Sustaining Value: Another Year of Growth

Regulatory News:

Gecina (Paris:GFC):

| Key takeaways

- Financial performance: a third consecutive year of

growth, with earnings up +6.7% (recurrent net income per

share (Group share) of €6.42), above guidance, supported

by a solid +6.3% like-for-like rental growth driven by a

still high level of indexation and rental uplift in ever-polarized

markets (+10% on the office portfolio, +12% on the residential

portfolio), favoring prime and central assets as the return to the

office in modern well-located assets is confirmed

- Portfolio strategy delivering immediate value and preparing

for future value creation: - Newly repositioned buildings

delivered in 2024 (Mondo, 35 Capucines, Porte Sud) or to be

delivered in early 2025 (Icône) achieving c. +30% value creation

on the Paris office pipeline (vs total investment cost at the

beginning of the projects) including the new landmark deal for

Paris Central Business District (CBD) with Icône - Continuous

asset rotation strategy with the disposal of mature assets,

reflecting a +14% premium vs the latest valuations (5

residential assets between Q1 2024 and Q1 2025, as well as the

student housing transaction project expected to close in H1 2025) -

Launch of 3 new flagship projects to be delivered in 2027 in

our clients’ preferred areas, representing a capex program of c.

€500m still to invest and expected to generate c. €60 to

€70m of revenues in 2027-2028

- Strong and healthy balance sheet providing capacity to

operate and grow with: - A 35.4% loan-to-value improved to a

low of 32.7% when the disposals secured are completed - A

recently confirmed best-in-class A-/A3 rating, securing the

best financial conditions with an average cost of debt at

1.2% (drawn debt) - An optimized hedging profile providing

strong visibility on the cost of debt (c. 100% hedged on

2025-2026 and 85% over the next 5 years based on end-2024 debt,

adjusted for disposals to date)

- Performance on energy and carbon still standing the test of

time with another step forward through a -4.2% reduction in

energy consumption (-31% since 2019), as well as a -12.3%

decrease in carbon emissions (-60% since 2019)

- 2024 dividend up + 15 cts to €5.45 per share to be submitted

at the Shareholders’ General Meeting, full cash (interim

payment of €2.70 on March 5 with an ex-date of March 3, €2.75

balance on July 4 with an ex-date of July 2)

- 2025 guidance: recurrent net income (Group share) expected

between €6.60 to €6.70 per share, reflecting another year of growth

with +2.8%/+4.4% vs 2024

| Beñat Ortega, CEO: “I am proud to present Gecina’s

remarkable performance across all facets of our business in 2024

again. This achievement highlights our extensive real estate

expertise, seamlessly integrated to support our development

strategy. Development of new tailor-made offerings to meet markets

demands for centrality and services within our operational

portfolio. Development of complex projects to drive immediate

growth and prepare for future value creation. Development of new

initiatives to address the sustainability challenges in real

estate. For the third consecutive year, our growing earnings

demonstrate Gecina’s ability to maintain a trajectory of resilient

growth, while ensuring day-to-day operational excellence, to create

immediate value and prepare for future growth.”

In million euros

2023

2024

YoY Growth

LfL growth

Offices

534.0

566.7

+6.1%

+6.6%

Residential

132.9

127.8

-3.8%

+4.7%

Gross rents

666.8

694.5

+4.1%

+6.3%

Consolidated net income (Group share)

(1,787.2)

309.8

na

Recurrent net income (Group share)

444.2

474.4

+6.8%

-

Recurrent net income (Group share, ps,

€)

6.01

6.42

+6.7%

-

LTV (incl. duties)

34.4%

35.4%

+1.0pts

-

LTV (incl. duties, after secured

disposals at end-2024)

-

32.7%

-

-

LTV (excl. duties)

36.5%

37.6%

+1.1pts

-

EPRA NRV in € per share

158.1

157.6

-0.3%

-

EPRA NTA in € per share

143.6

142.8

-0.5%

-

EPRA NDV in € per share

150.1

147.3

-1.9%

-

DPS in €

5.30

5.45(1)

+2.8%

-

(1) Submitted at the Shareholders’ General Meeting

Recurrent net income of €6.42 ps (+6.7%), above

guidance

In million euros

Dec 31, 23

Dec 31, 24

Change (%)

Gross rental income

666.8

694.5

+4.1%

Net rental income

609.5

638.7

+4.8%

Other income (net)

3.4

3.3

-0.5%

Salaries and administrative costs

(77.9)

(76.3)

-2.0%

EBITDA

535.0

565.7

+5.7%

Net financial expenses

(90.0)

(90.5)

+0.6%

Recurrent gross income

445.1

475.2

+6.8%

Recurrent net income from associates

2.7

3.3

+21.5%

Recurrent minority interests

(2.0)

(2.0)

+4.1%

Recurrent tax

(1.6)

(2.1)

+26.9%

Recurrent net income (Group

share)(1)

444.2

474.4

+6.8%

Recurrent net income per share (Group

share)

6.01

6.42

+6.7%

(1) EBITDA after deducting net financial expenses, recurrent

tax, minority interests, including income from associates and

restated for certain non-recurring items

- Recurrent net income up, above guidance, with a systematic

optimization from the top line to the bottom line and all drivers

contributing to Gecina’s robust cash-flow performance this year

again

- Solid rental growth, especially in central locations, driven

by indexation, rental uplift, and the new deliveries which have

more than offset the impact of the €1.3bn of disposals of mature,

low yielded assets in 2023

- Continuous optimization of the cost base: gross to net

rental income ratio optimized, through effective relationships

with service providers and consistent quality management (rental

margin up +0.6pts) as well as salaries and administrative

costs (-2.0% in 2024, after -2.3% already in 2023)

- Low and overall stable cost of debt thanks to long

maturities and optimized hedging profile

Sound operational performance in an ever-polarized

market

Gross rental income

Dec 31, 23

Dec 31, 24

Change (%)

In million euros

Current basis

Like-for-like

Offices

534.0

566.7

+6.1%

+6.6%

Residential

132.9

127.8

-3.8%

+4.7%

Total gross rental income

666.8

694.5

+4.1%

+6.3%

| Like-for-like basis: gross rent up +6.3% (+€38.2m)

- Global: rent growth fueled by sustained indexation (+5.2%,

+€31.4m), as well as a sound rental uplift contribution (+0.8%,

+€5.2m), confirming the good performance posted in the first

half of 2024 (+6.3%)

