BOND REPORT: Treasury Yield Curve Resumes Flattening To Kick Off Postholiday Trade

December 26 2017 - 4:24PM

Dow Jones News

By Sunny Oh

Long-dated Treasury yields fell while their short-dated peers

rose Tuesday as expectations for an aggressive Federal Reserve

helped flatten the so-called yield curve.

Trading volumes are expected to be thin in the week following

Christmas as European markets, including the U.K.'s, were closed

Tuesday

(http://www.marketwatch.com/story/when-do-financial-markets-close-for-christmas-2017-12-20).

What are Treasurys doing?

The 10-year Treasury note yield dipped 2 basis points to 2.467%,

while the 30-year bond fell 2 basis points to 2.813%.

The iShares 20+ Year Treasury Bond ETF (TLT), which tracks the

performance of long-dated Treasurys, was up 0.4% to $125.26.

The two-year note yield was slightly higher, at 1.899%, from

1.894%.

Bond prices move in the opposite direction of yields.

What's driving markets?

Prospects for the U.S. central bank to raise rates three to four

times next year even against a lackluster outlook for inflation

have dulled demand for short-dated Treasurys, while a tepid outlook

for inflation and prices has helped maintain a bid in long-term

bonds. As a result, the yield curve, a line tracing a bond's

maturities and its yields, has continued to flatten -- typically

viewed as a harbinger of bad economic prospects.

Tuesday's trade has retraced part of the steepening seen last

week, which was fueled by concerns that the Republican tax bill

could stimulate inflation in an economy where slack was nowhere to

be seen.

See: Steepening yield curve slams one of the bond market's

biggest bets

(http://www.marketwatch.com/story/steepening-yield-curve-slams-one-of-the-bond-markets-biggest-bets-2017-12-20)

With few major economic reports set for this week, the highlight

for traders was Tuesday's raft of auctions for $160 billion worth

of government paper.

A sale for the three-month Treasury bill drew weak demand

(http://www.marketwatch.com/story/3-month-treasury-auction-sees-poor-appetite-on-debt-ceiling-worries-2017-12-26)as

investors avoided buying debt at risk of default if Congress fails

to hike the federal government's debt ceiling.

Fresh issuance can influence appetite for bonds in the

outstanding market, but auctions on Tuesday were expected to

perform weakly because trading desks are lightly staffed the day

after Christmas.

What are market participants saying?

"It's just a re-flattening of the yield curve. And if you look

at what people are focused on this year, longer-term interest rates

versus the shorter-term interest rates. The Fed is set to raise

interest rates three to four times next year, that will have a

bigger impact on the short-end of the curve," said Tom di Galoma,

managing director for Treasurys trading at Seaport Global

Securities.

What else is on investors' radar?

The S&P/Case-Shiller national index rose 0.7% for the

three-month period ending in October

(http://www.marketwatch.com/story/home-prices-stay-high-up-62-from-a-year-earlier-case-shiller-shows-2017-12-26).

Higher real-estate values can encourage consumers to spend

more.

What assets are on the move?

Japanese government bonds struggled for direction after Japan's

inflation rate rose 0.9% year-over-year

(http://www.marketwatch.com/story/japanese-inflation-creeps-toward-2-target-2017-12-26)

in November, accelerating from the 0.8% increase seen in October.

But the improvement in inflation data remains gradual, and well

below the central bank's 2% annual target.

The 10-year Japanese government-bond yield stood at 0.039%.

(END) Dow Jones Newswires

December 26, 2017 16:09 ET (21:09 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

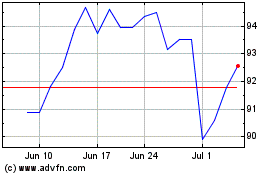

iShares 20 plus Year Tre... (NASDAQ:TLT)

Historical Stock Chart

From Nov 2024 to Dec 2024

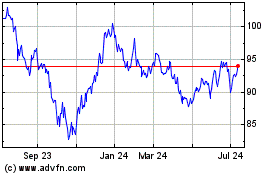

iShares 20 plus Year Tre... (NASDAQ:TLT)

Historical Stock Chart

From Dec 2023 to Dec 2024