false000161164700016116472024-08-052024-08-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 5, 2024

FRESHPET, INC.

(Exact name of Registrant as Specified in Its Charter)

| | | | | | | | |

| Delaware | 001-36729 | 20-1884894 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | |

1545 US-206, 1st Floor Bedminster,New Jersey | | 07921 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (201) 520-4000

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock | FRPT | NASDAQ Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On August 5, 2024, Freshpet, Inc. (“Freshpet”) issued a press release disclosing its financial results for the quarter ended June 30, 2024. The full text of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

As previously announced, Freshpet will hold a conference call at 8:00 a.m., Eastern Time, on Monday, August 5, 2024, to discuss its financial results for the quarter ended June 30, 2024.

Freshpet references non-GAAP financial information in the press release and makes similar references in the transcript to the conference call. A reconciliation of these non-GAAP financial measures to the nearest comparable GAAP financial measures is contained in the attached Exhibit 99.1 press release.

Item 7.01. Regulation FD Disclosure.

On August 5, 2024, Freshpet published to the investor relations section of its website a presentation which will be used by Freshpet’s management team in meetings with analysts and stockholders. A copy of the presentation is attached hereto as Exhibit 99.2 and is incorporated herein by reference.

The information furnished with Item 2.02 and this Item 7.01, including Exhibits 99.1 and 99.2, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (“the Exchange Act”) or incorporated by reference into any other filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Freshpet uses the “Investors” section of its website (investors.freshpet.com) as a means of disclosing material non-public information and for complying with its disclosure obligations under Regulation FD.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

Exhibit Number | | Description |

| | |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| FRESHPET, INC. |

| | |

| Date: August 5, 2024 | By: | /s/ Todd Cunfer |

| Name: Todd Cunfer |

| Title: Chief Financial Officer |

Exhibit 99.1

Freshpet, Inc. Reports Second Quarter 2024 Financial Results

Significant Profitability and Operating Cash Flow Improvement

Second Quarter 2024 Net Sales Driven Entirely by Volume Growth

Company Raises 2024 Net Sales and Adjusted EBITDA Guidance

Bedminster, N.J. – August 5, 2024 – Freshpet, Inc. (“Freshpet” or the “Company”) (Nasdaq: FRPT) today reported financial results for its second quarter ended June 30, 2024.

Second Quarter 2024 Financial Highlights Compared to Prior Year Period

•Net sales of $235.3 million, an increase of 28.3%.

•Net loss of $1.7 million, compared to the prior year period net loss of $17.0 million.

•Gross margin of 39.9%, compared to the prior year period of 32.3%.

•Adjusted Gross Margin of 45.9%, compared to the prior year period of 39.8%.1

•Adjusted EBITDA of $35.1 million, compared to the prior year period of $9.0 million.1

"Freshpet is delivering disciplined growth. That has enabled us to significantly improve profitability while continuing to deliver category-leading net sales growth. The momentum we have today gives us even greater confidence in our ability to achieve our 2027 targets, a number of which we have already exceeded,” commented Billy Cyr, Freshpet’s Chief Executive Officer. “We are raising our net sales and Adjusted EBITDA guidance for the year to reflect our outperformance in the first half, as well as our conviction in our ability to execute in the second half of the year. If we continue to deliver the kind of disciplined growth we have achieved so far this year, we believe we will create meaningful shareholder value in a way that serves pets, people, and the planet."

Second Quarter 2024

Net sales increased 28.3% to $235.3 million for the second quarter of 2024 compared to $183.3 million for the prior year period. The increase in net sales was entirely driven by volume gains of 28.3%.

Gross profit was $94.0 million, or 39.9% as a percentage of net sales, for the second quarter of 2024, compared to $59.2 million, or 32.3% as a percentage of net sales, for the prior year period. The increase in reported gross profit as a percentage of net sales was primarily due to lower input costs, reduced quality costs, and improved leverage on plant expenses. For the second quarter of 2024, Adjusted Gross Profit was $108.0 million, or 45.9% as a percentage of net sales, compared to $73.0 million, or 39.8% as a percentage of net sales, for the prior year period.1

Selling, general and administrative expenses (“SG&A”) were $95.7 million for the second quarter of 2024 compared to $76.0 million for the prior year period. As a percentage of net sales, SG&A decreased to 40.7% for the second quarter of 2024 compared to 41.5% for the prior year period. SG&A as a percentage of net sales decreased by 80 basis points, primarily due to reduced logistics costs and media as a percentage of net sales, offset by higher share-based compensation. Adjusted SG&A for the second quarter of 2024 was $72.9 million, or 31.0% as a percentage of net sales, compared to $64.0 million, or 34.9% as a percentage of net sales, for the prior year period.1

Net loss was $1.7 million for the second quarter of 2024 compared to net loss of $17.0 million for the prior year period. The decrease in net loss was due to contribution from higher sales, improved gross margin, and reduced logistics costs as a percentage of net sales, partially offset by increased SG&A expenses.

1Adjusted Gross Margin, Adjusted Gross Profit, Adjusted SG&A and Adjusted EBITDA are non-GAAP financial measures. See "Non-GAAP Measures" for how the Company defines these measures and the financial tables that accompany this release for reconciliations of these measures to the closest comparable GAAP measures.

Adjusted EBITDA was $35.1 million for the second quarter of 2024 compared to $9.0 million for the prior year period.1 The increase in Adjusted EBITDA was a result of increased Adjusted Gross Profit partially offset by higher Adjusted SG&A expenses.

First Six Months of 2024

Net sales increased 30.9% to $459.1 million for the first six months of 2024 compared to $350.9 million for the prior year period. The increase in net sales was primarily driven by volume gains of 29.4%.

Gross profit was $182.1 million, or 39.7% as a percentage of net sales, for the first six months of 2024, compared to $110.0 million, or 31.4% as a percentage of net sales, for the prior year period. The increase in reported gross profit as a percentage of net sales was primarily due to lower input costs, reduced quality costs, and improved leverage on plant expenses. For the first six months of 2024, Adjusted Gross Profit was $209.5 million, or 45.6% as a percentage of net sales, compared to $137.5 million, or 39.2% as a percentage of net sales, for the prior year period.1

Selling, general and administrative expenses (“SG&A”) were $175.4 million for the first six months of 2024 compared to $148.3 million for the prior year period. As a percentage of net sales, SG&A decreased to 38.2% for the first six months of 2024 compared to 42.3% for the prior year period. SG&A as a percentage of net sales decreased by 410 basis points, primarily due to reduced logistics costs and media as a percentage of net sales, offset by higher share-based compensation. Adjusted SG&A for the first six months of 2024 was $143.8 million, or 31.3% as a percentage of net sales, compared to $125.5 million, or 35.8% as a percentage of net sales, for the prior year period.1

Net income was $16.9 million for the first six months of 2024 compared to a net loss of $41.7 million for the prior year period. The improvement in net income was due to contribution from higher sales, improved gross margin, reduced logistics costs as a percentage of net sales, and gain on equity investment, partially offset by increased SG&A expenses.

