0001522540FALSE00015225402024-11-042024-11-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 4, 2024

MARQETA, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-40465 | | 27-4306690 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

180 Grand Avenue, 6th Floor

Oakland, California 94612

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (877) 962-7738

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A common stock, $0.0001 par value per share | | MQ | | The Nasdaq Stock Market LLC |

| | | | (Nasdaq Global Select Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 4, 2024, Marqeta, Inc. (the "Company") issued a press release announcing its financial results for the quarter ended September 30, 2024. A copy of the press release is furnished as Exhibit 99.1 to this current report on Form 8-K and is incorporated herein by reference.

The information furnished pursuant to this Item 2.02, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit Number | | Description |

99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| | MARQETA, INC. |

Date: November 4, 2024 | /s/ Michael (Mike) Milotich |

| | Michael (Mike) Milotich |

| | Chief Financial Officer |

MARQETA REPORTS THIRD QUARTER 2024 FINANCIAL RESULTS

The global modern card issuer reported Total Processing Volume growth of 30% and Gross Profit growth of 24% in the third quarter of 2024.

OAKLAND, Calif. – November 4, 2024 - Marqeta, Inc. (NASDAQ: MQ), the global modern card issuing platform, today reported financial results for the third quarter ended September 30, 2024.

The Company reported Total Processing Volume (TPV) of $74 billion, representing a year-over-year increase of 30%. The Company reported Net Revenue of $128 million and Gross Profit of $90 million, representing increases of 18% and 24%, respectively, year-over-year. GAAP Net Loss for the quarter was $29 million and Adjusted EBITDA was $9 million.

"In the third quarter our true growth trajectory was back on display as we lapped the Block contract renewal, while continuing to demonstrate operational discipline to fuel strong Adjusted EBITDA. We combined this with several new product announcements that further enhance the Marqeta platform to provide transformative payment solutions at scale for our expanding customer base,” said Simon Khalaf, CEO at Marqeta.

Marqeta highlighted several recent business updates that demonstrate its current business momentum:

•Marqeta introduced a Portfolio Migration service that reduces complexity for customers upgrading existing card programs onto the Marqeta platform, without impacting their existing cardholder experience. This ability allows for the seamless migration of customers from competitor platforms to Marqeta. Completed at the end of October, Marqeta successfully migrated millions of Klarna cards in Europe onto its platform from Klarna’s incumbent processor.

•Marqeta unveiled Marqeta Flex, an industry-leading solution that revolutionizes how BNPL loans can be delivered inside payment apps and wallets. Marqeta Flex is intended to increase BNPL’s acceptance and provide consumers with access to personalized BNPL options inside of the payment apps they use most often. Marqeta also announced Affirm and Klarna as the first BNPL providers to be integrated into Marqeta Flex and Branch, which is used by a large number of Uber drivers, as the first application to support Marqeta Flex.

•UX Toolkit, also introduced this quarter, is an addition to Marqeta's portfolio of card program management tools. The UX Toolkit includes user interface components that can be customized and enhanced to improve cardholder touchpoints. The UX Toolkit will allow Marqeta’s customers to create front-end modern payment experiences from scratch with fewer development resources required. This will further enhance Marqeta’s leadership in program management and enable its customers to deliver better user experiences for their cardholders.

Operating Highlights

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| In thousands, except percentages and per share data. % change is calculated over the comparable prior-year period (unaudited) | Three Months Ended September 30, | | %

Change | | Nine Months Ended September 30, | | %

Change |

| 2024 | | 2023 | | | 2024 | | 2023 | |

| Financial metrics: | | | | | | | | | | | |

| Net revenue | $ | 127,967 | | | $ | 108,891 | | | 18% | | $ | 371,205 | | | $ | 557,349 | | | (33%) |

| Gross profit | $ | 90,132 | | | $ | 72,508 | | | 24% | | $ | 253,646 | | | $ | 246,281 | | | 3% |

| Gross margin | 70 | % | | 67 | % | | 3 ppts | | 68 | % | | 44 | % | | 24 ppts |

| Total operating expenses | $132,363 | | | $142,334 | | | (7%) | | $240,687 | | | $472,960 | | | (49%) |

| Net (loss) income | ($28,643) | | | ($54,990) | | | 48% | | $54,405 | | | ($182,587) | | | 130% |

| Net (loss) income margin | (22 | %) | | (51 | %) | | 29 ppts | | 15 | % | | (33 | %) | | 48 ppts |

