CAMDEN NATIONAL CORP false 0000750686 0000750686 2024-09-09 2024-09-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 9, 2024

Camden National Corporation

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Maine |

|

001-13227 |

|

01-0413282 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| Two Elm Street, Camden, Maine |

|

04843 |

| (Address of principal executive offices) |

|

(ZIP Code) |

Registrant’s telephone number, including area code: (207) 236-8821

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☒ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class: |

|

Trading

Symbol |

|

Name of each exchange

on which registered: |

| Common stock, without par value |

|

CAC |

|

The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01 |

Regulation FD Disclosure |

A copy of the press release of Camden National Corporation (“Camden”) and Northway Financial, Inc. (“Northway”) and Camden’s investor presentation, each related to the transaction described in Item 8.01 below, are furnished as Exhibits 99.1 and 99.2 to this Current Report on Form 8-K.

The information furnished pursuant to Item 7.01 of this Current Report on Form 8-K (including Exhibit 99.1 and Exhibit 99.2 hereto) is being furnished and shall not be deemed “filed” under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall it be incorporated by reference into future filings by Camden under the Securities Act of 1933, as amended, or under the Exchange Act, except as expressly set forth by specific reference in such a filing. The furnishing of information pursuant to this Item 7.01 will not be deemed an admission as to the materiality of any information in this Current Report on Form 8-K that is required to be disclosed solely by Regulation FD.

On September 10, 2024, Camden and Northway issued a joint press release announcing the execution of an Agreement and Plan of Merger, dated as of September 9, 2024, by and between Camden and Northway pursuant to which, upon the terms and subject to the conditions set forth therein, Camden and Northway will merge, with Camden continuing as the surviving entity.

A copy of the joint press release issued by Camden and Northway and a copy of Camden’s investor presentation containing supplemental information regarding the proposed transaction are furnished as exhibits to the Current Report on Form 8-K under Item 7.01.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits

Forward-Looking Statements

This Current Report on Form 8-K and the exhibits filed herewith may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Any statements about Camden’s beliefs, plans, strategies, predictions, forecasts, objectives, intentions, assumptions or expectations are not historical facts and may be forward-looking. These include, but are not limited to, statements regarding the proposed transaction, revenues, earnings, loan production, asset quality, and capital levels, among other matters; Camden’s estimates of future costs and benefits of the actions it may take; Camden’s assessments of probable losses on loans; Camden’s assessments of interest rate and other market risks; Camden’s ability to achieve its financial and other strategic goals; the expected timing of completion of the proposed transaction; the expected cost savings, synergies and other anticipated benefits from the proposed transaction; and other statements that are not historical facts.

Forward-looking statements are often, but not always, identified by such words as “believe,” “expect,” “anticipate,” “can,” “could,” “may,” “predict,” “potential,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “should,” “will,” and other similar words and expressions, and are subject to numerous assumptions, risks, and uncertainties, which may change over time.

Because forward-looking statements are subject to assumptions and uncertainties, actual results or future events could differ, possibly materially, from those indicated in such forward-looking statements as a result of a variety of factors, many of which are beyond the control of Camden and Northway. Such statements are based upon the current beliefs and expectations of the management of Camden and Northway and are subject to significant risks and uncertainties outside of the control of the parties. Caution should be exercised against placing undue reliance on forward-looking statements. The factors that could cause actual results to differ materially include the following: the reaction to the transaction of the companies’ customers, employees and counterparties; customer disintermediation; inflation; expected synergies, cost savings and other financial benefits of the proposed transaction might not be realized within the expected timeframes or might be less than projected; the requisite stockholder and regulatory approvals for the proposed transaction might not be obtained; credit and interest rate risks associated with Camden’s and Northway’s respective businesses, customers, borrowings, repayment, investment, and deposit practices; general economic conditions, either nationally or in the market areas in which Camden and Northway operate or anticipate doing business, are less favorable than expected; new regulatory or legal requirements or obligations; and other risks. Certain risks and important factors that could affect Camden’s future results are identified in its Annual Report on Form 10-K for the year ended December 31, 2023 and other reports filed with the Securities and Exchange Commission, including among other things under the heading “Risk Factors” in such Annual Report on Form 10-K. These risks and uncertainties are not exhaustive. Other sections of such reports describe additional factors that could affect Camden’s business and financial performance. Any forward-looking statement speaks only as of the date on which it is made, and Camden undertakes no obligation to update any forward-looking statement, whether to reflect events or circumstances after the date on which the statement is made, to reflect new information or the occurrence of unanticipated events, or otherwise.

