0001520262FalseAlkermes plc.00015202622024-10-242024-10-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): October 24, 2024

ALKERMES PUBLIC LIMITED COMPANY

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Ireland |

|

001-35299 |

|

98-1007018 |

(State or other jurisdiction |

|

(Commission |

|

(IRS Employer |

of incorporation) |

|

File Number) |

|

Identification No.) |

|

|

|

|

|

|

Connaught House, 1 Burlington Road |

Dublin 4, Ireland D04 C5Y6 |

(Address of principal executive offices) |

Registrant's telephone number, including area code: + 353-1-772-8000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

☐ |

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

|

☐ |

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

|

☐ |

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

|

☐ |

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Ordinary shares, $0.01 par value |

|

ALKS |

|

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

|

|

|

Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On October 24, 2024, Alkermes plc (the “Company”) announced financial results for the three and nine months ended September 30, 2024. Copies of the related press release and the investor presentation to be displayed during the Company’s conference call on October 24, 2024 discussing such financial results are furnished herewith as Exhibit 99.1 and Exhibit 99.2, respectively. This information, including Exhibits 99.1 and 99.2, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

EXHIBIT INDEX

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

ALKERMES PLC |

|

|

Date: October 24, 2024 |

By: |

|

/s/ Blair C. Jackson |

|

|

|

Blair C. Jackson |

|

|

|

Executive Vice President, Chief Operating Officer (Interim Principal Financial Officer) |

|

|

|

|

Alkermes Contacts: |

|

|

For Investors: |

Sandy Coombs +1 781 609 6377 |

|

For Media: |

Katie Joyce +1 781 249 8927 |

Alkermes plc Reports Third Quarter 2024 Financial Results

— Third Quarter Revenues of $378.1 Million —

— Net Sales of Proprietary Products Increased Approximately 18% Year-Over-Year —

— GAAP Net Income from Continuing Operations of $92.8 Million and Diluted GAAP Earnings per Share from Continuing Operations of $0.56 —

— Company Reiterates 2024 Financial Expectations —

DUBLIN, Oct. 24, 2024 — Alkermes plc (Nasdaq: ALKS) today reported financial results for the third quarter of 2024.

“Our third quarter financial results reflect strong year-over-year growth of our portfolio of proprietary commercial products and position us well to meet our strategic, operational and financial priorities for the year. Looking ahead, we believe growing our proprietary commercial products and advancing our pipeline, particularly ALKS 2680, our novel, investigational, orexin 2 receptor agonist, and additional orexin development candidates, will serve as the key drivers of shareholder value. We plan to manage the business to deliver significant profitability and cash flow while investing in these strategic initiatives,” said Richard Pops, Chief Executive Officer of Alkermes. “2025 has the potential to be a transformational year for Alkermes as we expect to complete the ongoing phase 2 studies in narcolepsy type 1 and narcolepsy type 2, and prepare for potential registrational studies for ALKS 2680. With the potential to transform the treatment of hypersomnolence disorders, and with broad potential applicability across other symptomatic domains, orexin 2 receptor agonists represent one of the most exciting new therapeutic categories in development and we believe a significant opportunity for Alkermes and our shareholders.”

Key Financial Highlights

Revenues

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

(In millions) |

2024 |

2023 |

|

2024 |

2023 |

Total Revenues |

$ |

378.1 |

$ |

380.9 |

|

$ |

1,127.6 |

$ |

1,285.9* |

Total Proprietary Net Sales |

$ |

273.0 |

$ |

231.8 |

|

$ |

775.8 |

$ |

678.0 |

VIVITROL® |

$ |

113.7 |

$ |

99.3 |

|

$ |

323.2 |

$ |

298.0 |

ARISTADA®i |

$ |

84.7 |

$ |

81.8 |

|

$ |

249.6 |

$ |

244.3 |

LYBALVI® |

$ |

74.7 |

$ |

50.7 |

|

$ |

203.1 |

$ |

135.7 |

Profitability

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

(In millions) |

2024 |

2023 |

|

2024 |

2023* |

GAAP Net Income From Continuing Operations |

$ |

92.8 |

$ |

91.6 |

|

$ |

226.4 |

$ |

358.6 |

GAAP Net Loss From Discontinued Operations |

$ |

(0.4) |

$ |

(43.8) |

|

$ |

(5.8) |

$ |

(115.6) |

GAAP Net Income |

$ |

92.4 |

$ |

47.8 |

|

$ |

220.6 |

$ |

243.0 |

|

|

|

|

|

|

|

|

|

|

Non-GAAP Net Income From Continuing Operations |

$ |

121.4 |

$ |

150.4 |

|

$ |

321.0 |

$ |

314.7 |

Non-GAAP Net Loss From Discontinued Operations |

$ |

(0.4) |

$ |

(40.8) |

|

$ |

(5.8) |

$ |

(108.5) |

Non-GAAP Net Income |

$ |

121.0 |

$ |

109.5 |

|

$ |

315.2 |

$ |

206.2 |

|

|

|

|

|

|

|

|

|

|

EBITDA From Continuing Operations |

$ |

112.3 |

$ |

107.2 |

|

$ |

282.4 |

$ |

413.5 |

EBITDA From Discontinued Operations |

$ |

(0.5) |

$ |

(44.6) |

|

$ |

(6.9) |

$ |

(121.9) |

EBITDA |

$ |

111.8 |

$ |

62.7 |

|

$ |

275.5 |

$ |

291.5 |

*As a result of the successful resolution of the arbitration with Janssen Pharmaceutica N.V., the nine months ended September 30, 2023 included approximately $195.4 million of back royalties (and related interest) related to U.S. net sales of long-acting INVEGA® products that would ordinarily have been recognized in prior periods.

