material

Pursuant to §240.14a-12 |

Monogram Technologies

Inc.

(Name of Registrant as

Specified in its Charter)

Not applicable.

(Name of Person(s) Filing

Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that

apply):

| x |

No fee required. |

| |

|

| ¨ |

Fee paid previously with

preliminary materials. |

| |

|

| ¨ |

Fee computed on table in

exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

3913 Todd Lane,

Austin, TX 78744

November 8, 2024

Dear Stockholder:

We cordially invite you

to attend the 2024 Annual Meeting of Stockholders of Monogram Technologies Inc. (the “Annual Meeting”). The Annual Meeting

will be held on Thursday, December 19, 2024, at 1:00 p.m. Eastern Standard Time and will be held entirely online live via audio

webcast. You will be able to attend and participate in the Annual Meeting virtually by visiting www.monogram.vote, where you will be

able to listen to the Annual Meeting live and vote.

You will find important

information about the matters to be voted on at the Annual Meeting in the accompanying Notice of Annual Meeting of Stockholders and Proxy

Statement. We are sending most of our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”) instead

of sending a full set of printed materials. The Notice tells you how to access and review on the internet the important information contained

in the proxy materials. The Notice also tells you how to vote on the internet prior to the Annual Meeting and how to request to receive

a printed copy of our proxy materials.

Your vote is important.

We hope you will attend the virtual Annual Meeting. We encourage you to review the proxy materials and vote as soon as possible. You

may vote on the internet as described in the attached proxy materials, which is how we encourage you to vote. You also may vote by mail

if you timely request to receive printed copies of these proxy materials in the mail. You will also be able to vote your shares electronically

during the Annual Meeting. Details about how to attend the virtual Annual Meeting, how to submit questions, and how to cast your votes

are posted at www.monogram.vote and can be found in this proxy statement in the section entitled “Questions and Answers about the

Annual Meeting and Voting—How can I attend and vote at the Annual Meeting?”.

| |

Very truly yours, |

|

| |

|

|

| |

/s/ Benjamin

Sexson |

|

| |

Benjamin Sexson |

|

| |

Chief Executive Officer |

|

3913 Todd Lane,

Austin, TX 78744

NOTICE OF 2024 ANNUAL MEETING OF STOCKHOLDERS

| Annual Meeting Date |

Thursday, December 19,

2024 |

| Time |

1:00 p.m. Eastern

Standard Time |

| Place |

www.monogram.vote |

| Items of Business |

(1) |

To elect the

Class I director nominees to serve as directors until our 2027 annual meeting of stockholders, and until their respective successors

are elected and qualified or until their earlier resignation or removal; |

| |

|

|

| |

(2) |

To ratify the appointment

of Fruci & Associates II, PLLC as our independent registered public accounting firm for the year ending December 31,

2024; |

| |

|

|

| |

(3) |

To approve the amendment

to Amended and Restated 2019 Stock Option and Grant Plan; |

| |

|

|

| |

(4) |

To approve, on an advisory basis, the compensation of our named executive officers; and |

| |

|

|

| |

(5) |

To transact any other business

that properly comes before the Annual Meeting and any adjournment or postponement of the Annual Meeting. |

| Record

Date |

Holders

of record of our capital stock on October 25, 2024, are entitled to receive notice of, and to vote at, the Annual Meeting and

any postponement or adjournment of the Annual Meeting. |

| Voting |

Your vote is important.

We encourage you to read the accompanying proxy materials and submit your vote as soon as possible. You can find information about

how to cast your vote in the question-and-answer section of the accompanying proxy statement. |

Pursuant to rules adopted

by the U.S. Securities and Exchange Commission (the “SEC”), we have elected to provide access to our proxy materials via

the Internet. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials (the “Notice”) to our stockholders

entitled to notice of, and to vote at, the Annual Meeting and at any postponement or adjournment thereof. Stockholders will have the

ability to access the proxy materials at www.monogram.vote or request to receive a printed set of the proxy materials by mail or an electronic

set of materials by email. Instructions on how to access the proxy materials over the Internet or to request a printed copy may be found

in the Notice. In addition, stockholders may request to receive proxy materials in printed form by mail or electronically by email on

an ongoing basis. We believe these rules allow us to provide our stockholders with the information they need while lowering the

cost of delivery and reducing the environmental impact of our Annual Meeting.

IMPORTANT

NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON DECEMBER 19, 2024: This

notice and our proxy statement are available at www.monogram.vote.

| By Order of the Board of Directors

of Monogram Technologies Inc. |

|

| |

|

| /s/ Benjamin

Sexson |

|

| Benjamin Sexson |

|

| Chief Executive Officer |

|

| |

|

Austin, Texas

November 8, 2024 |

|

TABLE OF CONTENTS

3913 Todd Lane

Austin, TX 78744

(512) 399-2656

PROXY STATEMENT

QUESTIONS AND ANSWERS

ABOUT THE ANNUAL MEETING AND VOTING

Why did I receive these proxy materials?

We are providing these proxy

materials to you in connection with the solicitation by the Board of Directors (the “Board”) of Monogram Technologies Inc.,

a Delaware corporation, of proxies to be voted at our 2024 Annual Meeting of Stockholders (the “Annual Meeting”).

The Annual Meeting will be held on Thursday,

December 19, 2024, at 1:00 p.m. Eastern Standard Time, online at www.monogram.vote. The Annual Meeting will be a completely

virtual meeting conducted via live audio webcast. You will be able to attend the Annual Meeting online and by visiting www.monogram.vote

and following the instructions to register for the meeting. You must enter the control number included in your Notice, on your proxy

card or on the instructions that accompanied your proxy materials. If you are a stockholder of record and you lose the control number,

you may email Equity Stock Transfer at proxy.equitystock.com for assistance in recovering your control number. If you are a beneficial

holder and lose your control number, please contact your broker, bank, or other nominee for assistance in recovering your control number."

Only stockholders with a valid control number will be able to vote at the Annual Meeting, as well as access the list of stockholders

as of the close of business on the Record Date (as defined below).

We expect to begin furnishing these proxy materials

to stockholders on or about November 9, 2024.

A form of the proxy card is attached as Appendix

B to this proxy statement.

When we use the term “Monogram,”

“Company,” “us,” “we,” or “our,” we mean Monogram Technologies Inc.

What matters will be voted on at the Annual Meeting?

We will ask stockholders to vote on the following

matters at the Annual Meeting:

| (1) |

To elect the Class I

director nominees to serve as directors until our 2027 annual meeting of stockholders, and until their respective successors are

elected and qualified or until their earlier resignation or removal (“Proposal 1”); |

| (2) |

To ratify the appointment

of Fruci & Associates II, PLLC as our independent registered public accounting firm for the year ending December 31,

2024; |

| (3) |

To approve the amendment

to Amended and Restated 2019 Stock Option and Grant Plan; |

| (4) |

To approve, on an advisory

basis, the compensation of our named executive officers; and |

| (5) |

To transact any other business

that properly comes before the Annual Meeting and any adjournment or postponement of the Annual Meeting. |

Who can vote?

Stockholders of record of

our capital stock at the close of business on the record date of October 25, 2024 (the “Record Date”), are entitled

to receive notice of, and to vote at, the Annual Meeting. Our capital stock currently outstanding consists of our Common Stock, par value

$0.001 per share.

Each share of Common Stock

is entitled to one (1) vote per share as of the Record Date. For additional information, see our Sixth Amended and Restated Certificate

of Incorporation, filed as Exhibit 3.1, to our Annual Report on Form 10-K filed with the SEC on March 15, 2024. Cumulative

voting is not permitted.

