BOND REPORT: 10-year Treasury Yield Posts Largest Weekly Decline In More Than 4 Months

September 11 2017 - 8:03AM

Dow Jones News

By Sunny Oh

The 10-year Treasury yield close to psychologically significant

2% level

U.S. Treasurys on Friday stabilized, capping an overall decline

in long-dated yields, which saw rates on government paper test

fresh lows on the back of weakening inflation expectations,

President Donald Trump's waning pro-growth agenda, rising

geopolitical risks from North Korea--and a steady stream of flows

from yield-hungry foreign investors.

The moves put the 10-year Treasury yield on the verge of

slipping below 2%, a psychological and technical level that could

trigger a further decline as uncertainty about the economic impact

of Hurricane Irma and other storms in the Atlantic weigh on

appetite for assets perceived as risky, fostering buying in

Treasurys.

For the day, yields for key maturities were flat, keeping intact

sizable declines. The 10-year Treasury note yield slipped 10 basis

points for the five-day stretch to 2.058%, the largest weeklong

decline since April 13.

Similarly, the 2-year Treasury more sensitive to the vagaries of

monetary policy, posted a weeklong fall of 7.5 basis points to

1.270%. The 30-year bond yield dropped about 9 basis points to

2.678%.

Bond buying, which pushes prices higher and yields lower,

subsided somewhat later Friday, helping yields to come off intraday

lows.

Market participants attributed some of those moves to selling

ahead of next week's rush of new issuance, which can pressure

prices on outstanding government paper. The Treasury Department

will auction more than $56 billion of 3-year, 10-year and 30-year

government paper in the coming week.

"There's some setting up for the influx of government supply

next week," said Tom di Galoma, managing director of Treasurys

trading for Seaport Global Securities.

European yields ended mostly lower on the week even as European

Central Bank President Mario Draghi on Thursday delayed an

announcement of tapering the ECB's EUR60 billion asset-purchase

program, indicating that the central bank would broach that topic

at the October policy meeting.

The German 10-year government bond yield rose around 2 basis

points to 0.315% on Friday, compared with 0.379% at the start of

the week.

Yields have remained depressed as geopolitical concerns over a

possible test launch of an intercontinental ballistic missile by

North Korea this weekend unsettled investors. Market participants

were also worried that damages from Hurricane Harvey and Irma could

deal a blow to the economy while scrambling coming data. Doubts

about President Trump's business friendly agenda coming to fruition

also have helped contribute to depressed yields.

And with the chance of an interest-rate increase rapidly

diminishing, investors are snapping up longer-dated bonds that

would otherwise be pummeled during an aggressive tightening cycle.

Traders in the fed-fund futures market downgraded the chances of

the Federal Reserve raising rates as low as 20% from the 40% seen a

few weeks ago, CME Group data show.

A popular exchange-traded fund specializing in long-dated

Treasurys on Thursday attracted the most money in a single day

since May 2011

(http://www.marketwatch.com/story/long-dated-treasury-etf-sees-largest-inflows-since-may-2011-2017-09-08),

data from FactSet shows. The iShares 20+ year Treasury Bond ETF

(TLT) drew in $664.7 million of investment, more than doubling the

total amount of inflows this year.

Read: Death toll rises to 10 as Hurricane Irma barrels through

Caribbean, heads for Florida

(http://www.marketwatch.com/story/death-toll-rises-to-8-as-hurricane-irma-barrels-through-caribbean-heads-for-florida-2017-09-07)

Those betting on a dovish central bank might have taken some

cues from New York Fed President William Dudley's speech on late

Thursday

(http://www.marketwatch.com/story/feds-dudley-shows-no-signs-of-wavering-from-support-for-december-interest-rate-hike-2017-09-07).

He appeared to break from past form when he acknowledged the

troubling persistence of inflation slipping below the central

bank's 2% target.

But his comments on easy financial conditions and lack of

concern over undershooting the Fed's inflation target suggested it

was more of the same, all part of his steady campaign "to put a

December rate hike on the table," wrote Ward McCarthy, chief

financial economist for Jefferies.

Dudley is closely watched by analysts who see him as a

bellwether for policy shifts in the central bank.

(END) Dow Jones Newswires

September 11, 2017 07:48 ET (11:48 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

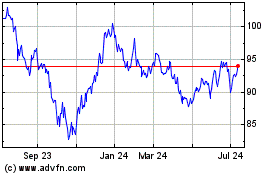

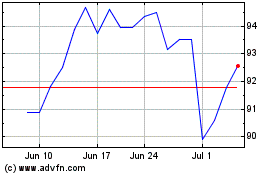

iShares 20 plus Year Tre... (NASDAQ:TLT)

Historical Stock Chart

From Nov 2024 to Dec 2024

iShares 20 plus Year Tre... (NASDAQ:TLT)

Historical Stock Chart

From Dec 2023 to Dec 2024