Filed by Inpixon

pursuant to Rule 425 under the Securities Act of

1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: XTI Aircraft Company

Inpixon Commission File No.: 333-273964

Date: August 14, 2023

Business Update Call August 14, 2023 Presented by: Nadir Ali, Inpixon Scott Pomeroy, XTI Mike Hinderberger, XTI AZ0

2 Disclaimer This presentation contains certain “forward - looking statements” within the meaning of the United States Private Securities Litig ation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than st atements of historical fact contained in this communication, including statements regarding the benefits of the proposed transaction, the anticipated timing of the completion of the proposed trans act ion, the products under development by XTI and the markets in which it plans to operate, the advantages of XTI’s technology, XTI’s competitive landscape and positioning, and XTI’s growth plans and strategies, are forward - looking statements. Some of these forward - looking statements can be identified by the use of forward - looking words, including “may,” “should,” “expect,” “intend,” “will,” “estimate,” “anticipate,” “believe,” “predict,” “plan,” “targets,” “projects,” “could,” “would,” “continue,” “forecast” or the negatives of these terms or variations of them or similar expressions. All fo rwa rd - looking statements are based upon estimates, forecasts and assumptions that, while considered reasonable by Inpixon and its management, and XTI and its management, as the case may be, are inherently uncertain and many factors may cause the actual results to differ materially from current expectations which include, but are not limited to: the risk that the proposed tran sac tion may not be completed in a timely manner or at all, which may adversely affect the price of Inpixon’s securities; the failure to satisfy the conditions to the consummation of the proposed tr ansaction, including the adoption of the merger agreement by the shareholders of Inpixon; the occurrence of any event, change or other circumstance that could give rise to the termination of th e merger agreement; the adjustments permitted under the merger agreement to the exchange ratio that could result in XTI shareholders or Inpixon shareholders owning less of the post - combinatio n company than expected; the effect of the announcement or pendency of the proposed transaction on Inpixon’s and XTI’s business relationships, performance, and business generally; that th e proposed transaction disrupts current plans of Inpixon and XTI and potential difficulties in Inpixon’s and XTI’s employee retention as a result of the proposed transaction; the outcome of any leg al proceedings that may be instituted against XTI or against Inpixon related to the merger agreement or the proposed transaction; failure to realize the anticipated benefits of the proposed transaction; th e inability to meet and maintain the listing of Inpixon’s securities (or the securities of the post - combination company) on Nasdaq; the price of Inpixon’s securities (or the securities of the post combinat ion company) may be volatile due to a variety of factors, including changes in the highly competitive industries in which Inpixon and XTI operate, the inability to implement business plans, for eca sts, and other expectations after the completion of the proposed transaction, and identify and realize additional opportunities; variations in performance across competitors, changes in laws , r egulations, technologies that may impose additional costs and compliance burdens on Inpixon and XTI’s operations, global supply chain disruptions and shortages, national security tensions , a nd macro - economic and social environments affecting Inpixon and XTI’s business and changes in the combined capital structure; the risk that XTI has a limited operating history, has not yet man ufactured any non - prototype aircraft or delivered any aircraft to a customer, and XTI and its current and future collaborators may be unable to successfully develop and market XTI’s aircraft or so lutions, or may experience significant delays in doing so; XTI is subject to the uncertainties associated with the regulatory approvals of its aircraft including the certification by the Federal Avia tio n Administration, which is a lengthy and costly process; the post - combination company may never achieve or sustain profitability; XTI, Inpixon and the post - combination company may be unable to raise additio nal capital on acceptable terms to finance its operations and remain a going concern; the post - combination company experiences difficulties in managing its growth and expanding operations; XTI’s co nditional pre orders (which include conditional aircraft purchase agreements, non - binding reservations, and options) are canceled, modified, delayed or not placed and that XTI must return the re fundable deposits; the risks relating to long development and sales cycles, XTI’s ability to satisfy the conditions and deliver on the orders and reservations, its ability to maintain quality c ont rol of its aircraft, and XTI’s dependence on third parties for supplying components and potentially manufacturing the aircraft; other aircraft manufacturers may develop competitive VTOL aircraft or oth er competitive aircraft that adversely affect XTI’s market position; XTI’s future patent applications may not be approved or may take longer than expected, and XTI may incur substantial costs in en forcing and protecting its intellectual property; XTI’s estimates of market demand may be inaccurate; XTI’s ability to sell its aircraft may be limited by circumstances beyond its control, such as a shortage of pilots and mechanics who meet the training standards, high maintenance frequencies and costs for the sold aircraft, and any accidents or incidents involving VTOL aircraft that may harm cu stomer confidence; and other risks and uncertainties set forth in the sections entitled “Risk Factors” and “Cautionary Note Regarding Forward - Looking Statements” in Inpixon’s Annual Report on Form 1 0 - K for the year ended December, 31, 2022, which was filed with the SEC on April 17, 2023 and Quarterly Report on Form 10 - Q for the quarterly period ended March 31, 2023 filed on May 16, 2023, and in the section entitled “Risk Factors” in XTI’s periodic reports filed pursuant to Regulation A of the Securities Act including XTI’s Annual Report on Form 1 - K for the year ended December 31, 2022, w hich was filed with the SEC on July 13, 2023, as such factors may be updated from time to time in Inpixon’s and XTI’s filings with the SEC, the registration statement on Form S - 4 and the proxy stat ement/prospectus contained therein. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward - looking statements. Nothing in this presentation should be regarded as a representation by any person that the forward - looking statements set forth herein will be achieved or that any of the contemplated results of such forward - looking statements will be achieved. You should not place undue reliance on forward - looking statements, which speak only as of the date they are made. Neit her Inpixon nor XTI gives any assurance that either Inpixon or XTI or the post - combination company will achieve its expected results. Neither Inpixon nor XTI undertakes any duty to update these forw ard - looking statements, except as otherwise required by law.

