Filed Pursuant to Rule 424(b)(7)

File no. 333-279625

Prospectus Supplement

(To Prospectus Dated May 22, 2024)

18,719,211 Ordinary Shares

GLOBALFOUNDRIES Inc.

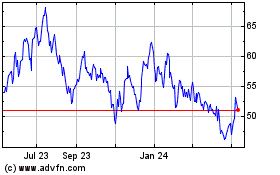

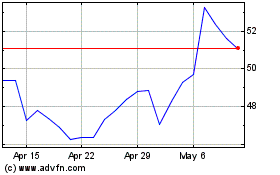

This is a public offering of the ordinary shares, US$0.02 par value per share, of GLOBALFOUNDRIES Inc., or the company. Our selling shareholder, Mubadala Technology Investment Company (“MTIC”), a wholly owned subsidiary of Mubadala Investment Company PJSC (“MIC,” together with MTIC, “Mubadala”), is offering 18,719,211 ordinary shares at a price to the public of $50.75 per share, including a share repurchase of 3,940,886 ordinary shares, as described below, under this prospectus supplement (the “Prospectus Supplement”) to the accompanying prospectus pursuant to a registration statement on Form F-3 that the company filed with the U.S. Securities and Exchange Commission (“SEC”) on May 22, 2024. On May 22, 2024, the last reported sale price for our ordinary shares on the Nasdaq Global Select Market (“Nasdaq”) was $55.21 per ordinary share. MTIC is offering 18,719,211 ordinary shares in this offering at a price to the public of $50.75 per share. We are not selling any ordinary shares under this prospectus supplement and will not receive any proceeds from the sale of the shares by MTIC. We intend to concurrently repurchase from the underwriters 3,940,886 ordinary shares that are subject to this offering, referred to as the share repurchase, at a price per share equal to the public offering price in this offering. We will repurchase 3,940,886 ordinary shares in this offering. The closing of the share repurchase is contingent upon the closing of this offering. The closing of this offering is not contingent on the closing of the share repurchase. Our ordinary shares are listed and traded on Nasdaq under the symbol “GFS.”

Investing in our ordinary shares involves risks. See “Risk Factors” beginning on page S-8 of this prospectus supplement, any risk factors included in the accompanying prospectus, and in the documents incorporated by reference in this prospectus supplement before investing in our ordinary shares. | | | | | | | | | | | |

| Per Ordinary Share | | Total |

Public offering price (1) | US$50.75 | | US$949,999,958 |

Underwriting discounts and commissions (2) | US$1.5225 | | US$22,500,000 |

Proceeds to Mubadala, before expenses (3) | US$49.2275 | | US$927,499,958 |

__________________

(1)The public offering price for the 14,778,325 ordinary shares sold to the public was $50.75 per share.

(2)The underwriting discount for the 14,778,325 shares offered to the public was $1.5225 per share. The price for the 3,940,886 ordinary shares we intend to repurchase from the underwriters was $50.75 per share. No underwriting discount or commissions will be paid to the underwriters with respect to the 3,940,886 shares we intend to repurchase.

(3)We refer you to “Underwriters” beginning on page S-17 of this prospectus supplement for additional information regarding underwriting compensation. MTIC has granted an option to the underwriters, exercisable for 30 days after the date of this prospectus supplement, to purchase up to 2,216,748 additional ordinary shares (equal to 15% of the initial ordinary shares being sold to the public). The underwriters will pay the public offering price, less underwriting discounts and commissions, for any shares sold pursuant to such option that are not resold to us, but will not receive any discount or commission in respect of shares repurchased by us.

Neither the U.S. Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus supplement. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the ordinary shares against payment in New York, New York on or about May 28, 2024, through the book-entry facility of The Depository Trust Company.

Book-Running Managers

| | | | | | | | |

| MORGAN STANLEY | | BofA Securities |

| | | | | | | | |

| Citigroup | Goldman Sachs & Co. LLC | J.P. Morgan |

| | | | | | | | |

| Deutsche Bank Securities | Evercore ISI | HSBC |

Co-Managers

| | | | | | | | | | | | | | | | | | | | |

| Baird | | Needham & Company | | Raymond James | | Wedbush Securities |

| | | | | | | | |

| Drexel Hamilton | | Siebert Williams Shank |

PROSPECTUS SUPPLEMENT DATED MAY 22, 2024

TABLE OF CONTENTS

PROSPECTUS SUPPLEMENT

PROSPECTUS

ABOUT THIS PROSPECTUS SUPPLEMENT

In this prospectus supplement, unless the context otherwise requires, the terms “GF,” “the company,” “we,” “us” and “our” refer to GLOBALFOUNDRIES Inc. and its consolidated subsidiaries.

You should rely only on the information contained or incorporated by reference in this prospectus supplement and the accompanying prospectus or contained in any free writing prospectus prepared by or on behalf of us or to which we have referred you. None of the company, Mubadala or the underwriters have authorized anyone to provide any information or make any representations other than those contained in this prospectus supplement and the accompanying prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We and Mubadala take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. MTIC is offering to sell, and seeking offers to buy, ordinary shares only in jurisdictions where offers and sales are permitted. The information contained in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein is accurate only as of the respective dates of the relevant documents, regardless of the time of delivery of this prospectus supplement or of any sale of the ordinary shares. Our results of operations, financial condition, business and prospects may have changed since such date.

This prospectus supplement and the accompanying prospectus form part of a registration statement on Form F-3 that we filed with the SEC, using a “shelf” registration process. This document is in two parts. The first part is this prospectus supplement, which adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference into the accompanying prospectus. The second part is the accompanying prospectus, which gives more general information, some of which may not apply to this offering of ordinary shares. You should read both this prospectus supplement and the accompanying prospectus, together with the documents incorporated by reference herein and therein in their entirety before making an investment decision. You should also read and consider the information contained in the documents to which we have referred you to in “Where You Can Find Additional Information” in this prospectus supplement and the accompanying prospectus. This prospectus supplement adds, updates and changes information contained in the accompanying prospectus and the information incorporated by reference. To the extent the information contained in this prospectus supplement differs or varies from the information contained in the accompanying prospectus or any document incorporated by reference, you should rely on the information in this prospectus supplement. However, if any statement in one of these documents is inconsistent with a statement in another document having a later date—for example, a document incorporated by reference in this prospectus supplement—the statement in the document having the later date modifies or supersedes the earlier statement as our business, financial condition, results of operations and prospects may have changed since the earlier dates. Generally, when we refer to the prospectus, we are referring to this prospectus supplement and the accompanying prospectus combined.

For investors outside of the United States: neither we, Mubadala, nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus supplement and the accompanying prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside of the United States who come into possession of this prospectus supplement and the accompanying prospectus must inform themselves about, and observe any restrictions relating to, the offering of ordinary shares and this distribution of this prospectus supplement and the accompanying prospectus outside of the United States.

PRESENTATION OF FINANCIAL AND OTHER INFORMATION

We report under International Financial Reporting Standards (“IFRS”), as issued by the International Accounting Standards Board (“IASB”). Our consolidated financial statements were not prepared in accordance with generally accepted accounting principles in the United States. We present our consolidated financial statements in U.S. dollars. References in this prospectus supplement to “US$” or “$” refer to U.S. dollars, the official currency of the United States.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement and the accompanying prospectus and certain documents incorporated by reference herein contain certain statements that are, or may be deemed to be, “forward-looking statements” within the meaning of U.S. securities laws. These forward-looking statements are based on current expectations, estimates, forecasts and projections. These forward-looking statements appear in a number of places in this prospectus supplement including, but not limited to, the sections titled “Prospectus Summary” and “Risk Factors.” Words such as “expect,” “anticipate,” “should,” “believe,” “hope,” “target,” “project,” “goals,” “estimate,” “potential,” “predict,” “may,” “will,” “might,” “could,” “intend,” “shall,” “outlook,” “on track,” and variations of these terms and similar expressions are intended to identify these forward-looking statements, although not all forward-looking statements contain these identifying words. Forward-looking statements are based on our management’s beliefs and assumptions and on information currently available to our management.

