false

0001633932

A1

0001633932

2024-08-05

2024-08-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________

FORM 8-K

___________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): August

5, 2024

___________

ESSA Pharma Inc.

(Exact name of registrant as specified in its charter)

___________

|

British Columbia, Canada

(State or other jurisdiction of incorporation) |

001-37410

(Commission File Number) |

98-1250703

(IRS Employer Identification No.) |

| |

|

|

|

Suite 720, 999 West Broadway, Vancouver, British

Columbia, Canada

(Address of principal executive offices) |

V5Z 1K5

(Zip Code) |

Registrant’s telephone number, including area

code: (778) 331-0962

_____________________

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of

each class |

Trading

Symbol(s) |

Name of

each exchange on which registered |

| Common Shares, no par value |

EPIX |

Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

The following information is filed pursuant to Item

2.02, “Results of Operations and Financial Condition.”

On August 5, 2024, ESSA Pharma Inc. (the “Company”)

issued a press release announcing its financial results for the fiscal quarter ended June 30, 2024. A copy of the press release is attached

as Exhibit 99.1 to this Form 8-K.

The information provided under this Item (including

Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange

Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under

the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

| Item 9.01 |

Financial Statements and Exhibits. |

| |

|

| |

(d) Exhibits |

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

_____ ESSA PHARMA INC. ___

(Registrant) |

| Date: August 5, 2024 |

|

|

| |

By: |

/s/ David Wood |

| |

|

Name: David Wood

Title: Chief Financial Officer |

Exhibit 99.1

ESSA Pharma Provides

Corporate Update and Reports Financial Results for Fiscal Third Quarter Ended June 30, 2024

On track to report

updated Phase 1 masofaniten plus enzalutamide dose escalation data in patients with mCRPC naïve to second generation antiandrogens

in the second half of 2024

Presentation of Phase

1b monotherapy results expected to be reported in the second half of 2024

Phase 2 dose expansion

underway evaluating masofaniten plus enzalutamide in patients with mCRPC naïve to second generation antiandrogens; ESSA projecting

completion of enrollment in the first quarter of 2025, with preliminary data expected in mid-2025

Cash runway sufficient

to fund operations well beyond 2025

SOUTH SAN FRANCISCO, California and VANCOUVER,

Canada, August 5, 2024 - ESSA Pharma Inc. ("ESSA", or the "Company") (NASDAQ: EPIX), a clinical-stage pharmaceutical

company focused on developing novel therapies for the treatment of prostate cancer, today provided a corporate update and reported financial

results for the fiscal third quarter ended June 30, 2024.

“With continued focus on execution,

we are progressing towards a stream of significant milestones throughout the next nine to twelve months, with the first being the presentation

at ESMO of more mature durability data from the Phase 1 dose escalation study evaluating masofaniten combined with enzalutamide in patients

with metastatic castration-resistant prostate cancer naïve to second-generation antiandrogens,” said David Parkinson, MD, President

and CEO of ESSA. “We are focused on the enrollment of the Phase 2 dose expansion study evaluating masofaniten in combination with

enzalutamide, with 25 sites activated in the US, Canada and Australia and an additional 14 sites being activated in Europe. We look forward

to reporting key data across these trials throughout the remainder of this year through 2025.”

Third Quarter Fiscal 2024 and Recent Highlights

Masofaniten Combination Studies

| • | Phase 1/2 study is still ongoing evaluating masofaniten in combination

with enzalutamide in patients with metastatic castration-resistant prostate cancer (“mCRPC”) naïve to second-generation

antiandrogens but may have been treated with chemotherapy in the metastatic castration-sensitive setting. The latest reported results,

which were presented at the ASCO-GU symposium in January 2024, demonstrated that the combination regimen continues to be well tolerated

at the dose levels tested in up to 25 cycles of dosing in some patients. Reductions in PSA were observed across evaluable patients for

efficacy in all dosing cohorts (n=16). Across all dosing cohorts, 88% of patients achieved PSA50, 81% of patients achieved PSA90, 69%

of patients achieved PSA90 in less than 90 days, and 63% of patients achieved PSA <0.2ng/mL. While the data for time to PSA progression

were still maturing, the median time to PSA progression was reported as 16.6 months with a median follow up at that time of 11.1 months.

ESSA plans to report updated data from the Phase 1 dose escalation study at the European Society for Medical Oncology (ESMO) 2024 congress.