As of the Record Date,

34,690,892 shares of our Common Stock were issued and outstanding, representing all outstanding shares of capital stock outstanding

of our Company.

A list of stockholders will

also be available during the Annual Meeting through the Annual Meeting website for those stockholders who choose to attend.

To attend and participate

in the Annual Meeting, you must visit www.monogram.vote, and follow the instructions to register for the meeting. The Annual Meeting

webcast will begin promptly at 1:00 p.m. Eastern Standard Time. We encourage you to access the Annual Meeting prior to the start

time, and allow ample time for the registration and check-in procedures.

What is the difference between a stockholder of record and a beneficial

holder?

Many of our stockholders

hold their shares through a broker, bank, or other nominee rather than directly in their own name. There are some important distinctions

between shares held of record and those owned beneficially.

Stockholder of Record

If your shares are registered

directly in your name with our transfer agent, Equity Stock Transfer, LLC (“Equity Stock Transfer”), you are the stockholder

of record for those shares and are receiving proxy materials directly from us. As the stockholder of record, you have the right to grant

your voting proxy directly to us or to vote online at the Annual Meeting.

Beneficial Holder

If your shares are held in

a stock brokerage account or by a bank or other nominee (commonly referred to as being held in “street name”), you are the

beneficial holder of those shares. Your broker, bank, or other nominee is the stockholder of record and has forwarded proxy materials

to you as the beneficial holder. As the beneficial holder, you have the right to direct your broker, bank, or other nominee how to vote

your shares and are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote

your shares online at the Annual Meeting unless you have the control number included in your Notice, on your proxy card or on the instructions

that accompanied your proxy materials giving you the right to vote the shares.

How do I vote?

Stockholder of Record

If you are a stockholder

of record, you can vote on the internet prior to the Annual Meeting by following the instructions you received from us in the mail or

by email. If you requested to receive a full set of proxy materials in the mail, you also can vote by mail using the proxy card included

with the materials. Finally, you can vote online at the Annual Meeting by attending the Annual Meeting online and following the instructions

posted at www.monogram.vote.

Beneficial Holder

If you are a beneficial holder,

you can vote on the internet prior to the Annual Meeting by following the instructions you received from your broker, bank, or other

nominee in the mail or by email. If you requested to receive a full set of proxy materials in the mail, you also can vote by mail using

the voting instruction card included with the materials. If you have not received this information from your broker, bank, or other nominee,

please contact them as soon as possible. You can vote online at the Annual Meeting by attending the Annual Meeting online and following

the instructions posted at www.monogram.vote.

If you do not give your broker,

bank, or other nominee instructions as to how to vote, under the rules of the Nasdaq, your broker, bank, or other nominee may vote

your shares with respect to “routine” items, but not with respect to “non-routine” items. Proposal 1 (Election

of Class I Directors), Proposal 2 (Ratify the Appointment of Fruci & Associates II, PLLC), Proposal 3 (Amendment to Amended

and Restated 2019 Stock Option and Grant Plan) and Proposal 4 (Advisory Vote on Executive Compensation) are “non-routine”

proposals. If you do not instruct your broker, bank, or other nominee how to vote with respect to Proposals 1, 2, 3 or 4, your broker,

bank, or other nominee will not vote on these proposals, as applicable. Please be sure to return your voting instructions to your broker,

bank, or other nominee so that your vote is counted. The voting deadlines and availability internet voting for beneficial owners of shares

held in “street name” will depend on the voting processes of the organization that holds your shares. Therefore, we urge

you to carefully review and follow the voting instructions card and any other materials that you receive from that organization.

Multiple Holdings

If you hold shares both as

a stockholder of record and as a beneficial holder, you must vote separately for each set of shares.

How can I attend and vote at the Annual Meeting?

This year’s Annual

Meeting will be held entirely online live via audio webcast. Any stockholder can attend the virtual Annual Meeting live at www.monogram.vote.

If you were a stockholder as of the Record Date and you have your control number included in your Notice, on your proxy card, or on the

instructions that accompanied your proxy materials, you can vote at the Annual Meeting.

A summary of the information you need to attend

the Annual Meeting online is provided below:

| · |

To participate in the Annual

Meeting, you will need the control number included in your Notice, on your proxy card, or on the instructions that accompanied your

proxy materials. |

| · |

The Annual Meeting webcast

will begin promptly at 1:00 p.m. Eastern Standard Time on December 19, 2024. We encourage you to access the Annual Meeting

prior to the start time. You should allow ample time for the check-in procedures. |

| · |

The virtual Annual Meeting

platform is fully supported across browsers (Internet Explorer, Firefox, Chrome, and Safari) and devices (desktops, laptops, tablets,

and smartphones) running the most updated version of applicable software and plugins. Participants should ensure that they have a

strong Internet connection wherever they intend to participate in the Annual Meeting. Participants should also give themselves plenty

of time to log in and ensure that they can hear streaming audio prior to the start of the Annual Meeting. |

| · |

Instructions on how to

attend and participate in the Annual Meeting via the internet are posted at www.monogram.vote. |

Stockholders are permitted

to submit questions pertinent to the Annual Meeting via email at investors@monogramtechnologies.com. Questions may be submitted until

7:00am EST on December 19, 2024. The Company will select a number of questions to answer from these submissions during the virtual

Annual Meeting, subject to time constraints. Questions regarding personal matters, including those related to employment, product or

service issues, or suggestions for product innovations, are not pertinent to Annual Meeting matters, and therefore, will not be answered.

To participate in the Annual

Meeting, you will need the control number included in your Notice, on your proxy card or on the instructions that accompanied your proxy

materials. If your shares are held in “street name,” you should contact your broker, bank, or other nominee to obtain your

control number or otherwise vote through the broker, trustee, bank, or other holder of record. If you lose your control number, you may

join the Annual Meeting as a “Guest” but you will not be able to vote or access the list of stockholders as of the close

of business on the Record Date. Only stockholders with a valid control number will be able vote at the Annual Meeting, as well as access

the list of stockholders as of the close of business on the Record Date.

What if during the check-in time or during

the Annual Meeting I have technical difficulties or trouble accessing the virtual Annual Meeting website?

We will have technicians

ready to assist you with any technical difficulties you may have accessing the virtual Annual Meeting website. If you encounter any difficulties

accessing the virtual Annual Meeting website during the check-in or meeting time, please call the technical support number that will

be posted on the Annual Meeting login page.

Can I change or revoke my vote?

If you are a stockholder

of record, you may change your vote at any time prior to the vote at the Annual Meeting by taking any of the following actions:

| · |

submitting a new proxy

with a later date using any of the available methods described above; |

| · |

providing a written revocation

to our Board Chairman; or |

| · |

voting online at the Annual

Meeting by following the instructions at www.monogram.vote. |

If you are a beneficial holder,

you may change your vote by submitting new voting instructions to your broker, bank, or other nominee following the instructions they

provided to you. You may also vote online at the Annual Meeting, which will have the effect of revoking any previously submitted voting

instructions, assuming you obtain your control number included in your Notice, on your proxy card, or on the instructions that accompanied

your proxy materials.

Whether you are a stockholder

of record or a beneficial owner of shares held in “street name”, your attendance at the Annual Meeting online will not, by

itself, automatically revoke your proxy.

What is the quorum requirement for the Annual

Meeting?