By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. Forward-looking statements are not guarantees of future performance and our actual results of operations, financial condition and liquidity, and the development of the industries in which we operate may differ materially from those made in or suggested by the forward-looking statements contained in this prospectus supplement and the accompanying prospectus and certain documents incorporated by reference herein. Important factors that could cause those differences include, but are not limited to:

•general global economic and geopolitical conditions;

•our ability to manage reduced demand and average selling prices in a prolonged inflationary environment;

•the cyclical nature, volatility and seasonality of the semiconductor and microelectronics industry;

•our ability to secure and maintain design wins, particularly single-source design wins, and manage our long-term supply agreements;

•our business and operating strategies and plans for the development of existing and new businesses, ability to implement such strategies and plans and expected time;

•our reliance on a small number of customers;

•our future business development, financial condition, and results of operations;

•expected changes in our revenue, costs or expenditures;

•our assumptions and estimates regarding design wins;

•our expectations regarding demand for and market acceptance of our products and services;

•our expectations regarding our relationships with customers, contract manufacturers, component suppliers, third-party service providers, strategic partners and other stakeholders;

•our expectations regarding our capacity to develop, manufacture and deliver semiconductor products in fulfillment of our contractual commitments;

•our ability to conduct our manufacturing operations without disruptions;

•our ability to manage our capacity and production facilities effectively;

•our ability to develop new technologies successfully and remain a technological leader;

•our ability to maintain control over expansion and facility modifications;

•our ability to generate growth or profitable growth;

•our ability to maintain and protect our intellectual property;

•our ability to hire and maintain qualified personnel;

•our effective tax rate or tax liability;

•our dividend policy;

•our ability to acquire required equipment and supplies necessary to meet customer demand;

•the increased competition from other companies and our ability to retain and increase our market share;

•developments in, or changes to, laws, regulations, governmental policies, incentives and taxation affecting our operations relating to our industry; and

•assumptions underlying or related to any of the foregoing.

We caution you that the foregoing list does not describe all of the forward-looking statements made in this prospectus supplement.

Forward-looking statements include, but are not limited to, statements regarding our strategy and future plans, future business condition and financial results, our capital expenditure plans, our capacity management plans, expectations as to the commercial production using more advanced technologies, technological upgrades, investment in research and development, future market demand, future regulatory or other developments in our industry, business expansion plans or new investments as well as business acquisitions and financing plans. Please see “Risk Factors” for a further discussion of certain factors that may cause actual results to differ materially from those indicated by our forward-looking statements. Accordingly, you should not place undue reliance on these forward-looking statements. In any event, these statements speak only as of their dates, and we undertake no obligation to update or revise any of them, whether as a result of new information, future events or otherwise. You should carefully consider the “Risk Factors” below, as they may be amended or supplemented by subsequent filings with the SEC, and subsequent public statements, or reports filed with or furnished to the SEC before making any investment decision with respect to our securities. If any of these trends, risks or uncertainties actually occurs or continues, our business, financial condition or operating results could be materially adversely affected, the trading prices of our securities could decline and you could lose all or part of your investment. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by this cautionary statement.

SUMMARY

This summary highlights selected information that is presented in greater detail elsewhere in this prospectus supplement and the accompanying prospectus or incorporated by reference herein from our filings with the SEC listed under “Incorporation by Reference.” This summary does not contain all of the information you should consider before investing in our ordinary shares pursuant to this prospectus supplement. You should read this entire prospectus supplement and the accompanying prospectus carefully, including the section titled “Risk Factors,” as it may be amended or supplemented by subsequent filings with the SEC, and our financial statements and the related notes in our 2023 Form 20-F (as defined below) filed on April 29, 2024 and our Current Report on Form 6-K furnished on May 7, 2024, incorporated by reference in this prospectus supplement and other information incorporated herein by reference, before making an investment decision.

GLOBALFOUNDRIES INC.

Overview

We are one of the world’s leading semiconductor foundries. We manufacture complex, essential integrated circuits (“ICs”) that are used in billions of electronic devices across various industries. Our specialized foundry manufacturing processes, extensive library of qualified circuit-building block designs (known as IP titles or IP blocks), and advanced transistor and device technology allow us to serve a wide range of customers, including global leaders in IC design. We focus on providing optimized solutions for critical applications that drive key secular growth end markets, ensuring function, performance, and power requirements are met. As the only scaled pure-play foundry with a global footprint that is not based in China or Taiwan, we offer our customers the advantage of mitigating geopolitical risk and ensuring greater supply chain certainty. Our definition of a scaled pure-play foundry is a company that specializes in producing ICs for other companies, with annual foundry revenue exceeding $2.5 billion. Our differentiated foundry solutions redefine the industry by offering essential chip solutions that empower our customers to develop innovative products for a wide range of applications in diverse markets.

CORPORATE INFORMATION

We are an exempted company incorporated in the Cayman Islands with limited liability on October 7, 2008. Our principal executive offices are located at 400 Stonebreak Road Extension, Malta, New York 12020, United States, and our telephone number is (518) 305-9013. Our website address is www.gf.com. Information contained on, or that can be accessed through, our website is not incorporated by reference into this prospectus supplement, and you should not consider information on our website to be part of this prospectus supplement.

The GF design logo, “GF” and our other registered or common law trademarks, service marks, or trade names appearing in this prospectus supplement are the property of GLOBALFOUNDRIES Inc. Other trade names, trademarks and service marks used in this prospectus supplement are the property of their respective owners.

SHARE REPURCHASE

Subject to the completion of this offering, we intend to concurrently repurchase from the underwriters 3,940,886 ordinary shares that are subject to this offering at a price per share equal to the public offering price in this offering. We refer to this transaction as the “share repurchase.” The repurchased ordinary shares will be cancelled upon repurchase. Accordingly, the number of our ordinary shares offered in this prospectus supplement available to the general public will be 14,778,325 ordinary shares. The closing of the share repurchase is contingent upon the closing of this offering. The closing of this offering is not contingent on the closing of the share repurchase.

We intend to fund the share repurchase with cash on hand.

The description of, and the other information in this prospectus supplement regarding, the share repurchase are included in this prospectus supplement for informational purposes only. Nothing in this prospectus supplement should be construed as an offer to sell, or the solicitation of an offer to buy, any of our ordinary shares subject to the share repurchase.

