The global modern card issuer reported Total

Processing Volume growth of 30% and Gross Profit growth of 24% in

the third quarter of 2024

Marqeta, Inc. (NASDAQ: MQ), the global modern card

issuing platform, today reported financial results for the third

quarter ended September 30, 2024.

The Company reported Total Processing Volume (TPV) of $74

billion, representing a year-over-year increase of 30%. The Company

reported Net Revenue of $128 million and Gross Profit of $90

million, representing increases of 18% and 24%, respectively,

year-over-year. GAAP Net Loss for the quarter was $29 million and

Adjusted EBITDA was $9 million.

"In the third quarter our true growth trajectory was back on

display as we lapped the Block contract renewal, while continuing

to demonstrate operational discipline to fuel strong Adjusted

EBITDA. We combined this with several new product announcements

that further enhance the Marqeta platform to provide transformative

payment solutions at scale for our expanding customer base,” said

Simon Khalaf, CEO at Marqeta.

Marqeta highlighted several recent business updates that

demonstrate its current business momentum:

- Marqeta introduced a Portfolio Migration service that reduces

complexity for customers upgrading existing card programs onto the

Marqeta platform, without impacting their existing cardholder

experience. This ability allows for the seamless migration of

customers from competitor platforms to Marqeta. Completed at the

end of October, Marqeta successfully migrated millions of Klarna

cards in Europe onto its platform from Klarna’s incumbent

processor.

- Marqeta unveiled Marqeta Flex, an industry-leading solution

that revolutionizes how BNPL loans can be delivered inside payment

apps and wallets. Marqeta Flex is intended to increase BNPL’s

acceptance and provide consumers with access to personalized BNPL

options inside of the payment apps they use most often. Marqeta

also announced Affirm and Klarna as the first BNPL providers to be

integrated into Marqeta Flex and Branch, which is used by a large

number of Uber drivers, as the first application to support Marqeta

Flex.

- UX Toolkit, also introduced this quarter, is an addition to

Marqeta's portfolio of card program management tools. The UX

Toolkit includes user interface components that can be customized

and enhanced to improve cardholder touchpoints. The UX Toolkit will

allow Marqeta’s customers to create front-end modern payment

experiences from scratch with fewer development resources required.

This will further enhance Marqeta’s leadership in program

management and enable its customers to deliver better user

experiences for their cardholders.

Operating Highlights

In thousands, except percentages and

per share data. % change is calculated over the comparable

prior-year period (unaudited)

Three Months Ended September

30,

%

Change

Nine Months Ended September

30,

%

Change

2024

2023

2024

2023

Financial metrics:

Net revenue

$127,967

$108,891

18

%

$371,205

$557,349

(33

%)

Gross profit

$90,132

$72,508

24

%

$253,646

$246,281

3

%

Gross margin

70

%

67

%

3 ppts

68

%

44

%

24 ppts

Total operating expenses

$132,363

$142,334

(7

%)

$240,687

$472,960

(49

%)

Net (loss) income

($28,643

)

($54,990

)

48

%

$54,405

($182,587

)

130

%

Net (loss) income margin

(22

%)

(51

%)

29 ppts

15

%

(33

%)

48 ppts

Net (loss) income per share - basic

($0.06

)

($0.10

)

40

%

$0.11

($0.34

)

132

%

Net (loss) income per share - diluted

($0.06

)

($0.10

)

40

%

$0.10

($0.34

)

129

%

Key operating metric and Non-GAAP

financial measures:

Total Processing Volume (TPV)

(in millions) 1

$73,899

$56,650

30

%

$211,192

$160,285

32

%

Adjusted EBITDA 2

$9,019

($2,062

)

537

%

$16,429

($5,586

)

394

%

Adjusted EBITDA margin 2

7

%

(2

%)

9 ppts

4

%

(1

%)

5 ppts

Non-GAAP operating expenses 2

$81,113

$74,570

9

%

$237,217

$251,867

(6

%)

1 TPV represents the total dollar amount

of payments processed through our platform, net of returns and

chargebacks. We believe that TPV is a key indicator of the market

adoption of our platform, growth of our brand, growth of our

customers' businesses and scale of our business.

2 See "Information Regarding Non-GAAP

Measures" for definitions of Adjusted EBITDA, Adjusted EBITDA

margin, and Non-GAAP operating expenses and the reconciliations of

the net loss to Adjusted EBITDA, and of the total operating

expenses to Non-GAAP operating expenses.

