Intuit Inc. (Nasdaq: INTU), the global financial technology

platform that makes Intuit TurboTax, Credit Karma, QuickBooks, and

Mailchimp, today announced a suite of offerings designed to help

filers access their tax refunds faster and more affordably as

TurboTax e-file opens for the 2024 tax season. The offerings

include the only do-it-yourself mobile app offer on the market,

providing completely free federal and state tax preparation

regardless of tax complexity. In addition, TurboTax is providing

the first and only fast refund guarantee that delivers federal tax

refunds 5 days early no matter the filer’s banking institution,

helping consumers get faster access to critical funds.

For millions of Americans, the tax refund, averaging over

$3,000, represents the largest paycheck of the year. Getting fast

access to those funds can be indispensable. According to a

generational tax survey conducted on behalf of TurboTax by Talker

Research, 93% of Gen Z expects to get a refund this year and they

plan to use their refund to pay for necessities. In fact, access to

faster refunds would mean they are able to avoid debt fees (20%),

pay rent on time (35%), and pay off debt (35%).1

"We are proud to continue advancing our faster refund offerings

as well as provide free do-it-yourself filing through our mobile

app offer to arm our customers with the financial flexibility and

security they deserve,” said Executive Vice President and General

Manager of Intuit's Consumer Group, Mark Notarainni. “We are giving

our customers unparalleled access to their hard-earned money at

affordable prices, empowering them to pay bills, pay down debt, and

manage daily expenses with greater ease and peace of mind."

Although many companies claim to offer fast refund services,

they often do not deliver the funds where consumers need them.

Moving money between bank accounts can take up to 5 days. Unlike

traditional refund services, TurboTax’s newest 5 Days Early refund

offering delivers these vital funds into any U.S. bank account,

providing taxpayers expedited access to their money.

TurboTax’s fast money offerings include:

- NEW! 5 Days Early Refund Offering2 -

Consumers can get their federal refund delivered 5 days before IRS

settlement - guaranteed.3 For a $25 flat fee, TurboTax delivers the

refund into any U.S. bank account in the customer’s name whether

they file through TurboTax or Credit Karma. Refunds are guaranteed

to be delivered at least five days early into a customer's bank

account of choice or customers will not be charged the 5 Day Early

fee. Intuit will also continue to offer the option to deposit a

federal refund into a Credit Karma MoneyTM account,4 delivered up

to 5 days early, for no additional cost.5

- Refund Advance - TurboTax will continue to offer its no

fee, no interest loan for those filers who need funds immediately.

Customers can get approved to receive up to $4,000,6 delivered in

as little as 60 secs after IRS acceptance of their tax filing,7

into a Credit Karma MoneyTM account. $0 loan fees, 0% APR, no

credit score impact.

"TurboTax's accuracy and maximum refund guarantees, coupled with

our faster access to crucial money, deliver an unparalleled

experience, especially to those who need fast access to cash,” said

Notarainni. “We're not just meeting a financial need; we're doing

it with speed and simplicity, and at unmatched prices."

Unbeatable Pricing with Do-it-Yourself Mobile App Offer Plus

Exceptional Prices for Assisted Filers

Not only is TurboTax providing multiple ways for consumers to

access refunds faster, but the company is also providing the only

free do-it-yourself federal and state filing option on the market

available to filers of any tax complexity. Through its Free Mobile

App Offer everyone new to TurboTax, or those who did not file with

TurboTax last year, regardless of their tax complexity, can file

their own federal and state taxes for free through the TurboTax

mobile app through Feb. 18, 2025. No other tax preparation provider

on the market has an offer like this.

In addition, starting Jan. 15, 2025 assisted filers who hand off

their taxes to an expert with TurboTax Live Full Service and file

by March 25, 2025 are guaranteed a minimum 10 percent reduction in

the fees they paid their tax professional last season with the

upcoming Beat Your Price Offer.

The importance of faster refunds to consumers is clearly

demonstrated in TurboTax’s generational tax survey of 4,000

Americans. Results found that for many Gen Z and Millennial filers,

early access to funds is critical in helping them avoid late

payments and fees. TurboTax also found that a majority of consumers

across all generations plan to prioritize spending their refunds on

necessities, like food and medication.

TurboTax Generational Tax Survey Highlights:

When asked what getting their tax refund a week earlier would

allow them to do, those surveyed shared:

- The 93% of Gen Z who expect to receive a refund felt faster

funds will help pay off debt (35%), and even pay their rent on time

(35%), while all generations expressed earlier refunds would lead

to them comfortably affording necessities such as food and

medications, and noted being less stressed overall (Gen Z 35%,

Millennials 32%, Gen X 27% and Baby Boomers 13%).

When asked how they plan to spend their 2025 tax refund, those

surveyed shared:

- Despite generational differences, the common thread among all

generations is the prioritization of financial responsibility with

their tax refunds, focusing on essential needs such as housing,

food (33%), and savings (43%) over discretionary spending such as

travel, vacation (13%), and entertainment (8%).

