Stacks prepares for the biggest update in its history,

revolutionizing Bitcoin transactions

The Stacks network (COIN:STXUSD), the largest Bitcoin layer-2 by

market capitalization, is set to implement the Nakamoto upgrade on

August 28. This change will reduce transaction settlement times to

around five seconds, significantly improving the network’s

usability. Additionally, the launch of Super Bitcoin

(COIN:SBTCCUSD), a decentralized asset linked to Bitcoin, will

facilitate transfers between the Bitcoin blockchain and Stacks,

boosting the Bitcoin DeFi ecosystem.

Bitcoin ETFs see record inflows after Powell’s Jackson Hole speech

On August 23, U.S.-listed Bitcoin ETFs recorded daily net

inflows of $252 million, the highest volume since July 23, driven

by positive comments from Jerome Powell at the Jackson Hole

symposium. Trading volumes for ETFs exceeded $3.12 billion.

BlackRock’s ETF (NASDAQ:IBIT) led with $83 million in inflows,

while Grayscale’s ETF (AMEX:GBTC) saw $35 million in outflows.

Fidelity’s ETF (AMEX:FBTC) recorded $64 million in inflows, and

Bitwise’s ETF (AMEX:BITB) received $42 million, crossing the $2

billion assets under management mark for the first time.

In the last 24 hours, Bitcoin (COIN:BTCUSD) is priced at

$63,679, down 1.1%, failing to maintain its intraday high of

$64,509.36. Analysts from Crypto Chase and Jelle indicate signs of

weakness, warning of a possible price correction. Material

Indicators noted downward pressure on Bitcoin’s price, observing

that BTC liquidity on Binance is decreasing. Meanwhile, QCP Capital

expects BTC to remain between $62,000 and $67,000 in the short

term.

Semler Scientific expands Bitcoin reserves, now among top 20

corporate holders

Semler Scientific (NASDAQ:SMLR), a medical technology company,

purchased an additional 83 BTC for $5 million, bringing its total

reserves to 1,012 BTC. Since May, the company has acquired Bitcoin

worth $68 million, funding the purchases with operational funds and

its market equity program. Chairman Eric Semler highlighted

confidence in growing institutional adoption, predicting that it

will drive Bitcoin’s value and benefit shareholders.

Ethereum enters high school curriculum in Buenos Aires through

partnership with ETH Kipu

Argentina’s Ministry of Education, in collaboration with ETH

Kipu, has incorporated Ethereum and blockchain education into high

school curricula in Buenos Aires. The initiative, starting on

August 27, includes practical internships and an online Solidity

course to train 500 students in DApp programming. This partnership

aims to equip young people with advanced technological skills,

preparing them for the future and positioning Argentina as a leader

in the global blockchain movement.

ETH performance hits 40-month lows

Ethereum (COIN:ETHUSD) network trading volume and daily

transactions fell significantly in August. The seven-day moving

average of daily trading volume decreased by 55%, with daily

economic yield dropping from $6.56 billion in July to $2.9 billion.

Monthly trading volume fell to $91.46 billion, a low not seen since

May 2020. Analysts point out that the decline reflects a typical

cyclical pattern for this period.

The growing correlation between ETH/BTC (COIN:ETHBTC) and the

U.S. Dollar Index (CCOM:DXY) indicates a negative outlook, with

investors favoring Bitcoin, especially with expectations of Federal

Reserve interest rate cuts. Since early 2024, Ether has fallen 25%

against Bitcoin, hitting 40-month lows. The bearish trend could

lead to an additional 10% drop in the ETH/BTC pair in

September.

Cryptocurrencies see $533 million inflows amid interest rate cut

rumors

Cryptocurrency investment products experienced the largest

inflow streak in five weeks, totaling $533 million, driven by

expectations of U.S. interest rate cuts. Meanwhile, Polygon

(COIN:MATICUSD), Avalanche (COIN:AVAXUSD), and ZKsync faced Discord

attacks, and Fetch.ai (COIN:FETUSD) announced the creation of an

Innovation Lab in San Francisco to support AI startups, with an

annual investment of $10 million.

Stablecoin market capitalization hits new all-time high

The total market capitalization of stablecoins, excluding

algorithmic ones, reached an all-time high of $168.1 billion last

weekend, a 0.8% increase, surpassing the previous peak from March

2022. After a low of $122 billion in October, the value has been

growing since early 2024. Analysts suggest that the increase

reflects greater confidence and demand for stability in the

cryptocurrency market, especially among institutional investors.