Third Quarter 2024 Financial

Results:

Total Processing Volume increased by 30% year-over-year,

rising to $74 billion from $57 billion in the third quarter of

2023.

Net Revenue of $128 million increased by $19 million, or

18% year-over-year, primarily driven by increased volumes,

partially offset by unfavorable mix due to faster growth of Powered

by Marqeta volume and a renegotiated platform partnership in the

first quarter of 2024.

Gross Profit increased by 24% year-over-year to $90

million from $73 million in the third quarter of 2023 primarily due

to our TPV growth. Gross Margin was 70% in the third quarter of

2024.

Net Loss of $29 million in the quarter improved by $26

million year-over-year due to gross profit growth and lower

operating expenses. Net Loss margin was 22% in the third quarter of

2024, an improvement of 29 percentage points versus last year.

Adjusted EBITDA was $9 million in the third quarter of

2024, increasing by $11 million year-over year. Adjusted EBITDA

margin was 7% in the third quarter of 2024, an increase of 9

percentage points versus last year.

Financial Guidance

Our fourth quarter guidance reflects several changes that became

apparent over the last few months with regards to the heightened

scrutiny of the banking environment and specific customer program

changes.

The following summarizes Marqeta's guidance for the fourth

quarter of 2024:

Fourth Quarter 2024

Net Revenue Growth

10 - 12%

Gross Profit Growth

13 - 15%

Adjusted EBITDA Margin (1)

5 - 7%

(1) See "Information Regarding Non-GAAP

Measures" for the definition of Adjusted EBITDA Margin and for

information regarding non-availability of a forward

reconciliation.

Conference Call

Marqeta will host a live conference call today at 1:30 p.m.

Pacific time (4:30 p.m. Eastern time). To join the call, please

dial-in 10 minutes in advance: toll-free at 1-877-407-4018 or

direct at 1-201-689-8471. The conference call will also be

available live via webcast online at

http://investors.marqeta.com.

The telephone replay dial-in numbers are 1-844-512-2921 and

1-412-317-6671 and will be available until November 11, 2024, 8:59

p.m. Pacific time (11:59 p.m. Eastern time). The confirmation code

for the replay is 13748904.

Forward-Looking Statements

This press release contains "forward-looking statements" within

the meaning of the "safe harbor" provisions of the Private

Securities Litigation Reform Act of 1995. Forward-looking

statements expressed or implied in this press release include, but

are not limited to, statements relating to Marqeta’s quarterly

guidance; statements regarding Marqeta’s business plans, business

strategy and the continued success and growth of our customers;

statements and expectations regarding Marqeta's partnerships, new

product introductions, and product capabilities, including credit

card issuing; and statements made by Marqeta’s CEO and CFO. Actual

results may differ materially from the expectations contained in

these statements due to risks and uncertainties, including, but not

limited to, the following: the effect of uncertainties related to

our business, results of operations, financial condition, and

demand for our platform; the risk that Marqeta’s anticipated

accounting treatment may be subject to further changes or

developments; the risk that Marqeta is unable to further attract,

retain, diversify, and expand its customer base; the risk that

Marqeta is unable to drive increased profitable transactions on its

platform; the risk that consumers and customers will not perceive

the benefits of Marqeta’s products, including credit card issuing,

as Marqeta expects; the risk that Marqeta's platform does not

operate as intended resulting in system outages; the risk that

Marqeta will not be able to achieve the cost structure that Marqeta

currently expects; the risk that Marqeta’s solution will not

achieve the expected market acceptance; the risk that competition

could reduce expected demand for Marqeta’s services, including

credit card issuing; the risk that changes in the regulatory

landscape could adversely affect Marqeta's operations and revenues,

including heightened scrutiny of the banking environment and

specific customer program changes; the risk that Marqeta may be

unable to maintain relationships with issuing banks and card

networks; the risk that Marqeta is not able to identify and

recognize the anticipated benefits of any acquisition; the risk

that Marqeta is unable to successfully integrate any acquisition to

businesses and related operations; the risk of financial services

and banking sector instability and follow on effects to fintech

companies; the impact of macroeconomic factors, including various

geopolitical conflicts, uncertainty related to global elections,

changes in inflation and interest rates, and uncertainty in global

economic conditions; and the risk that Marqeta may be subject to

additional risks due to its international business activities.