- We also see more Gen Z noting they will invest their refunds

through stocks, bonds, or crypto (19%) over any other generation

(Millennials 16%, Gen X 10%, Baby Boomers 6%).

- They also feel they will spend their refund on entertainment,

such as concerts and sporting events (14%) over other generations.

Only 9% of Millennials, 5% of Gen X, and 1% of Baby Boomers noted

they would spend their refund in this way.

Tax year 2024 TurboTax products are now available for consumers

and small businesses in English and Spanish at www.TurboTax.com,

the Apple App Store and Google Play Store. Credit Karma tax

products are now available in English via the Credit Karma app.

Visit the following pages to learn more about TurboTax Faster

Money Offerings:

- 5 Days Early Refund Delivery with TurboTax:

https://turbotax.intuit.com/early-tax-refunds/

- Up To 5 Days Early with Credit Karma Money:

https://turbotax.intuit.com/credit-karma-money/

- Refund Advance no fee loan:

https://turbotax.intuit.com/refund-advance

About Intuit

Intuit is the global financial technology platform that powers

prosperity for the people and communities we serve. With

approximately 100 million customers worldwide using products such

as TurboTax, Credit Karma, QuickBooks, and Mailchimp, we believe

that everyone should have the opportunity to prosper. We never stop

working to find new, innovative ways to make that possible. Please

visit us at Intuit.com and find us on social for the latest

information about Intuit and our products and services.

1 The TurboTax Generational Tax Survey issued by Talker,

surveyed 4,000 Americans who plan to file taxes this year, split

evenly by generation and gender (500 women and 500 men, 1,000 Gen

Z, 1,000 millennials, 1,000 Gen X and 1,000 baby boomers).

2 5 Days Early to Your Bank Account: Personal taxes only.

For refunds $250 or greater only. Your federal tax refund will be

deposited to your selected bank account 5 days before the refund

settlement date provided by the IRS (the date your refund would

have arrived if sent from the IRS directly). The receipt of your

refund 5 Days Early is subject to IRS submitting refund information

to us at least 5 days before the refund settlement date. IRS does

not always provide refund settlement information 5 days early. You

will not be eligible to receive your refund 5 Days Early if (1) you

take a Refund Advance loan, (2) IRS delays payment of your refund,

(3) your refund is lower than $250, or (4) your bank’s policies do

not allow for same-day payment processing. 5 Days Early fee will be

deducted directly from your refund prior to being deposited to your

bank account. If your refund cannot be delivered 5 Days Early, you

will not be charged the 5 Days Early fee. 5 Days Early program may

change or be discontinued at any time.

Money movement services are provided by Intuit Payments Inc.,

licensed as a Money Transmitter by the New York State Department of

Financial Services. For more information about Intuit Payments'

money transmission licenses, please visit

https://www.intuit.com/legal/licenses/payment-licenses/.

3 5 Days Early Guarantee: If your federal refund is

deposited into your selected bank account less than 5 days before

the IRS refund settlement date (the date it would have arrived if

sent from the IRS directly), then you will not pay the 5 Days Early

fee. See Terms of Service for more details.

4 Credit Karma Money: Banking services provided by MVB

Bank, Inc., Member FDIC. Maximum balance and transfer limits apply.

A maximum of 6 withdrawals per monthly savings statement cycle may

apply.

5 Up To 5 Days Early with Credit Karma Money: To be

eligible, you don’t need to file your taxes with a particular tax

prep service. However, you will not be eligible if you choose to

pay your tax preparation fee using your federal tax refund or

choose to take a Refund Advance loan. 5-day early program may

change or discontinue at any time. Up to 5 days early access to

your federal tax refund is compared to standard tax refund

electronic deposit and is dependent on and subject to IRS

submitting refund information to the bank before release date. IRS

may not submit refund information early.

6 Refund Advance: Refund Advance loans issued by First

Century Bank, N.A., Member FDIC are facilitated by Intuit TT

Offerings Inc. (NMLS # 1889291), a subsidiary of Intuit Inc. Refund

Advance loans issued by WebBank are facilitated by Intuit Financing

Inc. (NMLS#1136148), a subsidiary of Intuit Inc. Terms apply. Learn

more here: https://turbotax.intuit.com/refund-advance.

7 IRS accepts returns starting late-Jan. Acceptance times vary.

Most customers receive funds within 15 minutes of acceptance.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250108097379/en/

Press Contacts: Intuit – Karen Nolan, karen_nolan@intuit.com

Hunter PR – Becky Brand, bbrand@hunterpr.com

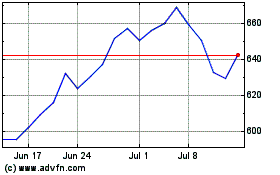

Intuit (NASDAQ:INTU)

Historical Stock Chart

From Dec 2024 to Jan 2025

Intuit (NASDAQ:INTU)

Historical Stock Chart

From Jan 2024 to Jan 2025