Adjusted EBITDA was $65.7 million for the first six months of 2024, compared to $12.0 million for the prior year period.1 The increase in Adjusted EBITDA was a result of increased Adjusted Gross Profit partially offset by higher Adjusted SG&A expenses.

Balance Sheet

As of June 30, 2024, the Company had cash and cash equivalents of $251.7 million with $394.1 million of debt outstanding net of $8.4 million of unamortized debt issuance costs. For the six months ended June 30, 2024, cash from operations was $47.8 million, an increase of $48.1 million compared to the prior year period.

The Company will utilize its balance sheet to support its ongoing capital needs in connection with its long-term capacity plan.

Outlook

For full year 2024, the Company is updating its guidance and now expects the following:

•Net sales of at least $965 million, an increase of at least 26% from 2023, compared to at least $950 million in the previous guidance;

•Adjusted EBITDA of at least $140 million, compared to at least $120 million in the previous guidance; and

•Capital expenditures of ~$200 million, compared to ~$210 million in the previous guidance.

The Company does not provide guidance for net income (loss), the U.S. GAAP measure most directly comparable to Adjusted EBITDA, and similarly cannot provide a reconciliation between its forecasted Adjusted EBITDA and net income (loss) metrics without unreasonable effort due to the unavailability of reliable estimates for certain components of net income (loss) and the respective reconciliations, including the timing of and amount of costs of goods sold and selling, general and administrative expenses. These items are not within the Company's control and may vary greatly between periods and could significantly impact future results.

Conference Call & Earnings Presentation Webcast Information

As previously announced, today, August 5, 2024, the Company will host a conference call beginning at 8:00 a.m. Eastern Time with members of its leadership team. The conference call webcast will be available live over the Internet through the "Investors" section of the Company's website at www.freshpet.com. To participate on the live call, listeners in North America may dial (877) 407-0792 and international listeners may dial (201) 689-8263.

A replay of the conference call will be archived on the Company's website and telephonic playback will be available from 12:00 p.m. Eastern Time today through August 19, 2024. North American listeners may dial (844) 512-2921 and international listeners may dial (412) 317-6671; the passcode is 13747795.

About Freshpet

Freshpet’s mission is to improve the lives of dogs and cats through the power of fresh, real food. Freshpet foods are blends of fresh meats, vegetables and fruits farmed locally and made at our Freshpet Kitchens. We thoughtfully prepare our foods using natural ingredients, cooking them in small batches at lower temperatures to preserve the natural goodness of the ingredients. Freshpet foods and treats are kept refrigerated from the moment they are made until they arrive at Freshpet Fridges in your local market.

Our foods are available in select grocery, mass, digital, pet specialty, and club retailers across the United States, Canada and Europe. From the care we take to source our ingredients and make our food, to the moment it reaches your home, our integrity, transparency and social responsibility are the way we like to run our business. To learn more, visit www.freshpet.com.

Connect with Freshpet:

https://www.facebook.com/Freshpet

https://x.com/Freshpet

http://instagram.com/Freshpet

http://pinterest.com/Freshpet

https://www.tiktok.com/@Freshpet

https://www.youtube.com/user/freshpet400

Forward Looking Statements

Certain statements in this release constitute “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements relating to our ability to achieve our 2027 targets, create meaningful shareholder value, and guidance with respect to 2024 net sales, Adjusted EBITDA and capital expenditures. These statements are based on management's current opinions, expectations, beliefs, plans, objectives, assumptions or projections regarding future events or future results. While Freshpet believes that its assumptions are reasonable, it is very difficult to predict the impact of known factors, and, of course, it is impossible to anticipate all factors that could affect actual results. There are several risks and uncertainties which could cause actual results, performance, and achievements to differ materially from those stated or implied by the forward-looking statements described herein, including, most prominently, the risks discussed under the heading “Risk Factors” in the Company's latest annual report on Form 10-K and its quarterly reports on Form 10-Q filed with the Securities and Exchange Commission. Such forward-looking statements are made only as of the date of this release. Freshpet undertakes no obligation to publicly update or revise any forward-looking statement because of new information, future events or otherwise, except as otherwise required by law. If we do update one or more forward-looking statements, no inference should be made that we will make additional updates with respect to those or other forward-looking statements.

Non-GAAP Financial Measures

Freshpet uses the following non-GAAP financial measures in its financial communications. These non-GAAP financial measures should be considered as supplements to the U.S. GAAP reported measures, should not be considered replacements for, or superior to, the U.S. GAAP measures and may not be comparable to similarly named measures used by other companies.

•Adjusted Gross Profit

•Adjusted Gross Profit as a percentage of net sales (Adjusted Gross Margin)

•Adjusted SG&A Expenses

•Adjusted SG&A Expenses as a percentage of net sales

•EBITDA

•Adjusted EBITDA

•Adjusted EBITDA as a percentage of net sales

Adjusted Gross Profit: Freshpet defines Adjusted Gross Profit as gross profit before depreciation expense, non-cash share-based compensation and loss on disposal of manufacturing equipment.

Adjusted SG&A Expenses: Freshpet defines Adjusted SG&A as SG&A expenses before depreciation and amortization expense, non-cash share-based compensation, implementation and other costs associated with the implementation of an enterprise resource planning ("ERP") system, fees related to the capped call transactions, loss on disposal of equipment, and advisory fees related to activism engagement.

EBITDA and Adjusted EBITDA: EBITDA represents net income (loss) plus interest expense net of interest income, income tax expense and depreciation and amortization expense, and Adjusted EBITDA represents EBITDA plus loss on equity method investment, gain on equity investment, non-cash share-based compensation expense, implementation and other costs associated with the implementation of an ERP system, loss on disposal of property, plant and equipment, fees related to the capped call transactions, and advisory fees related to activism engagement.

