-- Loan growth, net interest margin expansion,

and strong asset quality support continued tangible book value

growth --

First Business Financial Services, Inc. (the “Company”, the

“Bank”, or “First Business Bank”) (Nasdaq:FBIZ) reported quarterly

net income available to common shareholders of $9.9 million, or

$1.18 diluted earnings per share. This compares to net income

available to common shareholders of $10.6 million, or $1.25 per

share, in the third quarter of 2022 and $8.6 million, or $1.01 per

share, in the fourth quarter of 2021. For the full year 2022, the

Company reported net income available to common shareholders of

$40.2 million, or $4.75 per share, compared to $35.8 million, or

$4.17 per share, in 2021.

“Excellent execution across our commercial lending businesses

continued through the fourth quarter, highlighted by 20% annualized

loan growth,” Chief Executive Officer Corey Chambas said. “The

impact of rising rates and strong balance sheet management,

contributed to record net interest margin of 4.15%. We believe our

core net interest margin will remain relatively stable in the

near-term given the current interest rate environment. We bolstered

our funding position with solid in-market deposit expansion, along

with the use of wholesale deposits as part of our long-held

strategy to match-fund our fixed rate loans.” Chambas added, “This

important component of our interest rate risk management strategy

resulted in favorable margin expansion compared to peer banks.

Outstanding execution led to growth in tangible book value per

share of 9% for the year, which compares very favorably to the

industry. We enter 2023 with expectations for double-digit loan,

deposit, and revenue growth, driving strong earnings

performance.”

Quarterly Highlights

- Robust Loan Growth. Loans, excluding net Paycheck

Protection Program (“PPP”) loans, grew $114.2 million, or 19.6%

annualized, from the third quarter of 2022 and $230.4 million, or

10.4%, from the fourth quarter of 2021, reflecting balanced growth

across the Company’s commercial and industrial (“C&I”) and

commercial real estate (“CRE”) portfolios.

- Strong Deposit Growth. Total deposits grew to $2.168

billion, increasing 15.5% annualized from the linked quarter and

10.7% from the fourth quarter of 2021. In-market deposits grew to

$1.966 billion, up $36.7 million, or 7.6% annualized, from the

linked quarter.

- Record Net Interest Income. Net interest income grew to

a record $27.5 million, increasing $1.6 million, or 6.1%, from the

linked quarter and $6.5 million, or 31.2%, from the prior year

quarter. This was driven by a combination of 11.6% annualized

increase in average loans and leases as well as a record net

interest margin of 4.15%.

- Exceptional Asset Quality. Continued positive asset

quality trends resulted in non-performing assets of $3.8 million,

measuring a historically low of 0.13% of total assets and improving

from 0.25% of total assets on December 31, 2021.

- Tangible Book Value Growth. The Company’s strong

earnings generation produced a 17.0% annualized increase in

tangible book value per share compared to the linked quarter and

8.6% compared to the prior year quarter.

Quarterly

Financial Results

(Unaudited)

As of and for the Three Months

Ended

As of and for the Year

Ended

(Dollars in thousands, except per share

amounts)

December 31,

2022

September 30,

2022

December 31,

2021

December 31,

2022

December 31,

2021

Net interest income

$

27,452

$

25,884

$

20,924

$

98,422

$

84,662

Adjusted non-interest income (1)

6,164

8,197

7,569

28,619

28,071

Operating revenue (1)

33,616

34,081

28,493

127,041

112,733

Operating expense (1)

20,658

19,925

17,644

79,155

71,571

Pre-tax, pre-provision adjusted earnings

(1)

12,958

14,156

10,849

47,886

41,162

Less:

Provision for loan and lease losses

702

12

(508

)

(3,868

)

(5,803

)

Net loss on foreclosed properties

22

7

7

49

15

Amortization of other intangible

assets

—

—

2

—

25

Contribution to First Business Charitable

Foundation

809

—

—

809

—

SBA recourse (benefit) provision

(322

)

96

(122

)

(188

)

(76

)

Tax credit investment impairment

recovery

—

—

—

(351

)

—

Add:

Bank-owned life insurance claim

809

—

—

809

—

Net gain on sale of securities

—

—

—

—

29

Income before income tax expense

12,556

14,041

11,470

52,244

47,030

Income tax expense

2,400

3,215

2,879

11,386

11,275

Net income

$

10,156

$

10,826

$

8,591

$

40,858

$

35,755

Preferred stock dividends

219

218

—

683

—

Net income available to common

shareholders

$

9,937

$

10,608

$

8,591

$

40,175

$

35,755

Earnings per share, diluted

$

1.18

$

1.25

$

1.01

$

4.75

$

4.17

Book value per share

$

29.74

$

28.58

$

27.48

$

29.74

$

27.48

Tangible book value per share (1)

$

28.28

$

27.13

$

26.03

$

28.28

$

26.03

Net interest margin (2)

4.15

%

4.01

%

3.39

%

3.82

%

3.44

%

Adjusted net interest margin (1)(2)

3.94

%

3.89

%

3.23

%

3.64

%

3.21

%

Fee income ratio (non-interest income /

total revenue)

20.26

%

24.05

%

26.56

%

23.02

%

24.92

%

Efficiency ratio (1)

61.45

%

58.46

%

61.92

%

62.31

%

63.49

%

Return on average assets (2)

1.39

%

1.54

%

1.32

%

1.46

%

1.37

%

Pre-tax, pre-provision adjusted return on

average assets (1)(2)

1.81

%

2.05

%

1.66

%

1.74

%

1.58

%

Return on average common equity (2)

16.26

%

17.44

%

15.04

%

16.79

%

16.21

%

Period-end loans and leases receivable

$

2,443,066

$

2,330,700

$

2,239,408

$

2,443,066

$

2,239,408

Average loans and leases receivable

$

2,384,091

$

2,316,621

$

2,179,769

$

2,304,990

$

2,179,154

Period-end in-market deposits

$

1,965,970

$

1,929,224

$

1,928,285

$

1,965,970

$

1,928,285

Average in-market deposits

$

1,950,625

$

1,930,995

$

1,866,875

$

1,928,815

$

1,784,302

Allowance for loan and lease losses

$

24,230

$

24,143

$

24,336

$

24,230

$

24,336

Non-performing assets

$

3,754

$

3,796

$

6,522

$

3,754

$

6,522

Allowance for loan and lease losses as a

percent of total gross loans and leases

0.99

%

1.04

%

1.09

%

0.99

%

1.09

%

Non-performing assets as a percent of

total assets

0.13

%

0.13

%

0.25

%

0.13

%

0.25

%

(1)

This is a non-GAAP financial measure.

Management believes these measures are meaningful because they

reflect adjustments commonly made by management, investors,

regulators, and analysts to evaluate financial performance, provide

greater understanding of ongoing operations, and enhance

comparability of results with prior periods. See the section titled

Non-GAAP Reconciliations at the end of this release for a

reconciliation of GAAP financial measures to non-GAAP financial

measures.

(2)

Calculation is annualized.

