AMC Networks Inc. ("AMC Networks" or the "Company") (NASDAQ: AMCX)

today reported financial results for the fourth quarter and full

year ended December 31, 2022.

AMC Networks Interim Executive Chairman

James L. Dolan said: "AMC Networks is focused on

maximizing the value of our high-quality, popular content through

optimized content monetization as we reduce costs and drive cash

flow. We believe this approach will position the company well to

navigate current industry dynamics and enable us to generate

long-term shareholder value."

Operational Highlights:

- Launched new Anne Rice Universe franchise with Anne Rice’s

Interview with the Vampire, which became the #1 new series launch

in AMC+ history and the #2 new basic cable drama in 2022.

- Kicked off 2023 with the second series in the franchise, Anne

Rice’s Mayfair Witches, which is pacing to become the most viewed

single season of any show on AMC+, topping Interview’s performance,

and is a Top 10 cable drama in the current broadcast season.

- Renewed both Anne Rice’s Interview with the Vampire and Anne

Rice’s Mayfair Witches for second seasons.

- Premiered the final season of The Walking Dead, which concluded

with AMC+’s highest single day of viewership ever and which

commanded the series’ highest pricing in its 11-year run,

demonstrating high audience engagement and advertiser demand for

the franchise.

- Bringing fans of The Walking Dead Universe a new season of Fear

the Walking Dead and two new series: The Walking Dead: Dead City

and The Walking Dead: Daryl Dixon, in 2023.

- Renewed WE tv franchise hits Love After Lockup, Life After

Lockup, Love During Lockup and Growing Up Hip Hop for new

seasons.

- Renewed six multi-year carriage agreements, with Charter,

Altice, Philo, Mediacom and WOW! for continued carriage of U.S.

channel portfolio and with Bell for continued carriage of AMC in

Canada.

- Tested innovative new pricing and packaging offer with

Verizon’s +play Early Access, where Verizon mobile and 5G Home

customers were offered 12 months of Netflix Premium for free with

the purchase of a 12-month subscription to AMC+.

Fourth Quarter Financial

Highlights:

- Net revenues increased 20% from the prior year to $965

million

- Operating loss of $392 million; Adjusted Operating Income(1)

increased 34% to $137 million

- Diluted EPS of $(6.11); Adjusted EPS(1) of $2.52

- Net cash provided by operating activities of $145 million; Free

Cash Flow(1) of $128 million

Full Year Financial

Highlights:

- Net revenues increased 1% from the prior year to $3,097 million

- Streaming revenues increased 35% to $502 million; 11.8 million

subscribers as of December 31, 2022

- Operating income of $87 million; Adjusted Operating Income(1)

of $738 million

- Diluted EPS of $0.17; Adjusted EPS(1) of $9.21

- Net cash provided by operating activities of $182 million; Free

Cash Flow(1) of $103 million

| Dollars in

thousands, except per share amounts |

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

|

|

2022 |

|

|

2021 |

|

Change |

|

2022 |

|

2021 |

|

Change |

|

Net Revenues |

$ |

964,520 |

|

|

$ |

803,709 |

|

20.0 |

% |

|

$ |

3,096,545 |

|

$ |

3,077,608 |

|

0.6 |

% |

| Operating Income

(Loss) |

$ |

(391,641 |

) |

|

$ |

63,632 |

|

(715.5 |

)% |

|

$ |

86,916 |

|

$ |

489,922 |

|

(82.3 |

)% |

| Adjusted Operating

Income |

$ |

137,371 |

|

|

$ |

102,763 |

|

33.7 |

% |

|

$ |

738,402 |

|

$ |

816,070 |

|

(9.5 |

)% |

| |

|

|

|

|

|

|

|

|

|

|

|

| Diluted Earnings (Loss) Per

Share |

$ |

(6.11 |

) |

|

$ |

0.39 |

|

(1666.7 |

)% |

|

$ |

0.17 |

|

$ |

5.77 |

|

(97.1 |

)% |

| Adjusted Earnings Per

Share |

$ |

2.52 |

|

|

$ |

0.54 |

|

366.7 |

% |

|

$ |

9.21 |

|

$ |

9.64 |

|

(4.5 |

)% |

| |

|

|

|

|

|

|

|

|

|

|

|

| Net cash provided by operating

activities |

$ |

145,243 |

|

|

$ |

99,490 |

|

46.0 |

% |

|

$ |

181,834 |

|

$ |

143,474 |

|

26.7 |

% |

| Free Cash Flow |

$ |

127,756 |

|

|

$ |

72,379 |

|

76.5 |

% |

|

$ |

102,605 |

|

$ |

71,488 |

|

43.5 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) See page 6 of this earnings release for a discussion

of non-GAAP financial measures used in this release. This

discussion includes the definition of Adjusted Operating Income,

Adjusted EPS and Free Cash Flow.

