0001624512false00016245122024-08-072024-08-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of report (date of earliest event reported): August 7, 2024

BOXLIGHT CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Nevada | | 001-37564 | | 36-4794936 |

(State or other jurisdiction of

Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

2750 Premiere Parkway, Ste. 900

Duluth, Georgia 30097

(Address Of Principal Executive Offices) (Zip Code)

678-367-0809

(Registrant’s Telephone Number, Including Area Code)

N/A

(Former name or formed address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock $0.0001 per share | | BOXL | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 Results of Operations and Financial Condition.

On August 7, 2024, Boxlight Corporation, a Nevada corporation (the “Company”), issued a press release announcing its second quarter 2024 financial results. The press release also announced the Company will hold a conference call to discuss its second quarter financial results today, on Wednesday, August 7, 2024, at 4:30 p.m. Eastern Time.

The conference call details are as follows:

| | | | | |

| Date: | Wednesday, August 7, 2024 |

| Time: | 4:30 p.m. Eastern Time / 1:30 p.m. Pacific Time |

| Dial-in: | 1-888-506-0062 (Domestic)

|

| 1-973-528-0011 (International) |

| Participant Access Code: | 668734 |

| Webcast: | https://www.webcaster4.com/Webcast/Page/2213/50866 |

For those unable to participate during the live broadcast, a replay of the conference call will be available until 11:59 p.m. Eastern Time on Wednesday, August 21, 2024, by dialing 1-877-481-4010 (domestic) and 1-919-882-2331 (international) and referencing the replay passcode 50866.

A copy of the press release is attached as Exhibit 99.1 hereto and incorporated herein by reference.

In accordance with General Instruction B.2 of Form 8-K, the information in this Item 2.02, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section. Such information may be incorporated by reference in another filing under the Exchange Act or the Securities Act of 1933, as amended, only if and to the extent that such subsequent filing specifically references such information.

Item 9.01 Financial Statements and Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | |

| | BOXLIGHT CORPORATION |

| |

| Dated: | August 7, 2024 | |

| | By: /s/ Greg Wiggins |

| | Name: Greg Wiggins |

| | Title: Chief Financial Officer |

Boxlight Reports Second Quarter 2024 Financial Results

Duluth, GA – Business Wire – August 7, 2024 – Boxlight Corporation (Nasdaq: BOXL) (“Boxlight” or the “Company”), a leading provider of interactive technology solutions, today announced the Company’s financial results for the second quarter ended June 30, 2024.

Financial and Operational Highlights:

•Revenue was $38.5 million for the quarter, a decrease of 18.1% from the prior year quarter

•Gross profit margin in Q2'24 decreased to 37.7% from 37.9% from the prior year quarter

•Net loss was $1.5 million, compared to net loss of $0.8 million in the prior year quarter

•Net loss per basic and diluted common share was ($0.18), compared to ($0.12) net loss per basic and diluted common share in the prior year quarter

•Adjusted EBITDA, a non-GAAP measure, decreased by $1.7 million to $3.7 million from the prior year quarter

•Launched new products, UNITY, an all-in-one hardware device used in classrooms and on campus to unite and manage audio communication and safety ecosystems, providing audio, bells, paging, and alerts

•Released TimeSign, an affordable 22” digital clock display for customized visual campus communications

•Introduced our STEM Robo 3D printer, a succinct and affordable 3D printer for K12, backed with nationally aligned STEM curriculum

•Recognized by TIME as one of the World’s Top 250 EdTech Companies of 2024 placing 28th

•Ended the quarter with $7.5 million in cash, $46.7 million in working capital and $7.5 million in stockholders’ equity

Management Commentary

“We have made substantial progress in aligning our organization with current demand levels, while selectively investing in new solutions and enhanced sales capabilities to position Boxlight for the anticipated growth in future demand," commented Dale Strang, Chief Executive Officer. “While we faced challenging Industry conditions in certain markets in both EMEA and the Americas, our recent initiatives, including the elimination of over $5 million in annual operating expenses, have enabled us to maintain market share in the first half of 2024 and generate positive Adjusted EBITDA. We remain committed to maintaining operating expense discipline to drive future profitability."

