Arqit Quantum Inc. (Nasdaq: ARQQ, ARQQW) (“Arqit”), a global leader

in post quantum encryption technology, today announced its

operational and financial results for the six months ended 31 March

2023.

Recent Operational

Highlights

- In December

2022, Arqit launched a pivot in go-to-market strategy to selling

our cloud delivered QuantumCloud™ platform as a service

(“PaaS") through channel partnerships rather than a previous

emphasis on direct enterprise license sales. The first half of

fiscal year 2023 has been focussed on the establishment and

activation of these channel partnerships.

- Arqit generated

initial revenues through a channel partnership during the first

half of fiscal year 2023 which, combined with significant new

business enquiries through our channel partners, has provided

support for the merits of the pivot in go-to-market strategy.

- Arqit is

continuing to engage with customers on enterprise license sales in

the government and defence sectors where customers prefer not to

use cloud services, but the sales cycle in government and defence

has proven to be lengthy.

- In order to optimise the ease of

consumption for customers, Arqit is focussed on the sale of

specialised applications of its QuantumCloud™ PaaS for

specific vertical market opportunities. The first two applications

which are available to customers are:

- Arqit

NetworkSecure™ which provides a symmetric key agreement upgrade for

firewalls and has already been integrated with the products of two

market leading firewall vendors.

- Arqit TradeSecure™ which provides a

symmetric key agreement upgrade for digital assets used by banks

for international payments and for use in global trade

finance.

Arqit intends to launch further applications for

specific uses cases in the near term. Arqit’s

QuantumCloud™ PaaS product is also generally available for

license by systems integrators and developers to incorporate into

their own applications and use cases.

- In December 2022

Arqit announced that through innovation in the delivery of its

products, quantum satellite hardware was no longer required and

that it intends to monetize (in whole or in part as a capacity

sharing arrangement) its quantum satellite currently under

construction. Following that announcement, we initiated a partner

search process to consider wholesale capacity sales or joint

ventures, and received indications that an outright sale of the

business might be viable. As a result, Arqit is now considering the

sale of its satellite division amongst other potential

transactions. The satellite division consists of satellite assets

under construction, patents, customer contracts and an engineering

team. Arqit has retained an adviser to assist in the

process. There can be no certainty that Arqit will be

able to identify a purchaser for the satellite division, or if a

purchaser is identified, the sales price the purchaser would be

willing to pay.

- With a $10.0

million claim, Arqit is the largest unsecured creditor identified

to date in the Virgin Orbit Chapter 11 bankruptcy process, which

was initiated in the U.S. in April. We have already made a full

provision in our financial statements for amounts owed to Arqit by

Virgin Orbit, which may be mitigated in whole or in part through

the bankruptcy process. Given Arqit’s initiatives regarding its

satellite division, the Virgin Orbit bankruptcy is not expected to

have a material impact on the operation of our business results

going forward.

- In May 2023,

Arqit undertook a significant cost reduction initiative across all

business functions which included the elimination of 20 positions

in the company. These cost reduction actions have been implemented.

Pro forma for the cost reduction initiative, Arqit has 150

employees as compared to 170 at the end of the reporting period.

The cost reduction initiative results in a 30% decrease in monthly

budgeted operating costs to approximately $3.2 million commencing

July from previously budgeted monthly operating costs of

approximately $4.6 million. As of 31 March 2023, Arqit

had $41.5 million of cash and cash equivalents. We expect

additional cost reduction, including with respect to personnel,

should a transaction involving Arqit’s satellite division be

consummated.

-

In February 2023, Arqit issued 10 million ordinary shares, together

with warrants to purchase up to 7.5 million ordinary shares, at a

combined offering price of $2.00 per ordinary share and

accompanying warrant in a registered direct offering. The

transaction closed on February 22, 2023. Proceeds to the company

before fees and expenses were $20 million, and are being used to

enhance international customer service capabilities in support of

the growth of our channel partnerships and for general corporate

purposes.

-

In December 2022, Arqit established an at-the-market equity

offering program (the “ATM Program”) pursuant to which it may issue

and sell ordinary shares with an aggregate offering amount of up to

$50.0 million. We have no obligation to sell any shares under

the ATM Program. During the six months ended 31 March 2023, we

issued 472,396 shares under the ATM Program, generating proceeds to

the company before fees and expenses of approximately $1.3

million.

Management Commentary

The first half of fiscal year 2023 reflects the

pivot that we made at the end of 2022. We believe that early

evidence suggests that an all-software tech stack and a

go-to-market strategy of integrating with major global technology

vendors is the best path to success.