Quarterly

Financial Results - Excluding PPP Loans, Interest Income, and

Fees

(Unaudited)

As of and for the Three Months

Ended

As of and for the Year

Ended

(Dollars in thousands, except per share

amounts)

December 31,

2022

September 30,

2022

December 31,

2021

December 31,

2022

December 31,

2021

Net interest income

$

27,444

$

25,812

$

19,898

$

97,816

$

75,826

Adjusted non-interest income (1)

6,164

8,197

7,569

28,619

28,071

Operating revenue (1)

33,608

34,009

27,467

126,435

103,897

Operating expense (1)

20,658

19,925

17,644

79,155

71,571

Pre-tax, pre-provision adjusted earnings

(1)

$

12,950

$

14,084

$

9,823

$

47,280

$

32,326

Net interest margin (2)

4.15

%

4.00

%

3.29

%

3.81

%

3.29

%

Fee income ratio (non-interest income /

total revenue)

20.26

%

24.10

%

27.56

%

23.13

%

27.04

%

Efficiency ratio (1)

61.47

%

58.59

%

64.24

%

62.61

%

68.89

%

Pre-tax, pre-provision adjusted return on

average assets (1)(2)

1.81

%

2.05

%

1.53

%

1.72

%

1.32

%

Period-end loans and leases receivable

$

2,442,560

$

2,328,376

$

2,212,111

$

2,442,560

$

2,212,111

Average loans and leases receivable

$

2,381,958

$

2,312,116

$

2,126,846

$

2,295,250

$

2,026,890

Allowance for loan and lease losses as a

percent of total gross loans and leases

0.99

%

1.04

%

1.10

%

0.99

%

1.10

%

Non-performing assets as a percent of

total assets

0.13

%

0.13

%

0.25

%

0.13

%

0.25

%

(1)

This is a non-GAAP financial measure.

Management believes these measures are meaningful because they

reflect adjustments commonly made by management, investors,

regulators, and analysts to evaluate financial performance, provide

greater understanding of ongoing operations, and enhance

comparability of results with prior periods. See the section titled

Non-GAAP Reconciliations at the end of this release for a

reconciliation of GAAP financial measures to non-GAAP financial

measures.

(2)

Calculation is annualized.

Fourth Quarter 2022 Compared to Third

Quarter 2022

Net interest income increased $1.6 million, or 6.1%, to $27.5

million.

- Net interest income growth was driven by an increase in both

average loans and leases and in fees in lieu of interest combined

with net interest margin expansion. Average loans and leases

receivable increased $67.5 million, or 11.6% annualized, to $2.384

billion. Fees in lieu of interest, which can vary from quarter to

quarter based on client-driven activity, totaled $1.3 million,

compared to $807,000 in the prior quarter. Excluding fees in lieu

of interest and interest income from PPP loans, net interest income

increased $1.1 million, or 17.0% annualized.

- The yield on average interest-earning assets increased 87 basis

points to 5.79% from 4.92%. Excluding average net PPP loans, PPP

loan interest income, and fees in lieu of interest, the yield

earned on average interest-earning assets increased 79 basis points

to 5.59% from 4.80%.

- The rate paid for average interest-bearing, in-market deposits

increased 113 basis points to 2.01% from 0.88%. The rate paid for

average total bank funding increased 78 basis points to 1.67% from

0.89%. Total bank funding is defined as total deposits plus Federal

Home Loan Bank (“FHLB”) advances. The daily average effective

federal funds rate increased 147 basis points compared to the

linked quarter, which equates to a total bank funding beta of 53.1%

for the three months ended December 31, 2022.

- Net interest margin was 4.15%, up 14 basis points compared to

4.01% in the linked quarter. Adjusted net interest margin1 was

3.94%, up 5 basis points compared to 3.89% in the linked quarter.

Net interest margin expansion was due to an increase in fees of

lieu of interest and the beta on interest earning assets exceeding

the total bank funding beta.

- The Bank maintains an asset-sensitive balance sheet and ended

the quarter positioned for net interest income to continue to

benefit from rising rates. However, the Bank anticipates deposit

betas will continue to rise at a greater rate, and adjusted net

interest margin may begin to decline at a gradual pace in coming

quarters.

The Bank reported a provision expense of $702,000, compared to

$12,000 in the third quarter of 2022.

- The provision for loan and lease losses expense in the fourth

quarter of 2022 was primarily due to net charge offs of $615,000

and an increase of $982,000 in the general reserve due to loan

growth, partially offset by a $930,000 decrease in the general

reserve due to a decrease in the historical loss factor as elevated

losses during the Great Recession fall outside the model look-back

period.

- The Bank adopted ASU No. 2016-13, “Financial Instruments-

Credit Losses (Topic 326)", which is often referred to as CECL, on

January 1, 2023.

Non-interest income decreased $1.2 million, or 14.9%, to $7.0

million.

- Private Wealth and Retirement assets (“Private Wealth”) fee

income decreased $48,000, or 1.8% to $2.6 million. Private Wealth

assets under management and administration measured $2.660 billion

at December 31, 2022, up $167.4 million from the third quarter,

with a majority of the growth occurring late in the fourth

quarter.

- Gains on sale of Small Business Administration (“SBA”) loans

decreased $463,000, or 63.3%, to $269,000. Premiums on the sale of

SBA loans sold decreased compared to prior quarter and the Company

elected to hold a higher proportion of SBA loans on its balance

sheet in the current interest rate environment.

- Commercial loan swap fee income increased $415,000, or 121.7%,

to $756,000. Swap fee income can vary from period to period based

on loan activity and the interest rate environment.

- Service charges on deposits decreased $227,000, or 22.3%, to

$791,000, driven by an increase in the earnings credit rate

commensurate with the rising rate environment.

- Other fee income decreased $934,000 to $1.7 million, compared

to $2.7 million in the third quarter. The decrease was primarily

due to lower returns on the Company’s investments in mezzanine

funds and lower income in the equipment financing business line.

The fourth quarter decrease was partially offset by the recognition

of a $809,000 bank-owned life insurance claim. Income on mezzanine

funds can vary from period to period based on changes in the value

of underlying investments.

Non-interest expense increased $1.1 million, or 5.7%, to $21.2

million, while operating expense increased $733,000, or 3.7%, to

$20.7 million.

____________________ 1 Adjusted net interest margin is a

non-GAAP measure representing net interest income excluding fees in

lieu of interest and other recurring, but volatile, components of

net interest margin divided by average interest-earning assets less

average net PPP loans and other recurring, but volatile, components

of average interest-earning assets.

- Compensation expense was $15.3 million, reflecting an increase

of $450,000, or 3.0%, from the linked quarter due to a $347,000

adjustment to the annual cash incentive bonus program accrual

driven by above-target current year performance, as well as

expanded hiring to support the Bank’s growth plans. The Bank’s

compensation philosophy is to provide base salaries competitive

with the market. To stay competitive in the tight labor market, the

Company increased its base salaries consistent with 2021. Average

full-time equivalents (FTEs) for the fourth quarter of 2022 were

336, up three from 333 in the linked quarter.

- Equipment expense increased $106,000, or 41.9%, to $359,000

from the linked quarter primarily due to one-time costs associated

with an office relocation.

- Occupancy expense increased $103,000, or 18.2%, to $669,000

from the linked quarter primarily due to an office relocation and

one-time costs associated with building repairs.

- Other non-interest expense increased $354,000, or 62.2%, to

$923,000 from the linked quarter primarily due to a non-recurring

contribution to the First Business Charitable Foundation totaling

$809,000 during the fourth quarter partially offset by a recourse

release of $322,000 and a swap credit valuation benefit of

$153,000.

Income tax expense decreased $815,000, or 25.3%, to $2.4

million. The effective tax rate was 19.1% for the three months

ended December 31, 2022, compared to 22.9% for the linked quarter.

The three months ended December 31, 2022 benefited from low income

housing tax credits and a state return amendment. The Company

expects to report an effective tax rate of 21-22% for 2023.

