0001853816false--12-31Q220240.0001250000000693175261998144765000000000100000000.00010000009.500018538162024-01-012024-06-300001853816us-gaap:SubsequentEventMembersrt:MinimumMember2024-08-020001853816us-gaap:SubsequentEventMembersrt:MaximumMember2024-08-020001853816us-gaap:SubsequentEventMember2024-08-020001853816us-gaap:SubsequentEventMember2024-07-012024-07-310001853816drma:JulyThirtTwentyTwentyOneMemberus-gaap:LicensingAgreementsMemberdrma:SecondAmendmentMember2024-01-012024-06-300001853816drma:MarchThirtyFirstTwentySeventeenMemberus-gaap:LicensingAgreementsMemberdrma:FirstAmendmentMember2024-01-012024-06-300001853816drma:TwoThousandTwentyOneOmnibusEquityIncentivePlanMember2024-01-310001853816drma:TwoThousandTwentyOneOmnibusEquityIncentivePlanMember2023-01-3100018538162024-01-012024-01-310001853816drma:TwoThousandTwentyOneOmnibusEquityIncentivePlanMember2024-06-300001853816drma:TwoThousandTwentyOneOmnibusEquityIncentivePlanMember2024-01-012024-06-300001853816us-gaap:StockOptionMember2024-06-300001853816us-gaap:StockOptionMember2023-12-310001853816us-gaap:StockOptionMember2024-04-012024-06-300001853816us-gaap:StockOptionMember2024-01-012024-06-300001853816us-gaap:StockOptionMember2023-04-012023-06-300001853816us-gaap:StockOptionMember2023-01-012023-06-300001853816drma:CommonandPreFundedWarrantsMember2023-03-200001853816drma:MayTwentyTwentyFourInducementMember2024-01-012024-06-300001853816drma:CommonStockAndPreferredStockMember2023-03-200001853816drma:CommonStockAndPreferredStockMember2023-05-260001853816us-gaap:WarrantMember2023-03-012023-03-310001853816us-gaap:WarrantMember2023-11-012023-11-200001853816drma:CommonStockAndPreferredStockMember2023-03-012023-03-200001853816drma:CommonandPreFundedWarrantsMember2023-03-012023-03-200001853816drma:WarrantsMemberdrma:PIPEMember2023-03-200001853816drma:MayTwentyTwentyThreeMemberdrma:PIPECommonWarrantsMember2023-05-260001853816drma:CommonandPreFundedWarrantsMember2023-05-260001853816drma:MayTwentyTwentyFourInducementMember2023-11-200001853816drma:MayTwentyTwentyFourInducementMember2024-05-310001853816drma:MayTwentyTwentyFourInducementMember2023-05-2600018538162023-11-3000018538162023-11-2000018538162024-05-310001853816drma:MayTwentyTwentyThreeMemberdrma:PIPECommonWarrantsMember2023-05-012023-05-260001853816drma:AtmAgreementMember2024-06-070001853816drma:MayTwentyTwentyFourInducementMember2024-06-3000018538162023-11-012023-11-3000018538162023-05-012023-05-260001853816drma:SeriesACommonStockWarrantsMember2023-11-012023-11-200001853816drma:MayTwentyTwentyFourInducementMember2024-05-012024-05-210001853816drma:AtmAgreementMember2024-06-012024-06-070001853816drma:WarrantsMemberdrma:PIPEMember2023-11-012023-11-200001853816drma:MayTwentyTwentyFourInducementMember2024-05-012024-05-310001853816drma:SeriesACommonStockWarrantsMember2023-11-012023-11-300001853816drma:SeriesACommonStockWarrantsMember2024-05-012024-05-310001853816us-gaap:WarrantMember2024-05-012024-05-310001853816us-gaap:WarrantMember2024-01-012024-06-300001853816us-gaap:WarrantMember2024-06-300001853816drma:MayTwentyTwentyFourOfferingPlacementAgentWarrantsMember2024-01-012024-06-300001853816drma:MayTwentyTwentyFourOfferingPlacementAgentWarrantsMember2024-06-300001853816drma:MayTwentyTwentyFourSeriesBCommonWarrantsMember2024-01-012024-06-300001853816drma:MayTwentyTwentyFourSeriesBCommonWarrantsMember2024-06-300001853816drma:MayTwentyTwentyFourSeriesACommonWarrantsMember2024-01-012024-06-300001853816drma:MayTwentyTwentyFourSeriesACommonWarrantsMember2024-06-300001853816drma:NovemberOfferingPlacementAgentWarrantsMember2024-01-012024-06-300001853816drma:NovemberOfferingPlacementAgentWarrantsMember2023-12-310001853816drma:NovemberOfferingPlacementAgentWarrantsMember2024-06-300001853816drma:NovemberSeriesBCommonWarrantsMember2024-01-012024-06-300001853816drma:NovemberSeriesBCommonWarrantsMember2023-12-310001853816drma:NovemberSeriesACommonWarrantsMember2024-01-012024-06-300001853816drma:NovemberSeriesACommonWarrantsMember2023-12-310001853816drma:PlacementAgentWarrantsMember2024-01-012024-06-300001853816drma:PlacementAgentWarrantsMember2023-12-310001853816drma:PlacementAgentWarrantsMember2024-06-300001853816drma:MayTwentyTwentyThreeMemberdrma:PIPECommonWarrantsMember2024-01-012024-06-300001853816drma:MayTwentyTwentyThreeMemberdrma:PIPECommonWarrantsMember2023-12-310001853816drma:PIPEPlacementAgentWarrantsMember2024-01-012024-06-300001853816drma:PIPEPlacementAgentWarrantsMember2023-12-310001853816drma:PIPEPlacementAgentWarrantsMember2024-06-300001853816drma:MarchTwentyTwentyThreeOfferingSeriesACommonWarrantsMember2024-01-012024-06-300001853816drma:MarchTwentyTwentyThreeOfferingSeriesACommonWarrantsMember2023-12-310001853816drma:MarchTwentyTwentyThreeOfferingSeriesBCommonWarrantsMember2024-01-012024-06-300001853816drma:MarchTwentyTwentyThreeOfferingSeriesBCommonWarrantsMember2023-12-310001853816drma:IPOUnderwriterWarrantsMember2024-01-012024-06-300001853816drma:IPOUnderwriterWarrantsMember2024-06-300001853816drma:IPOUnderwriterWarrantsMember2023-12-310001853816drma:IPOWarrantsMember2024-01-012024-06-300001853816drma:IPOWarrantsMember2024-06-300001853816drma:IPOWarrantsMember2023-12-310001853816drma:SeriesBCommonWarrantsMember2024-01-012024-06-300001853816drma:SeriesBCommonWarrantsMember2024-06-300001853816drma:SeriesBCommonWarrantsMember2023-12-310001853816drma:SeriesACommonWarrantsMember2024-01-012024-06-300001853816drma:SeriesACommonWarrantsMember2024-06-300001853816drma:SeriesACommonWarrantsMember2023-12-310001853816us-gaap:EquitySecuritiesMember2024-06-300001853816drma:PreferredStocksMember2024-06-300001853816drma:CommonStockParValueMember2024-06-300001853816drma:TwentyTwentyOneOmnibusEquityIncentivePlanMember2024-06-300001853816drma:BalanceSheetMember2024-06-300001853816drma:BalanceSheetMember2023-12-310001853816drma:WarrantsMember2024-06-300001853816drma:WarrantsMember2023-06-300001853816us-gaap:OptionMember2024-06-300001853816us-gaap:OptionMember2023-06-3000018538162023-01-012023-12-310001853816us-gaap:RetainedEarningsMember2024-06-300001853816us-gaap:AdditionalPaidInCapitalMember2024-06-300001853816us-gaap:CommonStockMember2024-06-300001853816us-gaap:RetainedEarningsMember2024-04-012024-06-300001853816us-gaap:AdditionalPaidInCapitalMember2024-04-012024-06-300001853816us-gaap:CommonStockMember2024-04-012024-06-3000018538162024-03-310001853816us-gaap:RetainedEarningsMember2024-03-310001853816us-gaap:AdditionalPaidInCapitalMember2024-03-310001853816us-gaap:CommonStockMember2024-03-3100018538162024-01-012024-03-310001853816us-gaap:RetainedEarningsMember2024-01-012024-03-310001853816us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310001853816us-gaap:CommonStockMember2024-01-012024-03-310001853816us-gaap:RetainedEarningsMember2023-12-310001853816us-gaap:AdditionalPaidInCapitalMember2023-12-310001853816us-gaap:CommonStockMember2023-12-3100018538162023-06-300001853816us-gaap:RetainedEarningsMember2023-06-300001853816us-gaap:AdditionalPaidInCapitalMember2023-06-300001853816us-gaap:CommonStockMember2023-06-300001853816us-gaap:RetainedEarningsMember2023-04-012023-06-300001853816us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300001853816us-gaap:CommonStockMember2023-04-012023-06-3000018538162023-03-310001853816us-gaap:RetainedEarningsMember2023-03-310001853816us-gaap:AdditionalPaidInCapitalMember2023-03-310001853816us-gaap:CommonStockMember2023-03-3100018538162023-01-012023-03-310001853816us-gaap:RetainedEarningsMember2023-01-012023-03-310001853816us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001853816us-gaap:CommonStockMember2023-01-012023-03-3100018538162022-12-310001853816us-gaap:RetainedEarningsMember2022-12-310001853816us-gaap:AdditionalPaidInCapitalMember2022-12-310001853816us-gaap:CommonStockMember2022-12-3100018538162023-01-012023-06-3000018538162023-04-012023-06-3000018538162024-04-012024-06-3000018538162023-12-3100018538162024-06-3000018538162024-08-050001853816drma:CommonStockParValueMember2024-01-012024-06-300001853816drma:WarrantsExercisableMember2024-01-012024-06-30iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:pure