Detailed information about these risks and other factors that could

potentially affect Marqeta’s business, financial condition and

results of operations are included or incorporated by reference in

the “Risk Factors” disclosed in Marqeta's Annual Report on Form

10-K for the year ended December 31, 2023 and subsequent Quarterly

Reports on Form 10-Q, as such risk factors may be updated from time

to time in Marqeta’s periodic filings with the SEC, available at

www.sec.gov and Marqeta’s website at

http://investors.marqeta.com.

The forward-looking statements in this press release are based

on information available to Marqeta as of the date hereof. Marqeta

disclaims any obligation to update any forward-looking statements,

except as required by law.

Disclosure Information

Investors and others should note that Marqeta announces material

financial information to its investors using its investor relations

website, SEC filings, press releases, public conference calls and

webcasts. Marqeta also uses social media to communicate with its

customers and the public about Marqeta, its products and services

and other matters relating to its business and market. It is

possible that the information Marqeta posts on social media could

be deemed to be material information. Therefore, Marqeta encourages

investors, the media, and others interested in Marqeta to review

the information we post on social media channels including the

Marqeta X feed (@Marqeta), the Marqeta Instagram page

(@lifeatmarqeta), the Marqeta Facebook page, and the Marqeta

LinkedIn page. These social media channels may be updated from time

to time.

Use of Non-GAAP Financial Measures

Reconciliations of non-GAAP financial measures to the most

directly comparable financial results as determined in accordance

with GAAP are included at the end of this press release following

the accompanying financial data. For a description of these

non-GAAP financial measures, including the reasons management uses

each measure, please see the section of the tables titled

"Information Regarding Non-GAAP Financial Measures".

About Marqeta, Inc.

Marqeta makes it possible for companies to build and embed

financial services into their branded experience—and unlock new

ways to grow their business and delight users. The Marqeta platform

puts businesses in control of building financial solutions,

enabling them to turn real-time data into personalized, optimized

solutions for everything from consumer loyalty to capital

efficiency. With compliance and security built-in, Marqeta’s

platform has been proven at scale, processing more than $200

billion in annual payments volume in 2023. Marqeta is certified to

operate in more than 40 countries worldwide and counting. Visit

www.marqeta.com to learn more.

Marqeta® is a registered trademark of Marqeta, Inc.

Marqeta, Inc.

Condensed Consolidated

Statements of Operations

(in thousands, except per

share amounts)

(unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Net revenue

$

127,967

$

108,891

$

371,205

$

557,349

Costs of revenue

37,835

36,383

117,559

311,068

Gross profit

90,132

72,508

253,646

246,281

Operating expenses (benefit):

Compensation and benefits

100,964

102,433

299,120

350,592

Technology

16,317

13,930

44,204

41,674

Professional services

4,759

4,197

13,437

14,507

Occupancy

1,178

1,074

3,476

3,285

Depreciation and amortization

4,448

3,108

11,941

7,582

Marketing and advertising

582

346

1,688

1,348

Other operating expenses

4,115

3,833

11,438

14,171

Executive chairman long-term performance

award

—

13,413

(144,617

)

39,801

Total operating expenses

132,363

142,334

240,687

472,960

(Loss) income from operations

(42,231

)

(69,826

)

12,959

(226,679

)

Other income, net

13,703

15,074

41,845

37,508

(Loss) income before income tax

expense

(28,528

)

(54,752

)

54,804

(189,171

)

Income tax expense (benefit)

115

238

399

(6,584

)

Net (loss) income

$

(28,643

)

$

(54,990

)

$

54,405

$

(182,587

)

Net (loss) income per share

attributable to Class A and Class B common stockholders

Basic

$

(0.06

)

$

(0.10

)

$

0.11

$

(0.34

)

Diluted

$

(0.06

)

$

(0.10

)

$

0.10

$

(0.34

)

Weighted-average shares used in

computing net (loss) income per share attributable to Class A and

Class B common stockholders

Basic

507,160

529,489

513,678

535,797

Diluted

507,160

529,489

522,394

535,797

Marqeta, Inc.