Total period-end loans and leases receivable increased $112.4

million, or 19.3% annualized, to $2.443 billion. Excluding net PPP

loans, total period-end loans and leases receivable increased

$114.2 million, or 19.6% annualized.

- Commercial real estate loans increased by $57.0 million, or

15.4% annualized, to $1.542 billion, compared to $1.485 billion.

Growth spanned all commercial real estate categories, led by

increases in non-owner occupied and multi-family loans.

- C&I loans increased $52.2 million, or 26.4% annualized, to

$841.2 million, compared to $789.0 million. Excluding PPP loans,

C&I loans increased $54.0 million, or 27.6% annualized, due to

growth across products and geographies.

Total period-end in-market deposits increased $36.7 million, or

7.6% annualized, to $1.966 billion, compared to $1.929 billion. The

average rate paid was 1.43%, up 82 basis points from 0.61% in the

third quarter.

Period-end wholesale funding, including FHLB advances, brokered

deposits, and deposits gathered through internet deposit listing

services, increased $82.5 million to $618.6 million.

- Wholesale deposits increased $43.9 million to $202.2 million,

compared to $158.3 million as the Bank continued to replace FHLB

advances with wholesale deposits. The increase in wholesale funding

is consistent with the Company’s long-held philosophy to manage

interest rate risk by utilizing the most efficient and

cost-effective source of wholesale funds to match-fund our

fixed-rate loan portfolio. The average rate paid on wholesale

deposits increased 120 basis points to 3.66% and the weighted

average original maturity increased to 2.1 years from 0.3

years.

- FHLB advances increased $38.6 million to $416.4 million. The

average rate paid on FHLB advances increased 20 basis points to

2.21% and the weighted average original maturity decreased to 3.7

years from 4.8 years.

Non-performing assets were $3.8 million, or 0.13% of total

assets in both periods of comparison.

The allowance for loan and lease losses increased $87,000, or

0.4%, as increases in the general reserve from loan growth and net

charge-offs were partially offset by a decrease in the general

reserve due to a change in loss factors derived from the historical

look-back period. The allowance for loan and lease losses as a

percent of total gross loans and leases was 0.99% compared to 1.04%

in the third quarter.

Fourth Quarter 2022 Compared to Fourth

Quarter 2021

Net interest income increased $6.5 million, or 31.2%, to $27.5

million.

- The increase in net interest income primarily reflects an

increase in average gross loans and leases and net interest margin

expansion, partially offset by lower fees in lieu of interest. Fees

in lieu of interest decreased from $1.7 million to $1.3 million,

primarily due to a $889,000 reduction in PPP loan fee amortization.

Excluding fees in lieu of interest and interest income from PPP

loans, net interest income increased $7.0 million, or 36.9%.

Excluding net PPP loans, average gross loans and leases increased

$255.1 million, or 12.0%.

- Net interest margin increased 76 basis points to 4.15% from

3.39%. Adjusted net interest margin increased 71 basis points to

3.94% from 3.23%.

- The yield on average interest-earning assets measured 5.79%

compared to 3.81%. Excluding fees in lieu of interest, PPP loan

interest income, and net PPP loans, the yield on average

interest-earning assets measured 5.59%, compared to 3.60%. This

increase in yield was primarily due to the increase in short-term

market rates and the reinvestment of cash flows from the securities

and fixed rate loan portfolios in a rising rate environment.

- The rate paid for average interest-bearing in-market deposits

increased 183 basis points to 2.01% from 0.18%. The rate paid for

average total bank funding increased 124 basis points to 1.67% from

0.33%.

The Company reported a provision expense of $702,000, compared

to a provision benefit of $508,000 in the fourth quarter of 2021

primarily due to an increase in net charge-offs in the current

quarter and improvement in subjective factors in the prior year

quarter.

Non-interest income of $7.0 million decreased by $596,000, or

7.9%, from $7.6 million in the prior year period.

- Private Wealth fee income decreased $304,000, or 10.6%, to $2.6

million, due to a decline in market values. Private Wealth assets

under management and administration measured $2.660 billion at

December 31, 2022, down $260.7 million, or 8.9%.

- Gain on sale of SBA loans decreased $773,000, or 74.2%, to

$269,000. Premiums on the sale and notional value of SBA loans sold

decreased compared to prior year quarter, as the Company elected to

hold a higher proportion of SBA loans on its balance sheet in the

current interest rate environment.

- Service charges on deposits decreased $232,000, or 22.7%, to

$791,000. The reasons for the decrease are consistent with the

explanations discussed above in the linked quarter analysis.

- Loan fees of $847,000 increased by $168,000, or 24.7%,

primarily due to an increase in C&I lending activity.

- Other fee income increased $473,000, or 37.4%, to $1.7 million,

due to the recognition of a $809,000 bank owned life insurance

death benefit, partially offset by lower returns on the Company’s

investments in mezzanine funds. Income on mezzanine funds can vary

from period to period based on changes in the value of underlying

investments.

Non-interest expense increased $3.6 million, or 20.7%, to $21.2

million. Operating expense increased $3.0 million, or 17.1%, to

$20.7 million.

- Compensation expense increased $2.8 million, or 22.7%, to $15.3

million. Average FTEs increased 12% to 336 in the fourth quarter of

2022, compared to 301 in the fourth quarter of 2021. The increase

in compensation expense was mainly due to an increase in average

FTEs, annual merit increases and promotions, and an increase in

incentive compensation due to outstanding company performance.

- Full year 2022 compensation included a $6.7 million annual

incentive compensation accrual, which exceeded the Company’s target

payout by $2.5 million.

- Professional fees increased $277,000, or 29.7%, to $1.2

million, primarily due to a general increase in other professional

consulting services associated with various projects and an

increase in audit expenses.

- Equipment expense increased $136,000, or 61.0%, to $359,000.

The reasons for the increase in equipment expense are consistent

with the explanations discussed above in the linked quarter

analysis.

- Occupancy expense increased $118,000, or 21.4%, to $669,000.

The reasons for the increase in occupancy expense are consistent

with the explanations discussed above in the linked quarter

analysis.

- Other non-interest expense increased $94,000, or 11.3%, to

$923,000 primarily due to a non-recurring charitable contribution

totaling $809,000 during the fourth quarter partially offset by a

reduction in expenses related to swap credit valuations and

recourse provision.

Total period-end loans and leases receivable increased $203.7

million, or 9.1%, to $2.443 billion. Excluding net PPP loans, total

period-end loans and leases receivable increased $230.4 million, or

10.4%, to $2.443 billion.

- C&I loans increased $110.4 million, or 15.1% to $841.2

million. Excluding PPP loans, C&I loans increased $137.7

million, or 19.6%, to $840.6 million due to growth across

categories and geographies.

- CRE loans increased $87.3 million, or 6.0%, to $1.542 billion,

due to increases in most CRE categories.

Total period-end in-market deposits increased $37.7 million, or

2.0%, to $1.966 billion, and the average rate paid increased 130

basis points to 1.43%. The increase in in-market deposits was

principally due to a $99.7 million increase in certificates of

deposit, partially offset by a $55.9 million decline in money

market accounts.

Period-end wholesale funding increased $220.2 million to $618.6

million.

- Wholesale deposits increased $172.6 million to $202.2 million,

as the Bank utilized more wholesale deposits in lieu of short-term

FHLB advances. The average rate paid on brokered certificates of

deposit increased 263 basis points to 3.66% and the weighted

average original maturity decreased to 2.1 years from 3.8

years.

- FHLB advances increased $47.6 million to $416.4 million. The

average rate paid on FHLB advances increased 91 basis points to

2.21% and the weighted average original maturity decreased to 3.7

years from 5.9 years.