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Quarterly Period Ended June 30, 2024

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period from ___________ to ___________

Commission File Number: 001-40739

DERMATA THERAPEUTICS, INC. |

(Exact name of registrant as specified in the charter) |

Delaware | | 86-3218736 |

(State or other jurisdiction of | | (I.R.S. Employer |

incorporation or organization) | | Identification Number) |

3525 Del Mar Heights Rd., #322, San Diego, CA | | 92130 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: 858-800-2543

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Common Stock, par value $0.0001 per share | | DRMA | | The Nasdaq Capital Market |

Warrants, exercisable for one share of Common Stock | | DRMAW | | The Nasdaq Capital Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated Filer | ☒ | Smaller reporting company | ☒ |

| | Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards pursuant to Section 13(a) of the Exchange Act. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No.

There were 1,315,981 shares of Common Stock, par value $0.0001, of Dermata Therapeutics, Inc. issued and outstanding as of August 5, 2024.

DERMATA THERAPEUTICS, INC.

Form 10-Q

Table of Contents

INDEX

PART I

ITEM 1: FINANCIAL STATEMENTS

DERMATA THERAPEUTICS, INC.

Balance Sheets

| | June 30, 2024 | | | December 31, 2023 | |

| | (unaudited) | | | | |

Assets: | | | | | | |

Cash and cash equivalents | | $ | 4,947,100 | | | $ | 7,438,135 | |

Prepaid expenses and other current assets | | | 289,452 | | | | 540,499 | |

Total assets | | $ | 5,236,552 | | | $ | 7,978,634 | |

| | | | | | | | |

Liabilities and Stockholders’ Equity: | | | | | | | | |

Liabilities: | | | | | | | | |

Accounts payable | | $ | 1,327,179 | | | $ | 866,028 | |

Accrued and other current liabilities | | | 591,246 | | | | 757,588 | |

Total liabilities | | | 1,918,425 | | | | 1,623,616 | |

Commitments and Contingencies (see Note 6) | | | | | | | | |

Stockholders’ Equity: | | | | | | | | |

Common Stock, par value $0.0001 per share, 250,000,000 shares authorized; 693,175 shares issued and outstanding as of June 30, 2024; 261,998 shares issued and outstanding as of December 31, 2023. | | | 69 | | | | 26 | |

Additional paid-in capital | | | 62,669,304 | | | | 59,742,870 | |

Accumulated deficit | | | (59,351,246 | ) | | | (53,387,878 | ) |

Total stockholders’ equity | | | 3,318,127 | | | | 6,355,018 | |

Total liabilities and stockholders’ equity | | $ | 5,236,552 | | | $ | 7,978,634 | |

The accompanying notes are an integral part of these financial statements.

DERMATA THERAPEUTICS, INC.

Statements of Operations

(unaudited)

| | For the three months ended June 30, | | | For the six months ended June 30, | |

| | 2024 | | | 2023 | | | 2024 | | | 2023 | |

Operating expenses: | | | | | | | | | | | | |

Research and development | | $ | 2,009,102 | | | $ | 838,931 | | | $ | 3,609,843 | | | $ | 2,031,564 | |

General and administrative | | | 874,640 | | | | 893,483 | | | | 2,477,459 | | | | 1,978,532 | |

Total operating expenses | | | 2,883,742 | | | | 1,732,414 | | | | 6,087,302 | | | | 4,010,096 | |

Loss from operations | | | (2,883,742 | ) | | | (1,732,414 | ) | | | (6,087,302 | ) | | | (4,010,096 | ) |

Other income and expenses: | | | | | | | | | | | | | | | | |

Interest income, net | | | 54,636 | | | | 31,050 | | | | 123,934 | | | | 68,590 | |

Net loss | | $ | (2,829,106 | ) | | $ | (1,701,364 | ) | | $ | (5,963,368 | ) | | $ | (3,941,506 | ) |

| | | | | | | | | | | | | | | | |

Net loss per share of Common Stock, basic and diluted | | $ | (4.18 | ) | | $ | (9.43 | ) | | $ | (10.64 | ) | | $ | (31.96 | ) |

| | | | | | | | | | | | | | | | |

Weighted-average basic and diluted Common Stock | | | 676,567 | | | | 180,332 | | | | 560,282 | | | | 123,344 | |

The accompanying notes are an integral part of these financial statements.

DERMATA THERAPEUTICS, INC.

Statements of Stockholder’s Equity

(unaudited)

| | | | | | | | Additional | | | | | | Total | |

| | Common Stock | | | Paid-in | | | Accumulated | | | Stockholders’ | |

| | Shares | | | Par Value | | | Capital | | | Deficit | | | Equity | |

Balance at December 31, 2023 | | | 261,998 | | | $ | 26 | | | $ | 59,742,870 | | | $ | (53,387,878 | ) | | $ | 6,355,018 | |

Stock-based compensation | | | - | | | | - | | | | 587,234 | | | | - | | | | 587,234 | |

Issuance of abeyance shares | | | 182,000 | | | | 18 | | | | (18 | ) | | | - | | | | - | |

Net loss | | | - | | | | - | | | | - | | | | (3,134,262 | ) | | | (3,134,262 | ) |

Balance at March 31, 2024 | | | 443,998 | | | $ | 44 | | | $ | 60,330,086 | | | $ | (56,522,140 | ) | | $ | 3,807,990 | |

Issuance of Common Stock upon exercise of warrants, net of issuance costs | | | 249,336 | | | | 25 | | | | 2,320,438 | | | | - | | | | 2,320,463 | |

Stock-based compensation | | | - | | | | - | | | | 19,608 | | | | - | | | | 19,608 | |

Settlement of fractional shares paid in cash | | | (159 | ) | | | - | | | | (828 | ) | | | - | | | | (828 | ) |

Net loss | | | - | | | | - | | | | - | | | | (2,829,106 | ) | | | (2,829,106 | ) |

Balance at June 30, 2024 | | | 693,175 | | | $ | 69 | | | $ | 62,669,304 | | | $ | (59,351,246 | ) | | $ | 3,318,127 | |

The accompanying notes are an integral part of these financial statements.

DERMATA THERAPEUTICS, INC.

