Axonics, Inc. (Nasdaq: AXNX), a medical technology company that

develops, manufactures and commercializes innovative and minimally

invasive products to treat bladder and bowel dysfunction, today

reported financial results for the three months ended September 30,

2024.

“Axonics continued to execute at a high level in the third

quarter, generating revenue growth of 25% year over year,” said

Raymond W. Cohen, chief executive officer. “Revenue growth for both

sacral neuromodulation and Bulkamid® was driven by higher

utilization at existing customers and the onboarding of new

accounts.”

Mr. Cohen continued, “Our commitment to innovation, quality,

direct-to-consumer advertising and providing strong clinical

support continues to expand the market for life-changing

incontinence therapies and propel Axonics on its path to market

leadership. We look forward to the global impact the Axonics

portfolio can make as part of Boston Scientific as we endeavor to

treat more patients than ever before.”

Third Quarter 2024 Financial Results

- Net revenue was $116.2 million, an increase of 25% compared to

the prior year period.

- Sacral neuromodulation revenue was $92.3 million, an increase

of 25% compared to the prior year period.

- Bulkamid revenue was $23.8 million, an increase of 25% compared

to the prior year period.

- Gross margin was 77.2% compared to 74.2% in the prior year

period.

- Loss from operations was $6.3 million and includes $8 million

of one-time legal and acquisition-related costs. This compares to a

loss from operations of $0.7 million in the prior year period.

- Net loss was $21,000 compared to net income of $3.9 million in

the prior year period.

- Adjusted EBITDA was $23.6 million compared to $14.0 million in

the prior year period.

- Cash, cash equivalents, short-term investments and restricted

cash were $367 million as of September 30, 2024.

About Axonics

Axonics is a global medical technology company that is

developing and commercializing novel products for adults with

bladder and bowel dysfunction. Axonics ranked No. 2 on the 2023

Financial Times ranking of the fastest growing companies in the

Americas after being ranked No. 1 in 2022.

Axonics® sacral neuromodulation systems provide adults with

overactive bladder and/or fecal incontinence with long-lived, easy

to use, safe, clinically effective therapy. In addition, Axonics’

best-in-class urethral bulking hydrogel, Bulkamid®, provides safe

and durable symptom relief to women with stress urinary

incontinence. In the U.S., moderate to severe urinary incontinence

affects an estimated 28 million women and fecal incontinence

affects an estimated 19 million adults. For more information, visit

www.axonics.com.

Use of Non-GAAP Financial Measures

To supplement Axonics’ consolidated financial statements

prepared in accordance with generally accepted accounting

principles (GAAP), Axonics provides certain non-GAAP financial

measures in this release as supplemental financial metrics.

Adjusted EBITDA is calculated as net loss before other

income/expense (including interest), income tax expense (benefit),

depreciation and amortization expense, stock-based compensation

expense, acquisition-related costs, cash compensation in lieu of

equity compensation due to pending merger, one-time

litigation-related expense, acquired in-process research and

development expense, loss on disposal of property and equipment,

and expense related to impairment of intangible assets. Management

believes that in order to properly understand short-term and

long-term financial trends, investors may want to consider the

impact of these excluded items in addition to GAAP measures. The

excluded items vary in frequency and/or impact on our results of

operations and management believes that the excluded items are

typically not reflective of our ongoing core business operations

and financial condition. Further, management uses adjusted EBITDA

for both strategic and annual operating planning. A reconciliation

of adjusted EBITDA reported in this release to the most comparable

GAAP measure for the respective periods appears in the table

captioned “Reconciliation of GAAP Net (Loss) Income to Adjusted

EBITDA” later in this release.

The non-GAAP financial measures used by Axonics may not be the

same or calculated in the same manner as those used and calculated

by other companies. Non-GAAP financial measures have limitations as

analytical tools and should not be considered in isolation or as a

substitute for Axonics’ financial results prepared and reported in

accordance with GAAP. We urge investors to review the

reconciliation of these non-GAAP financial measures to the

comparable GAAP financial measures included in this press release,

and not to rely on any single financial measure to evaluate our

business.

Cautionary Statement Regarding Forward-Looking

Statements

This press release contains “forward-looking statements” within

the meaning of the safe harbor provisions of the U.S. Private

Securities Litigation Reform Act of 1995. Forward-looking

statements can be identified by words like “may,” “will,” “likely,”

“should,” “expect,” “anticipate,” “future,” “plan,” “believe,”

“intend,” “goal,” “seek,” “endeavor,” “estimate,” “project,”

“continue,” and variations of such words and similar expressions.