The planned monetization of our satellite

division in addition to the recent cost cutting initiative we have

undertaken has resulted in a leaner operation, focussed on customer

needs with a more nimble orientation.

The launch and positive reception by our initial

and prospective customers of our QuantumCloud™ PaaS offering

through channel partnerships and the TradeSecure™ and

NetworkSecure™ applications gives us confidence that our

products have a bright future. The pipeline of business through our

channel partnerships for our new applications is encouraging, and

we expect them to provide the underpinning of a business which is

capable of developing efficient scaling. It is clear from the

statements of the White House and others that an upgrade to

encryption is now regarded as essential, and Arqit is confident

that it has a product which is fit for purpose and is easy to

consume. We have given ourselves extra runway to demonstrate our

ability to scale. As we now execute a more focussed business plan,

we will also prepare for the next phase of growth by continuing to

look at best practice governance arrangements of the company, which

will include the intention during the next year to separate the

role of Chairman and Chief Executive.

Commented David Williams, Arqit Founder,

Chairman and Chief Executive Officer, “It has been a tough year in

technology markets generally, and Arqit has made some significant

pivots. But the reception we have seen for our channel partner

offerings and applications convince us that we have the right

products at the right moment to solve the evident problems with

legacy encryption which the world is finally addressing.”

First Half of Fiscal Year 2023 Financial

Highlights

The following is a summary of Arqit’s operating

results for the six month period ended 31 March 2023. Comparison is

made, where applicable, to the comparable period ended 31 March

2022.

- Generated $2.6

million in revenue and other operating income for the first half of

fiscal year 2023 as compared to $12.3 million for the comparable

period in 2022.

-

QuantumCloud™ revenue totalled $19.0 thousand for the period

from two contracts, including an initial sale through one of

Arqit’s NetworkSecure™ (firewall) channel partnerships and a

sale to a leading U.S. government and defence contractor.

Additional revenues from the contract associated with the sale of

NetworkSecure™ through our channel partner are expected. For

the comparable period in 2022, QuantumCloud™ revenue totalled

$5.3 million as a result of enterprise license sales in that

period.

- Other operating

income of $2.6 million resulted primarily from Arqit’s project

contract with the European Space Agency (“ESA”). For the first half

of fiscal 2022, other operating income totaled $7.0 million from

Arqit’s ESA contract.

- Administrative

expenses1 for the period were $25.0 million versus $26.6 million

for the comparable period in 2022. Higher employee costs during the

period were offset primarily by favorable movement in foreign

exchange rates. Headcount increased to 170 from 145 at 30 September

2022. Following the recently implemented cost reduction initiative,

Arqit’s pro forma headcount is 150. Administrative expense for the

period includes a $9.0 million non-cash charge for share based

compensation versus a $10.1 million charge for the comparable

period in 2022.

- Operating loss

for the period was $34.6 million versus a loss of $14.3 million for

the first half of fiscal year 2022. The variance in operating loss

between periods primarily reflects lower revenue and other

operating income, combined with a $12.2 million impairment on trade

receivables and contract assets associated with the Virgin Orbit

bankruptcy.

- Loss before tax

was $21.8 million. Adjusted loss before tax was $34.7 million2

which in management’s view reflects the underlying business

performance once the non-cash change in warrant value is deducted

from loss before tax. For the comparable period in fiscal year

2022, profit before tax was $58.0 million and adjusted loss before

tax was $14.4 million. The variance between periods is primarily

due to the change in fair value of warrants.

- Arqit ended the

first half of fiscal 2023 with a cash and cash equivalents of $41.5

million versus a cash balance of $48.9 million as of Arqit’s 30

September 2022 fiscal year end.

- During the

period 1,706,744 restricted share units were granted under Arqit’s

equity incentive plan. A total of 4,466,723 restricted share units

and 8,004,817 options, have been granted to employees, officers and

directors under the plan to date.

Conference Call Information

Arqit will host a conference call at 11:00 a.m.

ET / 8:00 a.m. PT on 17 May 2023 with the Company’s Founder,

Chairman and CEO, David Williams, and CFO, Nick Pointon. A live

webcast of the call will be available on the “News & Events”

page of the Company’s website at ir.arqit.uk. To access the call by

phone, please go to this link (registration link) and you will be

provided with dial in details. To avoid delays, we encourage

participants to dial into the conference call fifteen minutes ahead

of the scheduled start time. A replay of the webcast will also be

available for a limited time at ir.arqit.uk.

1 Administrative expenses are equivalent to operating

expenses.