Statements of Stockholder’s Equity

(unaudited)

| | | | | | | | Additional | | | | | | Total | |

| | Common Stock | | | Paid-in | | | Accumulated | | | Stockholders’ | |

| | Shares | | | Par Value | | | Capital | | | Deficit | | | Equity | |

Balance at December 31, 2022 | | | 51,338 | | | $ | 5 | | | $ | 51,615,037 | | | $ | (45,593,188 | ) | | $ | 6,021,854 | |

Stock-based compensation | | | - | | | | - | | | | 131,260 | | | | - | | | | 131,260 | |

Issuance of Common Stock and warrants, net of issuance costs | | | 5,666 | | | | 1 | | | | 4,174,984 | | | | - | | | | 4,174,985 | |

Issuance of Common Stock upon exercise of pre-funded warrants | | | 102,208 | | | | 10 | | | | 143 | | | | - | | | | 153 | |

Settlement of fractional shares paid in cash | | | (59 | ) | | | - | | | | (40 | ) | | | - | | | | (40 | ) |

Net loss | | | - | | | | - | | | | - | | | | (2,240,142 | ) | | | (2,240,142 | ) |

Balance at March 31, 2023 | | | 159,153 | | | $ | 16 | | | $ | 55,921,384 | | | $ | (47,833,330 | ) | | $ | 8,088,070 | |

Stock-based compensation | | | - | | | | - | | | | 131,177 | | | | - | | | | 131,177 | |

Issuance of Common Stock and warrants, net of issuance costs | | | 30,570 | | | | 3 | | | | 1,512,099 | | | | - | | | | 1,512,102 | |

Issuance of Common Stock upon exercise of pre-funded warrants | | | 22,821 | | | | 2 | | | | 32 | | | | - | | | | 34 | |

Net loss | | | - | | | | - | | | | - | | | | (1,701,364 | ) | | | (1,701,364 | ) |

Balance at June 30, 2023 | | | 212,544 | | | $ | 21 | | | $ | 57,564,692 | | | $ | (49,534,694 | ) | | $ | 8,030,019 | |

The accompanying notes are an integral part of these financial statements.

DERMATA THERAPEUTICS, INC.

Statements of Cash Flows

(unaudited)

| | For the six months ended June 30, | |

| | 2024 | | | 2023 | |

Cash flows from operating activities: | | | | | | |

Net loss | | $ | (5,963,368 | ) | | $ | (3,941,506 | ) |

Adjustments to reconcile net loss to net cash used in operating activities: | | | | | | | | |

Stock-based compensation | | | 606,842 | | | | 262,437 | |

Increase (decrease) in cash resulting from changes in: | | | | | | | | |

Prepaid expenses and other current assets | | | 367,802 | | | | 428,843 | |

Accounts payable | | | 360,253 | | | | (58,924 | ) |

Accrued and other current liabilities | | | (201,936 | ) | | | (180,848 | ) |

Total adjustments to reconcile net loss to net cash used in operations | | | 1,132,961 | | | | 451,508 | |

Net cash used in operating activities | | | (4,830,407 | ) | | | (3,489,998 | ) |

Cash flows from financing activities: | | | | | | | | |

Proceeds from issuance of Common Stock and warrants, net of issuance costs | | | 2,410,200 | | | | 5,687,087 | |

Issuance costs paid setting up ATM | | | (70,000 | ) | | | - | |

Proceeds from exercise of pre-funded warrants | | | - | | | | 187 | |

Payment for fractional shares in reverse stock split | | | (828 | ) | | | (40 | ) |

Net cash provided by financing activities | | | 2,339,372 | | | | 5,687,234 | |

Net increase (decrease) in Cash and cash equivalents | | | (2,491,035 | ) | | | 2,197,236 | |

Cash and cash equivalents at beginning of period | | | 7,438,135 | | | | 6,241,294 | |

Cash and cash equivalents at end of period | | $ | 4,947,100 | | | $ | 8,438,530 | |

Non-cash financing activities: | | | | | | | | |

Issuance of abeyance shares | | $ | (18 | ) | | $ | - | |

Incremental fair value of May 2024 warrant inducement | | $ | 1,526,232 | | | $ | - | |

Equity issuance costs in accounts payable or accrued expenses | | $ | 89,737 | | | $ | - | |

Deferred offering costs included in accounts payable and accrued expenses | | $ | 46,755 | | | | - | |

Incremental fair value of March 2023 warrant modification | | $ | - | | | $ | 144,765 | |

Supplemental disclosure: | | | | | | | | |

Cash paid for taxes | | $ | 950 | | | $ | 950 | |

The accompanying notes are an integral part of these financial statements.

DERMATA THERAPEUTICS, INC.

Notes to Financial Statements

(unaudited)

1. Organization and Basis of Presentation

Dermata Therapeutics, Inc., (the “Company”), was formed in December 2014 as a Delaware limited liability company (“LLC”) under the name Dermata Therapeutics, LLC. On March 24, 2021, the Company converted from an LLC to a Delaware C-corporation and changed its name to Dermata Therapeutics, Inc. The Company is a clinical-stage biotechnology company focused on the treatment of medical and aesthetic skin conditions and diseases.

Reverse Stock Splits

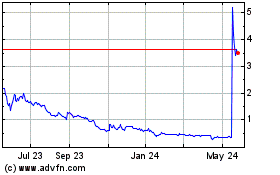

On May 7, 2024, the Company held its annual meeting of stockholders at which time the stockholders approved the adoption of an amendment to its Amended and Restated Certificate of Incorporation, as amended (the “Charter”), to effect a reverse stock split of its issued and outstanding shares of Common Stock, at a specific ratio, ranging from one-for-five to one-for-thirty, with the exact ratio determined by the Company’s board of directors without further approval or authorization of its stockholders (the “Reverse Split”).

On May 16, 2024, the Company effected the Reverse Split of its shares of Common Stock at a ratio of 1-for-15, as approved by the Company’s board of directors (the “May 2024 Reverse Stock Split”). The par value was not adjusted as a result of the May 2024 Reverse Stock Split. All issued and outstanding shares of Common Stock and per share amounts contained in the financial statements have been retroactively adjusted to reflect this reverse stock split for all periods presented.

On March 13, 2023, the Company effected a reverse stock split of shares of the Company’s Common Stock at a ratio of 1-for-16 pursuant to an amendment to the Company’s certificate of incorporation approved by the Company’s board of directors and stockholders. The par value was not adjusted as a result of the reverse split. All issued and outstanding shares of Common Stock and per share amounts contained in the financial statements have been retroactively adjusted to reflect this reverse stock split for all periods presented.

Liquidity and Going Concern Uncertainty

Since its inception, the Company has devoted substantially all of its resources to research and development activities and has not generated any revenue or commercialized any product candidates. As of June 30, 2024, cash and cash equivalents totaled $4.9 million and the Company had an accumulated deficit of $59.4 million. For the six months ended June 30, 2024, and the year ended December 31, 2023, the Company used cash of $4.8 million and $6.4 million, respectively, in operations. The Company’s cash and cash equivalents are expected to fund operations into the fourth quarter of 2024. The Company anticipates that it will continue to incur net losses for the foreseeable future. These factors raise substantial doubt about the Company’s ability to continue as a going concern for the one-year period following the date that these financial statements were issued.

Historically, the Company’s principal sources of cash have included proceeds from the issuance of equity securities and debt. The Company’s principal uses of cash have included cash used in operations and payments for license rights. The Company expects that the principal uses of cash in the future will be for continuing operations, funding of research and development, conducting preclinical studies and clinical trials, and general working capital requirements. The Company expects that as research and development expenses continue to grow, it will need to raise additional capital to sustain operations and research and development. The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. The financial statements do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets or the amounts and classification of liabilities that may result from the possible inability of the Company to continue as a going concern.

Management’s Plan to Continue as a Going Concern

To continue as a going concern, the Company will need, among other things, to raise additional capital resources. Until the Company can generate significant cash from operations, management’s plans to obtain such resources for the Company include proceeds from offerings of the Company’s equity securities or debt, or transactions involving product development, technology licensing or collaboration. Management can provide no assurance that any sources of a sufficient amount of financing or collaboration agreements will be available to the Company on favorable terms, if at all. The Company’s ability to raise additional capital may be adversely impacted by potential worsening of global economic conditions, potential future global pandemics or health crises, and the disruptions to, and volatility in, the credit and financial markets in the United States. Because of historical and expected operating losses and net operating cash flow deficits, there is substantial doubt about the Company’s ability to continue as a going concern for one year from the issuance of the financial statements, which is not alleviated by management’s plans. The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. The financial statements do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets or the amounts and classification of liabilities that may result from the possible inability of the Company to continue as a going concern.

Basis of Presentation

The accompanying unaudited financial statements have been prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) for interim financial information and in accordance with the instructions to Form 10-Q and Article 10 of Regulation S-X. Accordingly, since they are interim statements, the accompanying financial statements do not include all of the information and notes required by GAAP for complete financial statements. In the opinion of management, the accompanying financial statements reflect all adjustments (consisting of normal recurring adjustments) that are necessary for a fair statement of the financial position, results of operations, cash flows, and stockholders’ equity for the interim periods presented. Interim results are not necessarily indicative of results for a full year. The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the amounts reported in the financial statements and the accompanying notes. Actual results could differ materially from those estimates. The unaudited financial statements included in this Form 10-Q should be read in conjunction with the audited financial statements and notes thereto included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on March 21, 2024, which includes a broader discussion of the Company’s business and the risks inherent therein.