Management believes that the non-GAAP financial measures are meaningful to investors because they provide a view of the Company with respect to ongoing operating results. The non-GAAP financial measures are shown as supplemental disclosures in this release because they are widely used by the investment community for analysis and comparative evaluation. They also provide additional metrics to evaluate the Company’s operations and, when considered with both the Company’s GAAP results and the reconciliation to the most comparable U.S. GAAP measures, provide a more complete understanding of the Company’s business than could be obtained absent this disclosure. The non-GAAP measures are not and should not be considered an alternative to the most comparable U.S. GAAP measures or any other figure calculated in accordance with U.S. GAAP, or as an indicator of operating performance. The Company’s calculation of the non-GAAP financial measures may differ from methods used by other companies. Management believes that the non-GAAP measures are important to an understanding of the Company's overall operating results in the periods presented. The non-GAAP financial measures are not recognized in accordance with U.S. GAAP and should not be viewed as an alternative to U.S. GAAP measures of performance.

Investor Contact:

Rachel Ulsh

Rulsh@freshpet.com

Media Contact:

Press@freshpet.com

FRESHPET, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited, in thousands, except per share data)

| | | | | | | | | | | |

| June 30,

2024 | | December 31,

2023 |

ASSETS | | | |

CURRENT ASSETS: | | | |

Cash and cash equivalents | $ | 251,699 | | | $ | 296,871 | |

Accounts receivable, net of allowance for doubtful accounts | 68,156 | | | 56,754 | |

Inventories, net | 73,252 | | | 63,238 | |

Prepaid expenses | 8,566 | | | 7,615 | |

Other current assets | 3,547 | | | 2,841 | |

Total Current Assets | 405,220 | | | 427,319 | |

Property, plant and equipment, net | 1,032,730 | | | 979,164 | |

Deposits on equipment | 1,109 | | | 1,895 | |

Operating lease right of use assets | 2,851 | | | 3,616 | |

Long term investment in equity securities | 33,446 | | | 23,528 | |

Other assets | 30,975 | | | 28,899 | |

Total Assets | $ | 1,506,331 | | | $ | 1,464,421 | |

LIABILITIES AND STOCKHOLDERS' EQUITY | | | |

CURRENT LIABILITIES: | | | |

Accounts payable | $ | 34,051 | | | $ | 36,096 | |

Accrued expenses | 52,884 | | | 49,816 | |

Current operating lease liabilities | 1,034 | | | 1,312 | |

Current finance lease liabilities | 2,031 | | | 1,998 | |

Total Current Liabilities | $ | 90,000 | | | $ | 89,222 | |

Convertible senior notes | 394,108 | | | 393,074 | |

Long term operating lease liabilities | 2,064 | | | 2,591 | |

Long term finance lease liabilities | 24,355 | | | 26,080 | |

Total Liabilities | $ | 510,527 | | | $ | 510,967 | |

Commitments and contingencies | — | | | — | |

STOCKHOLDERS' EQUITY: | | | |

Common stock — voting, $0.001 par value, 200,000 shares authorized, 48,493 issued and 48,479 outstanding on June 30, 2024, and 48,277 issued and 48,263 outstanding on December 31, 2023 | 48 | | | 48 | |

Additional paid-in capital | 1,308,623 | | | 1,282,984 | |

Accumulated deficit | (311,823) | | | (328,731) | |

Accumulated other comprehensive loss | (788) | | | (591) | |

Treasury stock, at cost — 14 shares on June 30, 2024 and on December 31, 2023 | (256) | | | (256) | |

Total Stockholders' Equity | 995,804 | | | 953,454 | |

Total Liabilities and Stockholders' Equity | $ | 1,506,331 | | | $ | 1,464,421 | |

FRESHPET, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE (LOSS) INCOME

(Unaudited, in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| For the Three Months Ended

June 30, | | For the Six Months Ended

June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

NET SALES | $ | 235,253 | | | $ | 183,331 | | | $ | 459,102 | | | $ | 350,853 | |

COST OF GOODS SOLD | 141,301 | | | 124,087 | | | 276,992 | | | 240,849 | |

GROSS PROFIT | 93,952 | | | 59,244 | | | 182,110 | | | 110,004 | |

SELLING, GENERAL, AND ADMINISTRATIVE EXPENSES | 95,702 | | | 75,996 | | | 175,396 | | | 148,267 | |

(LOSS) INCOME FROM OPERATIONS | (1,750) | | | (16,752) | | | 6,714 | | | (38,263) | |

OTHER INCOME (EXPENSES): | | | | | | | |

Interest and Other Income, net | 2,861 | | | 4,108 | | | 6,195 | | | 5,055 | |

Interest Expense | (2,751) | | | (3,329) | | | (5,811) | | | (6,501) | |

Gain on Equity Investment | — | | | — | | | 9,918 | | | — | |

| 110 | | | 779 | | | 10,302 | | | (1,446) | |

(LOSS) INCOME BEFORE INCOME TAXES | (1,640) | | | (15,972) | | | 17,016 | | | (39,708) | |

INCOME TAX EXPENSE | 54 | | | 70 | | | 108 | | | 140 | |

LOSS ON EQUITY METHOD INVESTMENT | — | | | 910 | | | — | | | 1,890 | |

(LOSS) INCOME ATTRIBUTABLE TO COMMON STOCKHOLDERS | $ | (1,694) | | | $ | (16,952) | | | $ | 16,908 | | | $ | (41,738) | |

OTHER COMPREHENSIVE LOSS: | | | | | | | |

Change in foreign currency translation | $ | (79) | | | $ | (2,039) | | | $ | (197) | | | $ | (2,033) | |

TOTAL OTHER COMPREHENSIVE LOSS | (79) | | | (2,039) | | | (197) | | | (2,033) | |

TOTAL COMPREHENSIVE (LOSS) INCOME | $ | (1,773) | | | $ | (18,991) | | | $ | 16,711 | | | $ | (43,771) | |

NET (LOSS) INCOME PER SHARE ATTRIBUTABLE TO COMMON STOCKHOLDERS | | | | | | | |

-BASIC | $ | (0.03) | | | $ | (0.35) | | | $ | 0.35 | | | $ | (0.87) | |

-DILUTED | $ | (0.03) | | | $ | (0.35) | | | $ | 0.34 | | | $ | (0.87) | |

WEIGHTED AVERAGE SHARES OF COMMON STOCK OUTSTANDING | | | | | | | |

-BASIC | 48,461 | | 48,132 | | 48,400 | | 48,089 |

-DILUTED | 48,461 | | 48,132 | | 50,154 | | 48,089 |

FRESHPET, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

(Unaudited, in thousands)

| | | | | | | | | | | |

| For the Six Months Ended

June 30, |

| 2024 | | 2023 |

CASH FLOWS FROM OPERATING ACTIVITIES: | | | |

Net income (loss) | $ | 16,908 | | | $ | (41,738) | |

Adjustments to reconcile net income (loss) to net cash flows provided by (used in) operating activities: | | | |