OUR OFFERING

The offering terms are summarized below solely for your convenience. For a more complete description of the terms of our equity shares, see “Description of Share Capital” in the accompanying prospectus. | | | | | | | | |

Ordinary shares offered by MTIC | | 18,719,211 ordinary shares (or 20,935,959 shares if the underwriters exercise their option to purchase additional shares in full), including the 3,940,886 ordinary shares to be repurchased in the share repurchase. |

| | |

Option to purchase additional shares | | The underwriters have a 30-day option to purchase up to 2,216,748 additional ordinary shares from the selling shareholder (equal to 15% of the initial ordinary shares being sold to the public). The underwriters will pay the public offering price, less underwriting discounts and commissions, for any shares sold pursuant to such option that are not resold to us, but will not receive any discount or commission in respect of shares repurchased by us. |

| | |

Ordinary shares to be purchased by the company | | 3,940,886 ordinary shares |

| | |

Ordinary shares outstanding after this offering and share repurchase | | 551,564,348 ordinary shares |

| | |

Public offering price | | $50.75 per ordinary share |

| | |

Use of proceeds | | All of our ordinary shares sold pursuant to this prospectus supplement will be sold by MTIC. Mubadala will receive all of the net proceeds and bear the underwriting discount from the sale of our ordinary shares pursuant to this prospectus supplement. We will not receive any proceeds from such sale. See “Use of Proceeds” and “Principal and Selling Shareholder.” |

| | |

| Company Share Repurchase | | Subject to the completion of this offering, we intend to concurrently repurchase from the underwriters 3,940,886 ordinary shares that are subject to this offering at a price per share equal to the public offering price in this offering. The closing of the share repurchase is contingent upon the closing of this offering. The closing of this offering is not contingent on the closing of the share repurchase. See “Summary—Share Repurchase” for additional information. |

| | |

Principal Shareholder | | As of April 30, 2024, Mubadala beneficially owned approximately 84.52% of our ordinary shares. After the completion of this offering and the share repurchase described herein, assuming the sale of all ordinary shares offered pursuant to this prospectus supplement and the concurrent consummation of our share repurchase, Mubadala will beneficially own approximately 81.72% of our ordinary shares. For further information regarding our relationship with Mubadala, see “Principal and Selling Shareholder.” |

| | |

Dividend policy | | We currently do not expect to pay dividends on our ordinary shares for the foreseeable future. |

| | |

Risk factors | | Investing in our ordinary shares involves risk. See “Risk Factors” together with all of the other information in this prospectus supplement and the accompanying prospectus or incorporated by reference in this prospectus supplement and the accompanying prospectus for a discussion of factors you should carefully consider before deciding to invest. |

| | |

Nasdaq symbol | | “GFS” |

The number of our ordinary shares to be outstanding after this offering and the share repurchase disclosed above is based on 555,505,234 ordinary shares outstanding as of April 30, 2024. Unless otherwise indicated, all information contained in this prospectus supplement assumes no exercise of the option granted to the underwriters to purchase up to 2,216,748 additional ordinary shares.

The number of ordinary shares to be outstanding after this offering does not take into account 19,615,994 ordinary shares available for future grant under the 2021 Equity Plan and 0 ordinary shares available for future grant under the 2018 Equity Plan (as defined under “Executive Compensation”), 7,051,192 restricted share unit awards outstanding under the 2021 Equity Plan, options to purchase 907,397 ordinary shares and 305,366 restricted share unit awards outstanding under the 2018 Equity Plan, and 4,515 ordinary shares outstanding under the 2017 LTIP, all as of April 30, 2024.

RISK FACTORS

A description of the risks and uncertainties related to ownership of our ordinary shares is set forth below; however, these risks are not the only ones we face. You should carefully consider the risks and uncertainties described below, as they may be amended or supplemented by subsequent filings with the SEC, together with all of the other information in this prospectus supplement and the accompanying prospectus or incorporated by reference in this prospectus supplement and the accompanying prospectus, including the risks described under “Risk Factors” in Part I, Item 3D of our 2023 Form 20-F and the section titled “Management’s Discussion and Analysis of Financial Condition and Result of Operations”, before making a decision to invest in our shares. Our results of operations, financial condition, business and prospects could also be harmed by risks and uncertainties that are not presently known to us or that we currently believe are not material. If any of the risks actually occur, our results of operations, financial condition, business and prospects could be materially and adversely affected. In that event, the market price of our shares could decline and you could lose all or part of your investment.

Risks Related to our Ordinary Shares

Future sales or distributions of our shares by Mubadala could depress the price of our ordinary shares.

Sales by Mubadala in the public market or other distributions of substantial amounts of our ordinary shares, or the filing of a registration statement relating to a substantial amount of our ordinary shares, could depress our ordinary share price. All of the ordinary shares sold by Mubadala in this offering and not repurchased by us will be freely tradable without restriction or further registration under the Securities Act. In addition, in connection with our initial public offering, we have entered into agreements with Mubadala that provide a framework for our ongoing relationship, including a Shareholder’s Agreement and Registration Rights Agreement. Under the Registration Rights Agreement, Mubadala has the right, subject to certain conditions, to require us to file registration statements covering its shares or to include its shares in other registration statements that we may file. By exercising its registration rights and selling a large number of shares, Mubadala could cause the price of our ordinary shares to decline.

We do not expect to declare or pay any dividends on our ordinary shares for the foreseeable future.

We do not intend to pay cash dividends on our ordinary shares for the foreseeable future. Consequently, investors must rely on sales of their shares of our ordinary shares after price appreciation, which may never occur, as the only way to realize any future gains on their investment. Investors seeking dividends should not purchase shares of our ordinary shares. Any future determination to pay dividends will be at the discretion of our board of directors and subject to, among other things, our compliance with applicable law, and depending on, among other things, our business prospects, financial condition, results of operations, cash requirements and availability, debt repayment obligations, capital expenditure needs, the terms of any preferred equity securities we may issue in the future, covenants in the agreements governing our current and future indebtedness, other contractual restrictions, industry trends and any other factors or considerations our board of directors may regard as relevant.

Anti-takeover provisions in our organizational documents and Cayman Islands law may discourage or prevent a change of control, even if an acquisition would be beneficial to our shareholders, which could depress the price of our ordinary shares and prevent attempts by our shareholders to replace or remove our current management.

Our Memorandum and Articles of Association contain provisions that may discourage unsolicited takeover proposals that shareholders may consider to be in their best interests. Our board of directors is divided into three classes with staggered, three-year terms. Our board of directors has the ability to designate the terms of and issue preferred shares without shareholder approval. We are also subject to certain provisions under Cayman Islands law that could delay or prevent a change of control. Together these provisions may make more difficult the removal of management and may discourage transactions that otherwise could involve payment of a premium over prevailing market prices for our ordinary shares.

Our Memorandum and Articles of Association provide that the courts of the Cayman Islands will be the exclusive forum for certain disputes between us and our shareholders, which could limit our shareholders’ ability to obtain a favorable judicial forum for complaints against us or our directors, officers or employees.

Our Memorandum and Articles of Association provide that unless we consent in writing to the selection of an alternative forum, the courts of the Cayman Islands will, to the fullest extent permitted by the law, have exclusive jurisdiction over any claim or dispute arising out of or in connection with our Memorandum and Articles of Association or otherwise related in any way to each shareholder’s shareholding in us, including but not limited to (i) any derivative action or proceeding brought on our behalf, (ii) any action asserting a claim of breach of any fiduciary or other duty owed by any of our current or former directors, officers or other employees to us or our shareholders, (iii) any action asserting a claim arising pursuant to any provision of the Cayman Companies Act or our Memorandum and Articles of Association, and (iv) any action asserting a claim against us governed by the “Internal Affairs Doctrine” (as such concept is recognized under the laws of the United States) and that each shareholder irrevocably submits to the exclusive jurisdiction of the courts of the Cayman Islands over all such claims or disputes. Our Memorandum and Articles of Association provide that, unless we consent in writing to the selection of an alternative forum, to the fullest extent permitted by law, the federal district courts of the United States will be the exclusive forum for the resolution of any complaint asserting a cause or causes of action arising under the Securities Act of 1933, as amended (“Securities Act”), or Exchange Act, including all causes of action asserted against any defendant named in such complaint.

