0000004904false00000049042025-01-092025-01-090000004904aep:AEPTransmissionCoMember2025-01-092025-01-090000004904exch:XNASus-gaap:CommonStockMember2025-01-092025-01-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

| | | | | |

| Date of report (Date of earliest event reported) | January 9, 2025 |

| | |

| AMERICAN ELECTRIC POWER COMPANY, INC. |

(Exact Name of Registrant as Specified in Its Charter)

| | | | | | | | |

| New York | 1-3525 | 13-4922640 |

| (State or Other Jurisdiction of | (Commission File Number) | (IRS Employer Identification |

Incorporation) | | No.) |

| | |

| AEP TRANSMISSION COMPANY, LLC |

| | |

| Delaware | 333-217143 | 46-1125168 |

| (State or Other Jurisdiction of | (Commission File Number) | (IRS Employer Identification |

Incorporation) | | No.) |

| | | | | | | | | | | |

| 1 Riverside Plaza, | Columbus, | OH | 43215 |

| (Address of Principal Executive Offices) | (Zip Code) |

| | | | | | | | | | | |

| (Registrant's Telephone Number, Including Area Code) | (614) | 716-1000 | |

| | | |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | |

| Registrant | Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| American Electric Power Company, Inc. | Common Stock, $6.50 par value | AEP | The NASDAQ Stock Market LLC |

| | | | | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). |

Emerging growth company | ☐ |

| |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. |

| □ |

Item 1.01. Entry into a Material Definitive Agreement.

On January 9, 2025, AEP Transmission Company, LLC (“AEP Transmission”), a wholly owned subsidiary of American Electric Power Company, Inc. (“AEP”), along with Midwest Transmission Holdings, LLC (the “Company”), a newly formed wholly owned subsidiary of AEP Transmission that owns all of the issued and outstanding stock of each of AEP Indiana Michigan Transmission Company, Inc., and AEP Ohio Transmission Company, Inc., entered into a Contribution Agreement (the “Contribution Agreement”) with Olympus BidCo L.P. (the “Investor”), a special purpose entity controlled by (i) investment funds managed by or affiliated with Kohlberg Kravis Roberts & Co. L.P. ("KKR") and (ii) Public Sector Pension Investment Board ("PSPIB"), pursuant to which the Company agreed to issue to Investor at the closing (the “Closing”), and Investor agreed to acquire from the Company, certain newly issued membership interests of the Company, such that Investor will own 19.9% of the issued and outstanding membership interests of the Company, for a purchase price of $2,820,000,000.

The purchase price is subject to certain adjustments based on capital contributions made by AEP Transmission to the Company and cash dividends and cash distributions made or declared by the Company, in each case, subject to certain limitations.

The issuance of membership interests under the Contribution Agreement is subject to the satisfaction of certain customary conditions described in the Contribution Agreement, including receipt of authorization by the Federal Energy Regulatory Commission and clearance by the Committee on Foreign Investments in the United States.

The Contribution Agreement contains customary representations and warranties by AEP Transmission, the Company and Investor. In addition, each of the parties has agreed to customary covenants, including customary covenants to take actions necessary to obtain applicable regulatory approvals and consummate the transactions contemplated by the Contribution Agreement.

The Contribution Agreement may be terminated: (a) by mutual consent of the parties; (b) by AEP Transmission, the Investor or the Company if the Closing has not occurred within nine months, subject to possible automatic extension, or if, prior to the Closing a law or order restraining, enjoining or otherwise prohibiting the Closing in any competent jurisdiction becomes final and non-appealable; or (c) by the Investor or the Company, as the case may be, prior to the Closing upon the occurrence of certain material breaches or failures to perform any of the representations, warranties, covenants or agreements by the other parties.

Pursuant to the terms of the Contribution Agreement, in connection with the Closing, Investor, the Company and AEP Transmission will enter into an Amended and Restated Limited Liability Company Agreement of the Company (the “LLC Agreement”). The LLC Agreement, among other things, provides for the governance, capital contribution obligations, and distribution requirements, and other arrangements for the Company from and following the Closing. The LLC Agreement contains certain investor protections, including, among other things, requiring Investor approval for the Company to take certain major actions. In addition, certain transfer restrictions and other transfer rights apply to Investor and AEP Transmission under the LLC Agreement.

Item 7.01 Regulation FD Disclosure.

On January 9, 2025, AEP and AEP Transmission issued a press release announcing that AEP Transmission and the Company entered into the Contribution Agreement with the Investor, a special purpose entity controlled by KKR and PSPIB, pursuant to which the Company agreed to issue to Investor and Investor agreed to acquire from the Company, certain newly issued membership interests of the Company, such that Investor will own 19.9% of the issued and outstanding membership interests of the Company, for a purchase price of $2,820,000,000.