Condensed Consolidated Balance

Sheets

(in thousands)

September 30,

2024

December 31,

2023

(unaudited)

Assets

Current assets:

Cash and cash equivalents

$

886,417

$

980,972

Restricted cash

8,500

8,500

Short-term investments

217,569

268,724

Accounts receivable, net

26,373

19,540

Settlements receivable, net

11,817

29,922

Network incentives receivable

46,667

53,807

Prepaid expenses and other current

assets

23,821

27,233

Total current assets

1,221,164

1,388,698

Operating lease right-of-use assets,

net

4,894

6,488

Property and equipment, net

35,791

18,764

Intangible assets, net

31,238

35,631

Goodwill

123,523

123,523

Other assets

19,226

16,587

Total assets

$

1,435,836

$

1,589,691

Liabilities and stockholders'

equity

Current liabilities

Accounts payable

$

1,026

$

1,420

Revenue share payable

167,081

173,645

Accrued expenses and other current

liabilities

165,466

161,514

Total current liabilities

333,573

336,579

Operating lease liabilities, net of

current portion

2,082

5,126

Other liabilities

4,523

4,591

Total liabilities

340,178

346,296

Stockholders' equity :

Preferred stock

—

—

Common stock

50

52

Additional paid-in capital

1,865,565

2,067,776

Accumulated other comprehensive income

833

762

Accumulated deficit

(770,790

)

(825,195

)

Total stockholders’ equity

1,095,658

1,243,395

Total liabilities and stockholders'

equity

$

1,435,836

$

1,589,691

Marqeta, Inc.

Condensed Consolidated

Statements of Cash Flows

(in thousands)

(unaudited)

Nine Months Ended September

30,

2024

2023

Cash flows from operating

activities:

Net income (loss)

$

54,405

$

(182,587

)

Adjustments to reconcile net income (loss)

to net cash provided by operating activities:

Depreciation and amortization

11,941

7,582

Share-based compensation expense

103,258

95,911

Executive chairman long-term performance

award

(144,617

)

39,801

Non-cash postcombination compensation

expense

—

32,430

Non-cash operating leases expense

1,017

1,870

Amortization of premium (accretion of

discount) on short-term investments

(2,650

)

(5,525

)

Other

328

1,068

Changes in operating assets and

liabilities:

Accounts receivable

(7,285

)

(1,108

)

Settlements receivable

18,105

(1,477

)

Network incentives receivable

7,140

8,086

Prepaid expenses and other assets

3,195

7,760

Accounts payable

(3,274

)

(4,350

)

Revenue share payable

(6,564

)

4,289

Accrued expenses and other liabilities

545

3,331

Operating lease liabilities

(2,129

)

(2,499

)

Net cash provided by operating

activities

33,415

4,582

Cash flows from investing

activities:

Purchases of property and equipment

(2,382

)

(722

)

Capitalization of internal-use

software

(14,577

)

(9,488

)

Business combination, net of cash

acquired

—

(135,630

)

Purchases of short-term investments

—

(972,430

)

Sales of marketable securities

—

637,913

Maturities of short-term investments

54,000

437,034

Realized gain (loss) on investments

—

(73

)

Net cash provided by (used in) investing

activities

37,041

(43,396

)

Cash flows from financing

activities:

Proceeds from exercise of stock options,

including early exercised stock options, net of repurchase of early

exercised unvested options

121

4,081

Payment on acquisition-related contingent

consideration

—

(53,067

)

Proceeds from shares issued in connection

with employee stock purchase plan

1,629

1,775

Taxes paid related to net share settlement

of restricted stock units

(29,043

)

(18,553

)

Repurchase of common stock

(137,718

)

(131,519

)

Net cash used in financing activities

(165,011

)

(197,283

)

Net decrease in cash, cash equivalents,

and restricted cash

(94,555

)

(236,097

)

Cash, cash equivalents, and restricted

cash- Beginning of period

989,472

1,191,646

Cash, cash equivalents, and restricted

cash - End of period

$

894,917

$

955,549

Marqeta, Inc.

Financial and Operating

Highlights

(in thousands, except per

share data or as noted)

(unaudited)

2024

2023

Year over Year Change Q3'24 vs

Q3'23

Third Quarter

Second Quarter

First Quarter

Fourth Quarter

Third Quarter

Operating performance:

Net revenue

$

127,967

$

125,270

$

117,968

$

118,822

$

108,891

18

%

Costs of revenue

37,835

45,917

33,807

35,589

36,383

4

%

Gross profit

90,132

79,353

84,161

83,233

72,508

24

%

Gross margin

70

%

63

%

71

%

70

%

67

%

3 ppts

Operating expenses (benefit):