2 Adjusted loss before tax is a non-IFRS

measure. For a discussion of this measure, how its calculated and a

reconciliation to the most comparable measure calculated in

accordance with IFRS, please see “Use of Non-IFRS Financial

Measures” below.

About Arqit

Arqit supplies a unique quantum safe encryption

Platform-as-a-Service which makes the communications links or data

at rest of any networked device or cloud machine secure against

current and future forms of attack – even from a quantum computer.

Arqit’s product, QuantumCloud™, enables any device to download a

lightweight software agent, which can create encryption keys in

partnership with any number of other devices. The keys are

computationally secure, optionally one-time use and zero trust.

QuantumCloud™ can create limitless volumes of keys in limitless

group sizes and can regulate the secure entrance and exit of a

device in a group. The addressable market for QuantumCloud™ is

every connected device. Arqit was recently awarded the Innovation

in Cyber award at the UK National Cyber Awards and Cyber Security

Software Company of the Year Award at the UK Cyber Security Awards.

www.arqit.uk

Media relations

enquiries:Arqit: contactus@arqit.ukGateway: arqit@gatewayir.com

Investor relations

enquiries:Arqit: investorrelations@arqit.ukGateway: arqit@gatewayir.com

Use of Non-IFRS Financial Measures

Arqit presents adjusted loss before tax, which

is a financial measure not calculated in accordance with IFRS.

Although Arqit's management uses this measure as an aid in

monitoring Arqit's on-going financial performance, investors should

consider adjusted loss before tax in addition to, and not as a

substitute for, or superior to, financial performance measures

prepared in accordance with IFRS. Adjusted loss before tax is

defined as loss before tax excluding change in fair value of

warrants, which is non-cash. There are limitations associated with

the use of non-IFRS financial measures, including that such

measures may not be comparable to similarly titled measures used by

other companies due to potential differences among calculation

methodologies. There can be no assurance whether (i) items excluded

from the non-IFRS financial measures will occur in the future, or

(ii) there will be cash costs associated with items excluded from

the non-IFRS financial measures. Arqit compensates for these

limitations by using adjusted loss before tax as a supplement to

IFRS loss before tax and by providing the reconciliation for

adjusted loss before tax to IFRS loss before tax, as the most

comparable IFRS financial measure.

IFRS and Non-IFRS loss before tax

Arqit presents its consolidated statement of

comprehensive income according to IFRS and in line with SEC

guidance. Consequently, the changes in warrant values are included

within that statement in arriving at loss before tax. The changes

in warrant values are non-cash. After this adjustment is made to

Arqit’s IFRS loss before tax of $21.8 million, Arqit’s non-IFRS

adjusted loss before tax is $34.7 million, as shown in the

reconciliation table below.

|

|

Six month period ended 31 March

2023$’000 |

|

|

Loss before tax on an IFRS basis |

$ |

(21,836 |

) |

|

|

Change in fair value of warrants |

|

(12,910 |

) |

|

|

Adjusted loss before tax |

$ |

(34,746 |

) |

|

The change in fair value of warrants arises as

IFRS requires our outstanding warrants to be carried at fair value

within liabilities with the change in value from one reporting date

to the next being reflected against profit or loss in the period.

It is non-cash and will cease when the warrants are exercised, are

redeemed, or expire.

Other Accounting Information

As of 31 March 2023, we had $34.3 million of

total liabilities, $0.6 million of which related to our outstanding

warrants, which are classified as liabilities rather than equity

according to IFRS and SEC guidance. The warrant liability

amount reflected in our consolidated statement of financial

position is calculated as the fair value of the warrants as of 31

March 2023. Our liabilities other than warrant liabilities

were $33.7 million, and we had total assets of $114.5 million

including cash of $41.5 million.

Caution About Forward-Looking

Statements

This communication includes forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. All statements, other than statements of