2. Summary of Significant Accounting Policies

Use of Estimates

The Company’s financial statements are prepared in accordance with GAAP. The preparation of the Company’s financial statements requires management to make estimates and assumptions that impact the reported amounts of assets, liabilities, and expenses and disclosure of contingent assets and liabilities in the financial statements and accompanying notes. On an ongoing basis, management evaluates these estimates and judgments, including those related to accrued research and development expenses. Management evaluates its estimates on an ongoing basis. The Company bases its estimates on various assumptions that it believes are reasonable under the circumstances. Actual results may differ from these estimates under different assumptions or conditions.

Segment Information

Operating segments are defined as components of an enterprise about which separate discrete information is available for evaluation by the chief operating decision maker, or decision-making group, in deciding how to allocate resources and in assessing performance. The Company and the Company’s chief operating decision maker view the Company’s operations and manage its business in one operating segment, which is the business of developing and commercializing pharmaceuticals.

Cash and Cash Equivalents

The Company deposits its cash and cash equivalents with accredited financial institutions that are insured by the Federal Deposit Insurance Corporation (“FDIC”), which are held in checking and cash sweep accounts. At times, deposits held may exceed the amount of insurance provided by the FDIC. The Company maintains an insured cash sweep account in which cash from its main operating checking account is invested overnight in highly liquid, short-term investments. The Company considers all highly liquid investments with a maturity date of 90 days or less at the date of purchase to be cash equivalents.

Concentrations of Credit Risk

Financial instruments that potentially subject the Company to a concentration of credit risk consist primarily of cash and cash equivalents. The Company is exposed to credit risk in the event of a default by the financial institutions holding the Company’s cash and cash equivalents to the extent of the amounts held in excess of FDIC limits. The Company limits its credit risk by placing its cash and cash equivalents with financial institutions it believes are of high quality. To date, the Company has not experienced any losses on its deposits of cash and cash equivalents.

Deferred Financing Costs

The Company capitalizes certain legal, accounting, and other fees and costs that are directly attributable to in-process equity financing as deferred offering costs until such financings are completed. Upon the completion of an equity financing, these costs are recorded as a reduction of additional paid-in capital of the related financing. As of June 30, 2024, the Company had deferred offering costs of $0.1 million.

Fair Value Measurement

The Company uses a three-tier fair value hierarchy to prioritize the inputs used in the Company’s fair value measurements. These tiers include: Level 1, defined as observable inputs such as quoted prices in active markets for identical assets; Level 2, defined as inputs other than quoted prices in active markets that are either directly or indirectly observable; and Level 3, defined as unobservable inputs in which little or no market data exists, therefore requiring an entity to develop its own assumptions. The Company believes the carrying amount of cash and cash equivalents, accounts payable and accrued expenses approximate their estimated fair values due to the short-term nature of these assets and liabilities.

Interest Income

Interest income consists of interest income earned on cash and cash equivalents from interest bearing demand accounts.

Patent Costs

Patent costs related to obtaining and maintaining patent protection in both the United States and other countries are expensed as incurred. Patents costs are classified as general and administrative expenses.

Research and Development

Research and development costs consist of expenses incurred in connection with the development of the Company’s product candidates. Such expenses include expenses incurred under agreements with contract research organizations, manufacturing and supply scale-up expenses and the cost of acquiring and manufacturing preclinical and clinical trial supply, outsourced laboratory services, including materials and supplies used to support the Company’s research and development activities, and payments made for license fees and milestones that have not been demonstrated to have commercial value. Such costs are expensed in the periods in which they are incurred. Upfront payments and milestone payments for licensed technology are expensed as research and development as incurred or when the milestone is achieved or is determined to be probable of being achieved. Advanced payments for goods or services to be received in the future for research and development activities are recorded as prepaid expenses and expensed as the related goods are received or services are performed.

Income Taxes

The Company is a C-Corporation and accounts for income taxes under the asset and liability method, which requires the recognition of deferred tax assets and liabilities for the expected future tax consequences of events that have been included in the financial statements. Under this method, deferred tax assets and liabilities are determined on the basis of the differences between the financial statements and tax basis of assets and liabilities using enacted tax rates in effect for the year in which the differences are expected to reverse. The effect of a change in tax rates on deferred tax assets and liabilities is recognized in income in the period that includes the enactment date.

The Company recognizes net deferred tax assets to the extent that the Company believes these assets are more likely than not to be realized. In making such a determination, management considers all available positive and negative evidence, including future reversals of existing taxable temporary differences, projected future taxable income, tax-planning strategies, and results of recent operations. If management determines that the Company would be able to realize its deferred tax assets in the future in excess of their net recorded amount, management would make an adjustment to the deferred tax asset valuation allowance, which would reduce the provision for income taxes.

The Company records uncertain tax positions on the basis of a two-step process whereby (1) management determines whether it is more likely than not that the tax positions will be sustained on the basis of the technical merits of the position and (2) for those tax positions that meet the more-likely-than-not recognition threshold, management recognizes the largest amount of tax benefit that is more than 50 percent likely to be realized upon ultimate settlement with the related tax authority. The Company recognizes interest and penalties related to unrecognized tax benefits within income tax expense. Any accrued interest and penalties are included within the related tax liability.

Stock-Based Compensation

The Company measures and recognizes compensation expense for all stock-based awards made to employees, directors, and non-employees, based on estimated fair values recognized using the straight-line method over the requisite service period. The fair value of options to purchase Common Stock granted to employees is estimated on the grant date using the Black-Scholes valuation model. The calculation of stock-based compensation expense requires that the Company make certain assumptions and judgments about variables used in the Black-Scholes model, including the expected term of the stock-based award, expected volatility of the underlying Common Stock, dividend yield, and the risk-free interest rate. Forfeitures are accounted for in the period they occur. Restricted stock units granted under the Company’s 2021 Omnibus Equity Incentive Plan (the “2021 Plan”) are measured at the grant date fair value of the Common Stock, with corresponding compensation expense recognized ratably over the requisite service period. Refer to Note 5 - Equity Incentive Plan for further discussion.

Warrants

The Company performs an assessment of warrants upon issuance to determine their proper classification in the financial statements based upon the warrant’s specific terms, in accordance with the authoritative guidance provided in Financial Accounting Standards Board Accounting Standards Codification (“ASC”) 480, Distinguishing Liabilities from Equity (“ASC 480”), and ASC 815-40, Derivatives and Hedging – Contracts in Entity’s Own Equity (“ASC 815-40”). The assessment considers whether the warrants are freestanding financial instruments pursuant to ASC 480-40 and whether the warrants meet all of the requirements for equity classification under ASC 815, including whether the warrants are indexed in the Company’s own Common Stock and whether the warrant holders could potentially require cash settlement of the warrants.

For issued or modified warrants that meet all the criteria for equity classification, the warrants are required to be recorded as a component of additional paid-in capital. For issued or modified warrants that do not meet all the criteria for equity classification, the warrants are required to be liability-classified and recorded at their initial fair value on the date of issuance and remeasured at fair value at each balance sheet date thereafter. The Company has performed an assessment of all warrants issued and modified and determined that the Company’s warrants are equity-classified.

Comprehensive Loss

Comprehensive loss includes net loss and other comprehensive income (loss) for the periods presented. The Company did not have other comprehensive income (loss) items such as unrealized gains and losses and so for the periods presented, comprehensive loss was equal to the net loss.

Net Loss Per Share of Common Stock

Basic net loss per share is calculated by dividing net loss attributable to common shareholders by the weighted-average number of shares outstanding during the period. The weighted-average number of shares of Common Stock outstanding includes (i) pre-funded warrants because their exercise requires only nominal consideration for the delivery of shares, and (ii) shares held in abeyance because there is no consideration required for delivery of the shares, (collectively, “basic shares”), without consideration of common stock equivalents. Diluted net loss per share is calculated by adjusting basic shares outstanding for the dilutive effect of common stock equivalents outstanding for the period. For purposes of the diluted net loss per share calculation, stock options and warrants are considered to be common stock equivalents but are excluded from the calculation of diluted net loss per common stock if their effect would be anti-dilutive.