Net (loss) income per share - basic | ($0.06) | | | ($0.10) | | | 40% | | $0.11 | | | ($0.34) | | | 132% |

Net (loss) income per share - diluted | ($0.06) | | | ($0.10) | | | 40% | | $0.10 | | | ($0.34) | | | 129% |

| Key operating metric and Non-GAAP financial measures: | | | | | | | | | | | |

Total Processing Volume (TPV) (in millions) 1 | $ | 73,899 | | | $ | 56,650 | | | 30% | | $ | 211,192 | | | $ | 160,285 | | | 32% |

Adjusted EBITDA 2 | $9,019 | | | ($2,062) | | | 537% | | $16,429 | | | ($5,586) | | | 394% |

Adjusted EBITDA margin 2 | 7 | % | | (2 | %) | | 9 ppts | | 4 | % | | (1 | %) | | 5 ppts |

Non-GAAP operating expenses 2 | $ | 81,113 | | | $ | 74,570 | | | 9% | | $ | 237,217 | | | $ | 251,867 | | | (6%) |

1 TPV represents the total dollar amount of payments processed through our platform, net of returns and chargebacks. We believe that TPV is a key indicator of the market adoption of our platform, growth of our brand, growth of our customers' businesses and scale of our business.

2 See "Information Regarding Non-GAAP Measures" for definitions of Adjusted EBITDA, Adjusted EBITDA margin, and Non-GAAP operating expenses and the reconciliations of the net loss to Adjusted EBITDA, and of the total operating expenses to Non-GAAP operating expenses.

Third Quarter 2024 Financial Results:

Total Processing Volume increased by 30% year-over-year, rising to $74 billion from $57 billion in the third quarter of 2023.

Net Revenue of $128 million increased by $19 million, or 18% year-over-year, primarily driven by increased volumes, partially offset by unfavorable mix due to faster growth of Powered by Marqeta volume and a renegotiated platform partnership in the first quarter of 2024.

Gross Profit increased by 24% year-over-year to $90 million from $73 million in the third quarter of 2023 primarily due to our TPV growth. Gross Margin was 70% in the third quarter of 2024.

Net Loss of $29 million in the quarter improved by $26 million year-over-year due to gross profit growth and lower operating expenses. Net Loss margin was 22% in the third quarter of 2024, an improvement of 29 percentage points versus last year.

Adjusted EBITDA was $9 million in the third quarter of 2024, increasing by $11 million year-over year. Adjusted EBITDA margin was 7% in the third quarter of 2024, an increase of 9 percentage points versus last year.

Financial Guidance

Our fourth quarter guidance reflects several changes that became apparent over the last few months with regards to the heightened scrutiny of the banking environment and specific customer program changes.

The following summarizes Marqeta's guidance for the fourth quarter of 2024:

| | | | | | | |

| Fourth Quarter 2024 | | |

| Net Revenue Growth | 10 - 12% | | |

| | | |

Gross Profit Growth | 13 - 15% | | |

| | | |

Adjusted EBITDA Margin (1) | 5 - 7% | | |

(1) See "Information Regarding Non-GAAP Measures" for the definition of Adjusted EBITDA Margin and for information regarding non-availability of a forward reconciliation. | |

Conference Call

Marqeta will host a live conference call today at 1:30 p.m. Pacific time (4:30 p.m. Eastern time). To join the call, please dial-in 10 minutes in advance: toll-free at 1-877-407-4018 or direct at 1-201-689-8471. The conference call will also be available live via webcast online at http://investors.marqeta.com.

The telephone replay dial-in numbers are 1-844-512-2921 and 1-412-317-6671 and will be available until November 11, 2024, 8:59 p.m. Pacific time (11:59 p.m. Eastern time). The confirmation code for the replay is 13748904.