Segment Results:(dollars in thousands)

| |

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

|

|

2022 |

|

|

|

2021 |

|

|

Change |

|

|

2022 |

|

|

|

2021 |

|

|

Change |

| Net

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Domestic Operations |

$ |

861,108 |

|

|

$ |

684,886 |

|

|

25.70 |

% |

|

$ |

2,675,142 |

|

|

$ |

2,580,616 |

|

|

3.70 |

% |

|

International and Other |

|

107,633 |

|

|

|

121,933 |

|

|

(11.70 |

)% |

|

|

442,525 |

|

|

|

511,317 |

|

|

(13.50 |

)% |

|

Inter-segment Eliminations |

|

(4,221 |

) |

|

|

(3,110 |

) |

|

(35.70 |

)% |

|

|

(21,122 |

) |

|

|

(14,325 |

) |

|

(47.40 |

)% |

| Total Net Revenues |

$ |

964,520 |

|

|

$ |

803,709 |

|

|

20.00 |

% |

|

$ |

3,096,545 |

|

|

$ |

3,077,608 |

|

|

0.60 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating Income

(Loss): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Domestic Operations |

$ |

(287,426 |

) |

|

$ |

100,001 |

|

|

(387.40 |

)% |

|

$ |

286,517 |

|

|

$ |

617,875 |

|

|

(53.60 |

)% |

|

International and Other |

|

(36,702 |

) |

|

|

4,802 |

|

|

(864.30 |

)% |

|

|

3,031 |

|

|

|

37,167 |

|

|

(91.80 |

)% |

|

Corporate / Inter-segment Eliminations |

|

(67,513 |

) |

|

|

(41,171 |

) |

|

(64.00 |

)% |

|

|

(202,632 |

) |

|

|

(165,120 |

) |

|

(22.70 |

)% |

| Total Operating Income

(Loss) |

$ |

391,641 |

) |

|

$ |

63,632 |

|

|

(715.50 |

)% |

|

$ |

86,916 |

|

|

$ |

489,922 |

|

|

(82.30 |

)% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted Operating

Income (Loss): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Domestic Operations |

$ |

153,987 |

|

|

$ |

121,692 |

|

|

26.50 |

% |

|

$ |

789,396 |

|

|

$ |

845,441 |

|

|

(6.60 |

)% |

|

International and Other |

|

13,480 |

|

|

|

12,517 |

|

|

7.70 |

% |

|

|

68,989 |

|

|

|

83,294 |

|

|

(17.20 |

)% |

|

Corporate / Inter-segment Eliminations |

|

(30,096 |

) |

|

|

(31,446 |

) |

|

4.30 |

% |

|

|

(119,983 |

) |

|

|

(112,665 |

) |

|

(6.50 |

)% |

| Total Adjusted Operating

Income |

$ |

137,371 |

|

|

$ |

102,763 |

|

|

33.70 |

% |

|

$ |

738,402 |

|

|

$ |

816,070 |

|

|

(9.50 |

)% |

| |

Domestic Operations

Fourth Quarter Results:

- Domestic Operations’ revenues increased 26% from the prior year

to $861 million.

- Distribution and other revenues increased 45% to $655 million.

- Content licensing revenues increased 152% to $300 million, due

to the timing and availability of deliveries in the period,

including the delivery of an AMC Studios produced series to a third

party and the early delivery of episodes of The Walking Dead and

Fear the Walking Dead.

- Subscription revenues grew 7% due to increased streaming

revenues primarily driven by streaming subscriber growth, partially

offset by declines in the linear subscriber universe.

- Streaming revenues increased 41% with quarter end total

subscribers of 11.8 million.

- Affiliate revenues declined 7.5% due to basic subscriber

declines, partly offset by contractual rate increases.

- Advertising revenues decreased 12% to $206 million, due to

lower linear ratings, softness in the advertising market, and fewer

original programming episodes, partly offset by digital and

advanced advertising revenue growth.

- Operating loss of $287 million which included restructuring and

other related charges related to strategic programming assessments

and organizational restructuring costs of $423 million.

- Adjusted Operating Income increased 27% to $154 million, driven

by increased revenues and lower levels of marketing investment,

partly offset by increased programming investments.

Full Year Results:

- Domestic Operations’ revenues increased 4% from the prior year

to $2,675 million.

- Distribution and other revenues increased 9% to $1,887 million.

- Content licensing revenues increased 18% to $492 million, due

to the timing and availability of deliveries, including the

delivery of an AMC Studios produced series to a third party.

- Subscription revenues grew 6% due to increased streaming

revenues, primarily driven by streaming subscriber growth,

partially offset by declines in the linear subscriber universe.

- Streaming revenues increased 35% to $502 million.

- Affiliate revenues declined 5.8% due to basic subscriber

declines, partly offset by contractual rate increases.

- Advertising revenues decreased 7% to $788 million, due to lower

linear ratings, softness in the advertising market, and fewer

original programming episodes, partly offset by digital and

advanced advertising revenue growth.