- Office: +6.6% (+€33.1m) rental growth for the office

portfolio like-for-like, still fueled by indexation (+5.7%)

with c. 90% of the commercial leases indexed against the ILAT (the

other leases following the index of retail rents (ILC) or the index

of the cost of construction (ICC)), and the impact of rental uplift

(+0.6%), particularly on several assets in Central Paris

- Residential: +4.7% (€5.1m) rental growth on the residential

portfolio like-for-like, driven by sustained indexation (+2.8%)

and the rental uplift (+2.0%), particularly supported by the

diversification of the model to include new offerings and the good

performance by the student housing portfolio (optimization of

occupancy in summer through partnerships and the opening of student

accommodation to young urban professionals)

| Current basis: gross rent up +4.1%

- On top of the impact of like-for-like rental growth, current

rents were supported upwards by the full-year impact of the

assets delivered in 2023 (office & residential) following a

complete repositioning or a refurbishment (Boétie, 3 Opéra,

Horizons, Ville d’Avray, Montsouris) and the rents already

generated by assets recently delivered in 2024 (Mondo, 35

Capucines, Porte Sud) (+€17.2m)

- Downwards impact of the rent loss due to the transfer of

assets to the pipeline (-€7.3m, incl. Les Arches du Carreau in

Neuilly), as well as the 2023 disposals for both offices

(disposal of 10 office assets, including 101 Champs-Élysées) and

residential (three disposals in 2023, one additional asset sold in

the first quarter of 2024) (-€20.4m). This impact was more than

offset by organic growth and the revenue contributions from

recently delivered assets.

| Focus on offices

Gross rental income – Offices

Dec 31, 23

Dec 31, 24

Change (%)

In million euros

Current basis

Like-for-like

Offices

534.0

566.7

+6.1%

+6.6%

Central areas

386.8

416.9

+7.8%

+8.9%

Paris City

304.9

332.7

+9.1%

+10.1%

- Paris CBD & 5-6-7

193.3

211.4

+9.4%

+10.5%

- Paris other

111.6

121.3

+8.7%

+9.3%

Core Western Crescent

82.0

84.1

+2.6%

+4.4%

- Neuilly-Levallois

34.2

33.3

-2.6%

+10.9%

- Southern Loop

47.8

50.8

+6.3%

+0.0%

La Défense

72.5

77.6

+7.1%

+7.1%

Other locations (Peri-Défense,

Inner / Outer Rims and Other regions)

74.6

72.2

-3.2%

-4.9%

| Strong rental uplift in central areas

- Confirmation of the return to the office after a

post-Covid transition (3.5 days a week at the office (+0.2 in 2024,

IFOP), the highest figure in European metropolises), underscoring

the critical need for well-located, modern, and collaborative work

environments, irreplaceable to foster creativity, collaboration,

and well-being

- c. 83,000 sq.m leased in 2024, representing an annual rent

of €52m, including the preleasing of Icône ahead of its

delivery (firm 9-year lease on c. 11,000 sq.m at the best rent

levels), and 5,300 sq.m let under the Yourplace offering (operated

offices)

- Good performance in all locations, with a mix of leases

in Paris City (53 deals, €36.5m) and outside Paris (5 deals for

€9.6m in the Core Western Crescent, 16 deals for €6.1m in La

Défense and other locations), including new tenants, renewals and

renegotiations

- +10% rental uplift on the office portfolio, with +28% in

Paris City and +44% in the Central Business District (including

Yourplace) where supply for prime products remains scarce (vacancy

below 3.6% in the CBD – BNPP-RE), demonstrating the ever-stronger

polarization of the leasing market favoring centrality. Market

rents have adjusted in the Western Crescent (except for

Neuilly-sur-Seine) as well as in other locations (Outer Rims and

Other regions)

- +12% rental uplift on the residential portfolio in a

still undersupplied market

| Rental margin up +0.6pts

Group

Offices

Residential

Rental margin at Dec 31, 2023

91.4%

94.1%

80.4%

Rental margin at Dec 31, 2024

92.0%

94.7%

79.7%

| Occupancy maintained high (93.4%) and reflecting

polarization

Average financial occupancy

rate

Dec 31, 2023

March 31, 2024

Jun 30, 2024

Sep 30, 2024

Dec 31, 2024

Offices

93.7%

93.9%

93.8%

93.7%

93.4%

Paris City

93.0%

92.9%

93.5%

94.2%

94.7%

Core Western Crescent

94.3%

95.1%

95.2%

92.5%

89.0%

La Défense

98.3%

99.5%

99.5%

99.5%

99.6%

Other locations (Peri-Défense, Inner/

Outer Rims and Other regions)

91.9%

91.5%

88.5%

87.6%

86.8%

Residential

94.7%

96.7%

95.2%

93.6%

93.2%

YouFirst Residence

96.4%

97.2%

96.6%

95.2%

94.0%

YouFirst Campus

87.7%

95.0%

90.6%

88.5%

90.5%

Group Total

93.9%

94.3%

94.1%

93.7%

93.4%

- Average financial occupancy rate maintained high at

93.4%, with the slight variation over 12 months (-0.5pts)

reflecting the impact of longer leasing times for available space

in the Western Crescent (Boulogne) and Puteaux and the disposal of

fully-let assets in 2023 (101 Champs-Élysées, Pyramides, 142

Haussmann, etc.)

- Office portfolio occupancy rate (93.4%), reaching 94.7%

in Paris, 89.0% in the Core Western Crescent and 99.6% in La

Défense. Office occupancy was broadly stable (-0.3pts), due to

lease expiries in the Western Crescent assets (Boulogne) and

Puteaux partially offset by new leases across the portfolio (Paris

CBD, Boulogne, Courbevoie)

- Residential portfolio occupancy rate (93.2%), combining

a strong leasing performance in the student portfolio (90.5% at

end-2024 vs 87.7% at end-2023) and the impact of transferring

apartments to the new model of serviced, furnished apartments

including their redesign and transformation

| Portfolio value up +0.7%: resilience of a prime, central

portfolio

Breakdown by segment

Appraised values

Like-for-like change

(1)

Net cap. rates

In million euros

Dec 31, 2024

Dec 31, 2023

Dec 2024 vs. Dec 2023

Dec 31, 2024

Dec 31, 2023

Offices

13,719

13,476

+1.0%

5.3%

5.1%

Central locations

11,917

11,548

+2.6%

4.5%

4.4%

- Paris City

9,925

9,481

+4.1%

4.1%

4.0%

- Core Western Crescent

1,991

2,067

-4.5%

6.4%

6.0%

La Défense

886

966

-6.9%

9.2%

8.1%

Other locations (Peri-Défense,

Inner / Outer Rim, other regions)