Additional Information and Where to Find It

This communication is being made in respect of the proposed merger transaction involving Camden and Northway. Camden intends to file a registration statement on Form S 4 with the SEC, which will include a proxy statement of Northway and a prospectus of Camden, and Camden will file other documents regarding the proposed transaction with the SEC. A definitive proxy statement/prospectus will also be sent to Northway stockholders seeking the required stockholder approval of the proposed transaction. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, INVESTORS AND SECURITY HOLDERS OF NORTHWAY ARE URGED TO CAREFULLY READ THE ENTIRE REGISTRATION STATEMENT AND PROXY STATEMENT/PROSPECTUS, WHEN THEY BECOME AVAILABLE, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. The documents filed by Camden with the SEC may be obtained free of charge at the SEC’s website at www.sec.gov. In addition, the documents filed by Camden may be obtained free of charge under the “Investor Relations” section of Camden’s website at http://www.camdennational.bank. Alternatively, these documents, when available, can be obtained free of charge from Camden upon written request to Camden National Corporation, Attn: Corporate Secretary, 2 Elm Street, Camden, Maine 04843.

Participants in Solicitation

Camden, Northway, and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction under the rules of the SEC. Information regarding Camden’s directors and executive officers is available in its definitive proxy statement, which was filed with the SEC on April 5, 2024, and certain other documents filed by Camden with the SEC. Other information regarding the participants in the solicitation of proxies in respect of the proposed transaction and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC. Free copies of these documents, when available, may be obtained as described in the preceding paragraph.

-2-

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

Camden National Corporation |

|

|

|

|

| Date: September 10, 2024 |

|

|

|

By: |

|

/s/ Michael R. Archer |

|

|

|

|

|

|

Michael R. Archer |

|

|

|

|

|

|

Chief Financial Officer and Principal Financial & Accounting Officer |

-3-

Exhibit 99.1

FOR IMMEDIATE RELEASE

Media Inquiries:

For Camden National Corporation:

Renée Smyth

Chief Experience and Marketing Officer

(207) 518-5607

rsmyth@CamdenNational.bank

For Northway Financial, Inc.:

Gary Laurash

Chief Financial Officer

(603) 326-7377

GLaurash@northwaybank.com

Camden National

Corporation and Northway Financial, Inc. to Merge

Positions Camden National as a Premier Northern New England Bank

CAMDEN, Maine, and NORTH CONWAY, New Hampshire, September 10, 2024—Camden National Corporation (“Camden National”) (NASDAQ: CAC), the bank

holding company for Camden National Bank, and Northway Financial, Inc. (“Northway”) (OTCQB: NWYF), the parent company of Northway Bank, announced today that they have entered into a definitive agreement under which Camden National will

acquire Northway in an all-stock transaction valued at approximately $86.6 million.

The transaction presents a

unique opportunity to combine two high-quality and culturally aligned franchises with adjacent geographies, creating a premier publicly traded northern New England bank. The combined company will have 74 branches serving attractive markets

throughout a contiguous footprint in New Hampshire and Maine, with approximately $7.0 billion in assets, $5.1 billion in loans, $5.5 billion in deposits, and $2.0 billion of Assets Under Administration (AUA). The combined company

will operate under the Camden National Bank name.

“Camden National and Northway share a similar culture, consistent credit and risk profiles, and

deep commitment to the communities we serve,” said Simon Griffiths, president and chief executive officer of Camden National. “This union will increase our size and scale, and bolster our presence in New Hampshire, which we believe will

drive profitability and shareholder value. Our customers, employees, and communities will significantly benefit from broader product offerings, higher lending limits, and an enhanced customer experience.”

“We are excited to announce this strategic combination with Camden National. The ability to have two organizations with similar missions come together

positions us well in a significantly competitive market; particularly with an improved ability to allocate capital in more ways than we could on our own. Combined, we strengthen our foundations of a forward-thinking approach to community banking

while best serving clients with whom we have built strong relationships over the years.” said William Woodward, president, chief executive officer and chairman of Northway Financial. “With shared histories and community commitment, this

alliance doesn’t just extend our influence; it drives significant operational enhancements and strategically positions us for future growth for years to come.”

Subject to the terms of the definitive agreement, which both boards have unanimously approved, Northway

shareholders will receive 0.83 shares of Camden National common stock for each outstanding share of Northway common stock. Based on Camden National’s closing stock price of $37.90 on September 9, 2024, the transaction is valued at

approximately $86.6 million or $31.46 per share of Northway common stock. Following the completion of the transaction, one Northway director will join the boards of directors of both Camden National and Camden National Bank upon the completion

of the transaction.

Griffiths continued, “The merger will build upon our existing presence in New Hampshire and provide the opportunity to leverage

our significant technology investments and advice capabilities across an expanded customer base. Together, we will be able to unlock meaningful growth opportunities and create additional capacity for further strategic technology investments to

deliver an enhanced offering for customers. I am excited to work with Northway’s impressive team to build upon both of our successful community banking franchises.”