Forward-Looking Statements

This press release contains "forward-looking statements" within the meaning of the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements expressed or implied in this press release include, but are not limited to, statements relating to Marqeta’s quarterly guidance; statements regarding Marqeta’s business plans, business strategy and the continued success and growth of our customers; statements and expectations regarding Marqeta's partnerships, new product introductions, and product capabilities, including credit card issuing; and statements made by Marqeta’s CEO and CFO. Actual results may differ materially from the expectations contained in these statements due to risks and uncertainties, including, but not limited to, the following: the effect of uncertainties related to our business, results of operations, financial condition, and demand for our platform; the risk that Marqeta’s anticipated accounting treatment may be subject to further changes or developments; the risk that Marqeta is unable to further attract, retain, diversify, and expand its customer base; the risk that Marqeta is unable to drive increased profitable transactions on its platform; the risk that consumers and customers will not perceive the benefits of Marqeta’s products, including credit card issuing, as Marqeta expects; the risk that Marqeta's platform does not operate as intended resulting in system outages; the risk that Marqeta will not be able to achieve the cost structure that Marqeta currently expects; the risk that Marqeta’s solution will not achieve the expected market acceptance; the risk that competition could reduce expected demand for Marqeta’s services, including credit card issuing; the risk that changes in the regulatory landscape could adversely affect Marqeta's operations and revenues, including heightened scrutiny of the banking environment and specific customer program changes; the risk that Marqeta may be unable to maintain relationships with issuing banks and card networks; the risk that Marqeta is not able to identify and recognize the anticipated benefits of any acquisition; the risk that Marqeta is unable to successfully integrate any acquisition to businesses and related operations; the risk of financial services and banking sector instability and follow on effects to fintech companies; the impact of macroeconomic factors, including various geopolitical conflicts, uncertainty related to global elections, changes in inflation and interest rates, and uncertainty in global economic conditions; and the risk that Marqeta may be subject to additional risks due to its international business activities. Detailed information about these risks and other factors that could potentially affect Marqeta’s business, financial condition and results of operations are included or incorporated by reference in the “Risk Factors” disclosed in Marqeta's Annual Report on Form 10-K for the year ended December 31, 2023 and subsequent Quarterly Reports on Form 10-Q, as such risk factors may be updated from time to time in Marqeta’s periodic filings with the SEC, available at www.sec.gov and Marqeta’s website at http://investors.marqeta.com.

The forward-looking statements in this press release are based on information available to Marqeta as of the date hereof. Marqeta disclaims any obligation to update any forward-looking statements, except as required by law.

Disclosure Information

Investors and others should note that Marqeta announces material financial information to its investors using its investor relations website, SEC filings, press releases, public conference calls and webcasts. Marqeta also uses social media to communicate with its customers and the public about Marqeta, its products and services and other matters relating to its business and market. It is possible that the information Marqeta posts on social media could be deemed to be material information. Therefore, Marqeta encourages investors, the media, and others interested in Marqeta to review the information we post on social media channels including the Marqeta X feed (@Marqeta), the Marqeta Instagram page (@lifeatmarqeta), the Marqeta Facebook page, and the Marqeta LinkedIn page. These social media channels may be updated from time to time.

Use of Non-GAAP Financial Measures

Reconciliations of non-GAAP financial measures to the most directly comparable financial results as determined in accordance with GAAP are included at the end of this press release following the accompanying financial data. For a description of these non-GAAP financial measures, including the reasons management uses each measure, please see the section of the tables titled "Information Regarding Non-GAAP Financial Measures".

About Marqeta, Inc.

Marqeta makes it possible for companies to build and embed financial services into their branded experience—and unlock new ways to grow their business and delight users. The Marqeta platform puts businesses in control of building financial solutions, enabling them to turn real-time data into personalized, optimized solutions for everything from consumer loyalty to capital efficiency. With compliance and security built-in, Marqeta’s platform has been proven at scale, processing more than $200 billion in annual payments volume in 2023. Marqeta is certified to operate in more than 40 countries worldwide and counting. Visit www.marqeta.com to learn more.

Marqeta® is a registered trademark of Marqeta, Inc.