The common share equivalents that are not included in the calculation of diluted net loss per share of Common Stock but could potentially dilute basic earnings per share in the future are as follows:

| | As of June 30, | |

| | 2024 | | | 2023 | |

Common Stock options | | | 27,341 | | | | 6,763 | |

Common Stock warrants | | | 1,109,705 | | | | 290,090 | |

Total potentially dilutive securities | | | 1,137,046 | | | | 296,853 | |

Recent Accounting Pronouncements

For the six months ended June 30, 2024, the Company has reviewed recent accounting standards and identified the following as relevant to the Company.

In December 2023, the FASB issued ASU No. 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures (“ASU 2023-09”). ASU 2023-09 requires disaggregated information about a reporting entity’s effective tax rate reconciliation as well as information on income taxes paid. ASU 2023-09 is effective for public entities with annual periods beginning after December 15, 2024, with early adoption permitted. The Company is currently evaluating the impact of this guidance on its financial statements and income tax footnote.

3. Balance Sheet Details

The following provides certain balance sheet details:

| | June 30, | | | December 31, | |

| | 2024 | | | 2023 | |

Prepaid expenses and other current assets: | | | | | | |

Prepaid insurance | | $ | 83,627 | | | $ | 426,413 | |

Prepaid research and development costs | | | 27,534 | | | | 91,232 | |

Prepaid other and other current assets | | | 61,536 | | | | 22,854 | |

Deferred offering costs | | | 116,755 | | | | - | |

Total prepaid expenses and other current assets | | $ | 289,452 | | | $ | 540,499 | |

| | | | | | | | |

Accrued and other current liabilities: | | | | | | | | |

Accrued research and development costs | | $ | 263,018 | | | $ | 40,596 | |

Accrued compensation and benefits | | | 277,963 | | | | 716,490 | |

Accrued other | | | 50,265 | | | | 502 | |

Total accrued and other current liabilities | | $ | 591,246 | | | $ | 757,588 | |

4. Equity Securities

A summary of the Company’s equity securities as of June 30, 2024, is as follows:

Description | | Authorized | | | Issued | | | Abeyance | | | Reserved | | | Outstanding | |

Common Stock, par value $0.0001 | | | 250,000,000 | | | | 693,175 | | | | 267,000 | | | | - | | | | 693,175 | |

Preferred Stock | | | 10,000,000 | | | | - | | | | | | | | - | | | | - | |

Warrants | | | - | | | | 1,109,705 | | | | | | | | - | | | | 1,109,705 | |

2021 Omnibus Equity Incentive Plan | | | - | | | | 28,255 | | | | 267,000 | | | | 51,675 | | | | 27,341 | |

Total equity securities | | | 260,000,000 | | | | 1,831,135 | | | | 267,000 | | | | 51,675 | | | | 1,830,221 | |

Common Stock

On June 7, 2024, the Company entered into an At The Market Offering Agreement (the “ATM Agreement”) with H.C. Wainwright & Co., LLC (the “Sales Agent”) providing for the sale of up to $1,157,761 of its shares of Common Stock, par value $0.0001 per share, as set forth in the ATM Agreement. The Sales Agent will be entitled to compensation at a fixed commission rate of 3.0% of the gross sales price of the shares of Common Stock sold pursuant to the ATM Agreement, as well as other transactional fees. As of June 30, 2024, no shares have been sold under the ATM Agreement. See Note 7.

On May 21, 2024, the Company closed on inducement agreements (the “May 2024 Inducement”) with certain holders (the “Holders”) of certain of the Company’s existing warrants to purchase up to an aggregate of 516,336 shares of the Company’s Common Stock, issued to the Holders on (i) May 26, 2023 (the “May 2023 Warrants”), having an exercise price of $32.40 per share, and (ii) November 2023 New Warrants (as defined below), which were issued in two separate series, each having an exercise price of $9.7665 per share (together with the May 2023 Warrants, the “May 2024 Existing Warrants”). Pursuant to the May 2024 Inducement, the Holders agreed to exercise for cash their May 2024 Existing Warrants at a reduced exercise price of $5.16 per share in consideration for the Company’s agreement to issue in a private placement (i) new Series A Common Stock purchase warrants (the “New May 2024 Series A Warrants”) to purchase up to 601,174 shares of Common Stock, and (ii) new Series B Common Stock purchase warrants (the “New May 2024 Series B Warrants” and together with the New May 2024 Series A Warrants, the “New May 2024 Warrants”) to purchase up to 431,498 shares of Common Stock. The Company received net proceeds of approximately $2.3 million from the exercise of the May 2024 Existing Warrants by the Holders, after deducting placement agent fees and other offering expenses payable by the Company.

Related to the May 2024 Inducement, as of June 30, 2024, the Holders left 267,000 shares in abeyance at the Company’s transfer agent to be delivered to the Holders at their request. Accordingly, as of June 30, 2024, 267,000 shares were held in abeyance, which were not issued and not outstanding. See Note 7.

On November 20, 2023, the Company closed on an inducement agreement (the “November 2023 Inducement”) with a holder (the “Holder”) of certain of its existing warrants to purchase up to 231,473 shares of the Company’s Common Stock, issued to the Holder on (i) April 25, 2022 (as amended on March 20, 2023, the “April 2022 Warrants”) and (ii) March 20, 2023 (the “March 2023 Warrants” together with the April 2022 Warrants, the “November 2023 Existing Warrants”). The November 2023 Existing Warrants had an exercise price of $42.30. Pursuant to the November 2023 Inducement, the Holder agreed to exercise for cash its November 2023 Existing Warrants at a reduced exercise price of $9.7665 per share in consideration for the Company’s agreement to issue in a private placement (i) new series A Common Stock purchase warrants (the “November 2023 Series A Common Warrants”) to purchase 247,196 shares of Common Stock and (ii) new series B Common Stock purchase warrants (the “November 2023 Series B Common Warrants” and together with the November 2023 Series A Common Warrants, the “November 2023 New Warrants”) to purchase 215,749 shares of Common Stock. The November 2023 New Warrants were exercisable subject to stockholder approval, which the Company received at a stockholder meeting on January 12, 2024. The Company received net cash proceeds of approximately $2.0 million from the November 2023 Inducement after deducting underwriters’ discounts and offering expenses of approximately $0.3 million.

Related to the November 2023 Inducement, as of December 31, 2023, the Holder left 182,000 shares in abeyance at the Company’s transfer agent to be delivered to the Holder at their request, which were then delivered to the Holder on January 8, 2024. Accordingly, as of December 31, 2023, 182,000 shares were held in abeyance, which were not issued and not outstanding. Since all the abeyance shares from the November 2023 Inducement were pulled by the Holder in January 2024, there were no remaining November 2023 Inducement shares held in abeyance as of June 30, 2024.

On May 26, 2023, the Company closed a private placement (the “May 2023 PIPE”) priced at the market under Nasdaq rules, in which it sold 30,570 shares of its Common Stock together with 22,821 pre-funded warrants to purchase up to an aggregate of 53,391 shares of Common Stock with an exercise price of $0.0001 per share (the “May 2023 Pre-Funded Warrants”), and 53,391 warrants to purchase up to an aggregate of 53,391 shares of Common Stock with an exercise price of $32.40 per share (the “May 2023 PIPE Common Warrants”) at a combined offering price of $34.275. The May 2023 PIPE Common Warrants were set to expire on November 27, 2028. The Company received net cash proceeds of approximately $1.5 million from the May 2023 PIPE after deducting underwriters’ discounts and offering expenses of approximately $0.3 million. The May 2023 Pre-Funded Warrants were exercised fully during the second quarter of 2023. The May 2023 PIPE Common Warrants were exercised as part of the May 2024 Inducement.

On March 20, 2023, the Company closed a public offering (the “March 2023 Offering”) priced at the market under Nasdaq rules, in which it sold an aggregate of (i) 5,666 shares of Common Stock, (ii) pre-funded warrants (the “March 2023 Pre-Funded Warrants”) to purchase up to an aggregate of 102,208 shares of Common Stock with an exercise price of $0.0001 per share, (iii) Series A warrants (the “March 2023 Series A Common Warrants”) to purchase up to an aggregate of 107,874 shares of Common Stock, and (iv) Series B warrants (the “March 2023 Series B Common Warrants” and collectively with the March 2023 Series A Common Warrants, the “March 2023 Offering Warrants”) to purchase up to an aggregate of 107,874 shares of Common Stock. The March 2023 Offering Warrants had an exercise price of $42.30 per share. The Company received net cash proceeds of approximately $4.2 million after deducting the underwriter’s discounts and offering expenses of approximately $0.8 million. The March 2023 Pre-Funded Warrants were fully exercised during the first quarter of 2023, and the March 2023 Offering Warrants were exercised as part of the November 2023 Inducement.