historical facts, may be forward-looking statements. These

forward-looking statements are based on Arqit’s expectations and

beliefs concerning future events and involve risks and

uncertainties that may cause actual results to differ materially

from current expectations. These factors are difficult to predict

accurately and may be beyond Arqit’s control. Forward-looking

statements in this communication or elsewhere speak only as of the

date made. New uncertainties and risks arise from time to time, and

it is impossible for Arqit to predict these events or how they may

affect it. Except as required by law, Arqit does not have any duty

to, and does not intend to, update or revise the forward-looking

statements in this communication or elsewhere after the date this

communication is issued. In light of these risks and uncertainties,

investors should keep in mind that results, events or developments

discussed in any forward-looking statement made in this

communication may not occur. Uncertainties and risk factors that

could affect Arqit’s future performance and cause results to differ

from the forward-looking statements in this release include, but

are not limited to: (i) the outcome of any legal proceedings that

may be instituted against the Arqit related to the business

combination, (ii) the ability to maintain the listing of Arqit’s

securities on a national securities exchange, (iii) changes in the

competitive and regulated industries in which Arqit operates,

variations in operating performance across competitors and changes

in laws and regulations affecting Arqit’s business, (iv) the

ability to implement business plans, forecasts, and other

expectations, and identify and realise additional opportunities,

(v) the potential inability of Arqit to convert its pipeline into

contracts or orders in backlog into revenue, (vi) the potential

inability of Arqit to successfully deliver its operational

technology, (vii) the risk of interruption or failure of Arqit’s

information technology and communications system, (viii) the

enforceability of Arqit’s intellectual property, and (ix) other

risks and uncertainties set forth in the sections entitled “Risk

Factors” and “Cautionary Note Regarding Forward-Looking Statements”

in Arqit’s annual report on Form 20-F (the “Form 20-F”), filed with

the U.S. Securities and Exchange Commission (the “SEC”) on 14

December 2022 and in subsequent filings with the SEC. While the

list of factors discussed above and in the Form 20-F and other SEC

filings are considered representative, no such list should be

considered to be a complete statement of all potential risks and

uncertainties. Unlisted factors may present significant additional

obstacles to the realisation of forward-looking statements.