IR Contact: Marqeta Investor Relations, IR@marqeta.com

Marqeta, Inc.

Condensed Consolidated Statements of Operations

(in thousands, except per share amounts)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net revenue | $ | 127,967 | | | $ | 108,891 | | | $ | 371,205 | | | $ | 557,349 | |

| Costs of revenue | 37,835 | | | 36,383 | | | 117,559 | | | 311,068 | |

| Gross profit | 90,132 | | | 72,508 | | | 253,646 | | | 246,281 | |

| Operating expenses (benefit): | | | | | | | |

| Compensation and benefits | 100,964 | | | 102,433 | | | 299,120 | | | 350,592 | |

| Technology | 16,317 | | | 13,930 | | | 44,204 | | | 41,674 | |

| Professional services | 4,759 | | | 4,197 | | | 13,437 | | | 14,507 | |

| Occupancy | 1,178 | | | 1,074 | | | 3,476 | | | 3,285 | |

| Depreciation and amortization | 4,448 | | | 3,108 | | | 11,941 | | | 7,582 | |

| Marketing and advertising | 582 | | | 346 | | | 1,688 | | | 1,348 | |

| Other operating expenses | 4,115 | | | 3,833 | | | 11,438 | | | 14,171 | |

| Executive chairman long-term performance award | — | | | 13,413 | | | (144,617) | | | 39,801 | |

| Total operating expenses | 132,363 | | | 142,334 | | | 240,687 | | | 472,960 | |

| (Loss) income from operations | (42,231) | | | (69,826) | | | 12,959 | | | (226,679) | |

| Other income, net | 13,703 | | | 15,074 | | | 41,845 | | | 37,508 | |

| (Loss) income before income tax expense | (28,528) | | | (54,752) | | | 54,804 | | | (189,171) | |

| Income tax expense (benefit) | 115 | | | 238 | | | 399 | | | (6,584) | |

| Net (loss) income | $ | (28,643) | | | $ | (54,990) | | | $ | 54,405 | | | $ | (182,587) | |

| | | | | | | |

| | | | | | | |

| Net (loss) income per share attributable to Class A and Class B common stockholders | | | | | | | |

Basic | $ | (0.06) | | | $ | (0.10) | | | $ | 0.11 | | | $ | (0.34) | |

Diluted | $ | (0.06) | | | $ | (0.10) | | | $ | 0.10 | | | $ | (0.34) | |

| Weighted-average shares used in computing net (loss) income per share attributable to Class A and Class B common stockholders | | | | | | | |

Basic | 507,160 | | | 529,489 | | | 513,678 | | | 535,797 | |

| Diluted | 507,160 | | | 529,489 | | | 522,394 | | | 535,797 | |

Marqeta, Inc.

Condensed Consolidated Balance Sheets

(in thousands)

| | | | | | | | | | | |

| September 30,

2024 | | December 31,

2023 |

| (unaudited) | | |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 886,417 | | | $ | 980,972 | |