Compensation and benefits

100,964

103,166

94,990

95,790

102,433

(1

%)

Technology

16,317

14,769

13,118

13,938

13,930

17

%

Professional services

4,759

4,808

3,870

7,172

4,197

13

%

Occupancy and equipment

1,178

1,204

1,094

1,076

1,074

10

%

Depreciation and amortization

4,448

3,956

3,537

3,159

3,108

43

%

Marketing and advertising

582

728

378

1,219

346

68

%

Other operating expenses

4,115

3,418

3,905

3,804

3,833

7

%

Executive chairman long-term performance

award

—

(157,738

)

13,121

13,413

13,413

(100

%)

Total operating expenses (benefit)

132,363

(25,689

)

134,013

139,571

142,334

(7

%)

(Loss) income from operations

(42,231

)

105,042

(49,852

)

(56,338

)

(69,826

)

40

%

Other income, net

13,703

14,216

13,926

14,932

15,074

(9

%)

(Loss) income before income tax

expense

(28,528

)

119,258

(35,926

)

(41,406

)

(54,752

)

48

%

Income tax expense (benefit)

115

150

134

(1,030

)

238

(52

%)

Net (loss) income

$

(28,643

)

$

119,108

$

(36,060

)

$

(40,376

)

$

(54,990

)

48

%

(Loss) income per share - basic

$

(0.06

)

$

0.23

$

(0.07

)

$

(0.08

)

$

(0.10

)

40

%

(Loss) income per share - diluted

$

(0.06

)

$

0.23

$

(0.07

)

$

(0.08

)

$

(0.10

)

309

%

TPV (in millions)

$

73,899

$

70,627

$

66,666

$

61,979

$

56,650

30

%

Adjusted EBITDA

$

9,019

$

(1,817

)

$

9,228

$

3,292

$

(2,062

)

537

%

Adjusted EBITDA margin

7

%

(1

%)

8

%

3

%

(2

%)

9 ppts

Financial condition:

Cash and cash equivalents

$

886,417

$

924,730

$

970,357

$

980,972

$

947,749

(6

%)

Restricted cash

$

8,500

$

8,500

$

8,500

$

8,500

$

7,800

9

%

Short-term investments

$

217,569

$

228,833

$

228,324

$

268,724

$

349,395

(38

%)

Total assets

$

1,435,836

$

1,488,283

$

1,558,361

$

1,589,691

$

1,603,249

(10

%)

Total liabilities

$

340,178

$

345,908

$

347,696

$

346,296

$

308,166

10

%

Stockholders' equity

$

1,095,658

$

1,142,375

$

1,210,665

$

1,243,395

$

1,295,083

(15

%)

ppts = percentage points

Marqeta, Inc. Reconciliation of GAAP

to NON-GAAP Measures (in thousands)

(unaudited)

Information Regarding Non-GAAP Measures

In addition to the financial measures prepared in accordance

with generally accepted accounting principles in the United States

(“GAAP”), this press release contains certain non-GAAP financial

measures. Marqeta considers Adjusted EBITDA, Adjusted EBITDA

Margin, and Non-GAAP operating expenses as supplemental measures of

the company’s performance that are not required by, nor presented

in accordance with GAAP.

We define Adjusted EBITDA as net (loss) income adjusted to

exclude depreciation and amortization; share-based compensation

expense; executive chairman long-term performance award; payroll

tax related to share-based compensation; restructuring charges;

acquisition-related expenses which consist of due diligence costs,

transaction costs and integration costs related to potential or

successful acquisitions, and cash and non-cash postcombination

compensation expenses; income tax expense (benefit); and other

income (expense), net, which consists of interest income from our

short-term investments, realized foreign currency gains and losses,

our share of equity method investments’ profit or loss, impairment

of equity method investments or other financial instruments, and

gain from sale of equity method investments. We believe that

Adjusted EBITDA is an important measure of operating performance

because it allows management and our board of directors to evaluate

and compare our core operating results, including our operating

efficiencies, from period to period. Additionally, we utilize

Adjusted EBITDA as an input into our calculation of our annual

employee bonus plans and performance-based restricted stock

units.

Adjusted EBITDA Margin is calculated as Adjusted EBITDA divided

by net revenue. This measure is used by management and our board of

directors to evaluate our operating efficiency.