Revenue Highlights

LYBALVI

•Revenues for the quarter were $74.7 million.

•Revenues and total prescriptions for the quarter grew 47% and 37%, respectively, compared to the third quarter of 2023.

ARISTADAi

•Revenues for the quarter were $84.7 million.

VIVITROL

•Revenues for the quarter were $113.7 million.

•Revenues for the quarter grew 14% compared to the third quarter of 2023, driven by the alcohol dependence indication.

Manufacturing & Royalty Revenues

•Royalty revenues from INVEGA SUSTENNA®/XEPLION®, INVEGA TRINZA®/TREVICTA® and INVEGA HAFYERA®/BYANNLI® for the quarter were $58.4 million.

•VUMERITY® manufacturing and royalty revenues for the quarter were $32.6 million.

Key Operating Expenses

Please see Note 1 below for details regarding discontinued operations.

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

(In millions) |

2024 |

2023 |

|

2024 |

2023 |

R&D Expense – Continuing Operations |

$ |

59.9 |

$ |

64.9 |

|

$ |

187.2 |

$ |

196.9 |

R&D Expense – Discontinued Operations |

$ |

0.5 |

$ |

32.3 |

|

$ |

6.9 |

$ |

94.7 |

|

|

|

|

|

|

|

|

|

|

SG&A Expense – Continuing Operations |

$ |

150.4 |

$ |

156.4 |

|

$ |

498.2 |

$ |

520.0 |

SG&A Expense – Discontinued Operations |

$ |

— |

$ |

13.1 |

|

$ |

— |

$ |

29.2 |

Balance Sheet

At Sept. 30, 2024, the company recorded cash, cash equivalents and total investments of $927.8 million, compared to $962.5 million at June 30, 2024. The company’s total debt outstanding as of Sept. 30, 2024 was $288.8 million.

Share Repurchase Program

During the third quarter of 2024, the company repurchased approximately 4.4 million of the company’s ordinary shares under the share repurchase program authorized in February 2024, at a total purchase price of $115.6 million. As of Sept. 30, 2024, the company had $200 million (exclusive of any fees, commissions or other related expenses) remaining under the program.

Financial Expectations for 2024

Alkermes reiterates its financial expectations for 2024, as set forth in its press release dated Feb. 15, 2024.

Recent Events

•In October 2024, the company hosted an investor event to review its portfolio of orexin 2 receptor agonists and development strategy. The company presented data from its ALKS 2680 phase 1b study in patients with narcolepsy type 1 (NT1), narcolepsy type 2 (NT2) and idiopathic hypersomnia (IH), and discussed the study design for its ongoing phase 2 studies in NT1 and NT2. The company also announced its plans to initiate a phase 2 study in patients with IH in 2025.

• In September 2024, the company presented positive clinical data from its phase 1b study of ALKS 2680 in patients with NT2 and IH at the European Sleep Research Society’s 27th Congress, Sleep Europe 2024.

•In August 2024, the company announced the initiation of its Vibrance-2 phase 2 study of ALKS 2680 in patients with NT2.

•In August 2024, the company published its latest Corporate Responsibility Report, which details how the company integrates environmental, social and governance considerations into its business. A copy of the report is available on the Responsibility section of Alkermes’ website.

Notes and Explanations

1.The company determined that upon the separation of its oncology business, completed on Nov. 15, 2023, the oncology business met the criteria for discontinued operations in accordance with Financial Accounting Standards Board Accounting Standards Codification 205, Discontinued Operations. Accordingly, the accompanying selected financial information has been updated to present the results of the oncology business as discontinued operations for the three and nine months ended Sept. 30, 2023.

Conference Call

Alkermes will host a conference call and webcast presentation with accompanying slides at 8:00 a.m. ET (1:00 p.m. BST) on Thursday, Oct. 24, 2024, to discuss these financial results and provide an update on the company. The webcast may be accessed on the Investors section of Alkermes’ website at www.alkermes.com. The conference call may be accessed by dialing +1 877 407 2988 for U.S. callers and +1 201 389 0923 for international callers. In addition, a replay of the conference call may be accessed by visiting Alkermes’ website.

About Alkermes plc

Alkermes plc is a global biopharmaceutical company that seeks to develop innovative medicines in the field of neuroscience. The company has a portfolio of proprietary commercial products for the treatment of alcohol dependence, opioid dependence, schizophrenia and bipolar I disorder, and a pipeline of clinical and preclinical candidates in development for neurological disorders, including narcolepsy and idiopathic hypersomnia. Headquartered in Ireland, Alkermes also has a corporate office and research and development center in Massachusetts and a manufacturing facility in Ohio. For more information, please visit Alkermes’ website at www.alkermes.com.

Non-GAAP Financial Measures

This press release includes information about certain financial measures that are not prepared in accordance with generally accepted accounting principles in the U.S. (GAAP), including non-GAAP net income and EBITDA. These non-GAAP measures are not based on any standardized methodology prescribed by GAAP and are not necessarily comparable to similar measures presented by other companies.