.. |

| • | Masofaniten continues to be evaluated in combination with enzalutamide compared

to enzalutamide monotherapy in a Phase 2 dose randomized study in patients with mCRPC naïve to second-generation antiandrogens but

who may have been treated with chemotherapy in the metastatic castration-sensitive setting. Enrollment in the Phase 2 portion of this

Phase 1/2 study is expected to be completed during the first quarter of 2025. The study is currently enrolling at approximately 25 sites

in the US., Canada, and Australia. Expansion to European clinical sites is in progress with an additional 14 clinical sites planned to

be activated by the third quarter of 2024. ESSA is on track to report preliminary data from the Phase 2 dose expansion portion of the

study in mid-2025. |

| • | Two additional masofaniten combination arms are continuing enrollment as part

of the ongoing Phase 1 masofaniten study. One arm is evaluating masofaniten in combination with abiraterone acetate and prednisone in

patients with either metastatic castration-sensitive prostate cancer or mCRPC, while the second arm is evaluating masofaniten in combination

with apalutamide in patients with non-metastatic castration-resistant prostate cancer after 12 weeks of masofaniten single agent. |

| • | Two additional investigator-sponsored studies testing combinations of masofaniten

with darolutamide or enzalutamide in different patient populations are currently enrolling: a) an Australian investigator-sponsored neoadjuvant

study evaluating neoadjuvant use of the combination of masofaniten and darolutamide compared to darolutamide monotherapy in high-risk

patients undergoing prostatectomy and b) an investigator-sponsored study which is testing masofaniten and enzalutamide in metastatic castration-sensitive

prostate cancer patients. |

Masofaniten Monotherapy Study

| • | ESSA remains on track to complete the Phase 1b masofaniten monotherapy

study evaluating masofaniten in patients with mCRPC resistant to second-generation antiandrogens. The initial results from the monotherapy

study were reported at the 2023 ASCO-GU Symposium, and demonstrated that masofaniten monotherapy was well-tolerated, achieved clinically

significant exposures, and showed preliminary signals of anti-tumor activity in a subset of patients. ESSA plans to present the complete

Phase 1b monotherapy results in the second half of 2024 at a medical conference. |

Summary Financial results

(Amounts expressed in U.S. dollars)

| • | Net Loss. ESSA recorded a net loss of $7.2 million for the third quarter

ended June 30, 2024, compared to $7.3 million for the third quarter ended June 30, 2023. |

| • | Research and Development ("R&D") expenditures. R&D

expenditures for the third quarter ended June 30, 2024, were $5.5 million compared to $6.3 million for the third quarter ended June 30,

2023, and include non-cash costs related to share-based payments of $851,971 for the third quarter ended 2024 compared to $599,621 for

the third quarter ended 2023. The decrease is largely attributable to reductions in preclinical work with the focus on ongoing clinical

trials. |

| • | General and Administration ("G&A") expenditures. G&A

expenditures for the third quarter ended June 30, 2024, were $3.2 million compared to $2.6 million for the third quarter ended June 30,

2023, and include non-cash costs related to share-based payments of $1,748,227 for the third quarter ended 2024 compared to $561,452 for

the third quarter ended 2023. The net decrease (net of share-based payments) relates to the timing of corporate projects and lower insurance

premiums for the current period. |

Liquidity and Outstanding Share Capital

| • | As of June 30, 2024, the Company had available cash reserves and short-term

investments of $130.7 million. The Company's cash position is expected to be sufficient to fund current and planned operations beyond

2025. |

| • | As of June 30, 2024, the Company had 44,368,959 common shares issued and outstanding. |

| • | In addition, as of June 30, 2024, there were 2,920,000 common shares issuable

upon the exercise of prefunded warrants at an exercise price of $0.0001. |

About ESSA Pharma Inc.

ESSA is a clinical-stage pharmaceutical company

focused on developing novel and proprietary therapies for the treatment of patients with prostate cancer. For more information, please

visit www.essapharma.com, and follow us on X and LinkedIn.

Forward-Looking Statement Disclaimer

This release contains certain information

which, as presented, constitutes "forward-looking statements" within the meaning of the Private Securities Litigation Reform

Act of 1995 and, and “forward-looking information” within the meaning of Canadian securities laws (collectively, “forward-looking

statements”). Forward-looking statements include, but are not limited to, statements that relate to future events and often addresses

expected future business and financial performance, containing words such as "anticipate", "believe", "plan",

"estimate", "expect", and "intend", statements that an action or event "may", "might",

"could", "should", or "will" be taken or occur, or other similar expressions and includes, but is not limited

to, statements regarding the Company’s plans to report updated data from its studies, the Company’s advancement and evaluation

of masofaniten, the timing of the Company’s studies, enrollment in the Company’s studies, the presentation of Phase 1a and

1b monotherapy results and the Company’s expected cash runway.

Forward-looking statements are subject to

various known and unknown risks and uncertainties, many of which are beyond the ability of ESSA to control or predict, and which may cause

ESSA's actual results, performance or achievements to be materially different from those expressed or implied thereby. Such statements

reflect ESSA's current views with respect to future events, are subject to risks and uncertainties and are necessarily based upon a number

of estimates and assumptions that, while considered reasonable by ESSA as of the date of such statements, are inherently subject to significant

medical, scientific, business, economic, competitive, political and social uncertainties and contingencies. In making forward-looking

statements, ESSA may make various material assumptions, including but not limited to (i) the accuracy of ESSA's financial projections;

(ii) obtaining positive results of clinical trials; (iii) obtaining necessary regulatory approvals; and (iv) general business,

market and economic conditions.