Provision for loss on accounts receivable | 13 | | | 8 | |

Loss on disposal of property, plant and equipment | 286 | | | 464 | |

Share-based compensation | 25,755 | | | 16,862 | |

Inventory obsolescence | 699 | | | — | |

Depreciation and amortization | 33,324 | | | 28,930 | |

Write-off and amortization of deferred financing costs and loan discount | 1,035 | | | 3,034 | |

Change in operating lease right of use asset | 766 | | | 807 | |

Loss on equity method investment | — | | | 1,890 | |

Gain on equity investment | (9,918) | | | — | |

Amortization of discount on short-term investments | — | | | (996) | |

Changes in operating assets and liabilities: | | | |

Accounts receivable | (11,407) | | | 5,675 | |

Inventories | (8,685) | | | (6,979) | |

Prepaid expenses and other current assets | (3,968) | | | (430) | |

Other assets | (1,240) | | | (3,762) | |

Accounts payable | (981) | | | (7,488) | |

Accrued expenses | 6,069 | | | 4,529 | |

Operating lease liability | (837) | | | (1,037) | |

Net cash flows provided by (used in) operating activities | 47,819 | | | (231) | |

CASH FLOWS FROM INVESTING ACTIVITIES: | | | |

Purchase of short-term investments | — | | | (113,441) | |

Acquisitions of property, plant and equipment, software and deposits on equipment | (94,795) | | | (102,507) | |

Net cash flows used in investing activities | (94,795) | | | (215,948) | |

CASH FLOWS FROM FINANCING ACTIVITIES: | | | |

Proceeds from exercise of options to purchase common stock | 4,196 | | | 3,061 | |

Tax withholdings related to net shares settlements of restricted stock units | (1,440) | | | (850) | |

Purchase of capped call options | — | | | (66,211) | |

Proceeds from issuance of convertible senior notes | — | | | 393,518 | |

Debt issuance costs | — | | | (2,026) | |

Principal payments under finance lease obligations | (952) | | | — | |

Net cash flows provided by financing activities | 1,804 | | | 327,492 | |

NET CHANGE IN CASH AND CASH EQUIVALENTS | (45,172) | | | 111,313 | |

CASH AND CASH EQUIVALENTS, BEGINNING OF YEAR | 296,871 | | | 132,735 | |

CASH AND CASH EQUIVALENTS, END OF PERIOD | $ | 251,699 | | | $ | 244,048 | |

FRESHPET, INC. AND SUBSIDIARIES

RECONCILIATION BETWEEN GROSS PROFIT AND ADJUSTED GROSS PROFIT

| | | | | | | | | | | | | | | | | | | | | | | |

| For the Three Months Ended

June 30, | | For the Six Months Ended

June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| (Dollars in thousands) |

| Gross profit | $ | 93,952 | | | $ | 59,244 | | | $ | 182,110 | | | $ | 110,004 | |

| Depreciation expense | 11,827 | | | 10,618 | | | 22,502 | | | 21,339 | |

| Non-cash share-based compensation | 2,220 | | | 3,161 | | | 4,841 | | | 6,117 | |

| Loss on disposal of manufacturing equipment | 32 | | | — | | | 53 | | | — | |

| Adjusted Gross Profit | $ | 108,031 | | | $ | 73,023 | | | $ | 209,506 | | | $ | 137,460 | |

| Adjusted Gross Profit as a % of Net Sales | 45.9 | % | | 39.8 | % | | 45.6 | % | | 39.2 | % |

FRESHPET, INC. AND SUBSIDIARIES

RECONCILIATION BETWEEN SG&A EXPENSES AND ADJUSTED SG&A EXPENSES

| | | | | | | | | | | | | | | | | | | | | | | |

| For the Three Months Ended

June 30, | | For the Six Months Ended

June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| (Dollars in thousands) |

| SG&A expenses | $ | 95,702 | | | $ | 75,996 | | | $ | 175,396 | | | $ | 148,267 | |

| Depreciation and amortization expense | 5,385 | | | 3,820 | | | 10,455 | | | 7,591 | |

| Non-cash share-based compensation (a) | 17,313 | | | 5,286 | | | 20,913 | | | 10,745 | |

| Loss on disposal of equipment | 104 | | | 196 | | | 233 | | | 464 | |

| Enterprise Resource Planning (b) | — | | | 537 | | | — | | | 1,338 | |

| Capped Call Transactions fees (c) | — | | | — | | | — | | | 113 | |

| Activism engagement (d) | — | | | 2,241 | | | — | | | 2,630 | |

| Organization changes (e) | — | | | (67) | | | — | | | (67) | |

| Adjusted SG&A Expenses | $ | 72,900 | | | $ | 63,983 | | | $ | 143,795 | | | $ | 125,453 | |

| Adjusted SG&A Expenses as a % of Net Sales | 31.0 | % | | 34.9 | % | | 31.3 | % | | 35.8 | % |

(a)Includes true-ups to share-based compensation expense compared to prior periods. We have certain outstanding share-based awards with performance-based vesting conditions that require the achievement of certain Adjusted EBITDA and/or Net Sales targets as a condition of vesting. At each reporting period, we reassess the probability of achieving the performance criteria and the performance period required to meet those targets. When the probability of achieving such performance conditions changes, the compensation cost previously recorded is adjusted as needed. When such performance conditions are deemed to be improbable of achievement, the compensation cost previously recorded is reversed.

(b)Represents costs associated with the implementation of an ERP system.

(c)Represents fees associated with the Capped Call Transactions.

(d)Represents advisory fees related to activism engagement.

(e)Represents a true-up to transition costs related to the organization changes designed to support growth, including several changes in organizational structure designed to enhance capabilities and support long-term growth objectives.