Non-GAAP net income adjusts for certain one-time and non-cash charges by excluding from GAAP results: share-based compensation expense; amortization; depreciation; non-cash net interest expense; change in the fair value of contingent consideration; certain other one-time or non-cash items; and the income tax effect of these reconciling items. EBITDA represents earnings before interest, tax, depreciation and amortization; earnings include share-based compensation expense.

The company’s management and board of directors utilize these non-GAAP financial measures to evaluate the company’s performance. The company provides these non-GAAP financial measures of the company’s performance to investors because management believes that these non-GAAP financial measures, when viewed with the company’s results under GAAP and the accompanying reconciliations, are useful in identifying underlying trends in ongoing operations. However, non-GAAP net income and EBITDA are not measures of financial performance under GAAP and, accordingly, should not be considered as alternatives to GAAP measures as indicators of operating performance. Further, non-GAAP net income and EBITDA should not be considered measures of the company’s liquidity.

A reconciliation of GAAP to non-GAAP financial measures has been provided in the tables included in this press release.

Note Regarding Forward-Looking Statements

Certain statements set forth in this press release constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended, including, but not limited to, statements concerning: the company’s expectations concerning its future financial and operating performance, business plans or prospects, including drivers of shareholder value and profitability; and the company’s expectations regarding development plans, activities and timelines for, and the potential therapeutic and commercial value of, ALKS 2680 and the company’s other orexin portfolio candidates. The company cautions that forward-looking statements are inherently uncertain. The forward-looking statements are neither promises nor guarantees and they are necessarily subject to a high degree of uncertainty and risk. Actual performance and results may differ materially from those expressed or implied in the forward-looking statements due to various risks and uncertainties. These risks and uncertainties include, among others: whether the company is able to achieve its financial expectations, including those related to profitability; the unfavorable outcome of arbitration or litigation, including so-called “Paragraph IV” litigation and other patent litigation which may lead to competition from generic drug manufacturers, or other disputes related to the company’s products or products using the company’s proprietary technologies; clinical development activities may not be completed on time or at all; the results of the company’s development activities may not be positive, or predictive of final results from such activities, results of future development activities or real-world results; the U.S. Food and Drug Administration (FDA) or regulatory authorities outside the U.S. may make adverse decisions regarding the company’s products; the company and its licensees may not be able to continue to successfully commercialize their products or support revenue growth from such products; there may be a reduction in payment rate or reimbursement for the company’s products or an increase in the company’s financial obligations to government payers; the company’s products may prove difficult to manufacture, be

precluded from commercialization by the proprietary rights of third parties, or have unintended side effects, adverse reactions or incidents of misuse; and those risks and uncertainties described under the heading “Risk Factors” in the company’s Annual Report on Form 10-K for the year ended Dec. 31, 2023 and in subsequent filings made by the company with the U.S. Securities and Exchange Commission (SEC), which are available on the SEC’s website at www.sec.gov. Existing and prospective investors are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Except as required by law, the company disclaims any intention or responsibility for updating or revising any forward-looking statements contained in this press release.

VIVITROL® is a registered trademark of Alkermes, Inc.; ARISTADA®, ARISTADA INITIO® and LYBALVI® are registered trademarks of Alkermes Pharma Ireland Limited, used by Alkermes, Inc. under license; BYANNLI®, INVEGA®, INVEGA HAFYERA®, INVEGA SUSTENNA®, INVEGA TRINZA®, TREVICTA® and XEPLION® are registered trademarks of Johnson & Johnson or its affiliated companies; and VUMERITY® is a registered trademark of Biogen MA Inc., used by Alkermes under license.

(tables follow)

|

|

i |

The term “ARISTADA” as used in this press release refers to ARISTADA and ARISTADA INITIO®, unless the context indicates otherwise. |