- Operating income decreased 54% to $287 million which included

restructuring and other related charges related to strategic

programming assessments and organizational restructuring costs of

$423 million.

- Adjusted Operating Income decreased 7% to $789 million, driven

by lower advertising and affiliate revenues, increased programming

investments and increased SG&A expense.

International and Other

Fourth Quarter Results:

- International and Other revenues decreased 12% from the prior

year to $108 million; or a decrease of 4% excluding the impact of

foreign currency translation.

- Distribution and other revenues decreased 4% to $86 million,

due to the unfavorable impact of foreign currency translation at

AMCNI, partially offset by the timing of productions at 25/7 Media;

or an increase of 3% excluding the impact of foreign currency

translation.

- Advertising revenues decreased 33% to $22 million, due to the

wind-down of two channels in the U.K., the unfavorable impact of

foreign currency translation at AMCNI, and softer ratings in the

U.K.; excluding the impact of foreign currency translation,

advertising revenues decreased 24%.

- Operating loss of $37 million which included an impairment

charge of $41 million, reflecting a partial write-down of the

goodwill associated with AMCNI in addition to restructuring and

other related charges related to strategic programming assessments

and organizational restructuring costs of $3 million.

- Adjusted Operating Income increased 8% to $13 million,

reflecting cost savings related to channel rationalization and

contractual rights savings; excluding the impact of foreign

currency translation, Adjusted Operating Income increased 4%.

- International and Other revenues decreased 14% from the prior

year to $443 million; or a decrease of 7% excluding the impact of

foreign currency translation.

- Distribution and other revenues decreased 12% to $359 million,

due to the unfavorable impact of foreign currency translation at

AMCNI and the timing of productions at 25/7 Media; or a decrease of

6% excluding the impact of foreign currency translation.

- Advertising revenues decreased 21% to $84 million, due to the

wind-down of two channels in the U.K., the unfavorable impact of

foreign currency translation at AMCNI, and softer ratings in the

U.K.; excluding the impact of foreign currency translation,

advertising revenues decreased 12%.

- Operating income decreased 92% to $3 million which included an

impairment charge of $41 million, reflecting a partial write-down

of goodwill associated with AMCNI in addition to restructuring and

other related charges related to strategic programming assessments

and organizational restructuring costs of $3 million.

- Adjusted Operating Income decreased 17% to $69 million, driven

by decreased revenues, and the unfavorable impact of foreign

currency translation at AMCNI; excluding the impact of foreign

currency translation, Adjusted Operating Income decreased 15%.

Full Year Results:

Other Matters

Restructuring and other related charges

On November 28, 2022, the Company commenced a

restructuring plan designed to achieve significant cost reductions,

encompassing initiatives that include, among other things,

strategic programming assessments and organizational restructuring

costs. Programming assessments pertain to a broad mix of owned and

licensed content, including legacy television series and films that

will no longer be in active rotation on the Company’s linear or

digital platforms. Restructuring and other related charges recorded

in 2022, were primarily related to content impairments of $403.8

million, as well as severance and other personnel costs of $45.2

million. Of the $449.0 million total charge, $423.2 million related

to Domestic Operations, $2.9 million related to AMCNI, and $22.9

million related to Corporate.

Impairment and other charges

In December 2022, we performed our annual

goodwill impairment test and concluded that the estimated fair

value of our AMCNI reporting unit declined to less than its

carrying amount. The decrease in the estimated fair value was in

response to current and expected trends across the International

television broadcasting markets, as well as a decrease in the

financial multiples used to estimate the fair value using the

market approach. As a result, we recognized an impairment charge of

$40.7 million, reflecting a partial write-down of the goodwill

associated with the AMCNI reporting unit.

Stock Repurchase Program & Outstanding

Shares

As previously disclosed, the Company’s Board of

Directors has authorized a program to repurchase up to $1.5 billion

of the Company’s outstanding shares of common stock. The Stock

Repurchase Program has no pre-established closing date and may be

suspended or discontinued at any time. During the quarter ended

December 31, 2022, the Company did not repurchase any shares. As of

December 31, 2022, the Company had $135 million of authorization

remaining for repurchase under the Stock Repurchase Program.

As of February 10, 2023, the Company had

31,524,521 shares of Class A Common Stock and 11,484,408 shares of

Class B Common Stock outstanding.

Please see the Company’s Form 10-K for the year

ended December 31, 2022, which will be filed later today, for

further details regarding the above matters.

Description of Non-GAAP

Measures

The Company defines Adjusted Operating Income

(Loss), which is a non-GAAP financial measure, as operating income

(loss) before share-based compensation expense or benefit,

depreciation and amortization, impairment and other charges

(including gains or losses on sales or dispositions of businesses),

restructuring and other related charges, cloud computing

amortization, and including the Company’s proportionate share of

adjusted operating income (loss) from majority-owned equity method

investees. From time to time, we may exclude the impact of certain

events, gains, losses, or other charges (such as significant legal

settlements) from AOI that affect our operating performance.