A quorum of stockholders

is necessary for any action to be taken at the Annual Meeting (other than adjournment or postponement of the Annual Meeting). A quorum

exists if stockholders holding a majority of the votes which could be cast by the holders of all outstanding shares of stock entitled

to vote at the Annual Meeting in person, or by means of remote communication, or by proxy. If you submit a properly completed proxy,

even if you abstain from voting, your shares will be counted for purposes of determining the presence of a quorum. Broker non-votes (described

below) also will be counted for purposes of determining the presence of a quorum if the broker, bank or other nominee uses its discretionary

authority to vote on at least one routine matter under Nasdaq rules.

How will my shares be voted during the virtual

Annual Meeting?

Your shares will be voted

in accordance with your properly submitted instructions.

Stockholders of Record

If you are a stockholder

of record and you submit a proxy but do not include voting instructions on a matter, your shares will be voted in favor of each of the

Class I nominees named in Proposal 1 and in favor of Proposal 2, Proposal 3 and Proposal 4 in accordance with the recommendations

of our Board. If any other matters are properly presented for a vote at the Annual Meeting or any adjournment or postponement thereof,

your shares will be voted in the discretion of the named proxies.

Beneficial Holders and Broker Non-Votes

If you are a beneficial holder

and you do not provide voting instructions to your broker, bank, or other nominee, that organization will determine if it has the discretionary

authority to vote your shares on the particular matter. Under Nasdaq rules, these organizations have the discretion to vote your shares

on routine matters - however, they do not have the discretion to vote your shares on non-routine matters, such as Proposal 1, Proposal

2, Proposal 3 and Proposal 4. The unvoted shares are called “broker non-votes.” Shares that constitute broker non-votes are

considered present for purposes of determining a quorum but are not considered entitled to vote or votes cast on the particular matter.

What are the voting requirements for each matter?

| Proposal |

|

Vote

Required |

|

Effect

of

Abstentions |

|

Broker

Discretionary

Voting

Allowed |

|

Effect

of

Broker

Non-Vote |

| (1) To elect the Class I director nominees

to serve as directors until our 2027 annual meeting of stockholders, and until their respective successors are elected and qualified

or until their earlier resignation or removal |

|

More

votes FOR

than AGAINST |

|

No

effect |

|

No |

|

No

effect |

| (2) To ratify the appointment of Fruci &

Associates II, PLLC as our independent registered public accounting firm for the year ending December 31, 2024 |

|

More

votes FOR

than AGAINST |

|

No

effect |

|

No |

|

No

effect |

| (3) To approve the amendment to Amended and Restated

2019 Stock Option and Grant Plan |

|

More

votes FOR

than AGAINST |

|

No

effect |

|

No |

|

No

effect |

| (4) To approve, on an advisory basis, the compensation

of our named executive officers |

|

More

votes FOR

than AGAINST |

|

No

effect |

|

No |

|

No

effect |

What are the recommendations of the Board?

Our Board recommends that you vote:

| · |

“FOR” each

Class I director nominated by our Board to serve as directors until our 2027 annual meeting of stockholders, and until their

respective successors are elected and qualified or until their earlier resignation or removal (Proposal 1); |

| · |

“FOR” the Approval

to ratify the appointment of Fruci & Associates II, PLLC as our independent registered public accounting firm for the year

ending December 31, 2024 (Proposal 2); |

| · |

“FOR” the Approval

to amend the Amended and Restated 2019 Stock Option and Grant Plan (Proposal 3); and |

| · |

“FOR” the Approval,

on an advisory basis of the compensation of our named executive officers (Proposal 4). |

Any properly authorized proxy

as to which no instructions are given will be voted in accordance with the foregoing recommendations.

Who will pay the costs of soliciting votes

for the Annual Meeting?

We will bear all expenses

incurred in connection with the solicitation of proxies. We will reimburse brokers, fiduciaries, and custodians for their costs in forwarding

proxy materials to beneficial owners of our common stock. Our directors, officers, and employees also may solicit proxies by mail, telephone,

and personal contact. They will not receive any additional compensation for these activities. We will send proxy materials or additional

soliciting materials to banks, brokers, other institutions, nominees, and fiduciaries, and these organizations will then forward the

materials to the beneficial holders of our shares. On request, we will reimburse these organizations for their reasonable expenses in

forwarding these materials.

How can I find the results of the voting after the Annual Meeting?

We will announce preliminary

voting results at the Annual Meeting and will publish final results in a Current Report on Form 8-K to be filed with the SEC within

four business days following the Annual Meeting.

PROPOSAL 1 – ELECTION

OF CLASS I DIRECTORS

Our Board is currently composed

of five directors. Vacancies on the Board may be filled only by a majority of the directors then in office, although less than a quorum,

or by a sole remaining director. A director elected by the Board to fill a vacancy or a newly created directorship shall hold office

until the next election of the class for which such director shall have been chosen, subject to the election and qualification of a successor

and to such director’s earlier death, resignation or removal.

Our Bylaws provide that the

number of directors that constitute the entire Board shall consist of one or more members, the exact number thereof to be determined

from time to time by resolution of the Board. Currently, the Board is divided into three classes, Class I, Class II and Class III.

The initial term of office of the Class I, Class II and Class III directors expires at our annual meeting in 2024, 2025

and 2026, respectively. At each annual meeting, successors to the class of directors whose term expires at that annual meeting shall

be elected for a three-year term. A director shall hold office until the annual meeting in the year in which his or her term expires

and until his or her successor shall be elected and qualified, subject, however, to prior death, resignation, retirement or removal from

office. Our Board currently consists of five directors. The Class I director nominees for election, who have been nominated by our

Nominating and Governance Committee for election at the Annual Meeting are Rick Van Kirk, and Colleen Gray.

Each of the nominees listed

below is currently one of our directors. The Class II and Class III directors (Riss, Sexson and Unis) are still serving and

not in need of re-election. The Class I directors nominated for election, Van Kirk and Gray, if elected at the Annual Meeting, would

serve for a three-year term until the 2027 annual meeting and until their respective successors are duly elected and qualified, or, if

sooner, until the director’s death, resignation or removal.

Directors are elected by

a plurality of the votes of the holders of shares present in person or represented by proxy and entitled to vote on the election of directors.

Abstentions and broker non-votes will not be treated as a vote for or against any particular director nominee and will not affect the

outcome of the election. Stockholders may not vote, or submit a proxy, for a greater number of nominees than the two Class I nominees

named below. The director nominees receiving the highest number of affirmative votes will be elected. Shares represented by executed

proxies will be voted, if authority to do so is not withheld, for the election of the two Class I director nominees named below.

If any director nominee becomes unavailable for election as a result of an unexpected occurrence, shares that would have been voted for

that nominee will instead be voted for the election of a substitute nominee proposed by our Board. Each person nominated for election

has agreed to serve if elected. Our management has no reason to believe that any nominee will be unable to serve.

Nominees for Election as Class I Directors to the Board for

a Three-Year Term Expiring at the 2027 Annual Meeting

The following sets forth

certain information with respect to our Class II directors who are up for election or re-election at the Annual Meeting:

| Name

|

|

Age |

|

Class |

|

Position(s) |

| |

|

|

|

|

|

|

| Rick Van Kirk* |

|

64 |

|

Class I |

|

Director |

| Colleen Gray* |

|

71 |

|

Class I |

|

Director |

*Independent Director

Rick

Van Kirk, Independent Director. Mr. Richard L. Van Kirk is a Director of Monogram, and has served in this capacity

since our inception. He is the Chief Executive Officer of Pro-Dex, Inc. (“Pro-Dex”), the largest OEM manufacturer of

Orthopaedic Robotic End-Effectors on the market. Mr. Van Kirk also serves on Pro-Dex’s Board of Directors. Mr. Van Kirk

was appointed to the Board of Directors of Pro-Dex concurrent with his appointment as its CEO in January 2015. He joined Pro-Dex

in January 2006 and was named Pro-Dex’s Vice President of Manufacturing in December 2006. In April 2013 he was appointed

as the Chief Operating Officer of Pro-Dex. Mr. Van Kirk’s career includes over 13 years of management experience in manufacturing.