| Restricted cash | 8,500 | | | 8,500 | |

| Short-term investments | 217,569 | | | 268,724 | |

| Accounts receivable, net | 26,373 | | | 19,540 | |

| Settlements receivable, net | 11,817 | | | 29,922 | |

| Network incentives receivable | 46,667 | | | 53,807 | |

| Prepaid expenses and other current assets | 23,821 | | | 27,233 | |

| Total current assets | 1,221,164 | | | 1,388,698 | |

| Operating lease right-of-use assets, net | 4,894 | | | 6,488 | |

| Property and equipment, net | 35,791 | | | 18,764 | |

| Intangible assets, net | 31,238 | | | 35,631 | |

| Goodwill | 123,523 | | | 123,523 | |

| | | |

| Other assets | 19,226 | | | 16,587 | |

| Total assets | $ | 1,435,836 | | | $ | 1,589,691 | |

| Liabilities and stockholders' equity | | | |

| Current liabilities | | | |

| Accounts payable | $ | 1,026 | | | $ | 1,420 | |

| Revenue share payable | 167,081 | | | 173,645 | |

| Accrued expenses and other current liabilities | 165,466 | | | 161,514 | |

| Total current liabilities | 333,573 | | | 336,579 | |

| | | |

| Operating lease liabilities, net of current portion | 2,082 | | | 5,126 | |

| Other liabilities | 4,523 | | | 4,591 | |

| Total liabilities | 340,178 | | | 346,296 | |

| Stockholders' equity : | | | |

| Preferred stock | — | | | — | |

| Common stock | 50 | | | 52 | |

| Additional paid-in capital | 1,865,565 | | | 2,067,776 | |

| Accumulated other comprehensive income | 833 | | | 762 | |

| Accumulated deficit | (770,790) | | | (825,195) | |

| Total stockholders’ equity | 1,095,658 | | | 1,243,395 | |

| Total liabilities and stockholders' equity | $ | 1,435,836 | | | $ | 1,589,691 | |

Marqeta, Inc.

Condensed Consolidated Statements of Cash Flows

(in thousands)

(unaudited)

| | | | | | | | | | | |

| Nine Months Ended September 30, |

| 2024 | | 2023 |

| Cash flows from operating activities: | | | |

| Net income (loss) | $ | 54,405 | | | $ | (182,587) | |

Adjustments to reconcile net income (loss) to net cash provided by operating activities: | | | |

| Depreciation and amortization | 11,941 | | | 7,582 | |

| Share-based compensation expense | 103,258 | | | 95,911 | |

Executive chairman long-term performance award | (144,617) | | | 39,801 | |

| Non-cash postcombination compensation expense | — | | | 32,430 | |

| Non-cash operating leases expense | 1,017 | | | 1,870 | |

| Amortization of premium (accretion of discount) on short-term investments | (2,650) | | | (5,525) | |

| | | |

| Other | 328 | | | 1,068 | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | (7,285) | | | (1,108) | |

| Settlements receivable | 18,105 | | | (1,477) | |

| Network incentives receivable | 7,140 | | | 8,086 | |

| Prepaid expenses and other assets | 3,195 | | | 7,760 | |

| Accounts payable | (3,274) | | | (4,350) | |

| Revenue share payable | (6,564) | | | 4,289 | |

| Accrued expenses and other liabilities | 545 | | | 3,331 | |

| Operating lease liabilities | (2,129) | | | (2,499) | |

Net cash provided by operating activities | 33,415 | | | 4,582 | |

| Cash flows from investing activities: | | | |

| Purchases of property and equipment | (2,382) | | | (722) | |

| Capitalization of internal-use software | (14,577) | | | (9,488) | |

| Business combination, net of cash acquired | — | | | (135,630) | |

| | | |

| Purchases of short-term investments | — | | | (972,430) | |

| Sales of marketable securities | — | | | 637,913 | |

| Maturities of short-term investments | 54,000 | | | 437,034 | |

Realized gain (loss) on investments | — | | | (73) | |

Net cash provided by (used in) investing activities | 37,041 | | | (43,396) | |

| Cash flows from financing activities: | | | |

| | | |

| Proceeds from exercise of stock options, including early exercised stock options, net of repurchase of early exercised unvested options | 121 | | | 4,081 | |

Payment on acquisition-related contingent consideration | — | | | (53,067) | |

| | | |

| Proceeds from shares issued in connection with employee stock purchase plan | 1,629 | | | 1,775 | |

| Taxes paid related to net share settlement of restricted stock units | (29,043) | | | (18,553) | |

| Repurchase of common stock | (137,718) | | | (131,519) | |

| | | |

| Net cash used in financing activities | (165,011) | | | (197,283) | |

| Net decrease in cash, cash equivalents, and restricted cash | (94,555) | | | (236,097) | |

| Cash, cash equivalents, and restricted cash- Beginning of period | 989,472 | | | 1,191,646 | |

| Cash, cash equivalents, and restricted cash - End of period | $ | 894,917 | | | $ | 955,549 | |

Marqeta, Inc.