3 Disclaimer Important Information About the Proposed Transaction and Where to Find It This presentation relates to a proposed transaction between XTI Aircraft Company, a Delaware corporation (“ XTI ”), and Inpixon , a Nevada corporation (“ Inpixon ”), pursuant to an agreement and plan of merger, dated as of July 24, 2023, by and among Inpixon , Superfly Merger Sub Inc. and XTI (the “proposed transaction”). Inpixon filed a registration statement on Form S - 4 (the “Form S - 4”) with the U.S. Securities and Exchange Commission (“SEC”) on August 14, 2023, which included a preliminary prospectus and proxy stateme nt of Inpixon in connection with the proposed transaction, referred to as a proxy statement/prospectus. A proxy statement/prospectus will be sent to all Inpixon stockholders as of a record date to be established for voting on the transaction and to the stockholders of XTI . Inpixon also will file other documents regarding the proposed transaction with the SEC. Before making any voting decision, investors and security holders are urged to read the registration statement, the proxy sta tem ent/prospectus, and amendments thereto, and the definitive proxy statement/prospectus in connection with Inpixon’s solicitation of proxies for its stockholders’ meeting to be held to approve the transaction, and all other relevant documents filed or that will be filed with the SEC in connection with the proposed transaction as they become available becau se they will contain important information about Inpixon , XTI and the proposed transaction. Investors and securityholders will be able to obtain free copies of the registration statement, the proxy statement/prospectu s a nd all other relevant documents filed or that will be filed with the SEC by Inpixon through the website maintained by the SEC at www.sec.gov . The documents filed by Inpixon with the SEC also may be obtained free of charge at Inpixon’s website at www.inpixon.com or upon written request to: Inpixon , 2479 E. Bayshore Road, Suite 195, Palo Alto, CA 94303. NEITHER THE SEC NOR ANY STATE SECURITIES REGULATORY AGENCY HAS APPROVED OR DISAPPROVED THE TRANSACTIONS DESCRIBED IN THIS COM MUN ICATION, PASSED UPON THE MERITS OR FAIRNESS OF THE TRANSACTION OR RELATED TRANSACTIONS OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE DISCLOSURE IN THIS COMMUNI CAT ION. ANY REPRESENTATION TO THE CONTRARY CONSTITUTES A CRIMINAL OFFENSE. Participants in the Solicitation XTI and Inpixon and their respective directors and officers and other members of management may, under SEC rules, be deemed to be participant s in the solicitation of proxies from Inpixon’s stockholders with the proposed transaction and the other matters set forth in the registration statement. Information about Inpixon’s and XTI’s directors and executive officers is set forth in Inpixon’s filings and XTI’s filings with the SEC, including Inpixon’s 2022 Form 10 - K and XTI’s 2022 Form 1 - K. Additional information regarding the direct and indirect interests, by security holdings or otherwise, of those persons and other persons who may be deemed participants in the proposed transaction may be obtained by reading the pro xy statement/prospectus regarding the proposed transaction when it becomes available. You may obtain free copies of these documents as described above under “Important Information Abou t t he Proposed Transaction and Where to Find It.” No Offer or Solicitation This presentation is not a proxy statement or solicitation of a proxy, consent or authorization with respect to any securitie s o r in respect of the proposed transaction and is not intended to and does not constitute an offer to sell or the solicitation of an offer to buy, sell or solicit any securities or any proxy, vote or app roval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such ju ris diction. No offer of securities shall be deemed to be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act.