Non-performing assets decreased to $3.8 million, or 0.13% of

total assets, compared to $6.5 million, or 0.25% of total

assets.

The allowance for loan and lease losses decreased $106,000 to

$24.2 million, compared to $24.3 million. The allowance for loan

and lease losses as a percent of total gross loans and leases was

0.99%, compared to 1.09%.

Paycheck Protection

Program

As of December 31, 2022, the Company had $554,000 in gross PPP

loans outstanding and deferred processing fees outstanding of

$48,000. The processing fees are deferred and recognized over the

contractual life of the loan, or accelerated at forgiveness, as an

adjustment of yield using the interest method. During the three and

twelve months ended December 31, 2022, the Company recognized

$3,000 and $509,000 of PPP processing fees in interest income,

respectively, compared to $892,000 and $7.3 million for the three

and twelve months ended December 31, 2021. The SBA provides a

guaranty to the lender of 100% of principal and interest unless the

lender violated an obligation under the agreement.

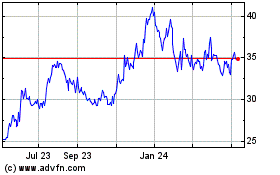

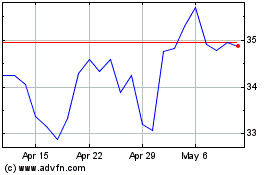

Share Repurchase Program

Update

As previously announced, effective March 4, 2022, the Company’s

Board of Directors authorized the repurchase by the Company of

shares of its common stock with a maximum aggregate purchase price

of $5.0 million, effective March 4, 2022 through March 4, 2023. As

of December 16, 2022, the Company had completed the share

repurchase program, purchasing a total of 142,074 shares for

approximately $5.0 million at an average cost of $35.14 per

share.

About First Business Financial Services, Inc.

First Business Financial Services, Inc., (Nasdaq: FBIZ) is the

parent company of First Business Bank. First Business Bank

specializes in business banking, including commercial banking and

specialized lending, private wealth, and bank consulting services,

and through its refined focus, delivers unmatched expertise,

accessibility, and responsiveness. Specialized lending solutions

are delivered through First Business Bank’s wholly owned subsidiary

First Business Specialty Finance, LLC. For additional information,

visit firstbusiness.bank.

This release may include forward-looking statements as defined

in the Private Securities Litigation Reform Act of 1995, which

reflect First Business Bank’s current views with respect to future

events and financial performance. Forward-looking statements are

not based on historical information, but rather are related to

future operations, strategies, financial results, or other

developments. Forward-looking statements are based on management’s

expectations as well as certain assumptions and estimates made by,

and information available to, management at the time the statements

are made. Those statements are based on general assumptions and are

subject to various risks, uncertainties, and other factors that may

cause actual results to differ materially from the views, beliefs,

and projections expressed in such statements. Such statements are

subject to risks and uncertainties, including among other

things:

- Adverse changes in the economy or business conditions, either

nationally or in our markets including, without limitation,

inflation, supply chain issues, labor shortages, and the adverse

effects of the COVID-19 pandemic on the global, national, and local

economy.

- Competitive pressures among depository and other financial

institutions nationally and in the Company’s markets.

- Increases in defaults by borrowers and other

delinquencies.

- Management’s ability to manage growth effectively, including

the successful expansion of our client service, administrative

infrastructure, and internal management systems.

- Fluctuations in interest rates and market prices.

- Changes in legislative or regulatory requirements applicable to

the Company and its subsidiaries.

- Changes in tax requirements, including tax rate changes, new

tax laws, and revised tax law interpretations.

- Fraud, including client and system failure or breaches of our

network security, including the Company’s internet banking

activities.

- Failure to comply with the applicable SBA regulations in order

to maintain the eligibility of the guaranteed portion of SBA

loans.

For further information about the factors that could affect the

Company’s future results, please see the Company’s annual report on

Form 10-K for the year ended December 31, 2021 and other filings

with the Securities and Exchange Commission.

SELECTED FINANCIAL CONDITION

DATA

(Unaudited)

As of

(in thousands)

December 31,

2022

September 30,

2022

June 30, 2022

March 31, 2022

December 31,

2021

Assets

Cash and cash equivalents

$

102,682

$

110,965

$

95,484

$

95,603

$

57,110

Securities available-for-sale, at fair

value

212,024

196,566

208,643

223,631

205,702

Securities held-to-maturity, at amortized

cost

12,635

13,531

13,968

17,267

19,746

Loans held for sale

2,632

773

2,256

2,418

3,570

Loans and leases receivable

2,443,066

2,330,700

2,290,100

2,251,249

2,239,408

Allowance for loan and lease losses

(24,230

)

(24,143

)

(24,104

)

(23,669

)

(24,336

)

Loans and leases receivable, net

2,418,836

2,306,557

2,265,996

2,227,580

2,215,072

Premises and equipment, net

4,340

3,143

1,899

1,621

1,694

Foreclosed properties

95

151

124

117

164

Right-of-use assets

7,690

5,424

5,772

6,118

4,910

Bank-owned life insurance

54,018

54,683

54,324

53,974

53,600

Federal Home Loan Bank stock, at cost

17,812

15,701

22,959

12,863

13,336

Goodwill and other intangible assets

12,159

12,218

12,262

12,184

12,268

Derivatives

68,581

73,718

44,461

26,890

26,343

Accrued interest receivable and other

assets

63,107

57,372

48,868

43,816

39,390

Total assets

$

2,976,611

$

2,850,802

$

2,777,016

$

2,724,082

$

2,652,905

Liabilities and Stockholders’

Equity

In-market deposits

$

1,965,970

$

1,929,224

$

1,857,010

$

2,011,373

$

1,928,285

Wholesale deposits

202,236

158,321

12,321

12,321

29,638

Total deposits

2,168,206

2,087,545

1,869,331

2,023,694

1,957,923

Federal Home Loan Bank advances and other

borrowings

456,808

420,297

596,642

414,487

403,451

Junior subordinated notes

—

—

—

—

10,076

Lease liabilities

10,175

6,827

7,207

7,580

5,406

Derivatives

61,419

66,162

40,357

24,961

28,283

Accrued interest payable and other

liabilities

19,363

16,967

13,556

8,309

15,344

Total liabilities

2,715,971

2,597,798

2,527,093

2,479,031

2,420,483

Total stockholders’ equity

260,640

253,004

249,923

245,051

232,422

Total liabilities and stockholders’

equity

$

2,976,611

$

2,850,802

$

2,777,016

$

2,724,082

$

2,652,905

STATEMENTS OF INCOME

(Unaudited)

As of and for the Three Months

Ended

As of and for the Year

Ended

(Dollars in thousands, except per share

amounts)

December 31,

2022

September 30,

2022

June 30, 2022

March 31, 2022

December 31,

2021

December 31,

2022

December 31,

2021

Total interest income

$

38,319

$

31,786

$

27,031

$

24,235

$

23,576

$

121,371

$

95,995

Total interest expense

10,867

5,902

3,371

2,809

2,652

22,949

11,333

Net interest income

27,452

25,884

23,660

21,426

20,924

98,422

84,662

Provision for loan and lease losses

702

12

(3,727

)

(855

)

(508

)

(3,868

)

(5,803

)

