For India, the year 2015 was all about making progress, with

many calling it "a bright spot" in an otherwise dull world economic

scene, though some crucial economic reforms hit

roadblocks.

Sizzling Growth After GDP Tweak, Beats China

India's economic growth rate surpassed China's this year on

strong demand and investment, making it the fastest growing major

economy in the world. Latest statistics showed that GDP rose 7.4

percent year-on-year in the three months to September, while the

Chinese economy expanded only 6.9 percent during the same

period.

While the robust growth data ought to be reason enough to cheer,

many economists and policymakers, including the central bank chief,

took the news with a pinch of salt.

Apparently, skeptics felt a change in the national accounts

calculation method introduced at the start of the year was masking

the real picture as other economic indicators failed to match the

optimism of the GDP figures.

The Central Statistical Office had revised the base year for GDP

data to 2011-12 from 2004-05 and also shifted to measuring GDP at

market prices, rather than on factor cost. The GDP growth figure

for 2013-14 was sharply revised to 6.9 percent from 4.7 percent

calculated in the old method. The economy expanded 7.4 percent in

2014-15.

The International Monetary Fund expects India to grow 7.5

percent the next year, above China's projected rate of 6.3 percent.

And in December, the government downgraded its growth forecast for

the financial year ending March 2016 to 7-7.5 percent from 8.1-8.5

percent seen earlier.

Eyeing Inflation

The country's central bank, the Reserve Bank of India, was in

for historical moves this year. Under the governorship of former

IMF chief economist Raghuram Rajan, the bank inked a deal with the

government for a major revamp of the monetary policy framework to

place focus on inflation.

The agreement, dated February 20, stated that the inflation

target "for financial year 2016-17 and all subsequent years shall

be 4 percent with a band of plus or minus 2 percent".

The deal was a major overhaul for the RBI, since its

establishment in 1935, and came at a time the Indian economy is

gearing up for stronger growth momentum in the coming years. The

move was also a major step for the economy that was opened up in

1991.

The RBI also started to target inflation based on the consumer

price index rather than wholesale prices.

The bank reduced interest rates four times this year, lowering

it by 125 points in total. After maintaining status quo early

December, Rajan signaled willingness to ease further, keeping in

view the imminent interest rate hike in the U.S.

The repo rate is currently at 6.75 percent and the reverse repo

rate at 5.75 percent. The cash reserve ratio for banks is at 4

percent.

Reform Power

During the year, India benefited from falling crude prices to a

large extent. The West Texas Intermediate grade of crude oil has

seen its price fall by roughly 29 percent this year and is

currently around $37-a-barrel mark. Lower oil prices helped to

reduce inflation and narrowed the current account deficit

considerably, as oil constitutes a major portion of the country's

imports. The forex reserves position also improved.

In its second year in office, the pro-business Narendra Modi

government were into economic reforms big time. Thanks to the

different government schemes, foreign investors flocked to the

country as investment norms were relaxed in several major

sectors.

Foreign Direct Investment limits were raised in defense,

banking, medical equipment, insurance, pension and airport

operations, among others. Foreign equity was allowed in the pension

sector and railways.

The government is confident of achieving the fiscal deficit

target of 3.9 percent of GDP and the revenue deficit of 2.8 percent

this financial year. However, the fiscal outlook for the next year

looks challenging.

No Surprises

The Indian stock market did not throw up any major surprises and

trading was largely affected through out the year by the

speculation over an imminent US Fed rate hike that eventually

materialized this month, and domestic factors such as politics.

Both the major indexes - the Sensex and the Nifty - are set to

end the year in the red, the weakest performance in four years. The

BSE Sensex is down 5.16 percent for the year (as of December 29th,

2015) and the NSE Nifty has lost 4.27 percent during the same

period.

The Indian rupee was largely stable during the year and even one

of the best performers among its Asian peers, despite global

concerns over the interest rate hike in the U.S. and the Chinese

yuan devaluation. The RBI intervened in the currency markets in

several instances to stem further depreciation of the currency.

Challenges

As a proposed wage increase for government employees is set to

add an additional 0.65 percent of GDP to expenditure, the

government said that the commitment to further fiscal consolidation

of 0.4 percent needs to be re-assessed.

Putting a damper on the economic cheer this year was the failure

of the government to win parliament approval for a key tax reform -

the Goods and Services Tax (GST) Bill. The GST is a single levy on

manufacture, sale and consumption of goods and services throughout

India that will replace the existing system under which taxes are

collected separately by central and state governments.

The government hopes to overcome the political gridlock in the

next session of the parliament so that it can meet the April 1,

2016 deadline set for the GST roll out.

Way Forward

The economic situation in the year ahead looks to be more stable

as analysts expect the government and the central bank to focus on

policy implementation than formulation. A key milestone to be

achieved would be the roll out of the GST in April. Consumption is

expected to receive a boost from increased spending power after the

implementation of the recent pay reforms for the public sector

employees.

The DBS Group Research said this month that if the normalization

cycle in the U.S. is accompanied by a stronger dollar, higher real

rates and / or a bout of weak foreign sentiment, India's

unfavorable external debt profile would emerge as a source of

concern.

India continues to be well positioned for robust growth in 2016

and 2017, Danske Bank analysts said, citing the benefits from lower

oil prices, better external and domestic balances and a

reform-oriented government. They expect higher inflation to keep

the RBI from easing further and the rupee to depreciate about 5

percent in 12 months

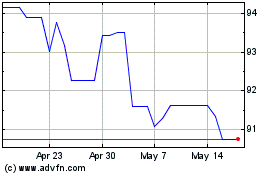

US Dollar vs RUB (FX:USDRUB)

Forex Chart

From Jun 2024 to Jul 2024

US Dollar vs RUB (FX:USDRUB)

Forex Chart

From Jul 2023 to Jul 2024