916

961

-7.0%

10.1%

9.6%

Residential

3,621

3,565

-0.4%

3.6%

3.4%

Hotel & financial lease

37

42

Group Total

17,377

17,082

+0.7%

4.9%

4,8%

(1) Excluding student residences

- Quiet investment market, driven primarily by transactions

concentrated on the €50m to €150m segment in Paris central

areas, with increasing competition driving yields down in this

area: €3.4bn in transactions in the Paris Region in 2024, marking a

return to office deal-making with a strong concentration in Paris

City (€2.1bn in Paris CBD and €0.7bn in the rest of the city, with

Paris representing over 80%), supporting the Group’s

valuations

- Portfolio value (block) of €17.4bn (79% offices, 21%

residential), including a +0.7% increase on a like-for-like basis

(compared with a -10.6% adjustment in 2023) demonstrating the

portfolio’s good fundamentals, supported by rental growth,

proactive asset management, and a more stable economic

backdrop

- Contrasted dynamics reflecting the polarization of the

markets in favor of centrality: - Valuations up +4.1% in

Paris: yield effect stabilized and completely offset by the

rental effect, with average and prime rents still up - Continued

value adjustment outside Paris (-5.7% overall, -6.9% in La

Défense), apart from Neuilly (+1.0%), which still follows the same

positive trend as Paris City

Portfolio strategy: creating immediate and future value with

more profitable, greener assets

| Optimizing rents in operations with turnkey real estate

models

- Yourplace (operated offices): strong leasing activity on

Gecina’s operated office platform, now deployed across 10 central

Parisian assets covering c. 7,000 sq.m as at end-2024 (net

annual rent of €6.8m). Yourplace addresses tenants’ needs for

well-located, small, turnkey offices, creating value with net rents

+30% to +40% above market rents (after refurbishment costs). The

Group plans to extend this model in 2025 as more spaces become

available on the relevant assets, with the ambition to continue our

expansion plan

- Turnkey apartments: leveraging insights from student housing

performance drivers, by applying them to the broader residential

portfolio, with a multi-offering approach including newly

designed and optimized, furnished living spaces for students,

corporates, young urban professionals and families looking for

modern accommodation in Paris City, close to their workplaces and

universities. This model is now deployed on 300 apartments,

generating annual rent of c. €4.0m.

| Delivering ever-more accretive, repositioned assets in 2024

& 2025

- Three office projects (Mondo, 35 Capucines, Porte Sud; total

annual rent of €35.3m) as well as one residential project (Dareau)

successfully delivered in 2024, on time and on budget,

demonstrating Gecina’s dedication to creating high-quality,

centrally-located, sustainable working and living spaces

- c. +30% value created on average (vs TIC) from the Paris

office projects delivered in 2024 or to be delivered early

2025, representing €2 of value created for each €1 of capex

invested despite a significant yield expansion since those projects

started. This proves the strong attraction of prime

repositioned assets in central Parisian areas, particularly in a

context of scarce supply of such properties and an ever-growing

polarization of the office market

Mondo

35 Capucines

Dareau

Premium returns achieved on this 30,100

sq.m CBD-located project, which was fully pre-let a year ahead

of delivery to Publicis Group. This project includes the creation

of +3,500 sq.m and a wide array of services.

Highest environmental certifica-tion

standards met

Optimized redevelopment of an

architectural and heritage asset in the heart of the CBD (6,400

sq.m), which was fully pre-let a year ahead of delivery to a luxury

company and a law firm

Highest environmental certifica-tion

standards met

Transformation of an obsolete office

building into a prime, fully serviced residential asset (gym,

coworking place) in Paris City, illustrating the Group’s unique

capacity to operate different asset classes in Paris

Ambitious certification targeted

- Icône (delivery in the first half of 2025), fully

pre-let to a single tenant (global investment manager) ahead of

delivery, creating c. +60% value (vs TIC) with a new landmark

deal in Paris hyper-central areas, just a step away from the

Champs-Élysées, at the best rent levels for the area. This c.

11,000 sq.m of premium office space meets the latest trends in

tenant expectations in terms of tailored services and environmental

performance (with six of the most demanding labels at the highest

levels awarded to the asset)

| 3 new central developments to refuel rent growth for

2027-2028

- 3 flagship developments launched in our clients’

preferred areas (Paris, Neuilly) and set to be delivered in

2027, representing a combined capex plan of c. €500m

still to invest at December, 2024 and projected annual rent of

c. €60 to €70m in 2027-2028 - Quarter, Paris City

(ex-Gamma: 19,100 sq.m, TIC of €227m, delivery: Q1-2027): premium,

turnkey offices just a step away from the bustling city hub of Gare

de Lyon - Les Arches du Carreau, Neuilly-Sur-Seine

(ex-Carreau de Neuilly: 36,500 sq.m, TIC of €483m, delivery:

Q2-2027): a visionary mixed-use transformation revitalizing a

landmark asset on the city's main avenue - Mirabeau, Paris

City (37,300 sq.m, TIC of €445m, delivery: Q3-2027): a new

iconic facade to soon enhance the Parisian skyline on this prime,

high-performing office building

- Total for the “committed” or “to be committed” pipeline:

€1.8bn total investment (with c. €650m CAPEX still to invest) 1 on

the committed or to be committed pipeline to create future,

sustained growth at a 5.4% yield overall

| Active rotation strategy to recycle value from mature

assets into new accretive projects

- Acceleration of the Group’s asset rotation strategy since 2022

by divesting mature assets at premiums versus their valuations

and low capitalization rates, unlocking capital to

consolidate its balance sheet (with positive impact on LTV,

ICR, net debt/EBITDA), reinvest in more profitable and greener,

higher-yield projects (+5.7% yield on the office committed

pipeline), and provide additional leeway to finance

opportunistic acquisitions while respecting its focused investment

discipline (assets with a high-quality and prime potential in

central areas)

- Accretive disposal project for the student housing

portfolio (18 assets, c. 3,300 beds, €25.6m gross rent and

€20.8m net rent after platform cost in 2024 & 4 developments,

c. 400 beds) for €567 million (incl. duties), expected to

close during the first half of 2025

- Continued rollout of the rotation strategy in 2024 with

the sale of mature residential assets in Q1 2024 (€56m) and

additional residential assets under preliminary agreement at

December 31, 2024 (€200m including Sibuet and Bel Air (Paris 12),

Py (Paris 20), Rueil Doumer (Rueil Malmaison)), following the

€1.3bn of disposals in 2023

- +14% premium overall on the 2024 disposals (sold or

secured as at December 31, 2024)

| Energy & Carbon: a performance that stands the test of

time

- A further step taken to radically reduce energy consumption

(-4.2%) and carbon emissions (-12.3%, now at 8.0 kgCO2/sq.m, ahead

of the 2025 milestone), building on the efforts initiated in

2008 (-31% in energy consumptions and -60% in carbon emissions

since 2019), with even stronger energy-saving targets for asset

using more carbon-intensive energy sources

- An impactful 3-way method: - better day-to-day

monitoring of equipment and comfort temperatures in the

buildings and a systematic on-site deep-dive approach to identify

and implement 800 energy efficiency actions (e.g. reprogramming of

heating, ventilation & air conditioning equipment, now

monitored via the building management system and sensor-based,

lighting optimization, etc.) - better energy with the

acceleration of the shift to renewables, including the

connection to urban networks (heating and cooling) and innovative

approaches to boost decarbonization by shifting the source of

energy instead of restructuring the entire building envelope (e.g.

partnership with Accenta and Idex for the largest borehole thermal

energy storage project on Gecina’s residential asset in Ville

d'Avray) - better investment with a targeted approach to

optimize capex and maximize its impact on energy consumption

and carbon emissions where it remains relevant

- Partnering with clients to achieve maximal impact and

further reduce consumption, with tenants in 5 already

low-carbon assets being offered to fully offset residual emissions

(project involving the afforestation of over 12 hectares)

