Current Report Filing (8-k)

November 01 2022 - 8:32AM

Edgar (US Regulatory)

0001517175

false

0001517175

2022-11-01

2022-11-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): November 1, 2022

THE CHEFS’ WAREHOUSE, INC.

(Exact Name of Registrant as Specified in its Charter)

| |

|

|

|

|

| Delaware |

|

001-35249 |

|

20-3031526 |

|

(State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

| |

|

|

|

|

| |

|

|

|

|

100 East Ridge Road,

Ridgefield, Connecticut 06877

(Address of Principal Executive Offices)

(203) 894-1345

Registrant’s Telephone Number, Including Area

Code

______________________________________________

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐ |

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

☐ |

Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ |

Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, $0.01 par value |

CHEF |

NASDAQ |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company ☐

If an emerging growth company, indicate by check mark if

the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

On November 1, 2022 The Chefs’ Warehouse, Inc. (NASDAQ:CHEF)

(the “Company”), a premier distributor of specialty food products, announced that as a result of the acquisition of Chef Middle

East as described in Item 8.01 of this report, the Company is raising full year 2022 guidance as follows:

| · | Net sales to be in the range of $2.48 billion to $2.58 billion, compared to a range of $2.45 billion

to $2.55 billion previously |

| · | Gross profit to be in the range of $582.0 million to $606.0 million, compared to a range of $575.0 million

to $599.0 million previously |

| · | Adjusted EBITDA1 to be in the range of $147.0 million to $157.0 million, compared to a range

of $145.0 million to $155.0 million previously |

| 1 | Adjusted EBITDA is a non-GAAP measure. Please see the accompanying schedule for a reconciliation of Adjusted EBITDA to the measure’s

most directly comparable GAAP measure. |

The information contained herein is being furnished pursuant to Item 7.01

of Form 8-K, “Regulation FD Disclosure.” This information shall not be deemed “filed” for purposes of Section

18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under

the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in

such a filing. The furnishing of this information will not be deemed an admission as to the materiality of any information contained herein.

Forward-Looking Statements

Statements in this report regarding the Company business

that are not historical facts are “forward-looking statements” that involve risks and uncertainties and are based on current

expectations and management estimates; actual results may differ materially. The risks and uncertainties which could impact these statements

include, but are not limited to the following: our sensitivity to general economic conditions, including disposable income levels and

changes in consumer discretionary spending; our ability to expand our operations in our existing markets and to penetrate new markets

through acquisitions; we may not achieve the benefits expected from our acquisitions, which could adversely impact our business and operating

results; we may have difficulty managing and facilitating our future growth; conditions beyond our control could materially affect the

cost and/or availability of our specialty food products or center-of-the-plate products and/or interrupt our distribution network; our

distribution of center-of-the-plate products, like meat, poultry and seafood, involves exposure to price volatility experienced by those

products; our business is a low-margin business and our profit margins may be sensitive to inflationary and deflationary pressures; because

our foodservice distribution operations are concentrated in certain culinary markets, we are susceptible to economic and other developments,

including adverse weather conditions, in these areas; fuel cost volatility may have a material adverse effect on our business, financial

condition or results of operations; our ability to raise capital in the future may be limited; we may be unable to obtain debt or other

financing, including financing necessary to execute on our acquisition strategy, on favorable terms or at all; interest charged on our

outstanding debt may be adversely affected by changes in the method of determining the Secured Overnight Financing Rate (“SOFR”);

our business operations and future development could be significantly disrupted if we lose key members of our management team; and significant

public health epidemics or pandemics, including COVID-19, may adversely affect our business, results of operations and financial condition.

Any forward-looking statements are made pursuant to the Private Securities Litigation Reform Act of 1995 and, as such, speak only as of

the date made. A more detailed description of these and other risk factors is contained in the Company’s most recent annual report

on Form 10-K filed with the SEC on February 22, 2022 and other reports filed by the Company with the SEC since that date. The Company

is not undertaking to update any information until required by applicable laws. Any projections of future results of operations are based

on a number of assumptions, many of which are outside the Company’s control and should not be construed in any manner as a guarantee

that such results will in fact occur. These projections are subject to change and could differ materially from final reported results.

The Company may from time to time update these publicly announced projections, but it is not obligated to do so.

Item 8.01 Other Events.

On November 1, 2022, the Company issued a press release

announcing the acquisition of Chef Middle East (CME), a specialty food distributor with operations in the United Arab Emirates (or The

UAE), Qatar and Oman, representing its first acquisition outside North America.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of

the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

THE CHEFS’ WAREHOUSE, INC. |

| |

|

|

| |

By: |

/s/ Alexandros Aldous |

| |

Name: |

Alexandros Aldous |

| |

Title: |

General Counsel, Corporate Secretary and Chief Government Relations Officer |

Date: November 1, 2022

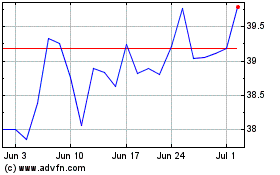

Chefs Warehouse (NASDAQ:CHEF)

Historical Stock Chart

From Aug 2024 to Sep 2024

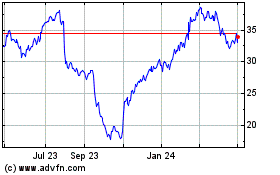

Chefs Warehouse (NASDAQ:CHEF)

Historical Stock Chart

From Sep 2023 to Sep 2024