false

0000038264

0000038264

2024-05-10

2024-05-10

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________

FORM 8-K

______________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event

reported): May 10, 2024

Forward

Industries, Inc.

(Exact name of registrant as specified in its charter)

| New York |

|

001-34780 |

|

13-1950672 |

| (State or Other Jurisdiction |

|

(Commission |

|

(I.R.S. Employer |

| of Incorporation) |

|

File Number) |

|

Identification No.) |

700 Veterans Memorial

Hwy. Suite 100

Hauppauge, New York

11788

(Address of Principal Executive Office) (Zip Code)

(631)

547-3055

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, par value $0.01 per share |

FORD |

The NASDAQ Capital Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities

Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company

☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.02. | Results of Operations and Financial Condition |

On May 10, 2024, Forward Industries, Inc. issued

a press release announcing its financial results for the for the three and six months ended March

31, 2024. A copy of such press release is furnished as Exhibit 99.1 to this report.

The information in Item 2.02 of this report,

including the information in the press release attached as Exhibit 99.1 to this report, is furnished pursuant to Item 2.02 of

Form 8-K and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934 or

otherwise subject to the liabilities of that section. Furthermore, the information in Item 2.02 of this report, including the information

in the press release attached as Exhibit 99.1 to this report, shall not be deemed to be incorporated by reference in the filings

of the registrant under the Securities Act of 1933.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

FORWARD INDUSTRIES, INC. |

|

| |

|

|

|

| Date: May 10, 2024 |

By: |

/s/ Kathleen Weisberg |

|

| |

|

Name: Kathleen Weisberg |

|

| |

|

Title: Chief Financial Officer |

|

Exhibit 99.1

FORWARD REPORTS FISCAL 2024 SECOND

QUARTER RESULTS

Hauppauge, NY – May 10, 2024 – Forward

Industries, Inc. (NASDAQ:FORD), a global design, sourcing and distribution group, today announced financial results for its second quarter

ended March 31, 2024.

Second

Quarter Fiscal Year 2024 Financial Highlights

| · | Revenues were $7.8 million, a decrease of 19.6%

from $9.7 million for 2023. |

| · | Gross margin increased to 20.5% compared to 19.8%

for 2023. |

| · | Loss from continuing operations was $0.5 million

compared to $0.1 million in 2023 and net loss was $0.6 million compared to $0.9 million in 2023. |

| · | Basic and diluted loss per share from continuing

operations was $0.05 compared to $0.01 for 2023. |

| · | Cash balance of $2.3 million at March 31, 2024

compared to $3.2 million at September 30, 2023. |

Terry Wise, Chief Executive Officer

of Forward Industries, stated “The business continues to focus on proactively taking measures to return the group to profitability.

Costs from our discontinued retail division have largely come to a conclusion. While this is pleasing, we will need a prolonged sustained

effort from all our divisions to fulfill our objective of robust growth and profitability.”

The

tables below are derived from the Company’s condensed consolidated financial statements included in its Form 10-Q filed on May 10,

2024 with the Securities and Exchange Commission. Please refer to the Form 10-Q for complete financial statements and further information

regarding the Company’s results of operations and financial condition relating to the fiscal quarters ended March 31, 2024 and 2023.

Please also refer to the Company’s Form 10-K for a discussion of risk factors applicable to the Company and its business.

Cautionary Note Regarding Forward-Looking

Statements

This

press release contains certain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933

and Section 21E of the Securities Exchange Act of 1934 including statements regarding profitability and growth. Forward has tried to

identify these forward-looking statements by using words such as “may”, “should,” “expect,” “hope,”

“anticipate,” “believe,” “intend,” “plan,” “estimate” and similar expressions.