- CSR embedded in day-to-day operations, based on the best

market standards with high levels of certification across the

portfolio: 100% of the office portfolio certified (vs 26% on

the market – CBRE), with more than one in two office buildings

achieving the highest certification levels, above "very good", and

the ISO 50001 international energy management standard obtained in

2024

- Excellent GRESB score achieved again (5 stars, 95/100), with

Gecina first in its peer group

Balance Sheet: maintained strong and healthy

| Continuous management of debt quality providing

agility

Ratios

Covenant

Dec 31, 2024

LTV (net debt/revalued block value of

property holding (excluding duties))

< 60%

37.6%

ICR (EBITDA/net financial expenses)

> 2.0x

6.3x

Outstanding secured debt/revalued block

value of property holding (excluding duties)

< 25%

-

Revalued block value of property holding

(excluding duties)

> €6.0bn

€17.4bn

- Best-in-class rating: recent confirmation of Gecina’s

A-/A3 ratings (stable outlook), supported by the continuous

capacity to generate steady cash flows due to the Group’s focused

investment strategy, securing the best financial conditions (A- by

S&P in August 2024, A3 by Moody's in July 2024)

- Low average cost of drawn debt at 1.2%, up slightly

compared with 2023 (+0.1pts), while the overall cost of debt came

to 1.5%. Gecina’s optimized hedging profile provides long-term

visibility on the cost of debt, with close to 100% of the

2025-2026 maturities hedged and 85% of the 2025-2029 ones based on

end-2024 debt, adjusted for disposals to date

- Liquidity profile further strengthened to provide short,

medium, and long-term security and flexibility (€3.8bn of net

liquidity – undrawn credit lines excluding commercial papers –,

covering maturities until 2029 all else equal). In 2024, Gecina

secured €1.3bn of financing on c. 7-year maturities from both

historic and new banks, through the early renewal of lines maturing

in 2025, 2026 and 2027

- Net debt volume of €6.5bn (+€0.3bn vs 2023, mainly due

to the financing of the Group’s development pipeline), with a

maturity close to 7 years

- 100% of Group financing now green, following the

greening of the latest credit line in the third quarter of

2024

| Low LTV of 35.4% providing long-term capacity to operate

and grow

- LTV kept low at 35.4% (incl. duties, prior to accounting

for the disposal projects under preliminary agreement), despite

significant valuation adjustments in the past years (2022-2024),

reflecting controlled net debt and the recent, slight increase in

values

- LTV of 32.7% (incl. duties) following the disposals of

mature assets secured at end 2024

| NAV (NTA) of €142.8 ps, materializing the value created

since H1 2024

- NAV (NTA) up +€0.7 per share since June 30, 2024 to

€142.8, primarily reflecting the value created through both the

pipeline deliveries and the asset rotation strategy (disposals

materialized or secured): - Dividend paid in the second half of

2024: -€2.7 - Recurrent net income: +€3.2 - Pipeline deliveries and

disposals: +€0.9 - Valuations and other effects (including IFRS

16): -€0.7

2025 Outlook, Dividend & Guidance

| Outlook: going further

- Indexation expected to continue to slow down, though

remaining above its 10-year average

- Still strong demand for centrally located offices

- Another step forward with the Group’s strategy,

maintaining a trajectory of resilient growth, operational

excellence, financial discipline and value creation in central

areas, including: - the continued development of the serviced,

operated real estate offerings (on both the office and residential

portfolios) - the delivery of two additional repositioned assets

(including Icône, fully pre-let already) - the launch of three new

iconic projects in tenants’ preferred areas of Paris and Neuilly

(Quarter, Les Arches du Carreau and Mirabeau)

- Taking up the 2025-2027 leasing challenges with innovative

initiatives, such as the unique FEAT – Pont de Sèvres

(Boulogne) project in one of the Greater Paris hubs, to offer

companies and their employees spaces that match their lifestyle,

strengthen their brand and help attract talents across Gecina’s

four office assets located in this business district

| 2024 Dividend up +15ct to €5.45 per share

- A dividend of €5.45 per share will be submitted at the

Shareholders’ General Meeting on April 17, 2025, reflecting a +15ct

growth. This proposal is based on the robust operational,

sustainable and financial performance achieved in 2024, following

three consecutive years of earnings growth

- Dividend all paid in cash, with an interim dividend of

€2.70 per share on March 5, 2025 (ex-date: March 3, 2025), and the

balance of €2.75 paid on July 4, 2025 (ex-date: July 2, 2025),

subject to approval at the Shareholders’ General Meeting

| 2025 Guidance: RNI expected between €6.60 and €6.70 per

share

- Recurrent net income (Group share) expected to reach €6.60

to €6.70 per share, reflecting a fourth consecutive year of growth

(between +2.8% and +4.4%) and average annual growth of c. +6% for

the last 4 years

Financial agenda

- 04.17.2025: General Meeting

- 04.17.2025: Business at March 31, 2025,

after market close

- 07.23.2025: 2025 first-half earnings, after

market close

- 10.16.2025: Business at September 30,2025,

after market close

About Gecina

Gecina is a leading operator, that fully integrates all the

expertise of real estate, owning, managing, and developing a unique

prime portfolio valued at €17.4bn as at December 31, 2024.

Strategically located in the most central areas of Paris and the

Paris Region, Gecina’s portfolio includes 1.2 million sq.m of

office space and over 9,000 residential units. By combining

long-term value creation with operational excellence, Gecina offers

high-quality, sustainable living and working environments tailored

to the evolving needs of urban users.

As a committed operator, Gecina enhances its assets with

high-value services and dynamic property and asset management,

fostering vibrant communities. Through its YouFirst brand, Gecina

places user experience at the heart of its strategy. In line with

its social responsibility commitments, the Fondation Gecina

supports initiatives across four core pillars: disability

inclusion, environmental protection, cultural heritage, and housing

access.

Gecina is a French real estate investment trust (SIIC) listed on

Euronext Paris, and is part of the SBF 120, CAC Next 20, CAC Large

60, and CAC 40 ESG indices. Gecina is also recognized as one of the

top-performing companies in its industry by leading sustainability

rankings (GRESB, Sustainalytics, MSCI, ISS-ESG, and CDP) and is

committed to radically reducing its carbon emissions by 2030.

www.gecina.fr

Appendices

| Financial statements, Net asset value (NAV) and

pipeline

At the Board meeting on February 13, 2025, chaired by Jérôme

Brunel, Gecina’s Directors approved the financial statements at

December 31, 2024. The audit procedures have been completed on

these accounts, and the certification reports have been issued. The

full consolidated financial statements are available on the Group’s

website

| Condensed income statement and recurrent income

In million euros

Dec 31, 23

Dec 31, 24

Change (%)

Gross rental income

666.8

694.5

+4.1%

Net rental income

609.5

638.7

+4.8%

Other income (net)

3.4

3.3

-0.5%

Salaries and administrative costs

(77.9)

(76.3)

-2.0%

EBITDA

535.0

565.7

+5.7%

Net financial expenses

(90.0)

(90.5)

+0.6%

Recurrent gross income

445.1

475.2

+6.8%

Recurrent net income from associates

2.7

3.3

+21.5%

Recurrent minority interests

(2.0)

(2.0)

+4.1%

Recurrent tax

(1.6)

(2.1)

+26.9%

Recurrent net income (Group

share)(1)

444.2

474.4

+6.8%

Gains or losses on disposals

67.0

0.7

n.a.