As of June 30, 2024, Northway had approximately $1.3 billion of total assets, $0.9 billion of total loans, and $1.0 billion of deposits.

Financially Compelling Transaction

On a combined

basis, the merger is expected to be approximately 19.9% accretive to Camden National’s 2025 earnings per share and 32.7% accretive to Camden National’s 2026 earnings per share. Following the completion of the merger, Camden National’s

capital ratios are expected to remain significantly above “well-capitalized” thresholds, with the pro forma company well-positioned for future growth.

The merger is expected to be completed during the first quarter of 2025, subject to certain customary conditions, including the receipt of required regulatory

approvals and approval by Northway shareholders.

Upon completion of the transaction, Camden National shareholders will own approximately 86% of the

combined company and Northway’s shareholders will own approximately 14% of the combined company, which will continue to trade on Nasdaq under the “CAC” stock ticker symbol.

Advisors

Raymond James & Associates, Inc. is

serving as the exclusive financial advisor and rendered a fairness opinion to the Board of Directors of Camden National. Sullivan & Cromwell LLP is serving as legal counsel to Camden National in the transaction. Performance Trust Capital

Partners LLC is serving as the exclusive financial advisor to Northway and rendered a fairness opinion to the Board of Directors of Northway. Goodwin Procter LLP is serving as legal counsel to Northway in the transaction.

Conference Call

Camden National Corporation will host a conference call to discuss the transaction at 1:00 p.m. Eastern Time today. Parties interested in listening to the

teleconference should dial into the call or connect to the webcast link 10 – 15 minutes before it begins. Dial-in and webcast information to participate is as follows:

Live Dial-In (United States): (833) 470-1428

Global Dial-In Numbers: https://www.netroadshow.com/conferencing/global-numbers?confId=70836

Participant access code: 479927

Live Webcast URL:

https://events.q4inc.com/attendee/862569267

A link to the live webcast will be available on Camden National Corporation’s website at

CamdenNationalCorporation.com prior to the meeting. The conference call’s transcript and replay will also be available on Camden National’s website following the conference call.

About Camden National Corporation

Camden National

Corporation (NASDAQ: CAC) is Northern New England’s largest publicly traded bank holding company, with $5.7 billion in assets. Founded in 1875, Camden National Bank has 57 branches in Maine and New Hampshire, is a full-service community

bank offering the latest digital banking, complemented by award-winning, personalized service. Additional information is available at CamdenNational.bank. Member FDIC. Equal Housing Lender.

Comprehensive wealth management, investment, and financial planning services are delivered by Camden National Wealth Management.

About Northway Financial, Inc.

Northway Financial, Inc.,

headquartered in North Conway, New Hampshire, is a bank holding company and parent company of Northway Bank. Through Northway Bank, Northway offers a broad range of financial products and services to individuals, businesses, and the public sector

from its 17 branches and its loan production offices located in North Conway, Laconia, Bedford, Concord, and Portsmouth, New Hampshire. Additional information is available at Northwaybank.com.

Forward-Looking Statements

This press release may

contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Any statements about Camden National’s beliefs, plans, strategies, predictions, forecasts, objectives, intentions,

assumptions or expectations are not historical facts and may be forward-looking. These include, but are not limited to, statements regarding the proposed transaction, revenues, earnings, loan production, asset quality, and capital levels, among

other matters; Camden National’s estimates of future costs and benefits of the actions it may take; Camden National’s assessments of probable losses on loans; Camden National’s assessments of interest

rate and other market risks; Camden National’s ability to achieve its financial and other strategic goals; the expected timing of completion of the proposed transaction; the expected cost

savings, synergies and other anticipated benefits from the proposed transaction; and other statements that are not historical facts.

Forward-looking

statements are often, but not always, identified by such words as “believe,” “expect,” “anticipate,” “can,” “could,” “may,” “predict,” “potential,” “intend,”

“outlook,” “estimate,” “forecast,” “project,” “should,” “will,” and other similar words and expressions, and are subject to numerous assumptions, risks, and uncertainties, which may change

over time.

Because forward-looking statements are subject to assumptions and uncertainties, actual results or future events could differ, possibly

materially, from those indicated in such forward-looking statements as a result of a variety of factors, many of which are beyond the control of Camden National and Northway. Such statements are based upon the current beliefs and expectations of the

management of Camden National and are subject to significant risks and uncertainties outside of the control of the parties. Caution should be exercised against placing undue reliance on forward-looking statements. The factors that could cause actual

results to differ materially include the following: the reaction to the transaction of the companies’ customers, employees and counterparties; customer disintermediation; inflation; expected synergies, cost savings and other financial benefits

of the proposed transaction might not be realized within the expected timeframes or might be less than projected; the requisite stockholder and regulatory approvals for the proposed transaction might not be obtained; credit and interest rate risks

associated with Camden National’s and Northway’s respective businesses, customers, borrowings, repayment, investment, and deposit practices; general economic conditions, either nationally or in the market areas in which Camden National and

