Amalgamated Announces the Appointment of Nicole Steele and Emily Robichaux as Directors of Climate Partnerships

August 06 2024 - 4:14PM

Business Wire

Two nationally recognized experts to join

the bank, adding to its position as a leader in sustainability

finance.

Amalgamated Financial Corp. (“Amalgamated” or the “Company”)

(Nasdaq: AMAL) today announced the appointment of Nicole Steele as

Director of Climate Partnership Banking and Emily Robichaux as

Director of Climate Partnership Lending. This team of industry

experts will lead the bank’s efforts to execute on the potential of

the $27B Greenhouse Gas Reduction Fund (“GGRF”).

Ms. Steele is a nationally recognized leader and expert with

over 20 years’ experience in clean energy, focusing on equitable

deployment and workforce development. She was instrumental in the

development of the GGRF programs including the National Clean

Investment Fund (“NCIF)”, Clean Communities Investment Accelerator

(“CCIA”), and Solar for All (“SFA”) at the U.S. Environmental

Protection Agency (“EPA”) and worked in partnership with the U.S.

Treasury on the Inflation Reduction Act’s solar tax credits

including the Low-Income Communities Bonus Tax Credit. Most

recently, Ms. Steele was the Program Manager of the Workforce and

Equitable Access Team in the Solar Energy Technologies Office

(“SETO”) at the U.S. Department of Energy (“DOE”) and the head of

the National Community Solar Partnership (“NCSP”) that created the

Community Power Accelerator and many other initiatives that

developed solutions for the rapid deployment of clean energy with

true meaningful benefits.

Ms. Robichaux is an accomplished executive with over fifteen

years of experience delivering business results in sustainable

finance, energy access, and technology. She will rejoin Amalgamated

from Opportunity Finance Network (“OFN”), where she built the

organization’s climate program. As Senior Vice President, Climate

and Environmental Programs, Ms. Robichaux was a lead author of

OFN’s award-winning GGRF Clean Communities Investment Accelerator

application, securing over $2bn for community clean energy projects

and climate lending capacity building for Community Development

Financial Institutions (“CDFIs”).

Sam Brown, Chief Banking Officer, commented: “I am thrilled to

have this team of experts join us at Amalgamated Bank as we

continue to lead by example and ramp up our efforts to support

America’s transition to a clean energy economy. National efforts

like the Greenhouse Gas Reduction Fund galvanize us to imagine a

world where climate sustainability is within reach of all

Americans, regardless of socioeconomic status or geography. Nicole

and Emily join our roster of leaders that are already leveraging

this vision and the financial system to drive climate justice.”

As a founder of the UN Net Zero Banking Alliance and the first

US bank to set net zero targets validated by Science Based Target

Initiatives (“SBTi”), Amalgamated is a leader in sustainable

finance. The bank is certified as Fossil Fuel free and 64% of our

lending meets our definition of “High Impact” and 100% mission

aligned, specifically with more than $547 million in loans

dedicated to Climate Protection and an additional $1.2 billion in

Property Assessed Clean Energy assets.”

About Amalgamated Financial Corp.

Amalgamated Financial Corp. is a Delaware public benefit

corporation and a bank holding company engaged in commercial

banking and financial services through its wholly-owned subsidiary,

Amalgamated Bank. Amalgamated Bank is a New York-based full-service

commercial bank and a chartered trust company with a combined

network of five branches across New York City, Washington D.C., and

San Francisco, and a commercial office in Boston. Amalgamated Bank

was formed in 1923 as Amalgamated Bank of New York by the

Amalgamated Clothing Workers of America, one of the country’s

oldest labor unions. Amalgamated Bank provides commercial banking

and trust services nationally and offers a full range of products

and services to both commercial and retail customers. Amalgamated

Bank is a proud member of the Global Alliance for Banking on Values

and is a certified B Corporation®. As of June 30, 2024, our total

assets were $8.3 billion, total net loans were $4.4 billion, and

total deposits were $7.4 billion. Additionally, as of June 30,

2024, our trust business held $34.6 billion in assets under custody

and $14.0 billion in assets under management.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240806558630/en/

Investor Contact: Jamie Lillis Solebury Strategic

Communications shareholderrelations@amalgamatedbank.com

800-895-4172

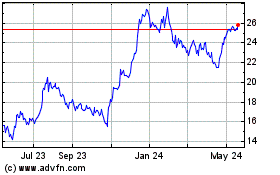

Amalgamated Financial (NASDAQ:AMAL)

Historical Stock Chart

From Oct 2024 to Nov 2024

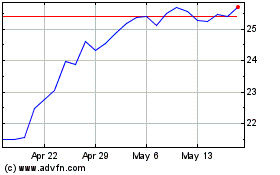

Amalgamated Financial (NASDAQ:AMAL)

Historical Stock Chart

From Nov 2023 to Nov 2024