Our Memorandum and Articles of Association also provide that, without prejudice to any other rights or remedies that we may have, each of our shareholders acknowledges that damages alone would not be an adequate remedy for any breach of the selection of the courts of the Cayman Islands as exclusive forum and that accordingly we shall be entitled, without proof of special damages, to the remedies of injunction, specific performance or other equitable relief for any threatened or actual breach of the selection of the courts of the Cayman Islands as exclusive forum.

This choice of forum provision may increase a shareholder’s cost and limit the shareholder’s ability to bring a claim in a judicial forum that it finds favorable for disputes with us or our directors, officers or other employees, which may discourage lawsuits against us and our directors, officers and other employees. Any person or entity purchasing or otherwise acquiring any of our shares or other securities, whether by transfer, sale, operation of law or otherwise, shall be deemed to have notice of and have irrevocably agreed and consented to these provisions. There is uncertainty as to whether a court would enforce such provisions, and the enforceability of similar choice of forum provisions in other companies’ charter documents has been challenged in legal proceedings. It is possible that a court could find this type of provisions to be inapplicable or unenforceable, and if a court were to find this provision in our Memorandum and Articles of Association to be inapplicable or unenforceable in an action, we may incur additional costs associated with resolving the dispute in other jurisdictions, which could have adverse effect on our business and financial performance.

Our Memorandum and Articles of Association provide for indemnification of officers and directors at our expense, which may result in a major cost to us and hurt the interests of our shareholders because corporate resources may be expended for the benefit of officers and/or directors.

Our Memorandum and Articles of Association and applicable law of the Cayman Islands provide for the indemnification of our directors and officers, under certain circumstances, against any liability, action, proceeding, claim, demand, costs, damages or expenses, including legal expenses, whatsoever which they or any of them may incur as a result of any act or failure to act in carrying out their functions in connection with our company, other than such liability (if any) that they may incur by reason of their own actual fraud, dishonesty, willful neglect or willful default. We will also bear the expenses of such litigation for any of our directors or officers, upon such person’s undertaking to repay any amounts paid, advanced, or reimbursed by us if it is ultimately determined that any such person shall not have been entitled to indemnification. This indemnification policy could result in substantial expenditures by us that we will be unable to recoup.

We have been advised that, in the opinion of the SEC, indemnification for liabilities arising under federal securities laws is against public policy as expressed in the Securities Act, and is, therefore, unenforceable.

USE OF PROCEEDS

Mubadala will receive all of the net proceeds from the sale of shares of ordinary shares in this offering. We are not selling any ordinary shares under this prospectus supplement and will not receive any proceeds from the sale of shares by MTIC. Mubadala will bear the underwriting discount attributable to their sale of our ordinary shares, and we will bear the remaining expenses. See “Principal and Selling Shareholder.”

DIVIDEND POLICY

We currently intend to retain all available funds and any future earnings to fund the development and growth of our business. Therefore, we do not anticipate declaring or paying any cash dividends to our shareholders in the foreseeable future. Any future determination as to the declaration and payment of dividends, if any, will be at the discretion of our board of directors, subject to applicable laws, and will depend on a number of factors, including our business prospects, results of operations, financial condition, cash requirements and availability, debt repayment obligations, capital expenditure needs, covenants in the agreements governing our current and future indebtedness, other contractual restrictions, industry trends and any other factors or considerations our board of directors may regard as relevant.

Under Cayman Islands law, dividends may be declared and paid only out of funds legally available therefore, namely out of either profit or distributable reserves, including our share premium account, and provided further that a dividend may not be paid if this would result in us being unable to pay our debts as they fall due in the ordinary course of business.

CAPITALIZATION

The following table sets forth our capitalization as of March 31, 2024:

•on an actual basis; and

•on an as adjusted basis giving effect to the share repurchase.

This table should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes included in our 2023 Form 20-F filed on April 29, 2024, and our Current Report on Form 6-K, furnished on May 7, 2024, and with other financial information contained in this prospectus supplement.

| | | | | | | | | | | |

| As of March 31, 2024 |

| ($ in millions) | Actual | | As adjusted(2) |

Cash and cash equivalents(1) | $ | 2,247 | | | $ | 2,047 | |

| | | |

Long term debt (including current portion thereof): | | | |

USD Term Loan A due 2025 | 649 | | | 649 | |

2019 EUR Dresden Equipment Financing due 2026 | 390 | | | 390 | |

2018 Tool Equipment Purchase and Lease Financing due 2023 | — | | | — | |

2019 Tool Equipment Purchase and Lease Financing due 2024 | — | | | — | |

2019 USD Dresden Equipment Financing due 2024 and 2026 | 108 | | | 108 | |

2020 USD Equipment Financing due 2025 | 79 | | | 79 | |

EUR Term Loan A due 2025 | 89 | | | 89 | |

2021 SGD EDB Loan due 2041 | 970 | | | 970 | |

Other long term debt | 23 | | | 23 | |

Total long-term debt | 2,308 | | | 2,308 | |

| | | |

Shareholder’s equity | | | |

Share capital | 11 | | | 11 | |

Additional paid-in capital(1) | 24,067 | | | 23,867 | |

Accumulated deficit | (12,868) | | | (12,868) | |

Accumulated other comprehensive loss | 41 | | | 41 |

| | | |

| | | |

Total equity attributable to the company | 11,251 | | | 11,051 | |

Non-controlling interests | 46 | | | 46 |

| | | |

Total equity | 11,297 | | | 11,097 | |

| | | |

Total capitalization | 13,605 | | | 13,405 | |

__________________

(1)We entered into loan facilities with Mubadala in 2012 to 2016 (collectively, the “Shareholder Loans”). After June 30, 2021, $442 million of cash payments were made. On October 3, 2021, we executed the conversion of the entire Shareholder Loans balance of approximately $10,113 million into additional paid-in-capital (the “Conversion”), which did not have an impact on shares outstanding or have any dilutive effects, as no additional shares were issued.

(2)Reflects repurchase of 3,940,886 ordinary shares to be cancelled upon repurchase for $200.0 million, using balance sheet cash.

PRINCIPAL AND SELLING SHAREHOLDER

The following table sets forth certain information with respect to the beneficial ownership of our ordinary shares as of April 30, 2024, (i) immediately prior to this offering and the concurrent share repurchase and (ii) as adjusted to reflect the sale of 18,719,211 ordinary shares offered by the selling shareholder in this offering and the concurrent repurchase of 3,940,886 ordinary shares. Subject to the completion of this offering, we intend to concurrently repurchase from the underwriters 3,940,886 of the ordinary shares that are subject to this offering at a price per share equal to the public offering price in this offering.

We have determined beneficial ownership in accordance with the rules of the SEC. Unless otherwise indicated below, to our knowledge, based on information furnished to us, the persons and entities named in the table have sole voting and investment power with respect to all shares that they beneficially own, subject to applicable community property laws. The information in the table below is based on 555,505,234 ordinary shares outstanding as of April 30, 2024.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Shares Beneficially Owned Prior to this Offering (1) | | Shares Being Offered | | Shares Beneficially Owned After this Offering (if Underwriters do not Exercise their Option to Purchase Additional Shares) (2) | | Shares Beneficially Owned After this Offering (if Underwriters Exercise their Option to Purchase Additional Shares) (2) |

Name of Beneficial Owner | | Shares | | Percentage | | | Shares | | Percentage | | Shares | | Percentage |

Mubadala Investment Company PJSC | | 469,501,994 | | | 84.52 | % | | 18,719,211 | | | 450,782,783 | | | 81.72% | | 448,566,035 | | | 81.33% |

__________________

(1)Consists of 355,199,925 ordinary shares held by MTIC, and 114,302,069 ordinary shares held by MTI International Investment Company LLC, both wholly owned subsidiaries of Mubadala Technology Investments PJSC. The address of Mubadala is Mamoura A Building Abu Dhabi, 45005 United Arab Emirates.