These forward-looking statements are based on information currently available to the Company and are subject to a number of risks, uncertainties

and other factors that could cause its actual results, performance, prospects or opportunities to differ materially from those expressed

in, or implied by, these forward-looking statements. These risks include the inability to expand our customer base, loss of additional

customers, competition, pricing pressures, supply chain issues, inability of our design division’s customers to pay for our services,

loss of talented employees, unanticipated issues with our affiliated sourcing agent, and issues at Chinese factories that source our

products. No assurance can be given that the actual results will be consistent with the forward-looking statements. Investors should

read carefully the factors described in the “Risk Factors” section of the Company’s filings with the SEC,

including the Company’s Form 10-K for the year ended September 30, 2023 for

information regarding risk factors that could affect the Company’s results. Except as otherwise required by Federal securities

laws, Forward undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information,

future events, changed circumstances or any other reason.About Forward Industries

Forward is a global design, sourcing

and distribution group serving top tier medical and technology customers worldwide. Through its acquisitions of Intelligent Product Solutions,

Inc. and Kablooe Design, Inc., the Company has expanded its ability to design and develop solutions for its existing multinational client

base and expand beyond the diabetic product line into a variety of industries with a full spectrum of hardware and software product design

and engineering services.

For

more information, contact:

Kathleen

Weisberg, CFO, Forward Industries, Inc.

(631) 547-3055, kweisberg@forwardindustries.com

FORWARD INDUSTRIES, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

| | |

March 31, | | |

September 30, | |

| | |

2024 | | |

2023 | |

| | |

(Unaudited) | | |

| |

| Assets | |

| | | |

| | |

| | |

| | | |

| | |

| | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash | |

$ | 2,261,853 | | |

$ | 3,180,468 | |

| Accounts receivable, net of allowances for credit losses of $771,189 and $955,965 as of March 31, 2024 and September 30, 2023, respectively | |

| 6,484,427 | | |

| 6,968,778 | |

| Inventories, net | |

| 308,895 | | |

| 334,384 | |

| Discontinued assets held for sale | |

| – | | |

| 508,077 | |

| Prepaid expenses and other current assets | |

| 457,071 | | |

| 378,512 | |

| Total current assets | |

| 9,512,246 | | |

| 11,370,219 | |

| | |

| | | |

| | |

| Property and equipment, net | |

| 254,971 | | |

| 274,046 | |

| Intangible assets, net | |

| 786,765 | | |

| 893,143 | |

| Goodwill | |

| 1,758,682 | | |

| 1,758,682 | |

| Operating lease right-of-use assets, net | |

| 2,810,059 | | |

| 3,021,315 | |

| Other assets | |

| 68,737 | | |

| 68,737 | |

| Total assets | |

$ | 15,191,460 | | |

$ | 17,386,142 | |

| | |

| | | |

| | |

| Liabilities and shareholders' equity | |

| | | |

| | |

| | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Note payable to Forward China | |

$ | 750,000 | | |

$ | – | |

| Accounts payable | |

| 147,518 | | |

| 518,892 | |

| Due to Forward China | |

| 8,687,898 | | |

| 8,246,015 | |

| Deferred income | |

| 228,827 | | |

| 297,407 | |

| Current portion of operating lease liability | |

| 423,042 | | |

| 416,042 | |

| Accrued expenses and other current liabilities | |

| 560,494 | | |

| 1,357,743 | |

| Total current liabilities | |

| 10,797,779 | | |

| 10,836,099 | |

| | |

| | | |

| | |

| Other liabilities: | |

| | | |

| | |

| Note payable to Forward China | |

| – | | |

| 1,100,000 | |

| Operating lease liability, less current portion | |

| 2,623,814 | | |

| 2,833,782 | |

| Total other liabilities | |

| 2,623,814 | | |

| 3,933,782 | |

| Total liabilities | |

| 13,421,593 | | |

| 14,769,881 | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| | | |

| | |

| | |

| | | |

| | |

| Shareholders' equity: | |

| | | |

| | |

| Common stock, par value $0.01 per share; 40,000,000 shares authorized; 10,061,185 shares issued and outstanding at March 31, 2024 and September 30, 2023 | |

| 100,612 | | |

| 100,612 | |

| Additional paid-in capital | |

| 20,263,242 | | |

| 20,202,202 | |

| Accumulated deficit | |

| (18,593,987 | ) | |

| (17,686,553 | ) |

| Total shareholders' equity | |

| 1,769,867 | | |

| 2,616,261 | |

| Total liabilities and shareholders' equity | |

$ | 15,191,460 | | |

$ | 17,386,142 | |

FORWARD INDUSTRIES, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED)