Because it is based upon operating income (loss), Adjusted

Operating Income (Loss) also excludes interest expense (including

cash interest expense) and other non-operating income and expense

items. The Company believes that the exclusion of share-based

compensation expense or benefit allows investors to better track

the performance of the various operating units of the business

without regard to the effect of the settlement of an obligation

that is not expected to be made in cash.

The Company believes that Adjusted Operating Income (Loss) is an

appropriate measure for evaluating the operating performance of the

business segments and the Company on a consolidated basis. Adjusted

Operating Income (Loss) and similar measures with similar titles

are common performance measures used by investors, analysts, and

peers to compare performance in the industry.

Internally, the Company uses net revenues and

Adjusted Operating Income (Loss) measures as the most important

indicators of its business performance and evaluates management’s

effectiveness with specific reference to these indicators. Adjusted

Operating Income (Loss) should be viewed as a supplement to and not

a substitute for operating income (loss), net income (loss), and

other measures of performance presented in accordance with U.S.

generally accepted accounting principles ("GAAP"). Since Adjusted

Operating Income (Loss) is not a measure of performance calculated

in accordance with GAAP, this measure may not be comparable to

similar measures with similar titles used by other companies. For a

reconciliation of operating income (loss) to Adjusted Operating

Income (Loss), please see pages 9-10 of this release.

The Company defines Free Cash Flow, which is a

non-GAAP financial measure, as net cash provided by operating

activities less capital expenditures and cash distributions to

noncontrolling interests, all of which are reported in our

Consolidated Statement of Cash Flows. The Company believes the most

comparable GAAP financial measure of its liquidity is net cash

provided by operating activities. The Company believes that Free

Cash Flow is useful as an indicator of its overall liquidity, as

the amount of Free Cash Flow generated in any period is

representative of cash that is available for debt repayment,

investment, and other discretionary and non-discretionary cash

uses. The Company also believes that Free Cash Flow is one of

several benchmarks used by analysts and investors who follow the

industry for comparison of its liquidity with other companies in

the industry, although the Company’s measure of Free Cash Flow may

not be directly comparable to similar measures reported by other

companies. For a reconciliation of net cash provided by operating

activities to Free Cash Flow, please see page 11 of this

release.

The Company defines Adjusted Earnings per

Diluted Share ("Adjusted EPS"), which is a non-GAAP financial

measure, as earnings per diluted share excluding the following

items: amortization of acquisition-related intangible assets;

impairment and other charges (including gains or losses on sales or

dispositions of businesses); non-cash impairments of goodwill,

intangible and fixed assets; restructuring and other related

charges; and gains and losses related to the extinguishment of

debt; as well as the impact of taxes on the aforementioned items.

The Company believes the most comparable GAAP financial measure is

earnings per diluted share. The Company believes that Adjusted EPS

is one of several benchmarks used by analysts and investors who

follow the industry for comparison of its performance with other

companies in the industry, although the Company’s measure of

Adjusted EPS may not be directly comparable to similar measures

reported by other companies. For a reconciliation of earnings per

diluted share to Adjusted EPS, please see pages 12-13 of this

release.

Forward-Looking Statements

This earnings release may contain statements

that constitute forward-looking statements within the meaning of

the Private Securities Litigation Reform Act of 1995. These

statements are based on management’s current expectations and are

subject to uncertainty and changes in circumstances. Investors are

cautioned that any such forward-looking statements are not

guarantees of future performance or results and involve risks and

uncertainties and that actual results or developments may differ

materially from those in the forward-looking statements as a result

of various factors, including financial community and rating agency

perceptions of the Company and its business, operations, financial

condition and the industries in which it operates and the factors

described in the Company’s filings with the Securities and Exchange

Commission, including the sections entitled "Risk Factors" and

"Management’s Discussion and Analysis of Financial Condition and

Results of Operations" contained therein. The Company disclaims any

obligation to update any forward-looking statements contained

herein.

Conference Call Information

AMC Networks will host a conference call today

at 11:00 a.m. ET to discuss its fourth quarter and full year 2022

results. To listen to the call, please visit

investors.amcnetworks.com.

About AMC Networks Inc.

AMC Networks (Nasdaq: AMCX) is a global

entertainment company known for its popular and critically

acclaimed content. Its brands include targeted streaming services

AMC+, Acorn TV, Shudder, Sundance Now, ALLBLK and the anime-focused

HIDIVE streaming service, in addition to AMC, BBC AMERICA (operated

through a joint venture with BBC Studios), IFC, SundanceTV, WE tv,

IFC Films and RLJE Films. AMC Studios, the Company’s in-house

studio, production and distribution operation, is behind some of

the biggest titles and brands known to a global audience, including

The Walking Dead, the Anne Rice catalog and the Agatha Christie

library. The Company also operates AMC Networks International, its

international programming business, and 25/7 Media, its production

services business.