Northway operate or anticipate doing business, are less favorable than expected; new regulatory or legal requirements or obligations; and other risks. Certain risks and important factors that could affect Camden National’s future results are

identified in its Annual Report on Form 10-K for the year ended December 31, 2023 and other reports filed with the Securities and Exchange Commission (“SEC”), including among other things under

the heading “Risk Factors” in such Annual Report on Form 10-K. These risks and uncertainties are not exhaustive. Other sections of such reports describe additional factors that could affect Camden

National’s business and financial performance. Any forward-looking statement speaks only as of the date on which it is made, and Camden National undertakes no obligation to update any forward-looking statement, whether to reflect events or

circumstances after the date on which the statement is made, to reflect new information or the occurrence of unanticipated events, or otherwise.

Additional Information and Where to Find It

This communication is being made in respect of the proposed merger transaction involving Camden National and Northway. Camden National intends to file a

registration statement on Form S-4 with the SEC, which will include a proxy statement of Northway and a prospectus of Camden National, and Camden National will file other documents regarding the proposed

transaction with the SEC. A definitive proxy statement/prospectus will also be sent to Northway stockholders seeking the required stockholder approval of the proposed transaction. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, INVESTORS AND

SECURITY HOLDERS OF NORTHWAY ARE URGED TO CAREFULLY READ THE ENTIRE REGISTRATION STATEMENT AND PROXY STATEMENT/PROSPECTUS, WHEN THEY BECOME AVAILABLE, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION ABOUT THE PROPOSED TRANSACTION. The documents filed by Camden National with the SEC may be obtained free of charge at the SEC’s website at www.sec.gov. In addition, the documents filed by Camden National may be obtained free of

charge under the “Investor Relations” section of Camden National’s website at http://www.camdennational.bank. Alternatively, these documents, when available, can be obtained free of charge from Camden National upon written

request to Camden National Corporation, Attn: Corporate Secretary, 2 Elm Street, Camden, Maine 04843.

Participants in Solicitation

Camden National, Northway, and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in

respect of the proposed transaction under the rules of the SEC. Information regarding Camden National’s directors and executive officers is available in its definitive proxy statement, which was filed with the SEC on April 5, 2024, and

certain other documents filed by Camden National with the SEC. Other information regarding the participants in the solicitation of proxies in respect of the proposed transaction and a description of their direct and indirect interests, by security

holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC. Free copies of these documents, when available, may be obtained as described in the preceding paragraph.

Exhibit 99.2 1 1 1

Forward-Looking Statements and Non-GAAP Financial Measures

Forward-Looking Statements This presentation may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Any statements about Camden’s beliefs, plans, strategies,

predictions, forecasts, objectives, intentions, assumptions or expectations are not historical facts and may be forward-looking. These include, but are not limited to, statements regarding the proposed transaction, revenues, earnings, loan

production, asset quality, and capital levels, among other matters; Camden’s estimates of future costs and benefits of the actions it may take; Camden’s assessments of probable losses on loans; Camden’s assessments of interest rate

and other market risks; Camden’s ability to achieve its financial and other strategic goals; the expected timing of completion of the proposed transaction; the expected cost savings, synergies and other anticipated benefits from the proposed

transaction; and other statements that are not historical facts. Forward-looking statements are often, but not always, identified by such words as “believe,” “expect,” “anticipate,” “can,”

“could,” “may,” “predict,” “potential,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “should,” “will,” and

other similar words and expressions, and are subject to numerous assumptions, risks, and uncertainties, which may change over time. Because forward-looking statements are subject to assumptions and uncertainties, actual results or future events

could differ, possibly materially, from those indicated in such forward-looking statements as a result of a variety of factors, many of which are beyond the control of Camden and Northway. Such statements are based upon the current beliefs and

expectations of the management of Camden and are subject to significant risks and uncertainties outside of the control of the parties. Caution should be exercised against placing undue reliance on forward-looking statements. The factors that could

cause actual results to differ materially include the following: the reaction to the transaction of the companies’ customers, employees and counterparties; customer disintermediation; inflation; expected synergies, cost savings and other

financial benefits of the proposed transaction might not be realized within the expected timeframes or might be less than projected; the requisite stockholder and regulatory approvals for the proposed transaction might not be obtained; credit and

interest rate risks associated with Camden’s and Northway’s respective businesses, customers, borrowings, repayment, investment, and deposit practices; general economic conditions, either nationally or in the market areas in which Camden

and Northway operate or anticipate doing business, are less favorable than expected; new regulatory or legal requirements or obligations; and other risks. Certain risks and important factors that could affect Camden’s future results are

identified in its Annual Report on Form 10-K for the year ended December 31, 2023 and other reports filed with the Securities and Exchange Commission, including among other things under the heading “Risk Factors” in such Annual Report on

