DexCom, Inc. (Nasdaq: DXCM) today reported its financial results

as of and for the quarter ended June 30, 2023.

Second Quarter 2023 Financial Highlights:

- Revenue grew 25% versus the same quarter of the prior year to

$871.3 million on a reported basis and 26% on an organic1

basis.

- U.S. revenue growth of 21% and international revenue growth of

38% on a reported basis. International revenue growth was 40% on an

organic1 basis.

- GAAP operating income of $128.1 million or 14.7% of revenue, an

increase of 360 basis points compared to the second quarter of

2022. Non-GAAP operating income* of $158.4 million or 18.2% of

reported revenue, an increase of 360 basis points compared with the

same quarter of the prior year.

1 Second quarter of 2023 organic revenue is $875.9 million and

excludes $4.6 million of foreign exchange impact.

Second Quarter 2023 Strategic Highlights:

- Provided key strategic updates and increased long-term

financial outlook at company’s 2023 Investor Day

- Showcased future potential of Dexcom CGM within diabetes care

and beyond through significant research presence at the American

Diabetes Association’s 83rd Scientific Sessions

- Initiated commercial production at Malaysia manufacturing

facility, representing key milestone in long-term capacity

plans

- Completed a $1.25 billion senior convertible notes offering,

creating additional financial flexibility for company

“In the second quarter, we advanced several key strategic

initiatives and shared our latest vision for the future of Dexcom

at our 2023 Investor Day,” said Kevin Sayer, Dexcom’s chairman,

president and CEO. “Given our strong start to the year and rapidly

growing market opportunity, we are pleased to raise our 2023

revenue and margin guidance.”

2023 Annual Guidance

The company is increasing fiscal year 2023 guidance for revenue,

Non-GAAP Gross Profit Margin, Non-GAAP Operating Margin, and

Adjusted EBITDA Margin at the following levels:

- Revenue of approximately $3.500 - 3.550 billion (20-22%

growth)

- Non-GAAP Gross Profit Margin of approximately 63%

- Non-GAAP Operating Margin of approximately 17%

- Adjusted EBITDA Margin of approximately 26.5%

Second Quarter 2023 Financial Results

Revenue: In the second quarter of 2023, worldwide revenue

grew 25% to $871.3 million on a reported basis, up from $696.2

million in the second quarter of 2022. Volume growth in conjunction

with strong new customer additions continues to be the primary

driver of revenue growth as awareness of real-time CGM

increases.

Gross Profit: GAAP gross profit totaled $546.4 million or

62.7% of revenue for the second quarter of 2023, compared to $449.5

million or 64.6% of revenue in the second quarter of 2022.

Non-GAAP gross profit* totaled $553.5 million or 63.5% of

revenue for the second quarter of 2023, compared to $449.5 million

or 64.6% of reported revenue in the second quarter of 2022.

Operating Income: GAAP operating income for the second

quarter of 2023 was $128.1 million, compared to GAAP operating

income of $77.0 million for the second quarter of 2022.

Non-GAAP operating income* for the second quarter of 2023 was

$158.4 million, compared to non-GAAP operating income of $101.9

million for the second quarter of 2022.

Net Income and Diluted Net Income Per Share: GAAP net

income was $115.9 million, or $0.28 per diluted share, for the

second quarter of 2023, compared to GAAP net income of $50.9

million, or $0.12 per diluted share, for the same quarter of

2022.

Non-GAAP net income* was $139.4 million, or $0.34 per diluted

share, for the second quarter of 2023, compared to non-GAAP net

income of $69.5 million, or $0.17 per diluted share, for the same

quarter of 2022. The second quarter 2023 non-GAAP amount excludes

$0.7 million of business transition and related costs, $20.8

million of intellectual property litigation costs, $8.8 million of

amortization of intangible assets, and $(6.8) million of tax

adjustments.

Cash and Liquidity: As of June 30, 2023, Dexcom held

$3.64 billion in cash, cash equivalents and marketable securities

and our revolving credit facility remains undrawn. The cash balance

represents significant financial and strategic flexibility as

Dexcom continues to expand production capacity and explore new

market opportunities.