Net interest income after provision for

loan and lease losses

26,750

25,872

27,387

22,281

21,432

102,290

90,465

Private wealth management service fees

2,570

2,618

2,852

2,841

2,874

10,881

10,784

Gain on sale of SBA loans

269

732

951

585

1,042

2,537

4,044

Service charges on deposits

791

1,018

1,041

999

1,023

3,849

3,837

Loan fees

847

814

697

652

679

3,010

2,506

Net gain on sale of securities

—

—

—

—

—

—

29

Swap fees

756

341

471

225

684

1,793

1,368

Other non-interest income

1,740

2,674

860

2,084

1,267

7,358

5,532

Total non-interest income

6,973

8,197

6,872

7,386

7,569

29,428

28,100

Compensation

15,267

14,817

14,020

13,638

12,447

57,742

51,710

Occupancy

669

566

568

555

551

2,358

2,180

Professional fees

1,210

1,203

1,298

1,170

933

4,881

3,736

Data processing

806

719

892

780

773

3,197

3,087

Marketing

641

543

670

500

548

2,354

2,022

Equipment

359

253

235

244

223

1,091

990

Computer software

1,089

1,128

1,117

1,082

1,017

4,416

4,260

FDIC insurance

203

230

296

313

210

1,042

1,143

Other non-interest expense

923

569

360

541

829

2,393

2,407

Total non-interest expense

21,167

20,028

19,456

18,823

17,531

79,474

71,535

Income before income tax expense

12,556

14,041

14,803

10,844

11,470

52,244

47,030

Income tax expense

2,400

3,215

3,599

2,172

2,879

11,386

11,275

Net income

$

10,156

$

10,826

$

11,204

$

8,672

$

8,591

$

40,858

$

35,755

Preferred stock dividends

219

218

246

—

—

683

—

Net income available to common

shareholders

$

9,937

$

10,608

$

10,958

$

8,672

$

8,591

$

40,175

$

35,755

Per common share:

Basic earnings

$

1.18

$

1.25

$

1.29

$

1.02

$

1.01

$

4.75

$

4.17

Diluted earnings

1.18

1.25

1.29

1.02

1.01

4.75

4.17

Dividends declared

0.1975

0.1975

0.1975

0.1975

0.18

0.79

0.72

Book value

29.74

28.58

28.08

27.46

27.48

29.74

27.48

Tangible book value

28.28

27.13

26.63

26.02

26.03

28.28

26.03

Weighted-average common shares

outstanding(1)

8,180,531

8,230,902

8,225,838

8,232,142

8,228,311

8,226,943

8,314,921

Weighted-average diluted common shares

outstanding(1)

8,180,531

8,230,902

8,225,838

8,232,142

8,228,311

8,226,943

8,314,921

(1)

Excluding participating securities.

NET INTEREST INCOME ANALYSIS

(Unaudited)

For the Three Months

Ended

(Dollars in thousands)

December 31, 2022

September 30, 2022

December 31, 2021

Average

Balance

Interest

Average

Yield/Rate(4)

Average

Balance

Interest

Average

Yield/Rate(4)

Average

Balance

Interest

Average

Yield/Rate(4)

Interest-earning assets

Commercial real estate and other mortgage

loans(1)

$

1,515,975

$

20,948

5.53

%

$

1,486,530

$

17,280

4.65

%

$

1,417,498

$

13,225

3.73

%

Commercial and industrial loans(1)

806,019

14,816

7.35

%

765,440

12,266

6.41

%

702,108

8,711

4.96

%

Direct financing leases(1)

13,747

156

4.54

%

15,093

160

4.24

%

17,662

200

4.53

%

Consumer and other loans(1)

48,350

514

4.25

%

49,558

468

3.78

%

42,501

376

3.54

%

Total loans and leases receivable(1)

2,384,091

36,434

6.11

%

2,316,621

30,174

5.21

%

2,179,769

22,512

4.13

%

Mortgage-related securities(2)

164,120

1,008

2.46

%

168,433

915

2.17

%

170,002

677

1.59

%

Other investment securities(3)

49,850

261

2.09

%

51,812

250

1.93

%

49,927

209

1.67

%

FHLB stock

16,281

301

7.40

%

18,167

289

6.36

%

12,345

155

5.02

%

Short-term investments

34,807

315

3.62

%

27,912

158

2.26

%

59,970

23

0.15

%

Total interest-earning assets

2,649,149

38,319

5.79

%

2,582,945

31,786

4.92

%

2,472,013

23,576

3.81

%

Non-interest-earning assets

218,326

176,016

140,892

Total assets

$

2,867,475

$

2,758,961

$

2,612,905

Interest-bearing liabilities

Transaction accounts

$

492,586

2,360

1.92

%

$

486,704

1,005

0.83

%

$

497,743

239

0.19

%

Money market

748,502

3,784

2.02

%

746,227

1,610

0.86

%

749,247

321

0.17

%

Certificates of deposit

148,949

849

2.28

%

113,529

340

1.20

%

42,507

36

0.34

%

Wholesale deposits

128,908

1,180

3.66

%

36,702

226

2.46

%

62,342

161

1.03

%

Total interest-bearing deposits

1,518,945

8,173

2.15

%

1,383,162

3,181

0.92

%

1,351,839

757

0.22

%

FHLB advances

389,310

2,149

2.21

%

432,528

2,173

2.01

%

353,637

1,149

1.30

%

Other borrowings

41,143

545

5.30

%

42,800

548

5.12

%

35,270

466

5.28

%

Junior subordinated notes

—

—

—

%

—

—

—

%

10,073

280

11.12

%

Total interest-bearing liabilities

1,949,398

10,867

2.23

%

1,858,490

5,902

1.27

%

1,750,819

2,652

0.61

%

Non-interest-bearing demand deposit

accounts

560,588

584,535

577,378

Other non-interest-bearing liabilities

100,998

60,705

56,280

Total liabilities

2,610,984

2,503,730

2,384,477

Stockholders’ equity

256,491

255,231

228,428

Total liabilities and stockholders’

equity

$

2,867,475

$

2,758,961

$

2,612,905

Net interest income

$

27,452

$

25,884

$

20,924

Interest rate spread

3.56

%

3.65

%

3.21

%

Net interest-earning assets

$

699,751

$

724,455

$

721,194

Net interest margin

4.15

%

4.01

%

3.39

%

(1)

The average balances of loans and leases

include non-accrual loans and leases and loans held for sale.

Interest income related to non-accrual loans and leases is

recognized when collected. Interest income includes net loan fees

collected in lieu of interest.

(2)

Includes amortized cost basis of assets

available for sale and held to maturity.

(3)

Yields on tax-exempt municipal obligations

are not presented on a tax-equivalent basis in this table.

(4)

Represents annualized yields/rates.