Preferred Stock

While the Company has 10,000,000 shares of preferred stock authorized with a par value of $0.0001, no shares of preferred stock are outstanding as of June 30, 2024, or December 31, 2023, respectively.

Warrants

Summary of Warrants Outstanding

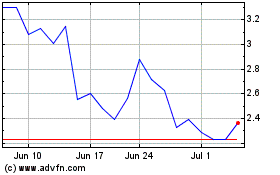

The table below lists outstanding warrants for the dates presented. The warrants outstanding as of June 30, 2024, are exercisable into 1,109,705 shares of Common Stock which had a fair value of $2.39 per share, based on the closing trading price on June 28, 2024, the last trading day prior to June 30, 2024. The aggregate intrinsic value of warrants outstanding as of June 30, 2024, is calculated as the difference between the exercise price of the warrants and the closing market price of the Company’s Common Stock on that date. The intrinsic value of warrants outstanding as of June 30, 2024, was zero due to the warrants’ exercise prices being above market value.

| | Quantity of Warrants Outstanding as of | | | | | | | |

Description | | June 30, 2024 | | | December 31, 2023 | | | Exercise Price | | | Expiration Date | |

Pre-IPO Series 1a Warrants | | | 279 | | | | 279 | | | $ | 4,920.00 | | | 11/15/2026 | |

Pre-IPO Class B Common Warrants | | | 268 | | | | 268 | | | | 1,377.60 | | | 12/31/2024 | |

IPO Warrants | | | 12,320 | | | | 12,320 | | | | 1,680.00 | | | 8/17/2026 | |

IPO Underwriter Warrants | | | 535 | | | | 535 | | | | 1,932.00 | | | 8/17/2026 | |

March 2023 Offering Series A Common Warrants | | | - | | | | 107,874 | | | | 42.30 | | | 3/20/2028 | |

March 2023 Offering Series B Common Warrants | | | - | | | | 107,874 | | | | 42.30 | | | 7/20/2025 | |

March 2023 Offering Placement Agent Warrants | | | 7,549 | | | | 7,549 | | | | 57.94 | | | 3/16/2028 | |

May 2023 PIPE Common Warrants | | | - | | | | 53,391 | | | | 32.40 | | | 11/27/2028 | |

May 2023 PIPE Placement Agent Warrants | | | 3,736 | | | | 3,736 | | | | 42.84 | | | 5/23/2028 | |

November 2023 Series A Common Warrants | | | - | | | | 247,196 | | | | 9.7665 | | | 11/20/2028 | |

November 2023 Series B Common Warrants | | | - | | | | 215,749 | | | | 9.7665 | | | 3/20/2026 | |

November 2023 Placement Agent Warrants | | | 16,202 | | | | 16,202 | | | | 12.21 | | | 11/20/2028 | |

May 2024 Series A Common Warrants | | | 601,174 | | | | - | | | | 4.91 | | | 11/21/2029 | |

May 2024 Series B Common Warrants | | | 431,498 | | | | - | | | | 4.91 | | | 5/21/2026 | |

May 2024 Placement Agent Warrants | | | 36,144 | | | | - | | | | 6.45 | | | 11/21/2029 | |

Total warrants outstanding | | | 1,109,705 | | | | 772,973 | | | | | | | | |

Warrant Inducements

In May 2024, the Company completed the May 2024 Inducement with the Holders who agreed to exercise 516,336 warrants to purchase Common Stock at a reduced exercise price of $5.16 per share in exchange for 601,174 New May 2024 Series A Warrants and 431,498 New May 2024 Series B Warrants with an exercise price of $4.91 per share. The May 2024 Inducement, which resulted in the lowering of the exercise price of the May 2024 Existing Warrants and the issuance of the May 2024 New Warrants, is considered a modification of the May 2024 Existing Warrants under the guidance ASC 815-40. The modification is consistent with the equity issuance classification under that guidance as the reason for the modification was to induce the holders of the May 2024 Existing Warrants to cash exercise their warrants, which raised equity capital and generated net proceeds of approximately $2.3 million. As the May 2024 Existing Warrants and the May 2024 New Warrants were classified as equity instruments before and after the exchange, and as the exchange is directly attributable to an equity offering, the Company recognized the effect of the modification of approximately $1.5 million as an equity issuance cost.

In November 2023, the Company completed the November 2023 Inducement, in which a Holder agreed to exercise 231,472 common warrants to purchase Common Stock at a reduced exercise price of $5.16 per share in exchange for 247,196 November 2023 Series A Warrants and 215,749 November 2023 Series B Warrants with an exercise price of $9.7655 per share. The November 2023 New Warrants were exercisable subject to stockholder approval, which the Company received at a stockholder meeting on January 12, 2024. The November 2023 Inducement, which resulted in the lowering of the exercise price of the November 2023 Existing Warrants and the issuance of the November 2023 New Warrants, is considered a modification of the November 2023 Existing Warrants under the guidance of ASC 815-40. The modification is consistent with the equity issuance classification under that guidance as the reason for the modification was to induce the holder of the November 2023 Existing Warrants to cash exercise their warrants, which raised equity capital and generated net proceeds for the Company of approximately $2.0 million. As the November 2023 Existing Warrants and the November 2023 New Warrants were classified as equity instruments before and after the exchange, and as the exchange is directly attributable to an equity offering, the Company recognized the effect of the modification of approximately $3.0 million as an equity issuance cost.

Warrant Modification

In connection with the March 2023 Offering, the Company agreed to amend the terms of the April 2022 PIPE Common Warrants, which were held by the purchaser in the March 2023 Offering. The exercise price of the April 2022 PIPE Common Warrants was reduced from $318.00 to $42.30 per share upon closing of the March 2023 Offering. The original expiration date of the April 2022 PIPE Common Warrants was May 12, 2027, which was extended to five years after the closing of the March 2023 Offering, or March 20, 2028. The modification of the April 2022 PIPE Common Warrants was accounted for as a modification of equity-linked instruments. In accordance with ASU 2021-04, as the warrants were classified as equity instruments before and after the modification, and as the modification was directly attributable to an equity offering, the Company recognized the effect of the modification of approximately $0.1 million as an equity issuance cost. The April 2022 PIPE Warrants were exercised as part of the November 2023 Inducement.

5. Equity Incentive Plan

Under the Company’s 2021 Plan as amended, the Company may grant options to purchase shares of Common Stock, restricted stock awards, performance stock awards, incentive bonus awards, other cash-based awards or directly issue shares of Common Stock to employees, directors, and consultants of the Company. At the Company’s 2024 Annual Meeting of Stockholders held on May 7, 2024, the Company’s stockholders approved an amendment to the Company’s 2021 Plan to increase the number of shares of Common Stock authorized for issuance thereunder from 41,937 shares to 79,930 shares. Further at the Company’s 2024 Annual Meeting of Stockholders, the Company’s stockholders approved an amendment to the Company’s 2021 Plan, to increase the evergreen provision from one percent to five percent of the total number of the Company’s Common Stock outstanding starting on January 1, 2025. The one percent evergreen provision resulted in an additional 2,620 and 513 shares of Common Stock issuable pursuant to the 2021 Plan as of January 1, 2024, and 2023, respectively.

Stock awards may be granted at an exercise price per share of not less than 100% of the fair market value at the date of grant. Stock awards granted are exercisable over a maximum term of 10 years from the date of grant and generally vest over a period of four years for employees and one year for directors of the Company’s Board and consultants.

As of June 30, 2024, there remain 51,675 shares reserved for issuance under the 2021 Plan, as amended.