|

|

|

|

|

|

|

|

|

Alkermes plc and Subsidiaries |

|

Selected Financial Information (Unaudited) |

|

|

|

|

|

|

|

|

Condensed Consolidated Statements of Operations - GAAP |

|

Three Months Ended |

|

|

Three Months Ended |

|

(In thousands, except per share data) |

|

September 30, 2024 |

|

|

September 30, 2023 |

|

Revenues: |

|

|

|

|

|

|

Product sales, net |

|

$ |

272,999 |

|

|

$ |

231,822 |

|

Manufacturing and royalty revenues |

|

|

105,144 |

|

|

|

149,113 |

|

Research and development revenue |

|

|

— |

|

|

|

3 |

|

Total Revenues |

|

|

378,143 |

|

|

|

380,938 |

|

Expenses: |

|

|

|

|

|

|

Cost of goods manufactured and sold |

|

|

63,099 |

|

|

|

61,498 |

|

Research and development |

|

|

59,892 |

|

|

|

64,878 |

|

Selling, general and administrative |

|

|

150,382 |

|

|

|

156,373 |

|

Amortization of acquired intangible assets |

|

|

14 |

|

|

|

8,995 |

|

Total Expenses |

|

|

273,387 |

|

|

|

291,744 |

|

Operating Income |

|

|

104,756 |

|

|

|

89,194 |

|

Other Income, net: |

|

|

|

|

|

|

Interest income |

|

|

10,916 |

|

|

|

9,370 |

|

Interest expense |

|

|

(6,000 |

) |

|

|

(6,006 |

) |

Other income, net |

|

|

558 |

|

|

|

149 |

|

Total Other Income, net |

|

|

5,474 |

|

|

|

3,513 |

|

Income Before Income Taxes |

|

|

110,230 |

|

|

|

92,707 |

|

Income Tax Provision |

|

|

17,435 |

|

|

|

1,153 |

|

Net Income From Continuing Operations |

|

|

92,795 |

|

|

|

91,554 |

|

Loss From Discontinued Operations — Net of Tax |

|

|

(414 |

) |

|

|

(43,796 |

) |

Net Income — GAAP |

|

$ |

92,381 |

|

|

$ |

47,758 |

|

|

|

|

|

|

|

|

GAAP Earnings (Loss) Per Ordinary Share - Basic: |

|

|

|

|

|

|

From continuing operations |

|

$ |

0.57 |

|

|

$ |

0.55 |

|

From discontinued operations |

|

$ |

(0.00 |

) |

|

$ |

(0.26 |

) |

From net income |

|

$ |

0.57 |

|

|

$ |

0.29 |

|

|

|

|

|

|

|

|

GAAP Earnings (Loss) Per Ordinary Share - Diluted: |

|

|

|

|

|

|

From continuing operations |

|

$ |

0.56 |

|

|

$ |

0.53 |

|

From discontinued operations |

|

$ |

(0.00 |

) |

|

$ |

(0.25 |

) |

From net income |

|

$ |

0.55 |

|

|

$ |

0.28 |

|

|

|

|

|

|

|

|

Weighted Average Number of Ordinary Shares Outstanding: |

|

|

|

|

|

|

Basic — GAAP and Non-GAAP |

|

|

163,368 |

|

|

|

166,607 |

|

Diluted — GAAP and Non-GAAP |

|

|

167,025 |

|

|

|

171,903 |

|

|

|

|

|

|

|

|

|

|

Condensed Consolidated Statements of Operations - GAAP (Continued) |

|

Three Months Ended |

|

|

Three Months Ended |

|

(In thousands, except per share data) |

|

September 30, 2024 |

|

|

September 30, 2023 |

|

An itemized reconciliation between net income from continuing operations on a GAAP basis and EBITDA is as follows: |

|

|

|

|

|

|

Net Income from Continuing Operations |

|

$ |

92,795 |

|

|

$ |

91,554 |

|

Adjustments: |

|

|

|

|

|

|

Depreciation expense |

|

|

6,958 |

|

|

|

8,886 |

|

Amortization expense |

|

|

14 |

|

|

|

8,995 |

|

Interest income |

|

|

(10,916 |

) |

|

|

(9,370 |

) |

Interest expense |

|

|

6,000 |

|

|

|

6,006 |

|

Income tax provision |

|

|

17,435 |

|

|

|

1,153 |

|

EBITDA from Continuing Operations |

|

|

112,286 |

|

|

|

107,224 |

|

EBITDA from Discontinued Operations |

|

|

(481 |

) |

|

|

(44,567 |

) |

EBITDA |

|

$ |

111,805 |

|

|

$ |

62,657 |

|

|

|

|

|

|

|

|

An itemized reconciliation between net income from continuing operations on a GAAP basis and non-GAAP net income is as follows: |