Mr. Van Kirk previously served as Manufacturing Manager and Manager of Product Development at Comarco Wireless Technologies, ChargeSource

Division, which provides power and charging functionality for popular electronic devices and wireless accessories. Prior to Comarco,

Mr. Van Kirk was General Manager at Dynacast, a leader in precision die casting. Mr. Van Kirk earned a BA in Business Administration

at California State University, Fullerton, and an MBA from Claremont Graduate School.

Colleen

Gray, Independent Director. Ms. Gray has over 25 years of operations and financial management experience with emerging,

high-growth companies in the data storage and orthopedic industries. Ms. Gray served as the President and Chief Executive Officer

of Consensus Orthopedics, a global manufacturer of large joint orthopedic devices, from August 2008 until May 2021. Under her

tenure, Ms. Gray led the development of 5 new product lines, navigated the FDA regulatory approval process, and drove revenue from

$4M in annual sales to $21M in annual sales. Additionally, Consensus became a leader in the patient monitoring device market with its

medical-grade interactive surface sensor products through its TracPatch Health Division. Ms. Gray assumed the role of Chief Executive

Officer of Tracpatch in January 2016 and served through August of 2023. In this role, Ms. Gray led the raise of over $27M

in early round financing and closed commercial agreements with two large hospital systems.

Before joining Consensus

Orthopedics, Ms. Gray was President and Chief Executive Officer at Solid Data Systems, where she successfully negotiated and managed

the sale of the company. Before Solid Data, Ms. Gray was a co-founder of StorageWay, Inc., one of the first cloud-based storage

service providers, serving as its Vice President of Finance and Chief Financial Officer. Ms. Gray began her career with the Mylex

Corporation in April 1992. She served as its Vice President of Finance and Chief Financial Officer during its successful public

offering and IBM’s company acquisition. Mylex led storage management and data protection in the networked PC and server environments.

Ms. Gray received a Bachelor of Science in Accounting from Arizona State University and is a member of Women in Bio.

| OUR

BOARD RECOMMENDS A VOTE “FOR” THE ELECTION OF EACH OF THE CLASS I DIRECTOR NOMINEES. |

CONTINUING DIRECTORS

Class II Director of the Board Continuing

in Office for a Term Expiring at the 2025 Annual Meeting

Paul

Riss, MBA, Independent Director. Mr. Riss has 30 years of experience with Securities Act and Exchange Act filings

as a CEO of publicly traded companies and as a CPA with Ernst & Young. He is the Chief Compliance Officer and a board member

of an equity-based funding portal, Netcapital Funding Portal Inc., and a member of FINRA and the AICPA. Ernst & Young selected

Mr. Riss as a 2001 finalist in the Entrepreneur of the Year award program for the Connecticut / Hudson Valley region. Mr. Riss

earned an MBA with distinction from the Stern School of Business at New York University and was a Magna Cum Laude graduate with distinction

from Carleton College. In 2000, he won the James P. Kelly Award for distinguished public service as a member of the Westchester chapter

of the New York State Society of Public Accountants. Mr. Riss wrote and directed ten musical parodies to raise money for college

scholarships.

Class III Directors of the Board Continuing

in Office for a Term Expiring at the 2026 Annual Meeting

Benjamin

Sexson, CFA, Chief Executive Officer, President and Director. Benjamin Sexson is the Chief Executive Officer, President, and

a Director of Monogram Orthopaedics, and has served in such capacities since he joined the Company in April 2018. Prior to joining

Monogram, Mr. Sexson served as the Director of Business Development at Pro-Dex, Inc., one of the largest OEM manufacturers

of Orthopaedic Robotic End-Effectors in the world, from October 2015 to April 2018. In his tenure at Pro-Dex, Mr. Sexson

was responsible for helping support the development, management, and launch of the Company’s first ever custom proprietary product

solution and successfully negotiating high margin distribution agreements with a major strategic partner. In addition, Mr. Sexson

helped secure and negotiate two additional major development agreements and helped expand the Company’s addressable markets from

powered surgical tools in CMF to Thoracic, Trauma, Spine and Extremities as well as other product applications. Mr. Sexson is a

named inventor on multiple patent applications at Pro-Dex. Prior to that, Mr. Sexson worked in various finance positions and is

a CFA Charterholder. Mr. Sexson graduated with honors from Caltech with a Bachelor’s Degree in Mechanical Engineering in 2006.

Dr. Douglas

Unis, Founder and Director. Dr. Douglas Unis is a board certified orthopaedic surgeon specializing in adult reconstructive

surgery and is the founder and Chief Medical Officer of Monogram Orthopaedics Inc. Dr. Unis founded Monogram Orthopaedics in 2015,

and has served as a Director of the Company since its inception. Dr. Unis has served as an Associate Professor at the Icahn School

of Medicine since November 2015 and has been a practicing surgeon since 2004. He began serving as an Assistant Professor at Icahn

School of Medicine at Mount Sinai in March 2014, until becoming an Associate Professor in November 2015. Dr. Unis has

consulted with many leading orthopaedic companies including Zimmer Biomet and Think Surgical. Prior to founding Monogram Orthopaedics,

Dr. Unis was a consultant with Think Surgical, working with them for over 4 years to help with the development of their robotic

total hip and knee arthroplasty system. Dr. Unis is widely recognized as a leader and innovator in the NYC area having performed

the regions’ first muscle sparing anterior total hip replacement in 2005. Dr. Unis earned his BA from Duke University and

Doctor of Medicine from Case Western Reserve University and later completing his residency at Northwestern University and a fellowship

from Rush University in Adult Reconstruction.

Family Relationships

There are no family relationships

between or among the directors, executive officers or persons nominated or chosen by our stockholders or us to become directors or executive

officers

Involvement in Certain Legal Proceedings

To our knowledge, during

the past ten years, none of our directors, executive officers, promoters, control persons, or nominees has:

| · |

Been convicted in a criminal

proceeding or been subject to a pending criminal proceeding (excluding traffic violations and other minor offenses); |

| |

|

| · |

Had any bankruptcy petition

filed by or against the business or property of the person, or of any partnership, corporation or business association of which he

was a general partner or executive officer, either at the time of the bankruptcy filing or within two years prior to that time; |

| |

|

| · |

Been subject to any order,

judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction or federal or state

authority, permanently or temporarily enjoining, barring, suspending or otherwise limiting, his involvement in any type of business,

securities, futures, commodities, investment, banking, savings and loan, or insurance activities, or to be associated with persons

engaged in any such activity; |

| · |

Been found by a court of

competent jurisdiction in a civil action or by the SEC or the Commodity Futures Trading Commission to have violated a federal or

state securities or commodities law, and the judgment has not been reversed, suspended, or vacated; |

| |

|

| · |

Been the subject of, or

a party to, any federal or state judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended

or vacated (not including any settlement of a civil proceeding among private litigants), relating to an alleged violation of any

federal or state securities or commodities law or regulation, any law or regulation respecting financial institutions or insurance

companies including, but not limited to, a temporary or permanent injunction, order of disgorgement or restitution, civil money penalty

or temporary or permanent cease-and-desist order, or removal or prohibition order, or any law or regulation prohibiting mail or wire

fraud or fraud in connection with any business entity; or |

| |

|

| · |

Been the subject of, or

a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization (as defined

in Section 3(a)(26) of the Exchange Act), any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange

Act), or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons

associated with a member. |

Board Diversity Matrix (As of September 30th, 2024)

| Total Number of Directors: |

|

5 |

| | |

Female | | |

Male | | |

Non-Binary | | |

Did Not

Disclose

Gender | |

| Part I: Gender Identity | |

| | | |

| | | |

| | | |

| | |

| Directors | |

| 1 | | |

| 4 | | |

| – | | |

| – | |

| Part II: Demographic Background | |

| | | |

| | | |

| | | |

| | |

| African American or Black | |

| - | | |

| – | | |

| – | | |

| – | |

| Alaskan Native or Native American | |

| – | | |

| – | | |

| – | | |

| – | |

| Asian | |

| – | | |

| – | | |

| – | | |

| – | |

| Hispanic or Latinx | |

| - | | |

| - | | |

| – | | |

| – | |

| Native Hawaiian or Pacific Islander | |

| – | | |

| – | | |

| – | | |

| – | |

| White | |

| 5 | | |

| – | | |

| – | | |

| – | |

| Two or More Races or Ethnicities | |

| – | | |

| – | | |

| – | | |

| – | |

| LGBTQ+ | |

| – | | |

| – | | |

| – | | |

| – | |

| Did Not Disclose Demographic Background | |

| – | | |

| – | | |

| – | | |

| – | |

PROPOSAL 2 –

RATIFY THE APPOINTMENT OF FRUCI & ASSOCIATES, PLLC AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE YEAR ENDING

DECEMBER 31, 2024

In 2019, we engaged Fruci &

Associates, PLLC (“Fruci”) as our principal independent registered public accounting firm. The decision to appoint Fruci

was approved by our board of directors.

During Monogram Technologies’

two most recent fiscal years ended December 31, 2023 and 2022, there were no reportable events as described in Item 304(a)(1)(v) of

Regulation S-K between the Company and Fruci, as applicable, on any matter of accounting principles or practices, financial statement

disclosure, or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of the accountant, would have caused

the accountant to make reference to the subject matter of the disagreements in connection with its reports on the consolidated financial

statements for such fiscal years, or (2) reportable events.

During our two most recent

fiscal years ended December 31, 2023 and 2022, we have not consulted with Fruci regarding either the application of accounting principles

to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on our financial statements,

nor has Fruci provided to us a written report or oral advice that Fruci concluded was an important factor considered by us in reaching

a decision as to the accounting, auditing or financial reporting issue. In addition, during such periods, we have not consulted with

Fruci regarding any matter that was either the subject of a disagreement (as defined in Item 304(a)(1)(iv) and the related instructions)

or a reportable event (as described in Item 304(a)(1)(v) of Regulation S-K).

The Audit Committee has appointed

Fruci as our independent registered public accounting firm to audit the financial statements of the Company for the fiscal year ending

December 31, 2024, and has further directed that management submit their selection of independent registered public accounting firm

for ratification by our stockholders at the Annual Meeting. Neither the accounting firm nor any of its members has any direct or indirect

financial interest in or any connection with us in any capacity other than as public registered accounting firm. Representative(s) of

Fruci are expected to be available by phone to respond to appropriate questions at the Annual Meeting.

Although stockholder ratification

of the selection of Fruci as our independent registered public accounting firm is not required by our Bylaws or otherwise, the Audit

Committee believes it appropriate as a matter of policy to request that stockholders ratify the selection of our independent registered

public accounting firm. In the event the stockholders do not ratify the appointment of Fruci, the Audit Committee will reconsider its

appointment. In addition, even if the stockholders ratify the appointment of Fruci, the Audit Committee may in its discretion appoint

a different independent public accounting firm at any time if the Audit Committee determines that a change is in the best interests of

us and our stockholders.

Principal Accounting Fees and Services.

The following table sets

forth the fees for services provided and reasonably expected to be billed by Fruci & Associates, PLLC. The following is a summary

of the fees billed to the Company for professional services rendered for the fiscal years ended December 31, 2023 and 2022.

| | |

Fiscal

Year

2023 | | |

Fiscal

Year

2022 | |

| Audit fees (1) | |

$ | 64,500 | | |

$ | 47,500 | |

| Audit-related fees (2) | |

$ | - | | |

$ | - | |

| Tax Fees (3) | |

$ | 5,500 | | |

$ | 5,500 | |

| All other fees (4) | |

$ | 22,760 | | |

$ | 8,955 | |

| | |

| | | |

| | |

| Total | |

$ | 92,760 | | |

$ | 61,955 | |

(1) Audit

fees consist of fees billed for professional services rendered for the audit of our year-end financial statements, reviews of our

quarterly financial statements and services that are normally provided by our independent registered public accounting firm in connection

with statutory and regulatory filings.

(2) Audit-related

fees consist of fees billed for assurance and related services that are reasonably related to performance of the audit or review

of our year-end financial statements and are not reported under “Audit Fees.” These services include attest services that

are not required by statute or regulation and consultation concerning financial accounting and reporting standards.

(3) Tax

fees consist of fees billed for professional services relating to tax compliance, tax planning and tax advice.

(4) All

Other Fees consist of fees billed for all other services.

Audit

Committee Pre-Approval Policies and Procedures. The Audit Committee oversees and monitors our financial reporting process

and internal control system, reviews and evaluates the audit performed by our registered independent public accountants and reports to

the Board any substantive issues found during the audit. The Audit Committee is directly responsible for the appointment, compensation

and oversight of the work of our registered independent public accountants. The Audit Committee convenes on a quarterly basis to approve

each quarterly filing, and an annual basis to review the engagement of the Company’s external auditor.

The Audit Committee has considered

whether the provision of Audit-Related Fees, Tax Fees, and all other fees as described above is compatible with maintaining Fruci &

Asscoiates, PLLC’s independence and has determined that such services for fiscal years 2023 and 2022, respectively, were compatible.

All such services were approved by the Audit Committee pursuant to Rule 2-01 of Regulation S-X under the Exchange Act to the extent

that rule was applicable.

| OUR

BOARD RECOMMENDS A VOTE “FOR” THE APPROVAL OF PROPOSAL 2 – TO RATIFY THE APPOINTMENT OF FRUCI &

ASSOCIATES, PLLC AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE YEAR ENDING DECEMBER 31, 2024 |

PROPOSAL 3 – APPROVAL

OF AMENDMENT TO AMENDED AND RESTATED 2019 STOCK OPTION AND GRANT PLAN

On

October 30, 2024, our Board unanimously adopted an amendment (the “Plan Amendment”) to the Amended and Restated Monogram

Technologies Inc. 2019 Stock Option and Grant Plan (as amended, the “2020 Plan”), subject to stockholder approval. If approved

by our stockholders, the Plan Amendment would (i) increase the number of shares of our common stock that are available for issuance

pursuant to the 2020 Plan by 6,000,000 shares, from 5,200,000 shares to 11,200,000 shares, and (ii) adopt an evergreen

provision to the 2020 Plan providing for an increase in the shares of common stock available for issuance under the 2020 Plan on a periodic

basis, according to an approved formula. Pursuant to the 2020 Plan, we are able to grant equity and equity-based awards in the form of

stock options (including nonqualified stock options and incentive stock options), restricted stock awards, unrestricted stock awards,

restricted stock units, or any combination of the foregoing (collectively, “stock rights”) to our officers, employees, directors,

consultants, and other key persons of the Company (collectively, “participants”). We believe that the effective use of equity

and equity-based awards is essential to attract, motivate, and retain officers, employees, consultants and directors, to further align

participants’ interests with those of our stockholders, and to provide participants incentive compensation opportunities that are

competitive with those offered by other companies that we compete with for talent.