4 Disclaimer This presentation includes industry and trade association data, forecasts and information that we have prepared based, in part, upon data, forecasts and information obtained from independent trade associations, industry publications and surveys, government agencies and other information publicly available to us, which information may be specific to particular markets or geographic locations. Some data is also based on our good faith estimates, which are derived from management’s knowledge of the industry and independent sources. Industry publications and surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable. Statements as to our market position are based on market data currently available to us. Although we believe these sources are reliable, we have not independently verified the information. While we are not aware of any misstatements regarding our industry data presented herein, our estimates involve risks and uncertainties and are subject to change based on various factors. Similarly, we believe our internal research is reliable, even though such research has not been verified by any independent sources. None of the source information was commissioned by us for the purpose of citing such information in the presentation or any other communications or SEC filings and using it in connection with the presentation, other communications or SEC filings and/or the transaction and as such, no consents of any third parties are required in connection with the presentation. Further, all such information derives from studies and reports that are non - commissioned publicly available information which is accessible on the internet.

Business Update Call August 14, 2023 Presented by: Nadir Ali, Inpixon Scott Pomeroy, XTI Mike Hinderberger, XTI

6 Complete line - up of location technologies and form factors to meet the needs of any facility - type and use case. Technology - agnostic, open platform integrates the complete technology stack and communicates with 3 rd - party systems. LOCATE LEARN LEVERAGE Ultra - Wideband QR Codes Chirp (CSS) Wirepas RFID NFC GPS L i DAR BLE Wi - Fi REST API MQTT SAP/ERP WMS/MES Single solution addresses a multitude of use cases. Actionable intelligence enables automation and data - driven decision making. Tags Anchors Chips Modules E - Ink Industry 4.0 Smart Factories, Warehouses, Mining Operations, and Digital Supply Chains Our full - stack industrial RTLS enables customers to Locate, Learn and Leverage information allowing for automation, cost reductions, and improved productivity Inpixon: Real - Time Location System (RTLS) Smart Factory Smart Warehouse Smart Mine Smart Facility Digital Supply Chain Real - Time Tracking Process Automation Scannerless AutoID Worker Safety Predictive Analytics

7 Transformational Merger All images of the XTI TriFan 600 are computer rendered simulations

8 Enters Definitive Merger Agreement; Expected to Enhance Shareholder Value • XTI opportunity expected to unlock additional value for shareholders • Upon INPX shareholder approval and closing (expected Q4 2023): • Post - merger entity will be renamed XTI Aerospace, Inc. and ticker change to “XTIA” • New Sr. management team • Enterprise value of XTI ascertained to be within the range of $252 million and $343 million 4 1 A combination of conditional aircraft purchase agreements, non - binding reservation deposit agreements, and options. 2 Based on current list price of $10 million per aircraft assuming the company is able to execute on the development program for the TriFan, secure FAA certification, and deliver these aircraft. 3 Sources detailed on slide 17. • Established RTLS business line • Utilization in production and manufacturing facilities streamlines operations • Listed on Nasdaq • Aviation business developing an innovative long range , high - speed VLCA ( vertical lift crossover airplane ) • 700+ conditional pre - orders 1 , representing possible gross revenues of ~$7.1 billion 2 • TAM: $1.15 trillion 3 BEFORE MERGER POST - PROPOSED MERGER Entered definitive merger agreement on July 24, 2023 4 The enterprise value of XTI was ascertained by an independent financial advisory firm after comparison with certain public companies with similar business models to XTI in the air travel/VTOL segment of the aviation industry, with an average enterprise value of approximately $1.6 billion.