Tether (COIN:USDTUSD) represents 70% of the total, and USD Coin

(COIN:USDCUSD) is also showing significant growth.

Pavel Durov, founder of Telegram, arrested in France in judicial

investigation

Telegram founder and CEO Pavel Durov was arrested on August 24

in France as part of a judicial investigation. Charges include

complicity in illegal activities, money laundering, and providing

cryptography services without prior declaration. French prosecutors

extended his custody until August 28 for questioning. President

Emmanuel Macron stated that the arrest was not politically

motivated, reaffirming France’s commitment to freedom of

expression.

Health of Binance executive detained in Nigeria deteriorates

severely, family says

The family of Tigran Gambaryan, a Binance executive detained in

Nigeria since February, reported that his health has deteriorated

severely, with extreme pain due to a herniated disc leaving him

unable to walk. He also faces recurring malaria and pneumonia

without access to adequate medical care. Despite international

appeals, Gambaryan remains detained, with his wife emphasizing the

urgent need for medical assistance to prevent irreversible

damage.

U.S. DOJ opposes Ryan Salame’s plea reversal

The U.S. Department of Justice contests former FTX co-CEO Ryan

Salame’s attempt to reverse his guilty plea for campaign finance

violations. On August 26, prosecutors stated their opposition to

Salame’s petition, which seeks to overturn his

seven-and-a-half-year conviction. Salame claimed he was induced to

plead guilty with the promise that the investigation into his

partner, Michelle Bond, would be dropped.

Binance Labs invests in AI startups to boost blockchain innovation

Binance Labs, the venture capital arm of Binance, invested in AI

startups Sahara AI and MyShell. Sahara AI aims to create a

decentralized ecosystem for onchain attribution and operational

rewards, while MyShell enables the creation and sharing of AI

applications. Max Coniglio, Director of Investments at Binance

Labs, highlights that AI and blockchain, when combined and open,

can drive innovation and address joint challenges, promoting

decentralized applications and more authentic systems.

KBW 2024 debuts ‘Institutional Stage’ for Web3 leaders

The “Institutional Stage” at Korea Blockchain Week (KBW) 2024,

dedicated to institutions and major companies in the Web3 sector,

was announced by organizer FACTBLOCK. Part of the IMPACT

conference, the stage will feature 300+ speakers and cover topics

such as cryptocurrency ETFs and asset tokenization. The event will

take place from September 3 to 4, highlighting leaders like Pranav

Kanade from VanEck and Edward Lee from Coinbase.

India moves slowly with CBDC testing, no rush for full

implementation

India is exploring its central bank digital currency (CBDC)

cautiously, with no rush for full implementation, according to Shri

Shaktikanta Das, Governor of the Reserve Bank of India (RBI). Since

the launch of digital rupee pilots in 2022, 5 million retail users

and 16 banks have participated. India is testing offline

functionality and CBDC programmability, prioritizing a

comprehensive understanding of impacts before a broad and gradual

adoption.

Fruition Production releases ‘XRP Unleashed’ documentary in

November

Los Angeles-based Fruition Production will release the

documentary “XRP Unleashed” in November, opting for

self-distribution on platforms like Apple TV (NASDAQ:AAPL) and

Amazon (NASDAQ:AMZN). Instead of seeking Hollywood backing or

partnerships with major platforms like Netflix (NASDAQ:NFLX), the

studio aims to maintain creative control and reach audiences

directly. The film, which covers Ripple Labs’ legal battle with the

SEC, will feature important interviews and analyses on XRP

(COIN:XRPUSD) and its implications.

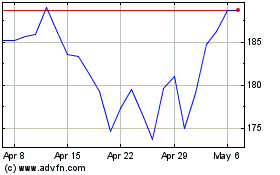

Amazon.com (NASDAQ:AMZN)

Historical Stock Chart

From Oct 2024 to Nov 2024

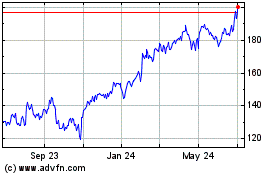

Amazon.com (NASDAQ:AMZN)

Historical Stock Chart

From Nov 2023 to Nov 2024