Contacts

|

Investor Relations |

|

Corporate Communications |

| Nicholas Seibert (646)

740-5749 |

|

Georgia Juvelis (917)

542-6390 |

|

nicholas.seibert@amcnetworks.com |

|

georgia.juvelis@amcnetworks.com |

| |

|

|

AMC NETWORKS

INC.CONSOLIDATED STATEMENTS OF INCOME

(LOSS) (Dollars in thousands, except per

share amounts)(unaudited)

| |

Three Months EndedDecember 31, |

|

Twelve Months EndedDecember 31, |

|

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

| Revenues, net |

$ |

964,520 |

|

|

$ |

803,709 |

|

|

$ |

3,096,545 |

|

|

$ |

3,077,608 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

Technical and operating (excluding depreciation and

amortization) |

|

612,434 |

|

|

|

434,406 |

|

|

|

1,515,902 |

|

|

|

1,432,083 |

|

|

Selling, general and administrative |

|

226,373 |

|

|

|

281,570 |

|

|

|

896,817 |

|

|

|

891,734 |

|

|

Depreciation and amortization |

|

27,671 |

|

|

|

22,620 |

|

|

|

107,227 |

|

|

|

93,881 |

|

|

Impairment and other charges |

|

40,717 |

|

|

|

637 |

|

|

|

40,717 |

|

|

|

159,610 |

|

|

Restructuring and other related charges |

|

448,966 |

|

|

|

844 |

|

|

|

448,966 |

|

|

|

10,378 |

|

|

Total operating expenses |

|

1,356,161 |

|

|

|

740,077 |

|

|

|

3,009,629 |

|

|

|

2,587,686 |

|

|

Operating income (loss) |

|

(391,641 |

) |

|

|

63,632 |

|

|

|

86,916 |

|

|

|

489,922 |

|

| Other income (expense): |

|

|

|

|

|

|

|

|

Interest expense |

|

(36,677 |

) |

|

|

(31,399 |

) |

|

|

(133,762 |

) |

|

|

(129,073 |

) |

|

Interest income |

|

4,774 |

|

|

|

2,629 |

|

|

|

13,326 |

|

|

|

10,243 |

|

|

Loss on extinguishment of debt |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(22,074 |

) |

|

Miscellaneous, net |

|

28 |

|

|

|

5,580 |

|

|

|

3,568 |

|

|

|

25,214 |

|

|

Total other expense |

|

(31,875 |

) |

|

|

(23,190 |

) |

|

|

(116,868 |

) |

|

|

(115,690 |

) |

| Income (loss) from operations before income taxes |

|

(423,516 |

) |

|

|

40,442 |

|

|

|

(29,952 |

) |

|

|

374,232 |

|

|

Income tax benefit (expense) |

|

144,098 |

|

|

|

(16,413 |

) |

|

|

40,980 |

|

|

|

(94,393 |

) |

| Net income (loss) including noncontrolling interests |

|

(279,418 |

) |

|

|

24,029 |

|

|

|

11,028 |

|

|

|

279,839 |

|

| Net (income) loss attributable to noncontrolling interests |

|

14,729 |

|

|

|

(6,990 |

) |

|

|

(3,434 |

) |

|

|

(29,243 |

) |

| Net income (loss) attributable to AMC Networks’

stockholders |

$ |

(264,689 |

) |

|

$ |

17,039 |

|

|

$ |

7,594 |

|

|

$ |

250,596 |

|

| |

|

|

|

|

|

|

|

| Net income (loss) per share attributable to AMC

Networks’ stockholders: |

|

|

|

|

| Basic |

$ |

(6.11 |

) |

|

$ |

0.40 |

|

|

$ |

0.18 |

|

|

$ |

5.92 |

|

| Diluted |

$ |

(6.11 |

) |

|

$ |

0.39 |

|

|

$ |

0.17 |

|

|

$ |

5.77 |

|

| |

|

|

|

|

|

|

|

| Weighted average common shares: |

|

|

|

|

|

|

|

| Basic |

|

43,328 |

|

|

|

42,518 |

|

|

|

43,135 |

|

|

|

42,361 |

|

| Diluted |

|

43,328 |

|

|

|

43,755 |

|

|

|

43,731 |

|

|

|

43,439 |

|

AMC NETWORKS

INC.SUPPLEMENTAL FINANCIAL

DATA(Dollars in

thousands)(Unaudited)