* See Table E below for a reconciliation of these GAAP and

non-GAAP financial measures.

Conference Call

Management will hold a conference call today starting at 4:30

p.m. (Eastern Time). The conference call will be concurrently

webcast. The link to the webcast will be available on the Dexcom

Investor Relations website at investors.dexcom.com by navigating to

“Events and Presentations,” and will be archived for future

reference. To listen to the conference call, please dial (888)

414-4585 (US/Canada) or (646) 960-0331 (International) and use the

confirmation ID “9430114” approximately five minutes prior to the

start time.

Statement Regarding Use of Non-GAAP Financial

Measures

This press release and the accompanying tables include non-GAAP

financial measures. For a description of these non-GAAP financial

measures, including the reasons management uses each measure, and

reconciliations of these non-GAAP financial measures to the most

directly comparable financial measures prepared in accordance with

Generally Accepted Accounting Principles (GAAP), please see the

section of the accompanying tables titled “About Non-GAAP Financial

Measures” as well as the related Table E. We have not reconciled

our total revenue, Non-GAAP Gross Profit Margin, Non-GAAP Operating

Margin and Adjusted EBITDA Margin estimates for fiscal year 2023

because certain items that impact these figures are uncertain or

out of our control and cannot be reasonably predicted. Accordingly,

a reconciliation of total revenue, Non-GAAP Gross Profit Margin,

Non-GAAP Operating Margin and Adjusted EBITDA Margin is not

available without unreasonable effort.

About DexCom, Inc.

DexCom, Inc. empowers people to take real-time control of health

through innovative continuous glucose monitoring (CGM) systems.

Headquartered in San Diego, Calif., and with operations across

Europe and select parts of Asia/Oceania, Dexcom has emerged as a

leader of diabetes care technology. By listening to the needs of

users, caregivers, and providers, Dexcom works to simplify and

improve diabetes management around the world. For more information

about Dexcom CGM, visit www.dexcom.com.

Category: IR

Cautionary Statement Regarding Forward Looking

Statements

This press release contains forward-looking statements that are

not purely historical regarding Dexcom’s or its management’s

intentions, beliefs, expectations and strategies for the future,

including those related to Dexcom’s estimated total revenue,

Non-GAAP Gross Profit Margin, Non-GAAP Operating Margin, and

Adjusted EBITDA Margin for fiscal 2023, as well as expected growth

rates as compared to the year ended December 31, 2022. All

forward-looking statements included in this press release are made

as of the date of this release, based on information currently

available to Dexcom, deal with future events, are subject to

various risks and uncertainties, and actual results could differ

materially from those anticipated in those forward-looking

statements. The risks and uncertainties that may cause actual

results to differ materially from Dexcom’s current expectations are

more fully described in Dexcom’s Annual Report on Form 10-K for the

period ended December 31, 2022, as filed with the Securities and

Exchange Commission (SEC) on February 9, 2023, and our most recent

Quarterly Report on Form 10-Q for the quarter ended June 30, 2023,

as filed with the SEC on July 27, 2023. Except as required by law,

Dexcom assumes no obligation to update any such forward-looking

statement after the date of this report or to conform these

forward-looking statements to actual results.

DexCom, Inc.

Table A

Consolidated Balance

Sheets

(In millions, except par value

data)

(Unaudited)

June 30, 2023

December 31, 2022

Assets

Current assets:

Cash and cash equivalents

$

1,194.9

$

642.3

Short-term marketable securities

2,441.3

1,813.9

Accounts receivable, net

750.6

713.3

Inventory

421.1

306.7

Prepaid and other current assets

195.0

192.6

Total current assets

5,002.9

3,668.8

Property and equipment, net

1,077.6

1,055.6

Operating lease right-of-use assets

76.3

80.0

Goodwill

25.8

25.7

Intangibles, net

154.2

173.3

Deferred tax assets

417.0

341.2

Other assets

66.9

47.1

Total assets

$

6,820.7

$

5,391.7

Liabilities and Stockholders’