Change in fair value of properties

(2,186.4)

(127.3)

n.a.

Depreciation and amortization

(29.7)

(11.7)

n.a.

Non-recurring items

0.0

0.0

n.a.

Change in value of financial

instruments

(66.2)

(24.7)

n.a.

Other

(16.0)

(1.5)

n.a.

Consolidated net income (Group

share)

(1,787.2)

309.8

n.a.

(1) EBITDA after deducting net financial

expenses, recurrent tax, minority interests, including income from

associates and restated for certain non-recurring items

| Consolidated balance sheet

ASSETS

Dec. 31,

Dec. 31,

LIABILITIES

Dec. 31,

Dec. 31,

In million euros

2023

2024

In million euros

2023

2024

Non-current assets

17,174.9

16,602.4

Shareholders' equity

10,599.5

10,522.3

Investment properties

15,153.5

14,828.2

Share capital

575.0

575.5

Buildings under redevelopment

1,398.4

1,212.0

Additional paid-in capital

3,307.6

3,312.8

Buildings in operation

81.8

80.6

Consolidated reserves

8,487.3

6,307.8

Other property, plant and equipment

9.3

10.1

Consolidated net income

(1,787.2)

309.8

Goodwill

165.8

165.8

Intangible assets

12.8

11.7

Capital and reserves attributable to

owners of the parent company

10,582.7

10,506.0

Financial receivables on finance

leases

32.8

27.6

Non-controlling interests

16.7

16.3

Investments in associates

86.7

82.0

Long-term financial investments

51.2

35.9

Non-current liabilities

6,051.0

5,569.3

Non-current financial instruments

181.9

147.7

Non-current financial liabilities

5,784.7

5,315.7

Deferred tax assets

0.9

0.9

Non-current lease obligations

49.6

49.6

Non-current financial instruments

123.9

108.0

Current assets

473.9

1,315.5

Non-current provisions

92.7

96.0

Properties for sale

184.7

990.4

Current liabilities

998.3

1,826.3

Trade receivables and related

35.4

31.5

Current financial liabilities

599.6

1,397.0

Other receivables

82.9

83.3

Security deposits

86.4

87.9

Prepaid expenses

23.6

28.7

Trade payables and related

185.6

160.6

Current financial instruments

3.6

2.6

Current taxes due & other

employee-related liabilities

58.0

58.5

Cash & cash equivalents

143.7

179.0

Other current liabilities

68.7

122.2

TOTAL ASSETS

17,648.7

17,918.0

TOTAL LIABILITIES

17,648.7

17,918.0

| Net asset value

December 31, 2024

EPRA NRV

(Net Reinstatement

Value)

EPRA NTA (Net Tangible Asset

Value)

EPRA NDV (Net Disposal

Value)

IFRS Equity attributable to

shareholders

10,506.0

10,506.0

10,506.0

Due dividends

-

-

-

Include / Exclude

Hybrid instruments

-

-

-

Diluted NAV

10,506.0

10,506.0

10,506.0

Include

Revaluation of IP (if IAS 40 cost option

is used)

170.4

170.4

170.4

Revaluation of IPUC (if IAS 40 cost option

used)

-

-

-

Revaluation of other non-current

investments

-

-

-

Revaluation of tenant leases held as

finance leases

0.2

0.2

0.2

Revaluation of trading properties

-

-

-

Diluted NAV at Fair Value

10,676.5

10,676.5

10,676.5

Exclude

Deferred tax in relation to fair value

gains of IP

-

-

x

Fair value of financial instruments

(42.3)

(42.3)

x

Goodwill as result of deferred tax

-

-

-

Goodwill as per the IFRS balance sheet

x

(165.8)

(165.8)

Intangibles as per the IFRS balance

sheet

x

(11.7)

x

Include

Fair value of fixed interest rate debt

(1)

x

x

416.3

Revaluation of intangibles to fair

value

-

x

x

Real estate transfer tax

1,059.3

139.5

x

EPRA NAV

11,693.5

10,596.3

10,927.1

Fully diluted number of shares

74,196,991

74,196,991

74,196,991

NAV per share

€157.6

€142.8

€147.3

Unit NAV per share

€165.6

€150.3

€154.8

(1) Fixed rate debt has been fair valued based on the interest

rate curve as of December 31, 2024 (2) Taking into account the

residential portfolio’s unit values

| Development pipeline overview

Project

Location

Delivery date

Total space (sq.m)

Total invest. (€m)

Already invest. (€m)

Still to invest (€m)

YoC (est.)

Pre-let (%)

Paris – Icône

Paris CBD

Q1-25

13,500

213

100%

Paris - 27 Canal

Paris

Q3-25

15,600

127

0%

Paris - Quarter (Gamma)

Paris

Q1-27

19,100

227

0%

Neuilly – Les Arches du Carreau

Western Crescent

Q2-27

36,500

483

0%

Paris – Mirabeau

Paris

Q3-27

37,300

445

0%

Total offices

122,000

1,495

940

555

5.7%

11%

Rueil – Arsenal

Rueil-M.

Q1-25

6,000

47

n.a

Bordeaux – Belvédère

Bordeaux

Q1-25

8,000

39

n.a

Garenne Colombes – Madera

La Garenne Colombes

Q1-25

4,900

43

n.a

Bordeaux – Brienne

Bordeaux

Q3-25

5,500

27

n.a

Total residential

24,400

156

138

18

3.7%

Total committed projects

146,400

1,652

1,078

574

5.5%

Controlled & Certain

offices

9,400

128

85

43

4.6%

Controlled & Certain

residential

4,200

29

0

29

4.8%

Total Controlled & Certain

13,600

157

85

72

4.6%

Total Committed + Controlled &

Certain

160,000

1,809

1,163

646

5.4%

Total Controlled & likely

121,350

609

328

281

4.9%

TOTAL PIPELINE

281,350

2,418

1,490

927

5.3%

1.2 EPRA reporting at December 31, 2024

Gecina applies the EPRA(1) best practices recommendations

regarding the indicators listed hereafter. Gecina has been a member

of EPRA, the European Public Real Estate Association, since its

creation in 1999. The EPRA best practice recommendations include,

in particular, key performance indicators to make the financial

statements of real estate companies listed in Europe more

transparent and more comparable across Europe.