NET INTEREST INCOME ANALYSIS

(Unaudited)

For the Year Ended

(Dollars in thousands)

December 31, 2022

December 31, 2021

Average

Balance

Interest

Average

Yield/Rate

Average

Balance

Interest

Average

Yield/Rate

Interest-earning assets

Commercial real estate and other mortgage

loans(1)

$

1,484,239

$

66,917

4.51

%

$

1,387,434

$

51,930

3.74

%

Commercial and industrial loans(1)

755,837

45,893

6.07

%

727,923

37,470

5.15

%

Direct financing leases(1)

15,219

682

4.48

%

19,591

872

4.45

%

Consumer and other loans(1)

49,695

1,876

3.78

%

44,206

1,572

3.56

%

Total loans and leases receivable(1)

2,304,990

115,368

5.01

%

2,179,154

91,844

4.21

%

Mortgage-related securities(2)

173,495

3,486

2.01

%

159,242

2,633

1.65

%

Other investment securities(3)

51,700

986

1.91

%

44,739

777

1.74

%

FHLB stock

16,462

989

6.01

%

13,066

651

4.98

%

Short-term investments

30,845

542

1.76

%

64,308

90

0.14

%

Total interest-earning assets

2,577,492

121,371

4.71

%

2,460,509

95,995

3.90

%

Non-interest-earning assets

175,424

144,499

Total assets

$

2,752,916

$

2,605,008

Interest-bearing liabilities

Transaction accounts

$

503,668

3,963

0.79

%

$

506,693

988

0.19

%

Money market

761,469

6,241

0.82

%

693,608

1,183

0.17

%

Certificates of deposit

97,448

1,358

1.39

%

47,020

396

0.84

%

Wholesale deposits

48,825

1,616

3.31

%

119,831

986

0.82

%

Total interest-bearing deposits

1,411,410

13,178

0.93

%

1,367,152

3,553

0.26

%

FHLB advances

414,191

7,024

1.70

%

376,781

4,908

1.30

%

Other borrowings

43,818

2,243

5.12

%

31,935

1,759

5.51

%

Junior subordinated notes(4)

2,429

504

20.75

%

10,068

1,113

11.05

%

Total interest-bearing liabilities

1,871,848

22,949

1.23

%

1,785,936

11,333

0.63

%

Non-interest-bearing demand deposit

accounts

566,230

536,981

Other non-interest-bearing liabilities

65,611

61,580

Total liabilities

2,503,689

2,384,497

Stockholders’ equity

249,227

220,511

Total liabilities and stockholders’

equity

$

2,752,916

$

2,605,008

Net interest income

$

98,422

$

84,662

Interest rate spread

3.48

%

3.27

%

Net interest-earning assets

$

705,644

$

674,573

Net interest margin

3.82

%

3.44

%

(1)

The average balances of loans and leases

include non-accrual loans and leases and loans held for sale.

Interest income related to non-accrual loans and leases is

recognized when collected. Interest income includes net loan fees

collected in lieu of interest.

(2)

Includes amortized cost basis of assets

available for sale and held to maturity.

(3)

Yields on tax-exempt municipal obligations

are not presented on a tax-equivalent basis in this table.

(4)

The calculation for the year ended

December 31, 2022 includes $236,000 in accelerated amortization of

debt issuance costs.

ASSET AND LIABILITY BETA

ANALYSIS

For the Three Months

Ended

For the Year Ended

(Unaudited)

December 31, 2022

September 30, 2022

December 31, 2021

December 31, 2022

December 31, 2021

Average Yield/Rate (3)

Average Yield/Rate (3)

Increase (Decrease)

Average Yield/Rate (3)

Increase (Decrease)

Average Yield/Rate

Average Yield/Rate

Increase (Decrease)

Total loans and leases receivable (a)

6.11

%

5.21

%

0.90

%

4.13

%

1.98

%

5.01

%

4.21

%

0.80

%

Total interest-earning assets(b)

5.79

%

4.92

%

0.87

%

3.81

%

1.98

%

4.71

%

3.90

%

0.81

%

Adjusted total loans and leases receivable

(1)(c)

5.90

%

5.08

%

0.82

%

3.89

%

2.01

%

4.79

%

3.91

%

0.88

%

Adjusted total interest-earning assets

(1)(d)

5.59

%

4.80

%

0.79

%

3.60

%

1.99

%

4.52

%

3.61

%

0.91

%

Total in-market deposits(e)

1.43

%

0.61

%

0.82

%

0.13

%

1.30

%

0.60

%

0.14

%

0.46

%

Total bank funding(f)

1.67

%

0.89

%

0.78

%

0.33

%

1.34

%

0.84

%

0.37

%

0.47

%

Net interest margin(g)

4.15

%

4.01

%

0.14

%

3.39

%

0.76

%

3.82

%

3.44

%

0.38

%

Adjusted net interest margin(h)

3.94

%

3.89

%

0.05

%

3.23

%

0.71

%

3.64

%

3.21

%

0.43

%

Effective fed funds rate (2)(i)

3.65

%

2.18

%

1.47

%

0.09

%

3.56

%

1.69

%

0.08

%

1.61

%

Beta

Calculations:

Total loans and leases

receivable(a)/(i)

61.42

%

55.67

%

49.69

%

Total interest-earning assets(b)/(i)

58.74

%

55.36

%

50.15

%

Adjusted total loans and leases receivable

(1)(c)/(i)

55.61

%

56.38

%

54.66

%

Adjusted total interest-earning assets

(1)(d)/(i)

53.50

%

56.05

%

56.39

%

Total in-market deposits(e/i)

55.78

%

36.52

%

28.57

%

Total bank funding(f)/(i)

53.06

%

37.64

%

29.19

%

Net interest margin(g/i)

9.52

%

21.35

%

23.60

%

Adjusted Net interest margin(h/i)

3.40

%

19.94

%

26.71

%

(1)

Excluding average net PPP loans, PPP loan

interest income, and fees in lieu of interest.

(2)

Board of Governors of the Federal Reserve

System (US), Effective Federal Funds Rate [DFF]. Retrieved from

FRED, Federal Reserve Bank of St. Louis. Represents average daily

rate.

(3)

Represents annualized yields/rates.

PROVISION FOR LOAN AND LEASE LOSS

COMPOSITION

(Unaudited)

For the Three Months

Ended

For the Year Ended

(Dollars in thousands)

December 31,

2022

September 30,

2022

June 30, 2022

March 31, 2022

December 31,

2021

December 31,

2022

December 31,

2021

Change in general reserve due to

qualitative factor changes

$

85

$

132

$

(185

)

$

(416

)

$

(805

)

$

(384

)

$

(426

)

Change in general reserve due to

historical loss factor changes

(930

)

(940

)

64

(206

)

(862

)

(2,012

)

(4,456

)

Charge-offs

818

54

85

22

106

979

3,508

Recoveries

(203

)

(81

)

(4,247

)

(210

)

(274

)

(4,741

)

(5,126

)

Change in specific reserves on impaired

loans, net

(50

)

447

29

(280

)

(64

)

146

(2,175

)

Change due to loan growth, net

982

400

527

235

1,391

2,144

2,872

Total provision for loan and lease

losses

$

702

$

12

$

(3,727

)

$

(855

)

$

(508

)

$

(3,868

)

$

(5,803

)

PERFORMANCE RATIOS

For the Three Months

Ended

For the Year Ended

(Unaudited)

December 31,

2022

September 30,

2022

June 30, 2022

March 31, 2022

December 31,

2021

December 31,

2022

December 31,

2021

Return on average assets (annualized)

1.39

%

1.54

%

1.61

%

1.30

%

1.32

%

1.46

%

1.37

%

Return on average common equity

(annualized)

16.26

%

17.44

%

18.79

%

14.70

%

15.04

%

16.79

%

16.21

%

Efficiency ratio

61.45

%

58.46

%

64.47

%

65.55

%

61.92

%

62.31

%

63.49

%

Interest rate spread

3.56

%

3.65

%

3.51

%

3.22

%

3.21

%

3.48

%

3.27

%

Net interest margin

4.15

%

4.01

%

3.71

%

3.39

%

3.39

%

3.82

%

3.44

%

Average interest-earning assets to average

interest-bearing liabilities

135.90

%

138.98

%

137.40

%

138.64

%

141.19

%

137.70

%

137.77

%

ASSET QUALITY RATIOS

(Unaudited)

As of

(Dollars in thousands)