Equity

Current liabilities:

Accounts payable and accrued

liabilities

$

1,156.5

$

901.8

Accrued payroll and related expenses

108.6

134.3

Current portion of long-term senior

convertible notes

773.8

772.6

Short-term operating lease liabilities

21.8

20.5

Deferred revenue

9.0

10.1

Total current liabilities

2,069.7

1,839.3

Long-term senior convertible notes

2,430.6

1,197.7

Long-term operating lease liabilities

86.9

94.6

Other long-term liabilities

133.1

128.3

Total liabilities

4,720.3

3,259.9

Commitments and contingencies

Stockholders’ equity:

Preferred stock, $0.001 par value, 5.0

million shares authorized; no shares issued and outstanding at June

30, 2023 and December 31, 2022

—

—

Common stock, $0.001 par value, 800.0

million shares authorized; 394.6 million and 386.1 million shares

issued and outstanding, respectively, at June 30, 2023; and 393.2

million and 386.3 million shares issued and outstanding,

respectively, at December 31, 2022

0.4

0.4

Additional paid-in capital

2,269.0

2,258.1

Accumulated other comprehensive loss

(29.3

)

(11.6

)

Retained earnings

644.4

479.9

Treasury stock, at cost; 8.5 million

shares at June 30, 2023 and 6.9 million shares at December 31,

2022

(784.1

)

(595.0

)

Total stockholders’ equity

2,100.4

2,131.8

Total liabilities and stockholders’

equity

$

6,820.7

$

5,391.7

DexCom, Inc.

Table B

Consolidated Statements of

Operations

(In millions, except per share

data)

(Unaudited)

Three Months Ended

June 30,

Six Months Ended

June 30,

2023

2022

2023

2022

Revenue

$

871.3

$

696.2

$

1,612.8

$

1,325.0

Cost of sales

324.9

246.7

603.8

477.4

Gross profit

546.4

449.5

1,009.0

847.6

Operating expenses:

Research and development

119.3

121.7

238.3

257.6

Amortization of intangible assets

1.7

1.9

3.5

3.9

Selling, general and administrative

297.3

248.9

591.9

467.8

Total operating expenses

418.3

372.5

833.7

729.3

Operating income

128.1

77.0

175.3

118.3

Interest expense

(5.9

)

(4.7

)

(10.5

)

(9.3

)

Income from equity investments

—

—

—

0.2

Interest and other income, net

37.1

3.0

59.0

2.2

Income before income taxes

159.3

75.3

223.8

111.4

Income tax expense (benefit)

43.4

24.4

59.3

(36.8

)

Net income

$

115.9

$

50.9

$

164.5

$

148.2

Basic net income per share

$

0.30

$

0.13

$

0.43

$

0.38

Shares used to compute basic net income

per share

386.7

392.5

386.7

390.7

Diluted net income per share

$

0.28

$

0.12

$

0.40

$

0.36

Shares used to compute diluted net income

per share

431.5

421.4

426.6

429.1

DexCom, Inc.

Table C

Revenue by Geography

(Dollars in millions)

(Unaudited)

Three Months Ended

June 30,

Six Months Ended

June 30,

2023

2022

2023

2022

U.S. revenue

$

616.6

$

511.0

$

1,142.6

$

962.2

Year over year growth

21

%

11

%

19

%

14

%

% of total revenue

71

%

73

%

71

%

73

%

International revenue

$

254.7

$

185.2

$

470.2

$

362.8

Year over year growth

38

%

39

%

30

%

41

%

% of total revenue

29

%

27

%

29

%

27

%

Total revenue (1)

$

871.3

$

696.2

$

1,612.8

$

1,325.0

Year over year growth

25

%

17

%

22

%

20

%

(1)

The sum of the revenue components may not

equal total revenue due to rounding.

DexCom, Inc.