In this Proposal No. 3,

we are asking our stockholders to approve the Plan Amendment. A full text of the Plan Amendment is attached as Appendix A to this

Proxy Statement.

As of September 30th,

2024, approximately three (3) officers, twenty three (23) employees, and five (5) directors would have been eligible to participate

in the 2020 Plan if the Plan Amendment were in effect on such date, and we expect that the same or similar number of officers, employees

and directors will be eligible to participate in the 2020 Plan following the approval of the Plan Amendment. The closing price of our

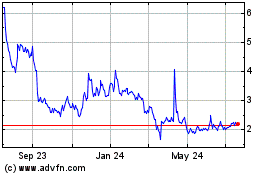

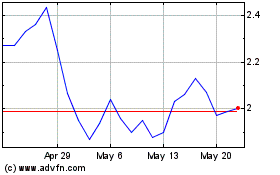

common stock on Nasdaq Stock Market on November 7, 2024 was $2.29.

As more fully described below

under the section titled “Summary of the 2020 Plan,” as of September 30th, 2024, 205,734 shares remain available

for grant under the 2020 Plan. If this Proposal No. 3 is approved by our stockholders at the Annual Meeting, the maximum aggregate

number of additional shares that may be issued under the 2020 Plan will be 11,200,000 shares, subject to adjustment as described below.

Description of Changes

The terms of the 2020 Plan

after approval of the Plan Amendment are the same as the 2020 Plan, except that (i) 6,000,000 additional shares of our common stock

will be available for issuance under the 2020 Plan on or after the effective date of the Plan Amendment, and (ii) an evergreen provision

to the 2020 Plan will be adopted, providing for an increase in the shares of common stock available for issuance under the 2020 Plan

on a periodic basis, according to an approved formula, on or after the effective date of the Plan Amendment.

Evergreen Provision

The 2020 Plan amendment calls

for the adoption of an evergreen provision to the 2020 Plan to provide for an increase in the shares of common stock available for issuance

under the 2020 Plan on a periodic basis, according to an approved formula. Pursuant to the evergreen provision, the number of shares

available for issuance under the 2020 Plan shall increase according to the following formula: “The Share Reserve will automatically

increase on January 1st of each year, for a period of not more than ten years, commencing on January 1, 2025 and ending on

(and including) January 1, 2034 by the lesser of (a) 5.0% of the total number of the shares of Common Stock outstanding on

December 31st of the immediately preceding calendar year, and (b) such number of Shares determined by the Board.”, provided

that our Board may decide that there shall be no increase in the shares available for issuance under the 2020 Plan based on the formula,

or that the increase shall be a lesser number of shares than otherwise provided under the evergreen provision.

Our Board believes that the

Plan Amendment is an effective and cost-efficient means to ensure that we maintain under the 2020 Plan the flexibility with respect to

stock-based compensation necessary to establish appropriate long-term incentives to achieve our objectives. Specifically, our Board believes

that it is advisable to ensure formulaic increases in the share limit under the 2020 Plan in order to attract and compensate employees,

officers, directors and others upon whose judgment, initiative and effort we depend.

Pursuant to the Plan Amendment, a new Section 3(d) to

the 2020 Plan will be included, as follows:

“(d) Automatic

Share Reserve Increase. The Share Reserve will automatically increase on January 1st of each year, for a period of not more

than ten years, commencing on January 1, 2025 and ending on (and including) January 1, 2034 by the lesser of (a) 5.0%

of the total number of the shares of Common Stock outstanding on December 31st of the immediately preceding calendar year, and (b) such

number of Shares determined by the Board.”

Vote Required

Provided there is a quorum

for the meeting, approval of the Plan Amendment requires the affirmative vote of a majority of the votes cast on this Proposal No. 3.

Broker non-votes, if any, are not treated as votes cast, and therefore will have no effect on this Proposal No. 3 to approve

the Plan Amendment. Under applicable Nasdaq Stock Market rules and guidance, in the context of stockholder approval of an equity

compensation plan, abstentions, if any, are treated as votes cast, and therefore will have the same effect as a vote against this Proposal No. 3.

Summary of the 2020 Plan

Following is a summary of

the principal features of the 2020 Plan after giving effect to the Plan Amendment. For additional information, please refer to the specific

provision of the full text of the 2020 Plan incorporated by reference to Exhibit 10.12

to the Company's Form S-1 filed with the SEC on July 27, 2023 and the Plan Amendment as set forth in Appendix A to this

proxy statement.

Key Provisions

Following are the key provisions of the 2020

Plan after giving effect to the Plan Amendment:

| Provisions

of the 2020 Plan |

|

Description |

| · Eligible

Participants: |

|

· Officers,

employees, directors, consultants, and other key persons of the Company that adopt the 2020 Plan. |

| |

|

|

| · Share

Reserve: |

|

· Subject

to adjustment as described below, the maximum aggregate number of shares of our common stock which may be issued pursuant to all

awards is 11,200,000 shares and 3,360,000 may be issued through the exercise of incentive stock options. |

| |

|

|

| |

|

· The

reserved shares will be reduced by one share for each share granted pursuant to stock rights awarded under the 2020 Plan. |

| |

|

|

| · Award

Types: |

|

· Incentive

and nonqualified stock options

· Restricted

stock awards

· Unrestricted

stock awards

· Restricted

stock unit awards (referred to as “RSUs”)

· Other

rights or benefits |

| |

|

|

| · Vesting: |

|

· Determined

by our Board, or at the discretion of the Board, by a committee of the Board, comprised of not less than two directors, or another

committee if appointed by our Board, or their respective delegates. |

| |

|

|

| · No

Dividends on Unvested Awards: |

|

· Any

payment of accumulated dividends or dividend equivalent rights on an outstanding award is contingent on the actual vesting or payment,

as applicable, of such award. |

| |

|

|

| · Repricing: |

|

· The

plan administrator may exercise its discretion to reduce the exercise price of outstanding stock options or effect repricing through

cancellation of outstanding stock options and by granting such holders new awards in replacement of the cancelled stock options. |

Determination of Shares to be Available for Issuance

As of September 30th,

2024, there were 4,994,266 shares underlying outstanding awards granted pursuant to the 2020 Plan and 205,734 shares remaining

available for future grant under the 2020 Plan. As noted above, the number of shares available for grant under the 2020 Plan will be

increased by the number of shares underlying outstanding awards under the 2020 Plan that are forfeited, canceled or expire, or are settled

in cash. The Board believes that attracting and retaining officers, employees, consultants and directors of high quality has been and

will continue to be essential to the Company’s growth and success. Consistent with this view, the Board believes that the number

of shares that remain available for issuance under the 2020 Plan is not sufficient for future grants in light of our compensation structure

and strategy.

If this Proposal No. 3

is approved by our stockholders at the Annual Meeting, the maximum aggregate number of new shares that may be issued under the 2020 Plan

will be 11,200,000 shares, subject to adjustment as described below. When deciding on the number of shares to be available for awards

under the Plan Amendment, the Board considered a number of factors, including the number of shares currently available under the 2020

Plan, the Company’s past share usage (“burn rate”), the number of shares needed for future awards, a dilution analysis,

the current and future accounting expenses associated with the Company’s equity award practices, and stockholder perspectives.

Dilution Analysis

The proposed share authorization

is a request to amend the 2020 Plan so that 6,000,000 additional shares will be available for awards under the 2020 Plan on or after

the effective date of the Plan Amendment.