Financial and Operating Highlights

(in thousands, except per share data or as noted)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 2024 | | 2023 | | | | Year over Year Change Q3'24 vs Q3'23 |

| | Third Quarter | | Second Quarter | | First Quarter | | Fourth Quarter | | Third Quarter | | |

| Operating performance: | | | | | | | | | | | | | | |

| Net revenue | | $ | 127,967 | | | $ | 125,270 | | | $ | 117,968 | | | $ | 118,822 | | | $ | 108,891 | | | | | 18 | % |

| Costs of revenue | | 37,835 | | | 45,917 | | | 33,807 | | | 35,589 | | | 36,383 | | | | | 4 | % |

| Gross profit | | 90,132 | | | 79,353 | | | 84,161 | | | 83,233 | | | 72,508 | | | | | 24 | % |

| Gross margin | | 70 | % | | 63 | % | | 71 | % | | 70 | % | | 67 | % | | | | 3 | ppts |

| Operating expenses (benefit): | | | | | | | | | | | | | | |

| Compensation and benefits | | 100,964 | | | 103,166 | | | 94,990 | | | 95,790 | | | 102,433 | | | | | (1 | %) |

| Technology | | 16,317 | | | 14,769 | | | 13,118 | | | 13,938 | | | 13,930 | | | | | 17 | % |

| Professional services | | 4,759 | | | 4,808 | | | 3,870 | | | 7,172 | | | 4,197 | | | | | 13 | % |

| Occupancy and equipment | | 1,178 | | | 1,204 | | | 1,094 | | | 1,076 | | | 1,074 | | | | | 10 | % |

| Depreciation and amortization | | 4,448 | | | 3,956 | | | 3,537 | | | 3,159 | | | 3,108 | | | | | 43 | % |

| Marketing and advertising | | 582 | | | 728 | | | 378 | | | 1,219 | | | 346 | | | | | 68 | % |

| Other operating expenses | | 4,115 | | | 3,418 | | | 3,905 | | | 3,804 | | | 3,833 | | | | | 7 | % |

| Executive chairman long-term performance award | | — | | | (157,738) | | | 13,121 | | | 13,413 | | | 13,413 | | | | | (100 | %) |

| Total operating expenses (benefit) | | 132,363 | | | (25,689) | | | 134,013 | | | 139,571 | | | 142,334 | | | | | (7 | %) |

| (Loss) income from operations | | (42,231) | | | 105,042 | | | (49,852) | | | (56,338) | | | (69,826) | | | | | 40 | % |

| Other income, net | | 13,703 | | | 14,216 | | | 13,926 | | | 14,932 | | | 15,074 | | | | | (9 | %) |

| (Loss) income before income tax expense | | (28,528) | | | 119,258 | | | (35,926) | | | (41,406) | | | (54,752) | | | | | 48 | % |

| Income tax expense (benefit) | | 115 | | | 150 | | | 134 | | | (1,030) | | | 238 | | | | | (52 | %) |

| Net (loss) income | | $ | (28,643) | | | $ | 119,108 | | | $ | (36,060) | | | $ | (40,376) | | | $ | (54,990) | | | | | 48 | % |

| (Loss) income per share - basic | | $ | (0.06) | | | $ | 0.23 | | | $ | (0.07) | | | $ | (0.08) | | | $ | (0.10) | | | | | 40 | % |

| (Loss) income per share - diluted | | $ | (0.06) | | | $ | 0.23 | | | $ | (0.07) | | | $ | (0.08) | | | $ | (0.10) | | | | | 309 | % |

| TPV (in millions) | | $ | 73,899 | | | $ | 70,627 | | | $ | 66,666 | | | $ | 61,979 | | | $ | 56,650 | | | | | 30 | % |

| Adjusted EBITDA | | $ | 9,019 | | | $ | (1,817) | | | $ | 9,228 | | | $ | 3,292 | | | $ | (2,062) | | | | | 537 | % |

| Adjusted EBITDA margin | | 7 | % | | (1 | %) | | 8 | % | | 3 | % | | (2 | %) | | | | 9 | ppts |

| Financial condition: | | | | | | | | | | | | | | |

| Cash and cash equivalents | | $ | 886,417 | | | $ | 924,730 | | | $ | 970,357 | | | $ | 980,972 | | | $ | 947,749 | | | | | (6 | %) |