Table D

Revenue by Component

(Dollars in millions)

(Unaudited)

Three Months Ended

June 30,

Six Months Ended

June 30,

2023

2022

2023

2022

Sensor and other revenue (1) (2)

$

778.0

$

597.7

$

1,429.9

$

1,140.9

Year over year growth

30

%

21

%

25

%

24

%

% of total revenue

89

%

86

%

89

%

86

%

Hardware revenue (1) (3)

$

93.3

$

98.5

$

182.9

$

184.1

Year over year growth

(5

)%

(2

)%

(1

)%

2

%

% of total revenue

11

%

14

%

11

%

14

%

Total revenue (4)

$

871.3

$

696.2

$

1,612.8

$

1,325.0

Year over year growth

25

%

17

%

22

%

20

%

(1)

Includes allocated subscription

revenue.

(2)

Includes services, freight, accessories,

Non-CGM acquired revenue, etc.

(3)

Includes transmitter and receiver

revenue.

(4)

The sum of the revenue components may not

equal total revenue due to rounding.

DexCom, Inc.

Table E

Itemized Reconciliation

Between GAAP and Non-GAAP Financial Measures

(In millions, except per share

data)

(Unaudited)

Three Months Ended

June 30,

Six Months Ended

June 30,

2023

2022

2023

2022

GAAP gross profit

$

546.4

$

449.5

$

1,009.0

$

847.6

Amortization of intangible assets (1)

7.1

—

14.3

—

Non-GAAP gross profit

$

553.5

$

449.5

$

1,023.3

$

847.6

GAAP operating income

$

128.1

$

77.0

$

175.3

$

118.3

Amortization of intangible assets (1)

8.8

1.9

17.8

3.9

Business transition and related costs

(2)

0.7

13.8

1.8

13.8

Intellectual property litigation costs

(3)

20.8

9.2

42.1

16.2

Non-GAAP operating income

$

158.4

$

101.9

$

237.0

$

152.2

GAAP net income

$

115.9

$

50.9

$

164.5

$

148.2

Business transition and related costs

(2)

0.6

13.8

1.6

13.8

Depreciation and amortization

43.7

43.6

85.3

80.4

Intellectual property litigation costs

(3)

20.8

9.2

42.1

16.2

Income from equity investments (4)

—

—

—

(0.2

)

Share-based compensation

39.7

32.6

74.9

61.7

Interest expense and interest income

(31.5

)

1.0

(49.2

)

4.6

Income tax (benefit) expense

43.4

24.4

59.3

(36.8

)

Adjusted EBITDA

$

232.6

$

175.5

$

378.5

$

287.9

GAAP net income

$

115.9

$

50.9

$

164.5

$

148.2

Amortization of intangible assets (1)

8.8

1.9

17.8

3.9

Business transition and related costs

(2)

0.7

13.8

1.8

13.8

Intellectual property litigation costs

(3)

20.8

9.2

42.1

16.2

Income from equity investments (4)

—

—

—

(0.2

)

Adjustments related to taxes (5)

(6.8

)

(6.3

)

(18.3

)

(80.1

)

Non-GAAP net income

$

139.4

$

69.5

$

207.9

$

101.8

GAAP net income

$

115.9

$

50.9

$

164.5

$

148.2

Interest expense on senior convertible

notes, net of tax

3.8

1.6

5.5

5.5

GAAP net income used for diluted EPS,

if-converted (6)

$

119.7

$

52.5

$

170.0

$

153.7

Non-GAAP net income

$

139.4

$

69.5

$

207.9

$

101.8

Interest expense on senior convertible

notes, net of tax

1.2

1.2

2.4

—

Non-GAAP net income used for diluted

EPS, if-converted (6)

$

140.6

$

70.7

$

210.3

$

101.8

DexCom, Inc.