The table below shows our

potential dilution (referred to as “overhang”) levels based on our fully diluted shares of common stock and our request for

6,000,000 new shares to be available for awards under the 2020 Plan. The request for 6,000,000 additional shares to be reserved under

the 2020 Plan represents 12.3% of the fully diluted shares of our common stock, as described in the table below. The Board believes that

this number of shares of common stock under the 2020 Plan represents a reasonable amount of potential equity dilution, which will allow

us to continue awarding stock rights, and that such stock rights are an important component of the Company’s equity compensation

program.

Potential Overhang

| Stock

Options Outstanding as of September 30th, 2024(1) | |

| 4,994,266 | |

| Weighted

Average Exercise Price of Stock Options Outstanding as of September 30th, 2024 | |

$ | 1.7103 | |

| Weighted

Average Remaining Contractual Term of Stock Options Outstanding as of September 30th, 2024 | |

| 7.2 years | |

| Outstanding

Full Value Awards as of September 30th, 2024(2) | |

$ | 7,745,704 | |

| Total

Equity Awards Outstanding as of September 30th, 2024(1)(2) | |

| 4,994,266 | |

| Shares

Available for Grant under the 2020 Plan as of September 30th, 2024 | |

| 205,734 | |

| Additional Shares

Requested under the 2020 Plan | |

| 6,000,000 | |

| Total Potential Overhang

under the 2020 Plan | |

| 11,200,000 | |

| Shares

of Common Stock Outstanding as of September 30th, 2024 | |

| 34,245,669 | |

| Warrants

and Convertible Equity Shares as of September 30th, 2024 | |

| 9,644,079 | |

| Fully Diluted Shares

of Common Stock | |

| 48,884,014 | |

| Potential Dilution

to Stockholders of 2020 Plan’s Reserve as a Percentage of Fully Diluted Shares of Common Stock | |

| 11.3 | % |

(1) Represents

the number of outstanding stock option awards under the 2020 Plan.

(2) The

Full Value Awards are comprised of time-based restricted stock units granted to employees and directors under the 2020 Plan.

Based on our current equity

award practices, the Board estimates that the authorized shares under the 2020 Plan may be sufficient to provide us with an opportunity

to grant stock rights for approximately five (5) years. This is only an estimate, and circumstances could cause the share reserve

to be used more quickly or more slowly. These circumstances include, but are not limited to, the future price of our common stock, the

mix and grant value of cash, options and full value awards provided as long-term incentive compensation, grant amounts provided by our

competitors, hiring activity, and promotions during the next few years.

Share Usage

The table below sets forth

the following information regarding the awards granted under the 2020 Plan: (i) the share usage for each of the last three calendar years

and (ii) the average share usage rate over the last three calendar years. The share usage for each specified year has been

calculated as (i) the sum of (x) all stock options granted in the applicable year, and (y) all time-based stock units

and stock awards granted in the applicable year, divided by (ii) the weighted average number of shares of common stock outstanding

for the applicable year.

Share Usage Table

| Element | |

2023 | | |

2022 | | |

2021 | | |

Three-Year

Average | |

| Time-Based

Stock Units and Stock Awards Granted | |

| 0 | | |

| 0 | | |

| 0 | | |

| — | |

| Total Full Value Awards | |

| 0 | | |

| 0 | | |

| 0 | | |

| — | |

| Stock Options Granted: | |

| 113,500 | | |

| 2,143,152 | | |

| 343,800 | | |

| 866,817 | |

| Total Full Value Awards

and Stock Options Granted | |

$ | 560,737 | | |

$ | 6,782,487 | | |

$ | 520,104 | | |

$ | 2,621,109 | |

| Weighted Average Shares Outstanding

at December 31 | |

| 31,338,391 | | |

| 18,205,457 | | |

| 11,477,975 | | |

| 20,340,608 | |

| Share Usage | |

| 0.36 | % | |

| 10.53 | % | |

| 2.91 | % | |

| 4.09 | % |

As noted in the table above,

we used an average of 4.09% of the weighted average shares outstanding on an annual basis for awards granted over the past three years

under the 2020 Plan. The average shares outstanding includes any preferred shares as calculated on an as converted basis.

The Board believes that

the Company’s executive compensation program, and particularly the granting of stock rights, allows us to align the interests of

officers, employees, consultants and directors who are selected to receive awards with those of our stockholders. The Board believes

that awards granted pursuant to the 2020 Plan are a vital component of our compensation program and, accordingly, that it is important

that an appropriate number of shares of stock be authorized for issuance under the 2020 Plan.

Administration

The 2020 Plan is administered

by our Board, or at the discretion of the Board, by a committee of the Board, comprised of not less than two directors. With respect

to awards to our officers or directors, the 2020 Plan is administered in a manner to satisfy applicable laws and that permits such grants

and related transactions to be exempt from Section 16(b) of the Securities Exchange Act of 1934, as amended,

or the Exchange Act. The plan administrator has the full authority to select recipients of the grants, determine whether and to

what extent grants are awarded, establish additional terms, conditions, rules or procedures to accommodate rules or laws of

applicable non-U.S. jurisdictions, adjust awards and take any other action deemed appropriate; however, no action may be taken that

is inconsistent with the terms of the 2020 Plan.

Available Shares

Subject to adjustment as

described below, the maximum aggregate number of additional shares which may be issued pursuant to awards under the 2020 Plan will be

11,200,000 shares of our common stock. The maximum number of shares of common stock that may be issued will not exceed 11,200,000 shares.

Shares underlying any awards that are forfeited, canceled, reacquired by the Company prior to vesting, satisfied without the issuance

of stock or otherwise terminated (other than by exercise) and shares that are withheld upon exercise of an option or settlement of an

award to cover the exercise price or tax withholding shall be added back to the shares available for issuance under the Plan.

Eligibility and Types of Awards

The 2020 Plan permits us

to grant stock awards, including stock options (including incentive stock options and nonqualified stock options), restricted stock awards,

unrestricted stock awards, restricted stock units, or any combination of the foregoing, to our officers, employees, directors, and consultants.

Stock Options

A stock option may be an

incentive stock option within the meaning of, and qualifying under, Section 422 of the Internal Revenue Code of 1986, as amended

(referred to as the “Code”), or a nonqualified stock option. However, only our employees (or employees of our parent or subsidiaries,

if any) may be granted incentive stock options. Incentive and nonqualified stock options are granted pursuant to option agreements adopted

by the plan administrator. The plan administrator determines the exercise price for a stock option, within the terms and conditions of

the 2020 Plan, provided that the exercise price of a stock option cannot be less than 100% of the fair market value of our common stock

on the date of grant except with respect to Substitute Awards. Options granted under the 2020 Plan will become exercisable at the rate

specified by the plan administrator.

The plan administrator determines

the term of the stock options granted under the 2020 Plan, up to a maximum of 10 years, except in the case of certain incentive

stock options, as described below. Unless the terms of an optionholder’s stock option agreement provide otherwise, if an optionholder’s

relationship with us, or any of our affiliates, ceases for any reason other than disability or death, the optionholder may exercise any

options otherwise exercisable as of the date of termination, but only during the post-termination exercise period designated in the optionholder’s

stock option award agreement. The optionholder’s stock option award agreement may provide that upon the termination of the optionholder’s

relationship with us for cause, the optionholder’s right to exercise his or her options will terminate concurrently with the termination

of the relationship. If an optionholder’s service relationship with us, or any of our affiliates, ceases due to disability or death,

or an optionholder dies within a certain period following cessation of service, the optionholder or his or her estate or person who acquired

the right to exercise the award by bequest or inheritance may exercise any vested options for a period of 12 months following such

date. The option term may be extended in the event that exercise of the option within the applicable time periods is prohibited by applicable

securities laws or such longer period as specified in the stock option award agreement but in no event beyond 30 days immediately

following the expiration of its term.