|

|

|

|

|

|

Net Income from Continuing Operations |

|

$ |

92,795 |

|

|

$ |

91,554 |

|

Adjustments: |

|

|

|

|

|

|

Share-based compensation expense |

|

|

22,533 |

|

|

|

21,733 |

|

Depreciation expense |

|

|

6,958 |

|

|

|

8,886 |

|

Amortization expense |

|

|

14 |

|

|

|

8,995 |

|

Non-cash net interest expense |

|

|

114 |

|

|

|

115 |

|

Separation expense |

|

|

206 |

|

|

|

9,640 |

|

Income tax effect related to reconciling items |

|

|

(1,255 |

) |

|

|

3,511 |

|

Restructuring expense |

|

|

— |

|

|

|

5,938 |

|

Non-GAAP Net Income from Continuing Operations |

|

|

121,365 |

|

|

|

150,372 |

|

Non-GAAP Net Loss from Discontinued Operations |

|

|

(414 |

) |

|

|

(40,835 |

) |

Non-GAAP Net Income |

|

$ |

120,951 |

|

|

$ |

109,537 |

|

|

|

|

|

|

|

|

Non-GAAP diluted earnings per ordinary share from continuing operations |

|

$ |

0.73 |

|

|

$ |

0.87 |

|

Non-GAAP diluted loss per ordinary share from discontinued operations |

|

$ |

(0.00 |

) |

|

$ |

(0.24 |

) |

Non-GAAP diluted earnings per ordinary share from net income |

|

$ |

0.72 |

|

|

$ |

0.64 |

|

|

|

|

|

|

|

|

|

|

Alkermes plc and Subsidiaries |

|

Selected Financial Information (Unaudited) |

|

|

|

|

|

|

|

|

Condensed Consolidated Statements of Operations - GAAP |

|

Nine Months Ended |

|

|

Nine Months Ended |

|

(In thousands, except per share data) |

|

September 30, 2024 |

|

|

September 30, 2023 |

|

Revenues: |

|

|

|

|

|

|

Product sales, net |

|

$ |

775,808 |

|

|

$ |

678,026 |

|

Manufacturing and royalty revenues |

|

|

351,835 |

|

|

|

607,888 |

|

Research and development revenue |

|

|

3 |

|

|

|

16 |

|

Total Revenues |

|

|

1,127,646 |

|

|

|

1,285,930 |

|

Expenses: |

|

|

|

|

|

|

Cost of goods manufactured and sold |

|

|

183,215 |

|

|

|

182,911 |

|

Research and development |

|

|

187,152 |

|

|

|

196,873 |

|

Selling, general and administrative |

|

|

498,244 |

|

|

|

519,962 |

|

Amortization of acquired intangible assets |

|

|

1,087 |

|

|

|

26,693 |

|

Total Expenses |

|

|

869,698 |

|

|

|

926,439 |

|

Operating Income |

|

|

257,948 |

|

|

|

359,491 |

|

Other Income, net: |

|

|

|

|

|

|

Interest income |

|

|

31,050 |

|

|

|

21,105 |

|

Interest expense |

|

|

(17,930 |

) |

|

|

(16,978 |

) |

Other income (expense), net |

|

|

2,793 |

|

|

|

(415 |

) |

Total Other Income, net |

|

|

15,913 |

|

|

|

3,712 |

|

Income Before Income Taxes |

|

|

273,861 |

|

|

|

363,203 |

|

Income Tax Provision |

|

|

47,460 |

|

|

|

4,598 |

|

Net Income From Continuing Operations |

|

|

226,401 |

|

|

|

358,605 |

|

Loss From Discontinued Operations — Net of Tax |

|

|

(5,834 |

) |

|

|

(115,627 |

) |

Net Income — GAAP |

|

$ |

220,567 |

|

|

$ |

242,978 |

|

|

|

|

|

|

|

|

GAAP Earnings (Loss) Per Ordinary Share - Basic: |

|

|

|

|

|

|

From continuing operations |

|

$ |

1.36 |

|

|

$ |

2.16 |

|

From discontinued operations |

|

$ |

(0.04 |

) |

|

$ |

(0.70 |

) |

From net income |

|

$ |

1.32 |

|

|

$ |

1.47 |

|

|

|

|

|

|

|

|

GAAP Earnings (Loss) Per Ordinary Share - Diluted: |

|

|

|

|

|

|

From continuing operations |

|

$ |

1.33 |

|

|

$ |

2.10 |

|

From discontinued operations |

|

$ |

(0.03 |

) |

|

$ |

(0.68 |

) |

From net income |

|

$ |

1.30 |

|

|

$ |

1.42 |

|

|

|

|

|

|

|

|

Weighted Average Number of Ordinary Shares Outstanding: |

|

|

|

|

|

|

Basic — GAAP and Non-GAAP |

|

|

166,546 |

|

|

|

165,686 |

|

Diluted — GAAP and Non-GAAP |

|

|

170,196 |

|

|

|

170,747 |

|

|

|

|

|

|

|

|

|

|

Condensed Consolidated Statements of Operations - GAAP (Continued) |

|

Nine Months Ended |

|

|

Nine Months Ended |

|

(In thousands, except per share data) |

|

September 30, 2024 |

|

|

September 30, 2023 |

|

An itemized reconciliation between net income from continuing operations on a GAAP basis and EBITDA is as follows: |

|

|

|

|

|

|

Net Income from Continuing Operations |

|

$ |

226,401 |

|

|

$ |

358,605 |

|

Adjustments: |

|

|

|

|

|

|

Depreciation expense |

|

|

20,599 |

|

|

|

27,696 |

|

Amortization expense |

|

|

1,087 |

|

|

|

26,693 |

|

Interest income |

|

|

(31,050 |

) |

|

|

(21,105 |

) |

Interest expense |

|

|

17,930 |

|

|

|

16,978 |

|

Income tax provision |

|

|

47,460 |

|

|

|

4,598 |

|

EBITDA from Continuing Operations |

|

|

282,427 |

|

|

|

413,465 |

|

EBITDA from Discontinued Operations |

|

|

(6,910 |

) |

|

|

(121,947 |

) |

EBITDA |

|

$ |

275,517 |

|

|

$ |

291,518 |

|

|

|

|

|

|

|

|

An itemized reconciliation between net income from continuing operations on a GAAP basis and non-GAAP net income is as follows: |