Gecina reports on all the EPRA indicators defined by the “Best

Practices Recommendations” available on the EPRA website. When they

are not applicable, the lines of the tables defined by EPRA do not

appear below.

Moreover, EPRA defined recommendations related to corporate

social responsibility (CSR), called “Sustainable Best Practices

Recommendations”.

(1) European Public Real Estate Association.

12/31/2024

12/31/2023

See Note

EPRA Earnings (in million euros)

463.4

433.0

1.2.1

EPRA Earnings per share (in euros)

€6.27

€5.86

1.2.1

EPRA Net Tangible Asset Value (in euros

per share)

€142.8

€143.6

1.2.2

EPRA Net Initial Yield

4.1%

3.9%

1.2.3

EPRA “Topped-up” Net Initial Yield

4.4%

4.2%

1.2.3

EPRA Vacancy Rate

7.0%

5.7%

1.2.4

EPRA Cost Ratio (including direct vacancy

costs)

19.7%

21.6%

1.2.5

EPRA Cost Ratio (excluding direct vacancy

costs)

17.8%

19.8%

1.2.5

EPRA Property related Capex (in million

euros)

445

383

1.2.6

EPRA Loan-to-Value (including duties)

36.4%

35.7%

1.2.7

EPRA Loan-to-Value (excluding duties)

38.6%

37.9%

1.2.7

| 1.2.1 EPRA earnings

The table below indicates the transition between the

consolidated net income and the EPRA earnings:

In thousand euros

12/31/2024

12/31/2023

Consolidated net income (Group share) per

IFRS income statement

309,763

(1,787,184)

Exclude:

Changes in value in properties

(127,282)

(2,186,389)

Profits or losses on disposals

673

66,968

Tax on profits or losses on disposals

-

(141)

Goodwill impairment and derecognition

-

(17,462)

Changes in fair value of financial

instruments and associated close-out costs

(24,732)

(66,200)

Adjustments related to non-operating and

exceptional items

(717)

(1,319)

Adjustments above in respect of joint

ventures

(2,841)

(23,528)

Non-controlling interests in respect of

the above

1,293

7,862

EPRA Earnings

463,369

433,025

Average number of shares excluding

treasury shares

73,937,919

73,848,175

EPRA Earnings per Share (EPS)

€6.27

€5.86

Company specific adjustments:

Depreciation and amortization, net

impairment and provisions

11,020

11,135

Recurrent net income (Group share)

474,389

444,160

Recurrent net income (Group share) per

share

€6.42

€6.01

| 1.2.2 Net Asset Value

In euros per share

12/31/2024

12/31/2023

EPRA NAV NRV

€157.6

€158.1

EPRA NAV NTA

€142.8

€143.6

EPRA NAV NDV

€147.3

€150.1

| 1.2.3 EPRA net initial yield and EPRA “Topped-up” net

initial yield

The table below indicates the transition between the yield rate

disclosed by Gecina and the yield rates defined by EPRA:

In %

12/31/2024

12/31/2023

Gecina net capitalization

rate(1)

4.9%

4.8%

Impact of estimated costs and duties

-0.3%

–0.3%

Impact of changes in scope

+0.1%

+0.0%

Impact of rent adjustments

–0.6%

–0.6%

EPRA net initial yield(2)

4.1%

3.9%

Exclusion of lease incentives

+0.3%

+0.3%

EPRA “Topped-up” net initial

yield(3)

4.4%

4.2%

(1) Like-for-like December 2024.

(2) The EPRA net initial yield rate is

defined as the annualized contractual rent, net of property

operating expenses, excluding lease incentives, divided by the

portfolio value including duties.

(3) The EPRA “Topped-up” net initial yield

rate is defined as the annualized contractual rent, net of property

operating expenses, excluding lease incentives, divided by the

portfolio value including duties.

EPRA net initial yield and EPRA

“Topped-up” net initial yield

(in million euros)

Offices

Residential

Total 2024

Investment properties

13,719

3,621

17,340 (3)

Adjustment of assets under development and

land reserves

(2,346)

(510)

(2,856)

Value of the property portfolio in

operation excluding duties

11,373

3,111

14,484

Transfer duties

771

199

970

Value of the property portfolio in

operation including duties

B

12,144

3,310

15,453

Gross annualized IFRS rents

538

133

671

Non-recoverable property charges

16

27

43

Annual net rents

A

522

106

628

Rents at the expiration of the lease

incentives or other rent discount

51

0

51

“Topped-up” annual net rents

C

572

107

679

EPRA net initial yield(1)

A/B

4.3%

3.2%

4.1%

EPRA “Topped up” net initial

yield(2)

C/B

4.7%

3.2%

4.4%

(1) The EPRA net initial yield rate is

defined as the annualized contractual rent, net of property

operating expenses, excluding lease incentives, divided by the

portfolio value including duties.

(2) The EPRA “Topped-up” net initial yield

rate is defined as the annualized contractual rent, net of property

operating expenses, excluding lease incentives, divided by the

portfolio value including duties.

(3) Except finance lease and hotel.

| 1.2.4 EPRA vacancy rate

In %

12/31/2024

12/31/2023

Offices

7.1%

6.2%

Residential

6.2%

3.9%

◆ YouFirst Residence

6.5%

3.8%

◆ YouFirst Campus

4.9%

4.1%

EPRA vacancy rate

7.0%

5.7%

EPRA vacancy rate corresponds to the vacancy rate “spot” at

year-end. It is calculated as the ratio between the estimated

market rental value of vacant spaces and potential rents for the

operating property portfolio.

The financial occupancy rate reported in other parts of this

document corresponds to the average financial occupancy rate of the

operating property portfolio.

EPRA vacancy rate does not include leases signed with a future

effect date.

Market rental value of vacant

units (in million euros)

Potential rents (in million

euros)

EPRA vacancy rate at the end

of 2024 (in %)

Offices

47

662

7.1%

Residential

8

135

6.2%

◆ YouFirst Residence

7

105

6.5%

◆ YouFirst Campus

1

30

4.9%

EPRA vacancy rate

55

797

7.0%

| 1.2.5 EPRA cost ratios

In thousand euros/in %

12/31/2024

12/31/2023

Property expenses(1)

(201,214)

(209,594)

Overheads(1)

(83,672)

(88,992)

Recharges to tenants

145,428

152,303

Other income/income covering overheads

1,996

2,127

Share in costs of associates

(294)

(561)

EPRA costs (including vacancy costs)

(A)

(137,756)

(144,717)

Vacancy costs

13,530

12,247

EPRA costs (excluding vacancy costs)

(B)

(124,226)

(132,470)

Gross rental income

694,481

666,835

Share in rental income from associates

4,141

3,785

Gross rental income (C)

698,622

670,620

EPRA cost ratio (including vacancy

costs) (A/C)

19.7%

21.6%

EPRA cost ratio (excluding vacancy

costs) (B/C)

17.8%

19.8%

(1) Costs incurred for entering into

leases, eviction allowances, and time spent by the operational

teams directly attributable to marketing, development or disposals

are capitalized or reclassified as gains or losses on disposals of

€18.8 million in 2024 and €21.7 million in 2023 (see Notes 5.5.4.1

and 5.5.5.5 to the consolidated financial statements.

| 1.2.6 Capital expenditure

In million euros

12/31/2024

12/31/2023

Group

Joint ventures

Total

Group

Joint ventures

Total

Acquisitions

0

n.a.

