Aspen Technology, Inc. (NASDAQ: AZPN), the asset optimization

software company, today announced financial results for its second

quarter of fiscal year 2019 ended December 31, 2018.

“AspenTech delivered strong second quarter results, highlighted

by annual spend growth of 9.4% year-over-year. We saw positive

trends across each product suite and geography,” said Antonio

Pietri, President and Chief Executive Officer of AspenTech. “The

breadth of our performance demonstrated the positive impact of

multiple favorable growth drivers and strong execution.”

Pietri continued, “We had our strongest quarterly APM

performance to date, reflecting our ability to convert our pipeline

into customer wins. We also saw solid demand in our core industries

and increasing demand in the global economy industries for our APM

suite. The growing adoption of APM reinforces our confidence in the

ability to capitalize on this substantial market opportunity. We

believe the success of the APM suite, the continued strength of our

MSC suite and positive momentum in our Engineering suite position

us to achieve our strategic objectives.”

Second Quarter Fiscal 2019 and Recent Business

Highlights

- Annual spend, which the company defines

as the annualized value of all term license and maintenance

contracts at the end of the quarter, was approximately $513 million

at the end of the second quarter of fiscal 2019, which increased

9.4% compared to the second quarter of fiscal 2018 and 3.0%

sequentially.

- AspenTech repurchased approximately 1.2

million shares of its common stock for $100.0 million in the second

quarter of fiscal 2019.

Summary of Second Quarter Fiscal Year 2019 Financial

Results

AspenTech’s total revenue of $140.4 million included:

- License revenue, which

represents the portion of a term license agreement allocated to the

initial license, was $93.4 million in the second quarter of fiscal

2019, compared to $57.0 million in the second quarter of fiscal

2018.

- Maintenance revenue, which

represents the portion of the term license agreement related to

on-going support and the right to future product enhancements, was

$41.0 million in the second quarter of fiscal 2019, compared to

$40.7 million in the second quarter of fiscal 2018.

- Services and other revenue: was

$6.0 million in the second quarter of fiscal 2019, compared to $7.8

million in the second quarter of fiscal 2018.

For the quarter ended December 31, 2018, AspenTech reported

income from operations of $63.8 million, compared to income from

operations of $30.1 million for the quarter ended December 31,

2017.

Net income was $59.2 million for the quarter ended December 31,

2018, leading to net income per share of $0.83, compared to net

income per share of $1.81 in the same period last fiscal year. Net

income in the year ago period benefited from one-time, non-cash

items related to the implementation of Topic 606 and the

implementation of the Tax Cuts and Jobs Act of 2017.

Non-GAAP income from operations, which adds back the impact of

stock-based compensation expense, amortization of intangibles

associated with acquisitions and acquisition related fees, was

$71.2 million for the second quarter of fiscal 2019, compared to

non-GAAP income from operations of $37.8 million in the same period

last fiscal year. Non-GAAP net income was $65.1 million, or $0.92

per share, for the second quarter of fiscal 2019, compared to

non-GAAP net income of $137.0 million, or $1.88 per share, in the

same period last fiscal year. A reconciliation of GAAP to non-GAAP

results is presented in the financial tables included in this press

release.

AspenTech had cash and marketable securities of $54.4 million

and borrowings of $220.0 million at December 31, 2018.

During the second quarter, the company generated $57.5 million

in cash flow from operations and $57.3 million in free cash flow.

Free cash flow is calculated as net cash provided by operating

activities adjusted for the net impact of: purchases of property,

equipment and leasehold improvements; capitalized computer software

development costs, and other nonrecurring items, such as

acquisition related payments.

Use of Non-GAAP Financial Measures

This press release contains “non-GAAP financial measures” under

the rules of the U.S. Securities and Exchange Commission. Non-GAAP

financial measures are not based on a comprehensive set of

accounting rules or principles. This non-GAAP information

supplements, and is not intended to represent a measure of

performance in accordance with, disclosures required by generally

accepted accounting principles, or GAAP. Non-GAAP financial

measures should be considered in addition to, not as a substitute

for or superior to, financial measures determined in accordance

with GAAP. A reconciliation of GAAP to non-GAAP results is included

in the financial tables included in this press release.