Forward-looking statements are developed based

on assumptions about such risks, uncertainties and other factors set out herein and in ESSA's Annual Report on Form 10-K dated December 12,

2023, under the heading "Risk Factors", a copy of which is available on ESSA's profile on EDGAR at www.sec.gov and on SEDAR+

at www.sedarplus.ca, and as otherwise disclosed from time to time on ESSA's EDGAR and SEDAR+ profiles. Forward-looking statements are

made based on management's beliefs, estimates and opinions on the date that statements are made and ESSA undertakes no obligation to update

forward-looking statements if these beliefs, estimates and opinions or other circumstances should change, except as may be required by

applicable United States and Canadian securities laws. Readers are cautioned against attributing undue certainty to forward-looking statements.

Contacts

ESSA Pharma, Inc.

David Wood, Chief Financial Officer

778.331.0962

dwood@essapharma.com

Investors and Media:

Argot Partners

212.600.1902

essa@argotpartners.com

ESSA PHARMA INC.

CONDENSED CONSOLIDATED INTERIM BALANCE SHEETS

(Unaudited)

Amounts in thousands of United States dollars

| | |

June 30,

2024 | |

September 30, 2023 |

| | |

| |

|

| Cash | |

$ | 85,985 | | |

$ | 33,702 | |

| Prepaids and other assets | |

| 46,681 | | |

| 115,420 | |

| | |

| | | |

| | |

| Total assets | |

$ | 132,666 | | |

$ | 149,122 | |

| | |

| | | |

| | |

| Current liabilities | |

| 3,575 | | |

| 3,495 | |

| Long-term debt | |

| 230 | | |

| — | |

| Shareholders' equity | |

| 128,861 | | |

| 145,627 | |

| | |

| | | |

| | |

| Total liabilities and shareholders’ equity | |

$ | 132,666 | | |

$ | 149,122 | |

ESSA PHARMA INC.

CONDENSED CONSOLIDATED INTERIM STATEMENTS OF OPERATIONS

AND COMPREHENSIVE LOSS

(Unaudited)

Amounts in thousands of United States dollars, except

share and per share data

| | |

Three months ended

June 30, 2024 | |

Three months ended

June 30, 2023 | |

Nine months ended

June 30, 2024 | |

Nine months ended

June 30, 2023 |

| | |

| |

| |

| |

|

| OPERATING EXPENSES | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

$ | 5,484 | | |

$ | 6,271 | | |

$ | 17,039 | | |

$ | 16,096 | |

| Financing costs | |

| — | | |

| 2 | | |

| — | | |

| 6 | |

| General and administration | |

| 3,154 | | |

| 2,639 | | |

| 9,688 | | |

| 8,889 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total operating expenses | |

| (8,638 | ) | |

| (8,912 | ) | |

| (26,727 | ) | |

| (24,991 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Interest and other items | |

| 1,405 | | |

| 1,613 | | |

| 4,539 | | |

| 3,892 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss before taxes | |

| (7,233 | ) | |

| (7,299 | ) | |

| (22,188 | ) | |

| (21,099 | ) |

| Income tax expense (recovery) | |

| — | | |

| — | | |

| — | | |

| (2 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss for the period | |

| (7,233 | ) | |

| (7,299 | ) | |

| (22,188 | ) | |

| (21,101 | ) |

| | |

| | | |

| | | |

| | | |

| | |

OTHER COMPREHENSIVE LOSS | |

| | | |

| | | |

| | | |

| | |

| Unrealized gain on short-term investments | |

| 1 | | |

| 43 | | |

| 20 | | |

| 13 | |

| | |

| | | |

| | | |

| | | |

| | |

| Comprehensive loss for the period | |

$ | (7,232 | ) | |

$ | (7,256 | ) | |

$ | (22,168 | ) | |

$ | (21,088 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted loss per common share | |

$ | (0.16 | ) | |

$ | (0.17 | ) | |

$ | (0.50 | ) | |

$ | (0.48 | ) |

| | |

| | | |

| | | |

| | | |

| | |

Weighted average number of

common shares outstanding | |

| 44,365,505 | | |

| 44,092,374 | | |

| 44,243,638 | | |

| 44,085,941 | |

v3.24.2.u1

Cover

|

Aug. 05, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 05, 2024

|

| Entity File Number |

001-37410

|

| Entity Registrant Name |

ESSA Pharma Inc.

|

| Entity Central Index Key |

0001633932

|

| Entity Tax Identification Number |

98-1250703

|

| Entity Incorporation, State or Country Code |

A1

|

| Entity Address, Address Line One |

Suite 720

|

| Entity Address, Address Line Two |

999 West Broadway

|

| Entity Address, City or Town |

Vancouver

|

| Entity Address, State or Province |

BC

|

| Entity Address, Country |

CA

|

| Entity Address, Postal Zip Code |

V5Z 1K5

|

| City Area Code |

778

|

| Local Phone Number |

331-0962

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Shares, no par value

|

| Trading Symbol |

EPIX

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

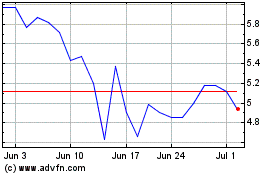

ESSA Pharma (NASDAQ:EPIX)

Historical Stock Chart

From Nov 2024 to Dec 2024

ESSA Pharma (NASDAQ:EPIX)

Historical Stock Chart

From Dec 2023 to Dec 2024