The information furnished herewith pursuant to Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing made by the Company under the Exchange Act or the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(c) Exhibits

| | | | | |

| 99.1 | |

| |

| 104 | Cover Page Interactive Data File - The cover page iXBRL tags are embedded within the inline XBRL document. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | |

| AMERICAN ELECTRIC POWER COMPANY, INC. |

| AEP TRANSMISSION COMPANY, INC. |

| | |

| By: | /s/ David C. House |

| Name: | David C. House |

| Title | Assistant Secretary |

January 10, 2025

Exhibit 99.1

| | | | | | | | |

| MEDIA CONTACT: | | ANALYSTS CONTACT: |

| Tammy Ridout | | Darcy Reese |

| Director, External Communications | | Vice President, Investor Relations |

| 614/716-2347 | | 614/716-2614 |

FOR IMMEDIATE RELEASE

AEP Secures Minority Equity Interest Investment in Ohio and Indiana & Michigan Transmission Companies

•A 50/50 strategic partnership between KKR and PSP Investments agrees to acquire 19.9% non-controlling equity interest in two AEP Transcos for $2.82 billion

•Transaction provides highly efficient financing to support AEP’s five-year, $54 billion capital investment plan, enhance reliability for customers and strengthen balance sheet

Columbus, Ohio, Jan. 9, 2025 – American Electric Power (Nasdaq: AEP) today announced a definitive agreement for a strategic partnership between KKR and PSP Investments to acquire a 19.9% equity interest in the company’s Ohio and Indiana & Michigan Transmission Companies (Transcos) for $2.82 billion. The Transcos are transmission-only, Federal Energy Regulatory Commission (FERC) regulated utilities that build, own and operate transmission infrastructure.

The transaction multiple of 30.3 times LTM P/E is highly attractive and is a significant premium to AEP’s current stock price. The 19.9% minority equity interest represents approximately 5% of AEP’s total transmission rate base.

This transaction allows AEP to efficiently finance a growing segment of its business in the Midwest and enhance its ability to serve growing customer demand and provide reliable service. The proceeds will support AEP’s five-year, $54 billion capital growth plan, which includes investments in transmission, distribution and generation projects and will offset a significant amount of AEP’s $5.35 billion equity financing needs through 2029. Upon closing, the transaction will immediately be accretive to AEP’s earnings and credit profile.

“Executing on our five-year capital plan is critical to meeting growing energy demand and bolstering reliability for our customers. Electricity demand is anticipated to grow significantly in AEP’s footprint by the end of the decade,” said Bill Fehrman, AEP president and chief executive officer. “Areas such as Ohio and Indiana are experiencing growth that has not been seen for

decades. This transaction allows us to address a portion of our capital needs efficiently and at a very attractive valuation, benefiting our customers and supporting economic development in our states.”

Fehrman continued, “We are pleased to launch this strategic partnership with two of the world’s premier global infrastructure investors. KKR and PSP Investments are experienced investors in the utilities and energy space with a proven track record of successful infrastructure investments. This transaction allows AEP to maintain a controlling interest in our valuable transmission assets, which we will support through growth and modernization initiatives.”

Customers and employees will not experience any changes as a result of this transaction. Long term, states and customers should benefit from the increased economic development opportunities enabled by investment in the transmission system. AEP’s employees will continue to operate and maintain the Transcos’ assets.

The transaction requires approval from FERC and clearance from the Committee on Foreign Investment in the United States. The transaction is expected to close in the second half of 2025.

J.P. Morgan Securities LLC is serving as exclusive financial advisor to AEP. Morgan Lewis & Bockius LLP is serving as legal counsel to AEP.

About AEP

Our team at American Electric Power (Nasdaq: AEP) is committed to improving our customers' lives with reliable, affordable power. We are investing $54 billion from 2025 through 2029 to enhance service for customers and support the growing energy needs of our communities. Our nearly 16,000 employees operate and maintain the nation's largest electric transmission system with 40,000 line miles, along with more than 225,000 miles of distribution lines to deliver energy to 5.6 million customers in 11 states. AEP also is one of the nation's largest electricity producers with approximately 29,000 megawatts of diverse generating capacity. We are focused on safety and operational excellence, creating value for our stakeholders and bringing opportunity to our service territory through economic development and community engagement. Our family of companies includes AEP Ohio, AEP Texas, Appalachian Power (in Virginia, West Virginia and Tennessee), Indiana Michigan Power, Kentucky Power, Public Service Company of Oklahoma, and Southwestern Electric Power Company (in Arkansas, Louisiana, east Texas and the Texas Panhandle). AEP also owns AEP Energy, which provides innovative competitive energy solutions nationwide. AEP is headquartered in Columbus, Ohio. For more information, visit aep.com.