(2)Assumes the consummation of our share repurchase as described herein concurrently with the closing of this offering.

TAXATION

Cayman Islands Tax Considerations

The following summary contains a description of certain Cayman Islands tax consequences of the acquisition, ownership and disposition of our ordinary shares, but it does not purport to be a comprehensive description of all the tax considerations that may be relevant to a decision to purchase our ordinary shares. The summary is based upon the tax laws of Cayman Islands and regulations thereunder as of the date hereof, which are subject to change. If you are considering the purchase of our ordinary shares, you should consult your own tax advisors concerning the particular tax consequences to you of the purchase, ownership and disposition of our ordinary shares, as well as the consequences to you arising under the laws of your country of citizenship, residence or domicile.

The following is a discussion of certain Cayman Islands income tax consequences of an investment in our ordinary shares. The discussion is a general summary of present law, which is subject to prospective and retroactive change. It is not intended to be tax advice, does not consider any investor’s particular circumstances, and does not consider tax consequences other than those arising under Cayman Islands law.

Under Existing Cayman Islands Laws

Payments of dividends and capital in respect of our ordinary shares will not be subject to taxation in the Cayman Islands and no withholding will be required on the payment of interest and principal or a dividend or capital to any holder of our ordinary shares, as the case may be, nor will gains derived from the disposal of our ordinary shares be subject to Cayman Islands income or corporation tax. The Cayman Islands currently has no income, corporation or capital gains tax and no estate duty, inheritance tax or gift tax.

No stamp duty is payable in respect of the issue of ordinary shares or on an instrument of transfer in respect of an ordinary share.

We were incorporated under the laws of the Cayman Islands as an exempted company with limited liability and, as such, has received an undertaking from the Governor in Cabinet of the Cayman Islands in substantially the following form:

The Tax Concessions Law

(1999 Revision)

Undertaking as to Tax Concessions

In accordance with Section 6 of the Tax Concessions Law (1999 Revision) the Governor in Cabinet undertakes with GLOBALFOUNDRIES Inc.:

(a)that no Law which is hereafter enacted in the Islands imposing any tax to be levied on profits, income, gains or appreciations shall apply to us the company or our operations; and

(b)in addition, that no tax to be levied on profits, income, gains or appreciations or which is in the nature of estate duty or inheritance tax shall be payable:

a.on or in respect of the shares, debentures or other obligations of the company; or

b.by way of the withholding in whole or part, of any relevant payment as defined in Section 6(3) of the Tax Concessions Law (2018 Revision).

These concessions shall be for a period of TWENTY years from 21st day of October 2008.

U.S. Federal Income Tax Considerations

The following is a summary of material U.S. federal income tax considerations that are likely to be relevant to the purchase, ownership and disposition of our ordinary shares by a U.S. Holder (as defined below).

This summary is based on provisions of the U.S. Internal Revenue Code of 1986, as amended (the “Code”), and regulations, rulings and judicial interpretations thereof, in force as of the date hereof. Those authorities may be changed at any time, perhaps retroactively, so as to result in U.S. federal income tax consequences different from those summarized below.

This summary is not a comprehensive discussion of all of the tax considerations that may be relevant to a particular investor’s decision to purchase, hold, or dispose of ordinary shares. In particular, this summary is directed only to U.S. Holders that hold ordinary shares as capital assets and does not address particular tax consequences that may be applicable to U.S. Holders who may be subject to special tax rules, such as banks, brokers or dealers in securities or currencies, traders in securities electing to mark to market, financial institutions, life insurance companies, tax-exempt entities, regulated investment companies, real estate investment trusts, entities or arrangements that are treated as partnerships for U.S. federal income tax purposes (or partners therein), holders that own or are treated as owning 10% or more of our ordinary shares by vote or value, persons holding ordinary shares as part of a hedging or conversion transaction or a straddle, persons whose functional currency is not the U.S. dollar, or persons holding our ordinary shares in connection with a trade or business outside the United States. Moreover, this summary does not address state, local or foreign taxes, the U.S. federal estate and gift taxes, the Medicare contribution tax applicable to net investment income of certain non-corporate U.S. Holders, or alternative minimum tax consequences of acquiring, holding or disposing of ordinary shares.

For purposes of this summary, a “U.S. Holder” is a beneficial owner of ordinary shares that is a citizen or resident of the United States or a U.S. domestic corporation or that otherwise is subject to U.S. federal income taxation on a net income basis in respect of such ordinary shares.

You should consult your own tax advisors about the consequences of the acquisition, ownership, and disposition of the ordinary shares, including the relevance to your particular situation of the considerations discussed below and any consequences arising under foreign, state, local or other tax laws.

Taxation of Distributions

Subject to the discussion below under “—Passive Foreign Investment Company Status,” the gross amount of any distribution of cash or property with respect to our shares that is paid out of our current or accumulated earnings and profits (as determined for U.S. federal income tax purposes) will generally be includible in your taxable income as ordinary dividend income on the day on which you receive the dividend and will not be eligible for the dividends-received deduction allowed to corporations under the Code.

We do not expect to maintain calculations of our earnings and profits in accordance with U.S. federal income tax principles. U.S. Holders therefore should expect that distributions generally will be treated as dividends for U.S. federal income tax purposes.

Subject to certain exceptions for short-term positions, dividends received by an individual with respect to the shares will be subject to taxation at a preferential rate if the dividends are “qualified dividends.” Dividends paid on the shares will be treated as qualified dividends if:

•the shares are readily tradable on an established securities market in the United States or we are eligible for the benefits of a comprehensive tax treaty with the United States that the U.S. Treasury determines is satisfactory for purposes of this provision and that includes an exchange of information program; and

•we were not, in the year prior to the year in which the dividend was paid, and are not, in the year in which the dividend is paid, a passive foreign investment company (a “PFIC”).

The ordinary shares are listed on the Nasdaq, and will qualify as readily tradable on an established securities market in the United States so long as they are so listed. Based on our financial statements and relevant market and

shareholder data, we believe that we were not a PFIC for U.S. federal income tax purposes with respect to our 2022 and 2023 taxable years. In addition, based on our financial statements and our current expectations regarding the value and nature of our assets, the sources and nature of our income, and relevant market and shareholder data, we do not anticipate becoming a PFIC for our current taxable year or in the foreseeable future. Holders should consult their own tax advisors regarding the availability of the reduced dividend tax rate in light of their own particular circumstances.

U.S. Holders that receive distributions of additional shares or rights to subscribe for shares as part of a pro rata distribution to all our shareholders generally will not be subject to U.S. federal income tax in respect of the distributions, unless the U.S. Holder has the right to receive cash or property instead, in which case the U.S. Holder will be treated as if it received cash equal to the fair market value of the distribution.

Taxation of Dispositions of Shares

Subject to the discussion below under “—Passive Foreign Investment Company Status,” upon a sale, exchange or other taxable disposition of the shares, U.S. Holders will realize gain or loss for U.S. federal income tax purposes in an amount equal to the difference between the amount realized on the disposition and the U.S. Holder’s adjusted tax basis in the shares, as determined in U.S. dollars as discussed below. Such gain or loss will be capital gain or loss, and will generally be long-term capital gain or loss if the shares have been held for more than one year. Long-term capital gain realized by a U.S. Holder that is an individual generally is subject to taxation at a preferential rate. The deductibility of capital losses is subject to limitations.