9 Scott Pomeroy Chairman & CEO of XTI Aerospace, Inc . Mike Hinderberger CEO of XTI Aircraft Company Soumya Das CEO of RTLS Division New Leadership

10 VISION: To transform business aviation for a more efficient and sustainable future

11 An expensive derivative of a military vertical lift aircraft Commercial VTOL | Vertical Take - off & Landing Photo source: Adobe Stock

12 Battery - powered aircraft inspired by drones, limited in speed, range and mission eVTOL | Electric VTOL Photo source: Adobe Stock

13 eVTOL Photo source: Adobe Stock • Archer • Beta Alia • Joby • eHang • Lilium • Vertical • Eve • Others

14 The business aircraft that hovers like a helicopter and flies like a plane to make point - to - point missions possible VLCA | Vertical Lift Crossover Airplane

15 XTI TriFan 600 Computer Simulation https://vimeo.com/674028999

16 The “Missing Link” in Air Travel Our “crossover” airplane will elegantly blend what we believe is the best of a business aircraft and a helicopter into one highly versatile airplane Saves Time Twice the speed of most conventional helicopters Uses Existing Infrastructure No waiting for new regulations or construction Long Range Fly up to 700 miles in pressurized comfort TriFan 600 aircraft under development. Estimated performance based on XTI Aircraft analysis. Subject to change and FAA certification

17 XTI TriFan 600 VLCA: Versatile Serve existing and emerging markets TriFan 600 anticipated to serve diverse markets Minimal competition from a few companies with sporadic development eVTOL aircraft will serve a limited market Competition between hundreds of new companies Existing business aircraft market $30B 1 Emerging Regional Air Mobility (RAM) market $ 95B 2 Emerging Urban Air Mobility (UAM) market $ 1T 3 Existing helicopter market $ 30B 4 1 Business jets market: $30.1B in 2022, source: https://www.marketsandmarkets.com/Market - Reports/business - jet - market - 33698426.htm l 2 Emerging Regional Air Mobility (RAM) market: $95B by 2035 (midpoint between low & high estimate), source: https://www.mckinsey.com/industries/aerospace - and - defense/our - insights/short - haul - flying - redefined - the - promise - of - regional - air - m obility# 3 Emerging Urban Air Mobility (UAM) market: $1T by 2040, source: https://assets.verticalmag.com/wp - content/uploads/2021/05/Morgan - Stanley - URBAN_20210506_0000.pdf 4 Helicopters market: $30.6B in 2022, source: https://www.marketsandmarkets.com/Market - Reports/helicopters - market - 253467785.html

18 VTOL Range 600 NM / 700 mi / 1100 km Cruise Speed 300 kts / 345 mph / 555 kph Cruise Altitude 25,000 ft Certified IFR Can fly into clouds & known icing Operate from • Helipads • Firm ground • Airports XTI TriFan 600 VLCA Performance 1 NO NEW INFRASTRUCTURE REQUIRED 1 TriFan 600 aircraft under development. Estimated performance based on XTI Aircraft analysis. Subject to change and FAA certification Range 700 mi Range 700 mi Helena Las Vegas Vertiport Chicago Los Angeles Kansas City SFO Ok City Boise Sacramento Salt Lake City Pittsburgh Portland Bangor Atlanta Jacksonville Casper Bismarck Tampa DC Louisville Denver Boston Detroit Omaha Phoenix Albuquerque Dallas Houston Vancouver New York Toronto Memphis Minneapolis New Orleans Seattle Miami Charlotte