| | |

For the Three Months Ended

March 31, | | |

For the Six Months Ended

March 31, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

| | |

| | |

| | |

| |

| Revenues, net | |

$ | 7,830,130 | | |

$ | 9,738,804 | | |

$ | 14,982,080 | | |

$ | 19,491,488 | |

| Cost of sales | |

| 6,222,432 | | |

| 7,813,696 | | |

| 11,731,897 | | |

| 15,600,310 | |

| Gross profit | |

| 1,607,698 | | |

| 1,925,108 | | |

| 3,250,183 | | |

| 3,891,178 | |

| | |

| | | |

| | | |

| | | |

| | |

| Sales and marketing expenses | |

| 370,839 | | |

| 450,380 | | |

| 739,575 | | |

| 861,554 | |

| General and administrative expenses | |

| 1,776,491 | | |

| 1,566,549 | | |

| 3,430,561 | | |

| 3,249,360 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating loss | |

| (539,632 | ) | |

| (91,821 | ) | |

| (919,953 | ) | |

| (219,736 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Fair value adjustment of earnout consideration | |

| – | | |

| – | | |

| – | | |

| (40,000 | ) |

| Interest income | |

| (18,712 | ) | |

| (856 | ) | |

| (36,180 | ) | |

| (856 | ) |

| Interest expense | |

| 16,971 | | |

| 26,781 | | |

| 35,981 | | |

| 54,739 | |

| Other income, net | |

| 7,846 | | |

| 965 | | |

| 7,158 | | |

| (23,595 | ) |

| Loss from continuing operations before income taxes | |

| (545,737 | ) | |

| (118,711 | ) | |

| (926,912 | ) | |

| (210,024 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Provision for income taxes | |

| – | | |

| – | | |

| – | | |

| – | |

| Loss from continuing operations | |

| (545,737 | ) | |

| (118,711 | ) | |

| (926,912 | ) | |

| (210,024 | ) |

| (Loss) / income from discontinued operations, net of tax | |

| (7,477 | ) | |

| (752,237 | ) | |

| 19,478 | | |

| (1,091,199 | ) |

| Net loss | |

$ | (553,214 | ) | |

$ | (870,948 | ) | |

$ | (907,434 | ) | |

$ | (1,301,223 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Basic loss per share : | |

| | | |

| | | |

| | | |

| | |

| Basic loss per share from continuing operations | |

$ | (0.05 | ) | |

$ | (0.01 | ) | |

$ | (0.09 | ) | |

$ | (0.02 | ) |

| Basic loss per share from discontinued operations | |

| (0.00 | ) | |

| (0.07 | ) | |

| 0.00 | | |

| (0.11 | ) |

| Basic loss per share | |

$ | (0.05 | ) | |

$ | (0.09 | ) | |

$ | (0.09 | ) | |

$ | (0.13 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Diluted loss per share: | |

| | | |

| | | |

| | | |

| | |

| Diluted loss per share from continuing operations | |

$ | (0.05 | ) | |

$ | (0.01 | ) | |

$ | (0.09 | ) | |

$ | (0.02 | ) |

| Diluted loss per share from discontinued operations | |

| (0.00 | ) | |

| (0.07 | ) | |

| 0.00 | | |

| (0.11 | ) |

| Diluted loss per share | |

$ | (0.05 | ) | |

$ | (0.09 | ) | |

$ | (0.09 | ) | |

$ | (0.13 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average common shares outstanding: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 10,061,185 | | |

| 10,061,185 | | |

| 10,061,185 | | |

| 10,061,185 | |

| Diluted | |

| 10,061,185 | | |

| 10,061,185 | | |

| 10,061,185 | | |

| 10,061,185 | |

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

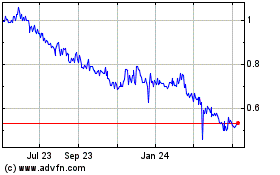

Forward Industries (NASDAQ:FORD)

Historical Stock Chart

From Jan 2025 to Feb 2025

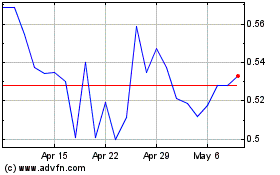

Forward Industries (NASDAQ:FORD)

Historical Stock Chart

From Feb 2024 to Feb 2025