|

|

|

|

|

|

Net Income from Continuing Operations |

|

$ |

226,401 |

|

|

$ |

358,605 |

|

Adjustments: |

|

|

|

|

|

|

Share-based compensation expense |

|

|

75,889 |

|

|

|

69,943 |

|

Depreciation expense |

|

|

20,599 |

|

|

|

27,696 |

|

Amortization expense |

|

|

1,087 |

|

|

|

26,693 |

|

Separation expense |

|

|

1,446 |

|

|

|

19,280 |

|

Income tax effect related to reconciling items |

|

|

(3,316 |

) |

|

|

3,332 |

|

Gain on sale of Athlone manufacturing facility |

|

|

(1,462 |

) |

|

|

— |

|

Restructuring expense |

|

|

— |

|

|

|

5,938 |

|

Final award in the Janssen arbitration (2022 back royalties and interest) |

|

|

— |

|

|

|

(197,092 |

) |

Non-cash net interest expense |

|

|

342 |

|

|

|

346 |

|

Non-GAAP Net Income from Continuing Operations |

|

|

320,986 |

|

|

|

314,741 |

|

Non-GAAP Net Loss from Discontinued Operations |

|

|

(5,834 |

) |

|

|

(108,511 |

) |

Non-GAAP Net Income |

|

$ |

315,152 |

|

|

$ |

206,230 |

|

|

|

|

|

|

|

|

Non-GAAP diluted earnings per ordinary share from continuing operations |

|

$ |

1.89 |

|

|

$ |

1.84 |

|

Non-GAAP diluted loss per ordinary share from discontinued operations |

|

$ |

(0.03 |

) |

|

$ |

(0.64 |

) |

Non-GAAP diluted earnings per ordinary share from net income |

|

$ |

1.85 |

|

|

$ |

1.21 |

|

|

|

|

|

|

|

|

|

|

Alkermes plc and Subsidiaries |

|

Selected Financial Information (Unaudited) |

|

|

|

|

|

|

|

|

Condensed Consolidated Balance Sheets |

|

September 30, |

|

|

December 31, |

|

(In thousands) |

|

2024 |

|

|

2023 |

|

Cash, cash equivalents and total investments |

|

$ |

927,784 |

|

|

$ |

813,378 |

|

Receivables |

|

|

367,211 |

|

|

|

332,477 |

|

Inventory |

|

|

191,087 |

|

|

|

186,406 |

|

Contract assets |

|

|

2,969 |

|

|

|

706 |

|

Prepaid expenses and other current assets |

|

|

94,047 |

|

|

|

98,166 |

|

Property, plant and equipment, net |

|

|

225,422 |

|

|

|

226,943 |

|

Intangible assets, net and goodwill |

|

|

83,931 |

|

|

|

85,018 |

|

Assets held for sale |

|

|

— |

|

|

|

94,260 |

|

Deferred tax assets |

|

|

159,960 |

|

|

|

195,888 |

|

Other assets |

|

|

102,880 |

|

|

|

102,981 |

|

Total Assets |

|

$ |

2,155,291 |

|

|

$ |

2,136,223 |

|

Long-term debt — current portion |

|

$ |

3,000 |

|

|

$ |

3,000 |

|

Other current liabilities |

|

|

450,705 |

|

|

|

512,678 |

|

Long-term debt |

|

|

285,823 |

|

|

|

287,730 |

|

Liabilities from discontinued operations |

|

|

— |

|

|

|

4,542 |

|

Other long-term liabilities |

|

|

123,658 |

|

|

|

125,587 |

|

Total shareholders' equity |

|

|

1,292,105 |

|

|

|

1,202,686 |

|

Total Liabilities and Shareholders' Equity |

|

$ |

2,155,291 |

|

|

$ |

2,136,223 |

|

|

|

|

|

|

|

|

Ordinary shares outstanding (in thousands) |

|

|

161,776 |

|

|

|

166,980 |

|

|

|

|

|

|

|

|

This selected financial information should be read in conjunction with the consolidated financial statements and notes thereto included in Alkermes plc's Quarterly Report on Form 10-Q for the quarter ended September 30, 2024, which the company intends to file in October 2024. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Alkermes plc and Subsidiaries |

|

Amounts Included in Discontinued Operations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(In thousands) |

|

Three Months

Ended

March 31,

2024 |

|

|

Three Months

Ended

June 30,

2024 |

|

|

Three Months

Ended

September 30,

2024 |

|

|

Nine Months

Ended

September 30,

2024 |

|

Cost of goods manufactured and sold |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

Research and development |

|

|

2,516 |

|

|

|

3,913 |

|

|

|

481 |

|

|

|

6,910 |

|

Selling, general and administrative |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Income tax benefit |

|

|

(396 |

) |

|

|

(613 |

) |

|

|

(67 |

) |

|

|

(1,076 |

) |

Loss from discontinued operations, net of tax |

|

$ |

2,120 |

|

|

$ |

3,300 |

|

|

$ |

414 |

|

|

$ |

5,834 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(In thousands) |

|

Three Months

Ended

March 31,

2023 |

|

|

Three Months

Ended

June 30,

2023 |

|

|

Three Months

Ended

September 30,

2023 |

|

|

Nine Months

Ended

September 30,

2023 |

|

Cost of goods manufactured and sold |

|

$ |

11 |

|

|

$ |

11 |

|

|

$ |

11 |

|

|

$ |

33 |

|

Research and development |

|

|

29,867 |

|

|

|

32,563 |

|

|

|

32,262 |

|

|

|

94,692 |

|

Selling, general and administrative |

|

|

6,644 |

|

|

|

9,502 |

|

|

|

13,073 |

|

|

|

29,219 |

|

Income tax benefit |

|

|

(6,727 |

) |

|

|

(40 |

) |

|

|

(1,550 |

) |

|

|

(8,317 |

) |

Loss from discontinued operations, net of tax |

|

$ |

29,795 |

|

|

$ |

42,036 |

|

|

$ |

43,796 |

|

|

$ |

115,627 |

|

Third Quarter 2024 �Financial Results & Business Update October 24, 2024 Exhibit 99.2