FRESHPET, INC. AND SUBSIDIARIES

RECONCILIATION BETWEEN NET (LOSS) AND ADJUSTED EBITDA

| | | | | | | | | | | | | | | | | | | | | | | |

| For the Three Months Ended

June 30, | | For the Six Months Ended

June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| (Dollars in thousands) |

Net (loss) income | $ | (1,694) | | | $ | (16,952) | | | $ | 16,908 | | | $ | (41,738) | |

Depreciation and amortization | 17,212 | | | 14,438 | | | 32,957 | | | 28,930 | |

Interest income, net of interest expense | (110) | | | (779) | | | (384) | | | 1,446 | |

Income tax expense | 54 | | | 70 | | | 108 | | | 140 | |

EBITDA | 15,462 | | | (3,223) | | | 49,589 | | | (11,222) | |

Loss on equity method investment | — | | | 910 | | | — | | | 1,890 | |

Gain on equity investment | — | | | — | | | (9,918) | | | — | |

Loss on disposal of property, plant and equipment | 136 | | | 196 | | | 286 | | | 464 | |

Non-cash share-based compensation (a) | 19,533 | | | 8,447 | | | 25,755 | | | 16,862 | |

Enterprise Resource Planning (b) | — | | | 537 | | | — | | | 1,338 | |

Capped Call Transactions fees (c) | — | | | — | | | — | | | 113 | |

Activism engagement (d) | — | | | 2,240 | | | — | | | 2,629 | |

Organization changes (e) | — | | | (67) | | | — | | | (67) | |

Adjusted EBITDA | $ | 35,131 | | | $ | 9,040 | | | $ | 65,712 | | | $ | 12,007 | |

Adjusted EBITDA as a % of Net Sales | 14.9 | % | | 4.9 | % | | 14.3 | % | | 3.4 | % |

(a)Includes true-ups to share-based compensation expense compared to prior periods. We have certain outstanding share-based awards with performance-based vesting conditions that require the achievement of certain Adjusted EBITDA and/or Net Sales targets as a condition of vesting. At each reporting period, we reassess the probability of achieving the performance criteria and the performance period required to meet those targets. When the probability of achieving such performance conditions changes, the compensation cost previously recorded is adjusted as needed. When such performance conditions are deemed to be improbable of achievement, the compensation cost previously recorded is reversed.

(b)Represents costs associated with the implementation of an ERP system.

(c)Represents fees associated with the Capped Call Transactions.

(d)Represents advisory fees related to activism engagement.

(e)Represents a true-up to transition costs related to the organization changes designed to support growth, including several changes in organizational structure designed to enhance capabilities and support long-term growth objectives.

Q2 2024 EARNINGS PRESENTATION1 Q2 2024 Earnings August 5, 2024

Q2 2024 EARNINGS PRESENTATION2 Q2 024 EAR INGS PR SEN ATION Forward Looking Statements & Non-GAAP Measures FORWARD-LOOKING STATEMENTS Certain statements in this presentation by Freshpet, Inc. (the “Company”) constitute “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995 and are based on our current expectations and assumptions. These forward- looking statements, which include any statements related to the timing of Freshpet Kitchens Expansion and capacity, our long-term strategy, focus, 2027 goals, our pace in achieving these goals, growth prospects, FY 2024 guidance and associated considerations. Words such as "anticipate", "believe", "could", "estimate", "expect", "guidance", "intend", "may", "might", "outlook", "plan", "predict", "seek", "will", "would" and variations of such word and similar future or conditional expressions are intended to identify forward looking statements. Such statements are subject to risks and uncertainties that could cause actual results to differ materially from those discussed in the forward- looking statements including difficulties in construction, third party data presented accompanying such statements, and most prominently, the risks discussed under the heading “Risk Factors” in the Company's latest annual report on Form 10-K and quarterly reports on Form 10-Q filed with the Securities and Exchange Commission. Such forward-looking statements are made only as of the date of this presentation. Freshpet undertakes no obligation to publicly update or revise any forward-looking statement because of new information, future events or otherwise, except as otherwise required by law. If we do update one or more forward-looking statements, no inference should be made that we will make additional updates with respect to those or other forward-looking statements. NON-GAAP MEASURES Freshpet uses certain non-GAAP financial measures, including EBITDA, adjusted EBITDA, adjusted EBITDA as a % of net sales (adjusted EBITDA Margin), adjusted Gross Profit, adjusted Gross Profit as a % of net sales (adjusted Gross Margin), adjusted SG&A and adjusted SG&A as a % of net sales. These non-GAAP financial measures should be considered as supplements to GAAP reported measures, should not be considered replacements for, or superior to, GAAP measures and may not be comparable to similarly named measures used by other companies. Freshpet defines EBITDA as net income (loss) plus interest expense, income tax expense and depreciation and amortization expense, and adjusted EBITDA as EBITDA plus net income (loss) on equity method investment, non-cash share-based compensation, fees related to equity offerings of our common stock, implementation and other costs associated with the implementation of an ERP system, and other expenses, including loss on disposal of equipment, COVID-19 expenses and organization changes designed to support long-term growth objectives. Freshpet defines adjusted Gross Profit as gross profit before depreciation expense, COVID-19 expense and non-cash share- based compensation, and adjusted SG&A as SG&A expenses before depreciation and amortization expense, non-cash share-based compensation, gain (loss) on disposal of equipment, fees related to equity offerings of our common stock, implementation and other costs associated with the implementation of an ERP system, COVID-19 expense and organization changes designed to support long term growth objectives. Management believes that the non-GAAP financial measures are meaningful to investors because they provide a view of the Company with respect to ongoing operating results. Non-GAAP financial measures are shown as supplemental disclosures in this presentation because they are widely used by the investment community for analysis and comparative evaluation. They also provide additional metrics to evaluate the Company’s operations and, when considered with both the Company’s GAAP results and the reconciliation to the most comparable GAAP measures, provide a more complete understanding of the Company’s business than could be obtained absent this disclosure. adjusted EBITDA is also an important component of internal budgeting and setting management compensation. The non-GAAP measures are not and should not be considered an alternative to the most comparable GAAP measures or any other figure calculated in accordance with GAAP, or as an indicator of operating performance. The Company’s calculation of the non-GAAP financial measures may differ from methods used by other companies. Management believes that the non-GAAP measures are important to an understanding of the Company’s overall operating results in the periods presented. The non-GAAP financial measures are not recognized in accordance with GAAP and should not be viewed as an alternative to GAAP measures of performance. Certain of these measures represent the Company's guidance for fiscal year 2024. The Company is unable to reconcile these forward-looking non-GAAP financial measures to the most directly comparable GAAP measures without unreasonable efforts because the Company is currently unable to predict with a reasonable degree of certainty the type and impact of certain items, including the timing of and amount of costs of goods sold and selling, general and administrative expenses, that would be expected to impact GAAP measures for these periods but would not impact the non-GAAP measures. The unavailable information could significantly impact our financial results. These items are not within the Company's control and may vary greatly between periods. Based on the foregoing, the Company believes that providing estimates of the amounts that would be required to reconcile these forecasted non-GAAP measures to forecasted GAAP measures would imply a degree of precision that would be confusing or misleading to investors for the reasons identified above.