| Arqit Quantum

Inc. |

|

|

|

|

|

|

Condensed Consolidated Statement of Comprehensive

Income |

|

|

|

|

|

|

|

| For the

period ended 31 March 2023 |

|

|

| |

|

|

|

|

|

| |

|

|

Unaudited six month |

|

Unaudited six month |

| |

|

|

period ended |

|

period ended |

| |

|

|

31 March 2023 |

|

31 March 2022 |

| |

|

|

$'000 |

|

$'000 |

| |

|

|

|

|

|

|

Revenue |

|

|

19 |

|

|

5,293 |

|

| Other operating income |

|

|

2,570 |

|

|

6,959 |

|

| Administrative expenses |

|

|

(24,963) |

|

|

(26,600) |

|

| Impairment loss on trade

receivables and contract assets |

|

|

(12,203) |

|

|

— |

|

| Operating

loss |

|

|

(34,577) |

|

|

(14,348) |

|

| Change in fair value of

warrants |

|

|

12,910 |

|

|

72,464 |

|

| Finance costs |

|

|

(169) |

|

|

(69) |

|

| Finance income |

|

|

— |

|

|

— |

|

| (Loss)/ profit before

tax |

|

|

(21,836) |

|

|

58,047 |

|

| Income tax |

|

|

— |

|

|

— |

|

| |

|

|

|

|

|

| (Loss)/ profit for the

financial year attributable to equity holders |

|

|

(21,836) |

|

|

58,047 |

|

| Other comprehensive

(loss)/income : |

|

|

|

|

|

| Items that may be reclassified

to profit or loss |

|

|

|

|

|

| Currency translation

differences |

|

|

(2,503) |

|

|

258 |

|

| |

|

|

|

|

|

| Total comprehensive

(loss)/ profit for the year attributable to equity

holders |

|

|

(24,339) |

|

|

58,305 |

|

| |

|

|

|

|

|

| Earnings per ordinary

share from continuing operations attributable to equity

holders |

|

|

|

|

|

| Basic earnings per share |

|

|

(0.17409) |

|

|

0.48212 |

|

| Diluted earnings per

share |

|

|

(0.17409) |

|

|

0.47999 |

|

| Arqit Quantum

Inc. |

|

|

|

|

|

| Condensed Consolidated

Statement of Financial Position |

|

|

|

|

|

|

|

| As at 31 March

2022 |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

Unaudited |

|

Audited |

| |

|

|

31 March |

|

30 September |

|

|

|

|

2023 |

|

|

2022 |

|

| |

|

|

$'000 |

|

$'000 |

| ASSETS |

|

|

|

|

|

| Non-current

assets |

|

|

|

|

|

| Property, plant and

equipment |

|

|

2,435 |

|

|

2,206 |

|

| Right of use asset |

|

|

7,106 |

|

|

6,139 |

|

| Intangible assets |

|

|

57,221 |

|

|

40,291 |

|

| Fixed asset investments |

|

|

31 |

|

|

28 |

|

| Trade and other

receivables |

|

|

1,918 |

|

|

18,565 |

|

| Total non-current assets |

|

|

68,711 |

|

|

67,229 |

|

| |

|

|

|

|

|

| Current

assets |

|

|

|

|

|

| Trade and other

receivables |

|

|

4,252 |

|

|

7,677 |

|

| Cash and cash equivalents |

|

|

41,504 |

|

|

48,966 |

|

| Total current assets |

|

|

45,756 |

|

|

56,643 |

|

| Total

assets |

|

|

114,467 |

|

|

123,872 |

|

| |

|

|

|

|

|

|

LIABILITIES |

|

|

|

|

|

| Current

liabilities |

|

|

|

|

|

| Trade and other payables |

|

|

19,203 |

|

|

22,655 |

|

| Lease liabilities |

|

|

1,580 |

|

|

1,154 |

|

| Total current liabilities |

|

|

20,783 |

|

|

23,809 |

|

| |

|

|

|

|

|

| Non-current

liabilities |

|

|

|

|

|

| Trade and other payables |

|

|

5,293 |

|

|

4,183 |

|

| Lease liabilities |

|

|

7,595 |

|

|

6,681 |

|

| Warrants liability |

|

|

633 |

|

|

10,644 |

|

| Total non-current

liabilities |

|

|

13,521 |

|

|

21,508 |

|

| Total

liabilities |

|

|

34,304 |

|

|

45,317 |

|

| |

|

|

|

|

|

| Net

assets |

|

|

80,163 |

|

|

78,555 |

|

| |

|

|

|

|

|

| EQUITY |

|

|

|

|

|

| Share capital |

|

|

13 |

|

|

12 |

|

| Share premium |

|

|

109,195 |

|

|

92,306 |

|

| |

|

|

|

|

|

| Other reserves |

|

|

166,804 |

|

|

166,804 |

|

| Foreign currency translation

reserve |

|

|

854 |

|

|

3,357 |

|

| Share-based payment

reserve |

|

|

32,272 |

|

|

23,216 |

|

| Retained earnings |

|

|

(228,975) |

|

|

(207,140) |

|

| Total

Equity |

|

|

80,163 |

|

|

78,555 |

|

| Arqit

Quantum Inc. |

| Condensed

Consolidated Statement of Cash Flows |

| For the

period ended 31 March 2023 |

| |

|

Unaudited six month period ended |

|

Unaudited six month period ended |

| |

|

31 March 2023 |

|

31 March 2022 |

| |

|

$'000 |

|

$'000 |

| Cash flows from

operating activities |

|

|

|

|

|

Cash used in operations |

|

(8,077) |

|

|

(13,221) |

|

| |

|

|

|

|

| Net cash used in

operating activities |

|

(8,077) |

|

|

(13,221) |

|

| |

|

|

|

|

| Cash flows from

investing activities |

|

|

|

|

| Capital expenditure on

property, plant and equipment |

|

(207) |

|

|

(609) |

|

| Capital expenditure on

intangibles |

|

(16,930) |

|

|

(12,883) |

|

| |

|

|

|

|

| Net cash used in

investing activities |

|

(17,137) |

|

|

(13,492) |

|

| |

|

|

|

|

| Cash flows from

financing activities |

|

|

|

|

| Shares issued on exercise of

warrants |

|

— |

|

|

21,279 |

|

| Proceeds from issue of

shares |

|

18,509 |

|

|

— |

|

| Payments of lease

liabilities |

|

(558) |

|

|

(205) |

|

| Payments of interest portion

of lease liabilities |

|

(99) |

|

|

(73) |

|

| Proceeds from government

grants |

|

508 |

|

|

— |

|

| |

|

|

|

|

| Net cash generated

from financing activities |

|

18,360 |

|

|

21,001 |

|

| |

|

|

|

|

| |

|

|

|

|

| Net decrease in cash

and cash equivalents |

|

(6,854) |

|

|

(5,712) |

|

| Cash and cash equivalents at

beginning of period |

|

48,966 |

|

|

86,966 |

|

| Foreign exchange on cash and

cash equivalents |

|

(608) |

|

|

904 |

|

| |

|

|

|

|

| Cash and cash

equivalents at end of period |

|

41,504 |

|

|

82,158 |

|

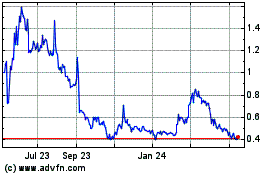

Arqit Quantum (NASDAQ:ARQQ)

Historical Stock Chart

From Dec 2024 to Jan 2025

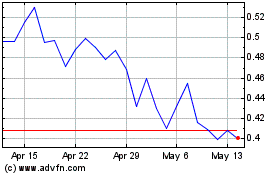

Arqit Quantum (NASDAQ:ARQQ)

Historical Stock Chart

From Jan 2024 to Jan 2025