Passive Foreign Investment Company Status

Special U.S. tax rules apply regarding companies that are considered to be PFICs. We will be classified as a PFIC in a particular taxable year if either:

•75% or more of our gross income for the taxable year is passive income; or

•the average percentage of the value of our assets that produce or are held for the production of passive income is at least 50%.

For this purpose, passive income generally includes dividends, interest, gains from certain commodities transactions, rents, royalties and the excess of gains over losses from the disposition of assets that produce passive income.

We believe, and this discussion assumes, that we were not a PFIC for our taxable year ended December 31, 2023 and that, based on the present composition of our income and assets and the manner in which we conduct our business, we will not be a PFIC in our current taxable year or in the foreseeable future. Whether we are a PFIC is a factual determination made annually, and our status could change depending, among other things, upon changes in the composition of our gross income and the relative quarterly average value of our assets. If we were a PFIC for any taxable year in which you hold ordinary shares, you generally would be subject to additional taxes on certain distributions and any gain realized from the sale or other taxable disposition of the ordinary shares regardless of whether we continued to be a PFIC in any subsequent year. You are encouraged to consult your own tax advisor as to our status as a PFIC, the tax consequences to you of such status, and the availability and desirability of making a mark-to-market election to mitigate the unfavorable rules mentioned in the preceding sentence.

Foreign Financial Asset Reporting

Individual U.S. Holders that own “specified foreign financial assets” with an aggregate value in excess of US$50,000 on the last day of the taxable year or US$75,000 at any time during the taxable year are generally required to file an information statement along with their tax returns, currently on U.S. Internal Revenue Service (“IRS”) Form 8938, with respect to such assets. “Specified foreign financial assets” include any financial accounts held at a non-U.S. financial institution, as well as securities issued by a non-U.S. issuer that are not held in accounts maintained by financial institutions. Higher reporting thresholds apply to certain individuals living abroad and to certain married individuals. Regulations extend this reporting requirement to certain entities that are treated as

formed or availed of to hold direct or indirect interests in specified foreign financial assets based on objective criteria. U.S. Holders who fail to report the required information could be subject to substantial penalties. In addition, the statute of limitations for assessment of tax would be suspended, in whole or part. Prospective investors are encouraged to consult with their own tax advisors regarding the possible application of these rules, including the application of the rules to their particular circumstances.

Backup Withholding and Information Reporting

Dividends paid on, and proceeds from the sale or other disposition of, the shares to a U.S. Holder generally may be subject to the information reporting requirements of the Code and may be subject to backup withholding unless the U.S. Holder provides an accurate taxpayer identification number and makes any other required certification or otherwise establishes an exemption. Backup withholding is not an additional tax. The amount of any backup withholding from a payment to a U.S. Holder will be allowed as a refund or credit against the U.S. Holder’s U.S. federal income tax liability, provided the required information is furnished to the IRS in a timely manner.

A holder that is not a U.S. Holder may be required to comply with certification and identification procedures in order to establish its exemption from information reporting and backup withholding.

UNDERWRITERS

Under the terms and subject to the conditions in an underwriting agreement dated the date of this prospectus supplement, the underwriters named below, for whom Morgan Stanley & Co. LLC and BofA Securities, Inc. are acting as representatives, have severally agreed to purchase, and Mubadala has agreed to sell to them, severally, the number of shares indicated below:

| | | | | | | | |

| Name | | Number of Shares |

Morgan Stanley & Co. LLC | | 7,682,676 | |

BofA Securities, Inc. | | 3,665,845 | |

Citigroup Global Markets Inc. | | 1,715,928 | |

Goldman Sachs & Co. LLC | | 1,715,928 | |

J.P. Morgan Securities LLC | | 1,715,928 | |

Deutsche Bank Securities, Inc. | | 623,974 | |

Evercore Group, L.L.C. | | 623,974 | |

HSBC Securities (USA) Inc. | | 623,974 | |

Robert W. Baird & Co. Incorporated | | 64,347 | |

Needham & Company, LLC | | 64,347 | |

Raymond James & Associates, Inc. | | 64,347 | |

Wedbush Securities Inc. | | 64,347 | |

Drexel Hamilton, LLC | | 46,798 | |

Siebert Williams Shank & Co., Inc. | | 46,798 | |

Total: | | 18,719,211 | |

The underwriters and the representatives are collectively referred to as the “underwriters” and the “representatives,” respectively. The underwriters are offering the ordinary shares subject to their acceptance of the shares from MTIC and subject to prior sale. The underwriting agreement provides that the obligations of the several underwriters to pay for and accept delivery of the ordinary shares offered by this prospectus supplement are subject to the approval of certain legal matters by their counsel and to certain other conditions. The underwriters are obligated to take and pay for all of the ordinary shares offered by this prospectus supplement if any such shares are taken. However, the underwriters are not required to take or pay for the shares covered by the underwriters’ option to purchase additional shares described below.

Subject to the completion of the offering, we intend to concurrently repurchase from the underwriters 3,940,886 ordinary shares that are subject to this offering at a price per share equal to the public offering price in this offering. See “Summary—Share Repurchase.” The underwriters initially propose to offer part of the ordinary shares directly to the public at the offering price listed on the cover page of this prospectus supplement and part to certain dealers. After the offering of the ordinary shares, the offering price and other selling terms may from time to time be varied by the representatives.

MTIC has granted to the underwriters an option, exercisable for 30 days from the date of this prospectus supplement, to purchase up to 2,216,748 additional ordinary shares. The underwriters will pay the public offering price, less underwriting discounts and commissions for any shares sold pursuant to such option that are not resold to us, but will not receive any discount or commission in respect of shares repurchased by us. To the extent the option is exercised, each underwriter will become obligated, subject to certain conditions, to purchase about the same percentage of the additional ordinary shares as the number listed next to the underwriter’s name in the preceding table bears to the total number of ordinary shares listed next to the names of all underwriters in the preceding table.

The following table shows the per share and total public offering price, underwriting discounts and commissions, and proceeds before expenses to Mubadala. These amounts are shown assuming both no exercise and full exercise of the underwriters’ option to purchase up to an additional 2,216,748 ordinary shares.

| | | | | | | | | | | | | | | | | | | | | | | |

| | | Total |

| Per Share | | No Exercise | | Full Exercise | | Percentage |

Public offering price(1) | US$ | 50.75 | | | US$ | 949,999,958 | | | US$ | 1,062,499,919 | | | 100 | % |

Underwriting discounts and commissions to be paid by: Mubadala(2)(3) | US$ | 1.5225 | | | US$ | 22,500,000 | | | US$ | 25,874,999 | | | 97 | % |

Proceeds, before expenses, to Mubadala | US$ | 49.2275 | | | US$ | 927,499,958 | | | US$ | 1,036,624,921 | | | 3 | % |

__________________

(1)The public offering price for the 14,778,325 shares sold to the public was $50.75 per share.

(2)The underwriting discount for the 14,778,325 shares sold to the public was $1.5225 per share. The price for the 3,940,886 shares we intend to repurchase from the underwriters was $50.75 per share. No underwriting discount or commissions will be paid to the underwriter with respect to the 3,940,886 shares we intend to repurchase.

(3)See below for additional information regarding total underwriter compensation.

The estimated offering expenses payable by us, exclusive of the underwriting discounts and commissions, are approximately $1.1 million. We have agreed to reimburse the underwriters for certain of their expenses in an amount up to $50,000, which expenses Mubadala has agreed to reimburse to us. The following is a statement of estimated offering expenses, exclusive of underwriting discounts and commissions:

| | | | | |

Registration fees | $ | 156,825 | |

Trustees’ and transfer agents’ fees | $ | 6,575 | |

Legal fees | $ | 628,000 | |

Accounting fees | $ | 330,000 | |

Total | $ | 1,121,400 | |

The underwriters have informed us that they do not intend sales to discretionary accounts to exceed 5% of the total number of ordinary shares offered by them.