Q2 2024 EARNINGS PRESENTATION3 Freshpet strengthens the bond between people and our pets so that we both live longer, healthier and happier lives while being kind to the planet. 1

Q2 2024 EARNINGS PRESENTATION4 MAINSTREAM Expand the Freshpet consumer base MAIN MEAL Increase the percentage of consumers who are HIPPOHs* MORE PROFITABLE Create a sustainable business by improving our margin and increasing our capital efficiency *High profit pet owning households 1

Q2 2024 EARNINGS PRESENTATION5 Highlights

Q2 2024 EARNINGS PRESENTATION6 "Freshpet is delivering disciplined growth. That has enabled us to significantly improve profitability while continuing to deliver category-leading net sales growth.”

Q2 2024 EARNINGS PRESENTATION7 Source: Internal Data FINANCIAL RETAIL Q2 2024 YoY Change YoY Change Net Sales $235.3M +28% Household Penetration +25% Adjusted Gross Margin* 45.9% +610 bps Buy Rate +3% Adjusted EBITDA $35.1M +$26.1M Cubic Feet +15% Adjusted EBITDA Margin* 14.9% +1,000 bps Store Count +6% Logistics Costs* 5.8% -220 bps Total Distribution Points +17% Input Costs* 29.8% -460 bps Quality Costs* 2.7% -90 bps Operating Cash Flow $42.4M +$28.9M *As a percent of net sales Q2 2024: Robust growth and profitability improvement across each key metric

Q2 2024 EARNINGS PRESENTATION8 Strong performance driven by key fundamentals: • 24th consecutive quarter of >25% net sales growth • Volume-based growth of 28% • Household penetration growth of 25% in-line with long-term target • Media spend driving household penetration at a healthy customer acquisition cost • 770 basis point improvement across quality, input, and logistics costs in Q2 2024 • Adjusted gross margin, input, quality and logistics costs all exceeded long-term targets in Q2 2024 • Adding organizational capabilities at all levels to support growth • Expanding capacity on-budget and on-time while improving margins • Strong fill rates (high 90s) support excellent customer service Strength of the Freshpet growth model Improved operational effectiveness Operating discipline to balance capacity and demand at a high growth rate Source: Internal data; Numerator Panel data for the 52-week periods ending 6/30/2024

Q2 2024 EARNINGS PRESENTATION9 Long-term tailwinds supporting our growth: • Growing importance of pets in our lives • Long-term trend we have seen for over a decade • Consumers recognize quality for the price, not just price • Find value in a differentiated product • Heaviest users growing faster than total households Humanization of Pets Value

Q2 2024 EARNINGS PRESENTATION10 Vast runway for growth in a growing category MAINSTREAM 1. NielsenIQ Total US Pet Food $ - OmniChannel by Category 52 Weeks Ended 6/29/24 2. Nielsen MegaChannel 52 Weeks Ended 6/29/24, Gently Cooked Fresh/Frozen Branded Dog Food $53B U.S. pet food category1 $36B Dog food category1 3% Freshpet market share of dog food1 Freshpet market share of fresh/frozen in measured channels2 96%

Q2 2024 EARNINGS PRESENTATION11 6.6 7.7 9.4 10.2 12.8 - 2.0 4.0 6.0 8.0 10.0 12.0 14.0 2020 2021 2022 2023 2024 +8% +25% +22% +17% Continued growth in consumer franchise; added 2.5m+ households YoYMAINSTREAM Source: Numerator Panel data for the 52-week periods ending 7/5/2020, 7/4/2021, 7/3/2022, 7/2/2023, 6/30/2024 Freshpet Household Penetration Growth (in millions) (52 weeks)

Q2 2024 EARNINGS PRESENTATION12 1.8 2.4 3.1 3.6 4.8 $195.86 $207.42 $211.76 $241.24 $237.35 $175.00 $195.00 $215.00 $235.00 $255.00 $275.00 $295.00 0.0 1.0 2.0 3.0 4.0 5.0 6.0 2020 2021 2022 2023 2024 Freshpet sales are increasingly concentrated in our heaviest users (HIPPOHs*) and account for 89% of Q2 2024 net sales Source: Numerator data for 52-week periods ending 7/5/2020, 7/4/2021, 7/3/2022, 7/2/2023, 6/30/2024 *High profit pet owning households MAIN MEAL % of total Freshpet households that are SH/H 27% 31% 33% 36% 37% Freshpet Users who are Super Heavy/Heavy Buyers (in millions) Super Heavy/Heavy HHP Super Heavy/Heavy Buy Rate 89% of Freshpet sales

Q2 2024 EARNINGS PRESENTATION13 $63.26 $75.64 $80.35 $96.77 $99.94 $0.00 $20.00 $40.00 $60.00 $80.00 $100.00 2020 2021 2022 2023 2024 MAIN MEAL Converting toppers into main meal users will continue to increase buy rate Source: Numerator Panel data for the 52-week periods ending 7/5/2020, 7/4/2021, 7/3/2022, 7/2/2023, 6/30/2024 Freshpet Buy Rate (52 weeks) +3%+20% +6% +20%

Q2 2024 EARNINGS PRESENTATION14 Expanding depth and breadth: 22% of all stores have multiple fridges Source: Internal data for the period ending 6/30/24; *U.S. Fridges Freshpet Store Count Number of Fridges per Store* Second/Third Fridges 22% One Fridge 78% YTD +720 10,826 13,387 15,015 16,609 18,004 19,499 21,570 22,716 23,631 25,281 26,777 27,497 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2Q 2024

Q2 2024 EARNINGS PRESENTATION15 MORE PROFITABLE Enhancing margins through improved operating performance and leveraging scale and efficiency Source: Internal Data 1. Excluding an $11.1 million true-up of non-cash share-based compensation based on multi-year share-based awards granted in fiscal year 2020, net income for Q2 2024 would have been $9.4 million. Q2 2024 Adj. Gross Margin % of net sales Q2 2024 Adj. EBITDA ($m) % of net sales 39.8% 45.9% Q2 2023 Q2 2024 $9.0 $35.1 Q2 2023 Q2 2024 4.9% 14.9% Gross Margin (GAAP) 39.9%32.3% Net loss (income) ($17.0m) ($1.7m)1

Q2 2024 EARNINGS PRESENTATION16 -220 bps Q2 2024 -90 bps Q2 2024 -460 bps Q2 2024 Improved costs by 770 bps in Q2 2024 across key focus areas MORE PROFITABLE All comparisons to prior year period