Form 10-K. These risks and uncertainties are not exhaustive. Other sections of such reports describe additional factors that could affect Camden’s business and financial performance. Any forward-looking statement speaks only as of the date on

which it is made, and Camden undertakes no obligation to update any forward-looking statement, whether to reflect events or circumstances after the date on which the statement is made, to reflect new information or the occurrence of unanticipated

events, or otherwise. Non‐GAAP Financial Measures This presentation references historical and forward-looking non‐GAAP financial measures, including tangible common equity and related measures, as well as core deposits, efficiency ratio

and projected cash net income, which excludes the impact of certain items. These measures are commonly used by investors in evaluating business combinations and financial condition. Reconciliations of certain forward-looking non-GAAP financial

measures are not provided because the Company is unable to provide such reconciliations without unreasonable effort due to the uncertainty and inherent difficulty of predicting the occurrence and the financial impact of items affecting comparability

and the periods in which such items may be recognized. For the same reasons, the Company is unable to address the probable significance of the unavailable information, which could be material to future results. 2 2 2 2

Additional Information and Participants in Solicitation Additional

Information and Where to Find It This communication is being made in respect of the proposed merger transaction involving Camden and Northway. Camden intends to file a registration statement on Form S-4 with the SEC, which will include a proxy

statement of Northway and a prospectus of Camden, and Camden will file other documents regarding the proposed transaction with the SEC. A definitive proxy statement/prospectus will also be sent to Northway stockholders seeking the required

stockholder approval of the proposed transaction. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, INVESTORS AND SECURITY HOLDERS OF NORTHWAY ARE URGED TO CAREFULLY READ THE ENTIRE REGISTRATION STATEMENT AND PROXY STATEMENT/PROSPECTUS, WHEN THEY

BECOME AVAILABLE, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. The documents filed by Camden with the SEC may be obtained free of charge at the

SEC’s website at www.sec.gov. In addition, the documents filed by Camden may be obtained free of charge under the “Investor Relations” section of Camden’s website at http://www.camdennational.bank. Alternatively, these

documents, when available, can be obtained free of charge from Camden upon written request to Camden National Corporation, Attn: Corporate Secretary, 2 Elm Street, Camden, Maine 04843. Participants in Solicitation Camden, Northway, and certain of

their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction under the rules of the SEC. Information regarding Camden’s directors and executive

officers is available in its definitive proxy statement, which was filed with the SEC on April 5, 2024, and certain other documents filed by Camden with the SEC. Other information regarding the participants in the solicitation of proxies in respect

of the proposed transaction and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC. Free copies of these

documents, when available, may be obtained as described in the preceding paragraph. 3 3 3 3

Building a Premier Northern New England Community Bank 1 Enhanced Scale

& Capabilities $7.0B $5.1B $5.5B Assets Loans Deposits ME $2.0B 74 $630M+ AUM/A Branches Market Cap 2 Compelling Financial Metrics NH 20% 5% 24% 2025 GAAP 2025 Cash IRR 3 EPS Accretion EPS Accretion Camden Branches (57) 33% 12% 3.3 years

Northway Branches (17) 2026 GAAP 2026 Cash TBV 3 4 EPS Accretion EPS Accretion Earnback 1) Pro forma financial and branch data as of June 30, 2024 and excludes the impact of purchase accounting adjustments; 3) Excludes the impact of purchase

accounting rate marks, CDI and CECL amortization Market capitalization based on CAC’s market price of $37.90 as of September 9, 2024 4) Tangible book value earnback calculated using the crossover method 2) Based on assumed cost savings (75%

phased-in 2025, 100% phased-in 2026) and purchase accounting adjustments 4 4 4 4

Strategic Rationale Provides immediate, meaningful scale and builds upon

growth initiatives in New Hampshire Increased scale Complementary businesses, adding best-in-class $1.0 to propel billion deposit franchise growth Will unlock meaningful growth opportunities through business diversification and a larger balance

sheet Significantly enhances profitability profile, propelling ROAA above 1.00% and producing top-quartile returns Enhanced compared to peers financial Strong earnings per share accretion (30%+ GAAP | performance 10%+ cash in 2026) creating value

for shareholders Provides an opportunity to leverage investments in Leverages technology and capabilities across an expanded customer base strengths and Like-minded institutions with common cultural values and investments strong credit cultures 5 5