|

|

Three Months Ended December 31, 2022 |

|

|

Domestic Operations |

|

Internationaland Other |

|

Corporate /Inter-segmentEliminations |

|

Consolidated |

|

Operating income (loss) |

$ |

(287,426 |

) |

|

$ |

(36,702 |

) |

|

$ |

(67,513 |

) |

|

$ |

(391,641 |

) |

|

Share-based compensation expenses |

|

2,815 |

|

|

|

2,142 |

|

|

|

1,167 |

|

|

|

6,124 |

|

|

Depreciation and amortization |

|

11,872 |

|

|

|

4,469 |

|

|

|

11,330 |

|

|

|

27,671 |

|

|

Restructuring and other related charges |

|

423,205 |

|

|

|

2,854 |

|

|

|

22,907 |

|

|

|

448,966 |

|

|

Impairment and other charges |

|

— |

|

|

|

40,717 |

|

|

|

— |

|

|

|

40,717 |

|

|

Cloud computing amortization |

|

6 |

|

|

|

— |

|

|

|

2,013 |

|

|

|

2,019 |

|

|

Majority owned equity investees AOI |

|

3,515 |

|

|

|

— |

|

|

|

— |

|

|

|

3,515 |

|

|

Adjusted operating income (loss) |

$ |

153,987 |

|

|

$ |

13,480 |

|

|

($ |

(30,096 |

) |

|

$ |

137,371 |

|

| |

Three Months Ended December 31, 2021 |

| |

DomesticOperations |

|

Internationaland Other |

|

Corporate /Inter-segmentEliminations |

|

Consolidated |

|

Operating income (loss) |

$ |

100,001 |

|

$ |

4,802 |

|

$ |

(41,171 |

) |

|

$ |

63,632 |

|

Share-based compensation expenses |

|

4,972 |

|

|

938 |

|

|

2,852 |

|

|

|

8,762 |

|

Depreciation and amortization |

|

11,347 |

|

|

5,330 |

|

|

5,943 |

|

|

|

22,620 |

|

Restructuring and other related charges |

|

8 |

|

|

810 |

|

|

26 |

|

|

|

844 |

|

Impairment and other charges |

|

— |

|

|

637 |

|

|

— |

|

|

|

637 |

|

Cloud computing amortization |

|

— |

|

|

— |

|

|

904 |

|

|

|

904 |

|

Majority owned equity investees AOI |

|

5,364 |

|

|

— |

|

|

— |

|

|

|

5,364 |

| Adjusted operating income

(loss) |

$ |

121,692 |

|

$ |

12,517 |

|

$ |

(31,446 |

) |

|

$ |

102,763 |

AMC NETWORKS

INC.SUPPLEMENTAL FINANCIAL

DATA (Dollars in

thousands)(Unaudited)

|

|

Twelve Months Ended December 31, 2022 |

|

|

DomesticOperations |

|

Internationaland Other |

|

Corporate /Inter-segmentEliminations |

|

Consolidated |

|

Operating income (loss) |

$ |

286,517 |

|

$ |

3,031 |

|

$ |

(202,632 |

) |

|

$ |

86,916 |

|

Share-based compensation expenses |

|

12,815 |

|

|

3,900 |

|

|

13,271 |

|

|

|

29,986 |

|

Depreciation and amortization |

|

49,588 |

|

|

18,487 |

|

|

39,152 |

|

|

|

107,227 |

|

Restructuring and other related charges |

|

423,205 |

|

|

2,854 |

|

|

22,907 |

|

|

|

448,966 |

|

Impairment and other charges |

|

— |

|

|

40,717 |

|

|

— |

|

|

|

40,717 |

|

Cloud computing amortization |

|

23 |

|

|

— |

|

|

7,319 |

|

|

|

7,342 |

|

Majority owned equity investees AOI |

|

17,248 |

|

|

— |

|

|

— |

|

|

|

17,248 |

|

Adjusted operating income (loss) |

$ |

789,396 |

|

$ |

68,989 |

|

$ |

(119,983 |

) |

|

$ |

738,402 |

|

|

Twelve Months Ended December 31, 2021 |

|

|

DomesticOperations |

|

Internationaland Other |

|

Corporate /Inter-segmentEliminations |

|

Consolidated |

|

Operating income (loss) |

$ |

617,875 |

|

$ |

37,167 |

|

$ |

(165,120 |

) |

|

$ |

489,922 |

|

Share-based compensation expenses |

|

22,077 |

|

|

3,627 |

|

|

22,221 |

|

|

|

47,925 |

|

Depreciation and amortization |

|

48,025 |

|

|

19,807 |

|

|

26,049 |

|

|

|

93,881 |

|

Restructuring and other related charges |

|

2,516 |

|

|

6,083 |

|

|

1,779 |

|

|

|

10,378 |

|

Impairment and other charges |

|

143,000 |

|

|

16,610 |

|

|

— |

|

|

|

159,610 |

|

Cloud computing amortization |

|

— |

|

|

— |

|

|

2,406 |

|

|

|

2,406 |

|

Majority owned equity investees AOI |

|

11,948 |

|

|

— |

|

|

— |

|

|

|

11,948 |

|

Adjusted operating income (loss) |

$ |

845,441 |

|

$ |

83,294 |

|

$ |

(112,665 |

) |

|

$ |

816,070 |

AMC NETWORKS

INC.SUPPLEMENTAL FINANCIAL

DATA(Dollars in

thousands)(Unaudited)