19 TriFan 600 vs eVTOL eVTOL Range Wall St. Heliport eVTOL Aircraft XTI TriFan 600 ~150 - 200 mi (less with reserves) 700 mi VTOL 850 mi CTOL Range ~150 - 200 mph 350 mph Speed No (Cancellations/ delays more likely) Yes Operations in inclement weather Yes (Possible cert delays) No (De - risked cert path) Certify novel propulsion Yes (Limited initial useability/routes) No (Rapid immediate worldwide deployment) Develop entire new battery charging infrastructure No Short - range local/intra - city only Yes Business, air taxi, air medical, inter - city regional markets Target several diverse markets TriFan 600 Range (with vertical takeoff) TriFan 600 aircraft under development. Estimated performance based on XTI Aircraft analysis of vendor and market data . Subject to change and FAA certification

20 VLCA Performance Advantages Business Airplane Helicopter eVTOL TRIFAN 600 Long range (700+ mi) High speed (300+ mph) Can land on a helipad or job sites, remote locations, clear driveways etc. Proven propulsion system Larger Payload Fully Operable with existing infrastructure No new airspace regulations required Certified IFR (flight into clouds & adverse weather improves reliability) Pressurized cabin for passenger comfort Versatile – targets varied markets Some TriFan 600 aircraft under development. Estimated performance based on XTI Aircraft analysis of vendor and market data . Subject to change and FAA certification

21 Technology Overcomes Previous Limitations 2. Vertical Lift Capability Rear fan provides stability and power during VTOL and stows in flight 6. Excellent Visibility Optimized windows augmented with cameras improve pilot’s situational awareness 1. Aerodynamic Advantage Optimized ducted fans and propellers provide efficient aerodynamics in hover and cruise flight 3. Fuel - Efficient Engines Two proven powerful turboshaft engines accelerate certification timeline, with a path to zero emissions 4. 'Fly By Wire’ Duct Controls Reduces pilot workload and enhances stability 5. Pressurized Comfort Pressurized fuselage enhances passenger experience TriFan 600 aircraft under development. Estimated performance based on XTI Aircraft analysis. Subject to change and FAA certification

22 Our Commitment to Sustainability Turboshaft Engines Adopting a measured - risk phased approach tied to: • Technology maturation of hydrogen/ b atteries • Formulation of regulatory g uidance • Infrastructure development Accelerate certification & entry into service Compatible with 100% sustainable aviation fuel (SAF) CO2 emissions reduced by up to 80% 1 depending on the SAF blend Hybrid Power Hydrogen fuel cell or batteries plus a turboshaft engine CO2 emissions reduced 90% Zero Emissions Propulsion All Electric Zero emissions 1 https://www.iata.org/en/programs/environment/sustainable - aviation - fuels TriFan 600 aircraft under development. Estimated performance based on XTI Aircraft analysis. Subject to change and FAA certification

23 TriFan 600 VLCA Exterior Configuration FORWARD FLIGHT VERTICAL FLIGHT TriFan 600 aircraft under development. Estimated performance based on XTI Aircraft analysis. Subject to change and FAA certification

24 Interior Configurations Business 2 pilot seats 4 passenger seats Baggage Club seating Air Medical 2 pilot seats 3 attendant seats Medical bay at aft Foldable seats Air Taxi 2 pilot seats 5 passenger seats Baggage Forward facing TriFan 600 aircraft under development. Estimated performance based on XTI Aircraft analysis. Subject to change and FAA certification

25 XTI 65% - Scale Proof - of - Concept Vehicle Development & hover tests 2017 - 2020

26 TriFan Expected Time, Cost and Emissions Reductions* • Manhattan to Boston or DC Example Mission: 200 - mile trip • London to Paris • Houston to Dallas • Tokyo to Osaka XTI TriFan 600 DOC: $733/hr 3 Cruise: 300 kts 3 Bell 429 DOC: $ 98 1/hr 1 Cruise: 155 kts 2 At 2X the speed, TriFan 600 completes the mission with… half the mission costs ( - 40 to 60%) half the time (50 min vs. 90 min) half the emissions ( - 40 to 60%) 2X revenue potential ( + 100%) Lower Direct Operating Cost Twice the speed of conventional helicopters DOC: Direct Operating Cost = Fuel + Maintenance/hour (Jet A cost assumed: $5/USG) AW 109 DOC: $1338/hr 1 Cruise: 153 kts 2 1 Conklin & deDecker /Renaissance Strategic Advisors 2 Leonardo/Bell websites 3 * TriFan 600 aircraft under development. Estimated performance based on XTI Aircraft analysis of vendor and market data. Subjec t t o change and FAA certification