5 5

Strong Market Position Community Bank Deposits in 1 Pro Forma Deposit

Franchise Maine and New Hampshire as of June 30, 2023 as of June 30, 2023 PF $5.8B + Camden Branches (57) Bangor Savings $5.6B Northway Branches (17) CAC $4.7B NH Mutual Bancorp $2.9B Bar Harbor $2.7B First National $2.5B Maine Community $2.2B Bank

of New Hampshire $2.1B Machias Savings $2.0B Northeast Bank $2.0B Kennebunk Savings $1.6B Mascoma $1.5B Norway Savings $1.5B Gorham Savings $1.4B $1.3B Kennebec Savings Androscoggin Savings $1.2B #1 Northway Financial Camden National NWYF $1.1B

Community bank Bath Savings Institution $1.0B $1.1B Deposits $4.7B Deposits in ME & NH Source: S&P Global Market Intelligence 1) Community banks defined as banks with total assets less than $50B; deposit data as of June 30, 2023, based on

combined deposits in Maine and New Hampshire and pro forma for pending or recently completed mergers; Including all banks in Maine and New Hampshire, the pro forma company would rank #4 overall by deposits 6 6 6 6

Positioned for Growth in Attractive Markets Select New Hampshire

Counties New Maine Hampshire Hillsborough Population 1,394K 1,406K Population: 423K Median HHI: $98.0K Berlin GDP: $35B Projected ’24-’29 growth Population Population: 2.8% 45/sq. mi 157/sq. mi density HHI: 9.0% Rockingham Laconia

Household $71.5K $94.9K Population: 322K Claremont Income Median HHI: $112.5K Concord GDP: $28B Portsmouth Projected ’24-’29 growth Keene Population: 3.3% GDP $94B $115B Manchester HHI: 9.1% Nashua Major Employers # of 74,836 91,452

Businesses Source: S&P Global Market Intelligence, US Bureau of Economic Analysis, NAICS Association // Household income (“HHI”) shown on a median basis 7 7 7 7

Best-in-Class Deposit Franchise Top 10 New England Stock Banks Ranked by

2024 YTD Cost of Deposits 1.14% #2 Bank 1.47% #1 Northway cost of #3 Bank 1.56% deposits rank out of 25 banks #4 Bank 1.71% #5 Bank 1.71% Includes New England #6 Bank 1.78% stock banks with assets #7 Bank 1.80% between $1 billion and $50 billion #8

Bank 1.84% #9 Bank 1.89% #10 Bank 2.10% Source: S&P Global Market Intelligence Note: 2024 YTD financial data as of June 30, 2024 8 8 8

Pro Forma Deposit Portfolio Pro forma 7% 7% 7% 8% 7% 9% $4.5B $1.0B

$5.5B 63% 21% 20% Deposits Deposits Deposits 65% 65% 21% Noninterest Bearing IB Demand, Savings & MMDA Retail Time Deposits Jumbo Time Deposits YTD Cost of Deposits: 2.10% YTD Cost of Deposits: 1.14% YTD Cost of Deposits: 1.92% 1 1 1 Deposit

Beta : 39.6% Deposit Beta : 21.0% Deposit Beta : 34.2% Loans to Deposits: 92.0% Loans to Deposits: 91.7% Loans to Deposits: 92.0% Source: S&P Global Market Intelligence; Deposit data as of June 30, 2024 and pro forma data excludes purchase

accounting adjustments; Jumbo time deposits are defined as time deposits greater than $100 thousand 1) Deposit beta is calculated as the difference between the Q4 2021 and Q2 2024 deposit cost divided by 5.25%, or the change in the federal funds

rate between 1/1/2022 and 6/30/2024 9 9 9

Pro Forma Loan Portfolio Pro forma 3% 1% 9% 8% 12% 39% 5% 5% 44% 3% 45%

4% 4% 3% $4.2B $0.9B $5.1B 2% Loans Loans Loans 36% 36% 41% CRE & Multi C&D Home Equity C&I Residential RE Other YTD Yield on Loans: 4.94% YTD Yield on Loans: 5.07% YTD Yield on Loans: 4.37% CRE Concentration: 240% CRE Concentration:

264% Source: S&P Global Market Intelligence; Loan data as of June 30, 2024 and pro forma data excludes purchase accounting adjustments 10 10 10 10

Thorough Due Diligence Process Comprehensive due diligence ▪

Thorough review by the Camden National team of all key functional Diligence Highlights areas of Northway ▪ Completed a coordinated comprehensive due diligence review with internal bank employees from Camden National and outside ~1,000+ 50+

professionals and attorneys documents reviewed individuals involved ▪ Rigorous evaluation of Northway’s risk management process, compliance and internal controls and BSA/AML 1 Comprehensive Loan Review Deep dive in credit 100% 65% of

criticized & of commercial ▪ Third-party loan review completed on loan portfolio, including review classified assets portfolio of current risk ratings and underwriting process ▪ Credit risk management team provided oversight and

validation of third-party analyses 55% 89% ▪ Detailed review of rating procedures and credit philosophy of total CRE of office CRE Credit and Finance & Technology & Legal & Compliance Commercial Banking Underwriting Accounting