December 31,

2022

September 30,

2022

June 30, 2022

March 31, 2022

December 31,

2021

Non-accrual loans and leases

$

3,659

$

3,645

$

5,585

$

5,617

$

6,358

Foreclosed properties

95

151

124

117

164

Total non-performing assets

3,754

3,796

5,709

5,734

6,522

Performing troubled debt

restructurings

156

172

188

203

217

Total impaired assets

$

3,910

$

3,968

$

5,897

$

5,937

$

6,739

Non-accrual loans and leases as a percent

of total gross loans and leases

0.15

%

0.16

%

0.24

%

0.25

%

0.28

%

Non-performing assets as a percent of

total gross loans and leases plus foreclosed properties

0.15

%

0.16

%

0.25

%

0.25

%

0.29

%

Non-performing assets as a percent of

total assets

0.13

%

0.13

%

0.21

%

0.21

%

0.25

%

Allowance for loan and lease losses as a

percent of total gross loans and leases

0.99

%

1.04

%

1.05

%

1.05

%

1.09

%

Allowance for loan and lease losses as a

percent of non-accrual loans and leases

662.20

%

662.36

%

431.58

%

421.38

%

382.76

%

ASSET QUALITY RATIOS - EXCLUDING NET

PPP LOANS

(Unaudited)

As of

(Dollars in thousands)

December 31,

2022

September 30,

2022

June 30, 2022

March 31, 2022

December 31,

2021

Non-accrual loans and leases as a percent

of total gross loans and leases

0.15

%

0.16

%

0.24

%

0.25

%

0.29

%

Non-performing assets as a percent of

total gross loans and leases plus foreclosed properties

0.15

%

0.16

%

0.25

%

0.26

%

0.29

%

Non-performing assets as a percent of

total assets

0.13

%

0.13

%

0.21

%

0.21

%

0.25

%

Allowance for loan and lease losses as a

percent of total gross loans and leases

0.99

%

1.04

%

1.06

%

1.06

%

1.10

%

PPP loans outstanding, net

$

506

$

2,324

$

8,172

$

18,206

$

27,297

NET CHARGE-OFFS (RECOVERIES)

(Unaudited)

For the Three Months

Ended

For the Year Ended

(Dollars in thousands)

December 31,

2022

September 30,

2022

June 30, 2022

March 31, 2022

December 31,

2021

December 31,

2022

December 31,

2021

Charge-offs

$

818

$

54

$

85

$

22

$

106

$

979

$

3,508

Recoveries

(203

)

(81

)

(4,247

)

(210

)

(274

)

(4,741

)

(5,126

)

Net charge-offs (recoveries)

$

615

$

(27

)

$

(4,162

)

$

(188

)

$

(168

)

$

(3,762

)

$

(1,618

)

Net charge-offs (recoveries) as a percent

of average gross loans and leases (annualized)

0.10

%

—

%

(0.73

) %

(0.03

) %

(0.03

) %

(0.16

) %

(0.07

) %

Annualized charge-offs (recoveries) as a

percent of average gross loans and leases, excluding average net

PPP loans

0.10

%

—

%

(0.74

) %

(0.03

) %

(0.03

) %

(0.16

) %

(0.08

) %

Average PPP loans outstanding, net

$

2,133

$

4,505

$

11,650

$

20,935

$

52,923

$

9,740

$

152,264

CAPITAL RATIOS

As of and for the Three Months

Ended

(Unaudited)

December 31,

2022

September 30,

2022

June 30, 2022

March 31, 2022

December 31,

2021

Total capital to risk-weighted assets

11.26

%

11.66

%

11.56

%

11.87

%

10.82

%

Tier I capital to risk-weighted assets

9.20

%

9.48

%

9.34

%

9.27

%

8.94

%

Common equity tier I capital to

risk-weighted assets

8.79

%

9.04

%

8.90

%

8.81

%

8.55

%

Tier I capital to adjusted assets

9.17

%

9.34

%

9.19

%

9.09

%

8.94

%

Tangible common equity to tangible

assets

7.98

%

8.06

%

8.16

%

8.14

%

8.34

%

Tangible common equity to tangible assets,

excluding net PPP loans

7.98

%

8.07

%

8.19

%

8.20

%

8.42

%

LOAN AND LEASE RECEIVABLE

COMPOSITION

(Unaudited)

As of

(in thousands)

December 31,

2022

September 30,

2022

June 30, 2022

March 31, 2022

December 31,

2021

Commercial real estate:

Commercial real estate - owner

occupied

$

268,354

$

265,989

$

258,375

$

254,237

$

235,589

Commercial real estate - non-owner

occupied

687,091

657,975

651,920

656,185

661,423

Land development

50,803

49,458

42,545

40,092

42,792

Construction

167,948

162,051

203,913

200,472

179,841

Multi-family

350,026

332,782

314,392

302,494

320,072

1-4 family

17,728

16,678

17,335

16,198

14,911

Total commercial real estate

1,541,950

1,484,933

1,488,480

1,469,678

1,454,628

Commercial and industrial

841,178

788,983

741,363

720,695

730,819

Direct financing leases, net

12,149

11,109

13,718

14,551

15,743

Consumer and other:

Home equity and second mortgages

6,761

5,413

5,132

4,523

4,223

Other

41,177

40,710

42,387

43,066

35,518

Total consumer and other

47,938

46,123

47,519

47,589

39,741

Total gross loans and leases

receivable

2,443,215

2,331,148

2,291,080

2,252,513

2,240,931

Less:

Allowance for loan and lease losses

24,230

24,143

24,104

23,669

24,336

Deferred loan fees

149

448

980

1,264

1,523

Loans and leases receivable, net

$

2,418,836

$

2,306,557

$

2,265,996

$

2,227,580

$

2,215,072

DEPOSIT COMPOSITION

(Unaudited)

As of

(in thousands)

December 31,

2022

September 30,

2022

June 30, 2022

March 31, 2022

December 31,

2021

Non-interest-bearing transaction

accounts

$

537,107

$

564,141

$

544,507

$

600,987

$

589,559

Interest-bearing transaction accounts

576,601

461,883

466,785

539,492

530,225

Money market accounts

698,505

742,545

731,718

806,917

754,410

Certificates of deposit

153,757

160,655

114,000

63,977

54,091

Wholesale deposits

202,236

158,321

12,321

12,321

29,638

Total deposits

$

2,168,206

$

2,087,545

$

1,869,331

$

2,023,694

$

1,957,923

PRIVATE WEALTH OFF BALANCE SHEET

COMPOSITION

(Unaudited)

As of

(in thousands)

December 31,

2022

September 30,

2022

June 30, 2022

March 31, 2022

December 31,

2021

Trust assets under management

$

2,483,811

$

2,332,448

$

2,386,637

$

2,636,896

$

2,711,760

Trust assets under administration

176,225

160,171

167,095

197,160

208,954

Total trust assets

$

2,660,036

$

2,492,619

$

2,553,732

$

2,834,056

$

2,920,714

NON-GAAP RECONCILIATIONS

Certain financial information provided in this release is

determined by methods other than in accordance with generally

accepted accounting principles (United States) (“GAAP”). Although

the Company’s management believes that these non-GAAP financial

measures provide a greater understanding of its business, these

measures are not necessarily comparable to similar measures that

may be presented by other companies.

TANGIBLE BOOK VALUE

“Tangible book value per share” is a non-GAAP measure

representing tangible common equity divided by total common shares

outstanding. “Tangible common equity” itself is a non-GAAP measure

representing common stockholders’ equity reduced by intangible

assets, if any. The Company’s management believes that this measure

is important to many investors in the marketplace who are

interested in period-to-period changes in book value per common

share exclusive of changes in intangible assets. The information

provided below reconciles tangible book value per share and

tangible common equity to their most comparable GAAP measures.

