false

0001347858

0001347858

2024-10-10

2024-10-10

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported): October 10, 2024

22nd Century Group, Inc.

(Exact

Name of Registrant as Specified in Charter)

| Nevada |

001-36338 |

98-0468420 |

(State or Other Jurisdiction

of

Incorporation) |

(Commission File Number) |

(I.R.S. Employer

Identification No.) |

|

321 Farmington Road, Mocksville, North Carolina

(Address of Principal Executive Office) |

27028

(Zip Code) |

Registrant’s

telephone number, including area code: (716) 270-1523

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant

to Section 12(b) of the Act:

| Title of each class |

Trading symbol |

Name

of each exchange on which registered |

| Common Stock, $0.00001 par value |

XXII |

NASDAQ Capital Market |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01 |

Entry into a Material Definitive Agreement. |

Senior Secured Credit

Facility

On

October 10, 2024, 22nd Century Group, Inc. (the “Company”) entered into that certain Letter Agreement to modify the terms of

the Securities Purchase Agrement dated March 3, 2023 (the “JGB SPA”) and debentures (the “Debentures”), as amended,

with JGB Partners, LP (“JGB Partners”),

JGB Capital, LP (“JGB Capital”) and JGB Capital Offshore Ltd. (“JGB

Offshore” and collectively with JGB Partners and JGB Capital, the “Holders”)

and JGB Collateral, LLC, as collateral agent for the Holders (the “Agent”).

Under

the terms of the Letter Agreement, subject to obtaining stockholder approval as described below, Company will be able to reset

the Conversion Price (as defined in the Debentures) currently in effect, at the discrection of the Board of Directors and on a one time

basis, to an amount equal to the average of the daily VWAPs for each of the five (5) consecutive Nasdaq trading days immediately preceding

the date on which the Conversion Price shall be reset. The reset Conversion Price shall in no event be greater than the Conversion Price

in effect on the date of the Letter Agreement, which is $.7458.

The

reduction in the Conversion Price will be subject to stockholder approval. The Company has agreed to seek stockholder approval

for the Conversion Price reset pursuant to applicable Nasdaq rules no later than December 31, 2024, and to seek stockholder approval at

each stockholder meeting thereafter if approval is not obtained by then.

A

copy of the Letter Agreement is attached hereto as Exhibit 10.1 and incorporated herein by reference.

| Item 9.01(d): |

Financial Statements and Exhibits. |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

22nd Century Group, Inc. |

| |

|

| |

|

| |

/s/ Lawrence Firestone |

| Date: October 10, 2024 |

Lawrence Firestone |

| |

Chief Executive Officer |

Exhibit 10.1

JGB Collateral,

LLC

JGB Capital Offshore

Ltd.

JGB Capital LP

JGB Partners LP

c/o JGB Management,

Inc.

246 Post Road East,

2nd Floor

Westport, CT 06880

October 10, 2024

Via Federal

Express and E-mail

22nd Century Group,

Inc.

321 Farmington

Rd.

Mocksville, NC

27028

E-mail: dotto@xxiicentury.com

Re: Securities

Purchase Agreement dated March 3, 2023, (the “SPA”) between 22nd Century Group, Inc. (the “Company”)

and the Purchasers.

Ladies

and Gentlemen:

Reference is made

to the SPA and the Debentures (as defined in the SPA). Capitalized terms used herein but not otherwise defined herein shall have the

respective meanings given such terms in the SPA or the Debentures, as applicable. Further reference is made to the letter agreement,

dated August 27, 2024, by and between the Company, the Holders and the Agent (the “August 2024 Letter Agreement”).

By the parties

agreement to and acceptance of this letter agreement (this “Letter Agreement”), the Company shall have the

right, on a one-time basis, to reset the Conversion Price in effect to an amount equal to the average of the daily VWAPs for each of

the five (5) consecutive Trading Days immediately preceding the Reset Date (as defined herein) (the “Reset Conversion Price”);

provided, however, that Reset Conversion Price shall in no event be greater than the Conversion Price (as adjusted in accordance with

the terms of the Debentures) in effect on the date of this Letter Agreement and, in any case, the Reset Conversion Price shall be subject

to written approval of the Holders. The Company shall give each Holder prior notice to the extent practicable of the date on which the

reset of the Conversion Price shall occur pursuant to the preceding sentence (the “Reset Date”), but in any

event the Company shall notify each Holder of the reset immediately after the reset. For clarity, the Company shall only be permitted

to reset the Conversion Price once pursuant to this Letter Agreement.

The Company acknowledges

that all Conversion Shares will be issued free and clear of restrictive legends in accordance with the terms of the Debentures. The Company

will cause its legal counsel to issue such legal opinions to its transfer agent as necessary to effect the foregoing.

In connection with

the foregoing, the Company agrees that it shall, by not later than December 31, 2024, obtain approval of its stockholders for the issuance

of an unlimited number of shares of Common Stock in excess of 20% of its outstanding shares at a discount to the applicable “Nasdaq

Minimum Price” (as defined in Nasdaq Rule 5635) pursuant to the Debentures. Without limiting the Holders’ other remedies,

if the Company fails to obtain such stockholder approval by December 31, 2024, it shall seek approval at every subsequent stockholder

meeting, but not less than once every six months.

The Company shall

file a Form 8-K announcing the terms of this Letter Agreement and filing this Letter Agreement as an exhibit thereto on or before 8:00

a.m. (local time in New York, New York) on October 10, 2024. Following the filing of such Form 8-K the Holders shall not be deemed to

be in possession of any material, non-public information of the Company.

Except as expressly

set forth above the Transaction Documents (including, for the avoidance of doubt the August 2024 Letter Agreement) remain in full force

and effect. This Letter Agreement is a Transaction Document.

Sincerely,

Brett Cohen for and on behalf of the

Holders and the Agent

| AGREED AND ACCEPTED: |

|

| |

|

| 22nd Century Group Inc. |

|

| |

|

| By: |

|

|

| Name: |

|

|

| Title: |

|

|

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

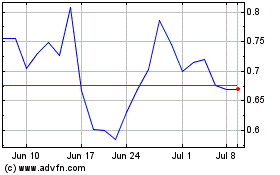

22nd Century (NASDAQ:XXII)

Historical Stock Chart

From Nov 2024 to Dec 2024

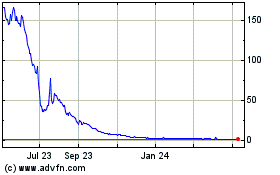

22nd Century (NASDAQ:XXII)

Historical Stock Chart

From Dec 2023 to Dec 2024