Forward-Looking Statements and Non-GAAP Financial Information Certain statements set forth in this presentation constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended, including, but not limited to, statements concerning: Alkermes plc’s (the “Company”) expectations with respect to its current and future financial, commercial and operating performance, business plans or prospects, including its expected revenue and profitability. The Company cautions that forward-looking statements are inherently uncertain. Actual performance and results may differ materially from those expressed or implied in the forward-looking statements due to various risks, assumptions and uncertainties. These risks, assumptions and uncertainties include, among others: whether the Company is able to sustain profitability; the unfavorable outcome of arbitration or litigation, including so-called “Paragraph IV” litigation or other patent litigation which may lead to competition from generic drug manufacturers, or other disputes related to the Company’s products or products using the Company’s proprietary technologies; the Company’s commercial activities may not result in the benefits that the Company anticipates; clinical development activities may not be completed on time or at all and the results of such activities may not be positive, or predictive of final results from such activities, results of future development activities or real-world results; potential changes in the cost, scope, design or duration of the Company’s development activities; the U.S. Food and Drug Administration or other regulatory authorities may make adverse decisions regarding the Company’s products; the Company and its licensees may not be able to continue to successfully commercialize their products or support growth of such products; there may be a reduction in payment rate or reimbursement for the Company’s products or an increase in the Company’s financial obligations to government payers; the Company’s products may prove difficult to manufacture, be precluded from commercialization by the proprietary rights of third parties, or have unintended side effects, adverse reactions or incidents of misuse; and those risks, assumptions and uncertainties described under the heading “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended Dec. 31, 2023 and in subsequent filings made by the Company with the U.S. Securities and Exchange Commission (“SEC”), which are available on the SEC’s website at www.sec.gov, and on the Company’s website at www.alkermes.com in the ‘Investors – SEC Filings’ section. Existing and prospective investors are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Except as required by law, the Company disclaims any intention or responsibility for updating or revising any forward-looking statements contained in this presentation. Non-GAAP Financial Measures: This presentation includes information about certain financial measures that are not prepared in accordance with generally accepted accounting principles in the U.S. (“GAAP”), including non-GAAP net income and EBITDA (earnings before interest, taxes, depreciation and amortization). The Company provides these non-GAAP financial measures of the Company’s performance to investors because management believes that these non-GAAP financial measures, when viewed with the Company’s results under GAAP and the accompanying reconciliations, are useful in identifying underlying trends in ongoing operations. These non-GAAP measures are not based on any standardized methodology prescribed by GAAP and are not necessarily comparable to similar measures presented by other companies. Reconciliations of non-GAAP financial measures to the most directly comparable GAAP financial measures, to the extent reasonably determinable, can be found in the Appendix of this presentation. Note Regarding Trademarks: The Company and its affiliates are the owners of various U.S. federal trademark registrations (®) and other trademarks (TM), including ARISTADA®, ARISTADA INITIO® , LYBALVI® and VIVITROL®. INVEGA SUSTENNA® is a registered trademark of Johnson & Johnson or its affiliated companies. Any other trademarks referred to in this presentation are the property of their respective owners. Appearances of such other trademarks herein should not be construed as any indicator that their respective owners will not assert their rights thereto.

Q3 2024 Financial and Operational Performance

In millions Q3 2024 Financial Results Summary Total Revenue In millions GAAP Net Income GAAP Earnings Per Share �Diluted *Q3 2024 results reflect expiration of royalty on U.S. net sales of INVEGA SUSTENNA® in August 2024

In millions Q3 2024 Profitability From Continuing Operations** GAAP Net Income �From Continuing Operations In millions Non-GAAP Net Income*�From Continuing Operations EBITDA* �From Continuing Operations In millions *EBITDA (earnings before interest, taxes, depreciation and amortization). Reconciliation of this non-GAAP financial measure to the most directly comparable GAAP financial measure can be found in the Appendix of this presentation **Q3 2024 results reflect expiration of royalty on U.S. net sales of INVEGA SUSTENNA® in August 2024.

Q3 2024 Revenue Summary Amounts in the table above may not sum due to rounding. In millions Q3’24 Q3’23 Total Proprietary Net Sales $273.0 $231.8 VIVITROL® $113.7 $99.3 ARISTADA®* $84.7 $81.8 LYBALVI® $74.7 $50.7 Manufacturing & Royalty Revenue $105.1 $149.1 Total Revenue $378.1 $380.9 *Inclusive of ARISTADA INITIO® **Reflects expiration of royalty on U.S. net sales of INVEGA SUSTENNA® in August 2024. ** **

Alkermes: 2024 Financial Expectations* *These expectations were initially provided by the Company on Feb. 15, 2024, are reiterated by the Company on Oct. 24, 2024 and are effective only as of such date. The Company expressly disclaims any obligation to update or reaffirm these expectations. ‡Reconciliation of these non-GAAP financial measures to the most directly comparable GAAP financial measures can be found in the Appendix of this presentation. (in millions) Financial Expectations for Year Ending Dec. 31, 2024 Total Revenues $1,500 – $1,600 COGS $230 – $250 R&D Expense $225 – $255 SG&A Expense $625 – $655 GAAP Net Income $350 – $390 EBITDA‡ $445 – $485 Non-GAAP Net Income‡ $465 – $505 Effective Tax Rate ~17% Expected net sales of proprietary products: VIVITROL® net sales of $410M – $430M ARISTADA® net sales of $340M – $360M LYBALVI® net sales of $275M – $295M