“While this turnaround process will take time, we are positioning our Company to capture market share through our comprehensive product portfolio, aligning our brand and go-to-market strategy and identifying underserved markets, continued Mr. Strang. “In addition, we have recently launched multiple new products including UNITY, an all-in-one hardware device used in classrooms and on campus to unite and manage audio communication and safety ecosystems, providing audio, bells, paging, and alerts; TimeSign, an affordable 22” digital clock display for customized visual campus communications, and a compact new large volume STEM 3D printer. I am increasingly confident in Boxlight’s overall competitive position, both in terms of product breadth and the individual quality of our product, and our ability to capture market share and deliver growth.”

Financial Results for the Three Months Ended June 30, 2024 (Q2'24) vs. Three Months Ended June 30, 2023 (Q2'23)

Total revenues were $38.5 million as compared to $47.1 million for the second quarter last year, resulting in a 18.1% decrease. The decrease in revenues was primarily due to lower sales volume across all markets primarily resulting from lower global demand for interactive flat panel displays.

Cost of revenues were $24.0 million as compared to $29.2 million for the second quarter last year, resulting in a 17.9% decrease. The decrease in cost of revenues was attributable to the decrease in units sold.

Gross profit was $14.5 million as compared to $17.8 million for the second quarter last year, resulting in a decrease of 18.5%. Gross profit margin decreased to 37.7% from 37.9% for the second quarter last year.

Total operating expenses were $13.3 million, accounting for 34.5% of revenues, as compared to $15.8 million and 33.5% of revenues for the second quarter last year. The decrease in operating expenses was due to planned initiatives to reduce costs across all regions, with the most significant reductions in employee-related expense of $0.7 million, professional fees of $0.5 million, and stock compensation of $0.3 representing the largest decline.

Other expense, net, was $2.8 million as compared to $2.6 million for the second quarter last year, representing an increase of $0.2 million. Other expense consists primarily of interest expense on our existing debt.

Net loss was $1.5 million compared to $0.8 million for the second quarter last year and was a result of the changes noted above.

The net loss attributable to common shareholders was $1.8 million. Net loss attributable to common shareholders for the second quarter last year was $1.1 million, after deducting fixed dividends paid to Series B preferred shareholders of $0.3 million in both years.

Total comprehensive loss was $1.5 million. Total comprehensive income for the second quarter last year was $0.9 million. The change reflects the effect of foreign currency translation adjustments on consolidation, with the net effect of a $47 thousand loss for the three months ended June 30, 2024 and a $1.7 million gain for the three months ended June 30, 2023.

Basic and diluted EPS for the three months ended June 30, 2024 was ($0.18). Basic and diluted EPS for the three months ended June 30, 2023 was ($0.12).

EBITDA, a non-GAAP measure, for the three months ended June 30, 2024 was $3.0 million, as compared to $4.5 million EBITDA for the three months ended June 30, 2023.

Adjusted EBITDA for the three months ended June 30, 2024 was $3.7 million, as compared to $5.4 million for the three months ended June 30, 2023. Adjustments to EBITDA included stock-based compensation expense, gains/losses from the remeasurement of derivative liabilities, and the effects of purchase accounting adjustments in connection with prior period acquisitions.

Financial Results for the Six Months Ended June 30, 2024 vs. Six Months Ended June 30, 2023

Total revenues were $75.6 million as compared to $88.2 million for the six months ended June 30, 2023, resulting in a 14.3% decrease. The decrease in revenues was primarily due to lower sales volume across all markets primarily resulting from lower global demand for interactive flat panel displays.

Gross profit was $27.3 million as compared to $33.0 million for six months ended June 30, 2023 resulting in a decrease of 17.1%. Gross profit margin decreased to 36.2% for Q2'24 from 37.4% for Q2'23. The decrease in gross profit margin is primarily related to a difference in product mix as well as lower sales volume as noted above.