Management considers both GAAP and non-GAAP financial results in

managing AspenTech’s business. As the result of adoption of new

licensing models, management believes that a number of AspenTech’s

performance indicators based on GAAP, including revenue, gross

profit, operating income and net income, should be viewed in

conjunction with certain non-GAAP and other business measures in

assessing AspenTech’s performance, growth and financial condition.

Accordingly, management utilizes a number of non-GAAP and other

business metrics, including the non-GAAP metrics set forth in this

press release, to track AspenTech’s business performance. None of

these non-GAAP metrics should be considered as an alternative to

any measure of financial performance calculated in accordance with

GAAP.

Conference Call and Webcast

AspenTech will host a conference call and webcast today, January

23, 2019, at 4:30 p.m. (Eastern Time), to discuss the company's

financial results for the second quarter fiscal year 2019 as well

as the company’s business outlook. The live dial-in number is (833)

713-6081 or (702) 374-0603, conference ID code 5661887. Interested

parties may also listen to a live webcast of the call by logging on

to the Investor Relations section of AspenTech’s website,

http://ir.aspentech.com/events-and-presentations, and clicking on

the “webcast” link. A replay of the call will be archived on

AspenTech’s website and will also be available via telephone at

(855) 859-2056 or (404) 537-3406, conference ID code 5661887,

through February 23, 2019.

About AspenTech

AspenTech is a leading software supplier for optimizing asset

performance. Our products thrive in complex, industrial

environments where it is critical to optimize the asset design,

operation and maintenance lifecycle. AspenTech uniquely combines

decades of process modeling expertise with big data machine

learning. Our purpose-built software platform automates knowledge

work and builds sustainable competitive advantage by delivering

high returns over the entire asset lifecycle. As a result,

companies in capital-intensive industries can maximize uptime and

push the limits of performance, running their assets faster, safer,

longer and greener. Visit AspenTech.com to find out more.

Forward-Looking Statements

The third paragraph of this press release contains

forward-looking statements for purposes of the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995.

Actual results may vary significantly from AspenTech’s expectations

based on a number of risks and uncertainties, including, without

limitation: AspenTech’s failure to increase usage and product

adoption of aspenONE offerings or grow the aspenONE APM business,

and failure to continue to provide innovative, market-leading

solutions; the demand for, or usage of, aspenONE software declines

for any reason, including declines due to adverse changes in the

process or other capital-intensive industries; unfavorable economic

and market conditions or a lessening demand in the market for asset

process optimization software; risks of foreign operations or

transacting business with customers outside the United States;

risks of competition and other risk factors described from time to

time in AspenTech’s periodic reports filed with the Securities and

Exchange Commission. AspenTech cannot guarantee any future results,

levels of activity, performance, or achievements. AspenTech

expressly disclaims any obligation to update forward-looking

statements after the date of this press release.

© 2019 Aspen Technology, Inc. AspenTech, aspenONE, and the Aspen

leaf logo are trademarks of Aspen Technology, Inc. All rights

reserved. All other trademarks are property of their respective

owners.

Source: Aspen Technology, Inc.

ASPEN TECHNOLOGY, INC. AND

SUBSIDIARIESCONSOLIDATED STATEMENTS OF

OPERATIONS(Unaudited in Thousands, Except per Share Data)

Three Months EndedDecember

31,

Six Months EndedDecember

31,

2018 2017 2018

2017 As Adjusted As Adjusted Revenue:

License $ 93,368 $ 56,975 $ 157,123 $ 135,865 Maintenance 41,038

40,729 84,077 80,993 Services and other 6,017 7,826

13,392 15,159 Total revenue 140,423 105,530

254,592 232,017

Cost of revenue:

License 1,819 1,233 3,484 2,464 Maintenance 5,286 4,250 9,279 8,802

Services and other 7,634 6,606 15,203 13,555

Total cost of revenue 14,739 12,089 27,966

24,821 Gross profit 125,684 93,441

226,626 207,196

Operating expenses: Selling

and marketing 26,310 23,928 53,122 47,444 Research and development

20,317 19,790 41,373 39,279 General and administrative 15,299

19,618 31,383 34,655 Total operating

expenses 61,926 63,336 125,878 121,378

Income from operations 63,758 30,105 100,748 85,818 Interest income

7,485 6,239 14,554 12,545 Interest (expense) (2,164 ) (1,261 )

(3,978 ) (2,467 ) Other (expense), net (578 ) (238 ) (451 ) (854 )

Income before income taxes 68,501 34,845 110,873 95,042 Provision

for (benefit from) income taxes 9,284 (97,187 ) 13,591

(77,510 ) Net income $ 59,217 $ 132,032 $

97,282 $ 172,552

Net income per common share:

Basic $ 0.84 $ 1.83 $ 1.38 $ 2.37 Diluted $ 0.83 $ 1.81 $ 1.36 $

2.35

Weighted average shares outstanding: Basic 70,428

72,342 70,708 72,683 Diluted 71,148 73,036 71,600 73,333

ASPEN TECHNOLOGY, INC. AND

SUBSIDIARIESCONSOLIDATED BALANCE SHEETS(Unaudited in

Thousands, Except Share and Per Share Data)

December 31, 2018

June 30, 2018

As Adjusted ASSETS Current assets: Cash and cash

equivalents $ 54,428 $ 96,165 Accounts receivable, net 56,586

41,810 Current contract assets 321,135 304,378

Contract costs

23,046

20,500

Prepaid expenses and other current assets 10,330 10,509 Prepaid

income taxes 921 2,601 Total current assets

466,446

475,963

Property, equipment and leasehold improvements, net 8,311 9,806

Computer software development costs, net 691 646 Goodwill 74,802

75,590 Intangible assets, net 32,889 35,310 Non-current contract

assets 366,581 340,622 Non-current deferred tax assets 1,651 11,090

Other non-current assets 1,075 1,297 Total assets $

952,446 $ 950,324

LIABILITIES AND STOCKHOLDERS’

EQUITY Current liabilities: Accounts payable $ 5,249 $ 4,230

Accrued expenses and other current liabilities 36,688 39,515 Income

taxes payable 43,573 1,698 Borrowings under credit agreement

220,000 170,000 Current deferred revenue 23,145 15,150

Total current liabilities 328,655 230,593 Non-current

deferred revenue 18,167 12,354 Deferred income taxes 157,238

214,125 Other non-current liabilities 16,192 17,068 Commitments and

contingencies (Note 16) Series D redeemable convertible preferred

stock, $0.10 par value—Authorized— 3,636 shares as of December 31,

2018 and June 30, 2018Issued and outstanding— none as of December

31, 2018 and June 30, 2018 — — Stockholders’ equity: Common stock,

$0.10 par value— Authorized—210,000,000 sharesIssued— 103,395,683

shares at December 31, 2018 and 103,130,300 shares at June 30,

2018Outstanding— 69,803,177 shares at December 31, 2018 and

71,186,701 shares at June 30, 2018 10,340 10,313 Additional paid-in

capital 725,493 715,475 Retained earnings 1,162,790 1,065,507

Accumulated other comprehensive income 70 1,388 Treasury stock, at

cost—33,592,506 shares of common stock at December 31, 2018 and

31,943,599 shares at June 30, 2018 (1,466,499 ) (1,316,499 ) Total

stockholders’ equity 432,194 476,184 Total

liabilities and stockholders’ equity $ 952,446 $ 950,324

ASPEN TECHNOLOGY, INC. AND

SUBSIDIARIESCONSOLIDATED STATEMENTS OF CASH

FLOWS(Unaudited in Thousands)