Q2 2024 EARNINGS PRESENTATION17 Capacity Update Source: Internal Data Facility # Lines Today # Lines Projected Bethlehem Kitchen 6 7 Kitchen South 3 5+ Ennis Kitchen 3 10 Total 12 22+ Q2 2024 EARNINGS PRESENTATION Fourth line in Ennis to begin production by the end of Q3 2024

Q2 2024 EARNINGS PRESENTATION18 Capital Efficiency Framework MORE OUT OF EXISTING LINES MORE OUT OF EXISTING SITES DEVELOP & IMPLEMENT NEW TECHNOLOGIES

Q2 2024 EARNINGS PRESENTATION19 Long-Term Strategy: Path to 2027 Expand HH Penetration Increase Velocity Advertising & Innovation Expand Visibility & Availability Drive Efficiencies Build Organization Capability to Increase Effectiveness & Leverage Scale Expand Capacity ~18% Adjusted EBITDA Margin (target) $1.8 billion Net Sales (target) 20 million Freshpet Households by 2027 (target)

Q2 2024 EARNINGS PRESENTATION20 Q2 2024 Results

Q2 2024 EARNINGS PRESENTATION21 Strong Q2 results demonstrate all volume-driven growth $183.3 $235.3 Q2 2023 Q2 2024 +28% Q2 2024 Net Sales ($m) Q2 2024 Net Sales Bridge Source: Internal Data

Q2 2024 EARNINGS PRESENTATION22 Consumption growth remains strong and has accelerated Source: NIQ consumption data, latest 13 weeks thru 6/29/24 and internal sales data Q2 2024 Consumption Growth ($) Consumption Growth Trends (volume in pounds) 24% 26% 24% 9% Total US Pet Retail Plus XAOC Food Pet Specialty 18% 23% 25% 31% 28% Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 PLUS >100% GROWTH IN UNMEASURED CHANNELS

Q2 2024 EARNINGS PRESENTATION23 $10,000,000 $12,000,000 $14,000,000 $16,000,000 $18,000,000 $20,000,000 $22,000,000 $24,000,000 $26,000,000 Nielsen Total US Pet Retail Plus Consumption Nielsen data demonstrates robust growth Source: NIQ Total US Pet Retail Plus, data thru 7/20/24. The Pet Retail Plus channel includes xAOC, Pet Retail, Farm & Feed, Amazon (1P), and Chewy.

Q2 2024 EARNINGS PRESENTATION24 Q2 2024 delivered significant margin improvement Gross Margin (GAAP) 39.9%32.3% Q2 2024 Adj. Gross Margin % of net sales Q2 2024 Adj. EBITDA ($m) % of net sales 39.8% 45.9% Q2 2023 Q2 2024 $9.0 $35.1 Q2 2023 Q2 2024 4.9% 14.9% Net Income (loss) ($17.0m) ($1.7m)1 Source: Internal Data 1. Excluding an $11.1 million true-up of non-cash share-based compensation based on multi-year share-based awards granted in fiscal year 2020, net income for Q2 2024 would have been $9.4 million.

Q2 2024 EARNINGS PRESENTATION25 34.4% 8.0% 3.6% 29.8% 5.8% 2.7% 33.5% 7.5% 2.9% Input Costs Logistics Quality 770 basis point improvement in Q2 2024; demonstrated our ability to deliver FY 2027 margin targets again Key Margin Improvement Targets & Progress Q2 2023 Q2 2024 2027 Target Source: Internal Data

Q2 2024 EARNINGS PRESENTATION26 Significant Adj. Gross Margin improvement YOY; ahead of our long-term target and now focused on consistent performance 39.8% 45.9% 45.0% Q2 2023 Q2 2024 2027 Target Adj. Gross Margin Progress vs. 2027 Targets Source: Internal Data

Q2 2024 EARNINGS PRESENTATION27 SG&A improvements tracking to long-term target; logistics is well ahead of plan and G&A will follow as we add scale Source: Internal Data Adj. SG&A Progress vs. Targets Q2 2023 Q2 2024 2027 Target SG&A (GAAP)40.7%41.5% 12.1% 14.8% 8.0% 34.9% 13.0% 12.2% 5.8% 31.0% 8.8% 9.0% 7.5% 25.3% Adj. SG&A Excluding Media & Logistics Media % Logistics % Total Adj. SG&A %

Q2 2024 EARNINGS PRESENTATION28 FY 2024 Guidance

Q2 2024 EARNINGS PRESENTATION29 Updated FY 2024 Guidance Additional considerations: • Net Sales: Raising guidance with improvements on production capacity; managing growth as new line ramps up at the end of 3Q and through 4Q • Volume cadence: Expect volume to be sequentially lower throughout the year to manage growth and cash with capacity • Adjusted Gross Margin: Expect improvement of +500 basis points year- over-year vs. +300 basis points previously; continue to expect modest deflation • Advertising investment: Expect media to grow in-line with sales Previous Updated Net Sales >$950M >$965M Net Sales Growth YoY >24% >26% Adjusted EBITDA >$120M >$140M Capital Expenditures ~$210M ~$200M

Q2 2024 EARNINGS PRESENTATION30 Capital Spending, Cash Flow & Liquidity

Q2 2024 EARNINGS PRESENTATION31 Significant improvement in operating cash flow Capital Spending: • Key projects remain on-track and on-budget; estimated 2024 spending of ~$200 million • Once Ennis Phase II is completed this summer/fall, we will have built adequate infrastructure/buildings to accommodate our next 5+ lines Cash flow: • Generated $47.8 million of operating cash flow YTD 2024, a YoY improvement of $48.0 million driven by: • Adj. EBITDA growth • Working capital position • Interest income is offsetting interest expense Liquidity: • $251.7 million of cash-on-hand as of 6/30/24 • Generating meaningful Adj. EBITDA which could be leveraged to provide increased liquidity in 2025, if necessary Operating Cash Flow ($m) ($0.2) $47.8 YTD 2023 YTD 2024 Source: Internal Data

Q2 2024 EARNINGS PRESENTATION32 Appendix

Q2 2024 EARNINGS PRESENTATION33 Freshpet, Inc. and Subsidiaries Reconciliation between Gross Profit and Adjusted Gross Profit For the Three Months Ended June 30, For the Six Months Ended June 30, 2024 2023 2024 2023 (Dollars in thousands) Gross profit $ 93,952 $ 59,244 $ 182,110 $ 110,004 Depreciation expense 11,827 10,618 22,502 21,339 Non-cash share-based compensation 2,220 3,161 4,841 6,117 Loss on disposal of manufacturing equipment 32 — 53 — Adjusted Gross Profit $ 108,031 $ 73,023 $ 209,506 $ 137,460 Adjusted Gross Profit as a % of Net Sales 45.9% 39.8% 45.6% 39.2%