Total operating expenses were $29.7 million as compared to $31.1 million for the six months ended June 30, 2023. The decrease in operating expenses was due to planed initiatives to reduce costs across all regions, with the most significant reductions employee-related expenses of $0.4 million, stock compensation of $0.4 million, and EMEA distribution costs of $0.6 million

Net loss increased $4.8 million to $8.6 million and was a result of the changes noted above. Net loss attributable to common shareholders was $9.2 million in the six months ended June 30, 2024 compared to $4.4 million in the six months ended June 30, 2023, after deducting fixed dividends paid to Series B preferred shareholders of approximately $0.6 million in both years.

Total comprehensive loss was $9.4 million compared to $1.5 million for the six months ended June 30, 2023, reflecting the effect of cumulative foreign currency translation adjustments on consolidation, with the net effect of $0.9 million loss and a $2.3 million gain for the six months ended June 30, 2024 and June 30, 2023, respectively.

Basic and diluted EPS for the six months ended June 30, 2024 was ($0.94), compared to ($0.47) per basic and diluted share for the six months ended June 30, 2023.

EBITDA for the six months ended June 30, 2024 was $1.5 million, as compared to $6.4 million EBITDA for the six months ended June 30, 2023. Adjusted EBITDA for the six months ended June 30, 2024 was $3.8 million, as compared to $8.7 million for the six months ended June 30, 2023.

Balance Sheet

At June 30, 2024, Boxlight had $7.5 million in cash and cash equivalents, $46.7 million in working capital and $40.3 million in debt, net of debt issuance costs.

The financial results for the three and six months ended June 30, 2024 are preliminary and may change as a result of the completion of our financial closing procedures.

Second Quarter 2024 Financial Results Conference Call

The Company will hold a conference call to discuss its second quarter 2024 financial results on Wednesday, August 7, 2024, at 4:30 p.m. Eastern Time.

The conference call details are as follows:

| | | | | |

| Date: | Wednesday, August 7, 2024 |

| Time: | 4:30 p.m. Eastern Time / 1:30 p.m. Pacific Time |

| Dial-in: | 1-888-506-0062 (Domestic)

|

| 1-973-528-0011 (International) |

| Participant Access Code: | 668734 |

| Webcast: | https://www.webcaster4.com/Webcast/Page/2213/50866 |

For those unable to participate during the live broadcast, a replay of the conference call will be available until 11:59 p.m. Eastern Time on Wednesday, August 21, 2024, by dialing 1-877-481-4010 (domestic) and 1-919-882-2331 (international) and referencing the replay passcode 50866.

About Boxlight Corporation

Boxlight Corporation (Nasdaq: BOXL) is a leading provider of interactive technology solutions under its award-winning brands Clevertouch®, FrontRow™ and Mimio®. Boxlight aims to improve engagement and communication in diverse business and education environments. Boxlight develops, sells, and services its integrated solution suite including interactive displays, collaboration software, audio solutions, supporting accessories, and professional services. For more information about Boxlight and the Boxlight story, visit http://www.boxlight.com, https://www.clevertouch.com and https://www.gofrontrow.com.

Forward Looking Statements

This press release may contain information about Boxlight’s view of its future expectations, plans and prospects that constitute forward-looking statements, including the information under the heading "Financial Outlook." Actual results may differ materially from historical results or those indicated by these forward-looking statements as a result of a variety of factors including, but not limited to, risks and uncertainties associated with its ability to maintain and grow its business, variability of operating results, its development and introduction of new products and services, marketing and other business development initiatives, and competition in the industry, among other things. Boxlight encourages you to review other factors that may affect its future results and performance in Boxlight’s filings with the Securities and Exchange Commission, including its Annual Report on Form 10-K for the year ended December 31, 2023, as filed on March 14, 2024. Given these factors, risks and uncertainties, we caution you not to place undue reliance on forward-looking statements. We expressly disclaim any obligation to update or revise any forward-looking statement as a result of new information, future events or otherwise, except as required by law.