0

0

n.a.

0

Pipeline

310

n.a.

310

256

n.a.

256

Of which capitalized interest

16

n.a.

16

9

n.a.

9

Maintenance Capex(1)

135

n.a.

135

127

n.a.

127

Incremental lettable space

n.a.

0

n.a.

0

No incremental lettable space

124

n.a.

124

98

n.a.

98

Tenant incentives

11

n.a.

11

29

n.a.

29

Other expenses

n.a.

0

n.a.

0

Capitalized interest

n.a.

0

n.a.

0

Total Capex

445

n.a.

445

383

n.a.

383

Conversion from accrual to cash basis

–25

n.a.

–25

9

n.a.

9

Total Capex on cash basis

420

n.a.

420

392

n.a.

392

(1) Capex corresponding to (i) renovation

work on apartments or private commercial surface areas to capture

rental reversion, (ii) work on communal areas, (iii) lessees’

work.

| 1.2.7 EPRA Loan-to-Value

In million euros

Group

Share of material associates

Non-controlling Interests

Total

Include:

Borrowings from Financial Institutions

165

13

178

Commercial paper

838

838

Bond Loans

5,692

5,692

Net Payables

198

1

(3)

197

Current accounts (Equity

characteristic)

14

(14)

0

Exclude:

Cash and cash equivalents

(179)

(5)

2

(181)

Net Debt (A)

6,729

10

(15)

6,724

Include:

Owner-occupied property

238

238

Investment properties at fair value

14,855

89

(30)

14,914

Properties held for sale

990

990

Properties under development

1,212

1,212

Intangibles

12

12

Financial assets

32

32

Total Property Value (B)

17,339

89

(30)

17,399

Real Estate Transfer Taxes

1,059

7

(2)

1,064

Total Property Value (incl. RETTs) (C)

18,398

96

(32)

18,463

Loan-to-Value (A/B)

38.8%

38.6%

LTV (incl. RETTs) (A/C)

36.6%

36.4%

1.3 Additional information on rental income

| 1.3.1 Rental situation

Gecina’s tenants come from a wide range of sectors of activity,

reflecting various macro-economic factors.

Breakdown of tenants by sector (offices – based on annualized

headline rents)

Group

Industry

37%

Consulting/services

24%

Technology

9%

Retail

8%

Media – television

6%

Finance

6%

Public sector

5%

Hospitality

5%

Total

100%

Weighting of the top 20 tenants (% of annualized total headline

rents)

Tenant

Group

Engie

7%

Publicis

3%

WeWork

3%

Boston Consulting Group

3%

Lagardère

2%

Yves Saint Laurent

2%

EDF

2%

Arkema

1%

Eight Advisory

1%

Renault

1%

Lacoste

1%

LVMH

1%

Edenred

1%

Jacquemus

1%

Salesforce

1%

CGI France

1%

Orange

1%

MSD

1%

Sanofi

1%

Latham & Watkins

1%

Top 10

25%

Top 20

34%

| 1.3.2 Annualized gross rental income

Annualized rental income was up by +€60 million compared to

December 31, 2023, mainly reflecting the rental dynamics on a

like-for-like basis (+€27 million) and the proceeds of building

deliveries during the year net of the loss of rents due to the

departure of tenants from buildings undergoing or expected to

undergo redevelopment (+€33 million) and other factors including

letting of the assets made unavailable for rent for more than one

year to be renovated (+€1 million).

Note that this annualized rental income includes €21 million

from assets intended to be vacated for redevelopment.

In addition, the annualized rental income figures below do not

yet include the rental income that will be generated by committed

or controlled projects, which may represent nearly €98 million of

potential headline rents, including almost €7 million pertaining to

assets that are yet to be committed.

In million euros

12/31/2024

12/31/2023

Offices

592

534

Residential

133

132

◆ YouFirst Residence

106

106

◆ YouFirst Campus

27

26

Total

726

666

| 1.3.3 Like-for-like rent change factors for 2024 vs.

2023

Group

Like-for-like change

Indexation

Reversion

Vacancy and other

+6.3%

+5.2%

+0.8%

+0.3%

Offices

Like-for-like change

Indexation

Reversion

Vacancy and other

+6.6%

+5.7%

+0.6%

+0.4%

Residential

Like-for-like change

Indexation

Reversion

Vacancy and other

+4.7%

+2.8%

+2.0%

–0.2%

| 1.3.4 Volume of rental income by three-year break and end

of leases

Commercial lease schedule

(in million euros)

2025

2026

2027

2028

2029

2030

2031

>2031

Total

Break-up options

81

65

145

61

53

41

37

139

621

End of leases

67

26

102

36

51

77

55

206

621

1.4 Financial resources

The year 2024 was marked by a gradual shift in central banks’

monetary policy after several months of high rates aimed at curbing

inflation. The ECB’s deposit rate, which had reached 4.00% in 2023,

gradually lowered throughout the year, reaching 3.00% by the end of

2024. This monetary easing led to a decline in long-term rates,

providing some relief to financial markets, although economic

uncertainty persisted in a context of moderate growth.

During 2024, Gecina was able to rely on its strengths – the

solidity and flexibility of its balance sheet, its low level of

debt, a high volume of liquidity, extensive access to various

sources of financing and a high credit rating – to pursue its

strategy of refinancing undrawn credit lines by securing €1.3

billion in new sustainable credit lines with an average maturity of

nearly seven years. With these refinancings, 100% of the Group’s

credit lines are now sustainable. Besides, Gecina continued to

adjust and optimize its hedging policy, by reenforcing the

medium/long term of its hedging profile.

At December 31, 2024, Gecina had immediate liquidity of €4.6

billion, or €3.8 billion excluding NEU CP significantly surpassing

the long-term internal target of a minimum of c. €2.0 billion. This

excess liquidity notably covers all bond maturities until 2029 (and

therefore in particular the 2025, 2027 and 2028 maturities).

This proactive and dynamic management of the Group’s financial

structure further increases its strength, resilience and visibility

for the coming years. It also ensures that the Group’s main credit

indicators remain at an excellent level. The maturity of the debt

is 6.7 years, the interest rate risk hedging is close to 100% over

the next two years and 85% on average until the end of 2029

(proforma of completed disposals), and the average maturity of this

hedging is 5.4 years. The loan-to-value (LTV) ratio (including

duties) was 35.4% (32.7% pro forma of secured disposals and the

student portfolio transaction project), and the interest coverage

ratio (ICR) stood at 6.3x. Gecina therefore has a significant

margin with respect to all of its banking covenants. The average

cost of drawn debt rose by 0.1% slightly compared to 2023, at

1.2%.

| 1.4.1 Debt structure at December 31, 2024

Net financial debt amounted to €6,531 million at the end of

December 2024.