|

Capitalization |

December 31, 2022 |

|

|

Cash and cash equivalents |

$ |

930,002 |

|

| |

|

|

|

Credit facility debt (a) |

$ |

641,250 |

|

|

Senior notes (a) |

|

2,200,000 |

|

|

Total debt |

$ |

2,841,250 |

|

| |

|

|

|

Net debt |

$ |

1,911,248 |

|

| |

|

|

|

Finance leases |

|

23,235 |

|

|

Net debt and finance leases |

$ |

1,934,483 |

|

| |

|

|

| |

Twelve Months Ended December 31, 2022 |

|

|

Operating Income (GAAP) |

$ |

86,916 |

|

|

Share-based compensation expense |

|

29,986 |

|

|

Depreciation and amortization |

|

107,227 |

|

|

Restructuring and other related charges |

|

448,966 |

|

|

Impairment and other charges |

|

40,717 |

|

|

Cloud computing amortization |

|

7,342 |

|

|

Majority owned equity investees AOI |

|

17,248 |

|

|

Adjusted Operating Income (Non-GAAP) |

$ |

738,402 |

|

| |

|

|

|

Leverage ratio (b) |

|

2.6 |

x |

|

|

|

|

|

(a) Represents the aggregate principal amount of the

debt.

(b) Represents net debt and finance leases divided by

Adjusted Operating Income for the twelve months ended December 31,

2022. This ratio differs from the calculation contained in the

Company’s credit facility. No adjustments have been made for

consolidated entities that are not 100% owned.

| Free Cash

Flow |

Three Months EndedDecember 31, |

|

Twelve Months EndedDecember 31, |

|

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

|

Net cash provided by operating activities |

$ |

145,243 |

|

|

$ |

99,490 |

|

|

$ |

181,834 |

|

|

$ |

143,474 |

|

|

Less: capital expenditures |

|

(10,762 |

) |

|

|

(12,603 |

) |

|

|

(44,272 |

) |

|

|

(42,572 |

) |

|

Less: distributions to noncontrolling interests |

|

(6,725 |

) |

|

|

(14,508 |

) |

|

|

(34,957 |

) |

|

|

(29,414 |

) |

|

Free cash flow |

$ |

127,756 |

|

|

$ |

72,379 |

|

|

$ |

102,605 |

|

|

$ |

71,488 |

|

AMC NETWORKS

INC.SUPPLEMENTAL FINANCIAL

DATA (Dollars in thousands, except per share

amounts)(Unaudited)

| Adjusted

Earnings Per Share |

| |

|

|

|

|

|

|

|

|

|

| |

Three Months Ended December 31, 2022 |

| |

Income (loss)from operationsbefore incometaxes |

|

Income tax(expense) benefit |

|

Net (income)loss attributableto noncontrollinginterests |

|

Net income(loss)attributable toAMC Networks’stockholders |

|

Diluted EPSattributable toAMC Networks’stockholders |

| Reported

Results (GAAP) |

$ |

(423,516 |

) |

|

$ |

144,098 |

|

|

$ |

14,729 |

|

|

$ |

(264,689 |

) |

|

$ |

(6.11 |

) |

| Adjustments: |

|

|

|

|

|

|

|

|

|

|

Amortization of acquisition-related intangible assets |

|

10,274 |

|

|

|

(1,911 |

) |

|

|

(1,680 |

) |

|

|

6,683 |

|

|

|

0.15 |

|

|

Restructuring and other related charges |

|

448,966 |

|

|

|

(99,285 |

) |

|

|

(21,846 |

) |

|

|

327,835 |

|

|

|

7.57 |

|

|

Impairment and other charges |

|

40,717 |

|

|

|

— |

|

|

|

— |

|

|

|

40,717 |

|

|

|

0.94 |

|

|

Loss on extinguishment of debt |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Dilutive share basis difference - GAAP vs. Adjusted(1) |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(0.03 |

) |

| Adjusted Results (Non-GAAP) |

$ |

76,441 |

|

|

$ |

42,902 |

|

|

$ |

(8,797 |

) |

|

$ |

110,546 |

|

|

$ |

2.52 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) For the reconciliation of Adjusted EPS

to GAAP EPS, the item "Dilutive share basis difference - GAAP vs.