These forward-looking statements are not guarantees of future

performance and involve risks, assumptions, and uncertainties,

including, but not limited to, risks related to: Axonics’ ability

to consummate the transactions contemplated by the Agreement and

Plan of Merger, dated January 8, 2024 (the “Merger Agreement”), by

and among Axonics, Boston Scientific Corporation (“Boston

Scientific”), and Sadie Merger Sub, Inc., a wholly owned subsidiary

of Boston Scientific (“Merger Sub”), providing for the merger of

Merger Sub with and into Axonics with Axonics continuing as the

surviving company and a wholly owned subsidiary of Boston

Scientific (the “Merger”), in a timely manner or at all; the risk

that the Merger Agreement may be terminated in circumstances

requiring the payment by Axonics of a termination fee; the

satisfaction (or waiver) of the conditions to the closing of the

Merger; potential delays in consummating the Merger; the occurrence

of any event, change or other circumstance or condition that could

give rise to termination of the Merger Agreement; Axonics’ ability

to timely and successfully realize the anticipated benefits of the

Merger; the ability to successfully integrate the businesses of

Axonics and Boston Scientific; the effect of the announcement or

pendency of the Merger on Axonics’ current plans, business

relationships, operating results and business generally; the effect

of limitations placed on Axonics’ business under the Merger

Agreement; significant transaction costs and unknown liabilities;

litigation or regulatory actions related to the Merger Agreement or

Merger; FDA or other U.S. or foreign regulatory or legal actions or

changes affecting Axonics or Axonics’ industry; the results of any

ongoing or future legal proceedings, including the litigation with

Medtronic, Inc., Medtronic Puerto Rico Operations Co., Medtronic

Logistics LLC and Medtronic USA, Inc. (the “Medtronic Litigation”);

any termination or loss of intellectual property rights, including

as a result of the Medtronic Litigation; introductions and

announcements of new technologies by Axonics, any commercialization

partners or Axonics’ competitors, and the timing of these

introductions and announcements; changes in macroeconomic and

market conditions and volatility, including the risk of recession,

inflation, supply chain constraints or disruptions and rising

interest rates; and economic and market conditions in general and

in the medical technology industry specifically, including the size

and growth, if any, of Axonics’ markets, and risks related to other

factors described under “Risk Factors” in other reports and

statements filed with the U.S. Securities and Exchange Commission

(“SEC”), including Axonics’ most recent Annual Report on Form 10-K,

which is available on the investor relations section of Axonics’

website at www.axonics.com and on the SEC’s website at www.sec.gov.

Should one or more of these risks or uncertainties materialize, or

should underlying assumptions prove incorrect, actual results may

vary materially from those indicated or anticipated by these

forward-looking statements. Therefore, you should not rely on any

of these forward-looking statements.

The forward-looking statements included in this press release

are made only as of the date of this press release, and except as

otherwise required by federal securities law, Axonics does not

assume any obligation nor does it intend to publicly update or

revise any forward-looking statements to reflect new information,

changed circumstances or unanticipated events.

Axonics, Inc.

Consolidated Balance

Sheets

(in thousands, except share

and per share data)

September 30,

December 31,

2024

2023

(unaudited)

ASSETS

Current assets

Cash and cash equivalents

$

239,452

$

104,811

Short-term investments

105,773

240,149

Accounts receivable, net of allowance for

credit losses of $1,198 and $442 at September 30, 2024 and December

31, 2023, respectively

62,644

57,243

Inventory, net

113,861

79,940

Prepaid expenses and other current

assets

4,184

9,279

Total current assets

525,914

491,422

Restricted cash

22,082

12,714

Property and equipment, net

20,698

10,760

Intangible assets, net

78,454

81,375

Other assets

22,478

24,235

Goodwill

104,545

99,417

Total assets

$

774,171

$

719,923

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities

Accounts payable

$

20,109

$

18,452

Accrued liabilities

5,701

10,527

Accrued compensation and benefits

35,998

15,060

Operating lease liabilities, current

portion

2,611

1,777

Total current liabilities

64,419

45,816

Operating lease liabilities, net of

current portion

29,900

25,840

Deferred tax liabilities, net

15,363

10,703

Total liabilities

109,682

82,359

Commitments and contingencies

Stockholders’ equity

Preferred stock, par value $0.0001 per

share; 10,000,000 shares authorized, no shares issued and

outstanding at September 30, 2024 and December 31, 2023

—

—

Common stock, par value $0.0001,

75,000,000 shares authorized at September 30, 2024 and December 31,

2023; 51,110,021 and 50,770,520 shares issued and outstanding at

September 30, 2024 and December 31, 2023, respectively

5

5

Additional paid-in capital

1,063,185

1,033,778

Accumulated deficit

(392,586

)

(380,352

)

Accumulated other comprehensive loss

(6,115

)

(15,867

)

Total stockholders’ equity

664,489

637,564

Total liabilities and stockholders’

equity

$

774,171

$

719,923

Axonics, Inc.