Q2 2024 EARNINGS PRESENTATION34 Freshpet, Inc. and Subsidiaries Reconciliation between SG&A Expenses and Adjusted SG&A Expenses (a) Includes true-ups to share-based compensation expense compared to prior periods. We have certain outstanding share-based awards with performance-based vesting conditions that require the achievement of certain Adjusted EBITDA and/or Net Sales targets as a condition of vesting. At each reporting period, we reassess the probability of achieving the performance criteria and the performance period required to meet those targets. When the probability of achieving such performance conditions changes, the compensation cost previously recorded is adjusted as needed. When such performance conditions are deemed to be improbable of achievement, the compensation cost previously recorded is reversed. (b) Represents costs associated with the implementation of an ERP system. (c) Represents fees associated with the Capped Call Transactions. (d) Represents advisory fees related to activism engagement. (e) Represents a true-up to transition costs related to the organization changes designed to support growth, including several changes in organizational structure designed to enhance capabilities and support long- term growth objectives. Source: Internal Data For the Three Months Ended June 30, For the Six Months Ended June 30, 2024 2023 2024 2023 (Dollars in thousands) SG&A expenses $ 95,702 $ 75,996 $ 175,396 $ 148,267 Depreciation and amortization expense 5,385 3,820 10,455 7,591 Non-cash share-based compensation (a) 17,313 5,286 20,913 10,745 Loss on disposal of equipment 104 196 233 464 Enterprise Resource Planning (b) — 537 — 1,338 Capped Call Transactions fees (c) — — — 113 Activism engagement (d) — 2,241 — 2,630 Organization changes (e) — (67) — (67) Adjusted SG&A Expenses $ 72,900 $ 63,983 $ 143,795 $ 125,453 Adjusted SG&A Expenses as a % of Net Sales 31.0% 34.9% 31.3% 35.8%

Q2 2024 EARNINGS PRESENTATION35 Freshpet, Inc. and Subsidiaries Reconciliation between Net (loss) Income and Adjusted EBITDA (a) Includes true-ups to share-based compensation expense compared to prior periods. We have certain outstanding share-based awards with performance-based vesting conditions that require the achievement of certain Adjusted EBITDA and/or Net Sales targets as a condition of vesting. At each reporting period, we reassess the probability of achieving the performance criteria and the performance period required to meet those targets. When the probability of achieving such performance conditions changes, the compensation cost previously recorded is adjusted as needed. When such performance conditions are deemed to be improbable of achievement, the compensation cost previously recorded is reversed. (b) Represents costs associated with the implementation of an ERP system. (c) Represents fees associated with the Capped Call Transactions. (d) Represents advisory fees related to activism engagement. (e) Represents a true-up to transition costs related to the organization changes designed to support growth, including several changes in organizational structure designed to enhance capabilities and support long-term growth objectives. Source: Internal Data For the Three Months Ended June 30, For the Six Months Ended June 30, 2024 2023 2024 2023 (Dollars in thousands) Net (loss) income $ (1,694) $ (16,952) $ 16,908 $ (41,738) Depreciation and amortization 17,212 14,438 32,957 28,930 Interest income, net of interest expense (110) (779) (384) 1,446 Income tax expense 54 70 108 140 EBITDA 15,462 (3,223) 49,589 (11,222) Loss on equity method investment — 910 — 1,890 Gain on equity investment — — (9,918) — Loss on disposal of property, plant and equipment 136 196 286 464 Non-cash share-based compensation (a) 19,533 8,447 25,755 16,862 Enterprise Resource Planning (b) — 537 — 1,338 Capped Call Transactions fees (c) — — — 113 Activism engagement (d) — 2,240 — 2,629 Organization changes (e) — (67) — (67) Adjusted EBITDA $ 35,131 $ 9,040 $ 65,712 $ 12,007 Adjusted EBITDA as a % of Net Sales 14.9 % 4.9% 14.3 % 3.4 %

Q2 2024 EARNINGS PRESENTATION36 Convertible Share Dilution Calculations at Maturity ▪ We have run share dilution calculations to compare outcomes for the 2028 convertible notes ▪ Freshpet has structured the convertible with Flexible Settlement, so we have the option to settle the convertible in shares, cash, or a combination at its option ▪ We have run convertible dilution calculations once using the most dilutive physical settlement method (i.e. Freshpet delivers all underlying shares upon conversion if the convertible is in-the-money) and again using net share settlement method (i.e. Freshpet delivers the $402.5mm principal amount in cash and any remaining in-the-money amount in shares under Treasury Stock method) Note: Based on Freshpet’s $402.5mm convertible offering, a $54.65 stock price at issue, a 27.5% conversion premium, and an up 120% capped call. (1) If the convertible is in-the-money, Freshpet can deliver full underlying shares at its option since it has chosen a Flexible Settlement Structure. (2) At stock prices below the conversion price, the convertible is redeemed for cash without any equity dilution. Physical Settlement (mm shares) (1,2) Net Share Settlement (mm shares) Stock Price at Maturity Convert Convert + Capped Call Convert Convert + Capped Call $80.00 5.8 5.0 0.7 0.0 $90.00 5.8 4.5 1.3 0.0 $100.00 5.8 4.0 1.8 0.0 $110.00 5.8 3.7 2.1 0.0 $120.00 5.8 3.4 2.4 0.0 $130.00 5.8 3.5 2.7 0.4 $140.00 5.8 3.7 2.9 0.8 $150.00 5.8 3.8 3.1 1.1 $160.00 5.8 4.0 3.3 1.4

Q2 2024 EARNINGS PRESENTATION37

Q2 2024 EARNINGS PRESENTATION38

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

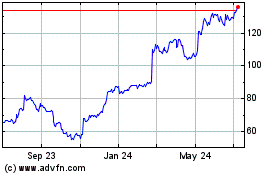

Freshpet (NASDAQ:FRPT)

Historical Stock Chart

From Nov 2024 to Dec 2024

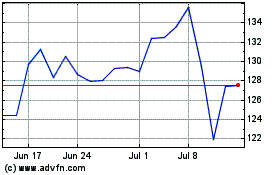

Freshpet (NASDAQ:FRPT)

Historical Stock Chart

From Dec 2023 to Dec 2024