Fair Value Measurement

The Company uses the Black-Scholes option valuation model, which requires the use of highly subjective assumptions, to determine the fair value of stock-based awards. The fair value of each employee stock option is estimated on the grant date under the fair value method using the Black-Scholes model. The estimated fair value of each stock option is then expensed over the requisite service period, which is generally the vesting period. The assumptions and estimates that the Company uses in the Black-Scholes model are as follows:

| · | Fair Value of Common Stock. The fair value of Common Stock is measured as the Company’s closing price of Common Stock on the date of grant. |

| | |

| · | Risk-Free Interest Rate. The Company bases the risk-free interest rate used in the Black-Scholes valuation model on the implied yield available on U.S. Treasury zero-coupon issues with a term equivalent to that of the expected term of the options. |

| | |

| · | Expected Term. The expected term represents the period that the Company’s stock-based awards are expected to be outstanding, which is calculated using the simplified method, as the Company has insufficient historical information to provide a basis for an estimate. The simplified method calculates the expected term as the average of the vesting term plus the contractual life of the options. |

| · | Volatility. The Company determines the price volatility based on the historical volatilities of industry peers as it has limited trading history for its Common Stock price. Industry peers consist of several public companies in the biotechnology industry with comparable characteristics, including clinical trials progress and therapeutic indications. |

| | |

| · | Dividend Yield. The expected dividend assumption is based on the Company’s current expectations about its anticipated dividend policy. To date, the Company has not declared any dividends to common shareholders and, therefore, the Company has used an expected dividend yield of zero. |

The following table presents the weighted-average assumptions used for stock options granted during the following periods:

| | Three Months Ended June 30, | | | Six Months Ended June 30, | |

| | 2024 | | | 2023 | | | 2024 | | | 2023 | |

Grant date fair value | | $ | 9.15 | | | $ | 63.45 | | | $ | 9.15 | | | $ | $63.45 | |

Risk-free interest rate | | | 4.0 | % | | | 3.9 | % | | | 4.0 | % | | | 3.9 | % |

Dividend yield | | | 0.00 | % | | | 0.00 | % | | | 0.00 | % | | | 0.00 | % |

Expected life in years | | | 5.9 | | | | 6.1 | | | | 5.9 | | | | 6.1 | |

Expected volatility | | | 110 | % | | | 112 | % | | | 110 | % | | | 112 | % |

Stock-based Compensation Expense

In general, stock-based compensation is allocated to research and development expense or general and administrative expense according to the classification of cash compensation paid to the employee, director, or consultant to whom the stock award was granted.

The following table summarizes the total stock-based compensation expense related to stock options included in the Company’s statements of operations:

| | Three Months Ended June 30, | | | Six Months Ended June 30, | |

| | 2024 | | | 2023 | | | 2024 | | | 2023 | |

Research and development | | $ | 4,623 | | | $ | 48,425 | | | $ | 241,960 | | | $ | 96,850 | |

General and administrative | | | 14,985 | | | | 82,752 | | | | 364,882 | | | | 165,587 | |

Total | | $ | 19,608 | | | $ | 131,177 | | | $ | 606,842 | | | $ | 262,437 | |

Stock Option Award Activity

A summary of the Company’s 2021 Plan stock option activity is as follows:

| | Number of Options Outstanding | | | Weighted- Average Exercise Price | | | Weighted- Average Remaining Contractual Term (in Years) | |

Balance at December 31, 2023 | | | 6,763 | | | $ | 609.81 | | | | 7.8 | |

Options granted | | | 27,325 | | | | 9.15 | | | | - | |

Options exercised | | | - | | | | - | | | | - | |

Options cancelled | | | (6,747 | ) | | | 607.99 | | | | - | |

Balance at June 30, 2024 | | | 27,341 | | | $ | 9.95 | | | | 9.5 | |

| | | | | | | | | | | | |

Options exercisable at June 30, 2024 | | | 1,955 | | | $ | 20.35 | | | | 9.5 | |

In January 2024, the Board unanimously approved to provide employees and directors of the Company the opportunity to cancel outstanding, out-of-the-money, stock options without consideration, in accordance with an option cancellation agreement. Accordingly, 6,747 of the 6,763 stock options outstanding as of December 31, 2023, were cancelled in February 2024.

In accordance with accounting guidance provided in ASC 718, since the stock option cancellations were not accompanied by a concurrent grant, or offer to grant, a replacement award, any unrecognized compensation cost was recognized at the cancellation date. Accordingly, the Company recognized stock-based compensation expense of $568,372 resulting from the stock option cancellation during the first quarter of 2024.

The aggregate intrinsic value of options outstanding and exercisable as of June 30, 2024, is calculated as the difference between the exercise price of the underlying options and the closing market price of the Company’s Common Stock on June 28, 2024, the last trading day prior to June 30, 2024, which was $2.39 per share. The intrinsic value of options outstanding and exercisable as of June 30, 2024, was zero.

As of June 30, 2024, total unrecognized compensation cost related to stock options was approximately $0.2 million and the weighted average period over which this cost is expected to be recognized is 1.7 years.

6. Commitments and Contingencies

Clinical Trials

During the fourth quarter of 2023, the Company initiated a Phase 3 clinical trial, STAR-1, which is expected to report top-line data in 2025. The total contract amount with the clinical research organization is approximately $6.9 million, which will extend from the fourth quarter of 2023 to the first half of 2025, and which has a 30-day termination notice period. As of June 30, 2024, the Company has recognized $2.9 million in expense for the STAR-1 trial.

Supplier Agreement

As a result of Russia’s invasion of Ukraine, the United States, the United Kingdom, and the European Union governments, among others, have developed coordinated sanctions and export-control measure packages against Russian individuals and entities. The Company is currently a party to an exclusive supply agreement for the supply of the Spongilla raw material used in DMT310 and DMT410. The counterparty to this supply agreement is a Russian entity. The imposition of enhanced export controls and economic sanctions on transactions with Russia and Russian entities by the United States, the United Kingdom, and/or the European Union could prevent the Company from performing under this existing contract or any future contract it may enter or may prevent the Company from remitting payment for raw material purchased from the Company’s supplier. The Company has received multiple shipments of raw material from its supplier subsequent to the implementation of export controls and sanctions, containing additional quantities of Spongilla raw material, which will provide the Company with sufficient quantities of Spongilla to initiate and complete two Phase 3 studies in moderate-to-severe acne and support filing a new drug application for DMT310 in acne upon the successful completion of two Phase 3 studies. Depending on the extent and breadth of new sanctions or export controls that may be imposed against Russia, otherwise or as a result of the impact of the war in Ukraine, it is possible that the Company’s ability to obtain additional supply of the Spongilla raw material used in DMT310 and DMT410 could be negatively impacted, which could adversely affect its business, results of operations, and financial condition.

License Agreements

On March 31, 2017, the Company entered into a license agreement, as amended (the “License Agreement”) with Villani, Inc. whereby Villani has granted the Company an exclusive, sub-licensable, royalty-bearing license (the “License”) under the Licensed Patents (as defined in the License Agreement), to formulate, develop, seek regulatory approval for, make or sell products that contain Spongilla lacustris (alone or in combination with other active or inactive ingredients) for the treatment of diseases, disorders and conditions of the skin, including but not limited to acne, rosacea, psoriasis, atopic dermatitis, seborrheic dermatitis, actinic keratosis and eczema that were developed using certain licensed know-how (“Licensed Products”). The Company is responsible for the development (including manufacturing, packaging, non-clinical studies, clinical trials and obtaining regulatory approval and commercialization (including marketing, promotion, distribution, etc.)) for all Licensed Products. The original License Agreement was amended in 2019, and pursuant to the amended License Agreement, the Company was required to make future milestone payments to Villani in an aggregate amount of up to $20.25 million upon the achievement of specified development and sales milestones, payable in cash or in equity, at the option of Villani, as well as single-digit royalty payments on net sales. On July 30, 2021, the Company further amended the License Agreement in the Second Amendment to the License and Settlement Agreement (the “Second Amendment”). Pursuant to the Second Amendment, the Company is required to make future milestone payments to Villani in an aggregate amount of up to $40.5 million upon the achievement of specified development and sales milestones, payable in cash or in equity, at the option of Villani, as well as single-digit royalty payments on net sales. The Second Amendment includes customary terms relating to, among others, indemnification, intellectual property protection, confidentiality, remedies, and warranties. As of June 30, 2024, the Company evaluated the likelihood of the Company achieving the specified milestones and determined that the likelihood is not yet probable and as such no accrual of these payments is required as of June 30, 2024.

Legal Proceedings

In the normal course of business, the Company may be involved in legal proceedings or threatened legal proceedings. The Company is not a party to any legal proceedings or aware of any threatened legal proceedings which are expected to have a material adverse effect on its financial condition, results of operations or liquidity.