Q3 2024 Commercial Review

LYBALVI® Performance and Expectations *These expectations were initially provided by the Company on Feb. 15, 2024, are reiterated by the Company on Oct. 24, 2024 and are effective only as of such date. The Company expressly disclaims any obligation to update or reaffirm these expectations. LYBALVI Quarterly Net Sales ($M) Q3’24 LYBALVI® net sales of $74.7M reflects 47% growth compared to Q3’23 Q3’24 gross-to-net deductions: ~30% Outlook: FY’24 net sales expected to range from $275M – $295M*

LYBALVI® Prescription Growth Trends Q3’24 total TRx: ~57,500 reflecting 5% sequential growth compared to Q2’24 *Source: IQVIA NPA Weekly Post-Launch TRx* (Through 10/11/24) TRx Week

ARISTADA® Performance and Expectations ARISTADA Quarterly Net Sales* ($M) Q3’24 ARISTADA® net sales were $84.7M Outlook: FY’24 net sales expected to range from $340M – $360M†* *Inclusive of ARISTADA INITIO®�† These expectations were initially provided by the Company on Feb. 15, 2024, are reiterated by the Company on Oct. 24, 2024 and are effective only as of such date. The Company expressly disclaims any obligation to update or reaffirm these expectations.

VIVITROL® Performance and Expectations VIVITROL Quarterly Net Sales ($M) * These expectations were initially provided by the Company on Feb. 15, 2024, are reiterated by the Company on Oct. 24, 2024 and are effective only as of such date. The Company expressly disclaims any obligation to update or reaffirm these expectations. Q3’24 VIVITROL® net sales were $113.7M Outlook: FY’24 net sales expected to range from $410M – $430M*

Appendix

Appendix: Amounts Included in Discontinued Operations (In millions) Year Ended December 31, 2023 Three Months Ended �September 30, 2024 Cost of goods manufactured and sold $ --- Research and development 0.5 Selling, general and administrative --- Income tax benefit $ (0.1) Loss from discontinued operations, net of tax $ 0.4 (In millions) Year Ended December 31, 2023 Three Months Ended �September 30, 2023 Cost of goods manufactured and sold $ 0.0 Research and development 32.3 Selling, general and administrative 13.1 Income tax benefit $ (1.6) Loss from discontinued operations, net of tax $ 43.8

Appendix: Financial Results GAAP to EBITDA Adjustments (In millions) Three Months Ended September 30, 2024 Three Months Ended September 30, 2023 Net Income from Continuing Operations — GAAP $ 92.8 $ 91.6 Adjustments: Depreciation expense 7.0 8.9 Amortization expense 0.0 9.0 Interest income (10.9) (9.4) Interest expense 6.0 6.0 Income tax provision 17.4 1.2 EBITDA from Continuing Operations $ 112.3 $ 107.2 EBITDA from Discontinued Operations $ (0.5) $ (44.6) EBITDA $ 111.8 $ 62.7

Appendix: Financial Results GAAP to Non-GAAP Adjustments (In millions) Three Months Ended September 30, 2024 Three Months Ended September 30, 2023 Net Income from Continuing Operations — GAAP $ 92.8 $ 91.6 Adjustments: Share-based compensation expense 22.5 21.7 Depreciation expense 7.0 8.9 Amortization expense 0.0 9.0 Non-cash net interest expense 0.1 0.1 Separation expense 0.2 9.6 Income tax effect related to reconciling items (1.3) 3.5 Restructuring expense --- 5.9 Non-GAAP Net Income from Continuing Operations $ 121.4 $ 150.4 Non-GAAP Net Loss from Discontinued Operations $ (0.4) $ (40.8) Non-GAAP Net Income $ 121.0 $ 109.5 Amounts in the table above may not sum due to rounding.

Appendix: 2024 Guidance GAAP to EBITDA Adjustments (In millions) Year Ended December 31, 2023 Year Ending December 31, 2024 Projected Net Income — GAAP $ 370.0 Adjustments: Net interest income (16.0) Depreciation expense 35.0 Amortization expense 1.0 Provision for income taxes 75.0 Projected EBITDA $ 465.0 Projected GAAP and non-GAAP measures reflect the mid-points within the Company’s financial expectations ranges.

Appendix: 2024 Guidance GAAP to Non-GAAP Adjustments (In millions) Year Ended December 31, 2023 Year Ending December 31, 2024 Projected Net Income — GAAP $ 370.0 Adjustments: Share-based compensation expense 86.0 Depreciation expense 35.0 Amortization expense 1.0 Non-cash net interest expense 0.5 Income tax effect related to reconciling items (7.5) Projected Net Income — Non-GAAP $ 485.0 Projected GAAP and non-GAAP measures reflect the mid-points within the Company’s financial expectations ranges.

www.alkermes.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

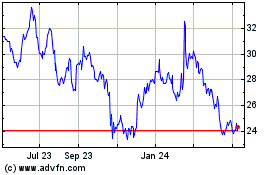

Alkermes (NASDAQ:ALKS)

Historical Stock Chart

From Jan 2025 to Feb 2025

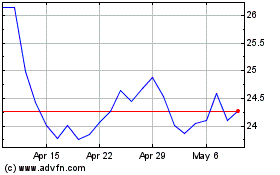

Alkermes (NASDAQ:ALKS)

Historical Stock Chart

From Feb 2024 to Feb 2025