UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For

the month of June 2024

Commission File Number: 001-40460

KANZHUN LIMITED

18/F, GrandyVic Building,

Taiyanggong Middle Road

Chaoyang District, Beijing 100020

People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Exhibit Index

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

KANZHUN LIMITED |

| |

|

|

|

| |

By |

: |

/s/ Yu Zhang |

| |

Name |

: |

Yu Zhang |

| |

Title |

: |

Director and Chief Financial Officer |

Date: June 17,

2024

Exhibit

99.1

Hong

Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement,

make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising

from or in reliance upon the whole or any part of the contents of this announcement.

KANZHUN

LIMITED

看準科技有限公司

(A

company controlled through weighted voting rights and incorporated in the Cayman Islands with limited liability)

(Stock

Code: 2076)

(Nasdaq

Stock Ticker: BZ)

GRANT

OF SHARE AWARDS

On

June 15, 2024, the Company granted an aggregate of 1,244,028 share awards in the form of RSUs (the “Share Awards”)

(representing the same number of Class A Ordinary Shares) to one independent non-executive Director (the “Director Grant”)

and 153 employees pursuant to the Post-IPO Share Scheme (the “Employee Grants”, together with the Director Grant,

the “Grants”).

The

Grants are subject to the terms and conditions of the Post-IPO Share Scheme and the award agreements entered into between the Company

and each of the Grantees. The principal terms of the Post-IPO Share Scheme were set out in the section headed “Statutory and General

Information – D. Share Incentive Plans – 2. Post-IPO Share Scheme” in Appendix IV to the listing document of the Company

dated December 16, 2022.

The

Share Awards will be satisfied through utilizing the Class A Ordinary Shares held by the depositary of the ADSs for bulk issuance of

ADSs reserved for future issuances upon the exercise or vesting of awards granted under the Post-IPO Share Scheme.

Details

of the Grants are as follows:

| Date of the Grants |

|

June 15, 2024 |

| |

|

|

| Number of Grantees |

|

154, including (i) in relation to the Director Grant, an independent non-executive Director, namely Ms. Mengyuan Dong (“Ms. Dong”); and (ii) in relation to the Employee Grants, 153 employees |

| |

|

|

| Number of Share Awards granted |

|

1,244,028 Class A Ordinary Shares |

| |

|

|

| Issue price of Share Awards granted |

|

Nil per Share Award |

| |

|

|

| Closing price of the Class A Ordinary

Shares on the Date of the Grants (Note) |

|

HK$76.85 per Share |

Note:

as the date of grant is a non-trading day, this is the closing price on June 14, 2024, being the trading day immediately preceding the

date of grant

Vesting

Periods of the Share Awards

For

the Director Grant, the Share Awards shall vest in equal portions on the date of the Director Grant and the first anniversary of the

date of the Director Grant, respectively, subject to Ms. Dong’s continued directorship with the Company on such vesting dates.

The vesting periods for part of the Share Awards to be granted to Ms. Dong are shorter than 12 months because the Share Awards granted

under the Director Grant have a mixed vesting schedule, such that the relevant Share Awards vest evenly over a period of one year, which

is pursuant to the terms of the Post-IPO Share Scheme and Rule 17.03F of the Listing Rules.

For

the Employee Grants, all of the Share Awards under the Employee Grants shall vest in equal portions on each of the first, second, third

and fourth anniversary of the date of the Employee Grants, respectively, subject to the Grantee’s continued employment relationship

with the Company on such vesting dates.

Performance

Target

The

vesting of the Share Award under the Grants is not subject to any performance target.

In

respect of the Director Grant, as the relevant Share Awards (i) form part of the compensation stipulated in the director agreement of

Ms. Dong entered into with the Company, and (ii) are subject to clawback mechanism as detailed below, the Compensation Committee is of

the view that it is not necessary to set any performance target for the Director Grant. This arrangement aligns with the purpose of the

Post-IPO Share Scheme to incentivize, retain, reward, compensate and/or providing benefits to the services of valuable employees or directors

and encourage such persons to contribute to the long-term growth and profitability of the Group, and is consistent with the grants of

Share Award to other Directors, which will also not be subject to any performance target.

Clawback

mechanism

The

Share Awards are subject to clawback in the event that:

| · | the

Grantee ceases to be a selected participant by reason of the termination of employment or

contractual engagement with the Group or Related Entity for cause or without notice or with

payment in lieu of notice; |

| · | the

Grantee has been convicted of a criminal offence involving his/her integrity or honesty;

or |

| · | in

the reasonable opinion of the scheme administrator, the Grantee has engaged in serious misconduct

or breaches the terms of the Post-IPO Share Scheme in any material respect. |

Listing

Rules Implications

Under

the Director Grant, all the Share Awards were granted to the following independent non- executive Director, being a connected person

of the Company, details of which are as follows:

| Name

of Grantee |

Position |

Number

of Share Awards Granted |

| Ms.

Dong |

Independent

non-executive Director |

8,424 |

Pursuant

to Rule 17.04(1) of the Listing Rules, the grant of Share Awards to Ms. Dong had been approved by the independent non-executive Directors

(other than Ms. Dong on her Director Grant). The Director Grant would not result in the shares issued and to be issued in respect of

all options and awards granted to either Ms. Dong under the Director Grant in the 12-month period up to and including the date of such

grant representing in aggregate to exceed 0.1% limit for the purpose of Rule 17.04(3) of the Listing Rules.