Cybersecurity Interest Rate Risk & Human Resources Retail Banking Loan & Deposit Ops Securities Portfolio ALM 1) Loan review percentages based on total dollars outstanding for each respective category 11 11 11 11

Northway Asset Quality NPAs / Assets NPLs / Loans 0.61% 0.40% 0.39%

0.33% 0.31% 0.29% 0.29% 0.22% 0.21% 0.20% 2020 2021 2022 2023 2024 YTD 2020 2021 2022 2023 2024 YTD NCOs / Average Loans Allowance for Credit Losses 1.29% 1.22% 1.3 1.19% 1.16% 1.15% 12 1.1 0.00% 0.00% 0.00% 7 $11.4M $10.7M $10.7M (0.00%) 0.9 $9.5M

$9.5M (0.01%) 2 0.7 2020 2021 2022 2023 2024YTD 2020 2021 2022 2023 2024 YTD ACL ACL / Total Loans Source: S&P Global Market Intelligence; NPLs/Loans and NPAs/Assets based on bank level financials Note: 2024 YTD financial data as of June 30,

2024; NCOs / Avg. Loans shown on an annualized basis 12 12 12 12

Transaction Structure and Overview • Northway Financial, Inc. to

merge into Camden National Corporation; Northway Structure & Bank to merge into Camden National Bank Consideration • 100% stock consideration • 0.83x of a CAC share for each NWYF share Transaction 1 • Implied price per NWYF

share of $31.46 for an aggregate deal value of $86.6M 1 Value Ownership / • Approximately 86% CAC / 14% NWYF Board • One director from NWYF to join the CAC board of directors • Price / TBV: 139% Transaction • Price / TBV

excluding AOCI: 89% 1 Multiples • Price / 2025E EPS + cost saves: 6.1x • Core deposit premium: 2.6% Approvals • Subject to NWYF shareholder approval and customary regulatory approvals Timing • Anticipated closing in Q1 2025

1) Based on CAC’s market price of $37.90 as of September 9, 2024 13 13 13

Key Transaction Assumptions • CAC earnings per street consensus

estimates for 2024 and 2025 with an assumed long- term earnings growth rate of 5.0% applied thereafter Earnings • NWYF assumes $4.2 million in net income in 2024, $5.3 million in net income in 2025 and $7.2 million in net income in 2026

• One-time pre-tax merger expenses of approximately $13.5 million Merger Costs & • Cost savings of approximately 35% of NWYF’s noninterest expense base Synergies─ 75% phased-in for 2025 and 100% thereafter •

Identified future revenue synergies, but not included in the model • Gross credit mark of $10.5 million, or 1.13% of total loans Loan Credit ─ PCD loan credit mark: $1.4 million Mark─ Non-PCD loan credit mark: $9.1 million,

accreted back into earnings over 5.5 years ─ Day-2 CECL reserve equal to $9.1 million 1 • After-tax negative AOCI of approximately $27.6 million is accreted back into earnings AOCI over 9 years • Loan portfolio write-down of $79.8

million (accreted over 5.5 years) Interest • Time deposits write-down of $0.3 million (amortized over 2 years) Rate Marks • Borrowings write-up of $0.2 million (accreted over 4 years) (Pre-Tax) • Trust preferred securities

write-down of $0.8 million (amortized over 13 years) • $34.1 million core deposit intangible (amortized over 10 years) • PP&E write up of $4.5 million (amortized over 30 years) Other • 100% of restructuring charges realized at

the close of the transaction • Pre-tax cost of cash of 5.0% and marginal tax rate of 21% 1) NWYF balance as of August 21, 2024 14 14 14

Pro Forma Financial Impact Financially compelling transaction with

significantly increased profitability 1 GAAP Metrics Non-GAAP Metrics (Excl. AOCI & Rate Marks) ~33% ~20% ~5% ~12% Earnings 2026E EPS 2025E EPS 2025E Cash EPS 2026E Cash EPS 2 2 Accretion Accretion Accretion Impact Accretion TBV (16.2%) 3.3

years 1.0% None 3 Dilution at Close Earnback Accretion at Close Earnback Impact 6.1% 8.4% 7.3% 9.5% Pro Forma TCE / TA Leverage Ratio TCE / TA Leverage Ratio 4 Capital 12.2% 13.1% 13.8% 14.8% Tier 1 Ratio TRBC Ratio Tier 1 Ratio TRBC Ratio 1)

Excludes the impact of purchase accounting rate marks (AOCI, loans, time deposits, borrowings, trust preferred) 3) Tangible book value earnback calculated using the crossover method 2) Cash EPS accretion also excludes CDI and CECL amortization 4)

Pro forma capital ratios are estimated and shown at the transaction close assuming a closing date of 3/31/25 15 15 15 15