Adjusted" represents the impact of the adjustments from a net loss

to net income position, which required a change in the dilutive

shares outstanding to reflect additional dilutive shares associated

with restricted stock units that were considered anti-dilutive on a

GAAP basis.

| |

Three Months Ended December 31, 2021 |

| |

Income fromoperationsbefore incometaxes |

|

Income taxexpense |

|

Net (income)loss attributableto noncontrollinginterests |

|

Net incomeattributable toAMC Networks’stockholders |

|

Diluted EPSattributable toAMC Networks’stockholders |

| Reported

Results (GAAP) |

$ |

40,442 |

|

$ |

(16,413 |

) |

|

$ |

(6,990 |

) |

|

$ |

17,039 |

|

$ |

0.39 |

| Adjustments: |

|

|

|

|

|

|

|

|

|

|

Amortization of acquisition-related intangible assets |

|

9,995 |

|

|

(1,613 |

) |

|

|

(2,952 |

) |

|

|

5,430 |

|

|

0.12 |

|

Restructuring and other related charges |

|

844 |

|

|

(394 |

) |

|

|

— |

|

|

|

450 |

|

|

0.01 |

|

Impairment and other charges |

|

637 |

|

|

171 |

|

|

|

— |

|

|

|

808 |

|

|

0.02 |

|

Loss on extinguishment of debt |

|

— |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

— |

| Adjusted Results (Non-GAAP) |

$ |

51,918 |

|

$ |

(18,249 |

) |

|

$ |

(9,942 |

) |

|

$ |

23,727 |

|

$ |

0.54 |

AMC NETWORKS

INC.SUPPLEMENTAL FINANCIAL

DATA (Dollars in thousands, except per share

amounts)(Unaudited)

| Adjusted

Earnings Per Share |

| |

|

|

|

|

|

|

|

|

|

| |

Twelve Months Ended December 31, 2022 |

| |

Income (loss)from operationsbefore incometaxes |

|

Income tax(expense) benefit |

|

Net (income)loss attributableto noncontrollinginterests |

|

Net incomeattributable toAMC Networks’stockholders |

|

Diluted EPSattributable toAMC Networks’stockholders |

| Reported

Results (GAAP) |

$ |

(29,952 |

) |

|

$ |

40,980 |

|

|

$ |

(3,434 |

) |

|

$ |

7,594 |

|

$ |

0.17 |

| Adjustments: |

|

|

|

|

|

|

|

|

|

|

Amortization of acquisition-related intangible assets |

|

41,469 |

|

|

|

(8,073 |

) |

|

|

(6,720 |

) |

|

|

26,676 |

|

|

0.61 |

|

Restructuring and other related charges |

|

448,966 |

|

|

|

(99,285 |

) |

|

|

(21,846 |

) |

|

|

327,835 |

|

|

7.50 |

|

Impairment and other charges |

|

40,717 |

|

|

|

— |

|

|

|

— |

|

|

|

40,717 |

|

|

0.93 |

|

Loss on extinguishment of debt |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

— |

| Adjusted Results (Non-GAAP) |

$ |

501,200 |

|

|

$ |

(66,378 |

) |

|

$ |

(32,000 |

) |

|

$ |

402,822 |

|

$ |

9.21 |

| |

Twelve Months Ended December 31, 2021 |

| |

Income fromoperationsbefore incometaxes |

|

Income taxexpense |

|

Net (income)loss attributableto noncontrollinginterests |

|

Net incomeattributable toAMC Networks’stockholders |

|

Diluted EPSattributable toAMC Networks’stockholders |

| Reported

Results (GAAP) |

$ |

374,232 |

|

$ |

(94,393 |

) |

|

$ |

(29,243 |

) |

|

$ |

250,596 |

|

$ |

5.77 |

| Adjustments: |

|

|

|

|

|

|

|

|

|

|

Amortization of acquisition-related intangible assets |

|

39,072 |

|

|

(6,274 |

) |

|

|

(11,880 |

) |

|

|

20,918 |

|

|

0.48 |

|

Restructuring and other related charges |

|

10,378 |

|

|

(1,813 |

) |

|

|

12 |

|

|

|

8,577 |

|

|

0.20 |

|

Impairment and other charges |

|

159,610 |

|

|

(37,907 |

) |

|

|

— |

|

|

|

121,703 |

|

|

2.80 |

|

Loss on extinguishment of debt |

|

22,074 |

|

|

(5,257 |

) |

|

|

— |

|

|

|

16,817 |

|

|

0.39 |

| Adjusted Results (Non-GAAP) |

$ |

605,366 |

|

$ |

(145,644 |

) |

|

$ |

(41,111 |

) |

|

$ |

418,611 |

|

$ |

9.64 |

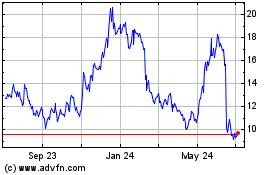

AMC Networks (NASDAQ:AMCX)

Historical Stock Chart

From Oct 2024 to Nov 2024

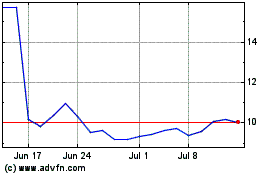

AMC Networks (NASDAQ:AMCX)

Historical Stock Chart

From Nov 2023 to Nov 2024