27 TriFan 600 Expected Monetary Savings* Ops Cost for 200 - mile trip x 6 times/day over 5 years. Aircraft price/ops costs: B&CA Ops & Purchase Planning Handbook 2023. Rotorcraft purchase price: https://air.one/ , ops costs: Conklin & deDecker * TriFan 600 aircraft under development. Estimated performance based on XTI Aircraft analysis. Subject to change and FAA certification $9.9 $6.5 $8.1 $8.2 $25.0 $7.8 $7.0 $11.0 $12.2 $6.0 $15.3 $14.9 $17.8 $18.2 $ - $6.9 $4.8 $7.1 $7.6 XTI TRIFAN 600* AIRBUS EC135 BELL 429 WLG AW109 GRAND NEW AGUSTA WESTLAND 609 BEECHCRAFT KING AIR 260 HONDAJET ELITE II EMBRAER PHENOM 300E PILATUS PC 24 FIVE YEAR COST OF OWNERSHIP Equipped Price($m) in 2023 DOC for 6 legs/day x 340 days x 5 years ($MM) Tiltrotor Turboprop Business Jet Helicopter Helicopter Ducted Fan All need a runway Operates from helipads Business Jet Business Jet Helicopter

28 Key Highlights Enterprise value of XTI ascertained by 3rd party to be within the range of $252 million and $343 million 5 Traction established: 700+ conditional pre - orders 2 , representing possible gross revenues of ~$7.1 billion 3 Superior projected range, speed, cost of ownership. Designed for current infrastructure and regulatory environment 4 $1.15 trillion total addressable market 1 1 TAM estimated as an aggregate of business jets market: $30.1B in 2022, source: https://www.marketsandmarkets.com/Market - Reports/business - jet - market - 33698426.html; helicopters market: $30.6B in 2022, source: https://www.marketsandmarkets.com/Market - Reports/helicopters - market - 253467785.html; Emerging Urban Air Mobility (UAM) market: $1T by 2040, source: https://assets.verticalmag.com/wp - content/uploads/2021/05/Morgan - Stanley - URBAN_20210506_0000.pdf; Emerging Regional Air Mobility (RAM) market: $95B by 2035 (midpoint between low & high estimate), source: https://www.mckinsey.com/industries/aerospace - and - defense/our - insights/short - haul - flying - redefined - the - promise - of - regional - air - mobility#. 2 A combination of conditional aircraft purchase agreements, non - binding reservation deposit agreements, and options. 3 Based on current list price of $10 million per aircraft assuming the company is able to execute on the development program for the TriFan, secure FAA certification, and deliver these aircraft. 4 TriFan 600 aircraft under development. Estimated performance based on XTI Aircraft analysis. Subject to change and FAA certif ic ation 5 The enterprise value of XTI was ascertained by an independent financial advisory firm after comparison with certain public co mp anies with similar business models to XTI in the air travel/VTOL segment of the aviation industry, with an average enterprise value of approximately $1.6 billion. Estimates and Projections by XTI Management Please visit xti - inpx - merger.com for transaction news updates XTI is guided by a leadership team with decades of experience and success bringing new aircraft to market, including more than 40 FAA - certified new aircraft configurations

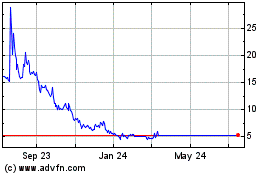

Inpixon (NASDAQ:INPX)

Historical Stock Chart

From Nov 2024 to Dec 2024

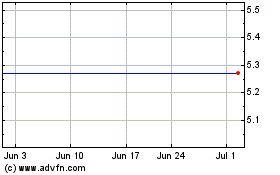

Inpixon (NASDAQ:INPX)

Historical Stock Chart

From Dec 2023 to Dec 2024