Consolidated Statements of

Comprehensive Income (Loss)

(in thousands, except share

and per share data)

(unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

Net revenue

$

116,193

$

93,100

$

322,167

$

256,644

Cost of goods sold

26,542

23,996

74,120

64,850

Gross profit

89,651

69,104

248,047

191,794

Operating expenses

Research and development

13,491

8,167

37,339

25,172

General and administrative

23,761

11,778

55,192

34,659

Sales and marketing

52,972

47,544

160,607

134,468

Amortization of intangible assets

2,221

2,302

6,722

6,803

Acquisition-related costs

3,474

—

9,953

2,368

Acquired in-process research &

development

—

—

—

15,447

Total operating expenses

95,919

69,791

269,813

218,917

Loss from operations

(6,268

)

(687

)

(21,766

)

(27,123

)

Other income (expense)

Interest and other income

4,704

4,271

13,379

12,149

Interest and other expense

8

(83

)

(83

)

774

Other income, net

4,712

4,188

13,296

12,923

(Loss) income before income tax (benefit)

expense

(1,556

)

3,501

(8,470

)

(14,200

)

Income tax (benefit) expense

(1,535

)

(427

)

3,764

(1,538

)

Net (loss) income

(21

)

3,928

(12,234

)

(12,662

)

Foreign currency translation

adjustment

10,438

(6,185

)

9,752

636

Comprehensive income (loss)

$

10,417

$

(2,257

)

$

(2,482

)

$

(12,026

)

Net (loss) income per share, basic

$

(0.00

)

$

0.08

$

(0.24

)

$

(0.26

)

Weighted-average shares used to compute

basic net (loss) income per share

51,088,073

49,244,981

51,010,885

48,973,252

Net (loss) income per share, diluted

$

(0.00

)

$

0.08

$

(0.24

)

$

(0.26

)

Weighted-average shares used to compute

diluted net (loss) income per share

51,088,073

50,086,491

51,010,885

48,973,252

Axonics, Inc.

Net Revenue by Product and

Region

(in thousands)

(unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

Sacral neuromodulation

United States

$

90,072

$

72,212

$

248,988

$

198,270

International

2,277

1,737

6,255

5,025

Sacral neuromodulation total

$

92,349

$

73,949

$

255,243

$

203,295

Bulkamid

United States

$

19,050

$

15,579

$

52,575

$

41,998

International

4,794

3,572

14,349

11,351

Bulkamid total

$

23,844

$

19,151

$

66,924

$

53,349

Total net revenue

$

116,193

$

93,100

$

322,167

$

256,644

Axonics, Inc.

Reconciliation of GAAP Net

(Loss) Income to Adjusted EBITDA

(in thousands)

(unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

GAAP Net (loss) income

$

(21

)

$

3,928

$

(12,234

)

$

(12,662

)

Non-GAAP Adjustments:

Interest and other income

(4,704

)

(4,271

)

(13,379

)

(12,149

)

Interest and other expense

(8

)

83

83

(774

)

Income tax (benefit) expense

(1,535

)

(427

)

3,764

(1,538

)

Depreciation and amortization expense

3,215

3,254

9,298

9,295

Stock-based compensation expense

8,231

11,470

26,393

33,388

Acquisition-related costs

3,474

—

9,953

2,368

Cash compensation in lieu of equity

compensation due to pending merger

10,404

—

21,586

—

One-time litigation-related expense

4,500

—

4,500

—

Acquired in-process research &

development

—

—

—

15,447

Adjusted EBITDA

$

23,556

$

14,037

$

49,964

$

33,375

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241107091750/en/

Axonics contact: Neil Bhalodkar IR@axonics.com

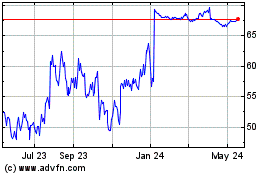

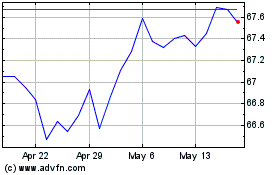

Axonics (NASDAQ:AXNX)

Historical Stock Chart

From Jan 2025 to Feb 2025

Axonics (NASDAQ:AXNX)

Historical Stock Chart

From Feb 2024 to Feb 2025