Positioned for Upside 1 Peers 2025 Estimated Pro Forma Company Median

Top Quartile 2 Profitability 2025E 2026E ROAA 1.02% 1.13% 0.84% 0.99% ROAE 11.5% 12.5% 8.9% 10.1% Efficiency ratio 57.9% 55.1% 63.0% 58.0% Implied Trading Multiples 3 Price / EPS 9.0x 7.8x 10.6x 12.4x Peer multiple differential to 17% 37% 2025E

multiple Source: S&P Global Market Intelligence; Market data as of September 9, 2024 // 1) CAC’s 2024 proxy peers; Peer data based on consensus street estimates // 2) Pro forma company 2025 estimates assume 75% phased-in cost savings // 3)

The pro forma price to earnings multiples are based on CAC’s market price of $37.90 as of September 9, 2024 16 16 16

Appendix 17 17 17 17

Northway Financial, Inc. (NWYF) Company Overview Branch Footprint

• Holding company for Northway Bank, founded Northway (17) in 1881, and headquartered in North Conway, New Hampshire Berlin nd • 2 largest New Hampshire headquartered stock bank with 17 full-service branches • Stable, high-quality

deposit base with $852 1 million in core deposits (84% of total deposits) Conway 2 2024 YTD Financial Highlights Laconia $1.3B $0.9B $1.0B Assets Loans Deposits Concord 2.60% 87.8% 0.29% Portsmouth Net Interest Margin Efficiency ratio NPAs / Assets

Nashua Source: S&P Global Market Intelligence 1) Core deposits defined as total deposits less time deposits 2) 2024 YTD financial data as of June 30, 2024 18 18 18

Pro Forma Reconciliation Tangible Book Value Per Share Dilution Shares

$ Per ($M) (M) Share Camden National Corporation Standalone TBV as of 6/30/24 $412.9 14.6 $28.34 Net Income to Common 37.1 Dividends (18.4) Change in Intangibles 0.4 Standalone TBV @ Close $432.0 14.6 $29.65 Adjustments @ Close (3/31/25) Standalone

CAC TBV at Close $432.0 14.6 $29.65 1 70.5 Est. Standalone NWYF TBV 1 (70.5) Reversal of NWYF TBV Stock Consideration to NWYF 86.6 2.3 Goodwill & CDI Created (82.9) CAC After-Tax Deal Charges (9.9) CECL Double Count on Non-PCD Loans (7.2) Pro

Forma CAC TBV @ Close $418.6 16.9 $24.84 $ Dilution to CAC ($4.81) % Dilution to CAC (16.2%) 1) NWYF closing TBV includes ~$7.7 million benefit due to reduction of AOCI from 6/30/24 through 8/21/24 19 19 19 19

Pro Forma Reconciliation 1 2025 & 2026 Earnings Per Share Accretion

2025E 2026E Diluted Diluted GAAP Cash Shares GAAP Cash Shares ($M) ($M) (M) ($M) ($M) (M) CAC Net Income $51.2 $51.2 14.6 $53.8 $53.8 14.6 NWYF Net Income 4.1 4.1 2.8 7.2 7.2 2.8 Combined Net Income $55.3 $55.3 $61.0 $61.0 AT Merger Related

Adjustments Cost Savings 5.0 5.0 9.2 9.2 Amortization of CDI, Net of DTL (3.1) (3.0) Opportunity Cost of Cash (0.3) (0.3) (0.4) (0.4) CECL Non-PCD Mark Amortization 1.0 1.3 Secondary Interest Effects 0.0 0.0 0.2 0.2 Loans – Interest Rate Mark

8.6 11.5 AOCI – AFS Securities 2.3 3.1 Other Marks (0.2) (0.2) Pro Forma Net Income $68.6 $60.0 16.4 $82.5 $69.9 16.9 CAC Standalone EPS $3.50 $3.50 $3.67 $3.67 Pro Forma CAC EPS $4.19 $3.67 $4.87 $4.13 $ Accretion to CAC $0.70 $0.17 $1.20

$0.46 % Accretion to CAC 19.9% 4.8% 32.7% 12.4% 1) Includes 9 months of NWYF net income and merger adjustments (75% phased-in cast savings) for 2025E assuming transaction close of 3/31/25 20 20 20 20

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

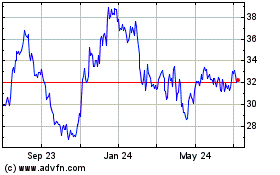

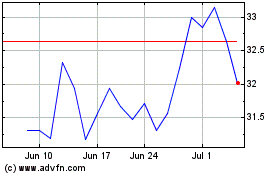

Camden National (NASDAQ:CAC)

Historical Stock Chart

From Oct 2024 to Nov 2024

Camden National (NASDAQ:CAC)

Historical Stock Chart

From Nov 2023 to Nov 2024