Three Months EndedDecember

31, Six Months EndedDecember 31, 2018

2017 2018 2017

As Adjusted As Adjusted Cash flows from operating

activities: Net income $ 59,217 $ 132,032 $ 97,282 $ 172,552

Adjustments to reconcile net income to net cash provided by

operating activities: Depreciation and amortization 2,049 1,605

4,049 3,358 Net foreign currency losses 518 54 318 990 Stock-based

compensation 6,335 5,455 15,200 11,869 Deferred income taxes (2,804

) (90,748 ) (47,474 ) (90,781 ) Provision for (recovery from) bad

debts 658 (48 ) 827 (28 ) Other non-cash operating activities 110

207 217 207

Changes in assets and liabilities: Accounts

receivable (3,935 ) 8,760 (16,464 ) (333 ) Contract assets (11,014

) (5,136 ) (41,928 ) (40,927 ) Contract costs (1,750 ) 126 (2,546 )

(59 ) Prepaid expenses, prepaid income taxes, and other assets

2,599 (1,333 ) 1,744 959 Accounts payable, accrued expenses, income

taxes payable and other liabilities 2,793 (8,557 ) 37,718 (1,792 )

Deferred revenue 2,751 (15 ) 14,154 (1,253 ) Net cash

provided by operating activities 57,527 42,402 63,097

54,762

Cash flows from investing activities:

Purchases of property, equipment and leasehold improvements (84 )

(33 ) (180 ) (156 ) Payments for business acquisitions — (10,800 )

— (10,800 ) Payments for capitalized computer software costs (99 )

(291 ) (189 ) (356 ) Net cash used in investing activities (183 )

(11,124 ) (369 ) (11,312 )

Cash flows from financing

activities: Exercises of stock options 412 1,137 4,466 3,548

Repurchases of common stock (97,446 ) (49,928 ) (147,423 ) (105,037

) Payments of tax withholding obligations related to restricted

stock (6,475 ) (1,817 ) (9,654 ) (3,467 ) Deferred business

acquisition payments (1,200 ) (2,000 ) (1,200 ) (2,600 ) Proceeds

from credit agreement 50,000 11,000 50,000 11,000 Payments of

credit agreement issuance costs — — — (351 )

Net cash used in financing activities (54,709 ) (41,608 ) (103,811

) (96,907 ) Effect of exchange rate changes on cash and cash

equivalents (255 ) 50 (654 ) 206 Increase (decrease)

in cash and cash equivalents 2,380 (10,280 ) (41,737 ) (53,251 )

Cash and cash equivalents, beginning of period 52,048 58,983

96,165 101,954

Cash and cash equivalents,

end of period $ 54,428 $ 48,703 $ 54,428 $

48,703 Supplemental disclosure of cash flow

information: Income taxes paid, net $ 15,072 $ 28,499 $ 17,827 $

29,742 Interest paid 2,003 1,071 3,541 2,039

ASPEN TECHNOLOGY, INC. AND

SUBSIDIARIESReconciliation of GAAP to Non-GAAP Results of

Operations and Cash Flows(Unaudited in Thousands, Except per

Share Data)

Three

Months EndedDecember 31, Six Months

EndedDecember 31, 2018 2017 2018

2017 As Adjusted As Adjusted

Total

expenses

GAAP total expenses (a) $ 76,665 $ 75,425 $ 153,844 $ 146,199 Less:

Stock-based compensation (b) (6,335 ) (5,455 ) (15,200 ) (11,869 )

Amortization of intangibles (1,156 ) (526 ) (2,223 ) (1,052 )

Litigation judgment — (1,548 ) — (1,548 ) Acquisition related fees

— (198 ) 7 (328 )

Non-GAAP total expenses

$ 69,174 $ 67,698

$ 136,428 $ 131,402

Income from

operations

GAAP income from operations $ 63,758 $ 30,105 $ 100,748 $ 85,818

Plus: Stock-based compensation (b) 6,335 5,455 15,200 11,869

Amortization of intangibles 1,156 526 2,223 1,052 Litigation

judgment — 1,548 — 1,548 Acquisition related fees — 198 (7 ) 328

Non-GAAP income from operations

$ 71,249 $ 37,832

$ 118,164 $ 100,615

Net

income

GAAP net income $ 59,217 $ 132,032 $ 97,282 $ 172,552 Plus:

Stock-based compensation (b) 6,335 5,455 15,200 11,869 Amortization

of intangibles 1,156 526 2,223 1,052 Litigation judgment — 1,548 —

1,548 Acquisition related fees — 198 (7 ) 328 Less: Income tax

effect on Non-GAAP items (c) (1,573 ) (2,782 ) (3,657 ) (5,327 )

Non-GAAP net income $

65,135 $ 136,977 $

111,041 $ 182,022

Diluted income

per share

GAAP diluted income per share $ 0.83 $ 1.81 $ 1.36 $ 2.35 Plus:

Stock-based compensation (b) 0.09 0.07 0.21 0.16 Amortization of

intangibles 0.02 0.01 0.03 0.01 Litigation judgment — 0.02 — 0.02

Acquisition related fees — 0.01 — 0.01 Less: Income tax effect on

Non-GAAP items (c) (0.02 ) (0.04 ) (0.05 ) (0.07 )

Non-GAAP diluted income per share $

0.92 $ 1.88 $ 1.55

$ 2.48 Shares used in computing

Non-GAAP diluted income per share 71,148 73,036 71,600 73,333

Three Months EndedDecember 31,

Six Months EndedDecember 31, 2018 2017

2018 2017 As Adjusted As Adjusted

Free Cash

Flow

GAAP cash flow from operating activities $ 57,527 $ 42,402 $ 63,097

$ 54,762 Purchase of property, equipment and leasehold

improvements (84 ) (33 ) (180 ) (156 ) Capitalized computer

software development costs (99 ) (291 ) (189 ) (356 )

Non-capitalized acquired technology (d) — — — 75 Acquisition

related fee payments — 88

12 88 Free Cash Flow

$ 57,344 $ 42,166

$ 62,740 $ 54,413 (a)

GAAP total expenses

Three Months EndedDecember 31,

Six Months EndedDecember 31, 2018 2017

2018 2017 As Adjusted As Adjusted Total

costs of revenue $ 14,739 $ 12,089 $ 27,966 $ 24,821 Total

operating expenses 61,926 63,336 125,878

121,378 GAAP total expenses $ 76,665 $ 75,425

$ 153,844 $ 146,199 (b) Stock-based

compensation expense was as follows:

Three Months

EndedDecember 31, Six Months EndedDecember

31, 2018 2017 2018 2017 Cost of

maintenance $ 391 $ — $ 537 $ — Cost of services and other 288 324

606 774 Selling and marketing 1,194 1,006 2,526 1,891 Research and

development 1,637 1,891 3,932 3,788 General and administrative

2,825 2,234 7,599 5,416 Total

stock-based compensation $ 6,335 $ 5,455 $ 15,200

$ 11,869

(c) The income tax effect on non-GAAP items for the three and

six months ended December 31, 2018 is calculated utilizing the

Company's statutory tax rate, of 21 percent. The income tax effect

on non-GAAP items for the three and six months ended December 31,

2017 is calculated utilizing the Company's estimated federal and

state tax rate.

(d) In the six months ended December 31, 2017, the Company has

excluded $0.1 million of final payments related to non-capitalized

acquired technology from prior fiscal periods from free cash flow

to be consistent with the treatment of other transactions where the

acquired assets were capitalized.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190123005797/en/

Media ContactDavid GripAspenTech+1

781-221-5273david.grip@aspentech.com

Investor ContactBrian DenyeauICR+1

646-277-1251brian.denyeau@icrinc.com

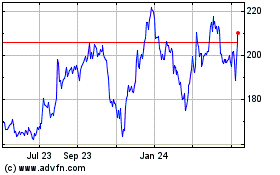

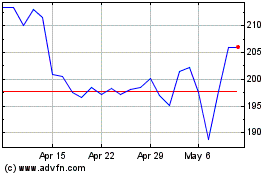

Aspen Technology (NASDAQ:AZPN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Aspen Technology (NASDAQ:AZPN)

Historical Stock Chart

From Jul 2023 to Jul 2024