Enovix Announces Pricing of Public Offering of Common Stock

October 30 2024 - 7:46PM

Enovix Corporation (“Enovix”) (NASDAQ: ENVX), a

global high-performance battery company, today announced the

pricing of an underwritten public offering of 10,416,667 shares of

its common stock for total gross proceeds of $100 million before

deducting underwriting discounts and commissions and estimated

offering expenses payable by Enovix. The offering is expected to

close on November 1, 2024, subject to satisfaction of customary

closing conditions. All of the shares of common stock in the

offering will be sold by Enovix.

Enovix has granted the underwriter a 30-day

option to purchase up to an additional 1,562,500 shares of its

common stock offered in the public offering, at the public offering

price, less underwriting discounts and commissions.

Cantor Fitzgerald & Co. is acting as sole

book-running manager for the offering.

The underwriter may offer the shares from time

to time for sale in one or more transactions on the Nasdaq Global

Select Market, in the over-the-counter market, through negotiated

transactions or otherwise at market prices prevailing at the time

of sale, at prices related to prevailing market prices or at

negotiated prices.

Enovix intends to use the net proceeds from this

offering, together with its existing cash, cash equivalents and

short-term investments, for general corporate purposes, and for

working capital and capital expenses to achieve high-volume

manufacturing at its high-volume production facility “Fab2” in

Penang, Malaysia.

The securities described above are being offered

by Enovix pursuant to a shelf registration statement on Form S-3,

including a base prospectus, that was filed on August 9, 2023 and

declared effective by the U.S. Securities and Exchange Commission

(“SEC”) on August 18, 2023. The offering is being made

only by means of a written prospectus and prospectus supplement

that form a part of the registration statement. A preliminary

prospectus supplement and accompanying prospectus relating to the

offering were filed with the SEC and are available on the SEC’s

website located at www.sec.gov. A final prospectus supplement and

accompanying prospectus relating to the offering will be filed with

the SEC and will be available on the SEC’s website at

http://www.sec.gov. Copies of the final prospectus supplement and

the accompanying prospectus relating to the offering, when

available, may also be obtained from Cantor Fitzgerald & Co.,

Attention: Capital Markets, 110 East 59th Street, 6th Floor, or by

email at prospectus@cantor.com.

This press release is neither an offer to sell

nor a solicitation of an offer to buy any of these securities nor

shall there be any sale of these securities in any state or

jurisdiction in which such an offer, solicitation or sale would be

unlawful prior to the registration or qualification thereof under

the securities laws of any such state or jurisdiction.

About Enovix

Enovix is on a mission to deliver

high-performance batteries that unlock the full potential of

technology products. Everything from IoT, mobile, and computing

devices, to the vehicle you drive, needs a better battery. Enovix

partners with OEMs worldwide to usher in a new era of user

experiences. Our innovative, materials-agnostic approach to

building a higher performing battery without compromising safety

keeps us flexible and on the cutting-edge of battery technology

innovation.

Forward-Looking StatementsThis

press release contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995, as

amended, including, without limitation, statements regarding

Enovix’s anticipated public offering. The words “may,”

“might,” “will,” “could,” “would,” “should,” “expect,” “plan,”

“anticipate,” “achieve,” “intend,” “believe,” “expect,” “estimate,”

“seek,” “predict,” “future,” “project,” “potential,” “continue,”

“target” and similar words or expressions are intended to identify

forward-looking statements, although not all forward-looking

statements contain these identifying words.

Any forward-looking statements in this press

release, such as the intended offering terms, are based

on management’s current expectations and beliefs and are subject to

a number of risks, uncertainties and important factors that may

cause actual events or results to differ materially from those

expressed or implied by any forward-looking statements contained in

this press release, including, without limitation, uncertainties

related to market conditions, the completion of the

public offering on the anticipated terms or at all and

satisfaction of customary closing conditions related to the

proposed offering. These and other risks and uncertainties are

described in greater detail in the section entitled “Risk Factors”

in Enovix’s Annual Report on Form 10-K for the year ended December

31, 2023, and its Quarterly Reports on Form 10-Q for the quarters

ended March 31, 2024, June 30, 2024 and September 30, 2024. In

addition, any forward-looking statements contained in this press

release represent the Enovix’s views only as of the date hereof and

should not be relied upon as representing its views as of any

subsequent date. Enovix explicitly disclaims any obligation to

update any forward-looking statements. No representations or

warranties (expressed or implied) are made about the accuracy of

any such forward-looking statements.

For investor and media inquiries, please

contact:

Enovix CorporationRobert LaheyEmail: ir@enovix.com

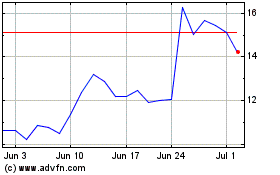

Enovix (NASDAQ:ENVX)

Historical Stock Chart

From Jan 2025 to Feb 2025

Enovix (NASDAQ:ENVX)

Historical Stock Chart

From Feb 2024 to Feb 2025