---

This report made by American Electric Power and its Registrant Subsidiaries contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934. Although AEP and each of its Registrant Subsidiaries believe that their expectations are based on reasonable assumptions, any such statements may be influenced by factors that could cause actual outcomes and results to be materially different from those projected. Among the factors that could cause actual results to differ materially from those in the forward-looking statements are: changes in economic conditions, electric market demand and demographic patterns in AEP service territories; the economic impact of increased global conflicts and trade tensions and the adoption or expansion of economic sanctions, tariffs or trade restrictions; inflationary or deflationary interest rate trends; volatility and disruptions in the financial markets precipitated by any cause, including turmoil related to federal budget or debt ceiling matters or instability in the banking industry, particularly developments affecting the availability or cost of capital to finance new capital projects and refinance existing debt; the availability and cost of funds to finance working capital and capital needs, particularly if expected sources of capital such as proceeds from the sale of assets, subsidiaries and tax credits, and anticipated securitizations, do not materialize or do not materialize at the level anticipated, and during periods when the time lag between incurring costs and recovery is long and the costs are material; shifting demand for electricity; the impact of extreme weather conditions, natural disasters and catastrophic events such as storms, drought conditions and wildfires that pose significant risks including potential litigation and the inability to recover significant damages and restoration costs incurred; limitations or restrictions on the amounts and types of insurance available to cover losses that might arise in connection with natural disasters or operations; the cost of fuel and its transportation, the creditworthiness and performance of parties who supply and transport fuel and the cost of storing and disposing of used fuel, including coal ash and spent nuclear fuel; the availability of fuel and necessary generation capacity and the performance of generation plants; AEP’s ability to recover fuel and other energy costs through regulated or competitive electric rates; the ability to build or acquire generation (including from renewable sources), transmission lines and facilities (including the ability to obtain any necessary regulatory approvals and permits) to meet the demand for electricity at acceptable prices and terms, including favorable tax treatment, cost caps imposed by regulators and other operational commitments to regulatory commissions and customers for generation projects, and to recover all related costs; the disruption of AEP’s business operations due to impacts on economic or market conditions, costs of compliance with potential government regulations, electricity usage, supply chain issues, customers, service providers, vendors and suppliers caused by pandemics, natural disasters or other events; new legislation, litigation and government regulation, including changes to tax laws and regulations, oversight of nuclear generation, energy commodity trading and new or heightened requirements for reduced emissions of sulfur, nitrogen, mercury, carbon, soot or particulate matter and other substances that could impact the continued operation, cost recovery, and/or profitability of generation plants and related assets; the impact of federal tax legislation on results of operations, financial condition, cash flows or credit ratings; the risks associated with fuels used before, during and after the generation of electricity and the byproducts and wastes of such fuels, including coal ash and spent nuclear fuel; timing and resolution of pending and future rate cases, negotiations and other regulatory decisions, including rate or other recovery of new investments in generation, distribution and transmission service and environmental compliance; resolution of litigation or regulatory proceedings or investigations; the ability to efficiently manage operation and maintenance costs; prices and demand for power generated and sold at wholesale; changes in technology, particularly with respect to energy storage and new, developing, alternative or distributed sources of generation; AEP’s ability to recover through rates any remaining unrecovered investment in generation units that may be retired before the end of their previously projected useful lives; volatility and changes in markets for coal and other energy-related commodities, particularly changes in the price of natural gas; the impact of changing expectations and demands of customers, regulators, investors and stakeholders, including evolving expectations related to environmental, social and governance concerns; changes in utility regulation and the allocation of costs within regional transmission organizations, including ERCOT, PJM and SPP; changes in the creditworthiness of the counterparties with contractual arrangements, including participants in the energy trading market; actions of rating agencies, including changes in the ratings of debt; the impact of volatility in the capital markets on the value of the investments held by AEP’s pension, other postretirement benefit plans, captive insurance entity and nuclear decommissioning trust and the impact of such volatility on future funding requirements; accounting standards periodically issued by accounting standard-setting bodies; other risks and unforeseen events, including wars and military conflicts, the effects of terrorism (including increased security costs), embargoes, cyber security threats, labor strikes impacting material supply chains, global information technology disruptions and other catastrophic events; and the ability to attract and retain the requisite work force and key personnel.

v3.24.4

Document and Entity Information

|

Jan. 09, 2025 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 09, 2025

|

| Entity Registrant Name |

AMERICAN ELECTRIC POWER COMPANY, INC.

|

| Entity File Number |

1-3525

|

| Entity Incorporation, State or Country Code |

NY

|

| Entity Tax Identification Number |

13-4922640

|

| Entity Address, Address Line One |

1 Riverside Plaza,

|

| Entity Address, City or Town |

Columbus,

|

| Entity Address, State or Province |

OH

|

| Entity Address, Postal Zip Code |

43215

|

| City Area Code |

(614)

|

| Local Phone Number |

716-1000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000004904

|

| Amendment Flag |

false

|

| AEP Transmission Co |

|

| Entity Information [Line Items] |

|

| Entity Registrant Name |

AEP TRANSMISSION COMPANY, LLC

|

| Entity File Number |

333-217143

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

46-1125168

|

| The NASDAQ Stock Market LLC | Common Stock, $6.50 par value |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, $6.50 par value

|

| Trading Symbol |

AEP

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

dei_LegalEntityAxis=aep_AEPTransmissionCoMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

dei_EntityListingsExchangeAxis=exch_XNAS |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementEquityComponentsAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

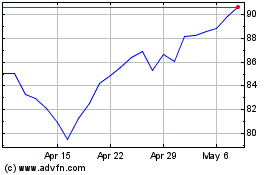

American Electric Power (NASDAQ:AEP)

Historical Stock Chart

From Jan 2025 to Feb 2025

American Electric Power (NASDAQ:AEP)

Historical Stock Chart

From Feb 2024 to Feb 2025