Blackbaud Releases 2015 Fundraising Insights

January 04 2016 - 12:57PM

Blackbaud, Inc. (NASDAQ:BLKB), the leading provider of software and

services for the global philanthropic community, today shared key

insight from industry experts to help guide nonprofit fundraising

efforts in 2016. Top fundraising recommendations include: Exceed

donor expectations; focus on impact; improve data quality; build a

seamless tech experience; and embrace a multi-channel approach.

- Visit

npengage.com/nonprofit-fundraising/5-fundraising-resolutions-for-2016

to read the full, detailed write up

2016 will be a year of great opportunity for the

philanthropic sector. The same trends that are changing the world

at a rapidly accelerating rate, are impacting the fundraising

profession in new and exciting ways. In the midst of all these

developments, it’s more important than ever for nonprofits to keep

their goals clear and focus on what matters.

Five Resolutions to Guide Nonprofit

Fundraising in 2016

- Exceed Donor Expectations – “Fight for every

donor. Even small changes in donor retention practices can make a

significant difference.” Chuck Longfield, Senior Vice President,

Chief Scientist, Blackbaud

- Focus on Impact – “Donors have more choice

than ever before. Fundraisers will need to focus on tying the

impact of gifts to the cause itself in order to retain and gain

supporters.” Rachel Hutchisson, Senior Vice President, Corporate

Citizenship & Philanthropy, Blackbaud

- Improve Data Quality – “With the proper data

quality and program analytics, you will be prepared to expand and

optimize your fundraising in 2016 and beyond.” Richard Becker,

President, Target Analytics, Blackbaud

- Build a Seamless Tech Experience – “2016 will

be a year of tremendous opportunity to further your mission in

innovative ways with technology.” Mary Beth Westmoreland, Chief

Technology Officer, Blackbaud

- Embrace a Multi-channel Approach – “Nonprofits

should embrace a multichannel outreach approach that will help them

build stronger relationships with their supporters.” Steve

MacLaughlin, Director of Analytics, Blackbaud

For additional information that will help impact

nonprofits’ fundraising performance, visit 50 Fascinating

Philanthropy Stats. This new central hub of need-to-know statistics

from reputable sources across the industry will help nonprofits

understand the sector and how their organization compares.

About Blackbaud Serving the

worldwide philanthropic community for more than 30 years, Blackbaud

(NASDAQ:BLKB) combines innovative software and services,

and expertise to help organizations achieve their missions.

Blackbaud works in over 60 countries to power the passions of

approximately 35,000 clients, including nonprofits, K-12 private

and higher education institutions, healthcare organizations,

foundations and other charitable

giving entities, and corporations. The company offers a

full spectrum of cloud and on-premise solutions, as well as a

resource network that empowers and connects organizations of all

sizes. Blackbaud's portfolio of software and services

support nonprofit fundraising and relationship management,

eMarketing, advocacy, accounting, payments and analytics, as well

as grant management, corporate social responsibility, and

education. Using Blackbaud technology, these organizations raise,

invest, manage and award more than $100 billion each year.

Recognized as a top company, Blackbaud is headquartered in

Charleston, South Carolina and has operations in the United States,

Australia, Canada, Ireland and the United Kingdom. For more

information, visit www.blackbaud.com.

Forward-looking

StatementsExcept for historical information, all of the

statements, expectations, and assumptions contained in this news

release are forward-looking statements that involve a number of

risks and uncertainties. Although Blackbaud attempts to be accurate

in making these forward-looking statements, it is possible that

future circumstances might differ from the assumptions on which

such statements are based. In addition, other important factors

that could cause results to differ materially include the

following: general economic risks; uncertainty regarding increased

business and renewals from existing customers; continued success in

sales growth; management of integration of acquired companies and

other risks associated with acquisitions; risks associated with

successful implementation of multiple integrated software products;

the ability to attract and retain key personnel; risks related to

our dividend policy and share repurchase program, including

potential limitations on our ability to grow and the possibility

that we might discontinue payment of dividends; risks relating to

restrictions imposed by the credit facility; risks associated with

management of growth; lengthy sales and implementation cycles,

particularly in larger organization; technological changes that

make our products and services less competitive; and the other risk

factors set forth from time to time in the SEC filings for

Blackbaud, copies of which are available free of charge at the

SEC’s website at www.sec.gov or upon request from Blackbaud's

investor relations department. All Blackbaud product names

appearing herein are trademarks or registered trademarks of

Blackbaud, Inc.

Media Contact

Nicole McGougan

Public Relations

843-654-3307

nicole.mcgougan@blackbaud.com

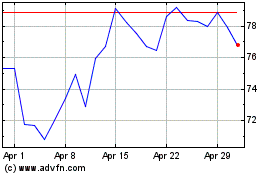

Blackbaud (NASDAQ:BLKB)

Historical Stock Chart

From Dec 2024 to Jan 2025

Blackbaud (NASDAQ:BLKB)

Historical Stock Chart

From Jan 2024 to Jan 2025