7. Subsequent Events

During July 2024, the balance of 267,000 of abeyance shares related to the May 2024 Warrant Inducement were pulled by the investor. Accordingly, shares outstanding increased by 267,000 during the third quarter of 2024 related to the issuance of the 267,000 abeyance shares from the May 2024 Warrant Inducement, leaving no further abeyance shares outstanding.

In June 2024, the Company entered into an ATM Agreement with the maximum offering price of $1,157,761. During July 2024, the Company issued 355,806 shares of Common Stock under the ATM Agreement resulting in gross proceeds of $1,157,248 before deducting issuance costs. After issuance of the 355,806 shares during July 2024, $513 remained registered under the ATM Agreement. On August 2, 2024, the Company increased the maximum aggregate offering price of the shares of the Company’s common stock issuable under the ATM Agreement by $505,000, from $1,157,761 to $1,662,761.

ITEM 2: MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis of our financial condition and results of operations should be read together with our financial statements and the related notes and the other financial information included elsewhere in this Quarterly Report. This discussion contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of various factors, including those discussed below and elsewhere in this Quarterly Report, particularly those under “Risk Factors.”

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report contains forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 under Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include statements with respect to our beliefs, plans, objectives, goals, expectations, anticipations, assumptions, estimates, intentions, and future performance, and involve known and unknown risks, uncertainties, and other factors, which may be beyond our control, and which may cause our actual results, performance, or achievements to be materially different from future results, performance or achievements expressed or implied by such forward-looking statements. All statements other than statements of historical fact are statements that could be forward-looking statements. You can identify these forward-looking statements through our use of words such as “may,” “can,” “anticipate,” “assume,” “should,” “indicate,” “would,” “believe,” “contemplate,” “expect,” “seek,” “estimate,” “continue,” “plan,” “point to,” “project,” “predict,” “could,” “intend,” “target,” “potential” and other similar words and expressions of the future.

There are a number of important factors that could cause the actual results to differ materially from those expressed in any forward-looking statement made by us. These factors include, but are not limited to:

| · | our lack of operating history; |

| | |

| · | the expectation that we will incur significant operating losses for the foreseeable future and will need significant additional capital; |

| | |

| · | our current and future capital requirements to support our development and commercialization efforts for our product candidates and our ability to satisfy our capital needs; |

| | |

| · | our dependence on our product candidates, which are still in various stages of clinical development; |

| · | our ability to acquire sufficient quantities of raw material needed to manufacture our drug product; |

| | |

| · | our, or that of our third-party manufacturers, ability to manufacture cGMP quantities of our product candidates as required for pre-clinical and clinical trials and, subsequently, our ability to manufacture commercial quantities of our product candidates; |

| | |

| · | our ability to complete required clinical trials for our product candidates and obtain approval from the FDA or other regulatory agencies in different jurisdictions; |

| | |

| · | our lack of a sales and marketing organization and our ability to commercialize our product candidates if we obtain regulatory approval; |

| | |

| · | our dependence on third parties to manufacture our product candidates; |

| | |

| · | our reliance on third-party CROs to conduct our clinical trials; |

| · | our ability to maintain or protect the validity of our intellectual property; |

| | |

| · | our ability to internally develop new inventions and intellectual property; |

| | |

| · | interpretations of current laws and the passages of future laws; |

| | |

| · | acceptance of our business model by investors; |

| | |

| · | the accuracy of our estimates regarding expenses and capital requirements; |

| | |

| · | our ability to adequately support organizational and business growth; and |

| | |

| · | other factors discussed in our most recent Annual Report on Form 10-K. |

The foregoing does not represent an exhaustive list of matters that may be covered by the forward-looking statements contained herein or risk factors that we are faced with that may cause our actual results to differ from those anticipate in our forward-looking statements. Please see “Risk Factors” for additional risks which could adversely impact our business and financial performance.

All forward-looking statements are expressly qualified in their entirety by this cautionary notice. You are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date of this report, or the date of the document incorporated by reference into this report. We have no obligation, and expressly disclaim any obligation, to update, revise or correct any of the forward-looking statements, whether as a result of new information, future events or otherwise. We have expressed our expectations, beliefs and projections in good faith, and we believe they have a reasonable basis. However, we cannot assure you that our expectations, beliefs, or projections will result or be achieved or accomplished.

Overview

We are a late-stage medical dermatology company focused on identifying, developing, and commercializing innovative pharmaceutical product candidates for the treatment of medical and aesthetic skin conditions and diseases we believe represent significant market opportunities.

Dermatological diseases such as acne vulgaris (or acne), psoriasis vulgaris (or psoriasis), hyperhidrosis, and various aesthetic indications, affect millions of people worldwide each year which may negatively impact their quality of life and emotional well-being. While there are multiple current treatment options for these indications on the market, we believe that most have significant drawbacks, including underwhelming efficacy, cumbersome application regimens and varying negative side effects, all of which we believe lead to decreased patient compliance. A majority of these indications are first treated with topical therapy; however, many patients frequently switch treatments or discontinue treatment altogether due to patient dissatisfaction. This is primarily due to slow and modest response rates, early onset of negative side effects, daily application schedules and long duration of therapy. Given the limitations with current topical therapies, we believe there is a significant opportunity to address the needs of frustrated patients searching for topical products that satisfy their dermatological and lifestyle needs.

Our two product candidates, DMT310 and DMT410, both incorporate our proprietary, multifaceted, Spongilla technology to topically treat a variety of dermatological conditions. Our Spongilla technology is derived from a naturally grown freshwater sponge, Spongilla lacustris or Spongilla, which is processed into a powder that is mixed with a fluidizing agent immediately prior to application to form an easily applicable paste. Spongilla is a unique freshwater sponge that only grows in commercial quantities in select regions of the world and under specific environmental conditions, all of which give it its distinctive anti-microbial, anti-inflammatory, and mechanical properties. The combination of these environmental conditions, the proprietary harvesting protocols developed with our exclusive supplier, and our post-harvest processing procedures produce a pharmaceutical product candidate that optimizes the mechanical components as well as the chemical components of the sponge to create a product candidate with multiple mechanisms of action for the treatment of medical and aesthetic skin diseases and conditions.

We believe our Spongilla technology platform will enable us to develop and formulate singular and combination products that are able to target the topical delivery of chemical compounds into the dermis for a variety of dermatology indications. We believe the combination of Spongilla’s mechanical and chemical components (which we believe have demonstrated, in-vitro, anti-microbial and anti-inflammatory properties), add to the versatility of our Spongilla technology platform’s effectiveness as a singular product, in the treatment of a wide variety of medical skin diseases like acne and psoriasis. We also believe the mechanical properties of our Spongilla technology allows for the intradermal delivery of a variety of large molecules, like botulinum toxins, monoclonal antibodies, or dermal fillers, to target treatment sites, through topical application without the need for needles.

Our lead product candidate, DMT310, is intended to utilize our Spongilla technology for the once weekly treatment of a variety of skin diseases, with our initial focus being the treatment of acne vulgaris, which has a U.S. market size of approximately 30 million diagnosed patients. We recently initiated a Phase 3 program of DMT310 in moderate-to-severe acne. Both studies will be double-blinded, randomized, placebo-controlled, and enroll about 550 patients, age 9 years or older across sites in the United States and Latin America. The primary endpoints include absolute reduction in inflammatory and noninflammatory lesions and the improvement in investigators global assessment (“IGA”) of acne, which are the same endpoints used in our Phase 2b study of DMT310 for moderate-to-severe acne. Patients will be treated once a week for 12 weeks with either DMT310 or placebo and will be evaluated monthly. The second Phase 3 study will be followed by a long-term extension study. We recently announced enrollment of 50% of the total expected patients in the STAR-1 study and we expect to have top-line results from the first Phase 3 study in the first quarter of 2025. Previously, DMT310 has shown its ability to treat the multiple causes of acne in a Phase 2b study where we initially saw a 45% reduction in inflammatory lesions after four treatments, with DMT310 achieving statistically significant improvements at all time points for all three primary endpoints throughout the study (reduction in inflammatory lesions, reduction in non-inflammatory lesions, and improvement in IGA). In addition, based on the multiple mechanisms of action and anti-inflammatory effect seen with the DMT310 acne trial, we completed a Phase 1b proof of concept, or POC, trial in psoriasis where we saw encouraging results warranting further investigation.