The

grantees under the Employee Grants are employees of the Group and do not fall under any of the following categories: (a) a Director,

chief executive, or substantial shareholder of the Company, or an associate of any of them; (b) a participant with share options and

awards granted and to be granted in the 12-month period up to and including the date of such grant in aggregate to exceed 1% individual

limit for the purpose of Rule 17.03D of the Listing Rules; or (c) a related entity participant or service provider with options and awards

granted and to be granted in any 12-month period exceeding 0.1% of the relevant class of Shares in issue.

Reason

for and benefits of the Grants

The

reasons for the grants of Share Awards are to reward continued efforts for the success of the Company and provide incentives for the

Grantees to exert maximum efforts, and to provide a means by which more employees may be given an opportunity to benefit from increases

in value of the Shares through the granting of the Share Awards. Such Grants will encourage them to work towards enhancing the value

of the Company and the Shares for the benefits of the Company and the Shareholders as a whole. In addition, the Director Grant form part

of the compensation stipulated in the respective director agreements of Ms. Dong entered with the Company.

Class

A Ordinary Shares available for future grant under the Post-IPO Share Scheme

As

at the date of this announcement and following the Grants, the number of Class A Ordinary Shares available for future grant under the

scheme mandate limit of the Post-IPO Share Scheme is 57,520,790.

Definitions

In this

announcement, unless the context otherwise requires, the following expressions shall have the following meanings:

| “ADSs” |

American Depositary Shares, each representing two Class A Ordinary Shares |

| |

|

| “Articles of Association” |

the fifteenth amended and restated articles of association of the Company conditionally adopted by special resolutions of the Shareholders on December 14, 2022, which took effect upon the listing of the Company’s Class A Ordinary Share on the Main Board of The Stock Exchange of Hong Kong Limited |

| |

|

| “Board” |

the board of Directors of the Company |

| |

|

| “Class A Ordinary Share(s)” |

class A ordinary shares in the share capital of the Company with a par value of US$0.0001 each, conferring a holder of Class A Ordinary Share one vote per Share on any resolution tabled at the Company’s general meeting |

| |

|

| “Class B Ordinary Share(s)” |

class B ordinary shares in the share capital of the Company with a par value of US$0.0001 each, conferring weighted voting rights in the Company such that a holder of a Class B Ordinary Share is entitled to ten votes per Share on any resolution tabled at the Company’s general meeting, save for resolutions with respect to any Reserved Matters, in which case they shall be entitled to one vote per Share |

| |

|

| “Company” |

KANZHUN LIMITED (看準科技有限公司), a company with limited liability incorporated in the Cayman Islands on January 16, 2014 |

| |

|

| “Director(s)” |

the director(s) of the Company |

| |

|

| “Grantee(s)” |

the employee(s) of the Group who were granted Share Awards in accordance with the Post-IPO Share Scheme on the Date of the Grants |

| |

|

| “Group” |

the Company, its subsidiaries and its consolidated affiliated entities |

| |

|

| “Holding Company” |

a company of which the Company is a subsidiary |

| |

|

| “HK$” |

Hong Kong dollars, the lawful currency of Hong Kong |

| |

|

| “Listing Rules” |

the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited, as amended, supplemented or otherwise modified from time to time |

| “Post-IPO Share Scheme” |

the share incentive plan conditionally approved and adopted on December 14, 2022, which took effect upon the listing of the Company’s Class A Ordinary Share on the Main Board of The Stock Exchange of Hong Kong Limited |

| |

|

| “Related Entity” |

(i) a Holding Company; (ii) subsidiaries of the Holding Company other than members of the Group; or (iii) any company which is an associate of the Company |

| |

|

| “Reserved Matters” |

those matters resolutions with respect to which each Share is entitled to one vote at general meetings of the Company pursuant to the Articles of Association, being (i) any amendment to the Memorandum or Articles, including the variation of the rights attached to any class of shares, (ii) the appointment, election or removal of any independent non-executive Director, (iii) the appointment or removal of the Company’s auditors, and (iv) the voluntary liquidation or winding-up of the Company |

| |

|

| “RSU(s)” |

restricted share units |

| |

|

| “Share(s)” |

the Class A Ordinary Shares and the Class B Ordinary Shares in the share capital of the Company, as the context so requires |

| |

|

| “Shareholder(s)” |

the shareholders

of the Company |

| |

|

| “US$” |

U.S. dollars, the lawful currency of the United States of America |

| |

By order of the Board |

| |

KANZHUN LIMITED |

| |

Mr. Peng Zhao |

| |

Founder, Chairman and Chief Executive Officer |

Hong Kong,

June 16, 2024

As

at the date of this announcement, the Board of the Company comprises Mr. Peng Zhao, Mr. Yu Zhang, Mr. Xu Chen, Mr. Tao Zhang and Ms.

Xiehua Wang as the executive Directors, Mr. Haiyang Yu as the non-executive Director, Mr. Yonggang Sun, Mr. Yan Li and Ms. Mengyuan Dong

as the independent non-executive Directors.

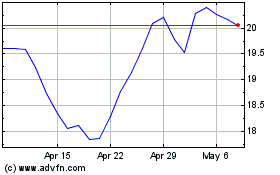

Kanzhun (NASDAQ:BZ)

Historical Stock Chart

From Nov 2024 to Dec 2024

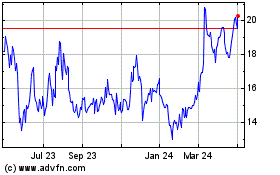

Kanzhun (NASDAQ:BZ)

Historical Stock Chart

From Dec 2023 to Dec 2024