Rubric Capital Management Increases Slate of Proposed Mereo BioPharma Director Nominees to Five

October 03 2022 - 9:00AM

Business Wire

Director Nominees Possess the Financial,

Regulatory and Strategic Expertise to Maximize Value for All

Shareholders

Details Mereo’s Desperate Efforts to Thwart

Requisition of General Meeting of Shareholders

Rubric Capital Management LP (“Rubric”), an investment advisor

whose funds and accounts collectively own approximately 14% of the

outstanding equity of Mereo BioPharma Group plc (NASDAQ: MREO)

(“Mereo” or the “Company”), today issued an open letter to Mereo’s

shareholders. In its letter, Rubric details Mereo’s entrenching

tactics in a desperate attempt to once more thwart Rubric’s effort

to call a general meeting of shareholders.

Rubric has delivered yet another revised requisition today and

is increasing the size of its slate of proposed directors to five

director nominees, who it believes will provide the Board with the

financial, regulatory, and strategic expertise to maximize value

for all shareholders. The five highly qualified candidates for

Mereo’s Board are: Annalisa Jenkins, MBBS, FRCP, Daniel Shames, MD,

Marc Yoskowitz, Justin Roberts, and David Rosen.

The full text of the letter follows:

Dear Fellow Mereo Shareholders,

The Mereo Board has once again rejected our request for a

special meeting based on the flimsiest of pretexts. On this

occasion they cite the “basic legal requirement” that the

requisition be delivered by a “registered shareholder”. On its

face, this seems like a reasonable request but for the following

facts they, once again, conveniently omit:

- Rubric delivered a requisition from two members. This included

letters from our prime brokers, who maintain all shares within

omnibus accounts, attesting to the fact that two funds managed by

Rubric beneficially own Ordinary Shares in Mereo BioPharma in

sufficient number to call a general meeting of shareholders

- In rejecting those attestation letters, the Board required

Rubric (and, for the record, any other shareholder who wishes in

the future to exercise their rights) to do the following:

- Convert digital holdings of Ordinary Shares into paper shareholder certificates, a process that was

tedious, time consuming, and adds significant risk to maintaining

proper custody on behalf of Rubric’s managed funds

- Request our prime brokers then to go to CREST, the electronic

registry for the majority of the UK market, to have it remove the

Shares from the digital records so our proof of ownership could be

maintained on the physical

certificates

- Finally, request our prime brokers to store our certificated

shares in their respective vaults for

safekeeping

Given the lengths this Board has gone to so far to prevent this

requisition, if the vaults are the victim of a heist I think we can

narrow the suspect list considerably.

Not since CSX held its 2008 annual meeting in an “inaccessible

rail yard” in a futile attempt to prevent TCI/3G’s proxy challenge

have we seen such depths of entrenchment and wasteful use of

shareholder resources. These tactics have not deterred Rubric from

its efforts, and we have completed them in order to deliver yet

another revised requisition today.

Rubric has attempted, throughout this process, to operate with

transparency about our intentions and clearly communicate as to why

we believe our course of action to be in the best interests of

shareholders. Our requests have thus far been met with bad faith,

in both word and deed, by the Mereo Board.

It is clear to Rubric (and we hope other shareholders) that the

problems on the Board of Mereo run deeper than we anticipated. In

light of this development and our belief that further boardroom

change is required to achieve the best outcome for shareholders, we

are increasing the size of our slate of proposed directors to

five in order to accommodate my

nomination. My nomination will further bolster our strong slate of

existing nominees and we believe will provide the Board with the

financial, regulatory, and strategic expertise to maximize value

for all shareholders.

Sincerely,

David Rosen

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221003005384/en/

Media: Jonathan Gasthalter/Sam Fisher Gasthalter & Co. (212)

257-4170

Investors: Okapi Partners LLC Bruce Goldfarb / Jason Alexander

(212) 297-0720 info@okapipartners.com

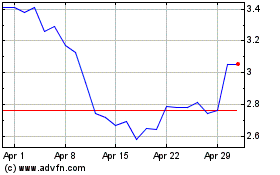

Mereo BioPharma (NASDAQ:MREO)

Historical Stock Chart

From Nov 2024 to Dec 2024

Mereo BioPharma (NASDAQ:MREO)

Historical Stock Chart

From Dec 2023 to Dec 2024