| Restricted cash | | $ | 8,500 | | | $ | 8,500 | | | $ | 8,500 | | | $ | 8,500 | | | $ | 7,800 | | | | | 9 | % |

| Short-term investments | | $ | 217,569 | | | $ | 228,833 | | | $ | 228,324 | | | $ | 268,724 | | | $ | 349,395 | | | | | (38 | %) |

| Total assets | | $ | 1,435,836 | | | $ | 1,488,283 | | | $ | 1,558,361 | | | $ | 1,589,691 | | | $ | 1,603,249 | | | | | (10 | %) |

| Total liabilities | | $ | 340,178 | | | $ | 345,908 | | | $ | 347,696 | | | $ | 346,296 | | | $ | 308,166 | | | | | 10 | % |

| | | | | | | | | | | | | | |

| Stockholders' equity | | $ | 1,095,658 | | | $ | 1,142,375 | | | $ | 1,210,665 | | | $ | 1,243,395 | | | $ | 1,295,083 | | | | | (15 | %) |

ppts = percentage points

Marqeta, Inc.

Reconciliation of GAAP to NON-GAAP Measures

(in thousands)

(unaudited)

Information Regarding Non-GAAP Measures

In addition to the financial measures prepared in accordance with generally accepted accounting principles in the United States (“GAAP”), this press release contains certain non-GAAP financial measures. Marqeta considers Adjusted EBITDA, Adjusted EBITDA Margin, and Non-GAAP operating expenses as supplemental measures of the company’s performance that are not required by, nor presented in accordance with GAAP.

We define Adjusted EBITDA as net (loss) income adjusted to exclude depreciation and amortization; share-based compensation expense; executive chairman long-term performance award; payroll tax related to share-based compensation; restructuring charges; acquisition-related expenses which consist of due diligence costs, transaction costs and integration costs related to potential or successful acquisitions, and cash and non-cash postcombination compensation expenses; income tax expense (benefit); and other income (expense), net, which consists of interest income from our short-term investments, realized foreign currency gains and losses, our share of equity method investments’ profit or loss, impairment of equity method investments or other financial instruments, and gain from sale of equity method investments. We believe that Adjusted EBITDA is an important measure of operating performance because it allows management and our board of directors to evaluate and compare our core operating results, including our operating efficiencies, from period to period. Additionally, we utilize Adjusted EBITDA as an input into our calculation of our annual employee bonus plans and performance-based restricted stock units.

Adjusted EBITDA Margin is calculated as Adjusted EBITDA divided by net revenue. This measure is used by management and our board of directors to evaluate our operating efficiency.

We define Non-GAAP operating expenses as total operating expenses adjusted to exclude depreciation and amortization; share-based compensation expense; executive chairman long-term performance award; payroll tax related to share-based compensation; restructuring charges; and acquisition-related expenses which consists of due diligence costs, transaction costs and integration costs related to potential or successful acquisitions, and cash and non-cash postcombination compensation expenses. We believe that Non-GAAP operating expenses is an important measure of operating performance because it allows management and our board of directors to evaluate and compare our core operating results, including our operating efficiencies, from period to period.

Adjusted EBITDA, Adjusted EBITDA Margin, and Non-GAAP operating expenses should not be considered in isolation, or construed as an alternative to net loss, or any other performance measures derived in accordance with GAAP, or as an alternative to cash flow from operating activities or as a measure of the company's liquidity. In addition, other companies may calculate Adjusted EBITDA differently than Marqeta does, which limits its usefulness in comparing Marqeta’s financial results with those of other companies.

