Successful conclusion of consent process under the Lock-Up Agreement dated March 27, 2021

April 21 2021 - 8:30AM

Ferroglobe PLC (NASDAQ: GSM) (the “Company”) refers to the

Company’s release on March 28, 2021 regarding the lock-up agreement

dated March 27, 2021 (the “Lock-Up Agreement”) between the Company

and certain financial stakeholders.

The Company is pleased to announce that holders

of approximately 96% by value of the 9.375% Senior Notes due 2022

issued by the Company and Globe Specialty Metals, Inc (the “2022

Senior Notes”) have signed or acceded to the Lock-Up Agreement.

In light of this, the Company has agreed an

amendment to the Lock-Up Agreement to allow it to proceed to

implement the transaction by way of an exchange offer instead of an

English law scheme of arrangement. The exchange offer will also

involve a concurrent solicitation of consents to amend the terms of

any non-participating 2022 Senior Notes to eliminate substantially

all of the restrictive covenants, certain events of default and

other related provisions. Further details of the exchange offer

will be made available to holders of 2022 Senior Notes in due

course.

Comments

Beatriz García-Cos, Ferroglobe’s Chief Financial

Officer, commented, “With approximately 96% of our existing

noteholders consenting, we view the response as a positive

confirmation of the investment community’s support for our

refinancing and confidence in the Company’s strategic plan. We

thank the ad hoc group of noteholders for their continued support

in driving this forward. The decision to follow an exchange offer

instead of a scheme of arrangement presents a quicker and more

cost-effective path towards closing and funding, which are

important to support execution of our plan. Overall, this is a

terrific outcome for our Company and an important milestone in the

broader refinancing.”

Next Steps

Holders of the 2022 Senior Notes that have not

yet signed the Lock-Up Agreement may contact the Information Agent

at ProjectFox@glas.agency to access further information relating to

the transaction and for details of how to accede to the Lock-Up

Agreement.

Noteholders may still become eligible for

the 0.5% Late Cash Consent Fee by signing the Lock-Up Agreement and

holding 2022 Senior Notes that became locked-up notes on or prior

to the date on which the solicitation period of the exchange offer

ends, and the 1.75% Exchange Offer Equity Fee by participating in

the exchange offer

About Ferroglobe

Ferroglobe is one of the world’s leading

suppliers of silicon metal, silicon-based and manganese-based

specialty alloys and ferroalloys, serving a customer base across

the globe in dynamic and fast-growing end markets, such as solar,

automotive, consumer products, construction and energy. For more

information, visit http://investor.ferroglobe.com.

Forward-Looking Statements

This release contains “forward-looking

statements” within the meaning of U.S. securities laws.

Forward-looking statements are not historical facts but are based

on certain assumptions of management and describe Ferroglobe’s

future plans, strategies and expectations. Forward-looking

statements often use forward-looking terminology, including words

such as “anticipate”, “believe”, “could”, “estimate”, “expect”,

“forecast”, “guidance”, “intends”, “likely”, “may”, “plan”,

“potential”, “predicts”, “seek”, “will” and words of similar

meaning or the negative thereof.

Forward-looking statements contained in this

press release are based on information currently available to

Ferroglobe and assumptions that management believe to be reasonable

but are inherently uncertain. As a result, Ferroglobe’s actual

results, performance or achievements may differ materially from

those expressed or implied by these forward-looking statements,

which are not guarantees of future performance and involve known

and unknown risks, uncertainties and other factors that are, in

some cases, beyond Ferroglobe’s control.

All information in this press release is as of

the date of its release. Ferroglobe does not undertake any

obligation to update publicly any of the forward-looking statements

contained herein to reflect new information, events or

circumstances arising after the date of this press release. You

should not place undue reliance on any forward-looking statements,

which are made only as of the date of this press release.

No offer

This press release is not an offer to sell or a

solicitation of an offer to buy or exchange or acquire securities

in the United States or in any other jurisdiction. The securities

referenced in this press release may not be offered, sold,

exchanged or delivered in the United States absent registration or

an applicable exemption from the registration requirement under the

U.S. Securities Act of 1933, as amended. This press release is not

directed at, or intended for distribution, publication,

availability to or use by, any person or entity that is a citizen

or resident or located in any locality, state, country or other

jurisdiction, where such distribution, publication, availability or

use would be contrary to law or regulation, or which would require

any registration or licensing within such jurisdiction.

Summary only

This press release is intended as a summary

only, and holders of 2022 Senior Notes should refer to the

additional details of the terms of the New $40 Equity, the New $60m

Notes and the Reinstated $350m Notes set forth in the Company’s

press release on March 28, 2021, and the detailed terms set out in

the Lock-Up Agreement.

INVESTOR CONTACT:

Gaurav Mehta Executive Vice President - Investor

Relations investor.relations@ferroglobe.com

MEDIA CONTACT:

Cristina Feliu Roig Executive Director –

Communications & Public Affairs

corporate.comms@ferroglobe.com

Source: Ferroglobe PLC

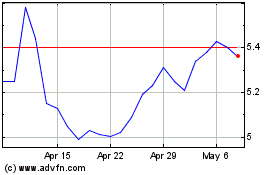

Ferroglobe (NASDAQ:GSM)

Historical Stock Chart

From Jun 2024 to Jul 2024

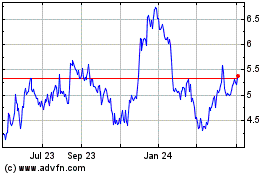

Ferroglobe (NASDAQ:GSM)

Historical Stock Chart

From Jul 2023 to Jul 2024