Acceptable consideration

for the purchase of common stock issued upon the exercise of a stock option may be made by one or more of the following methods (or any

combination thereof) to the extent provided in the award agreement: (a) in cash, by certified or bank check, by wire transfer of

immediately available funds, or other instrument acceptable to the Committee; (b) if permitted by the Committee, by the optionholder

delivering to the Company a promissory note, if the Board has expressly authorized the loan of funds to the optionholder for the purpose

of enabling or assisting the optionholder to effect the exercise of his or her option; provided, that at least so much of the exercise

price as represents the par value of the Stock shall be paid in cash if required by state law; (c) if permitted by the Committee,

through the delivery (or attestation to the ownership) of shares that have been purchased by the optionholder on the open market or that

are beneficially owned by the optionholder and are not then subject to restrictions under any Company plan. To the extent required to

avoid variable accounting treatment under ASC 718 or other applicable accounting rules, such surrendered shares if originally purchased

from the Company shall have been owned by the optionholders for at least six months. Such surrendered Shares shall be valued at Fair

Market Value on the exercise date; (d)if permitted by the Committee, by the optionholder delivering to the Company a properly executed

exercise notice together with irrevocable instructions to a broker to promptly deliver to the Company cash or a check payable and acceptable

to the Company for the purchase price; provided that in the event the optionholder chooses to pay the purchase price as so provided,

the optionholder and the broker shall comply with such procedures and enter into such agreements of indemnity and other agreements as

the Committee shall prescribe as a condition of such payment procedure; or (e) if permitted by the Committee, and only with respect

to options that are not incentive stock options, by a “net exercise” arrangement pursuant to which the Company will reduce

the number of Shares issuable upon exercise by the largest whole number of shares with a Fair Market Value that does not exceed the aggregate

exercise price.

Unless the plan administrator provides otherwise,

awards generally are not transferable, except by will or the laws of descent and distribution.

Incentive stock options

may be granted only to our employees (or to employees of our parent company and subsidiaries, if any). To the extent that the aggregate

fair market value, determined at the time of grant, of shares of our common stock with respect to which incentive stock options are exercisable

for the first time by an optionholder during any calendar year under any of our equity plans exceeds $100,000, such options will not

qualify as incentive stock options. A stock option granted to any employee who, at the time of the grant, owns or is deemed to own stock

representing more than 10% of the voting power of all classes of our stock or stock of any of our affiliates may not be an incentive

stock option unless (a) the option exercise price is at least 110% of the fair market value of the stock subject to the option on

the date of grant, and (b) the term of the incentive stock option does not exceed five years from the date of grant.

Restricted Stock

Restricted stock awards

are awards of shares of our common stock that are subject to established terms and conditions. The plan administrator sets the terms

of the restricted stock awards, including the size of the restricted stock award, the price (if any) to be paid by the recipient and

the vesting schedule and criteria (which may include terminates before the restricted stock is fully vested, all of the unvested shares

generally will be forfeited to, or repurchased by, us.

Unrestricted Stock

Unrestricted stock awards

are awards of shares of our common stock that are subject to established terms and conditions. The plan administrator sets the terms

of the unrestricted stock awards, including the size of the unrestricted stock award, the price (if any) to be paid by the recipient

and the vesting schedule and criteria (which may include terminates before the unrestricted stock is fully vested, all of the unvested

shares generally will be forfeited to, or repurchased by, us.

Restricted Stock Units

An RSU is a right to receive

stock, cash equal to the value of a share of stock or other securities or a combination of the three at the end of a set period or the

attainment of performance criteria. No stock is issued at the time of grant. The plan administrator sets the terms of the RSU award,

including the size of the RSU award, the consideration (if any) to be paid by the recipient, vesting schedule, and criteria and form

(stock or cash) in which the award will be settled. If a participant’s service terminates before the RSU is fully vested, the unvested

portion of the RSU award generally will be forfeited to us.

Rights as a Stockholder; No Dividends or Dividend Equivalent Rights

on Unvested Awards

Except as otherwise provided

in any award agreement or as required by applicable law, a participant shall have rights of a stockholder only as to shares of common

stock, if any, acquired upon settlement of restricted stock units. A participant shall not be deemed to have acquired any such shares

of common stock unless and until the restricted stock units shall have been settled in shares of common stock, the Company shall have

issued and delivered a certificate representing the shares of common stock to the participant (or transferred on the records of the Company

with respect to uncertificated stock), and the participant’s name has been entered in the books of the Company as a stockholder.

No dividends or dividend equivalent rights will be paid in respect of any unvested award of restricted stock, unless and until such shares

vest.

In the case of awards other

than restricted stock, except as otherwise provided in any award agreement, a participant will not have any rights of a stockholder.

No dividends or dividend equivalent rights will be paid with respect to any of the shares granted pursuant to such award agreement until

the award vests and is paid.

Adjustments

Subject

to any required action by the our stockholders, if, as a result of any reorganization, recapitalization, reclassification, stock dividend,

stock split, reverse stock split or other similar change in the Company's capital stock, the outstanding shares are increased or decreased

or are exchanged for a different number or kind of shares or other securities of the Company, or additional shares or new or different

shares or other securities of the Company or other non-cash assets are distributed with respect to such Shares or other securities, in

each case, without the receipt of consideration by the Company, or, if, as a result of any merger or consolidation, or sale of all or

substantially all of the assets of the Company, the outstanding Shares are converted into or exchanged for other securities of the Company

or any successor entity (or a parent or subsidiary thereof), the Committee shall make an appropriate and proportionate adjustment in

(i) the maximum number of Shares reserved for issuance under the Plan, (ii) the number and kind of Shares or other securities

subject to any then outstanding Awards under the Plan, (iii) the repurchase price, if any, per Share subject to each outstanding

Award, and (iv) the exercise price for each Share subject to any then outstanding stock options under the Plan, without changing

the aggregate exercise price (i.e., the exercise price multiplied by the number of stock options) as to which such stock options remain

exercisable. The Committee shall, if applicable, make such adjustments as may be required by Section 25102(o) of the California

Corporation Code and the rules and regulations promulgated thereunder. The adjustment by the Committee shall be final, binding and

conclusive. No fractional shares shall be issued under the Plan resulting from any such adjustment, but the Committee in its discretion

may make a cash payment in lieu of fractional shares.

Sale Events –

Unless otherwise set forth

in an award agreement, if a sale event occurs the 2020 Plan and all outstanding options issued thereunder shall terminate upon the effective

time of any such sale event unless assumed or continued by the successor entity, or new stock options or other awards of the successor

entity or parent thereof are substituted therefor, with an equitable or proportionate adjustment as to the number and kind of shares

and, if appropriate, the per share exercise prices, as such parties shall agree (after taking into account any acceleration hereunder

and/or pursuant to the terms of any award agreement).

In the event of the termination

of the 2020 Plan and all outstanding options issued under the 2020 Plan, each holder of options shall be permitted, within a period of

time prior to the consummation of the sale event as specified by the plan administrator, to exercise all such options which are then

exercisable or will become exercisable as of the effective time of the sale event; provided, however, that the exercise of

options not exercisable prior to the sale event shall be subject to the consummation of the sale event.

In the event of a sale event,

the Company shall have the right, but not the obligation, to make or provide for a cash payment to the holders of options, without any

consent of the holders, in exchange for the cancellation thereof, in an amount equal to the difference between (A) the value as

determined by the plan administrator of the consideration payable per share of common stock pursuant to the sale event (the “Sale