The following table shows Marqeta's GAAP results reconciled to non-GAAP results included in this release:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

Net revenue | $ | 127,967 | | | $ | 108,891 | | | $ | 371,205 | | | $ | 557,349 | |

| | | | | | | |

Net (loss) income | $ | (28,643) | | | $ | (54,990) | | | $ | 54,405 | | | $ | (182,587) | |

Net (loss) income margin | (22 | %) | | (51 | %) | | 15 | % | | (33 | %) |

Total operating expenses | $ | 132,363 | | | $ | 142,334 | | | $ | 240,687 | | | $ | 472,960 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Net (loss) income | $ | (28,643) | | | $ | (54,990) | | | $ | 54,405 | | | $ | (182,587) | |

| Depreciation and amortization expense | 4,448 | | | 3,108 | | | 11,941 | | | 7,582 | |

Share-based compensation expense(1) | 35,654 | | | 32,135 | | | 103,258 | | | 98,802 | |

Executive chairman long-term performance award(1) | — | | | 13,413 | | | (144,617) | | | 39,801 | |

| Payroll tax expense related to share-based compensation | 440 | | | 541 | | | 2,307 | | | 1,818 | |

Acquisition-related expenses (2) | 10,708 | | | 18,270 | | | 30,581 | | | 64,420 | |

| Restructuring | — | | | 297 | | | — | | | 8,670 | |

Other income, net | (13,703) | | | (15,074) | | | (41,845) | | | (37,508) | |

| Income tax expense (benefit) | 115 | | | 238 | | | 399 | | | (6,584) | |

| Adjusted EBITDA | $ | 9,019 | | | $ | (2,062) | | | $ | 16,429 | | | $ | (5,586) | |

| Adjusted EBITDA Margin | 7 | % | | (2 | %) | | 4 | % | | (1 | %) |

| | | | | | | |

Total operating expenses | $ | 132,363 | | | $ | 142,334 | | | $ | 240,687 | | | $ | 472,960 | |

| Depreciation and amortization expense | (4,448) | | | (3,108) | | | (11,941) | | | (7,582) | |

Share-based compensation expense(1) | (35,654) | | | (32,135) | | | (103,258) | | | (98,802) | |

Executive chairman long-term performance award(1) | — | | | (13,413) | | | 144,617 | | | (39,801) | |

| Payroll tax expense related to share-based compensation | (440) | | | (541) | | | (2,307) | | | (1,818) | |

| Restructuring | — | | | (297) | | | — | | | (8,670) | |

Acquisition-related expenses (2) | (10,708) | | | (18,270) | | | (30,581) | | | (64,420) | |

| Non-GAAP operating expenses | $ | 81,113 | | | $ | 74,570 | | | $ | 237,217 | | | $ | 251,867 | |

(1) Prior period amounts related to the Executive Chairman Long-Term Performance Award have been reclassified to conform to the current period presentation.

(2) Acquisition-related expenses, which include transaction costs, integration costs and cash and non-cash postcombination compensation expense, have been excluded from Adjusted EBITDA as such expenses are not reflective of our ongoing core operations and are not representative of the ongoing costs necessary to operate our business; instead, these are costs specifically associated with a discrete transaction.

A reconciliation of Adjusted EBITDA margin to the comparable GAAP measure for the fourth quarter of 2024 is not available due to the challenges and impracticability with estimating some of the items as such items cannot be reasonably predicted and could be significant. Because of those challenges, reconciliations of such forward-looking non-GAAP financial measures are not available without unreasonable effort.

v3.24.3

Cover page

|

Nov. 04, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 04, 2024

|

| Entity Registrant Name |

MARQETA, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-40465

|

| Entity Tax Identification Number |

27-4306690

|

| Entity Address, Address Line One |

180 Grand Avenue

|

| Entity Address, Address Line Two |

6th Floor

|

| Entity Address, City or Town |

Oakland

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94612

|

| City Area Code |

877

|

| Local Phone Number |

962-7738

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A common stock, $0.0001 par value per share

|

| Trading Symbol |

MQ

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001522540

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

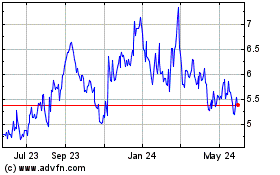

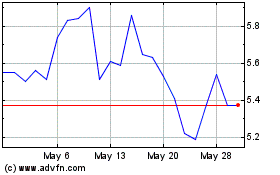

Marqeta (NASDAQ:MQ)

Historical Stock Chart

From Nov 2024 to Dec 2024

Marqeta (NASDAQ:MQ)

Historical Stock Chart

From Dec 2023 to Dec 2024