Canadian Dollar Drops As Easing Inflation Raises Rate Cut Hopes

May 21 2024 - 8:08AM

RTTF2

The Canadian dollar weakened against its major counterparts in

the New York session on Tuesday, as soft inflation data for April

increased the likelihood of an interest rate cut in June.

Data from Statistics Canada showed that the consumer price index

rose 2.7 percent year-on-year, down from a 2.9 percent gain in

March. The reading was in line with expectations.

On a seasonally adjusted monthly basis, the CPI came in at 0.2

percent in April, down from 0.3 percent in the prior month.

Core CPI, excluding food and energy, eased to 0.1 percent from

0.2 percent last month.

Oil prices dipped on worries of interest rates staying higher

for longer following hawkish comments from Fed officials.

The loonie touched 1.3675 against the greenback, setting a

1-week low. The loonie is seen finding support around the 1.38

level.

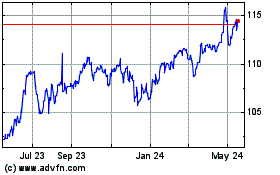

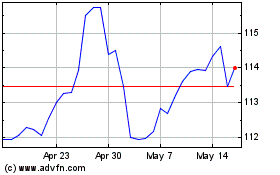

The loonie fell to near a 6-month low of 1.4834 against the euro

and a 4-day low of 114.15 against the yen, from an early high of

1.4790 and a session's high of 114.83, respectively. The currency

may locate support around 1.49 against the euro and 107.00 against

the yen.

The loonie dropped to 0.9119 against the aussie, from an early

6-day high of 0.9067. If the currency falls further, it is likely

to test support around the 0.94 region.

CAD vs Yen (FX:CADJPY)

Forex Chart

From Oct 2024 to Nov 2024

CAD vs Yen (FX:CADJPY)

Forex Chart

From Nov 2023 to Nov 2024