Use of Non-GAAP Financial Measures

To provide investors with additional insight and allow for a more comprehensive understanding of the information used by management in its financial and decision-making surrounding pro forma operations, we supplement our consolidated financial statements presented on a basis consistent with U.S. generally accepted accounting principles, or GAAP, with EBITDA and Adjusted EBITDA, which are non-GAAP financial measures of earnings. EBITDA represents net loss before income tax expense (benefit), interest expense, depreciation and amortization. Adjusted EBITDA represents EBITDA plus stock-based compensation, severance charges, the change in fair value of derivative liabilities, and the purchase accounting impact of inventory markup and fair value adjustments to deferred revenue. Our management uses EBITDA and Adjusted EBITDA as financial measures to evaluate the profitability and efficiency of our business model. We use these non-GAAP financial measures to assess the strength of the underlying operations of our business. These adjustments, and the non-GAAP financial measures that are derived from them, provide supplemental information to analyze our operations between periods and over time. We find this especially useful when reviewing pro forma results of operations, which include large non-cash amortizations of intangible assets from acquisitions and stock-based compensation. Investors should consider our non-GAAP financial measures in addition to, and not as a substitute for, financial measures prepared in accordance with GAAP.

We report our operating results in accordance with U.S. GAAP. We have disclosed in the table below the results on a constant currency basis to facilitate period-to-period comparisons of our results without regard to the impact of fluctuating foreign currency exchange rates. The term foreign currency exchange rates refers to the exchange rates we use to translate our operating results into U.S. Dollars for all countries where the functional currency is not the U.S. Dollar. Because we are a global company, the foreign currency exchange rates used for translation may have a significant effect on our reported results. In general, our reported financial results are affected positively by a weaker U.S. Dollar and are affected negatively by a stronger U.S. Dollar as compared to the foreign currencies in which we conduct our business. References to our operating results on a constant-currency basis mean our operating results without the impact of foreign currency exchange rate fluctuations.

We believe disclosure of constant-currency results is helpful to investors because it facilitates period-to-period comparisons of our results by increasing the transparency of our underlying performance by excluding the impact of fluctuating foreign currency exchange rates. However, constant-currency results are non-U.S. GAAP financial measures and are not meant to be considered in isolation or as a substitute for comparable measures prepared in accordance with U.S. GAAP. Constant-currency results have no standardized meaning prescribed by U.S. GAAP, are not prepared under any comprehensive set of accounting rules or principles, and should be read in conjunction with our consolidated financial statements prepared in accordance with U.S. GAAP. Constant-currency results have limitations in their usefulness to investors and may be calculated differently from, and therefore may not be directly comparable to, similarly titled measures used by other companies.

Discussion of the Effect of Constant Currency on Financial Condition

We calculate constant-currency amounts by translating local currency amounts in the current period at actual foreign exchange rates for the prior year period. Our constant-currency results do not eliminate the transaction currency impact of purchases and sales of products in a currency other than the functional currency.

| | | | | | | | | | | | | | |

| Three Months Ended

June 30, 2024 | | Three Months Ended

June 30, 2023 | %

Decrease |

| (Dollars in thousands) | |

| Total revenues | | | | |

| As reported | $ | 38,514 | | | $ | 47,052 | | (18) | % |

| Impact of foreign currency translation | (132) | | 88 | |

| Constant-currency | $ | 38,382 | | $ | 47,140 | (19) | % |

| | | | | | | | | | | | | | |

| Six Months Ended

June 30, 2024 | | Six Months Ended

June 30, 2023 | %

Decrease |

| (Dollars in thousands) | |

| Total revenues | | | | |

| As reported | $ | 75,608 | | $ | 88,242 | (14) | % |

| Impact of foreign currency translation | (939) | | 2,341 | |

| Constant-currency | $ | 74,669 | | $ | 90,583 | (18) | % |

Boxlight Corporation

Condensed Consolidated Balance Sheets

As of June 30, 2024 and December 31, 2023

(in thousands, except share and per share amounts)

| | | | | | | | | | | |

| June 30,

2024 | | December 31,

2023 |

| (Unaudited) | | |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 7,514 | | | $ | 17,253 | |

