Dollar Mixed Following U.S. Nonfarm Payrolls Data

October 02 2020 - 5:32AM

RTTF2

The U.S. dollar came in mixed against its major counterparts in

the European session on Friday, after a data showed that the

nation's job growth slowed much more than expected in September

amid the persistence of the pandemic and deadlock over stimulus

package.

Data from the Labor Department showed that non-farm payroll

employment rose by 661,000 jobs in September after spiking by an

upwardly revised 1.489 million jobs in August.

Economists had expected employment to increase by 850,000 jobs

compared to the jump of 1.371 million jobs originally reported for

the previous month.

The unemployment rate slid to 7.9 percent in September from 8.4

percent in August. The unemployment rate was expected to dip to 8.2

percent.

The House of Representatives passed a $2.2 trillion coronavirus

stimulus plan on Thursday night. The bill will go to the

Republican-held Senate and could be rejected.

House Speaker Nancy Pelosi said that Democrats and the Trump

administration still remained apart on issues including funding for

state and local governments.

The safe-haven dollar strengthened in the Asian session as U.S.

President Donald Trump contracted COVID-19.

The greenback held steady against the yen, after falling to a

9-day low of 104.94 at 1:45 am ET. The pair had closed Thursday's

deals at 105.50.

Data from the Cabinet Office showed that Japan's consumer

confidence improved to the highest level in seven months in

September.

On a seasonally adjusted basis, the consumer confidence index

increased to 32.7 in September from 29.3 in August.

The USD/CHF pair hovered at a 2-day high of 0.9219. At

yesterday's trading close, the pair was quoted at 0.9185. Should

the greenback strengthens further, it is likely to test resistance

around the 0.94 region.

The greenback remained higher against the euro, with the pair

trading at 1.1707. This may be compared to a 2-day high of 1.1696

set at 1:00 am ET. The pair was worth 1.1744 when it closed deals

on Thursday. Next key resistance for the greenback is likely seen

around the 1.14 level.

Flash data from Eurostat showed that Eurozone consumer prices

declined for the second straight month in September.

Consumer prices decreased 0.3 percent on a yearly basis,

following a 0.2 percent drop in August. Prices were expected to

fall again by 0.2 percent.

The greenback dropped to 1.2954 against the pound, from an early

high of 1.2837, and held steady afterwards. The pound-greenback

pair had ended yesterday's trading session at 1.2884.

The U.S. factory orders for August and University of Michigan's

final consumer sentiment index for September will be featured

shortly.

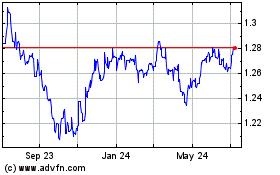

Sterling vs US Dollar (FX:GBPUSD)

Forex Chart

From Aug 2024 to Sep 2024

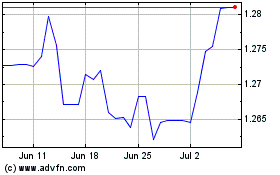

Sterling vs US Dollar (FX:GBPUSD)

Forex Chart

From Sep 2023 to Sep 2024