We and our directors and executive officers listed under “Directors and Senior Management” in Part I, Item 6 of our 2023 Form 20-F and MTIC have agreed that, without the prior written consent of Morgan Stanley & Co. LLC on behalf of the underwriters, we and they will not, and will not publicly disclose an intention to, during the period ending 60 days after the date of this prospectus supplement (the “restricted period”):

•offer, pledge, sell, contract to sell, sell any option or contract to purchase, purchase any option or contract to sell, grant any option, right or warrant to purchase, lend or otherwise transfer or dispose of, directly or

indirectly, any ordinary shares or any securities convertible into or exercisable or exchangeable for ordinary shares;

•file or confidentially submit registration statement with the SEC relating to the offering of any ordinary shares or any securities convertible into or exercisable or exchangeable for ordinary shares; or

•enter into any swap or other arrangement that transfers to another, in whole or in part, any of the economic consequences of ownership of the ordinary shares,

whether any such transaction described above is to be settled by delivery of ordinary shares or such other securities, in cash or otherwise.

In addition, we and each such person agrees that, without the prior written consent of Morgan Stanley & Co. LLC, on behalf of the underwriters, we or such other person will not, during the restricted period, make any demand for, or exercise any right with respect to, the registration of any ordinary shares or any security convertible into or exercisable or exchangeable for ordinary shares.

The restrictions described in the immediately preceding paragraph do not apply to:

•the transfer of ordinary shares to the underwriters pursuant to the underwriting agreement;

•the transfer of ordinary shares or other securities acquired in open market transactions after the completion of this offering, provided that no filing under Section 16(a) of the Exchange Act (other than a required Form 5), reporting a reduction in beneficial ownership of such ordinary shares, shall be required or shall be voluntarily made during the restricted period;

•the transfer of ordinary shares as a bona fide gift or as charitable contributions, provided that the donee or donees thereof agree to be bound in writing by the restrictions set forth in the lock-up agreements, and provided further that any filing under the Exchange Act made in connection with such transfer shall clearly indicate in the footnotes thereto that the filing relates to the circumstances described herein;

•the transfer of ordinary shares by operation of law;

•the distribution of ordinary shares to any corporation, partnership, limited partnership, limited liability company, governmental entity or other entity, in each case, that (i) controls, or is controlled by or is under common control with, the undersigned, or (ii) is directly or indirectly wholly owned by the Government of the Emirate of Abu Dhabi, or (iii) is otherwise an affiliate (as defined in Rule 405 promulgated under the Securities Act of 1933, as amended) of a lock-up party, provided that in the case of any such distribution, each distributee shall agree to be subject to the restrictions set forth in the lock-up agreements, and provided further that no filing under Section 16(a) of the Exchange Act, reporting a reduction in beneficial ownership of ordinary shares shall be required or shall be voluntarily made during the restricted period;

•any reclassification or conversion of the ordinary shares, provided that any securities received upon such conversion or reclassification will be subject to the restrictions set forth in the lock-up agreements;

•the transfer of ordinary shares pursuant to a trading plan pursuant to Rule 10b5-1 under the Exchange Act that is existing as of the date of this prospectus supplement;

•the establishment of a trading plan pursuant to Rule 10b5-1 under the Exchange Act provided that (i) such plan does not provide for the transfer of ordinary shares during the restricted period and (ii) to the extent a public announcement or filing under the Exchange Act, if any, is required of or voluntarily made by or on behalf of a lock-up party or the company regarding the establishment of such plan, such announcement or filing shall include a statement to the effect that no transfer of ordinary shares may be made under such plan during the restricted period;

•the transfer of ordinary shares pursuant to a bona fide third-party tender offer, merger, consolidation or other similar transaction that is approved by our board of directors (or a duly authorized committee thereof)

involving a change of control of the company in which the acquiring party becomes the beneficial owner (as defined in Rules 13d-3 and 13d-5 of the Exchange Act) of more than 50% of the total voting power of our voting ordinary shares following such transaction provided that all of the lock-up party’s ordinary shares subject to the lock-up agreement that are not so transferred, sold, tendered or otherwise disposed of remain subject the lock-up agreement; and provided, further, that in the event that such tender offer, merger, consolidation or other similar transaction is not completed, the lock-up party’s ordinary shares shall remain subject to the provisions of the lock-up agreement;

•the issuance of ordinary shares upon the exercise of an option or warrant (including net exercise), settlement of restricted stock units (including net settlement) or the conversion of a security outstanding as of the date of this prospectus supplement;

•the filing of a registration statement with the SEC on Form S-8 relating to the offering of securities granted or to be granted in accordance with the terms of an equity incentive plan, employment benefit plan, employment agreement or similar arrangement Act that is existing as of the date of this prospectus supplement (provided that any ordinary shares or securities registered pursuant to such registration statement shall be subject to restrictions described in the preceding paragraphs); and

•the issuance by the company of ordinary shares or the grant by the company of any options or warrants to purchase ordinary shares or any securities convertible into, exchangeable for or that represent the right to receive ordinary shares, in each case, pursuant to and subject to the terms of the company's equity incentive plans or employment benefit plans that are described in this prospectus supplement.

Morgan Stanley & Co. LLC, in its sole discretion, may release the ordinary shares and other securities subject to the lock-up agreements described above in whole or in part at any time.

In order to facilitate the offering of the ordinary shares, the underwriters, pursuant to Regulation M of the Securities Act, may engage in transactions that stabilize, maintain or otherwise affect the price of the ordinary shares. Specifically, the underwriters may sell more shares than they are obligated to purchase under the underwriting agreement, creating a short position. A short sale is covered if the short position is no greater than the number of shares available for purchase by the underwriters under the option to purchase additional shares. The underwriters can close out a covered short sale by exercising the option to purchase additional shares or purchasing shares in the open market. In determining the source of shares to close out a covered short sale, the underwriters will consider, among other things, the open market price of shares compared to the price available under the option to purchase additional shares. The underwriters may also sell shares in excess of the option to purchase additional shares, creating a naked short position. The underwriters must close out any naked short position by purchasing shares in the open market. A naked short position is more likely to be created if the underwriters are concerned that there may be downward pressure on the price of the ordinary shares in the open market after pricing that could adversely affect investors who purchase in this offering. As an additional means of facilitating this offering, the underwriters may bid for, and purchase, ordinary shares in the open market to stabilize the price of the ordinary shares. These activities may raise or maintain the market price of the ordinary shares above independent market levels or prevent or retard a decline in the market price of the ordinary shares. The underwriters are not required to engage in these activities and may end any of these activities at any time.

The underwriters may also impose a penalty bid. This occurs when a particular underwriter repays to the underwriters a portion of the underwriting discount received by it because the representatives have repurchased ordinary shares sold by or for the account of such underwriter in stabilizing or short covering transactions.

We, Mubadala and the underwriters have agreed to indemnify each other against certain liabilities, including liabilities under the Securities Act.

A prospectus supplement in electronic format may be made available on websites maintained by one or more underwriters, or selling group members, if any, participating in this offering. The representatives may agree to allocate a number of ordinary shares to underwriters for sale to their online brokerage account holders. Internet distributions will be allocated by the representatives to underwriters that may make Internet distributions on the same basis as other allocations.