| Accounts receivable – trade, net of allowances for credit losses of 304 and 421 | 29,147 | | | 29,523 | |

| Inventories, net of reserves | 37,847 | | | 44,131 | |

| Prepaid expenses and other current assets | 10,610 | | | 9,471 | |

| Total current assets | 85,118 | | | 100,378 | |

| | | |

| Property and equipment, net of accumulated depreciation | 2,512 | | | 2,477 | |

| Operating lease right of use asset | 8,287 | | | 8,846 | |

| Intangible assets, net of accumulated amortization | 41,999 | | | 45,964 | |

| | | |

| Other assets | 856 | | | 906 | |

| Total assets | $ | 138,772 | | | $ | 158,571 | |

| | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| | | |

| Current liabilities: | | | |

| Accounts payable and accrued expenses | $ | 22,707 | | | $ | 32,899 | |

| Short-term debt | 3,107 | | | 1,037 | |

| Operating lease liabilities, current | 2,061 | | | 1,827 | |

| Deferred revenues, current | 8,976 | | | 8,698 | |

| Derivative liabilities | 9 | | | 205 | |

| Other short-term liabilities | 1,598 | | | 1,566 | |

| Total current liabilities | 38,458 | | | 46,232 | |

| | | |

| Deferred revenues, non-current | 16,046 | | | 16,347 | |

| Long-term debt | 37,143 | | | 39,134 | |

| Deferred tax liabilities, net | 4,319 | | | 4,316 | |

| Operating lease liabilities, non-current | 6,813 | | | 7,282 | |

| Total liabilities | 102,779 | | | 113,311 | |

| | | |

| | | |

| Mezzanine equity: | | | |

| Preferred Series B, 1,586,620 shares issued and outstanding | 16,146 | | | 16,146 | |

| Preferred Series C, 1,320,850 shares issued and outstanding | 12,363 | | | 12,363 | |

| Total mezzanine equity | 28,509 | | | 28,509 | |

| | | |

| Stockholders’ equity: | | | |

| Preferred stock, $0.0001 par value, 50,000,000 shares authorized; 167,972 and 167,972 shares issued and outstanding, respectively | — | | | — | |

| Common stock, $0.0001 par value, 18,750,000 shares authorized; 9,817,875 and 9,704,496 Class A shares issued and outstanding, respectively | 1 | | | 1 | |

| Additional paid-in capital | 119,882 | | | 119,724 | |

| Accumulated deficit | (112,842) | | | (104,275) | |

| Accumulated other comprehensive income | 443 | | | 1,301 | |

| Total stockholders’ equity | 7,484 | | | 16,751 | |

| | | |

| Total liabilities and stockholders’ equity | $ | 138,772 | | | $ | 158,571 | |

Boxlight Corporation

Condensed Consolidated Statements of Operations and Comprehensive Loss

For the six months ended June 30, 2024 and 2023

(Unaudited)

(in thousands, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Revenues, net | $ | 38,514 | | | $ | 47,052 | | | $ | 75,608 | | | $ | 88,242 | |

| Cost of revenues | 23,986 | | | 29,224 | | | 48,265 | | | 55,266 | |

| Gross profit | 14,528 | | | 17,828 | | | 27,343 | | | 32,976 | |

| | | | | | | |

| Operating expense: | | | | | | | |

| General and administrative | 12,321 | | | 15,227 | | | 27,570 | | | 29,958 | |

| Research and development | 985 | | | 525 | | | 2,155 | | | 1,122 | |

| | | | | | | |

| Total operating expense | 13,306 | | | 15,752 | | | 29,725 | | | 31,080 | |

| | | | | | | |

| Income (loss) from operations | 1,222 | | | 2,076 | | | (2,382) | | | 1,896 | |

| | | | | | | |

| Other (expense) income: | | | | | | | |

| Interest expense, net | (2,566) | | | (2,788) | | | (5,173) | | | (5,235) | |

| Other expense, net | (229) | | | (28) | | | (429) | | | (50) | |

| | | | | | | |

| Change in fair value of derivative liabilities | 4 | | | 184 | | | 196 | | | (40) | |