We define Non-GAAP operating expenses as total operating

expenses adjusted to exclude depreciation and amortization;

share-based compensation expense; executive chairman long-term

performance award; payroll tax related to share-based compensation;

restructuring charges; and acquisition-related expenses which

consists of due diligence costs, transaction costs and integration

costs related to potential or successful acquisitions, and cash and

non-cash postcombination compensation expenses. We believe that

Non-GAAP operating expenses is an important measure of operating

performance because it allows management and our board of directors

to evaluate and compare our core operating results, including our

operating efficiencies, from period to period.

Adjusted EBITDA, Adjusted EBITDA Margin, and Non-GAAP operating

expenses should not be considered in isolation, or construed as an

alternative to net loss, or any other performance measures derived

in accordance with GAAP, or as an alternative to cash flow from

operating activities or as a measure of the company's liquidity. In

addition, other companies may calculate Adjusted EBITDA differently

than Marqeta does, which limits its usefulness in comparing

Marqeta’s financial results with those of other companies.

The following table shows Marqeta's GAAP results reconciled to

non-GAAP results included in this release:

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Net revenue

$

127,967

$

108,891

$

371,205

$

557,349

Net (loss) income

$

(28,643

)

$

(54,990

)

$

54,405

$

(182,587

)

Net (loss) income margin

(22

%)

(51

%)

15

%

(33

%)

Total operating expenses

$

132,363

$

142,334

$

240,687

$

472,960

Net (loss) income

$

(28,643

)

$

(54,990

)

$

54,405

$

(182,587

)

Depreciation and amortization expense

4,448

3,108

11,941

7,582

Share-based compensation expense(1)

35,654

32,135

103,258

98,802

Executive chairman long-term performance

award(1)

—

13,413

(144,617

)

39,801

Payroll tax expense related to share-based

compensation

440

541

2,307

1,818

Acquisition-related expenses (2)

10,708

18,270

30,581

64,420

Restructuring

—

297

—

8,670

Other income, net

(13,703

)

(15,074

)

(41,845

)

(37,508

)

Income tax expense (benefit)

115

238

399

(6,584

)

Adjusted EBITDA

$

9,019

$

(2,062

)

$

16,429

$

(5,586

)

Adjusted EBITDA Margin

7

%

(2

%)

4

%

(1

%)

Total operating expenses

$

132,363

$

142,334

$

240,687

$

472,960

Depreciation and amortization expense

(4,448

)

(3,108

)

(11,941

)

(7,582

)

Share-based compensation expense(1)

(35,654

)

(32,135

)

(103,258

)

(98,802

)

Executive chairman long-term performance

award(1)

—

(13,413

)

144,617

(39,801

)

Payroll tax expense related to share-based

compensation

(440

)

(541

)

(2,307

)

(1,818

)

Restructuring

—

(297

)

—

(8,670

)

Acquisition-related expenses (2)

(10,708

)

(18,270

)

(30,581

)

(64,420

)

Non-GAAP operating expenses

$

81,113

$

74,570

$

237,217

$

251,867

(1) Prior period amounts related to the

Executive Chairman Long-Term Performance Award have been

reclassified to conform to the current period presentation.

(2) Acquisition-related expenses, which

include transaction costs, integration costs and cash and non-cash

postcombination compensation expense, have been excluded from

Adjusted EBITDA as such expenses are not reflective of our ongoing

core operations and are not representative of the ongoing costs

necessary to operate our business; instead, these are costs

specifically associated with a discrete transaction.

A reconciliation of Adjusted EBITDA margin to the comparable

GAAP measure for the fourth quarter of 2024 is not available due to

the challenges and impracticability with estimating some of the

items as such items cannot be reasonably predicted and could be

significant. Because of those challenges, reconciliations of such

forward-looking non-GAAP financial measures are not available

without unreasonable effort.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241104895415/en/

IR Contact: Marqeta Investor Relations, IR@marqeta.com

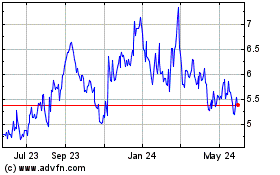

Marqeta (NASDAQ:MQ)

Historical Stock Chart

From Nov 2024 to Dec 2024

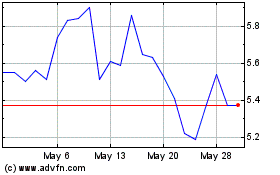

Marqeta (NASDAQ:MQ)

Historical Stock Chart

From Dec 2023 to Dec 2024