U.S. Dollar Turns Higher Against Majors

February 23 2023 - 2:50AM

RTTF2

The U.S. dollar strengthened against its major counterparts in

the European session on Thursday, as minutes from the Federal

Reserve's February meeting showed that the central bank would

continue raising interest rates to achieve the inflation

target.

The minutes noted all participants continued to anticipate that

ongoing rate increases would be appropriate to achieve the Fed's

dual goals of maximum employment and inflation at the rate of 2

percent over the longer run.

The minutes also revealed a "few participants" favored raising

rates by 50 basis points compared to the 25 basis point rate hike

that was ultimately announced.

Investors await economic data from the U.S., including GDP data

for the fourth quarter and weekly jobless claims report.

U.S. treasury yields rose, with the benchmark 10-year yield

touching 3.949 percent.

The greenback was up against the yen, at 134.99. On the upside,

139.00 is possibly seen as its next resistance level.

The greenback rebounded to 0.6814 against the aussie and 0.6225

against the kiwi, from its prior lows of 0.6842 and 0.6251,

respectively. The greenback is seen facing resistance around 0.66

against the aussie and 0.60 against the kiwi.

The greenback firmed to a 1-1/2-month high of 1.0586 against the

euro, 2-day high of 1.2014 against the pound and a 6-week high of

0.9335 against the franc, off its early lows of 1.0628, 1.2075 and

0.9290, respectively. The greenback may find resistance around 1.03

against the euro, 1.19 against the pound and 0.96 against the

franc.

In contrast, the greenback pulled back against the loonie and

was trading at 1.3527. If the currency slides further, 1.33 is

likely seen as its next support level.

U.S. weekly jobless claims for the week ended February 18 and

GDP data for the fourth quarter will be released in the New York

session.

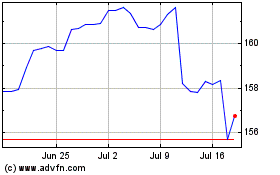

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Aug 2024 to Sep 2024

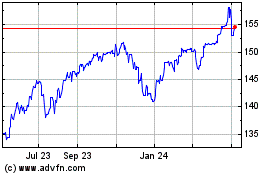

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Sep 2023 to Sep 2024