| Total other expense | (2,791) | | | (2,632) | | | (5,406) | | | (5,325) | |

| Loss before income taxes | $ | (1,569) | | | $ | (556) | | | $ | (7,788) | | | $ | (3,429) | |

| Income tax (expense) benefit | 91 | | | (255) | | | (779) | | | (306) | |

| Net loss | $ | (1,478) | | | $ | (811) | | | $ | (8,567) | | | $ | (3,735) | |

| Fixed dividends - Series B Preferred | (317) | | | (317) | | | (634) | | | (635) | |

| Net loss attributable to common stockholders | $ | (1,795) | | | $ | (1,128) | | | $ | (9,201) | | | $ | (4,370) | |

| | | | | | | |

| Comprehensive loss: | | | | | | | |

| Net loss | $ | (1,478) | | | $ | (811) | | | $ | (8,567) | | | $ | (3,735) | |

| Other comprehensive loss: | | | | | | | |

| Foreign currency translation adjustment | (47) | | | 1,722 | | | (858) | | | 2,280 | |

| Total comprehensive income (loss) | $ | (1,525) | | | $ | 911 | | | $ | (9,426) | | | $ | (1,455) | |

| | | | | | | |

| Net loss per common share – basic and diluted | $ | (0.18) | | | $ | (0.12) | | | $ | (0.94) | | | $ | (0.47) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Weighted average number of common shares outstanding – basic and diluted | 9,787 | | 9,385 | | 9,751 | | 9,359 |

| | | | | | | |

| | | | | | | |

Reconciliation of net loss for the six months ended June 30, 2024 and 2023 to EBITDA and Adjusted EBITDA

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in thousands) | | Three Months Ended

June 30, 2024 | | Three Months Ended

June 30, 2023 | | Six Months Ended

June 30, 2024 | | Six Months Ended

June 30, 2023 |

| Net Loss | | $ | (1,478) | | | $ | (811) | | | $ | (8,567) | | | $ | (3,735) | |

| Depreciation and amortization | | 2,043 | | | 2,298 | | | 4,112 | | | 4,561 | |

| Interest expense | | 2,566 | | | 2,788 | | | 5,173 | | | 5,235 | |

| Income tax expense | | (91) | | | 255 | | | 779 | | | 306 | |

| EBITDA | | $ | 3,040 | | | $ | 4,530 | | | $ | 1,497 | | | $ | 6,367 | |

| Stock compensation expense | | 243 | | | 511 | | | 792 | | | 1,152 | |

| Change in fair value of derivative liabilities | | (4) | | | (184) | | | (196) | | | 40 | |

| Purchase accounting impact of fair valuing inventory | | 113 | | | 80 | | | 225 | | | 223 | |

| Purchase accounting impact of fair valuing deferred revenue | | 262 | | | 472 | | | 570 | | | 942 | |

| | | | | | | | |

| | | | | | | | |

| Severance charges | | — | | | — | | | 943 | | | — | |

| Adjusted EBITDA | | $ | 3,654 | | | $ | 5,409 | | | $ | 3,831 | | | $ | 8,724 | |

Media

Sunshine Nance

+1 360-464-2119 x254

sunshine.nance@boxlight.com

Investor Relations

Greg Wiggins

+1 360-464-4478

investor.relations@boxlight.com

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

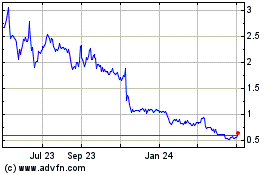

Boxlight (NASDAQ:BOXL)

Historical Stock Chart

From Oct 2024 to Nov 2024

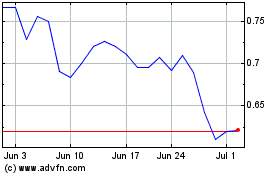

Boxlight (NASDAQ:BOXL)

Historical Stock Chart

From Nov 2023 to Nov 2024