(Unaudited)

As of

(Dollars in thousands, except per share

amounts)

December 31,

2022

September 30,

2022

June 30, 2022

March 31, 2022

December 31,

2021

Common stockholders’ equity

$

248,648

$

241,012

$

237,931

$

233,059

$

232,422

Goodwill and other intangible assets

(12,159

)

(12,218

)

(12,262

)

(12,184

)

(12,268

)

Tangible common equity

$

236,489

$

228,794

$

225,669

$

220,875

$

220,154

Common shares outstanding

8,362,085

8,432,048

8,474,699

8,488,585

8,457,564

Book value per share

$

29.74

$

28.58

$

28.08

$

27.46

$

27.48

Tangible book value per share

28.28

27.13

26.63

26.02

26.03

TANGIBLE COMMON EQUITY TO TANGIBLE ASSETS

“Tangible common equity to tangible assets” is defined as the

ratio of common stockholders’ equity reduced by intangible assets,

if any, divided by total assets reduced by intangible assets, if

any. The Company’s management believes that this measure is

important to many investors in the marketplace who are interested

in the relative changes from period to period in common equity and

total assets, each exclusive of changes in intangible assets. The

information below reconciles tangible common equity and tangible

assets to their most comparable GAAP measures.

(Unaudited)

As of

(Dollars in thousands)

December 31,

2022

September 30,

2022

June 30, 2022

March 31, 2022

December 31,

2021

Common stockholders’ equity

$

248,648

$

241,012

$

237,931

$

233,059

$

232,422

Goodwill and other intangible assets

(12,159

)

(12,218

)

(12,262

)

(12,184

)

(12,268

)

Tangible common equity

$

236,489

$

228,794

$

225,669

$

220,875

$

220,154

Total assets

$

2,976,611

$

2,850,802

$

2,777,016

$

2,724,082

$

2,652,905

Goodwill and other intangible assets

(12,159

)

(12,218

)

(12,262

)

(12,184

)

(12,268

)

Tangible assets

$

2,964,452

$

2,838,584

$

2,764,754

$

2,711,898

$

2,640,637

Tangible common equity to tangible

assets

7.98

%

8.06

%

8.16

%

8.14

%

8.34

%

Period-end net PPP loans

506

2,324

8,172

18,206

27,297

Tangible assets, excluding net PPP

loans

$

2,963,946

$

2,836,260

$

2,756,582

$

2,693,692

$

2,613,340

Tangible common equity to tangible assets,

excluding net PPP loans

7.98

%

8.07

%

8.19

%

8.20

%

8.42

%

EFFICIENCY RATIO & PRE-TAX, PRE-PROVISION ADJUSTED

EARNINGS

“Efficiency ratio” is a non-GAAP measure representing

non-interest expense excluding the effects of the SBA recourse

provision, impairment of tax credit investments, losses or gains on

foreclosed properties, amortization of other intangible assets and

other discrete items, if any, divided by operating revenue, which

is equal to net interest income plus non-interest income less

realized gains or losses on securities, if any. “Pre-tax,

pre-provision adjusted earnings” is defined as operating revenue

less operating expense. In the judgment of the Company’s

management, the adjustments made to non-interest expense and

non-interest income allow investors and analysts to better assess

the Company’s operating expenses in relation to its core operating

revenue by removing the volatility that is associated with certain

one-time items and other discrete items. The information provided

below reconciles the efficiency ratio and pre-tax, pre-provision

adjusted earnings to its most comparable GAAP measure.

(Unaudited)

For the Three Months

Ended

For the Year Ended

(Dollars in thousands)

December 31,

2022

September 30,

2022

June 30, 2022

March 31, 2022

December 31,

2021

December 31,

2022

December 31,

2021

Total non-interest expense

$

21,167

$

20,028

$

19,456

$

18,823

$

17,531

$

79,474

$

71,535

Less:

Net loss on foreclosed properties

22

7

8

12

7

49

15

Amortization of other intangible

assets

—

—

—

—

2

—

25

SBA recourse provision (benefit)

(322

)

96

114

(76

)

(122

)

(188

)

(76

)

Contribution to First Business Charitable

Foundation

809

—

—

—

—

809

—

Tax credit investment impairment

recovery

—

—

(351

)

—

—

(351

)

—

Total operating expense (a)

$

20,658

$

19,925

$

19,685

$

18,887

$

17,644

$

79,155

$

71,571

Net interest income

$

27,452

$

25,884

$

23,660

$

21,426

$

20,924

$

98,422

$

84,662

Total non-interest income

6,973

8,197

6,872

7,386

7,569

29,428

28,100

Less:

Bank-owned life insurance claim

809

—

—

—

—

809

—

Net gain on sale of securities

—

—

—

—

—

—

29

Adjusted non-interest income

6,164

8,197

6,872

7,386

7,569

28,619

28,071

Total operating revenue (b)

$

33,616

$

34,081

$

30,532

$

28,812

$

28,493

$

127,041

$

112,733

Efficiency ratio

61.45

%

58.46

%

64.47

%

65.55

%

61.92

%

62.31

%

63.49

%

Pre-tax, pre-provision adjusted earnings

(b - a)

$

12,958

$

14,156

$

10,847

$

9,925

$

10,849

$

47,886

$

41,162

Less:

PPP fee income

3

61

196

249

892

509

7,312

PPP loan interest income

5

11

29

52

134

97

1,524

Pre-tax, pre-provision adjusted earnings,

excluding PPP

$

12,950

$

14,084

$

10,622

$

9,624

$

9,823

$

47,280

$

32,326

Average total assets

$

2,867,475

$

2,758,961

$

2,716,707

$

2,666,241

$

2,612,905

$

2,752,916

$

2,605,008

Less:

Average net PPP loans

2,133

4,505

11,650

20,935

52,923

9,740

152,264

Adjusted average total assets

$

2,865,342

$

2,754,456

$

2,705,057

$

2,645,306

$

2,559,982

$

2,743,176

$

2,452,744

Pre-tax, pre-provision adjusted return on

average assets

1.81

%

2.05

%

1.60

%

1.49

%

1.66

%

1.74

%

1.58

%

Pre-tax, pre-provision adjusted return on

average assets, excluding PPP

1.81

%

2.05

%

1.57

%

1.46

%

1.53

%

1.72

%

1.32

%

ADJUSTED NET INTEREST MARGIN

“Adjusted Net Interest Margin” is a non-GAAP measure

representing net interest income excluding the fees in lieu of

interest and other recurring, but volatile, components of net

interest margin divided by average interest-earning assets less

average net PPP loans, if any, and other recurring, but volatile,

components of average interest-earning assets. Fees in lieu of

interest are defined as prepayment fees, asset-based loan fees,

non-accrual interest, and loan fee amortization. In the judgment of

the Company’s management, the adjustments made to net interest

income allow investors and analysts to better assess the Company’s

net interest income in relation to its core client-facing loan and

deposit rate changes by removing the volatility that is associated

with these recurring but volatile components. The information

provided below reconciles the net interest margin to its most

comparable GAAP measure.

(Unaudited)

For the Three Months

Ended

For the Year Ended

(Dollars in thousands)

December 31,

2022

September 30,

2022

June 30, 2022

March 31, 2022

December 31,

2021

December 31,

2022

December 31,

2021

Interest income

$

38,319

$

31,786

$

27,031

$

24,235

$

23,576

$

121,371

$

95,995

Interest expense

10,867

5,902

3,371