Table E (Continued)

Itemized Reconciliation

Between GAAP and Non-GAAP Financial Measures

(In millions, except per share

data)

(Unaudited)

Three Months Ended

June 30,

Six Months Ended

June 30,

2023

2022

2023

2022

GAAP diluted net income per share

(6)

$

0.28

$

0.12

$

0.40

$

0.36

Amortization of intangible assets (1)

0.02

—

0.04

0.01

Business transition and related costs

(2)

—

0.03

—

0.03

Intellectual property litigation costs

(3)

0.05

0.02

0.10

0.04

Income from equity investments (4)

—

—

—

—

Adjustments related to taxes (5)

(0.02

)

(0.02

)

(0.04

)

(0.20

)

Impact of adjustment to GAAP diluted

shares (7)

0.01

—

—

0.01

Non-GAAP diluted net income per share

(6) (8)

$

0.34

$

0.17

$

0.52

$

0.25

GAAP diluted weighted-average shares

outstanding

431.5

421.4

426.6

429.1

Non-GAAP diluted weighted-average shares

outstanding

407.8

410.5

407.7

402.2

Reconciliation of non-GAAP diluted

weighted-average shares outstanding:

GAAP diluted weighted-average shares

outstanding

431.5

421.4

426.6

429.1

Adjustment for dilutive impact of senior

convertible notes due 2023 (9)

(18.9

)

(18.9

)

(18.9

)

(18.9

)

Adjustment for dilutive impact of senior

convertible notes due 2025 (9)

—

8.0

—

(8.0

)

Adjustment for dilutive impact of senior

convertible notes due 2028 (9)

(4.8

)

—

—

—

Non-GAAP diluted weighted-average shares

outstanding

407.8

410.5

407.7

402.2

(1)

Represents amortization of acquired

intangible assets.

(2)

For the three and six months ended June

30, 2023, business transition and related costs are primarily

related to rent for vacated office space in San Diego, California.

For the three and six months ended June 30, 2022, business

transition and related costs are primarily related to consulting

and expenses related to vacating a portion of the San Diego office

space, including accelerated depreciation of tenant

improvements.

(3)

Represents costs related to a patent

infringement lawsuit.

(4)

Represents a gain from the sale of an

equity investment.

(5)

For the three and six months ended June

30, 2023, tax adjustments are primarily related to the tax effect

of non-GAAP adjustments and excess tax benefits from share-based

compensation for employees. For the three months ended June 30,

2022, tax adjustments are primarily related to the tax effect of

non-GAAP adjustments. For the six months ended June 30, 2022, tax

adjustments are primarily related to excess tax benefits from

share-based compensation for employees and the Verily regulatory

milestone payment.

(6)

When our senior convertible notes are

dilutive on a GAAP or non-GAAP basis, net income used for

calculating GAAP and non-GAAP diluted net income per share includes

an interest expense add back, net of tax, under the if-converted

method. In loss periods, basic and diluted net loss per share are

the same since the effect of potential common shares is

anti-dilutive and therefore excluded.

(7)

The adjustments are for the transition

from GAAP diluted net income per share to non-GAAP diluted net

income per share due to our senior convertible notes.

(8)

The sum of the non-GAAP per share

components may not equal the totals due to rounding.

(9)

We adjust for the dilutive effect of our

senior convertible notes when the effect is not the same on a GAAP

and non-GAAP basis for a given period.

ABOUT NON-GAAP FINANCIAL MEASURES

The accompanying press release dated July 27, 2023 contains

non-GAAP financial measures. These non-GAAP financial measures

include organic revenue, non-GAAP gross profit, non-GAAP operating

income (loss), non-GAAP net income (loss), and non-GAAP net income

(loss) per share as well as adjusted EBITDA.

We use these non-GAAP financial measures for financial and

operational decision making and as a means to evaluate

period-to-period comparisons. We believe that they provide useful

information about operating results, enhance the overall

understanding of our operating performance and future prospects,

and allow for greater transparency with respect to key metrics used

by senior management in our financial and operational decision

making. Our non-GAAP financial measures exclude amounts that we do

not consider part of ongoing operating results when planning and

forecasting and when assessing the performance of the organization

and our senior management. We compute non-GAAP financial measures

using the same consistent method from quarter to quarter and year

to year. We may consider whether other significant items that arise

in the future should be excluded from our non-GAAP financial

measures.