The main characteristics of the debt are:

12/31/2024

12/31/2023

Gross financial debt (in million

euros)(1)

6,710

6,380

Net financial debt (in million euros)

6,531

6,236

Gross nominal debt (in million euros)

6,755

6,445

Unused credit lines (in million euros)

4,428

4,535

Average maturity of debt (years, restated

from available credit lines)

6.7

7.4

LTV (including duties)

35.4%

34.4%

LTV (excluding duties)

37.6%

36.5%

ICR

6.3x

5.9x

Secured debt/Properties

–

–

(1) Gross financial debt (excluding fair

value related to Eurosic’s debt) = Gross nominal debt + impact of

the recognition of bonds at amortized cost + accrued interest not

yet due + miscellaneous.

Debt by type

Breakdown of gross nominal debt (€6.8 billion)

Breakdown of authorized financing (€10.3 billion, including €4.4

billion of unused credit lines at December 31, 2024)

Gecina uses diversified sources of financing. Long-term bonds

represent 85% of the Group’s nominal debt and 56% of the Group’s

authorized financing.

At December 31, 2024, Gecina’s gross nominal debt was €6,755

million and comprised:

◆ €5,750 million in long-term Green Bonds issued under the Euro

Medium-Term Notes (EMTN) program;

◆ €165 million in sustainable bank loans;

◆ €840 million in NEU CP covered by confirmed medium and

long-term credit lines.

| 1.4.2 Liquidity

The main objectives of the liquidity are to provide sufficient

flexibility to adapt the volume of debt to the pace of acquisitions

and disposals, cover the refinancing of short-term maturities,

allow refinancing under optimal conditions, meet the criteria of

the credit rating agencies, and finance the Group’s investment

projects.

Financing and refinancing transactions carried out since the

start of 2024 amounted to €1.3 billion and related in particular to

the setting up of eleven sustainable credit lines with an average

maturity of nearly seven years, through the early renewal of lines

maturing in 2025, 2026 and 2027. These new financing programs all

have a margin dependent on the achievement of CSR objectives, and

allowed the Group to renew all the 2025 maturities and a large part

of the 2026 maturities early with longer maturities, mainly in

2031.

In 2024, Gecina continued to use short-term resources via the

issue of NEU CPs. At December 31, 2024, the Group’s short-term

resources totaled €840 million.

| 1.4.3 Debt maturity breakdown

At December 31, 2024, the average maturity of Gecina’s debt,

after allocation of unused credit lines and cash, was 6.7

years.

The following chart shows the debt maturity breakdown after

allocation of unused credit lines at December 31, 2024:

Debt maturity breakdown after taking into account undrawn credit

lines (in billion euros)

All of the credit maturities up to 2029, including the 2025,

2027 and 2028 bond maturities in particular, were covered by unused

credit lines as at December 31, 2024 and by free cash.

| 1.4.4 Average cost of debt

The average cost of the drawn debt amounted to 1.2% at the end

of December 2024 (and 1.5% for total debt), slightly higher than in

2023.

| 1.4.5 Credit rating

The Gecina group is rated by both Standard & Poor’s and

Moody’s, which respectively maintained the following ratings in the

second half of 2024:

◆ A– (stable outlook) for Standard & Poor’s;

◆ A3 (stable outlook) for Moody’s.

| 1.4.6 Management of interest rate risk hedge

Gecina’s interest rate risk management policy is aimed at

hedging the Company’s exposure to interest rate risk. To do so,

Gecina uses fixed-rate debt and derivative products (mainly caps

and swaps) in order to limit the impact of interest rate changes on

the Group’s results and to keep the cost of debt under control.

In 2024, Gecina continued to adjust and optimize its hedging

policy with the aim of:

◆ maintaining an optimal hedging ratio;

◆ maintaining a high average maturity of hedges (fixed-rate debt

and derivative instruments); and

◆ securing favorable long-term interest rates.

At December 31, 2024, the average duration of the portfolio of

firm hedges stood at 5.4 years.

Based on the current level of debt, the hedging ratio will

average close to 100% until the end of 2026 and 85% on average

until the end of 2029 (proforma of completed disposals).

The chart below shows the profile of the hedging portfolio (in

billion euros):

Gecina’s interest rate hedging policy is implemented mainly at

Group level and on the long-term; it is not specifically assigned

to certain loans.

Measuring interest rate risk

Gecina’s anticipated nominal net debt in 2025 is fully hedged

against interest rate increase.

Based on the existing hedging portfolio, contractual conditions

as at December 31, 2024, and anticipated debt in 2025, a 50 basis

point increase or decrease in the interest rate, compared to the

forward rate curve of December 31, 2024, would have no material

impact on financial expenses in 2025.

| 1.4.7 Financial structure and banking covenants

Gecina’s financial position as at December 31, 2024, meets all

requirements that could affect the compensation conditions or early

repayment clauses provided for in the various loan agreements.

The table below shows the status of the main financial ratios

outlined in the loan agreements:

Benchmark standard

Balance at 12/31/2024

LTV – Net financial debt/revalued block

value of property holding (excluding duties)

Maximum 60%

37.6%

ICR – EBITDA/net financial expenses

Minimum 2.0x

6.3x

Outstanding secured debt/revalued block

value of property holding (excluding duties)

Maximum 25%

–

Revalued block value of property holding

(excluding duties)

Minimum €6 bn

€17.4 bn

The financial ratios shown above are the same as those used in

the covenants included in all the Group’s loan agreements.

1 €646m overall (on the committed and to be committed pipeline):

€206m in 2025, €284m in 2026, €143m in 2027, €14m in 2028

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250213928311/en/

Gecina

Financial communications

Nicolas BROBAND Tel.: +33 (0)1 40 40 18 46

nicolasbroband@gecina.fr

Attalia NZOUZI Tel.: + 33 (0)1 40 40 18 44

attalianzouzi@gecina.fr

Press relations

Glenn DOMINGUES Tel.: + 33 (0)1 40 40 63 86

glenndomingues@gecina.fr

Armelle MICLO Tel.: + 33 (0)1 40 40 51 98

armellemiclo@gecina.fr

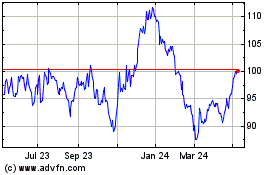

Gecina Nom (EU:GFC)

Historical Stock Chart

From Feb 2025 to Mar 2025

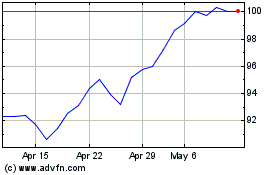

Gecina Nom (EU:GFC)

Historical Stock Chart

From Mar 2024 to Mar 2025