The underwriters and their respective affiliates are full service financial institutions engaged in various activities, which may include securities trading, commercial and investment banking, financial advisory, investment management, investment research, principal investment, hedging, financing and brokerage activities.

Certain of the underwriters and their respective affiliates have, from time to time, performed, do perform and may in the future perform in the ordinary course of business various financial advisory, investment banking, commercial banking services and other services for us, Mubadala and their affiliates, for which they received or will receive customary fees and expenses.

To the extent any underwriter that is not a U.S. registered broker-dealer intends to effect any offers or sales of any ordinary shares in the United States, it will do so through one or more U.S. registered broker-dealers in accordance with the applicable U.S. securities laws and regulations.

In addition, in the ordinary course of their various business activities, the underwriters and their respective affiliates may make or hold a broad array of investments and actively trade debt and equity securities (or related derivative securities) and financial instruments (including bank loans) for their own account and for the accounts of their customers and may at any time hold long and short positions in such securities and instruments. Such investment and securities activities may involve our securities and instruments. The underwriters and their respective affiliates may also make investment recommendations or publish or express independent research views in respect of such securities or instruments and may at any time hold, or recommend to clients that they acquire, long or short positions in such securities and instruments.

Selling Restrictions

European Economic Area

In relation to each Member State of the European Economic Area (each, a “Relevant State”), no shares have been offered or will be offered pursuant to the offering to the public in that Relevant State prior to the publication of a prospectus in relation to the shares which has been approved by the competent authority in that Relevant State or, where appropriate, approved in another Relevant State and notified to the competent authority in that Relevant State, all in accordance with the Prospectus Regulation, except that offers of shares may be made to the public in that Relevant State at any time under the following exemptions under the Prospectus Regulation:

(a)to any legal entity which is a qualified investor as defined under Article 2 of the Prospectus Regulation;

(b)to fewer than 150 natural or legal persons (other than qualified investors as defined under Article 2 of the Prospectus Regulation), subject to obtaining the prior consent of the representatives for any such offer; or

(c)in any other circumstances falling within Article 1(4) of the Prospectus Regulation;

provided that no such offer of shares shall require us or any of our representatives to publish a prospectus pursuant to Article 3 of the Prospectus Regulation or supplement a prospectus pursuant to Article 23 of the Prospectus Regulation and each person who initially acquires any shares or to whom any offer is made will be deemed to have represented, acknowledged, and agreed to and with each of the underwriters and the company that it is a “qualified investor” within the meaning of Article 2(e) of the Prospectus Regulation. In the case of any shares being offered to a financial intermediary as that term is used in Article 5(1) of the Prospectus Regulation, each such financial intermediary will be deemed to have represented, acknowledged, and agreed that the shares acquired by it in the offer have not been acquired on a non-discretionary basis on behalf of, nor have they been acquired with a view to their offer or resale to, persons in circumstances which may give rise to an offer of any shares to the public other than their offer or resale in a Relevant State to qualified investors as so defined or in circumstances in which the prior consent of the underwriters have been obtained to each such proposed offer or resale.

For the purposes of this provision, the expression an “offer to the public” in relation to any shares in any Relevant State means the communication in any form and by any means of sufficient information on the terms of the offer and any shares to be offered so as to enable an investor to decide to purchase or subscribe for any shares, and the expression “Prospectus Regulation” means Regulation (EU) 2017/1129 (as amended).

The above selling restriction is in addition to any other selling restrictions set out below.

In connection with the offering, the underwriters are not acting for anyone other than the issuer and will not be responsible to anyone other than the issuer for providing the protections afforded to their clients nor for providing advice in relation to the offering.

United Kingdom

No shares have been offered or will be offered pursuant to this offering to the public in the United Kingdom, prior to the publication of a prospectus in relation to the shares which has been approved by the Financial Conduct Authority in the United Kingdom in accordance with the UK Prospectus Regulation and the FSMA, except that the shares may be offered to the public in the United Kingdom at any time:

(a)to any legal entity which is a qualified investor as defined under Article 2 of the UK Prospectus Regulation;

(b)to fewer than 150 natural or legal persons (other than qualified investors as defined under Article 2 of the UK Prospectus Regulation), subject to obtaining the prior consent of the representatives for any such offer; or

(c)in any other circumstances falling within Section 86 of the FSMA;

provided that no such offer of shares shall require the company or any underwriter to publish a prospectus pursuant to Section 85 of the FSMA or Article 3 of the UK Prospectus Regulation or supplement a prospectus pursuant to Article 23 of the UK Prospectus Regulation.

Each person in the United Kingdom who initially acquires any ordinary shares or to whom any offer is made will be deemed to have represented, acknowledged and agreed to and with the company and the Underwriters that it is a qualified investor within the meaning of the UK Prospectus Regulation.

In the case of any ordinary shares being offered to a financial intermediary as that term is used in Article 5(1) of the UK Prospectus Regulation, each such financial intermediary will be deemed to have represented, acknowledged and agreed that the Shares acquired by it in the offer have not been acquired on a non-discretionary basis on behalf of, nor have they been acquired with a view to their offer or resale to, persons in circumstances which may give rise to an offer to the public other than their offer or resale in the United Kingdom to qualified investors, in circumstances in which the prior consent of the Underwriters has been obtained to each such proposed offer or resale.

The Company, the underwriters and their affiliates will rely upon the truth and accuracy of the foregoing representations, acknowledgments and agreements.

For the purposes of this provision, the expression an “offer to the public” in relation to the shares in the United Kingdom means the communication in any form and by any means of sufficient information on the terms of the offer and any shares to be offered so as to enable an investor to decide to purchase or subscribe for any shares. The expression “UK Prospectus Regulation” means Regulation (EU) 2017/1129 as it forms part of domestic law by virtue of the European Union (Withdrawal) Act 2018, and the expression “FSMA” means the Financial Services and Markets Act 2000.

In connection with the offering, the underwriters are not acting for anyone other than the issuer and will not be responsible to anyone other than the issuer for providing the protections afforded to their clients nor for providing advice in relation to the offering.

This document is for distribution only to persons who (i) have professional experience in matters relating to investments and who qualify as investment professionals within the meaning of Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended, the “Financial Promotion Order”), (ii) are persons falling within Article 49(2)(a) to (d) (“high net worth companies, unincorporated associations etc.”) of the Financial Promotion Order, (iii) are outside the United Kingdom, or (iv) are persons to whom an invitation or inducement to engage in investment activity (within the meaning of Section 21 of the FSMA) in connection with the

issue or sale of any securities may otherwise lawfully be communicated or caused to be communicated (all such persons together being referred to as “relevant persons”). This document is directed only at relevant persons and must not be acted on or relied on by persons who are not relevant persons. Any investment or investment activity to which this document relates is available only to relevant persons and will be engaged in only with relevant persons.

Japan

No registration pursuant to Article 4, paragraph 1 of the Financial Instruments and Exchange Law of Japan (Law No. 25 of 1948, as amended) (the “FIEL”) has been made or will be made with respect to the solicitation of the application for the acquisition of the ordinary shares.

Accordingly, the ordinary shares have not been, directly or indirectly, offered or sold and will not be, directly or indirectly, offered or sold in Japan or to, or for the benefit of, any resident of Japan (which term as used herein means any person resident in Japan, including any corporation or other entity organized under the laws of Japan) or to others for re-offering or re-sale, directly or indirectly, in Japan or to, or for the benefit of, any resident of Japan except pursuant to an exemption from the registration requirements, and otherwise in compliance with, the FIEL and the other applicable laws and regulations of Japan.

For Qualified Institutional Investors (“QII”)