We report non-GAAP financial measures in addition to, and not as

a substitute for, or superior to, measures of financial performance

prepared in accordance with GAAP. These non-GAAP financial measures

are not based on any comprehensive set of accounting rules or

principles, differ from GAAP measures with the same names, and may

differ from non-GAAP financial measures with the same or similar

names that are used by other companies. We believe that non-GAAP

financial measures should only be used to evaluate our results of

operations in conjunction with the corresponding GAAP financial

measures. We encourage investors to carefully consider our results

under GAAP, as well as our supplemental non-GAAP information and

the reconciliations between these presentations, to more fully

understand our business.

Management believes organic revenue is a meaningful metric to

investors as it provides a more consistent comparison of the

company’s revenue to prior periods as well as to industry peers. We

exclude the following items from the non-GAAP financial measure for

organic revenue:

- The effect of non-CGM revenue acquired or divested in the

trailing twelve months.

- The effect of foreign currency fluctuations.

Management believes that presentation of operating results that

excludes these items provides useful supplemental information to

investors and facilitates the analysis of our core operating

results and comparison of operating results across reporting

periods. Management also believes that this supplemental non-GAAP

information is therefore useful to investors in analyzing and

assessing our past and future operating performance.

These non-GAAP measures may be different from non-GAAP measures

used by other companies. In addition, these non-GAAP measures are

not based on any comprehensive set of accounting rules or

principles. We believe that non-GAAP measures have limitations in

that they do not reflect all of the amounts associated with our

results of operations as determined in accordance with U.S. GAAP

and that these measures should only be used to evaluate our results

of operations in conjunction with the corresponding GAAP measures.

We encourage investors to carefully consider our results under

GAAP, as well as our supplemental non-GAAP information and the

reconciliation between these presentations, to more fully

understand our business.

Table E reconciles the non-GAAP financial measures in the press

release to the most directly comparable financial measures prepared

in accordance with Generally Accepted Accounting Principles

(GAAP).

We exclude the following items from non-GAAP financial measures

for non-GAAP gross profit, non-GAAP operating income (loss),

non-GAAP net income (loss), and non-GAAP net income (loss) per

share:

- Amortization of acquired intangible assets

- Business transition and related costs associated with

acquisition, integration and business transition activities,

including severance, relocation, consulting, leasehold exit costs,

third party merger and acquisition costs, and other costs directly

associated with such activities

- COVID-19 costs associated with the COVID-19 outbreak related to

taking the necessary precautions for essential personnel to operate

safely both in person as well as remotely. Costs incurred include

items like incremental payroll costs, consulting support, IT

infrastructure and facilities related costs

- Income or loss from equity investments

- Intellectual property litigation costs

- Litigation settlement costs

- Loss on extinguishment of debt associated with our senior

convertible notes

- Adjustments related to taxes for the excluded items above, as

well as excess benefits or tax deficiencies from stock-based

compensation, and the quarterly impact of other discrete items

Adjusted EBITDA excludes non-cash operating charges for

share-based compensation, depreciation and amortization as well as

non-operating items such as interest income, interest expense, loss

on extinguishment of debt, income and loss from equity investments,

and income tax expense or benefit. For the reasons explained above,

adjusted EBITDA also excludes business transition and related

costs, COVID-19 costs, litigation settlement costs, and

intellectual property litigation costs.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230727540295/en/

INVESTOR RELATIONS CONTACT: Sean Christensen Vice President -

Finance and Investor Relations investor-relations@dexcom.com (858)

203-6657

MEDIA CONTACT: James McIntosh (619) 884-2118

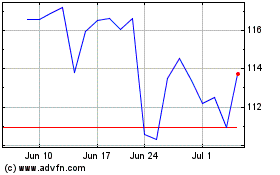

DexCom (NASDAQ:DXCM)

Historical Stock Chart

From Oct 2024 to Nov 2024

DexCom (NASDAQ:DXCM)

Historical Stock Chart

From Nov 2023 to Nov 2024